Current Report Filing (8-k)

June 17 2022 - 6:46AM

Edgar (US Regulatory)

0001483510false00014835102022-06-162022-06-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 16, 2022

EXPRESS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-34742 | | 26-2828128 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | |

| | |

1 Express Drive Columbus, Ohio | 43230 |

| (Address of principal executive offices) | (Zip Code) |

(614) 474-4001

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $.01 par value | | EXPR | | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On June 16, 2022, Express, Inc. (the “Company”) entered into a new employment agreement, effective June 18, 2022 (the “Employment Agreement”), with Timothy Baxter, the Company’s Chief Executive Officer. The Employment Agreement, the material terms of which are described herein, replaces the prior employment agreement between the parties, dated June 17, 2019, which was scheduled to expire by its terms on June 17, 2022. Under the Employment Agreement, Mr. Baxter’s compensation will consist of: (1) an annual base salary of $1.35 million (subject to review and increase by the Compensation and Governance Committee of the Board of Directors (the “Committee”)); (2) a short-term annual incentive target of 150% of base salary (subject to increase by the Committee, with the actual amount of any bonus based on the attainment of performance goals established by the Committee); and (3) a target annual long-term incentive award of $4.2 million, which awards shall be subject to the terms of the Company’s 2018 Incentive Compensation Plan or any successor plan (the “2018 Plan”) and applicable award agreements. On the third anniversary of the effective date of the Employment Agreement and on each subsequent anniversary thereafter, the term of Mr. Baxter’s employment under the Employment Agreement will automatically renew and extend for a period of twelve months unless written notice of non-renewal is delivered by either party to the other not less than sixty days prior to the expiration of the then-existing term.

Pursuant to the Employment Agreement, if Mr. Baxter’s employment with the Company is terminated by the Company other than for cause, or by Mr. Baxter with good reason (each as defined in the Employment Agreement), and Mr. Baxter signs a general release, then Mr. Baxter will be entitled to receive: (1) a lump sum amount equal to the product of 2.0 and his annual base salary; (2) a lump sum amount equal to the short-term incentive bonus that he would have received based on actual achievement of performance objectives if he had remained employed with the Company for one year following termination; (3) the amount of any unpaid short-term incentive bonus for any performance period ending prior to the termination date, but not yet paid; (4) a prorated bonus for the performance period during which the termination of employment occurs, based on actual achievement; and (5) a taxable lump-sum payment in an amount equal to the monthly Consolidated Omnibus Budget Reconciliation Act of 1985, as amended (“COBRA”), premium charged for the COBRA coverage elected by Mr. Baxter for himself and, if applicable, his dependents under the Company’s group medical and dental care plan multiplied by twenty-four. In addition to the amounts described above, the Company will also pay Mr. Baxter any earned but unpaid base salary as of the termination date and reimburse him for any and all monies advanced or expenses incurred through the termination date.

In the event that Mr. Baxter’s employment with the Company is terminated by the Company other than for cause, or by Mr. Baxter with good reason, and the termination occurs during the two-year period following, or six-month period preceding, a change in control of the Company (as defined in the Employment Agreement), and Mr. Baxter signs a general release, then Mr. Baxter will be entitled to: (1) an amount equal to two times his annual base salary; (2) an amount equal to one and one-half times his target annual short-term incentive bonus; (3) the amount of any unpaid short-term incentive bonus for any performance period ending prior to the termination date, but not yet paid; (4) a prorated bonus for the performance period during which the termination of employment occurs, based on actual achievement; (5) a taxable lump-sum payment in an amount equal to the monthly COBRA premium charged for the COBRA coverage elected by Mr. Baxter for himself and, if applicable, his dependents under the Company’s group medical and dental care plan multiplied by twenty-four; and (6) accelerated vesting of all outstanding equity-based and cash-based incentive awards under the 2018 Plan (based on target level of achievement for purposes of any performance-based awards).

Under the Employment Agreement, Mr. Baxter is subject to certain restrictive covenants, including non-compete and employee and customer non-solicitation obligations for a period of one year from any termination of employment.

The foregoing description of the Employment Agreement is qualified in its entirety by reference to the full text of the Employment Agreement, which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description of Exhibit |

| | Employment Agreement by and among Express, Inc., Express LLC and Timothy Baxter, dated effective June 18, 2022. |

| 104 | | The cover page from this Current Report on Form 8-K, formatted in Inline XBRL. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | EXPRESS, INC. |

Date: June 17, 2022 | | /s/ Jason Judd |

| | Jason Judd |

| | Senior Vice President, Chief Financial Officer and Treasurer |

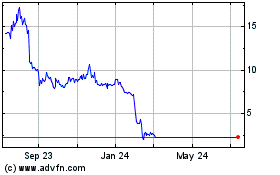

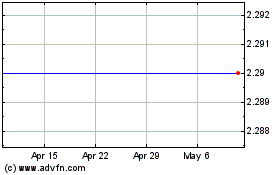

Express (NYSE:EXPR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Express (NYSE:EXPR)

Historical Stock Chart

From Apr 2023 to Apr 2024