Current Report Filing (8-k)

June 24 2022 - 4:33PM

Edgar (US Regulatory)

false000184115600018411562022-06-232022-06-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): June 23, 2022 |

Paymentus Holdings, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-40429 |

45-3188251 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

18390 NE 68th St. |

|

Redmond, Washington |

|

98052 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

(888) 440-4826 Registrant’s Telephone Number, Including Area Code: |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Class A Common Stock, par value $0.0001 per share |

|

PAY |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Adoption of Variable Compensation Plan

On June 23, 2022, the Board of Directors (the “Board”) of Paymentus Holdings, Inc. (the “Company”), based upon the recommendation of the Compensation Committee of the Board (the “Committee”), approved and adopted a variable compensation plan for the Company’s executive officers (the “VC Plan”). The VC Plan was developed based on a review of the executive bonus plans at peer companies and is designed to promote the recognition and retention of the Company’s executive officers. The VC Plan is comprised of the following corporate and individual components (along with their relative weights): (i) Contribution Profit (50%), (ii) Adjusted EBITDA Margin (30%), and (iii) individual performance (20%). The cash payout opportunity is contingent upon meeting the threshold achievement level, and thereafter increases for performance above the threshold level, as set forth below:

|

|

|

|

Achievement Level |

Contribution Profit |

Adjusted EBITDA Margin |

Payout as a % of Target for each metric |

Maximum |

$225M |

18% |

150% |

Exceed |

$215M |

17% |

125% |

Target |

$206M |

15% |

100% |

Threshold |

$204M |

14% |

50% |

The Company’s named executive officers participating in the VC Plan and their previously disclosed bonus target award payouts are as follows:

|

|

|

Name |

Title |

Target Award |

Dushyant Sharma |

Chairman, President and Chief Executive Officer |

$675,000 |

Matt Parson |

Chief Financial Officer |

$240,000 |

Jerry Portocalis |

Chief Commercial Officer |

$250,000 |

The award payouts under the VC Plan will be distributed following approval by the Audit Committee of the Board of the audited financial statements for the fiscal year ending December 31, 2022.

Approval of RSU Grants

Also on June 23, 2022, the Board, based upon the recommendation of the Committee, approved a broad-based grant of time-based restricted stock units (“RSUs”) under the Company’s 2021 Equity Incentive Plan (the “Plan”) to certain key employees of the Company, including Messrs. Portocalis and Parson (the “RSU Grants”). Mr. Sharma did not receive an RSU grant. The RSU Grants are designed to improve retention, incentivize future performance and increase the equity holdings of certain of the Company’s key employees, many of whom have little or no unvested equity in the Company. In approving the RSU Grants, the Board considered benchmark data for peer companies and other information from Compensia, the Committee’s independent compensation consultant, including a recent Equity Utilization Analysis and Executive Compensation Review.

Messrs. Portocalis and Parson will each receive 95,238 RSUs. Each RSU represents the right to receive one share of the Company’s Class A common stock upon vesting. The RSUs were granted on June 23, 2022. One fourth of each RSU Award will vest on the one-year anniversary of the grant date, and one sixteenth of the RSUs will vest on a quarterly basis thereafter on each quarterly vesting date beginning on November 15, 2023, subject to each recipient’s continued service to the Company through the vesting date. Quarterly vesting dates with respect to any calendar year are February 15, May 15, August 15 and November 15. The RSU Awards were granted pursuant to, and in accordance with, the terms of the Plan and the form of Restricted Stock Unit Award Agreement (the “RSU Agreement”), which is filed herewith as Exhibit 10.1. This summary description does not purport to be complete and is qualified entirely by reference to the full text of the RSU Agreement, which is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

PAYMENTUS HOLDINGS, INC. |

|

|

|

|

Date: |

June 24, 2022 |

By: |

/s/ Matt Parson |

|

|

|

Matt Parson

Chief Financial Officer |

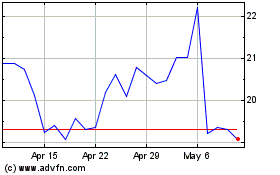

Paymentus (NYSE:PAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

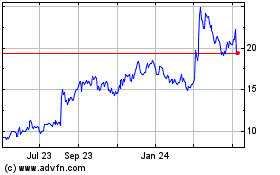

Paymentus (NYSE:PAY)

Historical Stock Chart

From Apr 2023 to Apr 2024