Anthracite Capital, Inc. (NYSE:AHR) (the "Company" or

"Anthracite") reported net loss available to common stockholders

for the third quarter of 2009 of $(0.51) per share, compared to

$(0.03) per share for the same three-month period in 2008. (All

currency amounts discussed herein are in thousands, except share

and per share amounts. All per share information is presented on a

diluted basis. Prior year amounts have been restated for the

adoption of recently issued guidance related to accounting for

convertible debt instruments).

Operating Earnings (defined below) for the third quarters of

2009 and 2008 were $0.03 and $0.32 per share, respectively.

Operating Earnings is a non-GAAP measure. Table 1, provided below,

reconciles Operating Earnings per share to diluted net income

(loss) per share available to common stockholders.

Update on Financial Condition

Given the circumstances described below, substantial doubt

continues to exist about the Company's ability to continue as a

going concern.

As of September 30, 2009, the Company had $297 of unrestricted

cash and cash equivalents, compared with $9,686 at December 31,

2008. As described in further detail below, the Company failed to

meet amortization payment requirements under its secured facilities

with Bank of America, Deutsche Bank and Morgan Stanley (the

"secured bank facilities") and has until December 29, 2009 to cure

such shortfall (as of November 1, 2009, over $1,315) or an event of

default will occur. During the cure period, all the cash flows from

the Company's assets are being diverted to a cash management

account for the benefit of the Company's secured bank lenders

subject to limited exceptions approved by them.

The Company did not make interest payments due on October 30,

2009 (approximately $1,554) on three series of its senior notes.

Under the indentures governing these notes, the failure to make an

interest payment is subject to a 30-day cure period before

constituting an event of default. Unless the secured bank lenders

allow the Company to access some of the cash flow currently being

diverted into the cash management account or the holders of these

notes agree to a refinancing or agree to waive the defaults, the

Company will not be able to make interest payments on these notes

and events of default will occur on November 30, 2009. An event of

default under these notes, absent a waiver, would trigger

cross-default and cross-acceleration provisions in the Company’s

secured bank facilities and its credit facility with BlackRock

Holdco 2, Inc. ("Holdco 2") and, if any such debt were accelerated,

would trigger a cross-acceleration provision in the Company’s

convertible notes indenture. If acceleration were to occur, the

Company would not have sufficient liquid assets available to repay

such indebtedness and, unless the Company was able to obtain

additional capital resources or waivers, the Company would be

unable to continue to fund its operations or continue its

business.

In addition, for the quarter ended September 30, 2009, the

Company is in breach of a covenant in its secured bank facilities

that requires the Company's operating earnings (as defined in the

applicable secured bank facility) not be less than a specified

amount at quarter end. Unless waived, this breach could lead to an

event of default and acceleration and lead to the consequences

described in the preceding paragraph. The Company also continues to

be in breach of the covenant in its secured facility with Holdco 2

that requires the Company to immediately repay outstanding

borrowings under the facility to the extent outstanding borrowings

exceed 60% of the fair market value (as determined by the Company's

manager, BlackRock Financial Management, Inc. (the ''Manager'')) of

the shares of common stock of Carbon Capital II, Inc. (''Carbon

II'') securing such facility. In March 2009, Holdco 2 waived the

Company's failure to repay borrowings in accordance with this

covenant until April 1, 2009 and subsequently extended this waiver

until January 22, 2010.

Based on the Company's current liquidity situation, the Company

continues to seek ways to refinance or restructure its indebtedness

and is focused on negotiations with its secured bank lenders and

unsecured noteholders to cure or obtain a waiver for missed

interest payment and amortization payment defaults and covenant

breaches.

Effect of Market Conditions on the Company's Business

Although the capital markets have shown recent signs of

stabilizing after a prolonged economic downturn and credit crisis,

the Company's assets linked to the U.S. and non-U.S. commercial

real estate finance markets continue to be adversely affected as

the market value of commercial real estate assets has not recovered

and delinquencies have risen significantly for CMBS and commercial

real estate loans. These adverse effects include:

- Adverse impact on liquidity. As

a result of a continued rise in delinquencies for commercial real

estate loans and CMBS during 2009, the Company's cash flow has been

materially and adversely affected. This negative trend has

continued into the fourth quarter of 2009 and the Company believes

this negative trend will continue into the foreseeable future. As a

result of the decline in the cash flows from the Company's assets,

the Company was unable to make the full September 30, 2009

amortization payments required under its secured bank facilities

for two of its three lenders. Pursuant to amendments to its secured

bank facilities which closed in May 2009, the Company is required

to make payments to reduce the principal balances under the

facilities by certain specified amounts as of the end of each

quarter, commencing for the quarter ended September 30, 2009. The

Company was only able to make the full required amortization

payment under its facility with Morgan Stanley. In addition,

separate and apart from the aforementioned amortization payment

obligations, the Company was unable to make the entire amount of a

monthly $1,250 amortization payment under its facility with Morgan

Stanley due October 31, 2009. The Company has 90 days after the end

of any applicable quarter to cure such aggregate amortization

payment shortfall or an event of default will occur. During the

cure period, all the cash flows from the Company's assets are being

diverted to a cash management account for the benefit of the

Company's secured bank lenders subject to limited exceptions

approved by the secured bank lenders. In the event the secured bank

lenders do not allow the Company access to the diverted cash flows,

the Company will not be able to make payments due on its unsecured

debt and will be unable to pay general and administrative expenses.

