Amended Annual Report (10-k/a)

December 23 2020 - 6:02AM

Edgar (US Regulatory)

true

0000357294

xbrli:shares

iso4217:USD

0000357294

2020-10-31

2020-10-31

0000357294

hov:ClassACommonStockCustomMember

2020-10-31

2020-10-31

0000357294

hov:PreferredStockPurchaseRightsCustomMember

2020-10-31

2020-10-31

0000357294

hov:DepositarySharesCustomMember

2020-10-31

2020-10-31

0000357294

2020-04-30

0000357294

hov:ClassACommonStockCustomMember

2020-12-11

0000357294

hov:ClassBCommonStockCustomMember

2020-12-11

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K/A

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT

OF 1934

For the fiscal year ended October 31, 2020

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number: 1-8551

Hovnanian Enterprises, Inc.

(Exact Name of Registrant as Specified in Its Charter)

|

Delaware

|

22-1851059

|

|

(State or Other Jurisdiction of Incorporation or Organization)

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

90 Matawan Road, Fifth Floor, Matawan, NJ

|

07747

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

|

|

|

|

732-747-7800

|

|

(Registrant’s Telephone Number, Including Area Code)

|

|

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

Title of each class

|

Trading symbol(s)

|

Name of each exchange on which registered

|

|

Class A Common Stock $0.01 par value per share

|

HOV

|

New York Stock Exchange

|

|

Preferred Stock Purchase Rights(1)

|

N/A

|

New York Stock Exchange

|

|

Depositary Shares each representing

1/1,000th of a share of 7.625% Series A

Preferred Stock

|

HOVNP

|

Nasdaq Global Market

|

(1) Each share of Common Stock includes an associated Preferred Stock Purchase Right. Each Preferred Stock Purchase Right initially represents the right, if such Preferred Stock Purchase Right becomes exercisable, to purchase from the Company one ten-thousandth of a share of its Series B Junior Preferred Stock for each share of Common Stock. The Preferred Stock Purchase Rights currently cannot trade separately from the underlying Common Stock.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act of 1933. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large Accelerated Filer ☐

|

Accelerated Filer ☒

|

Nonaccelerated Filer ☐

|

Smaller Reporting Company ☐

|

Emerging Growth Company ☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the voting and nonvoting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity as of April 30, 2020 (the last business day of the registrant’s most recently completed second fiscal quarter) was $64,080,000.

Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of the latest practicable date. 5,520,359 shares of Class A Common Stock and 622,201 shares of Class B Common Stock were outstanding as of December 11, 2020.

--10-31 2020 FY

This Amendment No. 1 (“Amendment No. 1”) to the Annual Report on Form 10-K of Hovnanian Enterprises, Inc. (the “Company”) for the year ended October 31, 2020, as filed with the Securities and Exchange Commission on December 22, 2020 (the “Original Form 10-K”), is being filed for the sole purpose of correcting a typographical error on the date of signature of each of the consents on Exhibits 23(a) and 23(b) (the “Consents”) and certifications on Exhibits 31(a), 31(b), 32(a) and 32(b) (the “Certifications”) in the Original Form 10-K. Although the Company had received the signed Consents and Certifications with the correct date, incorrect dates were included in the Original Form 10-K due to administrative error. Except as otherwise expressly noted herein, this Amendment No. 1 does not modify or update in any way the financial position, results of operations, cash flows, or other disclosures in, or exhibits to, the Original Form 10-K. Accordingly, this Amendment No. 1 should be read in conjunction with the Original Form 10-K.

