false

0001860871

DE

0001860871

2024-02-14

2024-02-14

0001860871

LGST:CommonStockParValue0.0001PerShareMember

2024-02-14

2024-02-14

0001860871

LGST:WarrantsEachExercisableForOneShareOfCommonStockFor11.50PerShareMember

2024-02-14

2024-02-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): February

14, 2024

Tevogen

Bio Holdings Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-41002 |

|

85-1284695 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

| 15

Independence Boulevard, Suite

#410 |

|

|

| Warren,

New Jersey |

|

07059 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (877) 838-6436

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title of

each class |

|

Trading Symbol(s) |

|

Name of each

exchange on which registered |

| Common

Stock, par value $0.0001 per share |

|

TVGN |

|

The

Nasdaq Stock Market LLC |

| Warrants,

each exercisable for one share of Common Stock for $11.50 per share |

|

TVGNW

|

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

5.05 Amendments to the Registrant’s Code of Ethics, or Waiver of a Provision of the Code of Ethics.

On

February 14, 2024, Tevogen Bio Holdings Inc. (the “Company”) adopted a Code of Business Conduct and Ethics (the “Code”)

applicable to all officers, directors, and employees of the Company, including its Chief Executive Officer, Chief Financial Officer,

and other executive officers. The Code is designed to deter wrongdoing and to promote honest and ethical conduct, full, fair, accurate,

timely, and understandable disclosure in the Company’s public communications, compliance with applicable laws, rules, and regulations,

protection of Company assets, prompt internal reporting of Code violations, and accountability for adherence to the Code. The foregoing

description of the Code is qualified in its entirety by reference to the text of the Code, a copy of which is filed as Exhibit 14.1 to

this report and incorporated herein by reference.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

Tevogen

Bio Holdings Inc. |

| |

|

|

| Date:

February 21, 2024 |

By: |

/s/

Ryan Saadi |

| |

Name:

|

Ryan

Saadi |

| |

Title: |

Chief

Executive Officer |

Exhibit

14.1

Tevogen

Bio Holdings Inc.

Code

of Business Conduct and Ethics

Effective

February 14, 2024

I.

Purpose

The

Board of Directors (the “Board”) of Tevogen Bio Holdings Inc. (together with its subsidiaries, the “Company”)

is committed to conducting business with the highest ethical and legal standards, and has adopted this Code of Business Conduct and Ethics

(the “Code”) in order to:

| ● | promote

honest and ethical conduct, including the ethical handling of actual or apparent conflicts

of interest between personal and professional relationships; |

| ● | promote

full, fair, accurate, timely, and understandable disclosure in reports and documents that

the Company files with, or submits to, the Securities and Exchange Commission and in other

public communications made by the Company; |

| ● | promote

compliance with applicable laws, rules, and regulations; |

| ● | promote

the protection of Company assets, including corporate opportunities and confidential information; |

| ● | promote

the prompt internal reporting of violations of the Code to an appropriate person or persons

identified in the code; and |

| ● | promote

accountability for adherence to the Code. |

II.

Application

The

Code covers a wide range of business practices and procedures. It does not cover every issue that may arise, but it sets out basic principles

to guide officers, directors, and employees of the Company. All of the Company’s officers, directors, and employees must use good

common sense and judgment to conduct themselves accordingly and seek to avoid even the appearance of improper behavior.

The

Code applies to all officers, directors, and employees of the Company (each, a “Covered Party”, and collectively,

the “Covered Parties”).

After

carefully reviewing this Code, each Covered Party shall sign the acknowledgment attached as Exhibit A hereto, indicating that

they have received, read, understand, and agree to comply with this Code. The acknowledgment must be returned either electronically in

a manner provided for by the Company or otherwise in writing to the Compliance Officer (as defined below) or such Compliance Officer’s

designee within ten (10) business days of such Covered Party’s receipt of this Code, and on an annual basis as may be required

by the Company.

III.

Enforcement

The

Board shall be responsible for monitoring compliance with the Code and shall assess the adequacy of the Code periodically and approve

any changes to the Code as may be recommended by the Audit Committee. The Board has designated the Chief Financial Officer to be the

compliance officer (the “Compliance Officer”) for the implementation, interpretation, and administration of the Code.