As a result, the Company may default on its obligations under its

unsecured debt and be unable to continue as a going concern. In

addition, the Company’s current projections show that, even if the

Company cures the aggregate amortization payment shortfall by

December 29, 2009 (i.e., within the 90-day period), the Company

will not be able to make the required amortization payments for the

quarter ended December 31, 2009. In such event, the Company would

need to cure such shortfall by March 31, 2010 to avoid an event of

default.

- Negative operating results

during the nine months ended September 30, 2009 and the year ended

December 31, 2008. For the nine months ended September 30, 2009,

the Company incurred a net loss available to common stockholders of

$(132,508) driven primarily by significant net realized and

unrealized losses, the incurrence of a $(98,999) provision for loan

losses and a significant decline in interest income due to rising

delinquencies on the Company's CMBS and commercial real estate

loans. For the year ended December 31, 2008, the Company incurred a

net loss available to common stockholders of $(258,050), driven

primarily by significant net realized and unrealized losses, the

incurrence of a $(165,928) provision for loan losses and a loss

from equity investments of ($53,630).

- Substantial doubt about the

ability to continue as a going concern. Substantial doubt continues

to exist about the Company's current ability to continue as a going

concern. The Company's independent registered public accounting

firm issued an opinion on the Company's December 31, 2008

consolidated financial statements that stated the consolidated

financial statements were prepared assuming the Company will

continue as a going concern and further stated that the Company's

liquidity position, current market conditions and the uncertainty

relating to the outcome of the Company's then ongoing negotiations

with its secured bank lenders raised substantial doubt about the

Company's ability to continue as a going concern.

- Elimination of dividends. The

Company's Board of Directors (the "Board of Directors") has not

declared any dividend on the Company's common stock or the

Company's preferred stock during 2009. The Board of Directors

anticipates that the Company will only pay cash dividends on its

preferred and common stock, if such cash is available, to the

extent necessary to maintain its REIT status until the Company's

liquidity position has improved and subject to restrictions in the

Company's debt instruments.

- NYSE Listing. On September 15,

2009, the Company was notified by the New York Stock Exchange, Inc.

(the "NYSE") that the average per share price of the Company's

common stock was below the NYSE's continued listing standard that

requires that the average closing price of listed common stock be

no less than $1.00 per share over a consecutive 30 trading-day

period (the "Price Condition"). The Company notified the NYSE that

it intends to cure the Price Condition deficiency by effecting a

reverse stock split, subject to stockholder approval. The notice

provides that the Company must obtain stockholder approval by no

later than its next annual meeting (scheduled on May 18, 2010) and

must implement the reverse stock split promptly thereafter. If the

Company has not cured the Price Condition deficiency by that date,

the common stock will be subject to suspension and delisting by the

NYSE, which would result in defaults under certain of the Company's

debt instruments. The exact ratio of the reverse stock split will

be determined based on the facts and circumstances at a later

date.

Completed Initiatives to Restructure Debt

Since May 2009, the Company, in addition to amending its secured

bank facilities in May 2009, restructured a significant portion of

its unsecured debt and thereby reduced its near-term interest

expense.

Equity-for-Debt Exchanges

From May through September 2009, the Company completed a number

of equity-for-debt exchanges with holders of its 11.75% Convertible

Senior Notes due 2027 (the "convertible notes") pursuant to which

the Company acquired and canceled over half of the outstanding

amount of convertible notes. In these exchanges, the Company issued

an aggregate of 14,997,000 shares of its common stock for $40,981

aggregate principal amount of convertible notes. Holders in these

exchanges generally released the Company from paying them any

accrued and unpaid interest on the exchanged convertible notes.

As of November 1, 2009, $39,019 aggregate principal amount of

convertible notes remained outstanding.

Junior Subordinated Debt Exchanges

From May through October 2009, the Company restructured all of

its junior subordinated debt, comprised of trust preferred

securities of its subsidiary capital trusts or related obligations

and euro-denominated junior subordinated notes, as described

below.

In May 2009 and July 2009, the Company completed exchanges with

holders of $160,000 aggregate liquidation amount of trust preferred

securities of its three subsidiary capital trusts and holders of

€50,000 aggregate principal amount of the Company's

euro-denominated junior subordinated notes. The Company issued new

notes with a significantly reduced initial interest rate (0.75% per

year) for up to four years (the "junior debt modification period")

and with a higher principal amount (125% of the principal or

liquidation amount of the securities exchanged).

In October 2009, the Company and the holder of $15,000 aggregate

liquidation amount of trust preferred securities agreed to amend

those securities in accordance with the terms of the May 2009 and

July 2009 new notes.

