As filed with the Securities and Exchange

Commission on April 16, 2019. Registration No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form

S-3

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

CURO

GROUP HOLDINGS CORP.

(Exact name of registrant as specified

in its charter)

|

Delaware

|

6199

|

90-0934597

|

(State or other jurisdiction of incorporation

or organization)

|

(Primary Standard Industrial

Classification Code Number)

|

(I.R.S. Employer Identification Number)

|

3527 North Ridge Road

Wichita, Kansas 67205

(316) 722-3801

(Address, including Zip Code, and Telephone

Number, including Area Code, of Registrant’s Principal Executive Offices)

Vin Thomas

Chief Legal Officer

3527 North Ridge Road

Wichita, Kansas 67205

(316) 722-3801

(Name, Address, including Zip Code, and

Telephone Number, including Area Code, of Agent for Service)

Copies to:

Thomas

Mark

David Cosgrove

Willkie Farr & Gallagher LLP

787 Seventh Avenue

New York, New York 10019

(212) 728-8000

Approximate date of commencement of proposed sale to the

public: From time to time after the effective date of this registration statement.

If the only securities being registered

on this form are being offered pursuant to dividend or interest reinvestment plans, please check the following box.

¨

If any of the securities being

registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933,

other than securities offered only in connection with dividend or interest reinvestment plans, check the following box.

x

If this form is filed to register

additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering.

¨

If this form is a post-effective

amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering.

¨

If this form is a registration

statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with

the Commission pursuant to Rule 462(e) under the Securities Act, check the following box.

¨

If this form is a post-effective

amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional

classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box.

¨

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions

of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging

growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

¨

|

Accelerated filer

|

x

|

|

|

|

|

|

|

Non-accelerated filer

|

¨

|

Smaller reporting company

|

¨

|

|

|

|

|

|

|

|

|

Emerging growth company

|

¨

|

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 7(a)(2)(B) of the Securities Act.

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities to Be Registered

|

|

Amount to Be

Registered (1)

|

|

|

Proposed Maximum

Offering Price per

Share (2)

|

|

|

Proposed Maximum

Aggregate Offering

Price (2)

|

|

|

Amount of

Registration

Fee

|

|

|

Common stock, par value $0.0001 per share (2)

|

|

|

32,542,555

|

(3)

|

|

$

|

11.17

|

|

|

$

|

363,500,339.35

|

|

|

$

|

44,056.24

|

|

|

|

(1)

|

Pursuant to Rule 416 under the Securities Act of 1933, as amended, the shares being registered hereunder include such indeterminate

number of shares of common stock as may be issuable with respect to the shares being registered hereunder as a result of stock

splits, stock dividends or similar transactions.

|

|

|

(2)

|

Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(c) under the Securities

Act of 1933, as amended. The proposed maximum offering price per share and proposed maximum aggregate offering price are based

on the average high and low prices of the Registrant’s common stock on April 12, 2019 as reported on the New York Stock Exchange.

|

|

|

(3)

|

Represents shares of our common stock that may be offered and sold from time to time by the selling stockholders identified

herein.

|

The registrant hereby amends this registration statement

on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment that

specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of

the Securities Act of 1933, as amended, or until this registration statement shall become effective on such date as the Securities

and Exchange Commission, acting pursuant to Section 8(a), may determine.

The information in this

prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the

Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting

an offer to buy these securities in any state or other jurisdiction where the offer or sale is not permitted.

Subject to Completion,

dated April 16, 2019

PROSPECTUS

32,542,555

Shares

CURO

GROUP HOLDINGS CORP.

Common

Stock

From time-to-time,

with this prospectus, the selling stockholders identified in this prospectus may sell up to an aggregate of 32,542,555 shares of

our common stock. As described in the section entitled "Plan of Distribution," the selling stockholders may offer and

sell the shares of common stock on any stock exchange, market or trading facility on which the shares of common stock are traded

or in private transactions, at fixed or negotiated prices, directly to purchasers or through underwriters, broker-dealers or agents,

who may receive compensation in the form of discounts, concessions or commissions. We will not receive any of the proceeds from

the sale of the shares of our common stock by the selling stockholders. In certain circumstances, we will describe the specific

manner in which these shares will be offered in supplements to this prospectus, which may also supplement, update or amend information

contained in this prospectus. Before you invest, you should carefully read this prospectus and any prospectus supplement, together

with the documents we incorporate herein by reference.

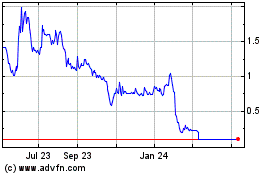

Our common stock is

listed on the New York Stock Exchange under the symbol “CURO.” On April 15, 2019, the last reported sale price of our

common stock was $11.00 per share.

INVESTING IN

OUR SECURITIES INVOLVES A HIGH DEGREE OF RISK. YOU SHOULD CAREFULLY REVIEW THE RISKS AND UNCERTAINTIES REFERENCED UNDER THE

HEADING “RISK FACTORS” ON PAGE 7 OF THIS PROSPECTUS AS WELL AS THOSE IN ANY SIMILAR SECTION CONTAINED IN ANY

APPLICABLE PROSPECTUS SUPPLEMENT AND ANY RELATED FREE WRITING PROSPECTUS, AND IN THE OTHER DOCUMENTS THAT ARE INCORPORATED BY

REFERENCE INTO THIS PROSPECTUS OR ANY APPLICABLE PROSPECTUS SUPPLEMENT.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this

prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2019

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration

statement that we filed with the Securities and Exchange Commission, or the SEC, using a “shelf” registration process.

Under this shelf registration process, the selling stockholders may, from time-to-time, offer and sell the offered securities in

one or more offerings or transactions.

In certain circumstances, we may provide

a prospectus supplement that will contain specific information about the terms of a particular offering. The prospectus supplement,

or information incorporated by reference in this prospectus or any prospectus supplement that is of a more recent date, may also

add, update or change information contained in this prospectus. To the extent that any statement that we make in a prospectus supplement

is inconsistent with statements made in this prospectus, the statements made in this prospectus will be deemed modified or superseded

by those made in the prospectus supplement. You should read both this prospectus and any prospectus supplement together with the

additional information described below under the heading “Where You Can Find More Information.” We may also authorize

one or more free writing prospectuses to be provided to you that may contain material information relating to these offerings.

You should rely only on the information

contained in or incorporated by reference in this prospectus, any accompanying prospectus supplement or in any related free writing

prospectus filed by us with the SEC. We have not authorized anyone to provide you with different information. If information is

given or representations are made, you may not rely on that information or representation as having been authorized by us. This

prospectus and any accompanying prospectus supplement do not constitute an offer to sell or the solicitation of an offer to buy

securities other than the securities described in such accompanying prospectus supplement or an offer to sell or the solicitation

of an offer to buy the securities in any circumstances in which such offer or solicitation is unlawful. You should assume that

the information appearing in this prospectus, any prospectus supplement, the documents incorporated by reference and any related

free writing prospectus is accurate only as of their respective dates, unless the information specifically indicates that another

date applies. Our business, financial condition, results of operations and prospects may have changed materially since those dates.

