0001606909false00016069092023-11-082023-11-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

______________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 8, 2023

PANGAEA LOGISTICS SOLUTIONS LTD.

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | |

| Bermuda | 001-36798 | 98-1205464 |

| (State or Other Jurisdiction | (Commission | (IRS Employer |

| of Incorporation) | File Number) | Identification No.) |

c/o Phoenix Bulk Carriers (US) LLC

109 Long Wharf, Newport, Rhode Island 02840

(Address of Principal Executive Offices) (Zip Code)

(401) 846-7790

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | | | | |

| | ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | | | | |

| | ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | | | | |

| | ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | | | | |

| | ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e 4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of exchange on which registered |

| Common Stock | PANL | Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 2.02 | Results of Operations and Financial Condition. |

On November 8, 2023, Registrant issued a press release announcing financial results for three months ended September 30, 2023. The press release is furnished as Exhibit 99.1, its Quarterly Investor Presentation is attached as Exhibit 99.2.

The information contained in, or incorporated into, this Current Report on Form 8-K is being furnished and shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities under that section, nor shall it be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in any such filing.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d)Exhibits

104 Cover Page Interactive Data File ( embedded within Inline XBRL document)

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: November 8, 2023

| | | | | | | | |

| | PANGAEA LOGISTICS SOLUTIONS LTD. |

| | |

| | By: | /s/ Gianni Del Signore |

| | | Name: Gianni Del Signore

Title: Chief Financial Officer |

Pangaea Logistics Solutions Ltd. Reports Financial Results for the Quarter Ended September 30, 2023

NEWPORT, RI - November 8, 2023 - Pangaea Logistics Solutions Ltd. (“Pangaea” or the “Company”) (Nasdaq: PANL), a global provider of comprehensive maritime logistics solutions, announced today its results for the three months ended September 30, 2023.

THIRD QUARTER 2023 RESULTS

•Net income attributable to Pangaea of $18.9 million, or $0.42 per diluted share

•Adjusted net income attributable to Pangaea of $14.4 million, or $0.32 per diluted share

•Operating cash flow of $16.3 million

•Adjusted EBITDA of $27.9 million

•Time Charter Equivalent ("TCE") rates earned by Pangaea of $15,748 per day

•Pangaea’s TCE rates exceeded the average Baltic Panamax and Supramax indices by 49%

•Ratio of net debt to trailing twelve-month Adjusted EBITDA of 2.2x

•Announced the sale of the Bulk Trident for $9.8 million in October 2023

For the third quarter ended September 30, 2023, Pangaea reported non-GAAP adjusted net income of $14.4 million, or $0.32 per diluted share, on total revenue of $135.6 million. Third quarter TCE rates declined 35% on a year-over-year basis, while total shipping days, which include both voyage and time charter days, declined 1% to 4,610 days, when compared to the year-ago period.

The TCE earned was $15,748 per day for the three months ended September 30, 2023, compared to an average of $24,107 per day for the same period in 2022. During the third quarter 2023, the Company’s average TCE rate exceeded the benchmark average Baltic Panamax and Supramax indices by 49%, supported by Pangaea’s long-term contracts of affreightment ("COAs"), specialized fleet, and cargo-focused strategy.

Total Adjusted EBITDA margin remained consistent when compared to the year-ago period, despite a decrease in revenue.

As of September 30, 2023, the Company had $87.4 million in cash and equivalents. Total debt, including lease finance obligations was $279.3 million. At the end of the third quarter 2023, the Company's net debt to trailing twelve-month adjusted EBITDA was at 2.2x. During the three months ended September 30, 2023, the Company repaid $3.3 million of long-term debt, $4.1 million of finance leases, and paid $4.5 million of cash dividends.

As of November 7, 2023 the Company has performed and booked approximately 2,715 total shipping days generating a TCE of $19,000 per day for the fourth quarter.

