Current Report Filing (8-k)

June 29 2020 - 8:46AM

Edgar (US Regulatory)

0000001750

false

Common Stock, $1.00 par value

AIR

Preferred Stock Purchase Rights

AIR

0000001750

2020-06-22

2020-06-23

0000001750

us-gaap:CommonStockMember

exch:XCHI

2020-06-22

2020-06-23

0000001750

us-gaap:PreferredStockMember

exch:XCHI

2020-06-22

2020-06-23

0000001750

us-gaap:CommonStockMember

exch:XNYS

2020-06-22

2020-06-23

0000001750

us-gaap:PreferredStockMember

exch:XNYS

2020-06-22

2020-06-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

|

Common Stock, $1.00 par value

|

|

AIR

|

|

|

Preferred Stock Purchase Rights

|

|

AIR

|

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event

Reported): June 23, 2020

AAR CORP.

(Exact name of registrant as specified in

its charter)

|

Delaware

|

|

1-6263

|

|

36-2334820

|

|

(State of Incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

One AAR Place

1100 N. Wood Dale Road

Wood Dale, Illinois 60191

(Address and Zip Code of Principal Executive

Offices)

Registrant’s telephone number, including

area code: (630) 227-2000

Not Applicable

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

¨

|

Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of

the Act:

|

Title of each class:

|

|

Trading Symbol(s):

|

|

Name of each exchange on which registered:

|

|

Common Stock, $1.00 par value

|

|

AIR

|

|

New York Stock Exchange

|

|

|

|

|

|

Chicago Stock Exchange

|

|

Preferred Stock Purchase Rights

|

|

AIR

|

|

New York Stock Exchange

|

|

|

|

|

|

Chicago Stock Exchange

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§ 240.12b—2 of this chapter).

Emerging

growth company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.06. Material Impairments.

On June 23, 2020,

AAR Manufacturing, Inc., an Illinois corporation and wholly-owned subsidiary (the “Seller”) of AAR CORP., a

Delaware corporation (the “Company”), entered into an asset purchase agreement (the “Agreement”) with

AE OpCo III LLC, a Delaware limited liability company (“Architect”), pursuant to which Architect will purchase

substantially all of Seller’s assets exclusively related to the design, fabrication and assembly of aerostructures and

aerospace products at facilities located in Clearwater, Florida and Sacramento, California for customers in the commercial

aerospace and defense industries (the “Composites Business”), as well as assume certain related liabilities as

set forth in the Agreement. The Composites Business is not core to the Company’s connected aviation services strategy,

and the transaction will allow the Company to further prioritize its efforts in its principal businesses. The transaction is

expected to close in the third quarter of calendar year 2020 and is subject to the satisfaction of customary closing

conditions. A copy of the Company’s press release is attached hereto as Exhibit 99.1.

In connection with

the entry into the Agreement, we anticipate recognizing an impairment charge of approximately $20 million in the first quarter

of fiscal 2021. The impairment charge reduces the net assets of the Composites Business to the estimated net proceeds we expect

to receive which is comprised of both cash received at closing of the transaction and the fair value of contingent consideration

related to achievement of sales targets for the Composites Business over the next three years.

This Form 8-K contains

certain forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. These forward-looking

statements include statements that address activities, events, conditions or developments that we expect or anticipate may occur

in the future and may relate to anticipated impairment charges.

Forward-looking statements may also be identified because they contain words such as ‘‘anticipate,’’ ‘‘believe,’’

‘‘continue,’’ ‘‘could,’’ ‘‘estimate,’’ ‘‘expect,’’

‘‘intend,’’ ‘‘likely,’’ ‘‘may,’’ ‘‘might,’’

‘‘plan,’’ ‘‘potential,’’ ‘‘predict,’’ ‘‘project,’’

‘‘seek,’’ ‘‘should,’’ ‘‘target,’’ ‘‘will,’’

‘‘would,’’ or similar expressions and the negatives of those terms. These forward-looking statements are

based on beliefs of our management, as well as assumptions and estimates based on information available to us as of the dates such

assumptions and estimates are made, and are subject to certain risks and uncertainties that could cause actual results to differ

materially from historical results or those anticipated, depending on a variety of factors, including those factors set forth under

‘‘Risk Factors’’ under Part II, Item 1A of our Quarterly Report on Form 10-Q for the quarter ended February

29, 2020 and Part I, Item 1A in our Annual Report on Form 10-K for the year ended May 31, 2019, which are incorporated by reference

herein. Should one or more of those risks or uncertainties materialize adversely, or should underlying assumptions or estimates

prove incorrect, actual results may vary materially from those described. Those events and uncertainties are difficult or impossible

to predict accurately and many are beyond our control. We assume no obligation to update any forward-looking statements to reflect

events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

99.1

|

|

Press Release issued by AAR CORP. dated June 29, 2020.

|

|

|

|

|

|

101

|

|

Cover Page Interactive Data—the cover page XBRL tags are

embedded within the Inline XBRL document.

|

|

|

|

|

|

104

|

|

Cover Page Interactive Data File (the cover page XBRL tags are

embedded in the Inline XBRL document).

|

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: June 29, 2020

|

|

|

|

|

|

AAR CORP.

|

|

|

|

By:

|

/s/ Sean Gillen

|

|

|

|

|

Sean Gillen

|

|

|

|

|

Vice President, Chief Financial Officer

|

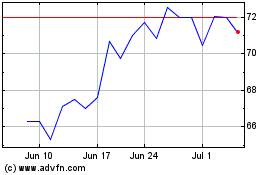

AAR (NYSE:AIR)

Historical Stock Chart

From Mar 2024 to Apr 2024

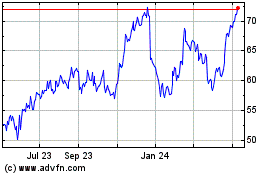

AAR (NYSE:AIR)

Historical Stock Chart

From Apr 2023 to Apr 2024