We are not making any representation to

you regarding the legality of an investment by you under any legal investment or similar laws or regulations. You should not consider

any information in this prospectus to be legal, business or tax advice. You should consult your own attorney, business advisor

and tax advisor for legal, business and tax advice regarding an investment in our securities.

Market data used throughout this prospectus

and the documents incorporated in this prospectus by reference, including information relating to our relative position in the

industries in which we conduct our business, is based on the good faith estimates of our management, which estimates are based

upon their review of internal surveys, independent industry publications and other publicly available information. Although we

believe these sources are reliable, we do not guarantee the accuracy or completeness of this information and we have not independently

verified this information. Although we are not aware of any misstatements regarding the market and industry data presented in this

prospectus, our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed

under the heading “Information Regarding Forward-Looking Statements” and “Risk Factors.”

We do not intend our use or display of

other companies’ tradenames, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us

by, any other company. Each trademark, tradename or service mark of any other company appearing in this prospectus is the property

of its respective holder.

We or one of our subsidiaries own or have

applied for ownership of the marks “CURO,” “CURO Financial Technologies Corp.,” “Speedy Cash®,”

“OPT+SM,” “Rapid Cash,” “Avio Credit,” “LendDirect” and “Wage Day Advance.”

All other trademarks, service marks and tradenames appearing in this prospectus are the property of their respective owners.

In this prospectus, when we refer to

|

|

•

|

“CURO,” we are referring to CURO Group Holdings Corp. and its subsidiaries

|

|

|

•

|

“CFTC,” we are referring to CURO Financial Technologies Corp., a wholly-owned subsidiary of CURO;

|

|

|

•

|

“FFL Holders,” we are referring to Friedman Fleischer & Lowe Capital Partners II,

L.P., FFL Executive Partners II, L.P. and FFL Parallel Fund II, L.P.; and

|

|

|

•

|

“Founder Holders,” we are referring to Doug Rippel, Chad Faulkner and Mike McKnight

and certain of their family trusts and affiliated entities.

|

Unless otherwise specified herein or the

context otherwise requires, all references to “$” in this prospectus refer to U.S. dollars and all references to “C$”

refer to Canadian dollars. The C$ is the functional currency of our Canadian operations.

For investors outside the United States:

neither we nor any of the selling stockholders have done anything that would permit possession or distribution of this prospectus

in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves

about and to observe any restrictions relating to the distribution of this prospectus outside of the United States.

WHERE YOU CAN FIND MORE INFORMATION

We file reports, proxy statements and other

information with the SEC under the Securities Exchange Act of 1934, or the Exchange Act. The SEC also maintains an Internet website

that contains reports, proxy statements and other information about issuers, like us, that file electronically with the SEC. The

address of that website is

www.sec.gov.

We maintain a website at

www.curo.com

. You may access our reports,

proxy statements and other information free of charge at this website as soon as reasonably practicable after such material is

electronically filed with, or furnished to, the SEC. The information on such website is not incorporated by reference and is not

a part of this prospectus.

INCORPORATION OF CERTAIN INFORMATION

BY REFERENCE

The SEC allows us to “incorporate

by reference” the information that we file with them. This allows us to disclose important information to you by referring

to those filed documents. Any information referred to in this way is considered part of this prospectus, and any information that

we file with the SEC after the date of this prospectus will automatically update and supersede this information.

We are incorporating by reference the documents

listed below, and all documents that we file after the date of this prospectus with the SEC pursuant to Section 13(a), 13(c), 14

or 15(d) of the Exchange Act prior to the termination of the offering of securities covered by this prospectus:

|

|

•

|

Annual Report on Form 10

-

K

for the year ended December 31, 2018, filed with the SEC on March 18, 2019;

|

|

|

•

|

Current Reports on Form 8

-

K

filed with the SEC on January 31, 2019 (solely with respect to Item 8.01 thereof); February 1, 2019; February 11, 2019; February

25, 2019; March 1, 2019 (solely with respect to Item 2.01 and 9.01 thereof); March 19, 2019 and April 16, 2019;

|

|

|

•

|

Definitive Proxy Statement on Schedule 14A filed with the SEC o

n April 16, 2019;

and

|

|

|

•

|

The description of our common stock contained in our registration statement on Form 8-A as filed

with the SEC on December 4, 2017, including any amendments or reports filed for the purpose of updating the description.

|

Notwithstanding the foregoing, no information

is incorporated by reference in this prospectus where such information under applicable forms and regulations of the SEC is not

deemed to be “filed” under Section 18 of the Exchange Act or otherwise subject to the liabilities of that section,

unless we indicate in the report or filing containing such information that the information is to be considered “filed”

under the Exchange Act or is to be incorporated by reference in this prospectus.

We will furnish without charge to you,

on written or oral request, a copy of any or all of the documents incorporated by reference in this prospectus, including exhibits

to these documents specifically incorporated by reference therein. You should direct any requests for documents to our Chief Legal

Officer at: c/o CURO Group Holdings Corp., 3527 North Ridge Road, Wichita, Kansas 67205.

INFORMATION REGARDING FORWARD-LOOKING

STATEMENTS

This prospectus, any prospectus supplement

and the information incorporated by reference in this prospectus include forward-looking statements that involve risks and uncertainties.

These forward-looking statements include, without limitation, statements regarding our industry, business strategy, plans, goals

and expectations concerning our market position, product expansion, future operations, margins, profitability, future efficiencies,

capital expenditures, liquidity and capital resources and other financial and operating information. When used in this discussion,

the words “may,” “believes,” “intends,” “seeks,” “anticipates,” “plans,”

“estimates,” “expects,” “should,” “assumes,” “continues,” “could,”

“will,” “future” and the negative of these or similar terms and phrases are intended to identify forward-looking

statements in this prospectus and the information incorporated by reference in this prospectus.

Forward

-

looking

statements reflect our current expectations regarding future events, results or outcomes. These expectations may or may not be

realized. Some of these expectations may be based upon assumptions or judgments that prove to be incorrect. In addition, our business

and operations involve numerous risks and uncertainties, many of which are beyond our control, which could result in our expectations

not being realized or otherwise materially affect our financial condition, results of operations and cash flows.

Our

forward

-

looking statements are not guarantees of future performance,

and actual events, results and outcomes may differ materially from our expectations suggested in any forward

-

looking

statements due to a variety of factors, including, among others, those set forth in the section entitled “Risk Factors.”