The Company's Board of Directors declared a quarterly cash dividend of $0.10 per common share, to be paid on December 15, 2023, to all shareholders of record as of December 1, 2023.

MANAGEMENT COMMENTARY

“Our strong third quarter results demonstrate the durability and flexibility of our business model during a period of broader market volatility,” stated Mark Filanowski, Chief Executive Officer of Pangaea Logistics Solutions. “Our entire ice class 1A fleet was fully utilized under long-term contracts during the third quarter, resulting in a realized TCE rate that was nearly 50% above prevailing market indices. Our other contract positions and our strategic focus on commercial growth across new and existing trades, together with a continued focus on disciplined expense management, positioned us to produce good margin realization, Adjusted EBITDA and free cash flow in a low market environment.”

“We remain committed to a balanced capital allocation strategy, one that prioritizes debt reduction, organic investments, the opportunistic acquisition of complementary assets and a stable quarterly cash dividend,” continued Filanowski. “On a trailing twelve-month basis, we’ve generated more than $62 million in operating cash flow while reducing our total outstanding debt by more than $23 million. Additionally, we have invested approximately $50 million in acquiring new vessels and logistics assets, and have returned more than $18 million to our shareholders through cash dividends, consistent with our mandate to maximize shareholder value. Pangaea also continues to prioritize its multi-year fleet renewal program, as we divest of older vessels while investing in newer, more efficient vessels. To that end, we announced the sale of the 2006-built Bulk Trident for nearly $10 million in October 2023. In 2024, we’ll seek to reinvest in one or more newer vessels as we manage a growing fleet of young, high quality vessels.

“The bulk shipping market continues its volatile path,” concluded Filanowski. We believe our premium rate model and long-term COAs position us to execute on our strategy, while continue to drive shareholder returns.”

STRATEGIC UPDATE

Pangaea remains committed to developing a leading dry bulk logistics and transportation services company of scale, providing its customers with specialized shipping and supply chain and logistics offerings in commodity and niche markets, which drive premium returns measured in time charter equivalent per day.

Leverage integrated shipping and logistics model. In addition to operating the largest high ice class dry bulk fleet of Panamax and post-Panamax vessels globally, Pangaea also performs stevedoring services, together with port and terminal operations capabilities. Following the acquisition of marine port terminal operations in Port Everglades/Ft. Lauderdale, Port of Palm Beach, Florida, and Port of Baltimore, Maryland in June 2023, the company has been actively working to expand its onshore relationships with new and existing customers.

Continue to drive strong fleet utilization. In the third quarter, Pangaea's 25 owned vessels were fully utilized and supplemented with an average of 26 chartered-in vessels to support cargo and COA commitments. Given the seasonal demand in artic trade routes, the Company utilized chartered-in vessels to support it’s non-artic trade routes. Going forward, the Company will continue to target an average fleet of 20 chartered-in vessels in order to maximize returns amid a period of more muted market pricing.

Continue to drive fleet upgrades and renewals. In October 2023, the Company announced its intent to sell the 2006-built Supramax Bulk Trident for $9.8 million. Looking ahead, the Company intends to opportunistically manage its fleet with the purpose of maximizing TCE rates, while continuing to support client requirements on an on-demand basis.

THIRD QUARTER 2023 CONFERENCE CALL

The Company’s management team will host a conference call to discuss the Company’s financial results on Thursday, November 9, 2023 at 8:00 a.m., Eastern Time (ET). Accompanying presentation materials will be available in the Investor Relations section of the Company’s website at https://www.pangaeals.com/investors/.

To participate in the live teleconference:

Domestic Live: 1-800-245-3047

International Live: 1-203-518-9765

Conference ID: PANLQ323

To listen to a replay of the teleconference, which will be available through November 16, 2023:

Domestic Replay: 1-800-839-7414

International Replay: 1-402-220-6068

Pangaea Logistics Solutions Ltd.

