Current Report Filing (8-k)

November 04 2014 - 4:20PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 4, 2014

RIGEL PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation)

|

0-29889 |

|

94-3248524 |

|

(Commission File No.) |

|

(IRS Employer Identification No.) |

1180 Veterans Boulevard

South San Francisco, CA

(Address of principal executive offices)

94080

(Zip Code)

Registrant’s telephone number, including area code: (650) 624-1100

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02. Results of Operations and Financial Condition.

On November 4, 2014, Rigel Pharmaceuticals, Inc. (“Rigel”) announced certain financial results for its third quarter ended September 30, 2014. A copy of Rigel’s press release, titled “Rigel Announces Third Quarter 2014 Financial Results,” is furnished pursuant to Item 2.02 as Exhibit 99.1 hereto.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit |

|

Description |

|

|

|

|

|

99.1 |

|

Press Release, dated November 4, 2014, titled “Rigel Announces Third Quarter 2014 Financial Results.” |

The information in this report, including the exhibit hereto, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information contained herein and in the accompanying exhibit shall not be incorporated by reference into any filing with the U.S. Securities and Exchange Commission made by Rigel Pharmaceuticals, Inc., whether made before or after the date hereof, regardless of any general incorporation language in such filing.

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Dated: November 4, 2014 |

|

RIGEL PHARMACEUTICALS, INC. |

|

|

|

|

|

|

By: |

/s/ Dolly A. Vance |

|

|

|

Dolly A. Vance |

|

|

|

Executive Vice President, General Counsel and Corporate Secretary |

3

EXHIBIT INDEX

|

Exhibit |

|

Description |

|

|

|

|

|

99.1 |

|

Press Release, dated November 4, 2014, titled “Rigel Announces Third Quarter 2014 Financial Results.” |

4

Exhibit 99.1

Rigel Announces Third Quarter 2014 Financial Results

South San Francisco, Calif. — November 4, 2014 — Rigel Pharmaceuticals, Inc. (Nasdaq:RIGL) today reported financial results for the third quarter and nine months ended September 30, 2014.

For the third quarter of 2014, Rigel reported a net loss of $20.9 million, or $0.24 per share, compared to a net loss of $23.8 million, or $0.27 per share, for the same period of 2013. Weighted average shares outstanding for the third quarters of 2014 and 2013 were 87.8 million and 87.4 million, respectively.

Rigel reported total operating expenses of $21.0 million for the third quarter of 2014, compared to $23.9 million for the same period in 2013. The decrease in operating expenses was primarily due to the completion of two Phase 2 studies in 2013 and a workforce reduction implemented in September 2013, partially offset by an increase in research and development costs in the third quarter of 2014 related to Rigel’s FIT program, a Phase 3 clinical program with fostamatinib in patients with immune thrombocytopenic purpura (ITP).

For the nine months ended September 30, 2014, Rigel reported a net loss of $68.6 million, or $0.78 per basic and diluted share, compared to a net loss of $72.2 million, or $0.83 per basic and diluted share, for the same period of 2013.

As of September 30, 2014, Rigel had cash, cash equivalents and available for sale securities of $157.7 million, compared to $212.0 million as of December 31, 2013. Rigel expects to end 2014 with cash and investments in excess of $135.0 million, which is expected to be sufficient to fund operations into the third quarter of 2016.

FIT Program Update

The FIT Phase 3 clinical program was initiated in July 2014 and consists of two identical multi-center, double-blind, placebo-controlled studies to evaluate the potential of fostamatinib to increase the blood platelet counts of patients with chronic ITP. One trial will enroll patients from predominantly US and UK-based sites while the other is more internationally focused. Rigel expects that the top line results of these two studies will be reported separately; with the US/UK-based study results expected by the end of 2015 and the other study results expected in the first quarter of 2016.

Recent Events

In October 2014, Rigel earned a milestone payment of $2.5 million from partner AstraZeneca for moving forward R256 toward clinical studies for the potential treatment of moderate to severe chronic asthma.

“We continue to focus on fostamatinib with our ongoing Phase 3 studies in ITP and the Phase 2 study in IgA nephropathy which is expected to begin shortly,” said James M. Gower, chairman and chief executive officer of Rigel. “Additionally, we are also pleased with AstraZeneca’s decision to move R256 forward in their development pipeline.”

About Rigel (www.rigel.com)

Rigel Pharmaceuticals, Inc. is a clinical-stage drug development company that discovers and develops novel, small-molecule drugs for the treatment of inflammatory and autoimmune diseases, as well as muscle disorders. Rigel’s pioneering research focuses on intracellular signaling pathways and related targets that are critical to disease mechanisms. Rigel currently has the following product candidates in development: fostamatinib, an oral SYK inhibitor, which is in Phase 3 clinical trials for ITP and is expected to enter a Phase 2 clinical trial for IgAN in the second half of 2014; R348, a topical JAK/SYK inhibitor, in a Phase 2 clinical trial for dry eye in GvHD; and two oncology product candidates in Phase 1 development with partners BerGenBio AS and Daiichi Sankyo.

