0001089907

false

0001089907

2023-11-09

2023-11-09

0001089907

swkh:CommonStockParValueMember

2023-11-09

2023-11-09

0001089907

swkh:Sec9.00SeniorNotesDue2027Member

2023-11-09

2023-11-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to

Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report

(Date of Earliest Event Reported): November 9, 2023

SWK HOLDINGS

CORPORATION

(Exact Name

of the Registrant as Specified in Its Charter)

Delaware

(State or

Other Jurisdiction of Incorporation)

| 001-39184 |

77-0435679 |

| (Commission File

Number) |

(IRS Employer Identification

No.) |

| |

|

| 5956 Sherry Lane,

Suite 650, Dallas, TX |

75225 |

| (Address of Principal

Executive Offices) |

(Zip Code) |

| |

|

(972) 687-7250

(Registrant’s

Telephone Number, Including Area Code)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| o |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| o |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| o |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| o |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| |

|

Securities registered pursuant to

Section 12(b) of the Act:

| Title

of each class |

Trading

Symbol(s) |

Name

of each exchange on

which

registered |

Common

Stock, par value

$0.001

per share |

SWKH |

The

Nasdaq Stock Market LLC |

| 9.00% Senior Notes due 2027 |

SWKHL |

The Nasdaq Stock Market LLC |

Indicate by

check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company

o

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

| Item 2.02. |

Results of Operations and Financial Condition. |

Attached as Exhibit 99.1 to this Current Report on form 8-K is

a copy of a press release of SWK Holdings Corporation, dated November 9, 2023, reporting SWK Holdings Corporation’s 2023 third

quarter financial results. Such information, including the exhibit attached hereto, shall not be deemed “filed” for purposes

of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall it be deemed incorporated

by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth

by specific reference in such filing.

| Item 9.01. |

Financial Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| SWK Holdings Corporation |

| |

|

| By: |

/s/ Joe D.

Staggs |

| |

Joe D. Staggs |

| |

President and Chief Executive Officer |

Date: November 9, 2023

Exhibit 99.1

SWK

Holdings Corporation Announces Financial Results for Third Quarter 2023

Conference

Call and Live Audio Webcast Scheduled for Thursday, November 9, 2023, at 10:00 a.m. ET

Corporate

Highlights

| · | Third

quarter of 2023 GAAP net income was $4.5 million or $0.36 per diluted share, compared with

GAAP net income of $6.6 million or $0.51 per diluted share, for the third quarter of 2022 |

| · | Closed

an approximately $33.0 million public offering of senior notes |

| · | After

quarter end, upsized existing credit facility to $60.0 million with new bank partner

Woodforest National Bank |

| · | Year-to-date

Enteris has booked $2.7 million of CDMO projects and has approximately $5.0 million of

proposals outstanding |

| · | SWK

repurchased 60,335 shares of common stock during the quarter for a total cost of $1.0

million; year-to-date through November 6, 2023, SWK has purchased 361,593 shares for

a total cost of $6.1 million |

Finance

Receivables Segment Update

| · | Third

quarter of 2023 finance receivables segment adjusted non-GAAP net income was $5.8 million,

compared with adjusted non-GAAP net income of $6.0 million for the third quarter of 2022 |

| · | As

of September 30, 2023, gross finance receivables were $234.9 million, a 10.3% increase

from September 30, 2022 |

| · | After

quarter end, closed a $20.0 million loan to Shield Therapeutics PLC as well as a $6.0

million loan to Nicoya Lifesciences, Inc. |

| · | Third

quarter of 2023 finance portfolio effective yield was 14.0%, a 30-basis-point decrease from

September 30, 2022 |

| · | As

of September 30, 2023, book value per share was $22.19 |

| · | As

of September 30, 2023, non-GAAP tangible financing book value per share was $19.35. After

adjusting for the effect of CECL adoption, non-GAAP tangible financing book value per

share increased 6.2% year-over-year |

Dallas,

TX, November 9, 2023 – SWK Holdings Corporation (Nasdaq: SWKH) (“SWK” or the “Company”), a

life science-focused specialty finance company catering to small- and mid-sized commercial-stage companies, today provided a business

update and announced its financial and operating results for the third quarter ended September 30, 2023.