Consolidated Statements of Operations

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Revenues: | | | | | | | |

| Voyage revenue | $ | 127,884,506 | | | $ | 173,167,990 | | | $ | 346,300,186 | | | $ | 522,693,814 | |

| Charter revenue | 3,797,528 | | | 11,309,147 | | | 16,636,920 | | | 49,089,682 | |

| Terminal & Stevedore Revenue | 3,934,154 | | | — | | | 4,453,811 | | | — | |

| Total revenue | 135,616,188 | | | 184,477,137 | | | 367,390,917 | | | 571,783,496 | |

| Expenses: | | | | | | | |

| Voyage expense | 59,075,208 | | | 74,716,194 | | | 170,349,472 | | | 207,874,485 | |

| Charter hire expense | 25,466,886 | | | 50,750,809 | | | 77,183,388 | | | 194,175,432 | |

| Vessel operating expense | 14,252,533 | | | 15,361,640 | | | 41,070,199 | | | 41,479,173 | |

| Terminal & Stevedore Expenses | 3,517,736 | | | — | | | 3,892,318 | | | — | |

| General and administrative | 5,500,121 | | | 5,776,666 | | | 17,115,013 | | | 16,195,441 | |

| Depreciation and amortization | 8,092,495 | | | 7,365,561 | | | 22,546,350 | | | 21,960,413 | |

| Loss on impairment of vessel | — | | | — | | | — | | | 3,007,809 | |

| Loss on sale of vessel | — | | | — | | | 1,172,196 | | | 318,032 | |

| Total expenses | 115,904,979 | | | 153,970,870 | | | 333,328,936 | | | 485,010,785 | |

| | | | | | | |

| Income from operations | 19,711,209 | | | 30,506,267 | | | 34,061,981 | | | 86,772,711 | |

| | | | | | | |

| Other income (expense): | | | | | | | |

| Interest expense | (4,348,686) | | | (4,400,473) | | | (12,724,920) | | | (11,445,249) | |

| Interest income | 775,504 | | | 284,154 | | | 2,867,914 | | | 323,025 | |

Income attributable to Non-controlling interest recorded as long-term liability interest expense | (267,198) | | | (2,418,844) | | | (1,027,798) | | | (5,961,851) | |

| Unrealized gain (loss) on derivative instruments, net | 4,531,912 | | | (4,508,758) | | | 2,760,059 | | | (510,093) | |

| Other income | (212,639) | | | 298,679 | | | 422,636 | | | 517,117 | |

| Total other income (expense), net | 478,893 | | | (10,745,242) | | | (7,702,109) | | | (17,077,051) | |

| | | | | | | |

| Net income | 20,190,102 | | | 19,761,025 | | | 26,359,872 | | | 69,695,660 | |

| Income attributable to non-controlling interests | (1,321,811) | | | (972,611) | | | (1,172,774) | | | (5,706,848) | |

| Net income attributable to Pangaea Logistics Solutions Ltd. | $ | 18,868,291 | | | $ | 18,788,414 | | | $ | 25,187,098 | | | $ | 63,988,812 | |

| | | | | | | |

| Earnings per common share: | | | | | | | |

| Basic | $ | 0.42 | | | $ | 0.42 | | | $ | 0.56 | | | $ | 1.44 | |

| Diluted | $ | 0.42 | | | $ | 0.42 | | | $ | 0.56 | | | $ | 1.43 | |

| | | | | | | |

| Weighted average shares used to compute earnings per common share: | | | | | | | |

| Basic | 44,775,438 | | | 44,415,575 | | | 44,754,620 | | | 44,386,628 | |

| Diluted | 45,081,668 | | | 44,640,278 | | | 45,108,039 | | | 44,624,228 | |

Pangaea Logistics Solutions Ltd.