Exhibits:

|

3(a)

|

|

|

3(b)

|

|

|

4(a)

|

|

|

4(b)

|

|

|

4(c)

|

|

|

4(d)

|

|

|

4(e)

|

|

|

4(f)

|

|

|

4(g)

|

Indenture, dated as of February 1, 2018, relating to the 13.5% Senior Notes due 2026 and 5.0% Senior Notes due 2040, by and among K. Hovnanian Enterprises, Inc., Hovnanian Enterprises, Inc., the other guarantors party thereto and Wilmington Trust, National Association, as Trustee, including the forms of 13.5% Senior Notes due 2026 and 5.0% Senior Notes due 2040 (Incorporated by reference to Exhibits to Current Report on Form 8-K of the Registrant filed February 2, 2018).

|

|

4(h)

|

Second Supplemental Indenture, dated as of May 30, 2018, relating to the 13.5% Senior Notes due 2026 and 5.0% Senior Notes due 2040, among K. Hovnanian Enterprises, Inc., Hovnanian Enterprises, Inc., the other guarantors party thereto and Wilmington Trust, National Association, as trustee (Incorporated by reference to Exhibits to Current Report on Form 8-K of the Registrant filed May 30, 2018).

|

|

4(i)

|

Sixth Supplemental Indenture, dated as of October 31, 2019, relating to the 13.5% Senior Notes due 2026 and 5.0% Senior Notes due 2040, among K. Hovnanian Enterprises, Inc., Hovnanian Enterprises, Inc., the other guarantors party thereto and Wilmington Trust, National Association, as trustee (Incorporated by reference to Exhibits to Current Report on Form 8-K of the Registrant filed on October 31, 2019).

|

|

4(j)

|

Indenture dated as of July 27, 2017, relating to the 10.000% Senior Secured Notes due 2022 and the 10.500% Senior Secured Notes due 2024, among K. Hovnanian Enterprises, Inc., Hovnanian Enterprises, Inc., the other guarantors party thereto and Wilmington Trust, National Association, as trustee and collateral agent, including the forms of 10.000% Senior Secured Notes due 2022 and the 10.500% Senior Secured Note due 2024 (Incorporated by reference to Exhibits to Current Report on Form 8-K of the Registrant filed on July 28, 2017).

|

|

4(k)

|

Second Supplemental Indenture, dated January 16, 2018, relating to the 10.500% Senior Secured Notes due 2024, by and among K. Hovnanian Enterprises, Inc., Hovnanian Enterprises, Inc., the other guarantors party thereto and Wilmington Trust, National Association, as trustee and collateral agent (Incorporated by reference to Exhibits to Current Report on Form 8-K of the Registrant filed January 16, 2018).

|

|

4(l)

|

Ninth Supplemental Indenture, dated as of October 30, 2019, relating to the 10.000% Senior Secured Notes due 2022 and 10.500% Senior Secured Notes due 2024, among K. Hovnanian Enterprises, Inc., Hovnanian Enterprises, Inc., the other guarantors party thereto and Wilmington Trust, National Association, as trustee and collateral agent (Incorporated by reference to Exhibits to Current Report on Form 8-K of the Registrant filed on October 31, 2019).

|

|

4(m)

|

Indenture, dated as of November 5, 2014, relating to the 8.000% Senior Notes due 2027, among K. Hovnanian Enterprises, Inc., Hovnanian Enterprises, Inc., the other guarantors party thereto and Wilmington Trust, National Association, as Trustee, including the form of 8.000% Senior Notes (Incorporated by reference to Exhibits to Current Report on Form 8-K of the Registrant filed November 5, 2014).

|

|

4(n)

|

Eighteenth Supplemental Indenture, dated as of October 17, 2019, relating to the 8.000% Senior Notes due 2027, among K. Hovnanian Enterprises, Inc., Hovnanian Enterprises, Inc., the other guarantors party thereto and Wilmington Trust, National Association, as trustee (Incorporated by reference to Exhibits to Current Report on Form 8-K of the Registrant filed on October 31, 2019).

