Current Report Filing (8-k)

May 31 2019 - 4:15PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

May

31

, 2019 (May 2

4

, 2019)

Date of Report (Date of earliest event reported)

DENTSPLY SIRONA Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

0-16211

|

39-1434669

|

|

|

(State of Incorporation)

|

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

|

|

|

|

|

|

|

13320 Ballantyne Corporate Place,

Charlotte, N

orth Carolina

|

|

|

28277

|

|

|

(Address of principal executive offices)

|

|

|

(Zip Code)

|

|

|

|

|

|

|

|

|

|

|

(844) 546-3722

|

|

|

|

|

(Registrant's telephone number, including area code)

|

|

|

|

|

|

|

|

|

|

|

|

N/A

|

|

|

|

|

|

(Former name or former address, if changed since last report)

|

|

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol

|

Name of each exchange on which registered

|

|

Common Stock, par value $.01 per share

|

XRAY

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

In connection with the previously announced departure of Nicholas W. Alexos, Executive Vice President and Chief Financial Officer of DENTSPLY SIRONA Inc. (the “Company”), on May 24, 2019, the Company and Mr. Alexos entered into a Separation and Release of Claims Agreement (the “Separation Agreement”), governing Mr. Alexos’ transition from his role as Executive Vice President and Chief Financial Officer. The Separation Agreement and the Company’s payment obligations thereunder become effective on specified dates, unless revoked by Mr. Alexos prior to such dates. Mr. Alexos has agreed to serve in his present position until his successor is hired or appointed, and his last day with the Company will be 90 days after the date his successor is hired or appointed or such other date as the Company and Mr. Alexos may mutually agree (the “Separation Date”).

Mr. Alexos’ employment will continue under that certain employment agreement previously entered into by the Company with Mr. Alexos, effective as of October 10, 2017, as amended by the First Amendment to Employment Agreement entered into as of March 5, 2019 (the “Employment Agreement”), except to the extent modified and superseded by the Separation Agreement. Mr. Alexos will continue to be bound by his duties and obligations under the Employment Agreement, including, without limitation, the restrictive covenants contained in his Employment Agreement. In addition, Mr. Alexos has agreed to certain ongoing cooperation obligations and to provide certain releases and waivers as contained in the Separation Agreement. Mr. Alexos will not be entitled to any severance under the Employment Agreement or any other arrangement following his termination of employment except as provided in the Separation Agreement.

Subject to the terms and conditions set forth therein and applicable taxes and other withholdings, as consideration under the Separation Agreement, the Company has agreed to provide Mr. Alexos compensation and benefits as follows: (i) an amount equal to $2,275,000, payable over 24 months in equal installments; (ii) the annual bonus amount contemplated under the Employment Agreement, determined based on the actual performance of the Company for the full fiscal year in which the Separation Date occurs, prorated for the number of days of Mr. Alexos’ employment completed during the fiscal year in which the Separation Date occurs and payable in a lump sum cash amount at the time it would otherwise have been paid had Mr. Alexos’ employment continued; (iii) a cash lump sum equal to $175,038, payable 60 days following the Separation Date; (iv) subject to certain limitations and continued payment by Mr. Alexos of any cost owed by him under the applicable plan, the continuation for 24 months following the Separation Date of certain insurance benefits substantially similar to those provided to Mr. Alexos and his dependents immediately prior to the Separation Date; (v) outplacement services commensurate with those customarily provided to the Company’s other senior executive officers for 18 months immediately following the Separation Date or, if earlier, until Mr. Alexos secures employment; (vi) a cash lump sum amount equal to Mr. Alexos’ attorneys’ fees incurred in the negotiation of the Separation Agreement, capped at $10,000, payable 60 days following the Separation Date upon submission of appropriate legal bills; (vii) continuing eligibility for vesting (for 24 months following the Separation Date) of certain equity awards identified in the Separation Agreement to the extent they remain outstanding and have not been forfeited or settled on the Separation Date, which equity awards shall remain exercisable until the earlier of 90 days following the 24-month anniversary of the Separation Date or the date such equity award would have expired had Mr. Alexos’ employment continued, subject to all other terms and conditions of the applicable plan and awards; (viii) the immediate vesting of certain restricted share units identified in the Separation Agreement to the extent they have not been forfeited, vested, or settled prior to the Separation Date; and (ix) the forfeiture without further consideration of any other equity award, including any stock option, restricted share unit, or performance restricted share unit, that is not set forth in the Separation Agreement.

The foregoing summary of the Separation Agreement does not purport to be complete and is qualified in its entirety by the full text of the Separation Agreement, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and which is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

Exhibit No.

Description

10.1

Separation and Release of Claims Agreement, dated May 24, 2019.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

DENTSPLY SIRONA Inc.

|

|

|

|

|

|

|

|

By:

/s/ Keith J. Ebling

|

|

|

|

Keith J. Ebling, Executive Vice President,

|

|

|

|

General Counsel and Secretary

|

|

|

|

|

|

Date: May 31, 2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

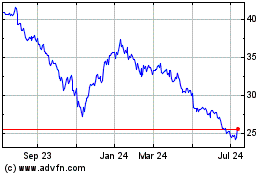

DENTSPLY SIRONA (NASDAQ:XRAY)

Historical Stock Chart

From Apr 2024 to May 2024

DENTSPLY SIRONA (NASDAQ:XRAY)

Historical Stock Chart

From May 2023 to May 2024