Gannett Adopts Shareholder Rights Plan Designed to Protect its Net Operating Loss Carryforwards and other Tax Assets

April 07 2020 - 6:45AM

Business Wire

Gannett Co., Inc. (“Gannett”, the “Company” or “we”) (NYSE: GCI)

announced today that on April 6, 2020, its Board of Directors acted

to preserve and protect the Company's valuable income tax net

operating loss carryforwards (“NOLs”) and other tax assets through

adoption of a shareholder rights plan in the form of a Section 382

Rights Agreement (“Rights Agreement”).

Gannett had approximately $435 million of NOLs available as of

December 31, 2019, which could be used in certain circumstances to

offset Gannett’s future federal taxable income. Gannett’s Rights

Agreement is similar to plans adopted by numerous other public

companies with significant tax assets.

Gannett’s ability to use these tax assets and others which may

be generated would be substantially limited if Gannett experienced

an "ownership change" as defined under Section 382 of the Internal

Revenue Code. In general, an ownership change would occur if

Gannett’s shareholders who are deemed to be owners of 5 percent or

more of its shares under Section 382 collectively increase their

aggregate ownership of Gannett’s shares by more than 50 percent

(measured over a three-year period).

Under the Rights Agreement, the Board declared a non-taxable

dividend of one preferred share purchase right for each outstanding

share of common stock. The rights will be exercisable only if a

person or group acquires 4.99% or more of Gannett’s common stock.

Gannett’s existing stockholders that beneficially own in excess of

4.99% of the common stock will be "grandfathered in" at their

current ownership level and the rights then become exercisable if

any of those stockholders acquire an additional 0.5% or more of

common stock of the Company. If the rights become exercisable, all

holders of rights, other than the person or group triggering the

rights, will be entitled to purchase Gannett common stock at a 50

percent discount or Gannett may exchange each right held by such

holders for one share of common stock. Rights held by the person or

group triggering the rights will become void and will not be

exercisable. The Board of Directors has the discretion to exempt

any person or group from the provisions of the Rights

Agreement.

The rights issued under the Rights Agreement will expire on the

day following the certification of the voting results for Gannett’s

2021 annual meeting of shareholders, unless Gannett’s shareholders

ratify the Rights Agreement at or prior to such meeting, in which

case the Rights Agreement will continue in effect until April 5,

2023. Gannett’s Board also has the ability to terminate the plan if

it determines that doing so would be in the best interest of

Gannett’s shareholders. The rights may also expire at an earlier

date if certain events occur, as described more fully in the Rights

Agreement that will be filed by the Company with the Securities and

Exchange Commission.

Additional information regarding the Rights Agreement will be

contained in a Form 8-K filing with the Securities and Exchange

Commission.

About Gannett

Gannett Co., Inc. (NYSE: GCI) is an innovative, digitally

focused media and marketing solutions company committed to

strengthening communities across our network. With an unmatched

reach at the national and local level, Gannett touches the lives of

nearly 140 million people monthly with our Pulitzer-Prize winning

content, consumer experiences and benefits, and advertiser products

and services. Gannett brands include the USA TODAY and more than

260 daily local newspaper brands, digital marketing services

companies ReachLocal, WordStream, and ThriveHive and U.K. media

company Newsquest. Following the completion of their recent merger,

starting November 20, 2019, New Media Investment Group Inc. trades

on the New York Stock Exchange under Gannett Co., Inc. and its

ticker symbol has changed to “GCI”. To connect with us, visit

www.gannett.com.

Forward-Looking

Statements

Certain items in this press release may constitute

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. These statements are

based on management’s current expectations and beliefs and are

subject to a number of evolving risks and uncertainties. These and

other risks and uncertainties could cause actual results to differ

materially from those described in the forward-looking statements,

many of which are beyond our control. The Company can give no

assurance that its expectations will be attained. Accordingly, you

should not place undue reliance on any forward-looking statements

contained in this press release. Some of the risks and important

factors that could cause actual results to differ from such

forward-looking statements include, but are not limited to, the

difficulty of determining all of the facts relative to Section 382

of the Internal Revenue Code, unreported buying and selling

activity by shareholders and unanticipated interpretations of the

Internal Revenue Code and regulations, in addition to the risk

factors described in the Company’s most recent Annual Report on

Form 10-K filed with the Securities and Exchange Commission.

Furthermore, new risks and uncertainties emerge from time to time,

and it is not possible for the Company to predict or assess the

impact of every factor that may cause its actual results to differ

from those contained in any forward-looking statements. Such

forward-looking statements speak only as of the date of this press

release. The Company expressly disclaims any obligation to release

publicly any updates or revisions to any forward-looking statements

contained herein to reflect any change in the Company’s

expectations with regard thereto or change in events, conditions or

circumstances on which any statement is based.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200407005268/en/

Ashley Higgins & Stacy Cunningham, Gannett Investor

Relations investors@gannett.com (212) 479-3160 or Media: Stephanie

Tackach, Gannett Public Relations stackach@gannett.com

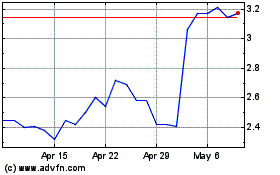

New Gannett (NYSE:GCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

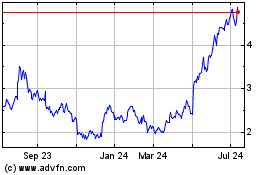

New Gannett (NYSE:GCI)

Historical Stock Chart

From Apr 2023 to Apr 2024