|

|

4(o)

|

Nineteenth Supplemental Indenture, dated as of October 31, 2019, relating to the 8.000% Senior Notes due 2027, among K. Hovnanian Enterprises, Inc., Hovnanian Enterprises, Inc., the other guarantors party thereto and Wilmington Trust, National Association, as trustee (Incorporated by reference to Exhibits to Current Report on Form 8-K of the Registrant filed on October 31, 2019).

|

|

4(p)

|

Twentieth Supplemental Indenture, dated as of November 1, 2019, relating to 8.000% Senior Notes due 2027, among K. Hovnanian Enterprises, Inc., Hovnanian Enterprises, Inc., the other guarantors party thereto and Wilmington Trust, National Association, as trustee (Incorporated by reference to Exhibits to Current Report on Form 8-K of the Registrant filed November 5, 2019).

|

|

4(q)

|

Indenture, dated as of October 31, 2019, relating to the 7.75% Senior Secured 1.125 Lien Notes due 2026, among K. Hovnanian Enterprises, Inc., Hovnanian Enterprises, Inc., the other guarantors party thereto and Wilmington Trust, National Association, as trustee and collateral agent, including the form of 7.75% Senior Secured 1.125 Lien Notes due 2026 (Incorporated by reference to Exhibits to Current Report on Form 8-K of the Registrant filed on October 31, 2019).

|

|

4(r)

|

First Supplemental Indenture, dated as of November 27, 2019, relating to the 7.75% Senior Secured 1.125 Lien Notes due 2026, among K. Hovnanian Enterprises, Inc., Hovnanian Enterprises, Inc., the other guarantors party thereto and Wilmington Trust, National Association, as trustee and collateral agent (Incorporated by reference to Exhibits to Current Report on Form 8-K of the Registrant filed December 3, 2019).

|

|

4(s)

|

Indenture, dated as of October 31, 2019, relating to the 10.5% Senior Secured 1.25 Lien Notes due 2026, among K. Hovnanian Enterprises, Inc., Hovnanian Enterprises, Inc., the other guarantors party thereto and Wilmington Trust, National Association, as trustee and collateral agent, including the form of 10.5% Senior Secured 1.25 Lien Notes due 2026 (Incorporated by reference to Exhibits to Current Report on Form 8-K of the Registrant filed on October 31, 2019).

|

|

4(t)

|

First Supplemental Indenture, dated as of November 27, 2019, relating to the 10.5% Senior Secured 1.25 Lien Notes due 2026, among K. Hovnanian Enterprises, Inc., Hovnanian Enterprises, Inc., the other guarantors party thereto and Wilmington Trust, National Association, as trustee and collateral agent (Incorporated by reference to Exhibits to Current Report on Form 8-K of the Registrant filed December 3, 2019).

|

|

4(u)

|

Tenth Supplemental Indenture, dated as of December 6, 2019, relating to the 10.500% Senior Secured Notes due 2024, by and among K. Hovnanian Enterprises, Inc., Hovnanian Enterprises, Inc., the other guarantors party thereto and Wilmington Trust, National Association, as trustee and collateral agent (Incorporated by reference to Exhibits to Current Report on form 8-K of the Registrant filed December 6, 2019).

|

|

4(v)

|

Indenture, dated as of October 31, 2019, relating to the 11.25% Senior Secured 1.5 Lien Notes due 2026, among K. Hovnanian Enterprises, Inc., Hovnanian Enterprises, Inc., the other guarantors party thereto and Wilmington Trust, National Association, as trustee and collateral agent, including the form of 11.25% Senior Secured 1.5 Lien Notes due 2026 (Incorporated by reference to Exhibits to Current Report on Form 8-K of the Registrant filed on October 31, 2019).

|

|

4(w)

|

First Supplemental Indenture, dated as of November 27, 2019, relating to the 11.25% Senior Secured 1.5 Lien Notes due 2026, among K. Hovnanian Enterprises, Inc., Hovnanian Enterprises, Inc., the other guarantors party thereto and Wilmington Trust, National Association, as trustee and collateral agent (Incorporated by reference to Exhibits to Current Report on Form 8-K of the Registrant filed December 3, 2019).