Consolidated Balance Sheets | | | | | | | | | | | |

| September 30, 2023 | | December 31, 2022 |

| (unaudited) | | (audited) |

| Assets | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 87,358,220 | | | $ | 128,384,606 | |

| | | |

| Accounts receivable (net of allowance of $5,301,297 and $4,367,848 at September 30, 2023 and December 31, 2022, respectively) | 53,498,562 | | | 36,755,149 | |

| Bunker inventory | 26,347,230 | | | 29,104,436 | |

| Advance hire, prepaid expenses and other current assets | 31,280,425 | | | 28,266,831 | |

| | | |

| Total current assets | 198,484,437 | | | 222,511,022 | |

| | | |

| | | |

| Fixed assets, net | 479,980,216 | | | 476,524,752 | |

| | | |

| Finance lease right of use assets, net | 40,951,455 | | | 43,921,569 | |

| Goodwill | 3,104,800 | | | — | |

| Other non-current Assets | 6,073,002 | | | 5,284,127 | |

| Total assets | $ | 728,593,910 | | | $ | 748,241,470 | |

| | | |

| Liabilities and stockholders' equity | | | |

| Current liabilities | | | |

| Accounts payable, accrued expenses and other current liabilities | $ | 42,374,839 | | | $ | 38,554,131 | |

| | | |

| Deferred revenue | 13,797,326 | | | 20,883,958 | |

| Current portion of secured long-term debt | 31,505,463 | | | 15,782,530 | |

| Current portion of finance lease liabilities | 26,630,754 | | | 16,365,075 | |

| Dividend payable | 977,592 | | | 626,178 | |

| Total current liabilities | 115,285,974 | | | 92,211,872 | |

| | | |

| Secured long-term debt, net | 70,953,795 | | | 98,819,739 | |

| Finance lease liabilities, net | 146,474,158 | | | 168,513,939 | |

| Long-term liabilities - other | 18,502,188 | | | 19,974,390 | |

| | | |

| Commitments and contingencies | | | |

| | | |

| Stockholders' equity: | | | |

| Preferred stock, $0.0001 par value, 1,000,000 shares authorized and no shares issued or outstanding | — | | | — | |

| Common stock, $0.0001 par value, 100,000,000 shares authorized; 46,466,622 shares issued and outstanding at September 30, 2023; 45,898,395 shares issued and outstanding at December 31, 2022 | 4,648 | | | 4,590 | |

| Additional paid-in capital | 164,160,253 | | | 162,894,080 | |

| Retained earnings | 162,544,652 | | | 151,327,392 | |

| Total Pangaea Logistics Solutions Ltd. equity | 326,709,553 | | | 314,226,062 | |

| Non-controlling interests | 50,668,242 | | | 54,495,468 | |

| Total stockholders' equity | 377,377,795 | | | 368,721,530 | |

| Total liabilities and stockholders' equity | $ | 728,593,910 | | | $ | 748,241,470 | |

Pangaea Logistics Solutions, Ltd.

Consolidated Statements of Cash Flows

| | | | | | | | | | | |

| Nine Months Ended September 30, |

| 2023 | | 2022 |

| Operating activities | (unaudited) | | (unaudited) |

| Net income | $ | 26,359,872 | | | $ | 69,695,660 | |

| Adjustments to reconcile net income to net cash provided by operations: | | | |

| Depreciation and amortization expense | 22,546,350 | | | 21,960,413 | |

| Amortization of deferred financing costs | 701,275 | | | 764,897 | |

| Amortization of prepaid rent | 91,048 | | | 91,453 | |

| Unrealized (gain) loss on derivative instruments | (2,760,059) | | | 510,093 | |

| Income from equity method investee | (417,636) | | | (517,117) | |

| Earnings attributable to non-controlling interest recorded as other long term liability | 1,027,798 | | | 5,961,851 | |

| Provision for doubtful accounts | 933,449 | | | 1,282,624 | |

| Loss on impairment of vessel | — | | | 3,007,809 | |

| Loss on sale of vessel | 1,172,196 | | | 318,032 | |

| Drydocking costs | (3,368,800) | | | (5,972,024) | |

| Share-based compensation | 1,393,514 | | | 1,457,972 | |

| Change in operating assets and liabilities: | | | |

| Accounts receivable | (17,676,862) | | | 10,633,346 | |

| Bunker inventory | 2,757,206 | | | (3,504,215) | |

| Advance hire, prepaid expenses and other current assets | 885,264 | | | 14,095,660 | |