“SWK

generated healthy financial returns, improved our balance sheet through the issuance of approximately $33.0 million of senior

unsecured notes and a $15.0 million upsizing of our credit facility, and our Enteris subsidiary made progress to achieving profitability.

The finance segment generated $5.6 million of pre-tax net income and $5.8 million of adjusted non-GAAP net income. The portfolio

generated a 14.0% effective yield, and gross finance receivables increased slightly sequentially to $234.9 million, as a new $5.0

million loan to a privately held CDMO was partially offset by principal repayments. After quarter end, we closed two additional

term loans, deploying $26.0 million of shareholder capital,” stated Jody Staggs, President and CEO of SWK.

Mr.

Staggs continued: “In 2023 Enteris has booked $2.7 million of CDMO projects and has proposals outstanding on an additional

$5.0 million of work. Enteris’ third quarter revenue increased 72% to $0.3 million sequentially, and we anticipate strong

revenue growth in the fourth quarter driven by referrals from our strategic partner. The increase in sequential revenue and reduced

cost structure led to a sequential improvement in the third quarter operating loss. We continue to work with the Enteris team

to achieve profitability and maximize subsidiary value.”

“During

the fourth quarter, we are focused on diligently deploying our balance sheet capital, which currently totals more than $60.0 million.

We are also in regular contact with our borrowers to ensure they acknowledge the challenging economic and capital markets environment

and are taking appropriate steps to ensure their business can operate through a more difficult period.”

Third

Quarter 2023 Financial Results

For

the third quarter 2023, SWK reported total revenue of $9.0 million, a 34.2% decrease compared to $13.6 million for the third quarter

2022. The $4.6 million decrease in revenue for the three months ended September 30, 2023 consisted of a $4.7 million decrease

in Pharmaceutical Development segment revenue and a $0.1 million increase in Finance Receivables segment revenue. The $4.7 million

decrease in Pharmaceutical Development segment revenue was primarily due to $5.0 million of milestone revenue related to Enteris’

License Agreement with Cara received during the three months ended September 30, 2022, and no similar milestone revenue was recognized

during the three months ended September 30, 2023. The $0.1 million increase in Finance Receivables segment revenue was primarily

the result of an increase in reference rates.

Pre-tax

net income for the three months ended September 30, 2023 was $4.1 million, compared to $8.6 million for the same period of the

previous year. The year-over-year decrease is primarily due to a $4.6 million decrease in consolidated revenue and a $2.0 million decrease

in unrealized losses on our warrant assets, equity securities and foreign currency transactions, partially offset

by a $2.4 million decrease in operating expenses in both segments.

GAAP

net income for the quarter ended September 30, 2023, decreased 32.4% to $4.5 million, or $0.36 per diluted share, from $6.6 million,

or $0.51 per diluted share, for the third quarter 2022.

For

the third quarter 2023, non-GAAP adjusted net income was $4.8 million, a 42.6% decrease from $8.3 million for the third quarter

2022. Non-GAAP adjusted net income for the Finance Receivables segment was $5.8 million, a 3.2% decrease from $6.0 million for

the third quarter 2022.

During

the twelve months ended September 30, 2023, there were $29.4 million of loan repayments and royalty paydowns, which were partially

offset by $41.1 million of new and existing investment funding. As a result, income-producing assets (defined as finance receivables

and corporate debt securities) totaled $235.0 million as of September 30, 2023. This is a 10.3% increase compared with income-producing

assets of $213.1 million as of September 30, 2022. Total investment assets, which include income-producing assets plus equity-linked

securities, totaled $236.3 million as of September 30, 2023, compared to September 30, 2022, total investment assets of $222.2

million.

Book

value per share was $22.19 as of September 30, 2023, compared to $21.62 as of September 30, 2022. Book value per share increased

6.2% compared to September 30, 2022, after adjusting for the effect of adopting the current expected credit losses methodology

(“CECL”). Non-GAAP tangible financing book value per share totaled $19.35. Non-GAAP tangible financing book value

per share increased 6.2% compared to $19.14 September 30, 2022, after adjusting for the effect of CECL adoption. Management views

non-GAAP tangible financing book value per share as a relevant metric to value the Company’s core finance receivable business.

Non-GAAP tangible financing book value per share removes the value of the deferred tax assets and Enteris net asset value.

Tables

detailing SWK’s financial performance for the third quarter of 2023 are below.