Although it is not possible to identify all of these factors, they include, among others, the following:

|

|

•

|

the identification of a material weakness in our internal control over financial reporting;

|

|

|

•

|

insufficiently providing for allowances for loan losses;

|

|

|

•

|

the adequacy of our allowance for loan losses, accrual for third-party loan losses and estimates of losses;

|

|

|

•

|

the higher levels of charge-offs we experience

due to the non

-

prime nature of our customers and the resulting

risk that we may not price our loan products appropriately in light of these charge-off levels;

|

|

|

•

|

risks associated with the failure of our proprietary credit and fraud scoring system to effectively

price the credit risk of our prospective or existing customers;

|

|

|

•

|

our failure to effectively forecast loss rates;

|

|

|

•

|

changes in demand for our products and services;

|

|

|

•

|

risks associated with effectively managing our growth;

|

|

|

•

|

our substantial indebtedness may expose us to material risks as we currently depend in large part

on debt financing to provide the cash needed to fund the loans we originate;

|

|

|

•

|

risks associated with our ability to refinance our substantial indebtedness;

|

|

|

•

|

changes in our financial condition or a potential disruption in the capital markets which could reduce available capital;

|

|

|

•

|

the lack of sufficient debt financing at acceptable prices or disruptions in the credit markets,

thereby reducing our access to credit and our ability to fund loans;

|

|

|

•

|

risks associated with a lack of sufficient debt financing made to our business on acceptable terms;

|

|

|

•

|

risks associated with disruption in the availability of our information systems;

|

|

|

•

|

adverse economic conditions which could cause demand for our loan products to decline or make it

more difficult for our customers to make payments on our loans and increase our default rates;

|

|

|

•

|

the possible impairment of goodwill;

|

|

|

•

|

the seasonality of our lending business;

|

|

|

•

|

the covenants in our debt agreements which may restrict our flexibility to operate our business;

|

|

|

•

|

implementation of new or changes in interpretation of existing accounting principles, financial reporting or tax law;

|

|

|

•

|

our ability to keep up with rapid changes in e

-

commerce,

the uses of the Internet and methods to access the same;

|

|

|

•

|

inability to affordably access third-party financing;

|

|

|

•

|

risks associated with our ability to protect our proprietary technology and analytics or keep up with that of our competitors;

|

|

|

•

|

risks associated with information provided by customers or third parties being inaccurate, and

causing us to misjudge a customer’s qualification to receive a loan;

|

|

|

•

|

risks associated with failure of third

parties who provide us products, services or support, including our ability to maintain relationships with banks and other third

-

party

electronic payment solutions providers;

|

|

|

•

|

our ability to maintain relationships with third

-

party

service providers to offer credit service organization loans in Texas;

|

|

|

•

|

the fragmentation of our industry and competition from various other sources providing similar

financial products, or other alternative sources of credit, to consumers;

|

|

|

•

|

risks related to operating outside of the United States;

|

|

|

•

|

risks related to potential inability to manage cash movements through the banking system or the

Automated Clearing House system;

|

|

|

•

|

risks associated with negative public perception of our products and services;

|

|

|

•

|

risks associated with the handling of

customer personal data and cyber

-

attacks that could result in liability

or harm to our reputation;

|

|

|

•

|

the sufficiency of indemnifications associated with assumed liabilities of acquired entities to

cover our exposures to litigation and settlement costs;

|

|

|

•

|

our ability to attract and retain qualified management and employees;

|

|

|

•

|

our ability to find suitable real estate to support future new store development;

|

|

|

•

|

the adverse impact of natural disasters and other business disruptions on our future revenue and financial condition;

|

|

|

•

|

our reliance on trademark protection to distinguish our products from the products of our competitors;

|

|

|

•

|

our ability to integrate acquisitions into our existing business operations;

|

|

|

•

|

risks associated with potential damages resulting from claims that our employees or we have wrongfully

used or disclosed alleged trade secrets of their former employers;

|

|

|

•

|

our ability to access preapproved marketing lists from credit bureaus or other developments impacting

our use of direct mail marketing;

|

|

|

•

|

the adverse impact of employee and third

-

party

theft and errors as well as liability resulting from crimes at our stores;

|

|

|

•

|

risks associated with judgments of management required in preparation of our financial statements

and certain tax positions;

|

|

|

•

|

risks associated with exiting the U.K. market and thereby decreasing the size of our total addressable market;

|

|

|

•

|

the CFPB examination authority over our U.S. consumer lending business;

|

|

|

•

|

the CFPB Rule on payday, vehicle title, and certain high

-

cost

installment loans;

|

|

|

•

|

the extent to which federal, state, local and foreign governmental regulation of consumer lending

and related financial products and services limits or prohibits the operation of our business;

|

|

|

•

|

our failure to comply with applicable laws and regulations, and resulting fines, penalties or other sanctions;

|

|

|

•

|

the impact of the complex regulatory environment in which we operate, which increases our costs

of compliance and the risk that we may fail to comply;

|

|

|

•

|

current and future litigation and regulatory proceedings against us;

|

|

|

•

|

the impact of existing, new or proposed local and state regulation of our industry;

|

|

|

•

|

risks associated with future judicial decisions or new legislation which could potentially render

our arbitration agreements unenforceable;

|

|

|

•

|

the adverse impact of material modifications of U.S. laws and regulations and existing trade agreements

by the U.S. presidential administration on our business, financial condition, and results of operations;

|

|

|

•

|

the risk that our interpretation and application of laws and regulations related to consumer lending

activities differs from the interpretations applied by federal, state, local and foreign regulatory bodies;

|

|

|

•

|

the effect of judicial decisions, agency rulemaking, or amendments to law on the legality or enforceability

of our agreements; and

|

|

|

•

|

the impact of any litigation or investigation on us, including the pending securities claims and

inquiries from governmental agencies related to our public disclosures surrounding our efforts to transition our Canadian inventory

of products from single-pay loans to open-end loans, and the sufficiency of our insurance, including our directors’ and officers’

policies.

|

Any

one of these factors or a combination of these factors could materially affect our future results of operations and could influence

whether any forward

-

looking statements ultimately prove to be accurate.

Our forward

-

looking statements speak only as of the date hereof

and are not guarantees of future performance. Actual results and future performance may differ materially from those suggested

in any forward

-

looking statements.

We and the selling stockholders undertake

no obligation to update these statements unless we are required to do so under applicable laws.

ABOUT CURO

We

are a growth

-

oriented, technology

-

enabled,

highly

-

diversified, multi

-

channel

and multi

-

product consumer finance company serving a wide range

of underbanked consumers in the United States, or U.S., Canada and, through February 25, 2019, the United Kingdom, or U.K., and

are a market leader in our industry based on revenues. We believe that we have the only true omni

-

channel

customer acquisition, onboarding and servicing platform that is integrated across store, online, mobile and contact center touchpoints.