| Accounts payable, accrued expenses and other current liabilities | 3,324,586 | | | (2,946,749) | |

| Deferred revenue | (7,086,632) | | | (14,971,451) | |

| Net cash provided by operating activities | 29,882,569 | | | 101,868,254 | |

| | | |

| Investing activities | | | |

| Purchase of vessels and vessel improvements | (27,217,355) | | | (18,370,977) | |

| | | |

| Purchase of fixed assets and equipment | — | | | 187,638 | |

| Contributions to non-consolidated subsidiaries | (275,000) | | | (18,505) | |

| Proceeds from sale of vessel | 8,037,804 | | | 8,400,000 | |

| Acquisitions, net of cash acquired | (7,200,000) | | | — | |

| Dividends received from equity method investments | 1,637,500 | | | — | |

| Net cash used in investing activities | (25,017,051) | | | (11,511,844) | |

| | | |

| Financing activities | | | |

| | | |

| | | |

| Payments of financing fees and issuance costs | — | | | (331,317) | |

| Payments of long-term debt | (12,435,039) | | | (12,223,052) | |

| Proceeds from finance leases | — | | | 15,000,000 | |

| Payments of finance lease obligations | (12,211,158) | | | (11,808,661) | |

| | | |

| Dividends paid to non-controlling interests | (5,000,000) | | | (5,000,000) | |

| Accrued common stock dividends paid | (13,618,424) | | | (8,966,039) | |

| Cash paid for incentive compensation shares relinquished | (127,283) | | | (287,629) | |

| | | |

| Payments to non-controlling interest recorded as long-term liability | (2,500,000) | | | — | |

| Net cash used in financing activities | (45,891,904) | | | (28,616,698) | |

| | | |

| Net (decrease) increase in cash and cash equivalents | (41,026,386) | | | 61,739,712 | |

| Cash and cash equivalents at beginning of period | 128,384,606 | | | 56,208,902 | |

| Cash and cash equivalents at end of period | $ | 87,358,220 | | | $ | 117,948,614 | |

| | | |

| | | |

| | | |

| | | |

| | | |

Pangaea Logistics Solutions Ltd.

Reconciliation of Non-GAAP Measures

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Net Transportation and Service Revenue | | | | | | | | |

| Gross Profit | | $ | 25,240,555 | | | $ | 36,301,324 | | | $ | 52,433,372 | | | $ | 106,349,167 | |

| Add: | | | | | | | | |

| Vessel Depreciation and Amortization | | 8,063,270 | | | 7,347,170 | | | 22,462,168 | | | 21,905,239 | |

| Net transportation and service revenue | | $ | 33,303,825 | | | $ | 43,648,494 | | | $ | 74,895,540 | | | $ | 128,254,406 | |

| | | | | | | | |

| Adjusted EBITDA | | | | | | | | |

| Net Income | | 20,190,102 | | | 19,761,025 | | | 26,359,872 | | | 69,695,660 | |

| Interest expense, net | | 3,573,182 | | | 4,116,319 | | | 9,857,006 | | | 11,122,224 | |