In the event that Covered Parties encounter an ethical issue where this Code or other Company policies do not expressly provide an answer,

or in the event that Covered Parties encounter a situation where they believe a law, rule, or regulation is unclear or conflicts with

a provision of the Code, they are encouraged to contact a manager, supervisor, the Compliance Officer, or any executive officer of the

Company, or use one of the other resources described in the Code.

The

Code will be strictly enforced. All managers and supervisors are required to enforce the Code and are not permitted to sanction or condone

violations. There will be serious adverse consequences to any Covered Party for non-adherence to the Code, which may include disciplinary

action, up to and including termination, restitution, reimbursement, or referral of the matter to the appropriate authorities. Discipline

may also be imposed for conduct that is considered unethical or improper even if the conduct is not specifically covered by the Code.

IV.

Compliance with Laws, Rules and Regulations

A

variety of laws apply to the Company and its operations. The Company requires that all Covered Parties comply with all laws, rules, and

regulations applicable to the Company, both in letter and in spirit. Although not all Covered Parties are expected to know the details

of these laws, it is important to know enough to determine when to seek advice from supervisors or the Compliance Officer. Covered Parties

are expected to use good judgment and common sense in seeking to comply with all applicable laws, rules, and regulations and to seek

advice when there is any uncertainty. Any violations of laws, rules, and regulations can result in civil and criminal penalties as well

as disciplinary action from the Company.

V.

Conflicts of Interest

Covered

Parties should always act in the best interest of the Company and not permit outside interests (for example, financial or personal) to

interfere with their job duties. The Company prohibits all Covered Parties from using their position with the Company or the Company’s

relationship with its customers or any other external party with which the Company has a business relationship (each an “External

Party,” and, collectively “External Parties”) for private gain or to obtain benefits for themselves or members

of their family.

For

purposes of the Code, a potential conflict of interest occurs when a Covered Party’s outside interests interfere with (or even

appear to interfere with) the Company’s interests or the Covered Party’s work-related duties. A conflict of interest can

occur when a Covered Party is in a position to influence a decision that may result in a personal gain for the Covered Party or a Related

Person as a result of the Company’s business dealings.

Any

direct or indirect conflict of interest between the Company and any Covered Party is prohibited unless otherwise consented to by the

Company. The Covered Party has a responsibility to the Company to disclose any situation that is, or reasonably could be expected to

give rise to, a conflict of interest or a situation giving the appearance of a conflict of interest. If a Covered Party, other than a

director or an executive officer, feels that they may have a conflict of interest or a potential conflict of interest, such Covered Party

should discuss the matter with, and seek a determination and prior authorization or approval from, such Covered Party’s supervisor

or the Compliance Officer. A supervisor may not authorize or approve conflict of interest matters or make determinations as to whether

a problematic conflict of interest exists without first providing the Compliance Officer with a description of the activity and seeking

the Compliance Officer’s written approval. If the supervisor is involved in the potential or actual conflict, the matter should

instead be discussed directly with the Compliance Officer. Conflicts of interest involving directors or executive officers must be referred

to the Audit Committee for consideration. After receiving the Audit Committee’s recommendations, the Board may approve, by a majority

vote of disinterested directors, the resolution of a conflict of interest involving directors and executive officers.

It

is not possible to describe every situation or occurrence that could lead to a conflict of interest between a Covered Party and the Company.

The following events are intended to describe, by way of example, situations that could occur that constitute or could lead to a conflict

of interest with the Company:

A.

Related Parties

Covered

Parties should avoid conducting business transactions with any Related Person without obtaining prior written approval in accordance

with the Code.

“Related

Person” is defined to include directors, executive officers, beneficial owners of 5% or more of any class of the Company’s

voting securities, immediate family members of any of the foregoing persons, and any entities in which any of the foregoing is an executive

officer or is an owner of 5% or more ownership interest. Immediate family members include any child, stepchild, parent, stepparent, spouse,

sibling, mother-in-law, father-in-law, son-in-law, daughter-in-law, brother-in-law, or sister-in-law, and any person (other than a tenant

or employee) sharing the household of such person.

