Initial Statement of Beneficial Ownership (3)

October 29 2020 - 5:02PM

Edgar (US Regulatory)

FORM 3

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

INITIAL STATEMENT OF BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0104

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

HENDERSON DAVID GORDON |

2. Date of Event Requiring Statement (MM/DD/YYYY)

10/22/2020

|

3. Issuer Name and Ticker or Trading Symbol

Barnes & Noble Education, Inc. [BNED]

|

|

(Last)

(First)

(Middle)

C/O BARNES & NOBLE EDUCATION, INC., 120 MOUNTAINVIEW BLVD. |

4. Relationship of Reporting Person(s) to Issuer (Check all applicable)

_____ Director _____ 10% Owner

___X___ Officer (give title below) _____ Other (specify below)

Pres, MBS; EVP, Strat Services / |

|

(Street)

BASKING RIDGE, NJ 07920

(City)

(State)

(Zip)

| 5. If Amendment, Date Original Filed(MM/DD/YYYY)

| 6. Individual or Joint/Group Filing(Check Applicable Line)

_X_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Beneficially Owned

|

1.Title of Security

(Instr. 4) | 2. Amount of Securities Beneficially Owned

(Instr. 4) | 3. Ownership Form: Direct (D) or Indirect (I)

(Instr. 5) | 4. Nature of Indirect Beneficial Ownership

(Instr. 5) |

| Common Stock | 198462 (1)(2) | D | |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 4) | 2. Date Exercisable and Expiration Date

(MM/DD/YYYY) | 3. Title and Amount of Securities Underlying Derivative Security

(Instr. 4) | 4. Conversion or Exercise Price of Derivative Security | 5. Ownership Form of Derivative Security: Direct (D) or Indirect (I)

(Instr. 5) | 6. Nature of Indirect Beneficial Ownership

(Instr. 5) |

| Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Non-Qualified Stock Option (Right to Buy) | 9/22/2021 (3) | 9/22/2030 | Common Stock | 54258.0 | $2.46 | D | |

| Non-Qualified Stock Option (Right to Buy) | 9/22/2021 (4) | 9/22/2030 | Common Stock | 54258.0 | $5.0 | D | |

| Phantom Share Unit | 9/22/2021 | 9/22/2023 | Common Stock | 118902.0 | (5) | D | |

| Explanation of Responses: |

| (1) | Shares include 52,380 Performance Share Units (PSUs) which are earned based on a combination of the Company's performance over the performance period as measured by absolute total shareholder return reflected by the BNED Common Stock price (50% of the PSUs) and BNED Adjusted EBITDA (50% of the PSUs). The performance period is the two year period beginning April 28, 2019 and ending on May 1, 2021. Earned PSUs will be converted to shares of Company Common Stock on a one-for-one basis after the expiration of an additional one year holding period ending on June 19, 2022. Unearned PSUs and earned PSUs that have not satisfied the one-year holding period will be forfeited. |

| (2) | Shares include 55,113 Restricted Stock Units(RSUs). Each RSU represents the contingent right to receive one share of Company common stock, par value $0.01. 17,460 RSUs will vest on each of June 19, 2021 and June 19, 2022, and 20,193 RSUs will vest on September 26, 2021, or in each case, if such date is not a business day, the business day immediately following such date. |

| (3) | Non-qualified Stock Options granted with an exercise price of $2.46 per share, which was the fair market value on the date of grant. These Options will vest in four equal installments on each of September 22, 2021, September 22, 2022, September 22, 2023 and September 22, 2024 and will expire on September 22, 2030 |

| (4) | Non-qualified Stock Options granted with an above market exercise price of $5 per share. These Options will vest in four equal installments on each of September 22, 2021, September 22, 2022, September 22, 2023 and September 22, 2024 and will expire on September 22, 2030. |

| (5) | Each phantom share represents the economic equivalent to one share of common stock of the Company and will be settled in cash based on the fair market value of a share of common stock at each vesting date in an amount not to exceed $7.38 per share. The phantom shares vest and will be settled in three equal installments on each of September 22, 2021, September 22, 2022 and September 22, 2023, or in each case, if such date is not a business day, the business day immediately following such date. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

HENDERSON DAVID GORDON

C/O BARNES & NOBLE EDUCATION, INC.

120 MOUNTAINVIEW BLVD.

BASKING RIDGE, NJ 07920 |

|

| Pres, MBS; EVP, Strat Services |

|

Signatures

|

| /s/ David G. Henderson | | 10/29/2020 |

| **Signature of Reporting Person | Date |

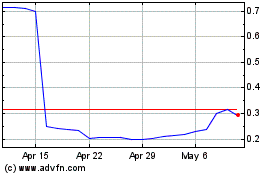

Barnes and Noble Education (NYSE:BNED)

Historical Stock Chart

From Mar 2024 to Apr 2024

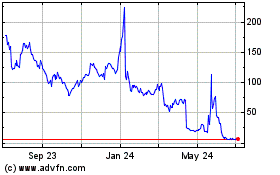

Barnes and Noble Education (NYSE:BNED)

Historical Stock Chart

From Apr 2023 to Apr 2024