Portfolio

Status

During

the third quarter, SWK closed a $5.0 million loan to a privately-held CDMO. After quarter close, SWK closed two loans totaling

$26.0 million. SWK is currently pursuing multiple financing opportunities and anticipates closing additional transactions over

the next few months.

For

the third quarter of 2023, the realized yield of the finance receivables portfolio was 14.7%, versus 17.5% for the same period in

the previous year. The realized yield is inclusive of all fees, including all realized unamortized fees, amendment fees, and prepayment

fees, and is calculated based on the simple average of finance receivables at the beginning and end of the period. The realized

yield may differ from the effective yield due to actual cash collections being greater or lesser than modeled.

As

of September 30, 2023, non-accrual finance receivables totaled $26.5 million. Of the total $26.5 million, $6.9 million consisted

of royalty purchases, $10.4 million consisted of a non-accrual financing to Flowonix Medical, which has now been reclassified

as a royalty, and $9.1 million consisted of a loan to Trio Healthcare, which was placed on non-accrual during the quarter. SWK

is working with Trio to achieve a resolution.

As

of September 30, 2023, SWK had $7.4 million of unfunded commitments.

Total

portfolio investment activity for the three months ended September 30, 2023 and 2022 was as follows (in thousands):

| | |

Three Months Ended

September

30, | |

| | |

2023 | | |

2022 | |

| Beginning Portfolio | |

$ | 224,468 | | |

$ | 181,416 | |

| Early/loan payoff | |

| — | | |

| (8,543 | ) |

| Provision for credit losses | |

| (223 | ) | |

| — | |

| Interest paid-in-kind | |

| 293 | | |

| 1,736 | |

| Investment in finance receivables | |

| 5,000 | | |

| 46,400 | |

| Loan discount and fee accretion | |

| 663 | | |

| (294 | ) |

| Remeasurement of finance receivable | |

| (690 | ) | |

| — | |

| Net unrealized gain (loss) on marketable investments and warrant assets | |

| (162 | ) | |

| 1,801 | |

| Principal payments received on investments | |

| (3,915 | ) | |

| (9 | ) |

| Royalty paydowns | |

| (483 | ) | |

| (1,200 | ) |

| Warrant and equity investments, net of sales and cancellations | |

| — | | |

| 871 | |

| Ending Portfolio | |

$ | 224,951 | | |

$ | 222,178 | |

Adjusted

Non-GAAP Net Income

The

following table provides a reconciliation of SWK’s reported (GAAP) consolidated net income to SWK’s adjusted consolidated

net income (Non-GAAP) for the three months ended September 30, 2023 and 2022. The table eliminates provisions for (benefits from)

income taxes, non-cash mark-to-market changes on warrant assets, equity securities, foreign currency gains and losses, amortization

of Enteris’ intangible assets and any non-cash impact on the remeasurement of contingent consideration.

| (in thousands) | |

Three Months Ended

September

30, | |

| | |

2023 | | |

2022 | |

| Net income | |

$ | 4,474 | | |

$ | 6,616 | |

| Add (subtract): Income tax (benefit) expense | |

| (386 | ) | |

| 1,942 | |

| Add: Enteris amortization expense | |

| 426 | | |

| 426 | |

| Add (subtract): Unrealized net (gain) loss on warrant assets | |

| 162 | | |

| (1,788 | ) |

| Subtract: Unrealized net gain on equity securities | |

| — | | |

| (13 | ) |

| Add: foreign currency transaction loss | |

| 76 | | |

| — | |

| Add: Other one-time expenses | |

| — | | |

| (1,100 | ) |

| Adjusted income before income tax expense | |

| 4,752 | | |

| 8,283 | |

| Add (subtract): Income tax (benefit) expense | |

| — | | |

| — | |

| Non-GAAP adjusted net income | |

$ | 4,752 | | |

$ | 8,283 | |

In

the table above, management has deducted the following non-cash items: (i) change in the fair-market value of equities and warrants,

as mark-to-market changes are non-cash, (ii) income taxes, as the Company has substantial net operating losses to offset against

future income, (iii) amortization expense associated with Enteris’ intangible assets, and (iv) (gain) loss on remeasurement

of contingent consideration.