|

|

4(x)

|

Indenture, dated as of December 10, 2019, relating to the 10.000% Senior Secured 1.75 Lien Notes due 2025, among K. Hovnanian Enterprises, Inc., Hovnanian Enterprises, Inc., the other guarantors party thereto and Wilmington Trust, National Association, as trustee and collateral agent, including the form of 10.000% Senior Secured 1.75 Lien Notes due 2025 (Incorporated by reference to Exhibits to Current Report on Form 8-K of the Registrant filed December 11, 2019).

|

|

4(y)

|

|

|

4(z)

|

Fourth Supplemental Indenture, dated as of March 25, 2020, relating to the additional 11.25% Senior Secured 1.5 Lien Notes due 2026, among K. Hovnanian Enterprises, Inc., Hovnanian Enterprises, Inc., the subsidiary guarantors named therein and Wilmington Trust, National Association, as Trustee and Collateral Agent, including the form of the additional 11.25% Senior Secured 1.5 Lien Notes due 2026 (Incorporated by reference to Exhibits to Current Report on Form 8-K of the Registrant field on March 26, 2020).

|

|

10(a)

|

Credit Agreement, dated as of October 31, 2019, by and among K. Hovnanian Enterprises Inc., Hovnanian Enterprises, Inc., the other guarantors party thereto, Wilmington Trust, National Association, as Administrative Agent, and the lenders party thereto (Incorporated by reference to Exhibits to Current Report on Form 8-K of the Registrant filed on October 31, 2019).

|

|

10(b)

|

First Amendment, dated as of November 27, 2019, to the Credit Agreement, dated as of October 31, 2019, among Hovnanian Enterprises, Inc., K. Hovnanian Enterprises Inc., the subsidiary guarantors party thereto, the lenders party thereto and Wilmington Trust, National Association, as administrative agent (Incorporated by reference to Exhibits to Current Report on Form 8-K of the Registrant filed December 3, 2019).

|

|

10(c)

|

$212,500,000 Credit Agreement, dated as of January 29, 2018, by and among K. Hovnanian Enterprises Inc., Hovnanian Enterprises, Inc., the other guarantors party thereto, Wilmington Trust, National Association, as Administrative Agent, and the lenders party thereto (Incorporated by reference to Exhibits to Current Report on Form 8-K of the Registrant filed February 2, 2018).

|

|

10(d)

|

First Amendment, dated as of May 14, 2018, to the $212,500,000 Credit Agreement, dated as of January 29, 2018, among Hovnanian Enterprises, Inc., K. Hovnanian Enterprises Inc., the subsidiary guarantors party thereto, the lenders party thereto and Wilmington Trust, National Association, as administrative agent (Incorporated by reference to Exhibits to Current Report on Form 8-K of the Registrant filed May 14, 2018).

|

|

10(e)

|

Second Amendment, dated as of October 31, 2019, to the $212,500,000 Credit Agreement, dated as of January 29, 2018, among Hovnanian Enterprises, Inc., K. Hovnanian Enterprises Inc., the subsidiary guarantors party thereto, the lenders party thereto and Wilmington Trust, National Association, as administrative agent (Incorporated by reference to Exhibits to Annual Report on Form 10-K for the year ended October 31, 2019 of the Registrant).

|

|

10(f)

|

Collateral Agency Agreement, dated as of July 27, 2017, among K. Hovnanian Enterprises, Inc., Hovnanian Enterprises, Inc., the other guarantors party thereto, Wilmington Trust, National Association, as Notes Collateral Agent and Wilmington Trust, National Association, as Collateral Agent (Incorporated by reference to Exhibits to Current Report on Form 8-K of the Registrant filed on July 28, 2017).