Our IT platform, which we refer to as the “Curo Platform,” seamlessly integrates customer acquisition loan underwriting,

scoring, servicing, collections, regulatory compliance and reporting activities into a single, centralized system. We use advanced

risk analytics powered by proprietary algorithms and over 15 years of loan performance data to efficiently and effectively score

our customers’ loan applications. From January 1, 2010 through December 31, 2018, we extended over $17.1 billion in total

credit across approximately 43.8 million total loans.

We operate in the U.S. under two principal

brands, “Speedy Cash” and “Rapid Cash,” as well as under the “Avio Credit” brand, which is

currently available in 11 states. We operate in Canada under two principal brands, “Cash Money” and “LendDirect,”

which offers Installment loans online and at certain stores.

On February 25, 2019, in accordance with

the provisions of the U.K. Insolvency Act 1986 and as approved by the boards of directors of the Company’s U.K. subsidiaries,

Curo Transatlantic Limited and SRC Transatlantic Limited (collectively with Curo Transatlantic Limited, “the U.K. Subsidiaries”),

insolvency practitioners from KPMG were appointed as administrators (“Administrators”) in respect of both of the U.K.

Subsidiaries. The effect of the U.K. Subsidiaries’ entry into administration was to place the management, affairs, business

and property of the U.K. Subsidiaries under the direct control of the Administrators. Accordingly, we deconsolidated the U.K. Subsidiaries

as of February 25, 2019 and will present the U.K. Subsidiaries as Discontinued Operations beginning with our Quarterly Report on

Form 10-Q for the quarter ended March 31, 2019.

As of December 31, 2018, our store network

consisted of 413 locations across 14 U.S. states and seven Canadian provinces and we offered our online services in 27 U.S. states,

five Canadian provinces and the U.K.

We

offer a broad range of consumer finance products, including Unsecured Installment loans, Secured Installment loans, Open

-

End

loans and Single

-

Pay loans. We have tailored our products to fit

our customers’ particular needs as they access and build credit. We believe that our product suite allows us to serve a broader

group of potential borrowers than most of our competitors. The flexibility of our products, particularly our Installment and Open

-

End

products, allows us to continue serving customers as their credit needs evolve and mature. Our broad product suite creates a diversified

revenue stream and our omni

-

channel platform seamlessly delivers

our products across all contact points—we refer to it as “Call, Click or Come In.” We believe these complementary

channels drive brand awareness, increase approval rates, lower our customer acquisition costs and improve customer satisfaction

levels and customer retention. We serve the large and growing market of individuals who have limited access to traditional sources

of consumer credit and financial services.

CURO

was founded in 1997 in California and, over 20 years of operations, expanded across the U.S. and Canada, and through February 25,

2019 the U.K. CFTC (then known as Speedy Cash Holdings Corp.) was incorporated in Delaware in July 2008. In September 2008, our

founders sold or contributed all of the outstanding equity of the various operating entities that comprised the CURO business to

a wholly

-

owned subsidiary of CFTC in connection with an investment

in CFTC by Friedman Fleischer & Lowe Capital Partners II, L.P. and its affiliated funds, or FFL Partners. CURO Group Holdings

Corp. (then known as Speedy Group Holdings Corp.) was incorporated in Delaware in February 2013 as the parent company of CFTC.

On May 11, 2016, we changed the name of Speedy Group Holdings Corp. to CURO Group Holdings Corp.

Our directors (including the Founder Holders),

executive officers and the FFL Holders, together beneficially own approximately 65% of our outstanding common stock as of April

1, 2019.

Our principal business office is located

at 3527 North Ridge Road, Wichita, Kansas 67205. Our website address is

www.curo.com

. We do not incorporate the

information contained on, or accessible through, our corporate website into this prospectus, and you should not consider it to

be part of this prospectus.

RISK FACTORS

Our operations and financial results are

subject to various risks and uncertainties that could adversely affect our business, results of operations, financial condition

and future results. Please see the risk factors under the heading “Risk Factors” in our most recently filed Annual

Report on Form 10-K, as revised or supplemented by our Quarterly Reports on Form 10-Q filed with the SEC since the filing of our

most recent Annual Report on Form 10-K, all of which are incorporated by reference in this prospectus. Before making an investment

decision, you should carefully consider these risks as well as other information we include or incorporate by reference in this

prospectus and any prospectus supplement. The risks and uncertainties we have described are not the only ones facing our company.

Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our business

operations.

USE OF PROCEEDS

We will not receive any proceeds from the

sale of common stock by the selling stockholders. All proceeds from the sale of the shares of common stock will be for the accounts

of the selling stockholders. See “Selling Stockholders” and “Plan of Distribution.”

DIVIDEND POLICY

We do not currently intend to pay cash

dividends on our common stock and do not anticipate paying any dividends on our common stock in the foreseeable future. Any future

determinations relating to our dividend policies will be made at the discretion of our Board of Directors and will depend on conditions

then existing, including our financial condition, results of operations, contractual restrictions, capital requirements, business

prospects and other factors our Board of Directors may deem relevant.

DESCRIPTION OF SECURITIES

The following description of our capital

stock and certain provisions of our amended and restated certificate of incorporation and amended and restated bylaws are summaries.

You should read these summaries in conjunction with our amended and restated certificate of incorporation and amended and restated

bylaws, copies of which are filed as exhibits to the registration statement of which this prospectus is a part.

Our authorized capital stock consists of

25,000,000 shares of preferred stock, par value $0.001 per share, and 225,000,000 shares of common stock, par value $0.001 per

share. As of December 31, 2018, there were 46,412,231 shares of our common stock outstanding.

Common Stock

Voting rights

Holders of shares of our common stock are

entitled to one vote for each share of common stock held on all matters submitted to a vote of the stockholders. Generally, holders

of shares of our common stock vote together as a single class on all matters (including the election of directors) submitted to

a vote of the stockholders, unless otherwise required by law or with respect to the matters described in the immediately following

paragraph. Generally, all matters to be voted on by the stockholders must be approved by a majority of the votes cast by all shares

of common stock present in person or represented by proxy, voting together as a single class.

Notwithstanding the foregoing paragraph,

amendments to our amended and restated certificate of incorporation, including as a result of a statutory merger, that would alter

or change the powers, preferences or the common stock so as to affect them adversely must also be approved by a majority of the

votes entitled to be cast by the holders of the shares affected by the amendment, voting as a separate class. Under our amended

and restated certificate of incorporation, we may not increase or decrease the authorized number of shares of common stock without

the affirmative vote of the holders of a majority of the voting power of the outstanding shares of our capital stock entitled to

vote, voting together as a single class.

Dividend rights

Subject to preferences that may apply to

any shares of preferred stock outstanding at the time, the holders of our common stock are entitled to receive dividends out of

funds legally available if our Board of Directors, in its discretion, determines to issue dividends and then only at the times

and in the amounts that our Board of Directors may determine. See “Dividend Policy” above for additional information.

No preemptive

or similar rights

Our common stock is not entitled to preemptive

rights and is not subject to redemption or sinking fund provisions.

