Form 8-K - Current report

July 31 2023 - 4:16PM

Edgar (US Regulatory)

0001849670false00018496702022-07-272022-07-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): July 31, 2023

PB Bankshares, Inc.

(Exact Name of Registrant as Specified in Charter)

| | | | |

Maryland | | 001-40612 | | 86-3947794 |

(State or Other Jurisdiction of Incorporation) | | (Commission File No.) | | (I.R.S. Employer Identification No.) |

| | |

185 East Lincoln Highway, Coatesville, Pennsylvania | | 19320 |

(Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s telephone number, including area code:(610) 384-8282

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Common Stock, par value $0.01 | | PBBK | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| Emerging growth company ☒ | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 | Regulation FD Disclosure |

On July 31, 2023, PB Bankshares, Inc. (the “Company”), parent company of Presence Bank, made available to current and prospective investors a slide presentation. The presentation materials include information regarding the Company’s operating and growth strategies and financial performance. The slide presentation is furnished in this Current Report on Form 8-K, pursuant to this Item 7.01, as Exhibit 99.1, and is incorporated herein by reference.

This Current Report and the information included below and furnished as exhibits hereto shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (“Exchange Act”), nor shall it be incorporated by reference into a filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing. The furnishing of the information in this Current Report is not intended to, and does not, constitute a determination or admission by the Company that the information in this report is material or complete, or that investors should consider this information before making an investment decision with respect to any security of the Company or any of its affiliates.

Item 9.01 | Financial Statements and Exhibits |

| | | | |

(a) | | Financial statements of businesses acquired. None. |

| | |

(b) | | Pro forma financial information. None. |

| | |

(c) | | Shell company transactions: None. |

| | |

(d) | | Exhibits. |

| | 99.1 | | Presentation Materials of PB Bankshares, Inc. |

| | 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| PB BANKSHARES, INC. |

| |

DATE: July 31, 2023 | By: | /s/ Lindsay Bixler |

| | Lindsay Bixler |

| | Executive Vice President and Chief Financial Officer |

Exhibit 99.1

| Janak M. Amin, President & CEO

July 31, 2023

2Q 2023 Performance

P R E S E N C E B A N K . C O M 1 |

| Disclaimers

P R E S E N C E B A N K . C O M 2

This presentation does not constitute or form part of any offer or invitation to purchase any securities of PB

BANKSHARES, INC in whole or in part. This presentation has been prepared by Presence Bank solely for informational

purposes to assist interested parties in making their own evaluation of Presence Bank. It does not purport to contain

all the information that may be relevant. In all cases, interested parties should conduct their own investigation and

analysis of PB BANKSHARES, INC and the data set forth in this presentation and other information provided by or on

behalf of Presence Bank is not providing you with any legal, business, tax or other advice regarding an investment in

the securities. You should consult with your own advisors as needed to assist you in making your investment decision.

Any securities of PB BANKSHARES, INC are not a deposit or bank account, and are not, and will not be, insured or

guaranteed by the FDIC or any other federal or state government agency.

This presentation may contain forward-looking statements as defined in the Private Securities Litigation Reform Act of

1995. These forward-looking statements are not historical facts, and are based on current expectations, estimates and

projections about Presence Bank’s industry, management’s beliefs and certain assumptions made by management,

many of which are by their nature inherently uncertain and beyond Presence Bank’s control. Accordingly, you are

cautioned that any such forward-looking statements are not guarantees of future performance and are subject to

certain risks, uncertainties and assumptions that are difficult to predict. Although Presence Bank believes that the

expectations reflected in such forward-looking statements are reasonable as of the date made, expectations may

prove to have been materially different from the results expressed or implied by such forward-looking statements. |

| Disclaimers (continued)

P R E S E N C E B A N K . C O M 3

You should not place undue reliance on any forward-looking statement and should carefully consider the risks and

other factors that Presence Bank faces, including, but not limited to (i) changes in general business, industry or

economic conditions or competition; (ii) changes in any applicable law, rule, regulation, policy, guideline or practice

governing or affecting bank holding companies and their subsidiaries or with respect to tax or accounting principles

or otherwise; (iii) adverse changes or conditions in capital and financial markets; (iv) the adverse impact on the U.S.

