SG Blocks Signs First Licensing Agreement Converting its Residential Construction Vertical to a Royalty Model Reducing Execut...

October 04 2019 - 8:30AM

Business Wire

SG Blocks, Inc. (NASDAQ: SGBX) (“SG Blocks” or the

“Company”) — a leading designer, innovator and fabricator of

container-based structures — today announced that it has entered

into its first Licensing transaction, with a Licensee that has

injected over $100 million into underserved communities.

The Company intends to enter into additional similar licensing

transactions for its other construction opportunity verticals –

such as education and hospitality - reducing the project execution

risk and corporate overhead costs associated with executing

construction projects, and allowing the Company to focus on sales

and marketing and on qualified lead generation for its

licensees.

The first Licensing transaction provides for the Licensee to pay

SG Blocks up to 5% of the total gross revenues generated from the

construction, development and manufacture of residential housing

using the SG Blocks method or SG Blocks referrals of any kind. It

is limited geographically to the United States and U.S.

territories.

As part of this transaction:

- The Licensee will operate under the name SG Residential,

thereby continuing to promote and represent the SG Blocks name and

continuing to build the SG Blocks brand in the marketplace.

- SG Residential (“SGR”) will pay SG Blocks a 5% royalty on the

first $20 million in annual topline revenues generated using the

SGBX residential pipeline, referrals and/or technology, regardless

of how it is generated. The Royalty fee decreases to 4.5% on the

next $30 million and increases back to 5% on revenues generated in

excess of $50 million from those sources.

- SGR has agreed to a rate card wherein it will reimburse SGBX

for staff time allocated to the residential business. These

reimbursements will be an offset to our SG&A. The Licensee will

also assume responsibility for SGBX’s remaining and future

residential pipeline and will accordingly reimburse SG Blocks for

any third-party expenses incurred by SGBX in developing those

projects as they come online.

- The agreement allows SGBX to pivot to a much lower cost

structure as it relates to overhead. Cash SG&A will be reduced

50% to just $2 million annually.

- SG Blocks retains its right to construction projects in

non-residential verticals. These include a wide variety of areas

including food service, military, non-military government, retail,

commercial, industrial and disaster relief related construction.

Additionally, we continue to be approached by developers,

contractors and consumers with new potential applications.

- SG Blocks retains the right to License its residential platform

internationally and may separately do so by country or region. For

example, the Company is free to enter into a similar arrangement in

Canada.

Paul Galvin, Chairman and CEO of SG Blocks commented, “Today’s

agreement is transformational for SG Blocks and its shareholders.

This deal significantly reduces project-level financing risk as

well as execution risk. As importantly, our fixed expenses are

reduced dramatically, and we expect with the execution of

additional License Agreements to reduce them even further. Given

the real estate experience and financial strength of our Licensee,

the Licensing model increases the likelihood of success of these

projects and ultimately reduces not only the amount of expense but

also the capital required by the Company.”

Said Galvin, “This licensing model allows SG Blocks to focus its

efforts on qualified lead generation, new product application. It

is our ultimate goal to be a product driven, low-overhead, high

margin, royalty-driven company.”

He continued, “Our focus is on working with well positioned,

financially stable and socially responsible operators. Our current

Licensee fits that profile, and we look forward to working with

others to craft similar agreements. Given that the Licensee has

injected over $100 million into disadvantaged and underserved

communities, we are proud to be aligned with them.”

About SG Blocks, Inc.

SG Blocks, Inc. is a premier innovator in advancing and

promoting the use of code-engineered cargo shipping containers for

safe and sustainable construction. The firm offers a product that

exceeds many standard building code requirements, and also supports

developers, architects, builders and owners in achieving greener

construction, faster execution, and stronger buildings of higher

value. Each project starts with GreenSteel™, the structural core

and shell of an SG Blocks building, and is then customized to

client specifications. For more information, visit

www.sgblocks.com. Due to confidentiality agreements, the

Company is limited in the details about the Licensee that it can

disclose now but anticipates communicating more details about the

Licensee in the near future.

Forward-Looking Statements

Certain statements in this press release constitute

"forward-looking statements" within the meaning of the federal

securities laws. Words such as "may," "might," "will," "should,"

"believe," "expect," "anticipate," "estimate," "continue,"

"predict," "forecast," "project," "plan," "intend" or similar

expressions, or statements regarding intent, belief, or current

expectations, are forward-looking statements. While SG Blocks

believes these forward-looking statements are reasonable, undue

reliance should not be placed on any such forward-looking

statements, which are based on information available to us on the

date of this release. These forward-looking statements are based

upon current estimates and assumptions and are subject to various

risks and uncertainties, including without limitation those set

forth in SG Blocks' filings with the Securities and Exchange

Commission. Thus, actual results could be materially different. SG

Blocks expressly disclaims any obligation to update or alter

statements whether as a result of new information, future events or

otherwise, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20191004005104/en/

Media Rubenstein Public Relations Christina

Levin Account Director 212-805-3029

clevin@rubensteinpr.com or James Carbonara

Hayden IR (646)-755-7412 james@haydenir.com

Brett Maas Hayden IR (646) 536-7331

brett@haydenir.com

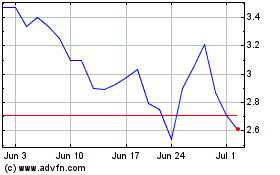

Safe and Green (NASDAQ:SGBX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Safe and Green (NASDAQ:SGBX)

Historical Stock Chart

From Apr 2023 to Apr 2024