Right to receive

liquidation distributions

Upon

our liquidation, dissolution or winding

-

up, the assets legally

available for distribution to our stockholders would be distributable ratably among the holders of shares of our common stock and

any participating preferred stock outstanding at that time, subject to prior satisfaction of all outstanding debt and liabilities

and the preferential rights of, and the payment of liquidation preferences on, if any, any outstanding shares of preferred stock.

All

of the shares of our common stock currently issued and all shares of our common stock are fully paid and non

-

assessable.

Preferred Stock

Under the terms of our amended and restated

certificate of incorporation, our Board of Directors is authorized to issue shares of preferred stock in one or more series without

stockholder approval. Our Board of Directors has the discretion to determine the rights, preferences, privileges and restrictions,

including voting rights, dividend rights, conversion rights, redemption privileges and liquidation preferences, of each series

of preferred stock.

The purpose of authorizing our Board of

Directors to issue preferred stock and determine its rights and preferences was to eliminate delays associated with a stockholder

vote on specific issuances. The issuance of preferred stock, while providing flexibility in connection with possible future acquisitions

and other corporate purposes, will affect, and may adversely affect, the rights of holders of common stock. It is not possible

to state the actual effect of the issuance of any shares of preferred stock on the rights of holders of common stock until the

Board of Directors determines the specific rights attached to that preferred stock. The effects of issuing preferred stock could

include one or more of the following:

|

|

•

|

restricting dividends on the common stock;

|

|

|

•

|

diluting the voting power of the common stock;

|

|

|

•

|

impairing the liquidation rights of the common stock; or

|

|

|

•

|

delaying or preventing changes in control or management of us.

|

We have no preferred stock outstanding

and no present plans to issue any shares of preferred stock.

Anti

-

Takeover

Effects of Delaware Law and Our Certificate of Incorporation and Bylaws

The provisions of Delaware law and our

amended and restated certificate of incorporation and amended and restated bylaws may have the effect of delaying, deferring or

discouraging another person from acquiring control of the Company. These provisions, which are summarized below, may have the effect

of hampering takeover bids. They are also designed, in part, to encourage persons seeking to acquire control of us to negotiate

first with our Board of Directors. We believe that the benefits of increased protection of our potential ability to negotiate with

an unfriendly or unsolicited acquirer outweigh the disadvantages of discouraging a proposal to acquire us, because negotiation

of these proposals could result in an improvement of their terms.

Delaware

Anti

-

Takeover Statute

Section 203 of the General Corporation

Law of the State of Delaware prohibits a publicly held Delaware corporation from engaging, under certain circumstances, in a business

combination with an interested stockholder for a period of three years following the date the person became an interested stockholder

unless:

|

|

•

|

prior to the date of the transaction, the Board of Directors of the corporation approved either

the business combination or the transaction which resulted in the stockholder becoming an interested stockholder;

|

|

|

•

|

upon completion of the transaction that resulted in the stockholder becoming an interested stockholder,

the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction commenced,

calculated as provided under Section 203; or

|

|

|

•

|

at or subsequent to the date of the transaction,

the business combination is approved by the Board of Directors of the corporation and authorized at an annual or special meeting

of the stockholders, and not by written consent, by the affirmative vote of at least two

-

thirds

of the outstanding voting stock which is not owned by the interested stockholder.

|

Generally, a business combination includes

a merger, asset or stock sale or other transaction resulting in a financial benefit to the interested stockholder. An interested

stockholder is a person who, together with affiliates and associates, owns or, within three years prior to the determination of

interested stockholder status, did own, 15% or more of a corporation’s outstanding voting stock.

The provisions of Delaware law and the

provisions of our amended and restated certificate of incorporation and amended and restated bylaws, could have the effect of discouraging

others from attempting hostile takeovers and, as a consequence, they might also inhibit temporary fluctuations in the market price

of our common stock that often result from actual or rumored hostile takeover attempts. These provisions might also have the effect

of preventing changes in our management. It is possible that these provisions could make it more difficult to accomplish transactions

that stockholders might otherwise deem to be in their best interests.

Classified Board

Our Board of Directors

is classified into three classes of directors, and directors may be removed from office only for cause. The existence of a classified

board of directors could delay a successful tender offeror from obtaining majority control of our Board of Directors, and the prospect

of that delay might deter a potential offeror.

Undesignated

Preferred Stock

As discussed above

in “—Preferred Stock,” our Board of Directors has the ability to issue preferred stock with voting or other rights

or preferences that could impede the success of any attempt to change control of us. These and other provisions may have the effect

of deterring hostile takeovers or delaying changes in control or management of us.

No Cumulative

Voting

Under Delaware law,

the right to vote cumulatively does not exist unless the certificate of incorporation specifically authorizes cumulative voting.

Our amended and restated certificate of incorporation does not authorize cumulative voting. Therefore, stockholders holding a majority

in voting power of the shares of our stock entitled to vote generally in the election of directors are able to elect all our directors.

Action by Written

Consent

Our amended and restated certificate of

incorporation provides that actions by our stockholders may not be taken by written consent. Actions to be taken by our stockholders

may be taken only at an annual or special meeting of our stockholders.

Ability of Stockholders to Call a

Special Meeting

Our amended and restated bylaws provide

that special meetings of the stockholders may be called only by the chairperson of the Board of Directors, our Chief Executive

Officer or a majority of our Board of Directors. Stockholders may not otherwise call a special meeting, which may delay the ability

of our stockholders to force consideration of a proposal.

Requirements

for Advance Notification of Stockholder Nominations and Proposals

Our amended and restated bylaws contain

advance notice procedures with respect to stockholder proposals and the nomination of candidates for election as directors, other

than nominations made by or at the direction of our Board of Directors or a committee of our Board of Directors. These provisions

may have the effect of precluding the conduct of certain business at a meeting if the proper procedures are not followed. These

provisions may also discourage or deter a potential acquirer from conducting a solicitation of proxies to elect the acquirer’s

own slate of directors or otherwise attempting to obtain control of us.

Amendment of

Charter Provisions

The amendment of the above provisions of

our amended and restated certificate of incorporation and amended and restated bylaws requires approval by holders of at least

a majority of our outstanding capital stock entitled to vote generally in the election of directors. In addition, amendments to

our amended and restated certificate of incorporation, including as a result of a statutory merger, that would alter or change

the powers, preferences or rights of the common stock so as to affect them adversely must also be approved by a majority of the

votes entitled to be cast by the holders of the shares affected by the amendment, voting as a separate class. Under our amended

and restated certificate of incorporation, we may not increase or decrease the authorized number of shares of common stock without

the affirmative vote of the holders of a majority of the voting power of the outstanding shares of our capital stock entitled to

vote, voting together as a single class.