Holders in these exchanges permitted the Company to

retrospectively apply the significantly reduced initial interest

rate to the most recently completed interest period for which

payment had not been previously made.

After the junior debt modification period, the interest rates of

the new notes and trust preferred securities return to the

original, higher rates of the securities for which they were

exchanged or from which they were amended. In addition, during the

junior debt modification period, the Company will be subject to

limitations on its ability to pay cash dividends on its common or

preferred stock or redeem, purchase or acquire any equity

interests, and to become liable for new debt other than trade debt

or similar debt incurred in the ordinary course of business and

debt in exchange for or to provide the funds necessary to

repurchase, redeem, refinance or satisfy the Company's existing

secured and senior unsecured debt (collectively, the "new junior

debt covenants"). In addition, during the junior debt modification

period, the cure period for a default in the payment of interest

when due is three days. The new notes and trust preferred

securities otherwise generally have the same terms, including

maturity dates, as the securities for which they were exchanged or

from which they were amended.

Senior Notes Exchanges

In October 2009, the Company restructured $64,500 aggregate

principal amount of its 7.22% Senior Notes due 2016, 7.20% Senior

Notes due 2016 and 7.772%-to-Floating Rate Senior Notes due 2017.

The senior notes exchanges were similar in structure to the junior

subordinated debt exchanges. The Company issued new notes with a

significantly reduced initial interest rate (1.25% per year) for up

to four years (the "senior notes modification period") and with a

higher principal amount (120% of the principal amount of the notes

exchanged).

Holders in these exchanges permitted the Company to

retrospectively apply the significantly reduced initial interest

rate to the most recently completed interest period.

After the senior notes modification period, the interest rates

of the new notes return to the original, higher rates of the notes

for which they were exchanged. In addition, during the senior notes

modification period, pursuant to the applicable indentures, the

Company is subject to new covenants similar to the new junior debt

covenants and additional covenants. In addition, during the senior

notes modification period, the cure period for a default in the

payment of interest when due is three days. The new notes otherwise

generally have the same terms, including maturity dates, as the

notes for which they were exchanged.

As of November 1, 2009, $13,750 aggregate principal amount of

the Company's 7.22% Senior Notes due 2016, $18,750 aggregate

principal amount of its 7.20% Senior Notes due 2016, $28,000

aggregate principal amount of its 7.772%-to-Floating Rate Senior

Notes due 2017, and the entire $37,500 aggregate principal amount

of its 8.1275%-to-Floating Rate Senior Notes due 2017 are

outstanding and have not been restructured.

Projected Cash Interest Payment Savings during Modification

Period

The Company estimates that the effect of the combined unsecured

restructurings and exchanges will result in cash savings of over

$22,000 per year during the period that the lower coupons are in

effect, excluding the impact of certain one-time fees paid in

connection with the completion of the restructurings and exchanges.

The Company intends to use cash from these savings to reduce

indebtedness under its secured bank facilities.

Short-form registration statements

The failure to file in a timely manner all required periodic

reports with the SEC for a period of twelve months or to otherwise

comply with eligibility requirements has made the Company

ineligible to use a Registration Statement on Form S-3. While it is

ineligible, the Company may use a Registration Statement on Form

S-1, but may find raising capital to be more expensive and, if the

SEC reviews any Registration Statement on Form S-1

of the Company, subject to delay.

CDO tests

In addition to the covenants under the Company's secured bank

facilities, four of the seven CDOs issued by the Company contain

compliance tests which, if violated, could trigger a diversion of

cash flows from the Company to bondholders of the CDOs. The

Company's three CDOs designated as its high yield (''HY'') series

do not have any compliance tests. The chart below is a summary of

the Company's CDO compliance tests as of September 30, 2009.

Cash Flow Triggers CDO I CDO II CDO III

Euro CDO Overcollateralization Current 125.9% 126.0%

118.4% 80.5% Trigger 115.6% 113.2% 108.9% 116.4% Pass/Fail Pass

Pass Pass Fail Interest Coverage/ Interest Reinvestment Current

206.5% 168.8% 305.3% 80.5% Trigger 108.0% 117.0% 111.0% 116.4%

Pass/Fail Pass Pass Pass Fail Collateral Quality Tests CDO I

CDO II CDO III Euro CDO Weighted Average Life Test Current N/A N/A

N/A 3.25 Trigger N/A N/A N/A 7.25 Pass/Fail N/A N/A N/A Pass

Minimum Weighted Average Recovery Rate Test Moody's Current N/A N/A

N/A 25.1% Trigger N/A N/A N/A 18.0% Pass/Fail N/A N/A N/A Pass

Vector Model Test Fitch Pass/Fail N/A N/A N/A Fail Weighted Average

Rating Factor Test Moody's Current N/A N/A N/A 2385 Trigger N/A N/A

N/A 2740 Pass/Fail N/A N/A N/A Pass

Because the failures of the Anthracite Euro CRE CDO 2006-1’s

(“Euro CDO”) overcollateralization tests were not cured by the May

15, 2009 payment date, any cash flows that remained after the

payment of interest to the Class A and Class B senior notes were

utilized to pay down the principal of the Class A notes. This

redirection of cash flows will continue until the failures of the

Class A through Class D overcollateralization tests are cured.