Income attributable to Non-controlling interest recorded as long-term liability interest expense | | 267,198 | | | 2,418,844 | | | 1,027,798 | | | 5,961,851 | |

| Depreciation and amortization | | 8,092,495 | | | 7,365,561 | | | 22,546,350 | | | 21,960,413 | |

| EBITDA | | 32,122,977 | | | 33,661,749 | | | 59,791,026 | | | 108,740,148 | |

| Non-GAAP Adjustments: | | | | | | | | |

| Loss on impairment of vessels | | — | | | — | | | — | | | 3,007,809 | |

| Loss on sale of vessels | | — | | | — | | | 1,172,196 | | | 318,032 | |

| Share-based compensation | | 270,007 | | | 319,188 | | | 1,393,514 | | | 1,457,972 | |

| Unrealized (gain) loss on derivative instruments, net | | (4,531,912) | | | 4,508,758 | | | (2,760,059) | | | 510,093 | |

| Other non-recurring items | | 19,476 | | | — | | | 445,178 | | | — | |

| Adjusted EBITDA | | $ | 27,880,548 | | | $ | 38,489,695 | | | $ | 60,041,855 | | | $ | 114,034,054 | |

| | | | | | | | |

| Earnings Per Common Share | | | | | | | | |

| Net income attributable to Pangaea Logistics Solutions Ltd. | | $ | 18,868,291 | | | $ | 18,788,414 | | | $ | 25,187,098 | | | $ | 63,988,812 | |

| | | | | | | | |

| Weighted average number of common shares outstanding - basic | | 44,775,438 | | | 44,415,575 | | | 44,754,620 | | | 44,386,628 | |

| Weighted average number of common shares outstanding - diluted | | 45,081,668 | | | 44,640,278 | | | 45,108,039 | | | 44,624,228 | |

| | | | | | | | |

| Earnings per common share - basic | | $ | 0.42 | | | $ | 0.42 | | | $ | 0.56 | | | $ | 1.44 | |

| Earnings per common share - diluted | | $ | 0.42 | | | $ | 0.42 | | | $ | 0.56 | | | $ | 1.43 | |

| | | | | | | | |

| Adjusted EPS | | | | | | | | |

| Net Income attributable to Pangaea Logistics Solutions Ltd. | | $ | 18,868,291 | | | $ | 18,788,414 | | | $ | 25,187,098 | | | $ | 63,988,812 | |

| Non-GAAP | | | | | | | | |

| Add: loss on impairment of vessels | | — | | | — | | | — | | | 3,007,809 | |

| Loss on sale of vessels | | — | | | — | | | 1,172,196 | | | 318,032 | |

| Unrealized (gain) loss on derivative instruments | | (4,531,912) | | | 4,508,758 | | | (2,760,059) | | | 510,093 | |

| Other non-recurring items | | 19,476 | | | $ | — | | | 445,178 | | | — | |

| Non-GAAP adjusted net income attributable to Pangaea Logistics Solutions Ltd. | | $ | 14,355,855 | | | $ | 23,297,172 | | | $ | 24,044,413 | | | $ | 67,824,746 | |

| | | | | | | | |

| Weighted average number of common shares - basic | | 44,775,438 | | | 44,415,575 | | | 44,754,620 | | | 44,386,628 | |

| Weighted average number of common shares - diluted | | 45,081,668 | | | 44,640,278 | | | 45,108,039 | | | 44,624,228 | |

| | | | | | | | |

| Adjusted EPS - basic | | $ | 0.32 | | | $ | 0.52 | | | $ | 0.54 | | | $ | 1.53 | |

| Adjusted EPS - diluted | | $ | 0.32 | | | $ | 0.52 | | | $ | 0.53 | | | $ | 1.52 | |

INFORMATION ABOUT NON-GAAP FINANCIAL MEASURES. As used herein, “GAAP” refers to accounting principles generally accepted in the United States of America. To supplement our consolidated financial statements prepared and presented in accordance with GAAP, this earnings release discusses non-GAAP financial measures, including non-GAAP net revenue and non-GAAP adjusted EBITDA. This is considered a non-GAAP financial measure as defined in Rule 101 of Regulation G promulgated by the Securities and Exchange Commission. Generally, a non-GAAP financial measure is a numerical measure of a company’s historical or future performance, financial position, or cash flows that either excludes or includes amounts that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with GAAP. The presentation of this non-GAAP financial information is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP.

