North American Construction Group Ltd. (“NACG”) (TSX:NOA/NYSE:NOA)

today announced results for the first quarter ended March 31,

2020.

Financial Highlights of the First

Quarter Ended March 31, 2020

- Revenue for the quarter was $198.8 million, compared to $186.4

million for the same period in the prior year, an increase of $12.4

million (or 7%).

- Adjusted EBITDA for the quarter was $59.9 million, compared to

$52.1 million for the same period in the prior year, an increase of

$7.9 million (or 15%).

- Adjusted EPS for the quarter was $0.70, compared to $0.51 for

same period in the prior year, an increase of $0.19 (or 37%).

- Free cash flow for the quarter was $9.4 million, compared to

$(5.3) million for the same period in the prior year, an increase

of $14.7

- million.

- Total liquidity at quarter-end was of $107.7 million, compared

to $114.6 million at December 31, 2019, a decrease of $6.9

million.

NACG Chairman and CEO, Martin Ferron, commented: “I will look

back on Q1 2020 when, firing on all cylinders, my amazing team of

employees put up numbers to be immensely proud of. Going forward in

an economy decimated by the COVID-19 virus, shareholders should

take comfort in the fact that we are battle hardened from previous

dealings with perils in our operating environment, especially in

the late 2014 to 2016 timeframe. I contend that we are strong

operators in any market conditions, good to difficult.

Unfortunately, it is the latter condition that has prevailed

from around March 15. Consequently, we are expecting a slow but

modestly profitable Q2 as we apply best efforts to help our

customers mitigate the direct and indirect impacts of the dreaded

virus. Hopefully, we will return to a more normal work environment

as the year progresses and will update our outlook

accordingly.”

Mr. Ferron added, “We have adequate liquidity and a manageable

debt level, especially after the call of the convertible debenture

that occurred early in Q2. We will keep an iron grip on what we can

control and a wary eye on what we cannot influence. As with the

last downturn, we will emerge stronger at the end of this one.”

Other Highlights of the Quarter Ended

March 31, 2020

- In January 2020, construction of a component rebuild shop in

Acheson was completed to enhance maintenance capabilities for both

our internal need and external customers.

- On January 30, 2020, a management services agreement for coal

mine operation in Texas, USA was executed with formal handover from

the existing manager planned for latter Q2 2020.

- On March 9, 2020, we announced our intention to commence a

normal course issuer bid ("NCIB") to purchase for cancellation up

to 2,300,000 common shares in the capital. This represented

approximately 8.3% of the issued and outstanding common shares as

of March 3, 2020. The NCIB commenced on March 12, 2020 and will

terminate no later than March 11, 2021.

Early Q2 2020 Highlights

- On April 6, 2020, our 5.50% convertible debentures due March

31, 2024 were redeemed in accordance with the original terms. The

redemption was satisfied through issuance of 4,583,655 voting

common share and all accrued and unpaid interest was paid in

cash.

Declaration of Quarterly

Dividend

On May 5, 2020, the NACG Board of Directors declared a regular

quarterly dividend (the “Dividend”) of four Canadian cents ($0.04)

per common share, payable to common shareholders of record at the

close of business on May 29, 2020. The Dividend will be paid on

July 3, 2020 and is an eligible dividend for Canadian income tax

purposes.