Choice of Forum

Our amended and restated certificate of

incorporation provides that the Court of Chancery of the State of Delaware is the exclusive forum for: (i) any derivative action

or proceeding brought on our behalf; (ii) any action asserting a breach of fiduciary duty; (iii) any action asserting a claim against

us arising pursuant to the General Corporation Law of the State of Delaware, our certificate of incorporation or bylaws; and (iv)

any action asserting a claim against us that is governed by the internal affairs doctrine.

Corporate Opportunity

Our amended and restated certificate of

incorporation provides that we renounce any interest or expectancy in, or in being offered an opportunity to participate in, any

business opportunity that may from time-to-time be presented to the FFL Holders or any of their respective officers, directors,

agents, stockholders, members, managers, partners, affiliates and subsidiaries (other than us and our subsidiaries) and that may

be a business opportunity for the FFL Holders, even if the opportunity is one that we might reasonably have pursued or had the

ability or desire to pursue if granted the opportunity to do so. No such person is liable to us for breach of any fiduciary or

other duty, as a director or officer or otherwise, to the fullest extent permitted by law, by reason of the fact that such person

pursues or acquires any such business opportunity, directs any such business opportunity to another person or fails to present

any such business opportunity, or information regarding any such business opportunity, to us. Neither the FFL Holders nor any of

their respective representatives has any duty to refrain from engaging directly or indirectly in the same or similar business activities

or lines of business as us or any of our subsidiaries.

Limitation on Director and Officer Liability and Indemnification

Our amended and restated certificate of

incorporation contains provisions that limit the liability of our directors and officers for monetary damages to the fullest extent

permitted by Delaware law. Consequently, our directors and officers are not personally liable to us or our stockholders for monetary

damages for any breach of fiduciary duties as directors or officers, except liability for:

|

|

•

|

any breach of the duty of loyalty to us or our stockholders;

|

|

|

•

|

any act or omission not in good faith or that involves intentional misconduct or a knowing violation of law;

|

|

|

•

|

any unlawful payments of dividends or unlawful stock repurchases or redemptions as provided in

Section 174 of the General Corporation Law of the State of Delaware; or

|

|

|

•

|

any transaction from which an improper personal benefit is derived.

|

Our amended and restated certificate of

incorporation and amended and restated bylaws provide that we are required to indemnify our directors and officers, in each case

to the fullest extent permitted by Delaware law. Our amended and restated bylaws also provide that we are obligated to advance

expenses incurred by a director or officer in advance of the final disposition of any action or proceeding, and permit us to secure

insurance on behalf of any officer, director, employee or other agent for any liability arising out of his or her actions in that

capacity regardless of whether we would otherwise be permitted to indemnify him or her under the provisions of Delaware law.

We have entered into agreements to indemnify

our directors and executive officers. With specified exceptions, these agreements provide for indemnification for related expenses

including, among other things, attorneys’ fees, judgments, fines and settlement amounts incurred by any of these individuals

in any action or proceeding. We believe these bylaw provisions and indemnification agreements are necessary to attract and retain

qualified persons as directors and officers. We also maintain directors’ and officers’ liability insurance.

The limitation of liability and indemnification

provisions in our amended and restated certificate of incorporation and amended and restated bylaws may discourage stockholders

from bringing a lawsuit against our directors and officers for breach of their fiduciary duty. They may also reduce the likelihood

of derivative litigation against our directors and officers, even though an action, if successful, might benefit us and other stockholders.

Further, a stockholder’s investment may be adversely affected to the extent that we pay the costs of settlement and damage

awards against directors and officers as required by these indemnification provisions. At present, there is no pending litigation

or proceeding involving any of our directors, officers or employees for which indemnification is sought, and we are not aware of

any threatened litigation that may result in claims for indemnification.

Registration Rights

The Amended and Restated Investor Rights

Agreement, dated December 11, 2017 and as further amended on May 14, 2018 and April 16, 2019 (the “Amended and Restated Investor

Rights Agreement”), provides certain holders of our common stock, including the Founders Holders and Freidman Fleisher &

Lowe Capital Partners II, L.P. (and its affiliated funds, the “FFL Funds”), subject to certain conditions, certain

registration rights. In connection with this prospectus, the parties to the Amended and Restated Investor Rights Agreement have

entered into an amendment thereto, in order to provide for certain waivers of the advance notice provisions of registration rights

under the Amended and Restated Investor Rights Agreement and the treatment of the offer and sale of shares of our common stock

by the selling stockholders contemplated by this prospectus as a demand registration thereunder.

Market Listing

Our common stock is listed on the NYSE

under the symbol “CURO.”

Transfer Agent and Registrar

The

transfer agent and registrar for our common stock is American Stock Transfer & Trust Company, LLC. The transfer agent’s

address is 6201 15th Avenue, Brooklyn, New York 11219 and telephone number is (800) 937

-

5449.

SELLING STOCKHOLDERS

The following table sets forth the number

of shares of common stock beneficially owned by the selling stockholders prior to this offering, the percentage of common stock

beneficially owned by the selling stockholders prior to this offering, the number of shares of common stock offered for sale by

the selling stockholders in this offering, the number of shares of common stock to be beneficially owned by the selling stockholders

after completion of this offering and the percentage of common stock to be beneficially owned by the selling stockholders after

the completion of this offering. We have prepared the table based on information given to us by, or on behalf of, the selling stockholders

on or before April 12, 2019. The percentage of common stock beneficially owned by the selling stockholders set forth in the table

is based on 46,431,289 shares of our common stock issued and outstanding as of April 12, 2019, the number of shares of common stock

offered hereby and registered by the registration statement of which this prospectus is a part and the number of shares of common

stock to be owned by each selling stockholder after the maximum number of shares being offered hereby are sold, which assumes that

all shares of common stock covered by this prospectus will be sold by the selling stockholders and that no additional shares of

common stock of the Company are subsequently bought or sold by the selling stockholders. However, because the selling stockholders

may offer from time-to-time all, some or none of their shares of common stock under this prospectus, or in another permitted manner,

no assurances can be given as to the actual number of shares of common stock that will be sold by the selling stockholders or that

will be held by the selling stockholders after completion of the sales. In addition, we do not know how long the selling stockholders

will hold their shares before selling them.

Unless otherwise noted below, each stockholder’s

address is c/o CURO Group Holdings Corp., 3527 North Ridge Road, Wichita, Kansas 67205.