Finance

Receivables Adjusted Non-GAAP Net Income

The

following table provides a reconciliation of SWK’s consolidated adjusted income before provision for income tax expense,

listed in the table above, to the non-GAAP adjusted net income for the Finance Receivable segment for the three months ended September

30, 2023 and 2022. The table eliminates Enteris’ operating loss. The adjusted income before income tax expense is derived

in the table above and eliminates income tax expense, non-cash mark-to-market changes on warrant assets and equity securities.

| (in thousands) | |

Three Months Ended

September

30, | |

| | |

2023 | | |

2022 | |

| Non-GAAP adjusted net income | |

$ | 4,752 | | |

$ | 8,283 | |

| Add (Subtract): Enteris operating loss (income), excluding amortization

expense and change in fair value of contingent consideration | |

| 1,070 | | |

| (2,270 | ) |

| Adjusted Finance Receivables segment income before income tax expense | |

$ | 5,822 | | |

$ | 6,013 | |

| Adjusted income tax expense | |

| — | | |

| — | |

| Finance Receivables segment adjusted non-GAAP net income | |

$ | 5,822 | | |

$ | 6,013 | |

Non-GAAP

Tangible Finance Book Value Per Share

The

following table provides a reconciliation of SWK’s GAAP book value per share to its non-GAAP tangible finance book value per share

as of September 30, 2023 and 2022. The table eliminates the deferred tax assets, intangible assets, goodwill, Enteris’ property

and equipment and acquisition-related contingent consideration.

| (in thousands) | |

Three Months Ended September

30, | |

| | |

2023 | | |

2022 | |

| GAAP shareholders’ equity | |

$ | 277,565 | | |

$ | 277,446 | |

| Shares outstanding | |

| 12,511 | | |

| 12,835 | |

| GAAP book value per share | |

$ | 22.19 | | |

$ | 19.14 | |

| | |

| | | |

| | |

| Subtract: Deferred tax assets, net | |

| 26,090 | | |

| 17,350 | |

| Subtract: Intangible assets, net | |

| 6,913 | | |

| 8,615 | |

| Subtract: Goodwill | |

| 8,404 | | |

| 8,404 | |

| Subtract: Enteris property and equipment, net | |

| 5,325 | | |

| 5,934 | |

| Add: Contingent consideration payable | |

| 11,200 | | |

| 8,530 | |

| Non-GAAP tangible finance book value | |

| 242,033 | | |

| 245,673 | |

| Shares outstanding | |

| 12,511 | | |

| 12,835 | |

| Non-GAAP tangible finance book value per share | |

$ | 19.35 | | |

$ | 19.14 | |

Non-GAAP

Financial Measures

This

release includes non-GAAP adjusted net income, non-GAAP finance receivable segment net income, and non-GAAP tangible financing

book value per share, which are metrics that are not compliant with generally accepted accounting principles in the United States

(GAAP).

Non-GAAP

adjusted net income is adjusted for certain items including (i) changes in the fair-market value of public equity-related assets

and SWK’s warrant assets as mark-to-market changes are non-cash, (ii) income taxes as the Company has substantial net operating

losses to offset against future income, (iii) changes in the fair-market value of contingent consideration associated with the

Enteris acquisition as these changes are non-cash, and (iv) depreciation and amortization expenses, primarily associated with

the Enteris acquisition.

In

addition to the adjustments noted above, non-GAAP finance receivable segment net income also excludes Enteris’ operating

losses.

Non-GAAP

tangible financing book value per share excludes the deferred tax asset, intangible assets, goodwill, Enteris’ PP&E,

and contingent consideration associated with the Enteris transaction.

These

non-GAAP measures may not be directly comparable to similar measures used by other companies in the Company’s industry, as other

companies may define such measures differently. Management believes that these measures are useful to investors and management

in understanding our ongoing operations and in analysis of ongoing operating trends and provides useful additional information

relating to our operations and financial condition. The Company encourages investors to carefully consider its results under GAAP,

as well as its supplemental non-GAAP information and the reconciliation between these presentations, to more fully understand

its business. Non-GAAP financial results are reported in addition to, and not as a substitute for, or superior to, financial measures

calculated in accordance with GAAP. Further, non-GAAP financial measures, even if similarly titled, may not be calculated in the

same manner by all companies, and therefore should not be compared.

