Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

May 03 2023 - 6:02AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of May, 2023

Commission File Number 001-36671

Atento S.A.

(Translation of Registrant's name into English)

1, rue Hildegard Von Bingen, 1282, Luxembourg

Grand Duchy of Luxembourg

(Address of principal executive office)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F: x Form 40-F: o

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes: o No: x

Note: Regulation S-T Rule 101(b)(1) only permits the

submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes: o No: x

Note: Regulation S-T Rule 101(b)(7) only permits

the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must

furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the

registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities

are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the

registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other

Commission filing on EDGAR.

Atento S.A. (NYSE: ATTO,

“Atento” or the “Company”) has determined that it is unable, without unreasonable effort or expense, to file its

Annual Report on Form 20-F for the year ended December 31, 2022 (the “Annual Report”) within the prescribed time period.

The main reason for this delay is that the Company has not yet finalized its assessment of the effectiveness of its internal controls

over financial reporting and its financial statement due to some complexities that have arisen from the implementation of its new Enterprise

Resource Planning (“ERP”) system during the fiscal year ended December 31, 2022. Upon complete resolution by the Company of

the existing complexities, its auditor, Deloitte Touche Tohmatsu Auditores Independentes Ltda, will finalize its related audit procedures.

Although the Company intends

to finalize its financial statements and file the related 20-F as soon as practicable, it does not currently expect to file the 20-F by

the extended filing date pursuant to Rule 12b-25.

Based on preliminary financial

results for the twelve months ended December 31, 2022, the Company anticipates a significant change in loss for the year to the same period

for the last fiscal year that will be reflected in the consolidated statement of loss to be included in the Annual Report.

Loss for the year ended December

31, 2022 is expected to be in the range of $180 million to $250 million. This estimate is still subject to revision. The primary reasons

for the anticipated change are: (1) an expected write-off of deferred tax assets in the range of US$ 40 million to US$ 60 million, based

on management's determination that future taxable income is not likely to be sufficient to realize these deferred tax assets; and (2)

the impact of expected changes in financial instruments measured at fair value, in the range of $50 million to $100 million related to

company's agreements on interest rate cross currency swap arrangements, primarily due to increases in underlying interest rates.

On May 2, 2023, Atento issued

a press release about the expected delay in the filing of the Annual Report, which is attached as exhibit 99.1.

Forward-Looking Statements

This report contains forward-looking statements. Forward-looking

statements can be identified by the use of words such as "may," "should," "expects," "plans,"

"anticipates," "believes," "estimates," "predicts," "intends," "continue"

or similar terminology. In particular, these forward-looking statements include those about the appointment of a replacement director

to the Company’s Board of Directors. These statements reflect only Atento’s current expectations and are not guarantees of

future events. These statements are subject to risks and uncertainties that could cause actual results and events to differ materially

from those contained in the forward-looking statements. Such risks and uncertainties include, but are not limited to, the Company’s

ability to attract and enter into satisfactory agreements securing the services of qualified director candidates. Atento is also subject

to other risk factors described in documents filed by the Company with the United States Securities and Exchange Commission. These forward-looking

statements speak only as of the date on which the statements were made. Atento undertakes no obligation to update or revise publicly any

forward-looking statements, whether as a result of new information, future events or otherwise.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

ATENTO S.A. |

| Date: May 2, 2023 |

By: /s/ Dimitrius Oliveira

Name: Dimitrius Oliveira

Title: Chief Executive Officer |

| |

|

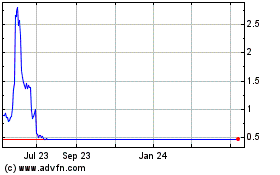

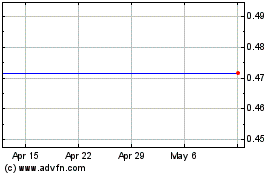

Atento (NYSE:ATTO)

Historical Stock Chart

From Apr 2024 to May 2024

Atento (NYSE:ATTO)

Historical Stock Chart

From May 2023 to May 2024