Consolidated Financial Highlights

|

|

Three months ended March 31, |

|

(dollars in thousands, except per share amounts) |

2020 |

|

|

2019 |

|

|

Change |

|

|

Revenue |

$ |

198,817 |

|

|

$ |

186,408 |

|

|

$ |

12,409 |

|

| Project costs |

60,117 |

|

|

70,491 |

|

|

(10,374 |

) |

| Equipment costs |

71,741 |

|

|

57,053 |

|

|

14,688 |

|

|

Depreciation |

32,308 |

|

|

29,281 |

|

|

3,027 |

|

| Gross

profit(i) |

$ |

34,651 |

|

|

$ |

29,583 |

|

|

$ |

5,068 |

|

| Gross profit margin(i) |

17.4 |

% |

|

15.9 |

% |

|

1.5 |

% |

| General and administrative

expenses (excluding stock-based compensation) |

8,670 |

|

|

8,820 |

|

|

(150 |

) |

| Stock-based compensation

(benefit) expense |

(6,863 |

) |

|

5,978 |

|

|

(12,841 |

) |

| Interest expense, net |

5,528 |

|

|

5,461 |

|

|

67 |

|

| Net income and comprehensive

income available to shareholders |

$ |

19,035 |

|

|

$ |

7,181 |

|

|

$ |

11,854 |

|

| |

|

|

|

|

|

| Adjusted EBITDA(i)(ii) |

$ |

59,933 |

|

|

$ |

52,070 |

|

|

$ |

7,863 |

|

| Adjusted EBITDA margin(i) |

30.1 |

% |

|

27.9 |

% |

|

2.2 |

% |

| |

|

|

|

|

|

| Per share

information |

|

|

|

|

|

| Basic net income per

share |

$ |

0.74 |

|

|

$ |

0.29 |

|

|

$ |

0.45 |

|

| Diluted net income per

share |

$ |

0.67 |

|

|

$ |

0.25 |

|

|

$ |

0.42 |

|

|

Adjusted EPS(i) |

$ |

0.70 |

|

|

$ |

0.51 |

|

|

$ |

0.19 |

|

(i)See "Non-GAAP Financial Measures".(ii)In the

three months ended December 31, 2019 we changed the calculation of

adjusted EBITDA. This change has not been reflected in results

prior to the three months ended December 31, 2019. Applying this

change to previously reported periods would result in an increase

of $0.2 million in adjusted EBITDA for the three months ended March

31, 2019.

Results for the Three Months Ended

March 31, 2020

For the three months ended March 31, 2020, revenue

was $198.8 million, up from $186.4 million in the same period last

year. The revenue growth in the current year is largely

attributable to the increased volume and strong ramp up of the

winter work programs at the Aurora and Millennium mines and an

increase in incremental work at the Fort Hills mine. New work this

quarter included civil construction services work at Mildred Lake

and equipment rentals at the Fort Hills mine. Adding to the strong

quarter was revenue from the operations support contract at the

coal mine in Wyoming, which began in Q2 of prior year. These

increases were partially offset by reduced revenue from the

completion of the heavy civil construction work assumed from the

Fort Hills legacy contract which ended in late Q4 2019, decreased

activity on several sites due to current market conditions and the

completion of the Highland Valley Copper mine contract in Q4

2019.

For the three months ended March 31, 2020, gross

profit was $34.7 million, or 17.4% gross profit margin, up from

$29.6 million, or 15.9% gross profit margin, in the same period

last year. The increase was a direct result of the higher revenue

earned in the current year from the impact improved operating

conditions on the utilization of the equipment fleet. Despite

reduced activity at several mine sites in the latter half of March,

we achieved improved gross profit margin from increased operating

efficiency primarily due to favourable winter weather and the

correlated haul road conditions. Year over year, the margins at the

Fort Hills mine significantly improved as the two unfavourable

legacy contracts were completed in Q1 2019. Additionally, margins

continue to be impacted by increased repair and maintenance costs

related to the fleet acquired in Q4 2018.

For the three months ended March 31, 2020,

depreciation was $32.3 million (or 16.3% of revenue), up from $29.3

million (or 15.7% of revenue) in the same period last year. The

increase in current period depreciation was primarily driven by

increased equipment fleet use. Depreciation as a percent of revenue

was higher in the quarter due to a specific one-time facility

write-down of $1.8 million included in depreciation expense,

required due to the impact of the suppressed economic

environment.

For the three months ended March 31, 2020, we

recorded operating income of $32.5 million, up from $14.5 million

for the same period last year. General and administrative expense,

excluding stock-based compensation, was $8.7 million (or 4.4% of

revenue) for the quarter, down slightly from $8.8 million (or 4.7%

of revenue) for the same period last year. Stock-based compensation

expense decreased $12.8 million compared to the prior year due to

the fluctuation in share price related to our liability classified

deferred stock units.