B.

Business Relationships

Employees

shall not engage in (whether directly or indirectly):

| ● | simultaneous

employment by, |

| ● | owning

a significant financial interest in, any entity that does business, seeks to do business, or competes with the Company without prior written consent in accordance with the

Code. |

C.

Service on Boards and Committees

A

Covered Party must not serve on the board of directors, advisory board, or committee of any entity with which the Company has a business

relationship or whose interests would be expected to conflict with those of the Company without prior written approval of the Compliance

Officer in accordance with the Code.

D.

External Parties

A

Covered Party shall not use such Covered Party’s position with the Company to influence a transaction with any External Parties

in which such Covered Party has any personal interest.

E.

Personal Use of Company Property and Company Information

Covered

Parties shall not use or divert any Company property, materials, equipment, systems, or procedures, including services of other Covered

Parties and Company information, for their own advantage or benefit or for use in outside business activities or non-business activities

unrelated to the Company, or otherwise use the Company’s name or influence for their personal benefit.

Conflicts

of interest may not always be clear-cut. If you have a question, you should consult with your supervisor or the Compliance Officer.

VI.

Corporate Opportunities

Employees

are prohibited from usurping, and may not improperly gain, from a corporate opportunity discovered through the use of the Company’s

resources, property, or information, or otherwise compete with the Company. Each employee owes a duty to the Company to advance any opportunity

learned through the course of employment to the Company. Any employee who learns of a corporate opportunity must obtain prior written

consent of the Board before taking advantage of any such opportunity.

VII.

Confidentiality AND INSIDER TRADING

Covered

Parties have access to a variety of confidential information regarding the Company and its business processes. Confidential information

includes, but is not limited to, all non-public information, including information that might be of use to competitors, or harmful to

the Company or External Parties, if disclosed, and information that may be considered material by the securities markets or investors.

Covered Parties are required to safeguard the confidentiality of information entrusted to them by the Company or External Parties, except

when disclosure is authorized by the Compliance Officer or legally mandated. Covered Parties are required to maintain the confidentiality

of information after their relationship with the Company ends. To avoid inadvertent disclosure, information that is confidential should

never be discussed with any unauthorized person, including unauthorized employees of the Company and family members or friends, and confidential

information should not be discussed in public areas such as elevators, restaurants, and airplanes, and confidential information and Company

property (like laptops, tablets, and smartphones) should not be left unattended or otherwise accessible to others. Unauthorized disclosure

of confidential information would not only result in a violation of the Code but could result in legal liability against a Covered Party.

In addition, using confidential information for personal financial benefit, or “tipping” others (including friends and family

members) who might make an investment decision on the basis of this information, is not only unethical but may also be illegal.

If

you have any questions concerning confidential information or the treatment of what is believed to be confidential Company information,

please contact the Company’s Compliance Officer.

Notwithstanding

the foregoing, this policy does not prevent Covered Parties from complying with legal requirements requiring the disclosure of confidential

information or reporting a possible violation of law to a government entity or law enforcement, including making a disclosure that is

protected under the whistleblower protections of applicable law.

VIII.

HONEST AND ETHICAL CONDUCT AND FAIR DEALING

The

Company is committed to achieving the highest standards of professionalism and ethical conduct in its operations and activities and expects

its Covered Parties to conduct business according to the highest ethical standards of conduct, in addition to complying with all applicable

laws, rules, and regulations.

The

Company has an interest in maintaining a fair and competitive marketplace and friendly work environment. In order to achieve that standard,

the Company expects its Covered Parties to maintain honest and ethical standards dealing with each other and the Company’s competitors,

as well as when transacting business with External Parties.

A.

Covered Parties must not take unfair advantage of anyone, including fellow Covered Parties, through the manipulation, concealment, or

abuse of privileged information, misrepresentation of material facts, or any other intentional unfair-dealing practice.

B.

Statements regarding the Company’s products and services must not be untrue, misleading, deceptive, or fraudulent.

C.