Conference

Call Information

SWK

Holdings will host a conference call and live audio webcast on Thursday, November 9, 2023 at 10:00 a.m. ET, to discuss its

corporate and financial results for the third quarter 2023.

Interested

participants and investors may access the conference call by dialing either:

(844)

378-6488 (U.S.)

(412)

317-1079 (International)

An

audio webcast will be accessible via the Investors Events & Presentations section of the SWK Holdings’ website: https://swkhold.investorroom.com/events.

An archive of the webcast will remain available for 90 days beginning at approximately 11:00 a.m. ET, on November 9, 2023.

About

SWK Holdings Corporation

SWK

Holdings Corporation is a life science focused specialty finance company partnering with small- and mid-sized commercial-stage

healthcare companies. SWK provides non-dilutive financing to fuel the development and commercialization of lifesaving and life-enhancing

medical technologies and products. SWK’s unique financing structures provide flexible financing solutions at an attractive

cost of capital to create long-term value for all SWK stakeholders. SWK’s solutions include structured debt, traditional

royalty monetization, synthetic royalty transactions, and asset purchases typically ranging in size from $5.0 million to $25.0

million. SWK also owns Enteris BioPharma, a clinical development and manufacturing organization

providing development services to pharmaceutical partners as well as innovative formulation solutions built around its proprietary

oral drug delivery technologies, the Peptelligence® platform. Additional information on the life science finance market

is available on the Company’s website at www.swkhold.com.

Safe

Harbor For Forward-Looking Statements

This

press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995.

Statements including words such as “believes,” “expects,” “anticipates,” “intends,”

“estimates,” “plan,” “will,” “may,” “look forward,” “intend,”

“guidance,” “future” or similar expressions are forward-looking statements. Because these statements reflect

SWK’s current views, expectations and beliefs concerning future events, these forward-looking statements involve risks and

uncertainties. Investors should note that many factors, as more fully described under the caption “Risk Factors” and

elsewhere in SWK’s Form 10-K, Form 10-Q and Form 8-K filings with the Securities and Exchange Commission and as otherwise

enumerated herein, could affect the Company’s future financial results and could cause actual results to differ materially

from those expressed in such forward-looking statements. The forward-looking statements in this press release are qualified by

these risk factors. These are factors that, individually or in the aggregate, could cause the Company’s actual results to

differ materially from expected and historical results. You should not place undue reliance on any forward-looking statements,

which speak only as of the date they are made. We assume no obligation to publicly update any forward-looking statements, whether

as a result of new information, future developments or otherwise.

For

more information, please contact:

Tiberend

Strategic Advisors, Inc.

Daniel

Kontoh-Boateng (Investors)

dboateng@tiberend.com

Eric

Reiss (Media)

ereiss@tiberend.com

SWK

HOLDINGS CORPORATION

UNAUDITED

CONDENSED CONSOLIDATED BALANCE SHEETS

(in

thousands, except share data)

| | |

September 30,

2023 | | |

December 31,

2022 | |

| ASSETS | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 31,034 | | |

$ | 6,156 | |

| Interest and accounts receivable, net | |

| 4,411 | | |

| 3,094 | |

| Other current assets | |

| 1,756 | | |

| 1,114 | |

| Total current assets | |

| 37,201 | | |

| 10,364 | |

| | |

| | | |

| | |

| Finance receivables, net of allowance for credit losses of $11,327 and $11,846, as of September 30, 2023 and December 31, 2022, respectively | |

| 223,604 | | |

| 236,555 | |

| Collateral on foreign currency forward contract | |

| 2,750 | | |

| 2,750 | |

| Marketable investments | |

| 50 | | |

| 76 | |

| Deferred tax assets, net | |

| 26,090 | | |

| 24,480 | |

| Warrant assets | |

| 1,297 | | |

| 1,220 | |

| Intangible assets, net | |

| 6,913 | | |

| 8,190 | |

| Goodwill | |

| 8,404 | | |

| 8,404 | |

| Property and equipment, net | |

| 5,479 | | |

| 5,840 | |

| Other non-current assets | |

| 4,057 | | |

| 1,742 | |

| Total assets | |

$ | 315,845 | | |

$ | 299,621 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable and accrued liabilities | |

