Zacks Top Ranked Bond ETF: SHV - ETF News And Commentary

January 30 2013 - 8:42AM

Zacks

Treasury bond ETFs have been having a dream run since mid 2011,

primarily thanks to the monetary stimulus program incorporated by

the Federal Reserve. The Fed has single handedly emerged as the

largest buyer of Treasury Bonds which has resulted in a massive

increase in its balance sheet since 2008.

Considering the last couple of years we have had the Operation

Twist, followed by the QE3 and now the open ended bond buying

program which has replaced these others. To sum it all up, the Fed

has been trying its utmost to keep long term borrowing costs low

and is at the same time ensuring adequate liquidity in the

market.

This had a huge impact on bond ETF investors. Due to the Fed

bond buying program coupled with increased demand for Treasury

bonds during the equity market turmoil in 2011, it led to a rally

in the Treasury bond market. However, it also caused the interest

rates to plunge extremely low leaving a pathetic amount of current

income (read AGG vs. BND: Which Bond ETF Do You Choose?).

Yet there is now some speculation that this may be changing

soon. The minutes of the last FOMC meeting caused widespread panic

among bond investors as most of the Fed members showed concern

about continuing the programs indefinitely.

Nevertheless, with a weak GDP report and concerns over spending,

Treasury Bonds can experience a flight to safety mode yet again.

This could be especially true if the sequester goes into effect or

if Europe and other international markets see weakness in 2013

(read Time to Exit Treasury Bond ETFs?).

With this backdrop, investors seeking exposure in the Treasury

Bond ETF space can consider the following Zacks top ranked bond ETF

as a safe haven instrument to ride out the stock volatility.

About the Zacks ETF Rank

The Zacks ETF Rank provides a recommendation for the ETF in the

context of our outlook of the underlying industry, sector, style

box, or asset class. Our proprietary methodology also takes into

account the risk preferences of investors as well.

The aim of our models is to select the best ETFs within each

risk category. We assign each ETF one of five ranks within each

risk bucket. Thus, Zacks Rank reflects the expected return of an

ETF relative to other ETFs with similar level of risk (see more in

the Zacks ETF Center).

Using this strategy, we have found a Ranked 2 or ‘Buy’ Treasury

Bond ETF which we have highlighted in greater detail below:

Launched in January of 2007, iShares Barclays Short

Treasury Bond ETF (SHV)

tracks the Barclays Capital U.S. Short Treasury Bond Index which

measures the performance of short term U.S. Treasury Bonds with a

residual maturity of less than or equal to a year.

The ETF targets the immediate end on the yield curve with a

weighted average maturity of 0.43 years. Also, it is subject to

negligible interest rate risk primarily due to its short term focus

as indicated by a weighted average duration of 0.43 years.

Furthermore, in terms of credit risk the ETF seems to be well

placed. This is because the government bonds have virtually no

default risk, thanks to their ability to print money to pay off

bills.

However, the ETF is not an appropriate choice for aggressive

bond investors seeking high returns as the scope for current income

and capital appreciation is very limited. Therefore it should

primarily be considered for stability and protection (read Target

Date Bond ETFs: Best or Worst Fixed Income Funds?).

SHV will be an appropriate and low cost choice for investors

seeking to ride out the current short term market volatility and

uncertainties over the debt ceiling debate. However, apart from

acting as the safe haven investment avenue, the ETF would serve

very little purpose.

In terms of popularity and liquidity, the ETF seems to be well

placed as it has a huge asset base of around $2.45 billion and does

a daily volume of around 287,000 shares. Its low cost structure of

just 15 basis points is an added advantage for the ETF.

The iShares Barclays Short Treasury Bond ETF (SHV) typically

invests in short term fixed income securities issued by the U.S.

Treasury. It invests across 14 securities with around 93% of its

total assets invested in the top 10 holdings. All components are

U.S. dollar denominated thereby eliminating any currency risk.

Not surprisingly, over the past three years, the ETF price has

remained virtually unchanged given its very low levels of interest

rate sensitivity and the near zero short term treasury interest

rates. Also, the short term focus of SHV does not make it a good

candidate for high levels of current income (see Which Volatility

Hedged ETF Should You Consider?).

However, the ETF has lived up to its safe haven status and has

gone a long way in protecting investors’ capital over the long

haul. This makes it an interesting choice for those worried about

both a bond bubble and near record stock prices as we push further

into 2013.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

ISHARS-BR SH TB (SHV): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

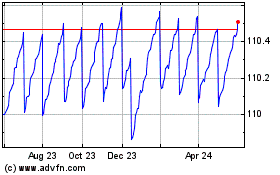

iShares Short Treasury B... (NASDAQ:SHV)

Historical Stock Chart

From Apr 2024 to May 2024

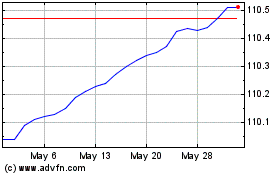

iShares Short Treasury B... (NASDAQ:SHV)

Historical Stock Chart

From May 2023 to May 2024