Spending, Charge-Offs Lead to Mixed Picture for Capital One, Discover Financial

October 24 2017 - 7:37PM

Dow Jones News

By AnnaMaria Andriotis

Credit-card issuers Discover Financial Services and Capital One

Financial Corp. reported Tuesday that rising interest rates helped

results in the third quarter as consumers took on more debt.

The rising rates collected by the lenders helped to offset the

year-over-year increases in charge-offs at both companies as well

as the growing amounts they are setting aside to cover for future

loan losses.

Capital One's profit for the third quarter increased 10% to

$1.11 billion, or $2.14 a share, from $1.01 billion, or $1.90 a

share, in the year-ago period. Profit beat analyst estimates, while

earnings per share came just shy of analysts' estimates of

$2.15.

When adjusted to exclude certain items, including restructuring

charges related to "realignment" of its workforce and the closing

on its purchase of the Cabela's credit-card portfolio, Capital One

said it reported earnings of $2.42 a share. Revenue came in at

$6.99 billion, up 8% from a year prior, beating analysts'

estimates.

Capital One shares rose about 2% in after-hours trading Tuesday,

while Discover's shares were inactive.

Discover's profit for the quarter totaled $602 million, down 6%

from year prior, or $1.59 a share, compared with $1.56 a year

prior. Both figures beat estimates as did revenue that came in at

$2.53 billion, up 10% from a year prior.

Net charge-off rates, which measure loan losses, largely

improved for both companies from the prior quarter but worsened

from the year-ago period. The third quarter is often when

charge-offs are lowest for card companies. Both Capital One and

Discover loan performance figures are generally indicators of

consumers' ability to pay back their debts in part because they

lend to a range of borrowers and aren't largely focused on the

affluent.

At Discover, the credit-card net charge-off rate totaled 2.80%

in the third quarter, up 0.63 percentage point from year prior. The

company increased provisions for loan losses by 51% from a year

prior to $674 million, suggesting it expects losses to grow.

Discover's earnings press release said charge-off rates increased

in part because of an oversupply of credit that is available to

consumers.

At Capital One, domestic credit-card net charge-off rate

increased 0.90 percentage point year-over-year to 4.64% and

provisions for overall credit losses rose 15% to $1.83 billion.

Write to AnnaMaria Andriotis at annamaria.andriotis@wsj.com

(END) Dow Jones Newswires

October 24, 2017 19:22 ET (23:22 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

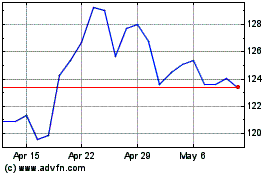

Discover Financial Servi... (NYSE:DFS)

Historical Stock Chart

From Mar 2024 to Apr 2024

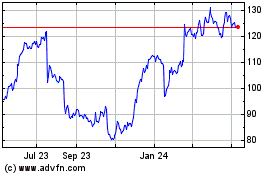

Discover Financial Servi... (NYSE:DFS)

Historical Stock Chart

From Apr 2023 to Apr 2024