This press release contains “forward-looking” statements, including, without limitation, statements related to Rigel’s clinical development plans, including the enrollment and timing of planned clinical trials and the timing and reporting of results from our current and planned clinical trials, as well as our expected cash balances and sufficiency of our cash. Any statements contained in this press release that are not statements of historical fact may be deemed to be forward-looking statements. Words such as “planned,” “will,” “may,” “expect,” and similar expressions are intended to identify these forward-looking statements. These forward-looking statements are based on Rigel’s current expectations and inherently involve significant risks and uncertainties. Actual results and the timing of events could differ materially from those anticipated in such forward looking statements as a result of these risks and uncertainties, which include, without limitation, the availability of resources to develop Rigel’s product candidates, Rigel’s need for additional capital in the future to sufficiently fund Rigel’s operations and research, the uncertain timing of completion of and the success of clinical trials, market competition, risks associated with and Rigel’s dependence on Rigel’s corporate partnerships, as well as other risks detailed from time to time in Rigel’s reports filed with the Securities and Exchange Commission, including its Quarterly Report on Form 10-Q for the quarter ended June 30, 2014. Rigel does not undertake any obligation to update forward-looking statements and expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein.

###

Contact: Ryan D. Maynard

Phone: 650.624.1284

Email: invrel@rigel.com

Media Contact: Susan C. Rogers, Rivily, Inc.

Phone: 650.430.3777

Email: susan@rivily.com

RIGEL PHARMACEUTICALS, INC.

STATEMENTS OF OPERATIONS

(in thousands, except per share amounts)

|

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

|

2014 |

|

2013 |

|

2014 |

|

2013 |

|

|

|

|

(unaudited) |

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

Contract revenues |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

1,400 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

Research and development (see Note A) |

|

16,151 |

|

17,574 |

|

53,083 |

|

57,282 |

|

|

General and administrative (see Note A) |

|

4,889 |

|

4,677 |

|

15,798 |

|

14,964 |

|

|

Restructuring charges (see Note A) |

|

— |

|

1,679 |

|

— |

|

1,679 |

|

|

Total operating expenses |

|

21,040 |

|

23,930 |

|

68,881 |

|

73,925 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from operations |

|

(21,040 |

) |

(23,930 |

) |

(68,881 |

) |

(72,525 |

) |

|

Interest income, net |

|

98 |

|

106 |

|

245 |

|

359 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(20,942 |

) |

$ |

(23,824 |

) |

$ |

(68,636 |

) |

$ |

(72,166 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share, basic and diluted |

|

$ |

(0.24 |

) |

$ |

(0.27 |

) |

$ |

(0.78 |

) |

$ |

(0.83 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average shares used in computing net loss per share, basic and diluted |

|

87,793 |

|

87,430 |

|

87,618 |

|

87,240 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Note A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation expense included in: |

|

|

|

|

|

|

|

|

|

|

Research and development |

|

$ |

1,151 |

|

$ |

1,035 |

|

$ |

3,654 |

|

$ |

3,060 |

|

|

General and administrative |

|

929 |

|

789 |

|

2,922 |

|

2,304 |

|

|

Restructuring charges |

|

— |

|

239 |

|

— |

|

239 |

|

|

|

|

$ |

2,080 |

|

$ |

2,063 |

|

$ |

6,576 |

|

$ |

5,603 |

|

SUMMARY BALANCE SHEET DATA

(in thousands)

|

|

|

September 30, |

|

December 31, |

|

|

|

|

2014 |

|

2013 (1) |

|

|

|

|

(unaudited) |

|

|

|

|

Cash, cash equivalents and available for sale securities |

|

$ |

157,672 |

|

$ |

211,975 |

|

|

Total assets |

|

163,219 |

|

226,058 |

|

|

Stockholders’ equity |

|

146,850 |

|

208,251 |

|

|

|

|

|

|

|

|

|

(1) Derived from audited financial statements

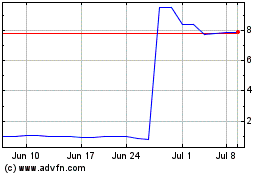

Rigel Pharmaceuticals (NASDAQ:RIGL)

Historical Stock Chart

From Mar 2024 to Apr 2024

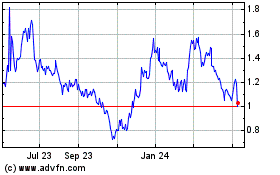

Rigel Pharmaceuticals (NASDAQ:RIGL)

Historical Stock Chart

From Apr 2023 to Apr 2024