|

|

10(g)

|

Security Agreement, dated as of July 27, 2017, among K. Hovnanian Enterprises, Inc., Hovnanian Enterprises, Inc., the other guarantors party thereto and Wilmington Trust, National Association, as Collateral Agent (Incorporated by reference to Exhibits to Current Report on Form 8-K of the Registrant filed on July 28, 2017).

|

|

10(h)

|

Pledge Agreement, dated as of July 27, 2017, among K. Hovnanian Enterprises, Inc., Hovnanian Enterprises, Inc., the other guarantors party thereto and Wilmington Trust, National Association, as Collateral Agent (Incorporated by reference to Exhibits to Current Report on Form 8-K of the Registrant filed on July 28, 2017).

|

|

10(i)

|

Third Amended and Restated Mortgage Tax Collateral Agency Agreement, dated as of October 31, 2019, among K. Hovnanian Enterprises, Inc., Hovnanian Enterprises, Inc., the other guarantors party thereto and Wilmington Trust, National Association, as Mortgage Tax Collateral Agent, Notes Collateral Agent and Junior Joint Collateral Agent (Incorporated by reference to Exhibits to Current Report on Form 8-K of the Registrant filed on October 31, 2019).

|

|

10(j)

|

|

|

10(k)

|

Second Amended and Restated Intercreditor Agreement, dated as of October 31, 2019, among K. Hovnanian Enterprises, Inc., Hovnanian Enterprises, Inc., the other guarantors party thereto and Wilmington Trust, National Association, as Administrative Agent, 1.125 Lien Trustee, 1.125 Lien Collateral Agent, 1.25 Lien Trustee, 1.25 Lien Collateral Agent, 1.5 Lien Trustee, 1.5 Lien Collateral Agent, Joint First Lien Collateral Agent, Mortgage Tax Collateral Agent, 10.000% Junior Trustee, 10.000% Junior Collateral Agent, 10.500% Junior Trustee, 10.500% Junior Collateral Agent and Junior Joint Collateral Agent (Incorporated by reference to Exhibits to Current Report on Form 8-K of the Registrant filed on October 31, 2019).

|

|

10(l)

|

Credit Agreement, dated as of December 10, 2019, relating to the 1.75 Lien Term Loans, among K. Hovnanian Enterprises, Inc., Hovnanian Enterprises, Inc., the subsidiary guarantors named therein, Wilmington Trust, National Association, as Administrative Agent, and the lenders party thereto (Incorporated by reference to Exhibits to Current Report on Form 8-K of the Registrant filed December 11, 2019).

|

|

10(m)

|

Joinder, dated as of December 10, 2019, to the Second Amended and Restated Intercreditor Agreement, dated as of October 31, 2019, among K. Hovnanian Enterprises, Inc., Hovnanian Enterprises, Inc., the subsidiary guarantors named therein and Wilmington Trust, National Association, as 1.75 Lien Trustee, 1.75 Term Loan Administrative Agent and 1.75 Pari Passu Lien Collateral Agent (Incorporated by reference to Exhibits to Current Report on Form 8-K of the Registrant filed December 11, 2019).

|

|

10(uu)*

|

|

|

10(vv)*

|

|

|

10(ww)*

|

|

|

10(xx)*

|

|

|

10(yy)*

|

|

|

10(zz)*

|

|

|

10(aaa)*

|

|

|

10(bbb)*

|

|

|

10(ccc)*

|

|

|

10(ddd)*

|

|

|

10(eee)*

|

|

|

10(fff)*

|

|

|

10(ggg)*

|

|

|

10(hhh)*

|

|

|

10(iii)*

|

|

|

10(jjj)*

|

|

|

10(kkk)*

|

|

|

10(lll)*

|

|

|

10(mmm)*

|

Retirement Agreement, dated as of May 18, 2020, between Hovnanian Enterprises, Inc. and Lucian T. Smith III (Incorporated by reference to Exhibits to Quarterly Report on Form 10-Q of the Registrant for the quarter ended April 30, 2020 of the Registrant).