In addition to the maintenance of honest and ethical standards in disseminating information, Covered Parties must gather information

about other companies and organizations, including competitors, using appropriate methods. Stealing proprietary information, knowingly

possessing trade secret information that was obtained without the owner’s consent, or inducing such disclosures by past or present

Covered Parties of other companies is prohibited. The Company will not tolerate taking unfair advantage of anyone through manipulation,

concealment, abuse of privileged information, misrepresentation of material facts, or any other intentional unfair dealing practice.

D.

Each Covered Party should endeavor to respect the rights of and deal fairly with the Company’s External Parties, competitors, and

Covered Parties.

IX.

PUBLIC COMMUNICATIONS

The

Company must monitor public communications about the Company in order to maintain credibility and a positive reputation in the community.

News media can have a direct impact on the Company’s profitability and its ability to achieve its mission. The Company’s

policy is to provide timely, accurate, and complete information in response to media inquiries consistent with its obligations to maintain

the confidentiality of proprietary information and to prevent selective disclosure of market-sensitive financial and other material information

in accordance with the Company’s Disclosure Policy. In accordance with such policy, Covered Parties must direct any news media

or public requests for information to the Company’s Disclosure Compliance Officer, who will assist in evaluating the inquiry and

creating an appropriate response to the request.

Only

authorized employees may make any public statements on behalf of the Company, whether to the media, investors, or in other external forums,

including on the Internet. This includes disclosing new or confidential information through social media and websites.

X.

GIFTS

Great

care should be exercised to assure that business entertainment and gifts for public officials and others who engage or propose to engage

in business transactions with the Company are not excessive and cannot reasonably be construed as bribes, kickbacks, improper inducements,

or any other illegal or improper payments. Covered Parties should not:

| ● | offer

or provide to those who engage or propose to engage in business transactions with the Company,

directly or indirectly, any gift, entertainment, or reimbursement of expenses of more than

nominal value or that exceeds customary courtesies for that time and place, except

in the case of meals and tickets to events that are reasonable and customary for that time

and place; or |

| ● | offer

or provide, directly or indirectly, any services to any individual in a position to make

or influence any business or governmental decision affecting the Company. |

The

Company prohibits employees from seeking or accepting gifts, favors, entertainment, payments, or loans for themselves or Related Persons

from External Parties, except:

| ● | gifts

of less than $100 in value (if reasonable and customary for that time and place); |

| ● | tickets

to an event if reasonable and customary for that time and place or if prior approval is obtained

from the Compliance Officer; |

| ● | meals

that are reasonable and customary for that time and place; or |

| ● | loans

from lending institutions at market rates. |

Under

no circumstances should a Covered Party accept a cash gift. All questions and concerns relating to this policy should be addressed to

the Compliance Officer. If a Covered Party violates this policy, the Company will take prompt corrective action, including discipline

and/or termination, if appropriate.

No

outside consultant, agent, or third party of any kind shall be used or employed in any manner or for any purpose that would be contrary

to the guidelines set forth above.

XI.

POLITICAL CONTRIBUTIONS

The

Company understands that Covered Parties may participate in the political process as individuals and encourages them to do so. However,

without prior authorization, no Covered Party shall, in such Covered Party’s capacity as an officer, director, or employee of the

Company, make any loan, donation, contribution, or payment to a political party, candidate, or political action committee, for or on

behalf of the Company or any project or development in which the Company is engaged, nor shall a Covered Party of the Company reimburse

any individual who does. This does not prohibit a Covered Party from taking any of the above actions in such Covered Party’s name,

provided that the action is exclusively on the Covered Party’s own accord and is not an indirect means of accomplishing one of

the prohibited actions.

XII.

EMPLOYMENT PRACTICES

The

Company endeavors to provide all Covered Parties an environment that is conducive to conducting business. In order to achieve this goal,

the Company has instituted several policies, which are in part summarized below.

A.

