true

Amendment No 1

0001860871

0001860871

2024-02-14

2024-02-14

0001860871

LGST:CommonStockParValue0.0001PerShareMember

2024-02-14

2024-02-14

0001860871

LGST:WarrantsEachExercisableForOneShareOfCommonStockFor11.50PerShareMember

2024-02-14

2024-02-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K/A

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): February 14, 2024

Tevogen

Bio Holdings Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-41002 |

|

85-1284695 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

| 15

Independence Boulevard, Suite

#410 |

|

|

| Warren,

New Jersey |

|

07059 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (877) 838-6436

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| |

|

|

|

|

| Common

Stock, par value $0.0001 per share |

|

TVGN |

|

The

Nasdaq Stock Market LLC |

| |

|

|

|

|

| Warrants,

each exercisable for one share of Common Stock for $11.50 per share |

|

TVGNW |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Explanatory

Note

This

Amendment No. 1 (this “Amendment”) amends the Current Report on Form 8-K filed on February

14, 2024 (the “Original 8-K”) by Tevogen Bio Holdings Inc. (the “Company”) to add certain additional information,

including in connection with the consummation

of the business combination (the “Business Combination”) between Semper Paratus Acquisition Corporation (“Semper Paratus”)

and Tevogen Bio Inc pursuant to which a subsidiary of Semper Paratus merged with and into Tevogen Bio Inc and Semper Paratus was renamed

Tevogen Bio Holdings Inc. The information under Item 1.01 and Item 8.01 below is incorporated by reference into “Certain Relationships

and Related Transactions, and Director Independence” in the Original 8-K. Except as amended by this Amendment, the Original 8-K

remains unchanged.

Item

1.01 Entry Into a Material Definitive Agreement.

Series

A Preferred Stock Purchase Agreement

On

February 14, 2024, the Company entered into a securities purchase agreement (the “Purchase Agreement”) with an investor pursuant

to which the investor agreed to purchase shares of Series A Preferred Stock of the Company for an aggregate purchase price of $8.0 million,

payable in two installments, with the first $2.0 million due February 15, 2024, and the remaining $6.0 million due by March 16, 2024.

The

shares of Series A Preferred Stock will be convertible into a total of 2,000,000 shares of the Company’s common stock at the election

of the holder. The Series A Preferred Stock will be subject to a call right providing the Company the right to call the stock if the

volume weighted average price of the common stock for the 20 days prior to delivery of the call notice is greater than $5.00 per share

and there is an effective resale registration statement on file covering the underlying common stock. The Series A Preferred Stock will

be non-voting, will have no mandatory redemption, and will carry an annual 5% cumulative dividend, increasing by 2% each year. The Company

also agreed that so long as the Series A Preferred Stock is outstanding, the Company will not, without the written consent of the holders

of 50.1% of the Series A Preferred Stock, amend, alter, or repeal any provision of the Company’s certificate of incorporation or

bylaws in a manner adverse to the Series A Preferred Stock.

The

Series A Preferred Stock is being sold in a transaction exempt from registration under Section 4(a)(2) of the Securities Act of 1933,

as amended (“Section 4(a)(2)”). The investor in the Series A Preferred Stock is an entity associated with Dr. Manmohan Patel,

an existing investor in the Company and beneficial owner of more than 5% of the Company’s common stock.

Assignment

and Assumption Agreement

In

connection with the consummation of the Business Combination, Semper Paratus entered into an agreement as of February 14, 2024 with SSVK

Associates, LLC (“SSVK”), which was Semper Paratus’ sponsor, pursuant to which Semper Paratus assigned to SSVK and

SSVK agreed to assume certain liabilities and obligations, including liabilities and obligations that would become liabilities and obligations

of the Company as a result of the Business Combination, in the aggregate amount of more than $4.2 million, in consideration

for the issuance of preferred stock of the Company (the “Series B Preferred Stock”).

The

Series B Preferred Stock will be non-voting, non-convertible, callable by the Company at any time, and will pay a 3.5% quarterly

dividend beginning March 21, 2024. Any dividend will be paid by the Company on behalf of SSVK to the creditors to which the assumed liabilities

and obligations are owed, pro rata in accordance with those liabilities and obligations. The dividend rate will increase by 0.25%

each month that the Series B Preferred Stock remains outstanding after the first 30 days after its issuance, but in no event will increase

to more than 7.5% per quarter.

