Current Report Filing (8-k)

May 18 2020 - 4:21PM

Edgar (US Regulatory)

0001232582

false

0001232582

2020-05-11

2020-05-12

0001232582

us-gaap:CommonStockMember

2020-05-11

2020-05-12

0001232582

us-gaap:SeriesDPreferredStockMember

2020-05-11

2020-05-12

0001232582

us-gaap:SeriesFPreferredStockMember

2020-05-11

2020-05-12

0001232582

us-gaap:SeriesGPreferredStockMember

2020-05-11

2020-05-12

0001232582

us-gaap:SeriesHPreferredStockMember

2020-05-11

2020-05-12

0001232582

aht:PreferredStockSeriesIMember

2020-05-11

2020-05-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 12, 2020

ASHFORD HOSPITALITY TRUST, INC.

(Exact name of registrant as specified in its charter)

|

Maryland

|

|

001-31775

|

|

86-1062192

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Commission file number)

|

|

(I.R.S. Employer Identification

Number)

|

|

14185 Dallas Parkway, Suite 1100

|

|

|

|

Dallas, Texas

|

|

75254

|

|

(Address of principal executive

offices)

|

|

(Zip Code)

|

Registrant’s

telephone number, including area code: (972) 490-9600

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

¨

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check

mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of

this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Securities registered pursuant to Section

12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock

|

|

AHT

|

|

New York Stock Exchange

|

|

Preferred Stock, Series D

|

|

AHT-PD

|

|

New York Stock Exchange

|

|

Preferred Stock, Series F

|

|

AHT-PF

|

|

New York Stock Exchange

|

|

Preferred Stock, Series G

|

|

AHT-PG

|

|

New York Stock Exchange

|

|

Preferred Stock, Series H

|

|

AHT-PH

|

|

New York Stock Exchange

|

|

Preferred Stock, Series I

|

|

AHT-PI

|

|

New York Stock Exchange

|

Item 2.04 Triggering Events That Accelerate or

Increase a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement.

On May 12, 2020, Ashford

New York LP (the “Borrower”), a subsidiary of Ashford Hospitality Trust, Inc. (the “Company”),

received an Acceleration Notice from Wells Fargo Bank, National Association, as Trustee for the benefit of the registered holders

of J.P. Morgan Chase Commercial Mortgage Securities Trust 2019-EMBSY, Commercial Mortgage Pass-Through Certificates, Series 2019-EMBSY

(the “Noteholder”) relating to a loan made on January 22, 2019 to Borrower in the original principal amount

of $108,750,000 (the “Loan”). The Loan is currently held by Noteholder and is evidenced by a Loan Agreement

dated January 22, 2019 (the “Loan Agreement”). Midland Loan Services, a division of PNC Bank, National Association

is the special servicer of the Loan for Noteholder. On April 1, 2020 and May 1, 2020, the Borrower failed to make monthly payments

that were due under the Loan. The failure to make such payments constituted an Event of Default, as such term is defined in the

Loan Agreement. Pursuant to the Acceleration Notice, Noteholder notified the Borrower that it was accelerating the Loan in full.

Pursuant to the Acceleration Notice, the Trustee demanded immediate payment of $108,772,028.20, which is the sum of all principal

and accrued interest amounts due under the Loan Agreement, together with default interest, a prepayment premium, a reconveyance/payoff

fee, a bank account maintenance fee, interest on advances, a special servicing fee, a liquidation fee, per diem interest through

the date of indefeasible payment in full, plus $60,000.00 to secure payment of legal fees incurred and anticipated to be incurred

by Trustee.

The Loan is secured by

a mortgage lien against the Embassy Suites Midtown Manhattan hotel and is non-recourse to the Company. The Acceleration Notice

does not trigger any cross default clauses in other loans taken out by subsidiaries of the Company (and the Company itself does

not have any loans or indebtedness at the parent company level).

Item 7.01 Regulation FD Disclosure.

Nearly

all of the Company’s properties are pledged as collateral for a variety of loans. On or about March 17, 2020, we

sent notice to all of our lenders notifying such lenders that the spread of the novel strain of coronavirus (COVID-19) was

having a significant impact on the travel and hospitality industry and that our hotels were experiencing a severe decrease in

revenue resulting in a negative impact on cash flow. While our loan agreements do not contain forbearance rights, we

requested a modification to the terms of the loans. Specifically, we requested that for a period of time, shortfalls in

debt service payments accrue without penalty and all extension options be deemed granted notwithstanding the existence of any

debt service payment accruals. Beginning on April 1, 2020, we did not make principal or interest payments under nearly all of

our loan agreements, which constituted an “Event of Default” as such term is defined under the applicable loan

agreement. Pursuant to the terms of the applicable loan agreement, such an Event of Default caused an automatic

increase in the interest rate on our outstanding loan balance for the period such Event of Default remains outstanding.

Following an Event of Default, our lenders can generally elect to accelerate all principal and accrued interest payments that

remain outstanding under the applicable loan agreement and start to foreclose on the applicable hotel properties that are

security for such loans. The Company is in the process of negotiating forbearance agreements with its lenders. At this

time, we cannot predict the likelihood that these forbearance agreement discussions will be successful in modifying such

terms.

On May 8, 2020, Ashford

Scotts Valley LP, a subsidiary of the Company, received an Acceleration Notice from U.S. Bank National Association, as Trustee,

for the benefit of the registered holders of GS Mortgage Securities Corporation II, Commercial Mortgage Pass-Through Certificates,

Series 2015-GC30 (the “2015 Noteholder”) relating to a loan made on March 6, 2015 and assumed by Ashford Scotts

Valley LP on February 26, 2019, in the original principal amount of $27,020,000.00 (the “2015 Loan”). The 2015

Loan is currently held by the 2015 Noteholder and is evidenced by a Loan Agreement dated as of March 6, 2015 (the “2015

Loan Agreement”). Midland Loan Services, a division of PNC Bank, National Association is the special servicer of the

2015 Loan for 2015 Noteholder. On April 6, 2020 and May 6, 2020, the Company failed to make monthly payments that were due under

the 2015 Loan. The failure to make such payments constituted an Event of Default, as such term is defined in the 2015 Loan Agreement.

Pursuant to the Acceleration Notice, the 2015 Noteholder notified Ashford Scotts Valley LP that it was accelerating the Loan in

full. Pursuant to the Acceleration Notice, the 2015 Noteholder demanded immediate payment of $27,020,000.00, which is the sum of

all principal and accrued interest amounts, plus late charges, default interest, attorney’s fees, and advances of costs and

expenses. Pursuant to the Acceleration Notice, the Trustee demanded immediate payment of the outstanding principal amount of the

Loan, plus late charges, default interest, attorney’s fees and costs and expenses. The 2015 Loan is secured by a mortgage

lien against the Hilton Scotts Valley hotel in Santa Cruz, California.

The information in this

Form 8-K and Exhibits attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange

Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, except as shall be

expressly set forth by specific reference in such filing.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

ASHFORD HOSPITALITY TRUST, INC.

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Deric S. Eubanks

|

|

|

|

Deric S. Eubanks

Chief Financial Officer

|

Date: May 18, 2020

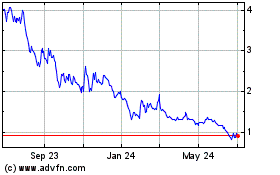

Ashford Hospitality (NYSE:AHT)

Historical Stock Chart

From Apr 2024 to May 2024

Ashford Hospitality (NYSE:AHT)

Historical Stock Chart

From May 2023 to May 2024