We use non-GAAP financial measures for internal financial and operational decision making purposes and as a means to evaluate period-to-period comparisons of the performance and results of operations of our core business. Our management believes that non-GAAP financial measures provide meaningful supplemental information regarding the performance of our core business by excluding charges that are not incurred in the normal course of business. Non-GAAP financial measures also facilitate management's internal planning and comparisons to our historical performance and liquidity. We believe certain non-GAAP financial measures are useful to investors as they allow for greater transparency with respect to key metrics used by management in its financial and operational decision making and are used by our institutional investors and the analyst community to help them analyze the performance and operational results of our core business.

Gross Profit. Gross profit represents total revenue less net transportation and service revenue and less vessel depreciation and amortization.

Net transportation and service revenue. Net transportation and service revenue represents total revenue less the total direct costs of transportation and services, which includes charter hire, voyage and vessel operating expenses and terminal & stevedore expenses. Net transportation and service revenue is included because it is used by management and certain investors to measure performance by comparison to other logistic service providers. Net transportation and service revenue is not an item recognized by the generally accepted accounting principles in the United States of America, or U.S. GAAP, and should not be considered as an alternative to net income, operating income, or any other indicator of a company's operating performance required by U.S. GAAP. Pangaea’s definition of net transportation and service revenue used here may not be comparable to an operating measure used by other companies.

Adjusted EBITDA and adjusted EPS. Adjusted EBITDA represents net income (or loss), determined in accordance with U.S. GAAP, excluding interest expense, interest income, income taxes, depreciation and amortization, loss on impairment, loss on sale and leaseback of vessels, share-based compensation, other non-operating income and/or expense and other non-recurring items, if any. Earnings per share represents net income divided by the weighted average number of common shares outstanding. Adjusted earnings per share represents net income attributable to Pangaea Logistics Solutions Ltd. plus, when applicable, loss on sale of vessel, loss on sale and leaseback of vessel, loss on impairment of vessel, unrealized gains and losses on derivative instruments, and certain non-recurring charges, divided by the weighted average number of shares of common stock.

There are limitations related to the use of net revenue versus income from operations, adjusted EBITDA versus income from operations, and adjusted EPS versus EPS calculated in accordance with GAAP. In particular, Pangaea’s definition of adjusted EBITDA used here are not comparable to EBITDA.

The table set forth above provides a reconciliation of the non-GAAP financial measures presented during the period to the most directly comparable financial measures prepared in accordance with GAAP.

About Pangaea Logistics Solutions Ltd.

Pangaea Logistics Solutions Ltd. (Nasdaq: PANL) provides logistics services to a broad base of industrial customers who require the transportation of a wide variety of dry bulk cargoes, including grains, pig iron, hot briquetted iron, bauxite, alumina, cement clinker, dolomite, and limestone. The Company addresses the transportation needs of its customers with a comprehensive set of services and activities, including cargo loading, cargo discharge, vessel chartering, and voyage planning. Learn more at www.pangaeals.com.

Investor Relations Contacts

| | | | | | | | |

| Gianni Del Signore | | Stefan C. Neely |

| Chief Financial Officer | | Vallum Advisors |

| 401-846-7790 | | |

| Investors@pangaeals.com | | PANL@val-adv.com |

Forward-Looking Statements

Certain statements in this press release are “forward-looking statements” within the meaning of the Private Securities Litigation Act of 1995. These forward-looking statements are based on our current expectations and beliefs and are subject to a number of risk factors and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. The Company disclaims any obligation to publicly update or revise these statements whether as a result of new information, future events or otherwise, except as required by law. Such risks and uncertainties include, without limitation, the strength of world economies and currencies, general market conditions, including fluctuations in charter rates and vessel values, changes in demand for dry bulk shipping capacity, changes in our operating expenses, including bunker prices, dry-docking and insurance costs, the market for our vessels, availability of financing and refinancing, charter counterparty performance, ability to obtain financing and comply with covenants in such financing arrangements, changes in governmental rules and regulations or actions taken by regulatory authorities, potential liability from pending or future litigation, general domestic and international political conditions, potential disruption of shipping routes due to accidents or political events, vessels breakdowns and instances of off-hires and other factors, as well as other risks that have been included in filings with the Securities and Exchange Commission, all of which are available at www.sec.gov.