Additionally, the Euro CDO failed its interest coverage test for

its preferred shares, which are held by the Company. This test is

calculated in the same manner as the Class E overcollateralization

test. Since the Euro CDO's preferred shares are pledged to one of

the Company's secured bank lenders, the cash flow available to pay

down the lender's outstanding balance has been reduced.

The chart below summarizes the cash flows received from the

fourth quarter 2008 through the third quarter of 2009 from the

Company's retained CDO bonds.

4Q 2008 1Q 2009 2Q 2009 3Q 2009 CDO I

$1,615 $1,524 $2,062 $1,215 CDO II 1,029 652

1,174 622 CDO III 1,000 617 956 911 CDO HY1 1,106 1,580 719 168 CDO

HY2 1,756 1,989 1,945 1,649 CDO HY3 3,583 4,243 3,074 2,238 Euro

CDO 3,248 4,503 - - Total $13,336

$15,108 $9,930

$6,803

Commercial Real Estate Loans

The Company did not record any additional provisions for

specific loan losses for the three months ended September 30, 2009.

The Company also reduced the general provision by $4,308. The

general loan loss provision methodology is more fully described in

the Company's 2008 Annual Report on Form 10-K for the year ended

December 31, 2008.

A summary of the changes in the Company's reserve for loan

losses is as follows:

General Specific Total Reserve for loan

losses, June 30, 2009 (including accrued interest of $2,347)

$44,710 $228,618 $273,328 Reserve for loan losses-

specific - - - Reserve for loan losses- general (5,532 ) -

(5,532 ) Provision for loan losses for three months

ended September 30, 2009 (5,532 ) - (5,532 )

Charge-off* (24,217 ) (24,217 ) Foreign currency gain 1,223

3,042 4,265 Reserve for loan losses,

September 30, 2009 (including accrued interest of $2,187) $40,401

$207,443 $247,844

* For the three months ended September 30, 2009, the Company

incurred a charge-off of $24,217 related to a realized loss on one

loan.

The Company's formula-based general reserve calculation (as more

fully described in the Company's 2008 Annual Report on Form 10-K

for the year ended December 31, 2008) resulted in a decrease of

$5,532 for the general loan loss provision for the three months

ended September 30, 2009.

The general reserve of $40,401 represents approximately 6% of

the carrying value of the loans against which the Company has not

specifically reserved. The specific reserve of $207,443 represents

approximately 77% of carrying value of ten specific loans.

The chart below summarizes the outstanding principal balance,

carrying value, and loan loss reserves for the commercial real

estate loans held directly by the Company at September 30,

2009.

OutstandingPrincipalBalance

CarryingValue

Loan LossReserve

Net CarryingValue

Retail $309,088 $300,800 $(7,453 ) $293,347

Office 227,716 224,213 (39,593 ) 184,620 Multifamily 165,092

164,826 (124,264 ) 40,562 Various 124,073 121,334 (32,760 ) 88,574

Storage 71,978 71,870 - 71,870 Hotel 14,346 13,777 - 13,777

Industrial 12,307 12,266 - 12,266 Other 3,989 3,941 -

3,941 $928,589 $913,027

$(204,070)* $708,957 General loan loss reserve

(40,401 ) Net Carrying Value $668,556

* Excludes $2,187 of accrued interest and $1,186 of loan related

expenses.

Earnings from Equity Investments

Also included in commercial real estate loans are the Company's

investments in Carbon Capital, Inc. ("Carbon I") and Carbon Capital

II, Inc. ("Carbon II" and together with Carbon I, the "Carbon

Funds"), which are managed by the Company's manager. For the

quarters ended September 30, 2009 and 2008, respectively, the

Company recorded losses of $(2,624) and income of $1,972 for the

Carbon Funds. The investment periods for the Carbon Funds have

expired and no new portfolio additions are expected.

The Company's investments in the Carbon Funds were as

follows:

September 30, 2009 December 31, 2008 Carbon I $1,710

$1,713 Carbon II 17,850 39,158 $19,560 $40,871

Carbon II recorded a provision for loan losses of $3,095 for the

three months ended September 30, 2009 which includes a net

decrease of a general provision of $325 and a provision of $2,770

related to two loans with an aggregate principal balance of

$14,438. The loans are in various stages of resolution and due to

the estimated fair value of the underlying collateral being below

the principal balance of the loans, Carbon II does not believe the

full collectability of the loans is probable. The Company incurs

its share of Carbon II's operating results through its

approximately 26% ownership interest in Carbon II.

Commercial Real Estate Securities

The Company considers CMBS where it maintains the right to

control the foreclosure/workout process on the underlying loans as

controlling class CMBS ("Controlling Class CMBS"). The Company owns

Controlling Class CMBS issued in 1998, 1999 and 2001 through

2007.