| 2,768 | | |

| 3,902 | |

| Revolving credit facility | |

| 22,000 | | |

| 2,445 | |

| Total current liabilities | |

| 24,768 | | |

| 6,347 | |

| | |

| | | |

| | |

| Contingent consideration payable | |

| 11,200 | | |

| 11,200 | |

| Other non-current liabilities | |

| 2,312 | | |

| 2,145 | |

| Total liabilities | |

| 38,280 | | |

| 19,692 | |

| | |

| | | |

| | |

| Stockholders’ equity: | |

| | | |

| | |

| Preferred stock, $0.001 par value; 5,000,000 shares authorized; no shares issued and outstanding | |

| — | | |

| — | |

| Common stock, $0.001 par value; 250,000,000 shares authorized; 12,510,776 and 12,843,157 shares issued and outstanding as of September 30, 2023 and December 31, 2022, respectively | |

| 12 | | |

| 12 | |

| Additional paid-in capital | |

| 4,425,198 | | |

| 4,430,922 | |

| Accumulated deficit | |

| (4,147,645 | ) | |

| (4,151,005 | ) |

| Total stockholders’ equity | |

| 277,565 | | |

| 279,929 | |

| Total liabilities and stockholders’ equity | |

$ | 315,845 | | |

$ | 299,621 | |

SWK

HOLDINGS CORPORATION

UNAUDITED

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(in

thousands, except per share data)

| | |

Three Months Ended

September 30, | | |

Nine Months Ended

September 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Revenues: | |

| | | |

| | | |

| | | |

| | |

| Finance receivable interest income, including fees | |

$ | 8,608 | | |

$ | 8,502 | | |

$ | 27,146 | | |

$ | 25,745 | |

| Pharmaceutical development | |

| 315 | | |

| 5,111 | | |

| 616 | | |

| 5,461 | |

| Other | |

| 39 | | |

| 1 | | |

| 108 | | |

| 481 | |

| Total revenues | |

| 8,962 | | |

| 13,614 | | |

| 27,870 | | |

| 31,687 | |

| Costs and expenses: | |

| | | |

| | | |

| | | |

| | |

| Provision for (benefit from) credit losses | |

| 223 | | |

| — | | |

| (459 | ) | |

| — | |

| Interest expense | |

| 176 | | |

| 82 | | |

| 721 | | |

| 242 | |

| Pharmaceutical manufacturing, research and development expense | |

| 606 | | |

| 1,792 | | |

| 2,834 | | |

| 5,173 | |

| Depreciation and amortization expense | |

| 652 | | |

| 634 | | |

| 1,937 | | |

| 1,964 | |

| General and administrative expense | |

| 2,979 | | |

| 4,349 | | |

| 8,516 | | |

| 10,527 | |

| Income from operations | |

| 4,326 | | |

| 6,757 | | |

| 14,321 | | |

| 13,781 | |

| Other income (expense), net: | |

| | | |

| | | |

| | | |

| | |

| Unrealized net (loss) gain on warrants | |

| (162 | ) | |

| 1,788 | | |

| (745 | ) | |

| 623 | |

| Unrealized net gain (loss) on equity securities | |

| — | | |

| 13 | | |

| — | | |

| (534 | ) |

| (Loss) gain on foreign currency transactions | |

| (76 | ) | |

| — | | |

| 426 | | |

| — | |

| Income before income tax (benefit) expense | |

| 4,088 | | |

| 8,558 | | |

| 14,002 | | |

| 13,870 | |

| Income tax (benefit) expense | |

| (386 | ) | |

| 1,942 | | |

| 959 | | |

| 3,211 | |

| Net income | |

$ | 4,474 | | |

$ | 6,616 | | |

$ | 13,043 | | |

$ | 10,659 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net income per share: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | 0.36 | | |

