Current Report Filing (8-k)

September 15 2021 - 9:29AM

Edgar (US Regulatory)

PRUDENTIAL FINANCIAL INC false 0001137774 0001137774 2021-09-15 2021-09-15 0001137774 us-gaap:CommonStockMember 2021-09-15 2021-09-15 0001137774 pru:A5.625JuniorSubordinatedNotesMember 2021-09-15 2021-09-15 0001137774 pru:A4125JuniorSubordinatedNotesMember 2021-09-15 2021-09-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 15, 2021

PRUDENTIAL FINANCIAL, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

New Jersey

|

|

001-16707

|

|

22-3703799

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S Employer

Identification Number)

|

|

|

|

751 Broad Street

Newark, New Jersey 07102

|

|

(Address of principal executive offices and zip code)

|

(973) 802-6000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

|

|

|

|

|

|

|

Title of Each Class

|

|

Trading

Symbol(s)

|

|

Name of Each Exchange

on Which Registered

|

|

Common Stock, Par Value $.01

|

|

PRU

|

|

New York Stock Exchange

|

|

5.625% Junior Subordinated Notes

|

|

PRS

|

|

New York Stock Exchange

|

|

4.125% Junior Subordinated Notes

|

|

PFH

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.☐

On September 15, 2021, Prudential Annuities, Inc. (the “Seller”), a subsidiary of Prudential Financial, Inc. (“Prudential” or the “Company”), entered into an agreement with Fortitude Group Holdings, LLC (the “Buyer”) pursuant to which the Seller has agreed to sell to the Buyer a portion of the Company’s in-force variable annuities business (the “Business”) through the sale of all of the equity interests in Prudential Annuities Life Assurance Corporation (“PALAC”). The sale has a total transaction value of approximately $2.2 billion, comprising the sales price for PALAC, a pre-closing net capital release to the Company and an expected tax benefit. Subject to the receipt of regulatory approvals and the satisfaction of customary closing conditions, the Company expects the transaction to close during the first half of 2022 and plans to use the proceeds for general corporate purposes.

|

Item 7.01

|

Regulation FD Disclosure

|

The Company estimates that it will incur pre-tax transaction costs of approximately $30 million prior to the closing. Upon closing of the transaction, the Company expects its pre-tax adjusted operating income to be reduced by approximately $290 million per year and to record a gain on the sale of the Business.

The Company is furnishing herewith as Exhibit 99.1 a news release announcing the transaction.

Forward-Looking Statements and Non-GAAP Measures

Certain of the statements included in this Current Report on Form 8-K, such as those regarding the expected closing of the transaction and the receipt and use of the proceeds thereof, the expected tax benefit, the expected reduction in pre-tax adjusted operating income as a result of the transaction, the expected costs related to the transaction and the timing thereof, and the Company’s expectation that it will record a gain on the sale of the Business, constitute forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Words such as “expects,” “believes,” “anticipates,” “includes,” “plans,” “assumes,” “estimates,” “projects,” “intends,” “should,” “will,” “shall” or variations of such words are generally part of forward-looking statements. Forward-looking statements are made based on management’s current expectations and beliefs concerning future developments and their potential effects upon Prudential Financial, Inc. and its subsidiaries. There can be no assurance that future developments affecting Prudential Financial, Inc. and its subsidiaries will be those anticipated by management. These forward-looking statements are not a guarantee of future performance and involve risks and uncertainties, and there are certain important factors that could cause actual results to differ, possibly materially, from expectations or estimates reflected in such forward-looking statements. Certain important factors that could cause actual results to differ, possibly materially, from expectations or estimates reflected in such forward-looking statements can be found in the “Risk Factors” and “Forward-Looking Statements” sections included in the Company’s Annual Report on Form 10-K. The Company does not undertake to update any particular forward-looking statement included in this document.

This Current Report on Form 8-K includes a reference to adjusted operating income. Adjusted operating income is the measure used by the Company to evaluate segment performance and to allocate resources. Due to the inherent difficulty in reliably quantifying future realized investment gains/losses and changes in asset and liability values given their unknown timing and potential significance, we cannot, without unreasonable effort, provide an estimate of expected lost income from continuing operations, which is the GAAP measure most comparable to adjusted operating income. More information about adjusted operating income can be found in the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section included in the Company’s Annual Report on Form 10-K.

|

Item 9.01

|

Financial Statements and Exhibits

|

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: September 15, 2021

|

|

|

|

|

PRUDENTIAL FINANCIAL, INC.

|

|

|

|

|

By:

|

|

/s/ Brian P. Spitser

|

|

Name:

|

|

Brian P. Spitser

|

|

Title:

|

|

Vice President and Assistant Secretary

|

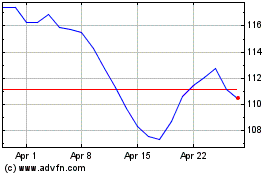

Prudential Financial (NYSE:PRU)

Historical Stock Chart

From Mar 2024 to Apr 2024

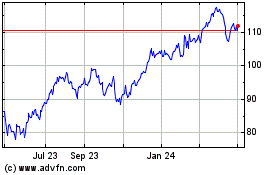

Prudential Financial (NYSE:PRU)

Historical Stock Chart

From Apr 2023 to Apr 2024