The Company did not acquire any additional Controlling Class

CMBS trusts during the third quarter of 2009. At September 30,

2009, the Company owned 39 Controlling Class CMBS trusts with an

aggregate underlying loan principal balance of $56,106,168.

Delinquencies of 30 days or more on these loans as a percent of

current loan balances were 5.6% at September 30, 2009, compared

with 5.2% at June 30, 2009.

The chart below summarizes the par, weighted average coupon,

market value, adjusted purchase price and third quarter 2009

estimated loss assumptions for the Company's U.S. dollar

denominated Controlling Class CMBS:

Vintage

Par

WeightedAverageCoupon

MarketValue

AdjustedPurchasePrice(1)

EstimatedCollateralLosses

1998 $260,667 6.1 % $145,979 $139,919

$136,256 1999 7,604 6.9 3,802 3,173 13,989 2001 34,790 6.1

18,121 28,862 13,610 2002 2,300 5.7 1,245 2,268 20,428 2003 78,209

4.9 25,884 49,452 55,142 2004 75,445 5.1 11,991 11,216 196,498 2005

213,362 5.0 9,957 26,422 353,214 2006 452,099 5.2 31,043 39,289

395,274 2007 678,641 5.2 48,143 54,122

1,111,893 Total $1,803,117 5.3 % $296,165

$354,723 $2,296,304

(1) Adjusted purchase price is inclusive of mark-to-market

losses taken since purchase

During the three months ended September 30, 2009, no securities

of the Company's Controlling Class CMBS were upgraded and 66

securities in 16 Controlling Class CMBS were downgraded by at least

one rating agency. Additionally, at least one rating agency

upgraded two of the Company's non-Controlling Class commercial real

estate securities and downgraded 15.

Summary of Commercial Real Estate Assets

A summary of the Company's commercial real estate assets with

estimated fair values in local currencies and U.S. dollars at

September 30, 2009 is as follows:

CommercialReal EstateSecurities(2)

CommercialReal EstateLoans

(1)

CommercialReal EstateEquity

CommercialMortgageLoan Pools

TotalCommercialReal EstateAssets

TotalCommercialReal EstateAssets (USD)

% of Total

USD $765,239 $204,752 - $939,646

$1,909,637 $1,909,637 76.6 % GBP £3,429 £43,580 - -

£47,009 75,183 3.0 % EUR €17,108 €290,921 - - €308,029 450,247 18.1

% CAD C$60,290 C$6,272 - - C$66,562 62,018

2.5

%

JPY ¥374,580 - - - ¥374,580 4,184

0.2

%

CHF - CHF 23,848 - - CHF 23,848 22,982

0.9

%

INR - - Rs 446,931 - Rs 446,931

9,350

0.4

%

General loan loss reserve - $(40,401 ) - -

$(40,401 ) (40,401 ) (1.7 )% Total USD

Equivalent $856,088 $688,116 $9,350

$939,646 $2,493,200 $2,493,200

100.0

%

(1) Includes the carrying value of the Company's investment in

AHR JV of $448 at December 31, 2008.

(2) Includes the carrying value of the Company's investments in

the Carbon Funds of $40,871 and AHR International JV of $28,199 at

December 31, 2008. In January 2009, in connection with the

amendment and extension of the Company's secured bank facility with

Morgan Stanley, the Company transferred its entire interest in

Anthracite International JV's sole investment, an investment in

non-U.S. commercial mortgage loan, to AHR MS, which then posted the

asset as additional collateral under the facility.

As of January 2009, the Company substantially reduced the use of

various currency instruments to hedge the capital portion of its

foreign currency risk. The Company reduced the use of such

instruments in an effort to avoid cash outlays caused by the

requirement to mark these instruments to market. The Company has

been primarily focused on preserving cash to pay down secured bank

lenders and maintaining these hedges creates unpredictable cash

flows as currency values move in relation to each other.

Book Value Per Share

The chart below is a comparison of book value per share at

September 30, 2009 and December 31, 2008.

9/30/2009

12/31/2008

Total Stockholders' Equity $490,361 $572,131* Less:

Series C Preferred Stock Liquidation Value (57,500 ) (57,500 )

Series D Preferred Stock Liquidation Value (86,250 ) (86,250 )

Preferred Dividends in Arrears** (12,206 ) - Common

Equity $334,405 $428,381 Common Shares Outstanding 93,951,522

78,371,715 Book Value per Share $3.56 $5.46

* On January 1, 2009, the Company adopted ASC 470-20 (formerly

FSP APB 14-1), which superseded ASC 825-10 (formerly FAS 159) with

respect to the Company's fair valuing its convertible debt and

decreased the Company's GAAP book value by $45,361, or $0.58 per

share. The impact of adopting ASC 470-20 is outlined in the

Company's Quarterly Report on Form 10-Q filing for the quarter

ended September 30, 2009.

** The Company elected not to declare any of the specified

dividends on its three series of preferred stock during 2009. At

September 30, 2009, $12,206 of preferred dividends were in arrears.