|

|

10(nnn)*

|

2020 Hovnanian Enterprises, Inc. Stock Incentive Plan (Incorporated by reference to Exhibits to Current Report on Form 8-K of the Registrant filed on March 25, 2020).

|

|

10(ooo)

|

Security Agreement, dated as of October 31, 2019, relating to Senior Secured Revolving Credit Facility, made by K. Hovnanian Enterprises, Inc., Hovnanian Enterprises, Inc. and the other guarantors party thereto in favor of Wilmington Trust, National Association, as Administrative Agent and Joint First Lien Collateral Agent (Incorporated by reference to Exhibits to Current Report on Form 8-K of the Registrant filed on October 31, 2019).

|

|

10(ppp)

|

Pledge Agreement, dated as of October 31, 2019, relating to Senior Secured Revolving Credit Facility, given by K. Hovnanian Enterprises, Inc., Hovnanian Enterprises, Inc. and the other guarantors party thereto to Wilmington Trust, National Association, as Administrative Agent and Joint First Lien Collateral Agent (Incorporated by reference to Exhibits to Current Report on Form 8-K of the Registrant filed on October 31, 2019).

|

|

10(qqq)

|

|

|

10(rrr)

|

1.125 Lien Security Agreement, dated as of October 31, 2019, relating to the 7.75% Senior Secured 1.125 Lien Notes due 2026, made by K. Hovnanian Enterprises, Inc., Hovnanian Enterprises, Inc. and the other guarantors party thereto in favor of Wilmington Trust, National Association, as 1.125 Lien Collateral Agent and Joint First Lien Collateral Agent (Incorporated by reference to Exhibits to Current Report on Form 8-K of the Registrant filed on October 31, 2019).

|

|

10(sss)

|

1.125 Lien Pledge Agreement, dated as of October 31, 2019, relating to the 7.75% Senior Secured 1.125 Lien Notes due 2026, given by K. Hovnanian Enterprises, Inc., Hovnanian Enterprises, Inc. and the other guarantors party thereto to Wilmington Trust, National Association, as 1.125 Lien Collateral Agent and Joint First Lien Collateral Agent (Incorporated by reference to Exhibits to Current Report on Form 8-K of the Registrant filed on October 31, 2019).

|

|

10(ttt)

|

|

|

10(uuu)

|

1.25 Lien Security Agreement, dated as of October 31, 2019, relating to the 10.5% Senior Secured 1.25 Lien Notes due 2026, made by K. Hovnanian Enterprises, Inc., Hovnanian Enterprises, Inc. and the other guarantors party thereto in favor of Wilmington Trust, National Association, as 1.25 Lien Collateral Agent and Joint First Lien Collateral Agent (Incorporated by reference to Exhibits to Current Report on Form 8-K of the Registrant filed on October 31, 2019).

|

|

10(vvv)

|

1.25 Lien Pledge Agreement, dated as of October 31, 2019, relating to the 10.5% Senior Secured 1.25 Lien Notes due 2026, given by K. Hovnanian Enterprises, Inc., Hovnanian Enterprises, Inc. and the other guarantors party thereto to Wilmington Trust, National Association, as the 1.25 Lien Collateral Agent and the Joint First Lien Collateral Agent (Incorporated by reference to Exhibits to Current Report on Form 8-K of the Registrant filed on October 31, 2019).

|

|

10(xxx)

|

1.5 Lien Security Agreement, dated as of October 31, 2019, relating to the 11.25% Senior Secured 1.5 Lien Notes due 2026, made by K. Hovnanian Enterprises, Inc., Hovnanian Enterprises, Inc. and the other guarantors party thereto in favor of Wilmington Trust, National Association, as the 1.5 Lien Collateral Agent and the Joint First Lien Collateral Agent (Incorporated by reference to Exhibits to Current Report on Form 8-K of the Registrant filed on October 31, 2019).