Except as set forth in the footnotes below,

none of the selling stockholders has served as our officer or director within the last three years, nor has any selling stockholder

had a material relationship with us. No selling stockholder is either a broker-dealer or an affiliate of a broker-dealer. None

of the selling stockholders had any agreement or understanding, directly or indirectly, to distribute any of the shares being registered

at the time of purchase.

|

|

|

Shares Beneficially

Owned

Prior to Offering

|

|

|

Number of

Shares Covered

by this

Registration

|

|

|

Shares Beneficially

Owned After the

Covered Shares are

Sold

|

|

|

Name of Selling Stockholder

|

|

Number

|

|

|

Percent

|

|

|

Statement

|

|

|

Number

|

|

|

Percent

|

|

|

FFL Holders

(1)(2)

|

|

|

9,162,392

|

|

|

|

19.73

|

|

|

|

9,162,392

|

|

|

|

0

|

|

|

|

*

|

|

|

Rippel Holdings, LLC

(2)(3)(6)

|

|

|

6,883,524

|

|

|

|

14.83

|

|

|

|

6,883,524

|

|

|

|

0

|

|

|

|

*

|

|

|

McKnight Holdings, LLC

(2)(4)(6)

|

|

|

6,383,524

|

|

|

|

13.75

|

|

|

|

6,383,524

|

|

|

|

0

|

|

|

|

*

|

|

|

Exempt Family Trust c/u Leah M. Faulkner 2017 Dynasty Trust

(2)(5)(6)

|

|

|

3,191,779

|

|

|

|

6.87

|

|

|

|

3,191,779

|

|

|

|

0

|

|

|

|

*

|

|

|

Exempt Family Trust c/u Chadwick H. Faulkner 2017 Dynasty Trust

(2)(5)(6)

|

|

|

3,191,743

|

|

|

|

6.87

|

|

|

|

3,191,743

|

|

|

|

|

|

|

|

|

|

|

J.P. Genova Family Trust

(2)

|

|

|

1,894,752

|

|

|

|

4.08

|

|

|

|

1,894,752

|

|

|

|

0

|

|

|

|

*

|

|

|

Matthew Miller

(2)

|

|

|

1,272,869

|

|

|

|

2.74

|

|

|

|

1,272,869

|

|

|

|

0

|

|

|

|

*

|

|

|

James Ackerman

(2)

|

|

|

287,972

|

|

|

|

*

|

|

|

|

287,972

|

|

|

|

0

|

|

|

|

*

|

|

|

Nick Adams

(2)

|

|

|

274,000

|

|

|

|

*

|

|

|

|

274,000

|

|

|

|

0

|

|

|

|

*

|

|

|

* Represents beneficial ownership of less than 1%.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

Amounts shown reflect 8,671,443 shares of common stock held by Friedman Fleischer & Lowe Capital

Partners II, L.P., 166,371 shares of common stock held by FFL Executive Partners II, L.P. and 324,578 shares of common stock held

by FFL Parallel Fund II, L.P. The FFL Holders are controlled by Friedman Fleischer & Lowe GP II, LP, their general partner,

which may be deemed a beneficial owner of the shares of common stock, with shared voting and dispositive power over such shares.

The address of the FFL Holders is c/o FFL Partners, LLC, One Maritime Plaza, Suite 2200, San Francisco, California 94111.

|

|

|

(2)

|

In connection with the completion of our initial public offering, we entered into the Amended and

Restated Investor Rights Agreement with certain of our existing stockholders, including the FFL Holders and Founder Holders. Pursuant

to the Amended and Restated Investors Rights Agreement, we have agreed to register the sale of shares of our common stock held

by the stockholders party thereto under certain circumstances. Our directors Chris Masto and Karen Winterhof are affiliates of

the FFL Holders.

|

|

|

(3)

|

Mr. Rippel is the sole member of Rippel Holdings, LLC. Mr. Rippel is a member of our Board of Directors.

|

|

|

(4)

|

Mr. McKnight is the sole member of McKnight Holdings, LLC. Mr. McKnight is a member of our

Board of Directors.

|

|

|

(5)

|

Mr. Faulkner is the adviser of the Exempt Family Trust c/u Leah M. Faulkner 2017 Dynasty Trust

and the Exempt Family Trust c/u Chadwick H. Faulkner 2017 Dynasty Trust (the “Faulkner Trusts”). Mr. Faulkner

disclaims beneficial ownership of the shares held by the Faulkner Trusts except to the extent of his pecuniary interest therein.

Mr. Faulkner is a member of our Board of Directors.

|

|

|

(6)

|

We lease certain facilities from the Founder Holders

(either directly or through entities in which they have a material interest). For more information, please see "Certain Relationships

and Related Party Transactions" in our Definitive Proxy Statement on Schedule 14A filed with the SEC on April 16, 2019.

|

PLAN OF DISTRIBUTION

The selling stockholders (including any selling stockholder’s

transferees, assignees or other successors-in-interest) may sell the securities offered under this prospectus in any one or more

of the following ways from time-to-time:

|

|

•

|

to or through underwriters;

|

|

|

•

|

through brokers or dealers;

|

|

|

•

|

through a block trade in which the broker or dealer engaged to handle the block trade will attempt to sell the shares as agent,

but may position and resell a portion of the block as principal to facilitate the transaction;

|

|

|

•

|

directly to one or more purchasers, including through a specific bidding, auction or other process;

|

|

|

•

|

through a combination of any of these methods of sale; or

|

|

|

•

|

any other method permitted by applicable law.

|

The securities may be sold in one or more transactions at:

|

|

•

|

prevailing market prices at the time of sale;

|

|

|

•

|

prices related to the prevailing market prices;

|

|

|

•

|

varying prices determined at the time of sale; or

|

These sales may be effected in transactions:

|

|

•

|

on any national securities exchange or quotation service on which our common stock may be listed or quoted at the time of sale,

including the New York Stock Exchange;

|

|

|

•

|

in the over-the-counter market;

|

|

|

•

|

otherwise than on such exchanges or services or in the over-the-counter market;

|

|

|

•

|

through the writing of options, whether the options are listed on an options exchange or otherwise (including the issuance

by the selling stockholders of derivative securities);

|

|

|

•

|

through the settlement of short sales; or

|

|

|

•

|

through a combination of the foregoing.

|

These transactions may include block transactions or crosses.

Crosses are transactions in which the same broker acts as agent on both sides of the trade.

If required by applicable law, we will

describe in a prospectus supplement the particular terms of the offering of the securities, including the following:

|

|

•

|

the names of any agents, underwriters, brokers or dealers;

|

|

|

•

|

the purchase price of the securities and the net proceeds from the sale;

|

|

|

•

|

any underwriting discounts and other items constituting underwriters’ compensation;

|

|

|

•

|

any public offering price and any discounts or concessions allowed or reallowed or paid to dealers;

|

|

|

•

|

any securities exchanges on which the shares of common stock may be listed; and

|

|

|

•

|

any other information we think is material.

|

In addition, any selling stockholder may

sell securities covered by this prospectus in private transactions or under Rule 144 of the Securities Act of 1933 rather than

pursuant to this prospectus.

The selling stockholders may sell securities

from time-to-time through agents. We will name any agent involved in the offer or sale of such securities and will list commissions

payable to these agents in a prospectus supplement, if required. These agents will be acting on a best efforts basis to solicit

purchases for the period of their appointment, unless we state otherwise in any required prospectus supplement.