These dividends in arrears are included as part of dividends on

preferred stock on the consolidated statements of operations since

they represent a claim on earnings superior to common stockholders.

These dividends in arrears have not been accrued as dividends

payable since they have not been declared.

Reconciliation of Operating Earnings (Deficit) Per Share to

Net Income (Loss) Available to Common Stockholders Per Share (Table

1)

The table below reconciles Operating Earnings with diluted net

income available to common stockholders:

Three Months Ended

Nine Months Ended September 30, September 30, 2009

2008 2009 2008 Operating earnings available to

common stockholders $0.03 $0.32 $0.17 $0.93 Net

realized and change in unrealized gain (loss) (0.69 ) (0.19 ) (0.73

) 0.86 Incentive fee attributable to other gains - - - (0.13 ) Net

foreign currency gain (loss) and hedge ineffectiveness 0.09 0.09

0.15 (0.04 ) Provision for loan loss 0.06 (0.25 )

(1.23 ) (0.55 ) Diluted net income (loss) available

to common stockholders $(0.51 ) $(0.03 ) $(1.64 )

$1.07

The Company considers its Operating Earnings to be net income

after operating expenses, income taxes and preferred dividends but

before net realized and change in unrealized gain (loss), incentive

fees attributable to other income (loss), dedesignation of

derivative instruments, net foreign currency gain (loss), hedge

ineffectiveness and provision for loan losses. The Company believes

Operating Earnings to be an effective indicator of the Company's

profitability and financial performance over time. Operating

Earnings can and will fluctuate based on changes in asset levels,

funding rates, available reinvestment rates and expected losses on

credit sensitive positions.

This release, including the reconciliation of Operating Earnings

with net income available to common stockholders, is also available

on the News section of the Company's website at

www.anthracitecapital.com.

Earnings Conference Call

The Company will host a conference call on November 10, 2009 at

9:00 a.m. (Eastern Time). The conference call will be available

live via telephone. Members of the public who are interested in

participating in Anthracite's third quarter earnings teleconference

should dial, from the U.S., (800) 374-0176, or from outside the

U.S., (706) 679-4634, shortly before 9:00 a.m. and reference the

Anthracite Teleconference Call (number 39786858). Please note that

the teleconference call will be available for replay beginning at

1:00 p.m. on Tuesday, November 10, 2009, and ending at midnight on

Tuesday, November 17, 2009. To access the replay, callers from the

U.S. should dial (800) 642-1687 and callers from outside the U.S.

should dial (706) 645-9291 and enter conference identification

number 39786858.

About Anthracite

Anthracite Capital, Inc. is a specialty finance company

focused on investments in high yield commercial real estate loans

and related securities. Anthracite is externally managed by

BlackRock Financial Management, Inc., which is a subsidiary of

BlackRock, Inc. ("BlackRock") (NYSE:BLK), one of the largest

publicly traded investment management firms in the United States

with approximately $1.435 trillion in global assets under

management at September 30, 2009. BlackRock Realty Advisors, Inc.,

another subsidiary of BlackRock, provides real estate equity and

other real estate-related products and services in a variety of

strategies to meet the needs of institutional investors.

Forward-Looking Statements

This release, and other statements that Anthracite may make, may

contain forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995, with respect to

Anthracite's future financial or business performance, strategies

or expectations. Forward-looking statements are typically

identified by words or phrases such as "trend," "potential,"

"opportunity," "pipeline," "believe," "comfortable," "expect,"

"anticipate," "current," "intention," "estimate," "position,"

"assume," "outlook," "continue," "remain," "maintain," "sustain,"

"seek," "achieve," and similar expressions, or future or

conditional verbs such as "will," "would," "should," "could," "may"

or similar expressions.

Anthracite cautions that forward-looking statements are subject

to numerous assumptions, risks and uncertainties, which change over

time. Forward-looking statements speak only as of the date they are

made, and Anthracite assumes no duty to and does not undertake to

update forward-looking statements. Actual results could differ

materially from those anticipated in forward-looking statements and

future results could differ materially from historical

performance.