The

Series B Preferred Stock will be issued pursuant to the exemption from registration under Section 4(a)(2). SSVK was the beneficial

owner of more than 5% of the Company’s common stock as of consummation, and Suren Ajjarapu, managing member of SSVK, is

a member of the Company’s board of directors.

Item

3.02 Unregistered Sales of Equity Securities.

On

February 14, 2024, the Company issued an aggregate of 600,000 shares of common stock to two financial institutions in consideration for

the provision of capital markets advisory services. The shares were issued pursuant to the exemption from registration under Section

4(a)(2).

Reference

is also made to the disclosure set forth under Items 1.01 and 8.01 of this Report, which is incorporated by reference into this Item

3.02.

Item

8.01 Other Information.

On

February 14, 2024, Semper Paratus entered into agreements with SSVK and Mr. Ajjarapu pursuant to which (i) SSVK agreed to convert $1.5

million in principal amount of loans that it made to Semper Paratus (the “SSVK Conversion”) and (ii) Mr. Ajjarapu agreed

to convert $240,000 in principal amount of loans that he made to SSVK, which funds had then been passed along to Semper Paratus,

into shares of Semper Paratus common stock at a conversion price of $10 per share of Semper Paratus common stock, following which the

loans were terminated and deemed to be of no further force or effect. The shares were issued pursuant to the exemption from registration

under Section 4(a)(2). In connection with the SSVK Conversion, the obligation of the Company to pay $2.0 million to SSVK in connection

with closing of the Business Combination pursuant to the merger agreement entered into in connection with the Business Combination was

deemed to be waived with respect to all but $500,000.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

| † |

Schedules

and exhibits to this Exhibit omitted pursuant to Regulation S-K Item 601(a)(5). The Registrant agrees to furnish supplementally a

copy of any omitted schedule or exhibit to the SEC upon request. |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

Tevogen

Bio Holdings Inc. |

| |

|

|

| Date:

February 20, 2024 |

By: |

/s/

Ryan Saadi |

| |

Name:

|

Ryan

Saadi |

| |

Title: |

Chief

Executive Officer |

Exhibit

10.11

ASSIGNMENT

AND ASSUMPTION AGREEMENT

This

Assignment and Assumption Agreement (this “Agreement”)

is made and entered into as of February 14, 2024, by and between Semper Paratus Acquisition Corporation, a Delaware corporation (“Assignor”

or the “Company”), and SSVK Associates, LLC, a Delaware liability company (“Assignee”).

WHEREAS,

Assignor has entered into the Agreement and Plan of Merger with Tevogen Bio Inc and the other parties thereto (the “Merger Agreement”);

and

WHEREAS,

in connection with the closing of the transactions contemplated by the Merger Agreement, the Company will issue preferred stock of the

Company to Assignee; and Assignee desires to assume all of Assignor’s liabilities listed on Schedule I hereto.

NOW,

THEREFORE, for and in consideration of the premises and the mutual covenants contained herein, and for other good and valuable consideration,

the receipt, adequacy and legal sufficiency of which are hereby acknowledged, the parties do hereby agree as follows:

1.

Assignment. Assignor hereby assigns, transfers and conveys to Assignee all of the liabilities and obligations listed on Schedule

I hereto, which include certain liabilities and obligations that will become liabilities and obligations of the Company as a result

of the Merger Agreement.

2.

Assumption. Assignee hereby assumes and agrees to be responsible for, and to pay, perform and discharge or cause to be paid, performed

and discharged, all of the liabilities and obligations of Assignor listed on Schedule I hereto in exchange for shares of preferred

stock of the Company, with a face value equal to the aggregate amount of such liabilities and obligations, to be issued on the following

terms.

3.

