Current Report Filing (8-k)

June 30 2020 - 4:03PM

Edgar (US Regulatory)

0001590560

false

00-0000000

0001590560

2020-06-24

2020-06-24

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

June 24, 2020

uniQure N.V.

(Exact Name of Registrant as Specified in

Charter)

|

The Netherlands

|

|

001-36294

|

|

N/A

|

(State or Other

Jurisdiction of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

Paasheuvelweg 25a,

1105 BP Amsterdam, The Netherlands

|

|

N/A

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including

area code: +31-20-566-7394

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

¨ Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material

pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class:

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered:

|

|

Ordinary Shares

|

|

QURE

|

|

The Nasdaq Global Select Market

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01 Entry into a Material Definitive Agreement.

Commercialization and License Agreement

On June 24, 2020, uniQure biopharma

BV, a wholly-owned subsidiary of uniQure N.V., (the “Company”) entered into a commercialization and license agreement

(the “Agreement”) with CSL Behring LLC (“CSL Behring”) providing CSL Behring exclusive global rights to

etranacogene dezaparvovec, the Company’s investigational gene therapy for patients with hemophilia B. Etranacogene dezaparvovec

consists of an AAV5 viral vector carrying a gene cassette with the patent-protected Padua variant of Factor IX (FIX-Padua) (the

“Product”).

Financial Terms

Under the terms of the Agreement, the Company

will receive a $450 million upfront cash payment and be eligible to receive up to $1.6 billion in payments based on regulatory

and commercial milestones. The Company will also be eligible to receive tiered double-digit royalties in a range of up to a low-twenties

percent of net sales of the Product based on sales thresholds.

Development and Commercialization

Under the terms of the Agreement, the Company

will be responsible for the completion of the HOPE-B pivotal study, manufacturing process validation, and the manufacturing supply

of the Product until such time that these capabilities may be transferred to CSL Behring or its designated contract manufacturing

organization. The Company will supply the Product to CSL Behring at a price slightly above its manufacturing cost pursuant to a

development and commercial supply agreement, which the parties executed simultaneously with the Agreement and which will become

effective simultaneously with the Agreement following antitrust review. Clinical development and regulatory activities performed

by the Company under the Agreement will be reimbursed by CSL Behring. CSL Behring will be responsible for regulatory submissions

and commercialization for the Product throughout the world.

Exclusivity

Other than under the Agreement, neither

party may perform any clinical trials for any gene therapy product, gene-editing product, or any other product comprising an AAV

vector to conduct nucleotide transfer (including DNA and RNA) for the treatment, prevention, or cure of Hemophilia B for a period

commencing as of the execution date of the Agreement and continuing for a period of four years following the first commercial sale

of the Product in the United States, and neither party may commercialize such a product for a period commencing as of the execution

date of the Agreement and continuing for a period of seven years following the first commercial sale of the Product in the United

States. The foregoing exclusivity commitment would not bind an acquirer of the Company that owns or controls such a product so

long as certain precautions are followed to ensure that CSL Behring’s confidential information and the Company’s proprietary

technology related to the Product are not used or accessed by personnel of such acquirer who are developing or commercializing

such competing product.

Term; Termination

Unless earlier terminated as described

below, the Agreement will continue on a country-by-country basis until expiration of the royalty term in a country. The royalty

term expires in a country on the later of (a) 15 years after the first commercial sale of the Product in such country, (b) expiration

of regulatory exclusivity for the Product in such country and (c) expiration of all valid claims of specific licensed patents

covering the Product in such country. Either party may terminate the Agreement for the other party’s material breach, if

such breach is not cured within a specified cure period. In addition, if CSL Behring fails to commercialize the Product in any

of a group of major countries for an extended period of time following the first regulatory approval of a Product in any of such

group of countries (other than due to certain specified reasons) and such failure has not been cured within a specified cure period,

then the Company may terminate the Agreement. CSL Behring may also terminate the Agreement for convenience.

Antitrust Review

The effectiveness of the transaction is

contingent on completion of review under antitrust laws in the United States, Australia, and the United Kingdom.

The foregoing description of the terms

of the Agreement is not complete and is qualified in its entirety by reference to the text of the Agreement, a copy of which the

Company intends to file as an exhibit to its Quarterly Report on Form 10-Q for the quarter ended June 30, 2020.

Item 8.01 Other Events.

On June 24, 2020, the Company issued

a press release entitled “uniQure Announces License Agreement with CSL Behring to Commercialize Hemophilia B Gene Therapy.”

The full text of the press release is filed herewith as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) The following exhibits are being filed herewith:

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

|

|

UNIQURE N.V.

|

|

|

|

|

|

|

|

|

Date: June 30, 2020

|

By:

|

/s/ Matthew Kapusta

|

|

|

|

Matthew Kapusta

|

|

|

|

Chief Executive Officer and Chief Financial Officer

|

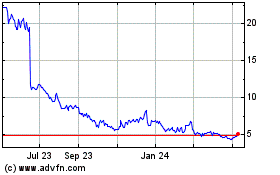

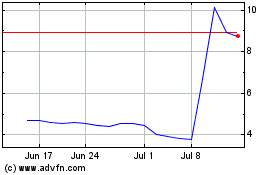

uniQure NV (NASDAQ:QURE)

Historical Stock Chart

From Mar 2024 to Apr 2024

uniQure NV (NASDAQ:QURE)

Historical Stock Chart

From Apr 2023 to Apr 2024