In addition to factors previously disclosed in Anthracite's SEC

reports and those identified elsewhere in this release, the

following factors, among others, could cause actual results to

differ materially from forward-looking statements or historical

performance: (1) as a result of its liquidity position, current

commercial real estate market conditions and the uncertainty

relating to its ability to meet covenants in restructured

agreements, substantial doubt about the Company's ability to

continue as a going concern; (2)the Company's ability to meet its

liquidity requirements to continue to fund its operations,

including its ability to renew its existing secured credit

facilities or obtain additional sources of financing, to meet

amortization payments under the facilities and to service debt

(including interest payment obligations not paid when originally

due); (3) the Company's ability to obtain amendments and waivers in

the event that a secured bank lender terminates a facility before

the maturity date or events of default occur under the Company's

debt obligations due to a covenant breach or otherwise; (4) the

Company's ability to maintain listing on the NYSE; (5) the

introduction, withdrawal, success and timing of business

initiatives and strategies; (6) changes in political, economic or

industry conditions, the interest rate environment, financial and

capital markets or otherwise, which could result in changes in the

value of the Company's assets and liabilities, including net

realized and unrealized gains or losses, and could adversely affect

the Company's operating results; (7) the relative and absolute

investment performance and operations of BlackRock Financial

Management, Inc. (the ''Manager''), the Company's Manager; (8) the

impact of increased competition; (9) the impact of future

acquisitions or divestitures; (10) the unfavorable resolution of

legal proceedings; (11) the impact of legislative and regulatory

actions and reforms and regulatory, supervisory or enforcement

actions of government agencies relating to the Company or the

Manager; (12) terrorist activities and international hostilities,

which may adversely affect the general economy, domestic and global

financial and capital markets, specific industries, and the

Company; (13) the ability of the Manager to attract and retain

highly talented professionals; (14) fluctuations in foreign

currency exchange rates; and (15) the impact of changes to tax

legislation and, generally, the tax position of the Company.

Anthracite's Annual Report on Form 10-K for the year ended

December 31, 2008 and Anthracite's subsequent filings with the SEC,

accessible on the SEC's website at www.sec.gov, identify additional

factors that can affect forward-looking statements.

To learn more about Anthracite, visit our website at

www.anthracitecapital.com. The information contained on the

Company's website is not a part of this release.

Anthracite Capital, Inc. and

Subsidiaries

Consolidated Statements of

Financial Condition (Unaudited)

(dollar amounts in

thousands)

September 30, 2009

December 31, 2008

ASSETS Cash and cash equivalents $297 $9,686

Restricted cash equivalents 38,939 23,982 RMBS 11 787 Commercial

mortgage loan pools $939,646 $1,022,105 Commercial real estate

securities 856,087 935,963 Commercial real estate loans, (net of

loan loss reserve of $244,271 and $164,282 in 2009 and 2008)

688,117 823,777 Commercial real estate 9,350 9,350

Total commercial real estate 2,493,200 2,791,195 Derivative

instruments, at estimated fair value 26,463 929,632 Other assets

(includes $31 and $384 at estimated fair value in 2009 and 2008)

42,215 73,766 Total Assets $2,601,125

$3,829,048

LIABILITIES AND STOCKHOLDERS'

EQUITY

Liabilities: Short-term borrowings: Secured by pledge of commercial

real estate securities $228,361 $308,123 Secured by pledge of

commercial mortgage loan pools 4,584 4,584 Secured by pledge of

commercial real estate loans 152,090 167,625 Total short-term

borrowings 385,035 $480,332 Long-term borrowings: Collateralized

debt obligations (at estimated fair value) 544,015 564,661 Secured

by pledge of commercial mortgage loan pools 918,452 999,804 Senior

unsecured notes (at estimated fair value) 14,040 18,411 Junior

unsecured notes (at estimated fair value) 14,073 5,726

Junior subordinated notes to

subsidiary trust issuing preferred securities (at estimated fair

value)

1,030

12,643

Convertible senior unsecured notes 35,766 72,000 Total long-term

borrowings 1,527,376 1,673,245 Total borrowings

1,912,411 2,153,577 Distributions payable - 3,019 Derivative

instruments, at estimated fair value 92,199 1,018,927 Other

liabilities 59,680 34,920 Total Liabilities 2,064,290

3,210,443 12% Series E-1 Cumulative Convertible

Redeemable Preferred Stock, liquidation preference $23,375

23,237

23,237 12% Series E-2 Cumulative Convertible Redeemable Preferred

Stock, liquidation preference $23,375

23,237

23,237 Stockholders' Equity: Preferred Stock, 100,000,000

shares authorized; 9.375% Series C Preferred Stock, liquidation

preference $57,500 55,435 55,435 8.25% Series D Preferred Stock,

liquidation preference $86,250 83,259 83,259 Common Stock, par

value $0.001 per share; 400,000,000 shares authorized;

93,951,522 and 78,371,715 shares

issued and outstanding in 2009 and 2008

94 78 Additional paid-in capital 810,236 797,372 Distributions in

excess of earnings (451,915 ) (331,613 ) Accumulated other

comprehensive loss (6,748 ) (32,400 ) Total Stockholders' Equity

490,361 572,131 Total Liabilities and Stockholders'

Equity $2,601,125 $3,829,048

Anthracite Capital, Inc. and

Subsidiaries

Consolidated Statements of

Operations (Unaudited)

(in thousands, except per share

data)

For the Three Months

EndedSeptember 30,

For the Nine Months EndedSeptember

30,

2009 2008

2009

2008

Operating Portfolio Income:

Commercial real estate securities $35,533 $ 53,374 $ 129,667

156,171 Commercial mortgage loan pools 9,901 12,779 30,249 38,445

Commercial real estate loans 12,571 22,674 41,837 69,506 Income

(loss) from equity investments (2,604 ) 3,067 (21,294 ) 2,510 Cash

and RMBS 226 571 723

2,630 Total Income 55,627 92,465

181,182 269,262 Expenses: Interest expense:

