Report of Foreign Issuer (6-k)

September 15 2020 - 6:19AM

Edgar (US Regulatory)

FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant

to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month

of September, 2020

Commission File Number: 001-15002

ICICI Bank Limited

(Translation of registrant’s name into English)

ICICI Bank Towers,

Bandra-Kurla Complex

Mumbai, India 400 051

(Address of principal executive office)

Indicate

by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Indicate

by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate

by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate

by check mark whether by furnishing the information

contained in this Form, the Registrant is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b)

under the Securities Exchange Act of 1934:

If “Yes” is marked,

indicate below the file number assigned to the registrant in

connection with Rule 12g 3-2(b): Not Applicable

Table

of Contents

OTHER

NEWS

Subject:

Disclosure under Indian Listing Regulations

IBN

ICICI

Bank Limited (the ‘Bank’) Report on Form 6-K

The

Bank has made the below announcement to the Indian stock exchanges:

The

Central Government on the recommendation of the Reserve Bank of India has vide notification dated September 9, 2020 as published

in the weekly Gazette of India for September 6-12, 2020 received by ICICI Bank today, exempted ICICI Bank from the provisions

of Section 19(2) of the Banking Regulation Act, 1949 with respect to shareholding above 30.0% in ICICI Lombard General Insurance

Company Limited and ICICI Prudential Life Insurance Company Limited, for a period of three years from the date of the notification.

As

previously announced by ICICI Lombard General Insurance Company Limited, it has proposed an acquisition of another general insurance

business, which if consummated would result in ICICI Bank’s shareholding in ICICI Lombard General Insurance Company Limited

reducing to less than 50.0%. The above exemption would facilitate compliance with the Banking Regulation Act.

The

exemption during its operation may permit both ICICI Lombard General Insurance Company Limited and/or ICICI Prudential Life Insurance

Company Limited to consider strategic options such as mergers and acquisitions or capital raise which have the potential of reducing

the Bank’s shareholding. There are no current plans for the Bank to divest to less than 50.0% shareholding in ICICI Prudential

Life Insurance Company Limited. There would be no impact on the current distribution arrangements.

It

may be further mentioned that the above is unrelated to the Bank’s current assessment of its financial position and outlook.

The Bank has stated in the past that based on its capital position, operating profits and provisions already made, the Bank expects

to be well-able to absorb the stress arising out of the Covid-19 pandemic. Subsequently, the Bank has further strengthened its

balance sheet by raising ₹ 150.00 billion of additional equity capital in August 2020.

This

disclosure is being made pursuant to Regulation 30 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations,

2015.

Certain

statements in this release relating to a future period of time (including inter alia concerning us or ICICI Lombard General Insurance

Company Limited or ICICI Prudential Life Insurance Company Limited with respect to future business plans or growth prospects or

strategic options including considering any mergers or acquisitions or capital raise) are forward - looking statements intended

to qualify for the 'safe harbor' under applicable securities laws, including the U S Private Securities Litigation Reform Act

of 1995. Such forward - looking statements involve a number of risks and uncertainties that could cause actual results to differ

materially from those in such forward - looking statements. These risks and uncertainties include, but are not limited to statutory

and regulatory changes, international economic and business conditions; political or economic instability in the jurisdictions

where we have operations, increase in non - performing loans, unanticipated changes in interest rates, foreign exchange rates,

equity prices or other rates or prices, growth and expansion in business (including by way of mergers or acquisitions or raising

capital to fund such growth or expansion), the adequacy of our allowance for credit losses, the actual growth in demand for banking

or insurance products and services, investment income, cash flow projections, our exposure to market risks, continuation or earlier

revocation of the exemption, timing of ensuring compliance within the period specified in the exemption, maintaining or reducing

the shareholding, changes in regulatory requirements, changes in India’s sovereign rating, and the impact of the Covid-19

pandemic which could result in fewer business opportunities, lower revenues, and an increase in the levels of non - performing

assets and provisions, depending inter alia upon the period of time for which the pandemic extends, the remedial measures adopted

by governments and central banks, and the time taken for economic activity to resume at normal levels after the pandemic, as well

as other risks, including additional risks that could affect our future operating results, that are detailed in reports filed

by us, including with the United States Securities and Exchange Commission www.sec.gov.

Any forward - looking statements contained herein are based on assumptions that we believe to be reasonable as of the date of

this release. ICICI Bank undertakes no obligation to update forward looking statements to reflect events or circumstances after

the date thereof.

|

ICICI

Bank Limited

ICICI

Bank Towers

Bandra-Kurla

Complex

Mumbai

400 051, India.

|

Tel.:

(91-22) 2653 1414

Fax:

(91-22) 2653 1122

Website

www.icicibank.com

CIN.:

L65190GJ1994PLC021012

|

Regd.

Office: ICICI Bank Tower,

Near

Chakli Circle,

Old

Padra Road

Vadodara

390007. India

|

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorised.

|

|

|

|

|

For

ICICI Bank Limited

|

|

Date:

|

September

14, 2020

|

|

By:

|

/s/

Prashant Mistry

|

|

|

|

|

|

Name

:

|

Prashant

Mistry

|

|

|

|

|

|

Title :

|

Chief Manager

|

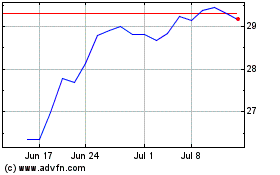

Icici Bank (NYSE:IBN)

Historical Stock Chart

From Mar 2024 to Apr 2024

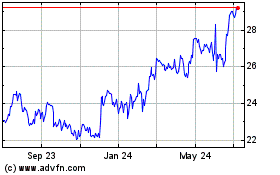

Icici Bank (NYSE:IBN)

Historical Stock Chart

From Apr 2023 to Apr 2024