|

|

10(yyy)

|

1.5 Lien Pledge Agreement, dated as of October 31, 2019, relating to the 11.25% Senior Secured 1.5 Lien Notes due 2026, given by K. Hovnanian Enterprises, Inc., Hovnanian Enterprises, Inc. and the other guarantors party thereto to Wilmington Trust, National Association, as the 1.5 Lien Collateral Agent and the Joint First Lien Collateral Agent (Incorporated by reference to Exhibits to Current Report on Form 8-K of the Registrant filed on October 31, 2019).

|

|

10(zzz)

|

|

|

10(aaaa)

|

1.75 Lien Security Agreement, dated as of December 10, 2019, relating to the 10.000% Senior Secured 1.75 Lien Notes due 2025 and the 1.75 Lien Term Loans, made by K. Hovnanian Enterprises, Inc., Hovnanian Enterprises, Inc. and the other guarantors party thereto in favor of Wilmington Trust, National Association, as the 1.75 Lien Pari Passu Collateral Agent, the Joint First Lien Collateral Agent, Administrative Agent and 1.75 Lien Collateral Agent (Incorporated by reference to Exhibits to Current Report on Form 8-K of the Registrant filed December 11, 2019).

|

|

10(bbbb)

|

1.75 Lien Pledge Agreement, dated as of December 10, 2019, relating to the 10.000% Senior Secured 1.75 Lien Notes due 2025 and the 1.75 Lien Term Loans, given by K. Hovnanian Enterprises, Inc., Hovnanian Enterprises, Inc. and the other guarantors party thereto in favor of Wilmington Trust, National Association, as the 1.75 Lien Pari Passu Collateral Agent and the Joint First Lien Collateral Agent (Incorporated by reference to Exhibits to Current Report on Form 8-K of the Registrant filed December 11, 2019).

|

|

10(cccc)

|

|

|

10(dddd)

|

First Lien Collateral Agency Agreement, dated as of October 31, 2019, among K. Hovnanian Enterprises, Inc., Hovnanian Enterprises, Inc., the other guarantors party thereto and Wilmington Trust, National Association, as Administrative Agent, 1.125 Lien Collateral Agent, 1.25 Lien Collateral Agent, 1.5 Lien Collateral Agent and Joint First Lien Collateral Agent (Incorporated by reference to Exhibits to Current Report on Form 8-K of the Registrant filed on October 31, 2019).

|

|

10(eeee)

|

First Lien Intercreditor Agreement, dated as of October 31, 2019, among K. Hovnanian Enterprises, Inc., Hovnanian Enterprises, Inc., the other guarantors party thereto and Wilmington Trust, National Association, as Administrative Agent, 1.125 Lien Trustee, 1.125 Lien Collateral Agent, 1.25 Lien Trustee, 1.25 Lien Collateral Agent, 1.5 Lien Trustee, 1.5 Lien Collateral Agent and Joint First Lien Collateral Agent (Incorporated by reference to Exhibits to Current Report on Form 8-K of the Registrant filed on October 31, 2019).

|

|

10(ffff)

|

Joinder No. 1, dated as of December 10, 2019, to the First Lien Intercreditor Agreement and First Lien Collateral Agency Agreement, each dated as of October 31, 2019, among Wilmington Trust, National Association, as 1.75 Lien Trustee and 1.75 Pari Passu Lien Collateral Agent, and acknowledged by Wilmington Trust, National Association, as 1.75 Lien Collateral Agent, with acknowledged receipt by Wilmington Trust, National Association, as Senior Credit Agreement Administrative Agent, 1.125 Lien Trustee, 1.125 Lien Collateral Agent, 1.25 Lien Trustee, 1.25 Lien Collateral Agent, 1.5 Lien Trustee, 1.5 Lien Collateral Agent and Joint First Lien Collateral Agent (Incorporated by reference to Exhibits to Current Report on Form 8-K of the Registrant filed December 11, 2019).