For the three months ended March 31, 2020, we

recorded $19.0 million of net income and comprehensive income

available to shareholders (basic net income per share of $0.74 and

diluted net income per share of $0.67), compared to $7.2 million of

net income and comprehensive income available to shareholders

(basic net income per share of $0.29 and diluted net income per

share of $0.25) recorded for the same period last year.

Cash provided by operating activities prior to

change in working capital for the three months ended March 31, 2020

was $54.5 million, compared to cash provided by operating

activities prior to change in working capital of $44.7 million for

the three months ended March 31, 2019. The increase in cash flow in

the current period is largely a result of improved gross

profit.

We have prepared our consolidated financial

statements in conformity with accounting principles generally

accepted in the United States ("US GAAP"). Unless otherwise

specified, all dollar amounts discussed are in Canadian dollars.

Please see the Management’s Discussion and Analysis (“MD&A”)

for the quarter ended March 31, 2020 for further detail on the

matters discussed in this release. In addition to the MD&A,

please reference the dedicated Q1 2020 Results Presentation for

more information on our results and projections which can be found

on our website under Investors - Presentations.

Conference Call and Webcast

Management will hold a conference call and webcast to discuss

our financial results for the quarter ended March 31, 2020

tomorrow, Thursday, May 7, 2020 at 9:00 am Eastern Time (7:00 am

Mountain Time).

| The call can be accessed by dialing: |

| |

Toll free:

1-877-648-7976 |

| |

International: 1-617-826-1698 |

| A replay will be available through June 7, 2020, by

dialing: |

| |

Toll Free: 1-855-859-2056 |

| |

International: 1-404-537-3406 |

| |

Conference ID: 2681391 |

A slide deck for the webcast will be available for download on

the company’s website at www.nacg.ca/presentations/

The live presentation and webcast can be accessed

at: www.nacg.ca/conference-calls/

For those unable to listen live, a replay will be available

using the link provided above until June 7, 2020.

Non-GAAP Financial Measures

A non-GAAP financial measure is generally defined by the

securities regulatory authorities as one that purports to measure

historical or future financial performance, financial position or

cash flows, but excludes or includes amounts that would not be

adjusted in the most comparable GAAP measures. We use non-GAAP

financial measures such as "gross profit", "adjusted net earnings",

"adjusted EBIT", "equity investment EBIT", "adjusted EBITDA",

"equity investment depreciation and amortization", "adjusted EPS",

"margin", "senior debt", "cash provided by operating activities

prior to change in working capital" and "free cash flow". We

provide tables in this document that reconcile non-GAAP measures

used to amounts reported on the face of the consolidated financial

statements.

"Gross profit" is defined as revenue less: project costs;

equipment costs; and depreciation. We believe that gross profit is

a meaningful measure of our business as it portrays results before

general and administrative overheads costs, amortization of

intangible assets and the gain or loss on disposal of property,

plant and equipment. Management reviews gross profit to determine

the profitability of operating activities, including equipment

ownership charges and to determine whether resources, property,

plant and equipment are being allocated effectively.

"Adjusted net earnings" is defined as net income and

comprehensive income available to shareholders excluding the

effects of unrealized foreign exchange gain or loss, realized and

unrealized gain or loss on derivative financial instruments, cash

and non-cash (liability and equity classified) stock-based

compensation expense, gain or loss on disposal of property, plant

and equipment and certain other non-cash items included in the

calculation of net income.

"Adjusted EBIT" is defined as adjusted net earnings before the

effects of interest expense, income taxes and equity earnings in

affiliates and joint ventures, but including the equity investment

EBIT from our affiliates and joint ventures accounted for using the

equity method.

“Equity investment EBIT” is defined as our proportionate share

(based on ownership interest) of equity earnings in affiliates and

joint ventures before the effects of gain or loss on disposal of

property, plant and equipment, interest expense and income

taxes.

“Adjusted EBITDA” is defined as adjusted EBIT before the effects

of depreciation, amortization and equity investment depreciation

and amortization.