Short-term borrowings 6,549 9,560 19,969 29,471 Collateralized debt

obligations 19,829 26,048 61,676 77,197 Commercial mortgage loan

pools 9,965 12,089 30,259 36479 Senior unsecured notes 3,089 3,072

9,280 9,146 Convertible senior notes 2,420 2,874 8,007 8,501 Junior

unsecured notes 2,223 1,434 3,965 4,204 Junior subordinated notes

323 3,354 3,162 9,949 General and administrative expense 2,318

2,025 11,284 5,706 Management fee 1,817 3,050 5,901 9,286 Incentive

fee - - - 1,963 Incentive fee – stock based 185 382

490 1,426 Total Expenses 48,718

63,888 153,993 193,328

Income from the Operating Portfolio 6,909

28,577 27,189 75,934

Other income (loss): Net realized and change in unrealized

gain (loss) (58,820 ) (13,931 ) (51,154 ) 69,918 Incentive fee

attributable to other gains - - - (9,916 ) Dedesignation of

derivative instruments - - (7,840 ) - Provision for loan loss 5,532

(18,752 ) (98,999 ) (43,942 ) Foreign currency gain (loss) 7,585

7,273 11,946 (2,913 ) Hedge ineffectiveness - (770 )

64 533 Total other income (loss)

(45,703 ) (26,180 ) (145,983 ) 13,680

Net Income (loss) (38,794 ) 2,397

(118,794 ) 89,614 Dividends on preferred stock (4,656

) (4,529 ) (13,714 ) (12,738 ) Net Income

(Loss) available to Common Stockholders $(43,450 ) $(2,132 )

$(132,508 ) $76,876 Operating Earnings:

Income from the Operating Portfolio $6,909 $28,577 $27,187 75,934

Dividends on preferred stock (4,656 ) (4,529 )

(13,714 ) (12,738 ) Net Operating Earnings $2,253

$24,048 $13,473 $63,196

Operating Earnings available to Common Stockholders per

share: Basic $0.03 $0.32 $0.17 $0.95 Diluted $0.03 $0.32 $0.17

$0.93 Net Income (loss) available to Common Stockholders per

share: Basic $(0.51 ) $(0.03 ) $(1.64 ) $1.11 Diluted $(0.51 )

$(0.03 ) $(1.64 ) $1.07 Weighted average number of

shares outstanding: Basic 84,840,171 74,365,259 80,777,805

69,099,689 Diluted 84,840,171 74,365,259 80,777,805 81,724,651

Dividend declared per share of Common Stock $- $0.31 $-

$0.92

NET INCOME (LOSS) AVAILABLE TO

COMMON STOCKHOLDERS PER SHARE *

(in thousands, except share and

per share data)

For the Three Months For the nine Months Ended

September 30, Ended September 30, 2009** 2008 2009**

2008 Numerator: Numerator for basic earnings

per share $(43,450 ) $(2,132 ) $(132,508 ) $76,876 Interest expense

on convertible senior notes - - - 7,066

Dividends on Series E convertible

preferred stock

- - - 3,343 Numerator for

diluted earnings per share $(43,450 ) $(2,312 )

$(132,508 ) $87,285 Denominator: Denominator for

basic earnings per share— weighted average common shares

outstanding 84,840,171 74,365,259 80,777,805 69,099,689 Assumed

conversion of convertible senior notes - - - 7,416,680 Assumed

conversion of Series E convertible preferred stock - - - 4,952,748

Dilutive effect of stock based incentive fee - -

- 255,534 Denominator for diluted

earnings per share—weighted average common shares outstanding and

common stock equivalents outstanding 84,840,171

74,365,259 80,777,805 81,724,651

Basic net income (loss) per weighted average common share:

$(0.51 ) $(0.03 ) $(1.64 ) $1.11

Diluted net income (loss) per weighted average common share and

common share equivalents: $(0.51 ) $(0.03 ) $(1.64 )

$1.07 * Convertible senior notes and Series E-1 and

Series E-2 convertible preferred stock were anti-dilutive for 2009.

** The Company elected not to declare any of the specified

dividends on its three series of preferred stock during 2009. For

the three and nine months ended September 30, 2009, $4,656 and

$12,206 of preferred dividends were in arrears. These dividends in

arrears are included as part of dividends on preferred stock on the

consolidated statements of operations since they represent a claim

on earnings superior to common stockholders. These dividends in

arrears have not been accrued as dividends payable since they have

not been declared.

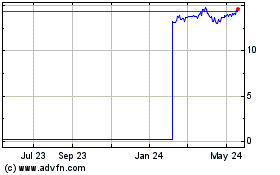

American Healthcare REIT (NYSE:AHR)

Historical Stock Chart

From Mar 2024 to Apr 2024

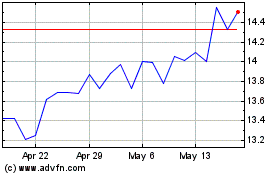

American Healthcare REIT (NYSE:AHR)

Historical Stock Chart

From Apr 2023 to Apr 2024