economy, including the markets in which we operate, of COVID-19; (v) changes in interest rates and inflation; (vi) the

inability to realize expected cost savings or achieve other anticipated benefits in connection with business

combinations and other acquisitions; (vii) changes in the quality or composition of our loan and investment

portfolios; (viii) adequacy of loan loss reserves; (ix) increased competition; (x) loss of certain key officers; (xi)

continued relationships with major customers; (xii) deposit attrition; (xiii) rapidly changing technology; (xiv)

unanticipated regulatory or judicial proceedings and liabilities and other costs; (xv) changes in the cost of funds,

demand for loan products or demand for financial services; (xvi)severe weather, acts of terrorism, an outbreak of

hostilities or other geopolitical events, or the anticipation of such events; (xvii) other economic, competitive,

governmental or technological factors affecting our operations, markets, products, services and prices; and (xvii) our

success at managing the foregoing items. Except as otherwise indicated, this presentation speaks only as of the

date hereof. The delivery of this presentation shall not, under any circumstances, create any implication that there

has been no change in the affairs of Presence Bank after the date hereof. This presentation does not purport to

contain all the information that may be required to evaluate the securities, and you should conduct and rely upon

your own independent analysis of PB BANKSHARES, INC and the data contained or referred to herein. |

| P R E S E N C E B A N K . C O M 4

Bank History |

| P R E S E N C E B A N K . C O M 5

Executive Team |

| P R E S E N C E B A N K . C O M 6

Who We Are |

| P R E S E N C E B A N K . C O M 7

Relationship-Based

White Glove Delivery Team

Harrisburg LPO Elizabethtown LPO Coatesville |

| P R E S E N C E B A N K . C O M 8

Core Operating Markets

Chester Region Lancaster Region Capital Region

• 10-County Market throughout

Southcentral Pennsylvania

• In 2021 opened two Loan Production

Offices in Harrisburg and Elizabethtown.

• We lend to local people and businesses

we know and trust us.

• Deposit customers are from the

communities we live, play and work in. |

| P R E S E N C E B A N K . C O M 9

Business Model & Execution

Our DELIVERY

Our CUSTOMERS |

| P R E S E N C E B A N K . C O M 10

New Management Team - Accomplishments

(dollars in thousands).

$168,039

$231,416 $251,130

$289,495 $312,091

$100,000

$150,000

$200,000

$250,000

$300,000

$350,000

(000)s Total Deposit Growth

CAGR = 22.9% |

| P R E S E N C E B A N K . C O M 11

Loan Composition

As part of the commercial real estate initiative, management is performing

quarterly stress testing and has segmented the commercial real estate

portfolio into categories such as industrial, office, multi-family, etc. See the

following slide for select June 30, 2023 detail. |

| Commercial Real Estate (CRE)

Portfolio

P R E S E N C E B A N K . C O M 12

Stress Test

• Completed 75% or

$101 million of CRE

portfolio.

• CRE Portfolio average

loan-to-value ratio is

58.4%.

• Debt service coverage

ratio 1.31 times without

sponsor or guarantor

support.

• Property type is diverse

and there is no

geographic

concentration.

Office Exposure

• $8.2 million in non-owner occupied office

space.

• 4 loans comprise office

segment, which all are

loans in medical space

not subject to general

market office issues.

• Average loan-to-value

ratio is 73.6%.

• Debt service coverage

ratio 1.52 times

exclusive of sponsor or

guarantor support.

Hospitality Exposure

• $17.4 million in flagship

hotel loans.

• 5 loans comprise the

hotel portfolio.

• Average loan-to-value

is 56.4%

• Debt service coverage

ratio 1.76 times

exclusive of any

sponsor or guarantor

support.

• Guarantors have strong

liquidity and are

experienced local

operators.

Management is monitoring the commercial real estate portfolio

and concentration, assessing its associated risks. |

| P R E S E N C E B A N K . C O M 13

Top Five (5) Priorities –

Customer & Revenue Focus

1. Deposit Growth

• Growing relational deposits assists with having enough liquidity to fund the

bank’s loan growth.

2. Loan Growth

• Provides revenue to direct more profits back into our Associates’ growth,

enhanced customer deliveries and support our local communities.

3. Cash Management & Not-for-Profit Growth

• Necessary products and services that supports unique needs of our customers

with having dedicated and sophisticated capabilities really being a niche focus.

4. Attract Talent

• Further building upon our team with passionate bankers that appreciate the

bank’s culture – High Care + High Accountability = High Performance.