“Equity investment depreciation and amortization” is defined as

our proportionate share (based on ownership interest) of

depreciation and amortization in other affiliates and joint

ventures accounted for using the equity method.

We believe that adjusted EBIT and adjusted EBITDA are meaningful

measures of business performance because they exclude items that

are not directly related to the operating performance of our

business. Management reviews these measures to determine whether

property, plant and equipment are being allocated efficiently.

"Adjusted EPS" is defined as adjusted net earnings, divided by

the weighted-average number of common shares.

As adjusted EBIT, adjusted EBITDA, adjusted net earnings and

adjusted EPS are non-GAAP financial measures, our computations may

vary from others in our industry. These measures should not be

considered as alternatives to operating income or net income as

measures of operating performance or cash flows and they have

important limitations as analytical tools and should not be

considered in isolation or as substitutes for analysis of our

results as reported under US GAAP. For example adjusted EBITDA does

not:

- reflect our cash expenditures or requirements for capital

expenditures or capital commitments or proceeds from capital

disposals;

- reflect changes in our cash requirements for our working

capital needs;

- reflect the interest expense or the cash requirements necessary

to service interest or principal payments on our debt;

- include tax payments or recoveries that represent a reduction

or increase in cash available to us; or

- reflect any cash requirements for assets being depreciated and

amortized that may have to be replaced in the future.

"Margin" is defined as the financial number as a percent of

total reported revenue. Examples where we use this reference and

related calculation are in relation to "gross profit margin",

"operating income margin", "net income margin", or "adjusted EBITDA

margin". We will often identify a relevant financial metric as a

percentage of revenue and refer to this as a margin for that

financial metric.

We believe that presenting relevant financial metrics as a

percentage of revenue is a meaningful measure of our business as it

provides the performance of the financial metric in the context of

the performance of revenue. Management reviews margins as part of

its financial metrics to assess the relative performance of its

results.

"Cash provided by operating activities prior to change in

working capital" is defined as cash used in or provided by

operating activities excluding net changes in non-cash working

capital.

"Free cash flow" is defined as cash from operations less cash

used in investing activities (including finance lease additions but

excluding cash used for growth capital expenditures, cash used for

/ provided by acquisitions and proceeds from equipment sale and

leaseback). We believe that free cash flow is a relevant measure of

cash available to service our total debt repayment commitments, pay

dividends, fund share purchases and fund both growth capital

expenditures and potential strategic initiatives.

A reconciliation of net income and comprehensive income

available to shareholders to adjusted net earnings, adjusted EBIT

and adjusted EBITDA is as follows:

