Statement of Changes in Beneficial Ownership (4)

January 26 2021 - 3:01PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

RANKIN BRUCE T |

2. Issuer Name and Ticker or Trading Symbol

NACCO INDUSTRIES INC

[

NC

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

_____ Director _____ 10% Owner

_____ Officer (give title below) __X__ Other (specify below)

Member of a group |

|

(Last)

(First)

(Middle)

NACCO INDUSTRIES, INC., 5875 LANDERBROOK DRIVE, STE. 220 |

3. Date of Earliest Transaction

(MM/DD/YYYY)

12/31/2020 |

|

(Street)

MAYFIELD HEIGHTS, OH 44124

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Class A Common Stock | 1/22/2021 | | S(1) | | 21916 | D | $15.1859 | 0 | I | BTR - MAIN TRUST RAII (2) |

| Class A Common Stock | | | | | | | | 14313 | I | BTR Main Trust - Class A (3) |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Class B Common Stock | (4) | 12/31/2020 | | G |

V

| | 1222 | (4) | (4) | Class A Common Stock | 1222 | (4) | 17672 | I | BTR - RA1 (5) |

| Class B Common Stock | (4) | 12/31/2020 | | G |

V

| | 1222 | (4) | (4) | Class A Common Stock | 1222 | (4) | 16450 | I | BTR - RA1 (5) |

| Class B Common Stock | (4) | 12/31/2020 | | G |

V

| | 1221 | (4) | (4) | Class A Common Stock | 1221 | (4) | 15229 | I | BTR - RA1 (5) |

| Class B Common Stock | (4) | 12/31/2020 | | G |

V

| | 1221 | (4) | (4) | Class A Common Stock | 1221 | (4) | 14008 | I | BTR - RA1 (5) |

| Class B Common Stock | (4) | 12/31/2020 | | G |

V

| | 1221 | (4) | (4) | Class A Common Stock | 1221 | (4) | 12787 | I | BTR - RA1 (5) |

| Class B Common Stock | (4) | 12/31/2020 | | G |

V

| | 1222 | (4) | (4) | Class A Common Stock | 1222 | (4) | 11565 | I | BTR - RA1 (5) |

| Class B Common Stock | (4) | 12/31/2020 | | G |

V

| | 1222 | (4) | (4) | Class A Common Stock | 1222 | (4) | 10343 | I | BTR - RA1 (5) |

| Class B Common Stock | (4) | 12/31/2020 | | G |

V

| | 1222 | (4) | (4) | Class A Common Stock | 1222 | (4) | 9121 | I | BTR - RA1 (5) |

| Class B Common Stock | (4) | 12/31/2020 | | G |

V

| | 1222 | (4) | (4) | Class A Common Stock | 1222 | (4) | 7899 | I | BTR - RA1 (5) |

| Class B Common Stock | (4) | 12/31/2020 | | G |

V

| | 1222 | (4) | (4) | Class A Common Stock | 1222 | (4) | 6677 | I | BTR - RA1 (5) |

| Class B Common Stock | (4) | 1/22/2021 | | S (6) | | | 6677 | (4) | (4) | Class A Common Stock | 6677 | $15.1859 | 0 | I | BTR - RA1 (5) |

| Class B Common Stock | $0 | 1/22/2021 | | S (7) | | | 59675 | (4) | (4) | Class A Common Stock | 59675 | $15.1859 | 0 | I | BTR - RAIV (8) |

| Explanation of Responses: |

| (1) | BTR RAII -- The shares conveyed in this transaction are part of a group of shares conveyed in exchange for a series of promissory notes each in the principal amount of $327,007.89 plus interest which will accrue at a rate of 0.52% per annum, the principal amount of which indebtedness will be due and owing on January 21, 2030 and the accrued interest will be due and owing annually during the term. These transactions were executed as part of multi-generational estate planning by and among members of the Rankin family. |

| (2) | Represents the Reporting Person's proportionate limited partnership interests in shares held by Rankin Associates II, L.P., which is held in a trust for the benefit of Bruce T. Rankin. Reporting Person's brother serves as the Trustee of the Trust. |

| (3) | Held by Trust for the benefit of Reporting Person. |

| (4) | N/A |

| (5) | Represents the proportionate limited partnership interest in shares held by Rankin Associates I, L.P., which is held in a trust for the benefit of Bruce T. Rankin. |

| (6) | BTR RAI -- The shares conveyed in this transaction are part of a group of shares conveyed in exchange for a series of promissory notes each in the principal amount of $99,671.39 plus interest which will accrue at a rate of 0.52% per annum, the principal amount of which indebtedness will be due and owing on January 21, 2030 and the accrued interest will be due and owing annually during the term. These transactions were executed as part of multi-generational estate planning by and among members of the Rankin family. |

| (7) | BTR RAIV -- The shares conveyed in this transaction are part of a group of shares conveyed in exchange for a series of promissory notes each in the principal amount of $890,720.11 plus interest which will accrue at a rate of 0.52% per annum, the principal amount of which indebtedness will be due and owing on January 21, 2030 and the accrued interest will be due and owing annually during the term. These transactions were executed as part of multi-generational estate planning by and among members of the Rankin family. |

| (8) | RA4-Represents the Reporting Person's proportionate limited partnership interest in shares of Rankin Associates IV, L.P. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

RANKIN BRUCE T

NACCO INDUSTRIES, INC.

5875 LANDERBROOK DRIVE, STE. 220

MAYFIELD HEIGHTS, OH 44124 |

|

|

| Member of a group |

Signatures

|

| /s/ Matthew J. Dilluvio, attorney-in-fact | | 1/26/2021 |

| **Signature of Reporting Person | Date |

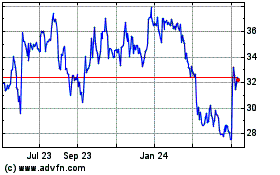

NACCO Industries (NYSE:NC)

Historical Stock Chart

From Mar 2024 to Apr 2024

NACCO Industries (NYSE:NC)

Historical Stock Chart

From Apr 2023 to Apr 2024