5. Maintaining Credit Quality

• Having customers that are honest and honor their commitments to repay debt. |

| P R E S E N C E B A N K . C O M 14

Percentage of Deposits Uninsured

National Mega-Banks

https://www.pnc.com/insights/corporate-institutional/mitigate-risk/bank-regulation-and-your-business. |

| P R E S E N C E B A N K . C O M 15

Percentage of Deposits Uninsured

National Mega-Banks

For the charts on the previous slide, the listed banks are derived from public Call

Report information obtained as of December 31, 2022. The more current data from

Presence Bank is as of June 30, 2023.

• Presence Bank’s uninsured and uncollateralized deposits were 14.1% well below the

banking system’s average.

• Presence Bank has deposits over $250,000 that are fully collateralized for our public

fund's customers. Presence Bank can meet the obligation of its uninsured and

uncollateralized deposits with the cash on hand and liquidity sources at

427%*.

* The Bank maintains highly liquid sources of available funds, including unused borrowing capacity with the Federal

Home Loan Bank of Pittsburgh and the Federal Reserve Bank of Philadelphia and available federal funds lines with

other banks, as well as available-for-sale debt securities with a fair value in excess of collateral obligations. At June

30, 2023, available funding from these sources totaled 427% of uninsured and uncollateralized deposits. |

| P R E S E N C E B A N K . C O M 16

Cash Management Services

1 Message and data rates may apply; check with your mobile provider. |

| P R E S E N C E B A N K . C O M 17

ICS – Insured up to $10 Million

• IntraFi Network Deposits is a banking network that allows customers to deposit more than

$250,000; having all funds fully FDIC-insured.

• A network that links many U.S. banks and financial institutions; sharing insured limits with

reciprocating deposits that all remain local with Presence Bank.

• Your one-stop relationship for dividing your money into separate, fully insured accounts, all

administered by Presence Bank.

• The IntraFi network includes more than 3,000 financial institutions, representing around 50%

of the total banks in the country. |

| P R E S E N C E B A N K . C O M 18

ICS – How it works?

Fully Insured up to $10 Million Dollars

Source: https://www.intrafinetworkdeposits.com/how-it-works/ |

| 2Q 2023 Performance

P R E S E N C E B A N K . C O M 19 |

| P R E S E N C E B A N K . C O M 20

Results: 2019 – 2023

(dollars in thousands)

1.82%

1.49%

0.66%

0.34% 0.26%

0.00%

0.50%

1.00%

1.50%

2.00%

Nonaccrual Loans/Loans (000)s

* The year ended December 31, 2022 includes a pre-tax gain on sale of land and building of $821,000. |

| P R E S E N C E B A N K . C O M 21

Financial Highlights (Unaudited)

(Dollars in thousands, except per share data) |

| P R E S E N C E B A N K . C O M 22

Financial Highlights (Unaudited)

(Dollars in thousands) |

| P R E S E N C E B A N K . C O M 23

Performance Ratios (as of and for the three months ended)

(Dollars in thousands, except per share data)

* See next slide for Non-GAAP Financial Measure Reconciliation. |

| P R E S E N C E B A N K . C O M 24

*Non-GAAP Financial Measure Reconciliation

(Dollars in thousands, except per share data) |

| P R E S E N C E B A N K . C O M 25

Growing our Greater Purpose

The bank’s goal is to support

three (3) children’s wishes per

year, one child in each of our

regions.

TOTAL Amount Raised to

Date: $29,887.83*

*Amount as of 6/30/23 |

| P R E S E N C E B A N K . C O M 26

Granting Wishes

Wish #1:

7-Year Girl

Wish #2:

9-Year Boy

Wish #3:

9-Year Girl |

| N A S D A Q S Y M B O L : [ P B B K ] 27

Contact Information

THANK YOU!

Janak M. Amin

President & CEO

Email: jamin@presencebank.com

Direct Mobile: (813) 659-6252 |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

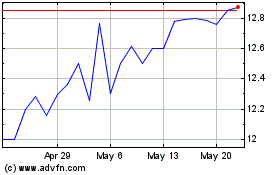

PB Bankshares (NASDAQ:PBBK)

Historical Stock Chart

From Mar 2024 to Apr 2024

PB Bankshares (NASDAQ:PBBK)

Historical Stock Chart

From Apr 2023 to Apr 2024