Discrimination and Harassment

The

Company aims to provide challenging, meaningful, and rewarding opportunities for personal and professional growth of all Covered Parties

without regard to gender, race, ethnicity, sexual orientation, physical or mental disability, age, pregnancy, religion, veteran status,

national origin, or any legally protected status. The Company encourages teamwork in order to leverage the diverse talents and expertise

of our Covered Parties through effective collaboration and cooperation. In order to promote the desired work environment, the Company

prohibits all forms of harassment, discrimination, and retaliation of Covered Parties by fellow Covered Parties and employees of External

Parties. All Covered Parties are required to comply with all applicable labor and employment laws, including anti-discrimination laws

and laws related to privacy.

B.

Workplace Safety

The

Company promotes and strives to maintain a safe and healthy work environment and conducts its business in ways that protect its employees’

safety and are sensitive to the environment. The Company will continue its goal of providing a workplace that is free from safety or

health hazards or will control such hazards to acceptable levels. Consistent with the Company’s goal and given the nature of the

Company’s activities, employees are required to understand and comply with the laws, rules, regulations, and policies relevant

to maintaining a safe and healthy workplace.

C.

Alcohol and Drugs

The

Company is committed to maintaining a drug-free work place. The Company prohibits the manufacture, distribution, sale, purchase, transfer,

possession, or use of illegal substances in the workplace, while representing the Company outside the workplace or if such activity affects

work performance or the work environment of the Company. The Company further prohibits use of alcohol while on duty, unless at Company-sanctioned

events. Employees are prohibited from reporting to work, or driving a Company vehicle or any vehicle on Company business, while under

the influence of alcohol, any illegal drug, controlled substance, or any other intoxicant.

D.

Communication

The

Company encourages open, timely communications that help the Company achieve organizational goals, share information, increase understanding,

participate in the decision-making process, and provide recognition for our work-related success.

XIII.

PROTECTION AND PROPER USE OF COMPANY ASSETS

Safeguarding

Company assets is the responsibility of all Covered Parties. The Company’s ability to achieve its mission requires the efficient

and appropriate use of Company assets and resources, including information systems. Theft, carelessness, and waste have a direct impact

on the Company’s profitability. Covered Parties are expected to:

A.

Use Company assets according to all Company policies and procedures, comply with policies and security programs that help prevent their

unauthorized use or theft, and abide by all regulations or contractual agreements governing their use.

B.

Protect from disclosure or misuse all nonpublic information pertaining to the Company.

C.

Protect from disclosure any proprietary information including intellectual property, business, marketing and service plans, databases,

records, salary information, and any unpublished financial data and reports.

D.

Not use Company property or nonpublic information of the Company to gain a personal profit; nor may any Covered Party make such property

or information available to any family member, friend, business associate, or other person for the benefit of such other person.

E.

Take actions necessary to safeguard all passwords and identification codes to prevent unauthorized access to the Company’s information

systems or resources.

F.

Read and comply with all information technology and cybersecurity policies and their applicable procedures.

XIV.

PROHIBITION OF LOANS

The

Company has a policy against making any loans to any officer or director of the Company, or any member of their immediate families, whether

directly or indirectly, or guaranteeing any loan or obligation on behalf of any officer or director or member of their immediate family.

XV.

REPORTING WITH INTEGRITY

The

Company has an obligation to make and keep books, records and accounts that, in reasonable detail, accurately and fairly reflect the

Company’s transactions and to maintain tax records and prepare tax returns that comply with applicable laws, rules, and regulations.

The Company must also maintain a system of internal accounting controls that meet applicable laws, rules, and regulations, and prepare

financial statements in accordance with generally accepted accounting principles and applicable laws, rules, and regulations. All employees

who are responsible for any aspect of the Company’s internal accounting controls and financial and tax reporting systems (including,

but not limited to, the Chief Executive Officer, the Chief Financial Officer, any principal accounting officers, and persons performing

similar functions) must conduct themselves using high ethical standards of integrity and honesty, in a manner that allows the Company

to meet accounting and legal requirements, and to prepare financial reports and financial statements that are not false or misleading,

and that present full, fair, accurate, timely, and understandable disclosure in the Company’s periodic reports and other public

communications.

A.

No Covered Party may override, or direct others to override, the Company’s established system of internal controls over financial

reporting and disclosure.

B.

No fund, asset, or liability of the Company which is not fully and properly disclosed and recorded on the Company’s books and records

– i.e., no unrecorded or “off-the-books” activity – shall be created or permitted to exist.