In connection with the sale of securities

covered by this prospectus, broker-dealers may receive commissions or other compensation from us or the selling stockholders in

the form of commissions, discounts or concessions. Broker-dealers may also receive compensation from purchasers of the securities

for whom they act as agents or to whom they sell as principals or both. Compensation as to a particular broker-dealer may be in

excess of customary commissions or in amounts to be negotiated. In connection with any underwritten offering, underwriters may

receive compensation in the form of discounts, concessions or commissions from us, a selling stockholder or from purchasers of

the securities for whom they act as agents. Underwriters may sell the securities to or through dealers, and such dealers may receive

compensation in the form of discounts, concessions or commissions from the underwriters and/or commissions from the purchasers

for whom they may act as agents. Any underwriters, broker-dealers, agents or other persons acting on our behalf or on behalf of

any selling stockholders that participate in a distribution of securities may be deemed to be “underwriters” within

the meaning of the Securities Act, and any profit on the sale of the securities by them and any discounts, commissions or concessions

received by any of those underwriters, broker-dealers, agents or other persons may be deemed to be underwriting discounts and commissions

under the Securities Act.

The aggregate amount of compensation in

the form of underwriting discounts, concessions or fees and any profit on the resale of shares by the selling stockholders that

may be deemed to be underwriting compensation pursuant to Financial Industry Regulatory, Inc. Rule 5110 will not exceed 8% of the

gross proceeds of the offering to the selling stockholders.

In connection with the distribution of

the common stock covered by this prospectus or otherwise, and subject to our insider trading policy to the extent applicable at

such time to a selling stockholder, the selling stockholders may enter into hedging transactions with broker-dealers or other financial

institutions. In connection with such transactions, broker-dealers or other financial institutions may engage in short sales of

our securities in the course of hedging the positions they assume with a selling stockholder. A selling stockholder may also sell

shares of common stock short and deliver the shares of common stock offered by this prospectus to close out short positions. A

selling stockholder may also enter into options or other transactions with broker-dealers or other financial institutions that

require the delivery to such broker-dealer or other financial institution of shares of common stock offered by this prospectus,

which shares such broker-dealer or other financial institution may resell pursuant to this prospectus, as supplemented or amended

to reflect such transaction. A selling stockholder may also from time to time pledge our securities pursuant to the margin provisions

of customer agreements with a broker or other agreements with lenders. Upon a default, the broker or lender may offer and sell

such pledged shares from time to time pursuant to this prospectus, as supplemented or amended to reflect such transaction.

Underwriters, agents, brokers or dealers

may be entitled, pursuant to relevant agreements entered into with us, to indemnification by us or a selling stockholder against

certain civil liabilities, including liabilities under the Securities Act that may arise from any untrue statement or alleged untrue

statement of a material fact, or any omission or alleged omission to state a material fact in this prospectus, any supplement or

amendment hereto, or in the registration statement of which this prospectus forms a part, or to contribution with respect to payments

which the underwriters, agents, brokers or dealers may be required to make.

The selling stockholders and any other

person participating in such distribution will be subject to the applicable provisions of the Exchange Act and the rules and regulations

thereunder, including, without limitation, Regulation M, which may limit the timing of purchases and sales of any of the shares

by the selling stockholders and any other participating person. Regulation M may also restrict the ability of any person engaged

in the distribution of the shares to engage in market-making activities with respect to the shares. All of the foregoing may affect

the marketability of the shares and the ability of any person or entity to engage in market-making activities with respect to the

shares.

There can be no assurance that any selling

stockholder will sell any or all of the securities registered pursuant to the registration statement of which this prospectus is

a part.

LEGAL MATTERS

Unless otherwise specified in a prospectus

supplement accompanying this prospectus, Willkie Farr & Gallagher LLP, New York, New York will pass upon the validity of the

shares of common stock offered hereby. If any legal matters relating to offerings made in connection with this prospectus are passed

upon by other counsel for underwriters, dealers or agents, such counsel will be named in the prospectus supplement relating to

any such offering.

EXPERTS

The consolidated financial statements of

CURO Group Holdings Corp. appearing in CURO Group Holdings Corp.’s Annual Report on Form 10-K for the year ended December

31, 2018 including schedules appearing therein, and the effectiveness of CURO Group Holdings Corp.’s internal control over

financial reporting as of December 31, 2018, have been audited by Grant Thornton LLP, independent registered public accounting

firm, as set forth in their reports thereon included therein, and incorporated herein by reference. Such financial statements are,

and audited financial statements to be included in subsequently filed documents will be, incorporated herein in reliance upon the

reports of Grant Thornton LLP pertaining to such financial statements and the effectiveness of our internal control over financial

reporting as of the respective dates (to the extent covered by consents filed with the SEC) given on the authority of such firm

as experts in accounting and auditing.

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution

The following table sets forth the estimated

costs and expenses, other than underwriting discounts and commissions, payable by us in connection with the sale of the securities

being registered. Pursuant to the Amended and Restated Investor Rights Agreement, we have agreed to pay these costs and expenses

on behalf of the selling stockholders. All amounts shown are estimates, except the SEC registration fee.

|

|

|

Amount to be Paid

|

|

|

SEC registration fee

|

|

$

|

44,056.24

|

|

|

Legal fees and expenses

|

|

|

400,000

|

*

|

|

Accounting fees and expenses

|

|

|

150,000

|

*

|

|

Printing Expenses

|

|

|

50,000

|

*

|

|

Miscellaneous

|

|

|

20,000

|

*

|

|

TOTAL

|

|

|

664,056.24

|

*

|

|

|

*

|

The amounts shown are estimates of expenses payable by

us in connection with the filing of this registrations statement and one underwritten offering of securities hereunder, but do

not limit the amount of securities that may be offered.

|

Item 15. Indemnification of Directors and Officers

Section 145 of the General Corporation

Law of the State of Delaware authorizes a court to award, or a corporation’s board of directors to grant, indemnity to officers

and directors under certain circumstances and subject to certain limitations. The terms of Section 145 of the General Corporation

Law of the State of Delaware are sufficiently broad to permit indemnification under certain circumstances for liabilities, including

reimbursement of expenses incurred, arising under the Securities Act of 1933, as amended.

As permitted by Section 102(b)(7) of the

General Corporation Law of the State of Delaware, the registrant’s amended and restated certificate of incorporation includes

provisions that eliminate the personal liability of its directors for monetary damages for any breach of fiduciary duties as a

director, except liability for the following:

|

|

•

|

any breach of the director’s duty of loyalty to the registrant or its stockholders;

|

|

|

•

|

acts or omissions not in good faith or that involve intentional misconduct or a knowing violation of law;

|

|

|

•

|

under Section 174 of the General Corporation Law of the State of Delaware (regarding unlawful dividends

and stock purchases); or

|

|

|

•

|

any transaction from which the director derived an improper personal benefit.

|

To the extent Section 102(b)(7) is interpreted,