| |

Three months ended |

|

|

March 31, |

|

(dollars in thousands) |

2020 |

|

|

2019 |

|

|

Net income and comprehensive income available to shareholders |

$ |

19,035 |

|

|

$ |

7,181 |

|

| Adjustments: |

|

|

|

|

Loss on disposal of property, plant and equipment |

157 |

|

|

44 |

|

|

Stock-based compensation (benefit) expense |

(6,863 |

) |

|

5,978 |

|

|

Restructuring costs |

— |

|

|

1,442 |

|

|

Unrealized loss on derivative financial instruments |

2,210 |

|

|

— |

|

|

Write-down on assets held for sale |

1,800 |

|

|

— |

|

|

Tax effect of the above items |

1,677 |

|

|

(1,978 |

) |

|

Adjusted net earnings(i) |

18,016 |

|

|

12,667 |

|

| Adjustments: |

|

|

|

|

Tax effect of the above items |

(1,677 |

) |

|

1,978 |

|

|

Interest expense, net |

5,528 |

|

|

5,461 |

|

|

Income tax expense |

5,994 |

|

|

2,475 |

|

|

Equity earnings in affiliates and joint ventures(ii) |

(460 |

) |

|

— |

|

|

Equity investment EBIT(i)(ii) |

560 |

|

|

— |

|

| Adjusted

EBIT(i)(ii) |

27,961 |

|

|

22,581 |

|

| Adjustments: |

|

|

|

|

Depreciation |

32,308 |

|

|

29,281 |

|

|

Write-down on assets held for sale |

(1,800 |

) |

|

— |

|

|

Amortization of intangible assets |

442 |

|

|

208 |

|

|

Equity investment depreciation and amortization(i)(ii) |

1,022 |

|

|

— |

|

|

Adjusted EBITDA(i)(ii) |

$ |

59,933 |

|

|

$ |

52,070 |

|

(i)See "Non-GAAP Financial Measures".(ii)In the three months

ended December 31, 2019 we changed the calculation of adjusted

EBITDA. This change has not been reflected in results prior to the

three months ended December 31, 2019. Applying this change to

previously reported periods would result in respective increases in

adjusted EBIT of $0.2 million and $0.2 million in adjusted EBITDA

for the three months ended March 31, 2019.

We have included equity investment EBITDA in the calculation of

adjusted EBITDA beginning in the fourth quarter of 2019. Below is a

reconciliation of the amount included in adjusted EBITDA for the

three months ended March 31, 2020.

| |

Three months ended |

|

|

March 31, |

|

(dollars in thousands) |

2020 |

|

|

2019 |

|

|

Equity earnings in affiliates and joint ventures |

$ |

460 |

|

|

$ |

— |

|

| Adjustments: |

|

|

|

|

Interest expense, net |

52 |

|

|

— |

|

|

Income tax expense |

48 |

|

|

— |

|

|

Equity investment EBIT(i)(ii) |

$ |

560 |

|

|

$ |

— |

|

| |

|

|

|

|

Depreciation |

$ |

989 |

|

|

$ |

— |

|

|

Amortization of intangible assets |

33 |

|

|

— |

|

|

Equity investment depreciation and

amortization(i)(ii) |

$ |

1,022 |

|

|

$ |

— |

|

(i)See "Non-GAAP Financial Measures".(ii)In the three months

ended December 31, 2019 we changed the calculation of adjusted

EBITDA. This change has not been reflected in results prior to the

three months ended December 31, 2019. Applying this change to

previously reported periods would result in respective increases in

adjusted EBIT of $0.2 million and $0.2 million in adjusted EBITDA

for the three months ended March 31, 2019.

Forward-Looking Information

The information provided in this release contains

forward-looking statements. Forward-looking statements include

statements preceded by, followed by or that include the words

“anticipate”, “believe”, “expect”, “should” or similar

expressions.

The material factors or assumptions used to develop the above

forward-looking statements include, and the risks and uncertainties

to which such forward-looking statements are subject, are

highlighted in the MD&A for the quarter ended March 31,

2020. Actual results could differ materially from those

contemplated by such forward-looking statements because of any

number of factors and uncertainties, many of which are beyond

NACG’s control. Undue reliance should not be placed upon

forward-looking statements and NACG undertakes no obligation, other

than those required by applicable law, to update or revise those

statements. For more complete information about NACG, please read

our disclosure documents filed with the SEC and the CSA. These free

documents can be obtained by visiting EDGAR on the SEC website at

www.sec.gov or on the CSA website at www.sedar.com.

About the Company

North American Construction Group Ltd. (www.nacg.ca) is one of

Canada’s largest providers of heavy civil construction and mining

contractors. For more than 65 years, NACG has provided services to

large oil, natural gas and resource companies.

For further information contact:

Jason Veenstra, CPA, CAChief Financial OfficerNorth American

Construction Group Ltd.(780)

948-2009jveenstra@nacg.cawww.nacg.ca

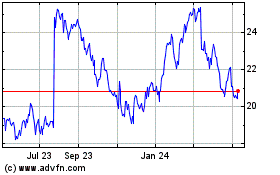

North American Construct... (NYSE:NOA)

Historical Stock Chart

From Mar 2024 to Apr 2024

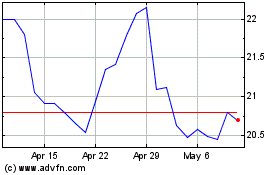

North American Construct... (NYSE:NOA)

Historical Stock Chart

From Apr 2023 to Apr 2024