|

|

10(gggg)

|

Joinder No. 2, dated as of December 10, 2019, to the First Lien Intercreditor Agreement and First Lien Collateral Agency Agreement, each dated as of October 31, 2019, among Wilmington Trust, National Association, as Administrative Agent and 1.75 Pari Passu Lien Collateral Agent, with acknowledged receipt by the Senior Credit Agreement Administrative Agent, 1.125 Lien Trustee, 1.125 Lien Collateral Agent, 1.25 Lien Trustee, 1.25 Lien Collateral Agent, 1.5 Lien Trustee, 1.5 Lien Collateral Agent and Joint First Lien Collateral Agent (Incorporated by reference to Exhibits to Current Report on Form 8-K of the Registrant filed December 11, 2019).

|

|

10(hhhh)*

|

Form of 2020 Performance Share Unit Agreement (Class A) (Incorporated by reference to Exhibits to Quarterly Report on Form 10-Q of the Registrant for the quarter ended July 31, 2020 of the Registrant).

|

|

10(iiii)*

|

Form of 2020 Performance Share Unit Agreement (Class B) (Incorporated by reference to Exhibits to Quarterly Report on Form 10-Q of the Registrant for the quarter ended July 31, 2020 of the Registrant).

|

|

10(jjjj)*

|

Form of 2020 Associate Restricted Share Unit Agreement (Class A) (Incorporated by reference to Exhibits to Quarterly Report on Form 10-Q of the Registrant for the quarter ended July 31, 2020 of the Registrant).

|

|

10(kkkk)*

|

Form of 2020 Associate Restricted Share Unit Agreement (Class B) (Incorporated by reference to Exhibits to Quarterly Report on Form 10-Q of the Registrant for the quarter ended July 31, 2020 of the Registrant).

|

|

10(llll)*

|

Form of Director Restricted Share Unit Agreement (Class A) (Incorporated by reference to Exhibits to Quarterly Report on Form 10-Q of the Registrant for the quarter ended July 31, 2020 of the Registrant).

|

|

21

|

|

|

23(a)

|

|

|

23(b)

|

|

|

23(c)

|

|

|

31(a)

|

|

|

31(b)

|

|

|

32(a)

|

|

|

32(b)

|

|

|

99(a)

|

|

|

99(b)

|

|

|

104

|

Cover page from our Annual Report on Form 10-K for the year ended October 31, 2020, formatted in Inline XBRL (and contained in Exhibit 101).

|

|

|

* Management contracts or compensatory plans or arrangements.

|

The agreements and other documents filed as exhibits to this report are not intended to provide factual information or other disclosure other than the terms of the agreements or other documents themselves, and you should not rely on them for that purpose. In particular, any representations and warranties made by the Company in these agreements or other documents were made solely within the specific context of the relevant agreement or document and may not describe the actual state of affairs at the date they were made or at any other time.

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this Amendment No. 1 to Annual Report on Form 10-K to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

HOVNANIAN ENTERPRISES, INC.

|

|

|

|

|

|

|

|

|

By:

|

/s/ BRAD G. O’CONNOR

|

|

|

|

|

Brad G. O’Connor

|

|

|

|

|

Senior Vice President, Treasurer and Chief Accounting Officer

|

|

|

|

|

December 22, 2020

|

|

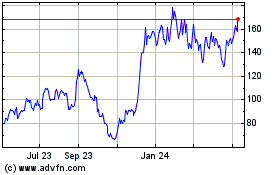

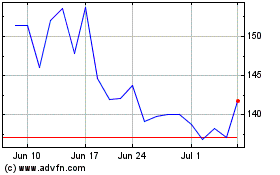

Hovnanian Enterprises (NYSE:HOV)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hovnanian Enterprises (NYSE:HOV)

Historical Stock Chart

From Apr 2023 to Apr 2024