C.

Transactions of the Company are to be executed only in accordance with management’s general or specific authorizations.

D.

No false, artificial, or misleading entries may be made in the books and records of the Company for any reason and no Covered Party may

engage in any arrangement that results in such prohibited act.

E.

No transaction shall be effected and no payment on behalf of the Company may be approved or made with the intention or understanding

that any part of the transaction or payment is to be used for any purpose other than that described by the documents supporting the transaction

or payment.

F.

Any uncertainty by an employee about judgments concerning accounting or tax matters should be discussed with a superior; when in doubt,

ask for guidance.

G.

No one shall take any action to fraudulently influence, coerce, manipulate, or mislead any internal or external auditor engaged in the

performance of an audit of the Company’s financial statements.

XVI.

INTERPRETATION / WAIVERS

Requests

for a waiver of a provision of the Code must be submitted in writing to the Compliance Officer for appropriate review, and the Audit

Committee will decide the outcome. Pursuant to its charter, the Audit Committee shall review any conduct of executive officers or directors

of the Company that is or may be in violation of the Code. Any waiver approved by the Audit Committee for executive officers and directors

and the reason for the waiver will be promptly disclosed to the Company’s stockholders, if required by and in accordance with applicable

laws, rules, and regulations.

XVII.

REPORTING SUSPECTED NON-COMPLIANCE / WHISTLEBLOWER HOTLINE

A.

Reporting

The

Company supports an open and honest atmosphere in which questions should be asked, and potential problems or concerns must be raised.

Any Covered Party who becomes aware of an existing or potential violation of this Code, or any applicable laws, rules, regulations, Company

policies, or the Code, suspected fraudulent activity, or any concerns or complaints regarding accounting, internal accounting controls,

or auditing matters should be promptly reported either openly or on an anonymous basis. Covered Parties may report any such violations

orally or in writing to the Compliance Officer or chairperson of the Audit Committee or through the Company’s Whistleblower Hotline

pursuant to the Company’s Whistleblower Policy.

B.

Investigations

The

Company is committed to taking prompt and consistent action, as appropriate, in response to suspected or reported violations of the Code,

any law, rule, or regulation, or Company policy. All Covered Parties are required to cooperate fully with internal investigations by

providing complete and truthful information in a timely manner. The Company will not tolerate retaliation against individuals for raising

good faith possible violations of the Code, any applicable law, rule, or regulation, or Company policy.

Adopted:

February 14, 2024

v3.24.0.1

Cover

|

Feb. 14, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 14, 2024

|

| Entity File Number |

001-41002

|

| Entity Registrant Name |

Tevogen

Bio Holdings Inc.

|

| Entity Central Index Key |

0001860871

|

| Entity Tax Identification Number |

85-1284695

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

15

Independence Boulevard

|

| Entity Address, Address Line Two |

Suite

#410

|

| Entity Address, City or Town |

Warren

|

| Entity Address, State or Province |

NJ

|

| Entity Address, Postal Zip Code |

07059

|

| City Area Code |

(877)

|

| Local Phone Number |

838-6436

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Common Stock, par value $0.0001 per share |

|

| Title of 12(b) Security |

Common

Stock, par value $0.0001 per share

|

| Trading Symbol |

TVGN

|

| Security Exchange Name |

NASDAQ

|

| Warrants, each exercisable for one share of Common Stock for $11.50 per share |

|

| Title of 12(b) Security |

Warrants,

each exercisable for one share of Common Stock for $11.50 per share

|

| Trading Symbol |

TVGNW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=LGST_CommonStockParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=LGST_WarrantsEachExercisableForOneShareOfCommonStockFor11.50PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

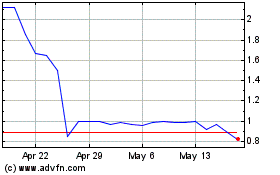

Tevogen Bio (NASDAQ:TVGN)

Historical Stock Chart

From Apr 2024 to May 2024

Tevogen Bio (NASDAQ:TVGN)

Historical Stock Chart

From May 2023 to May 2024