By Tim Higgins

Elon Musk's plan to build Tesla Inc.'s fourth vehicle assembly

factory represents the next phase in his effort to reshape the auto

maker to rapidly increase the number of electric cars it can sell

each year as it races to compete with global rivals.

The chief executive's announcement Wednesday that work has

already begun to prepare building a factory on more than 2,000

acres outside of Austin, Texas, marks one of the few new major car

assembly plants to be built in the U.S. in the past decade, and

comes while the rest of the auto industry is navigating through a

global pandemic and fears of a prolonged recession.

The factory, slated to begin production next year, would employ

at least 5,000 workers and build the Cybertruck pickup and other

vehicles. The truck, revealed last fall, drew enthusiasm -- and

some jeers -- for its "Blade Runner"-inspired appearance.

The Texas factory continues a building boom for Mr. Musk, who

opened a second assembly plant in China late last year, as he looks

to turn Tesla into a major auto maker. In 2017, Tesla sold about

100,000 vehicles. This year, the company aims to deliver 500,000

cars and sport-utility vehicles, though it cautioned on Wednesday

that economic uncertainty from the pandemic will make that more

difficult.

Beating out Tulsa, Okla., for the new factory, Texas Gov. Greg

Abbott cheered the more than $1 billion in planned investment and

jobs that the new assembly factory would bring to the area. His

office said Tesla didn't receive any state incentives to locate in

Texas, while local authorities have approved tax incentives

totaling about $60 million over several years.

Tesla's China plant allowed the company to continue building

cars during the second quarter when its lone U.S. assembly plant in

Fremont, Calif., was shut down for several weeks as part of an

effort to slow the spread of Covid-19.

The company is working to expand the China factory so it can

assemble the Model Y compact sport-utility vehicle, Tesla's latest

offering. The Model Y began U.S. deliveries in March and is

expected to overtake the Model 3 as its bestseller.

Earlier this year, Tesla began work to build a third assembly

plant outside of Berlin.

The added capacity could allow Tesla to build more than 2

million vehicles annually by the middle of the decade, according to

a note to investors from Emmanuel Rosner, a Deutsche Bank analyst.

BMW AG's namesake brand, for example, sold about 2.2 million

vehicles last year.

Tesla critics, some of whom are betting against the company by

short selling its stock, question if there is truly enough demand

for so many Tesla vehicles, noting recent price cuts.

On Wednesday, Mr. Musk was adamant that wasn't a concern.

"Demand is not a problem," he said.

During a public conference call with analysts, Mr. Musk was

joined by Jerome Guillen, president of Tesla's automotive division,

in talking about the need to hire additional workers to help with

manufacturing. "We want more people," Mr. Guillen said.

Mr. Musk became deeply interested in improving and automating

the car-building process after painful struggles to increase

production of the company's first SUV, the Model X, in 2016.

In a rare public acknowledgment of error, Mr. Musk conceded in

2018 that he went overboard with his automation attempts for the

Model 3. That mistake snarled the company's efforts to ramp up

production in 2017 and 2018 -- a dark period that shook investor

confidence in his ability to execute on his vision for Tesla to

evolve from a niche luxury brand into a mainstream electric-car

company.

That confidence has never been stronger. Shares this month have

risen almost 50%, though they dipped on Thursday along with the

rest of the market. For the year, Tesla's market value has nearly

quadrupled.

The factory expansion is a further acknowledgment by Tesla that

some of its founding assumptions were off. The original business

plan for the company, founded in 2003, was to create a car company

resembling more of a personal technology company, rather than a

traditional auto maker, by outsourcing vehicle assembly much like

how gadgets were made.

But that effort was eventually abandoned as Mr. Musk began to

realize the importance of controlling more of a company filled with

complex logistics and manufacturing nuances.

He has since brought in-house more of his supply chain than is

normal for a car maker, including seat manufacturing, and developed

greater expertise in battery cell manufacturing.

Mr. Musk said Wednesday that a lack of battery cells at an

affordable price is limiting the company's growth. Tesla is

expected to provide an update on its evolving battery strategy in

September.

He also said the Fremont factory, outside of San Francisco, will

continue to be important, despite suggesting in May he might close

it down and relocate the company's Palo Alto headquarters amid

frustration with local California authorities over the plant's

closure.

In fact, on Wednesday, Mr. Musk said the Fremont factory will

continue to be part of the company's plans, saying assembly will

continue there of its large sedan and SUV along with the Model 3

and Model Y for the western half of North America.

He also teased that the coming Roadster sports car might be made

in California. "We will continue to grow in California," he

said.

Records filed with local authorities in Texas show Tesla plans

to build a 4 million to 5 million square ft manufacturing facility

there over a period of two to three years. Mr. Musk later described

the plant as the company's biggest property when asked what kind of

production volume to expect. Tesla plans to begin operations in the

fourth quarter of next year, the records show.

In picking Austin, Tesla is joining tech companies, such as

Facebook Inc. and Apple Inc., in seeking a location with a lower

cost of operating compared with Silicon Valley. Mr. Musk touted the

factory's location near the Colorado River, saying the company

planned a boardwalk and trails for hiking and biking.

"We're going to make it a factory that is going to be stunning,"

Mr. Musk said. "It's going to basically be an ecological paradise

-- birds in the trees, butterflies, fish in the stream."

Write to Tim Higgins at Tim.Higgins@WSJ.com

(END) Dow Jones Newswires

July 23, 2020 17:24 ET (21:24 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

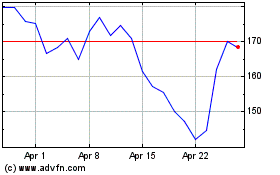

Tesla (NASDAQ:TSLA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tesla (NASDAQ:TSLA)

Historical Stock Chart

From Apr 2023 to Apr 2024