Preferred Stock. The Company shall issue to Assignee preferred stock of the Company that shall be non-voting, non-convertible,

callable by the Company at any time, and shall pay three and a half percent (3.5%) dividend per quarter for every quarter the preferred

stock remains outstanding, commencing thirty-five (35) days after the closing, provided that for so long as the liabilities and obligations

listed on Schedule I hereto are outstanding, any dividend will be paid by the Company on behalf of the Assignee to the creditors

set forth on Schedule I, pro rata in accordance with the liabilities and obligations. The dividend rate shall increase by one quarter

percent (0.25%) each month the preferred stock remains outstanding after the first thirty (30) days, but in no event shall increase to

more than seven and a half percent (7.5%) per quarter. The preferred stock shall have a liquidation preference equal to the aggregate

amount of the liabilities assumed by the Assignee.

4.

Further Actions and Governing Law. Each of the parties hereto covenants and agrees, at its own expense, to execute and deliver,

at the request of the other party hereto, such further instruments of transfer and assignment and to take such other action as such other

party may reasonably request to more effectively consummate the assignments and assumptions contemplated by this Agreement. This Agreement

shall be governed by the laws of the State of Delaware, without regard to principles of conflicts of law.

5.

Benefits; Modifications. This Agreement shall be binding on and inure to the benefit of Assignee, Assignor, and their respective

legal representatives, permitted successors, and permitted assigns.

6.

No Third Party Beneficiaries. Nothing in this Agreement will be construed as conferring upon any person other than the parties

hereto and their respective permitted assigns and successors in interest any rights, remedy, or claim under or by reason of this Agreement.

7.

Counterparts. This Agreement may be executed in any number of counterparts, each of which shall be deemed an original, but all

of which together shall constitute one and the same instrument. Photostatic, PDF or facsimile reproductions of this Agreement may be

made and relied upon to the same extent as originals.

[Signatures

Appear on Next Page]

IN

WITNESS WHEREOF, the parties have executed this Agreement as of the date first above written.

| ASSIGNOR |

|

ASSIGNEE |

| |

|

|

|

|

| Semper

Paratus Acquisition Corporation |

|

SSVK

Associates, LLC |

| |

|

|

|

|

| By: |

/s/

Surendra Ajjarapu |

|

By: |

/s/

Surendra Ajjarapu |

| Name: |

Surendra

Ajjarapu |

|

Name: |

Surendra

Ajjarapu |

| Its: |

Chief

Executive Officer |

|

Its: |

President |

[Signature

Page to Assignment and Assumption Agreement]

v3.24.0.1

Cover

|

Feb. 14, 2024 |

| Document Type |

8-K/A

|

| Amendment Flag |

true

|

| Amendment Description |

Amendment No 1

|

| Document Period End Date |

Feb. 14, 2024

|

| Entity File Number |

001-41002

|

| Entity Registrant Name |

Tevogen

Bio Holdings Inc.

|

| Entity Central Index Key |

0001860871

|

| Entity Tax Identification Number |

85-1284695

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

15

Independence Boulevard

|

| Entity Address, Address Line Two |

Suite

#410

|

| Entity Address, City or Town |

Warren

|

| Entity Address, State or Province |

NJ

|

| Entity Address, Postal Zip Code |

07059

|

| City Area Code |

(877)

|

| Local Phone Number |

838-6436

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Common Stock, par value $0.0001 per share |

|

| Title of 12(b) Security |

Common

Stock, par value $0.0001 per share

|

| Trading Symbol |

TVGN

|

| Security Exchange Name |

NASDAQ

|

| Warrants, each exercisable for one share of Common Stock for $11.50 per share |

|

| Title of 12(b) Security |

Warrants,

each exercisable for one share of Common Stock for $11.50 per share

|

| Trading Symbol |

TVGNW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=LGST_CommonStockParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=LGST_WarrantsEachExercisableForOneShareOfCommonStockFor11.50PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

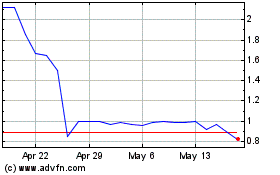

Tevogen Bio (NASDAQ:TVGN)

Historical Stock Chart

From Apr 2024 to May 2024

Tevogen Bio (NASDAQ:TVGN)

Historical Stock Chart

From May 2023 to May 2024