$ | 0.52 | | |

$ | 1.03 | | |

$ | 0.83 | |

| Diluted | |

$ | 0.36 | | |

$ | 0.51 | | |

$ | 1.02 | | |

$ | 0.83 | |

| Weighted average shares outstanding: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 12,539 | | |

| 12,832 | | |

| 12,703 | | |

| 12,832 | |

| Diluted | |

| 12,582 | | |

| 12,851 | | |

| 12,746 | | |

| 12,871 | |

SWK

HOLDINGS CORPORATION

UNAUDITED

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in

thousands)

| | |

Nine Months Ended

September

30, | |

| | |

2023 | | |

2022 | |

| Cash flows from operating activities: | |

| | | |

| | |

| Net income | |

$ | 13,043 | | |

$ | 10,659 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | |

| | | |

| | |

| Benefit from credit losses | |

| (459 | ) | |

| — | |

| Right-of-use asset amortization | |

| 244 | | |

| 171 | |

| Amortization of debt issuance costs | |

| 243 | | |

| 26 | |

| Deferred income taxes | |

| 915 | | |

| 3,189 | |

| Change in fair value of warrants | |

| 745 | | |

| (623 | ) |

| Change in fair value of equity securities | |

| — | | |

| 534 | |

| Foreign currency transaction gain | |

| (375 | ) | |

| — | |

| Loan discount and fee accretion | |

| (2,959 | ) | |

| (1,357 | ) |

| Interest paid-in-kind | |

| (1,826 | ) | |

| (3,335 | ) |

| Stock-based compensation | |

| 369 | | |

| 310 | |

| Depreciation and amortization expense | |

| 1,937 | | |

| 1,964 | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Interest and accounts receivable | |

| (1,317 | ) | |

| (5,581 | ) |

| Other assets | |

| (738 | ) | |

| (76 | ) |

| Accounts payable and other liabilities | |

| (635 | ) | |

| (603 | ) |

| Net cash provided by operating activities | |

| 9,187 | | |

| 5,278 | |

| | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| Proceeds from sale of investments | |

| 13,942 | | |

| — | |

| Investment in finance receivables | |

| (17,525 | ) | |

| (71,750 | ) |

| Repayment of finance receivables | |

| 7,430 | | |

| 43,938 | |

| Corporate debt securities principal payments | |

| 26 | | |

| 31 | |

| Purchases of property and equipment | |

| (299 | ) | |

| (194 | ) |

| Net cash provided by (used in) investing activities | |

| 3,574 | | |

| (27,975 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| Payments for financing costs | |

| (1,345 | ) | |

| — | |

| Proceeds from (payments on) credit facilities | |

| 19,555 | | |

| (8 | ) |

| Net settlement for employee taxes on restricted stock and options | |

| — | | |

| (160 | ) |

| Repurchases of common stock, including fees and expenses | |

| (6,093 | ) | |

| (599 | ) |

| Net cash provided by (used in) financing activities | |

| 12,117 | | |

| (767 | ) |

| | |

| | | |

| | |

| Net increase (decrease) in cash and cash equivalents | |

| 24,878 | | |

| (23,464 | ) |

| Cash and cash equivalents at beginning of period | |

| 6,156 | | |

| 42,863 | |

| Cash and cash equivalents at end of period | |

$ | 31,034 | | |

$ | 19,399 | |

v3.23.3

Cover

|

Nov. 09, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 09, 2023

|

| Entity File Number |

001-39184

|

| Entity Registrant Name |

SWK HOLDINGS

CORPORATION

|

| Entity Central Index Key |

0001089907

|

| Entity Tax Identification Number |

77-0435679

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

5956 Sherry Lane

|

| Entity Address, Address Line Two |

Suite 650

|

| Entity Address, City or Town |

Dallas

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

75225

|

| City Area Code |

(972)

|

| Local Phone Number |

687-7250

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock, par value |

|

| Title of 12(b) Security |

Common

Stock, par value

|

| Trading Symbol |

SWKH

|

| Security Exchange Name |

NASDAQ

|

| 9.00% Senior Notes due 2027 |

|

| Title of 12(b) Security |

9.00% Senior Notes due 2027

|

| Trading Symbol |

SWKHL

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=swkh_CommonStockParValueMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=swkh_Sec9.00SeniorNotesDue2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

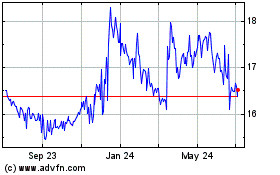

SWK (NASDAQ:SWKH)

Historical Stock Chart

From Mar 2024 to Apr 2024

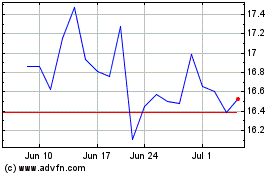

SWK (NASDAQ:SWKH)

Historical Stock Chart

From Apr 2023 to Apr 2024