Current Report Filing (8-k)

February 26 2020 - 4:29PM

Edgar (US Regulatory)

false0001051470

0001051470

cci:A6.875MandatoryConvertiblePreferredStockMember

2020-02-25

2020-02-25

0001051470

us-gaap:CommonStockMember

2020-02-25

2020-02-25

0001051470

2020-02-25

2020-02-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 25, 2020

Crown Castle International Corp.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-16441

|

|

76-0470458

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

1220 Augusta Drive, Suite 600, Houston, Texas 77057-2261

(Address of principal executives office) (Zip Code)

Registrant's telephone number, including area code: (713) 570-3000

|

|

|

|

|

(Former name or former address, if changed since last report.)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

|

|

|

|

☐

|

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 par value

|

CCI

|

New York Stock Exchange

|

|

6.875% Mandatory Convertible Preferred Stock, Series A, $0.01 par value

|

CCI.PRA

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 2.02 — RESULTS OF OPERATIONS AND FINANCIAL CONDITION

On February 26, 2020, Crown Castle International Corp. ("Company") issued a press release disclosing its financial results for fourth quarter and full year ended December 31, 2019. The February 26, 2020 press release is furnished herewith as Exhibit 99.1.

ITEM 4.02 — NON-RELIANCE ON PREVIOUSLY ISSUED FINANCIAL STATEMENTS OR A RELATED AUDIT REPORT OR COMPLETED INTERIM REVIEW

(a)

Correction of Errors in Previously Issued Financial Statements

Following review of the Company's accounting policies for tower installation services, we identified historical errors related to the timing of revenue recognition for such services. Due to these errors, on February 25, 2020, the Audit Committee of the Company’s Board of Directors, after considering the recommendation of management and after discussion with the Company’s independent registered public accounting firm, PricewaterhouseCoopers LLP, concluded that the following financial statements previously issued by the Company should no longer be relied upon: (1) audited consolidated financial statements and related disclosures for years ended December 31, 2016 through and including 2018 and (2) unaudited financial statements and related disclosures for the quarterly and year-to-date periods during 2018 and for the first three quarters of fiscal year 2019. As a result, the Company is restating its financial statements for the years ended December 31, 2018 and 2017 and unaudited financial information for the quarterly and year-to-date periods in the year ended December 31, 2018 and for the first three quarters in the year ended December 31, 2019. The restatement also affects periods prior to 2017, and the cumulative effect of the errors is expected to be reflected in the Company's Annual Report on Form 10-K for the year ended December 31, 2019 ("2019 10-K") as an adjustment to opening “Dividends/distributions in excess of earnings” as of January 1, 2017.

The restated financial statements and financial information will be included in the 2019 10-K, which the Company expects to file by the time period prescribed for such filing, including any available extension if needed to finalize the consolidated financial statements and disclosures and complete the associated audit work. Specifically, the Company intends to include in its 2019 10‑K, the restated 2018 and 2017 year-end financial statements in its consolidated financial statements and include the restated quarterly financial information in the unaudited quarterly financial information note to the consolidated financial statements. The Company does not intend to file amended Quarterly Reports on Form 10-Q to reflect the restatement.

Identification of Material Weakness

The Company has determined that the restatement of the Company's previously issued financial statements as described above indicates the existence of one or more material weaknesses in its internal control over financial reporting and that the Company's internal control over financial reporting and disclosure controls and procedures were ineffective as of December 31, 2019. The Company will report the material weakness(es) in its 2019 10-K and intends to create a plan of remediation to address the material weakness(es).

ITEM 7.01 — REGULATION FD DISCLOSURE

The press release referenced in Item 2.02 above refers to certain supplemental information that was posted as a supplemental information package on the Company's website on February 26, 2020. The supplemental information package is furnished herewith as Exhibit 99.2.

ITEM 9.01 — FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits

Exhibit Index

As described in Item 2.02 and 7.01 of this Current Report on Form 8-K ("Form 8-K"), the following exhibits are furnished as part of this Form 8-K:

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

99.1

|

|

|

|

99.2

|

|

|

|

104

|

|

Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document

|

The information in Items 2.02 and 7.01 of this Form 8-K and Exhibits 99.1 and 99.2 attached hereto shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended ("Exchange Act"), or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Cautionary Language Regarding Forward Looking Statements

This Current Report on Form 8-K contains forward-looking statements and information that are based on the current expectations of the management of the Company. Statements that are not historical facts are hereby identified as forward-looking statements. Words such as “may,” “should,” “could,” “estimate,” “anticipate,” “project,” “plan,” “intend,” “believe,” “expect,” “likely,” “predicted,” “positioned,” and any variations of these words and similar expressions are intended to identify such forward looking statements.

The forward-looking statements included in this report are based on our current expectations, projections, estimates and assumptions. These statements are only predictions, not guarantees. Such forward-looking statements are subject to numerous risks and uncertainties that are difficult to predict. These risks and uncertainties may cause actual results to differ materially from what is indicated in such forward-looking statements, and include, without limitation, the following: the timing of the filing of the 2019 10-K; the financial statements to be restated and the filing in which such restated financial statements will appear; additional restatement-related information that will be reflected in the 2019 10-K; the Company's intent to report one or more material weaknesses in its internal control over financial reporting; the Company's intent to create a remediation plan; and other factors described from time to time in our filings with the Securities and Exchange Commission.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CROWN CASTLE INTERNATIONAL CORP.

|

|

|

|

By:

|

/s/ Kenneth J. Simon

|

|

|

|

|

Name:

|

Kenneth J. Simon

|

|

|

|

|

Title:

|

Senior Vice President

and General Counsel

|

|

Date: February 26, 2020

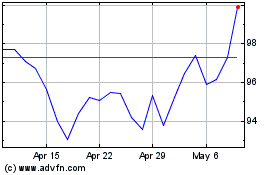

Crown Castle (NYSE:CCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

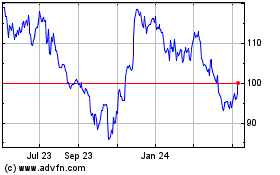

Crown Castle (NYSE:CCI)

Historical Stock Chart

From Apr 2023 to Apr 2024