3Q23 Earnings Call Presentation

2 Safe Harbor 3Q23 Earnings Call Presentation This presentation may include certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding future financial performance, future growth and future acquisitions. These statements are based on Pangaea’s and managements’ current expectations or beliefs and are subject to uncertainty and changes in circumstances. Actual results may vary materially from those expressed or implied by the statements herein due to changes in economic, business, competitive and/or regulatory factors, and other risks and uncertainties affecting the operation of Pangaea’s business. These risks, uncertainties and contingencies include: business conditions; weather and natural disasters; changing interpretations of GAAP; outcomes of government reviews; inquiries and investigations and related litigation; continued compliance with government regulations; legislation or regulatory environments; requirements or changes adversely affecting the business in which Pangaea is engaged; fluctuations in customer demand; management of rapid growth; intensity of competition from other providers of logistics and shipping services; general economic conditions; geopolitical events and regulatory changes; and other factors set forth in Pangaea’s filings with the Securities and Exchange Commission and the filings of its predecessors. The information set forth herein should be read in light of such risks. Further, investors should keep in mind that certain of Pangaea’s financial results are unaudited and do not conform to SEC Regulation S-X and as a result such information may fluctuate materially depending on many factors. Accordingly, Pangaea’s financial results in any particular period may not be indicative of future results. Pangaea is not under any obligation to, and expressly disclaims any obligation to, update or alter its forward-looking statements, whether as a result of new information, future events, changes in assumptions or otherwise.

3 3Q23 Performance Summary Strong operating results highlight value of specialized ice-class fleet Superior TCE rate driven by long-term COAs, seasonally strong ice-class utilization and cargo-focused strategy resulted in TCE rates exceeding the benchmark average Baltic Panamax and Supramax indices by 49%+ in 3Q23. Despite a 35% year-over-year decrease in TCE rates, maintained approximately flat Adjusted EBITDA margins of 20.6% compared to 20.9% in 3Q22. Lower TCE rates were offset by lower charter-hire expenses and vessel operating due to cost management efforts amid an inflationary environment. Subsequent to the end of the quarter, announced the sale of the Bulk Trident for $9.8 million. The Company continues to execute on its fleet renewal strategy aimed at maintaining an efficient fleet of vessels with an average age under 10 years. Continue to execute on key capital allocation priorities, maintaining cash dividend of $0.10 per common share, paid on December 15th. Expect to continue to deliver premium returns over market pricing even in a softer market environment, resulting in continued cash generation. As of November 7, 2023, 2,715 days booked at an average of $19,000/day. Repaid a total debt of $7.4 million during the quarter, including $3.3 million of long- term debt and $4.1 million of finance leases. The Company continues to focus on reducing its variable rate debt and lowering its cash interest costs to maximize cash flow.

4 3Q23 Performance Summary Adjusted EBITDA $s in Millions Adjusted EPS $s per Share TCE Rate $s per Shipping Day Operating Cash Flow $s in Millions $ 16 $ 33 3Q23 3Q22 $ 28 $ 38 3Q23 3Q22 $ 15,74 8 $ 24 ,10 7 3Q23 3Q22 $ 0 .32 $ 0 .52 3Q23 3Q22

5 Outperforming Industry Benchmark Our TCE has exceeded the market by an average of 33% on a trailing 5-year basis Cargo Focused Business Model Consistently Delivers Above- Market Performance • Current 4Q23 booked TCE rate of $19,000, a 38% premium to the market average through the quarter*. • Our niche, higher- margin trades remain a key area of differentiation * Q4 23 estimated TCE performance based on shipping days booked as of November 7, 2023 **Average of the published Panamax and Supramax indices, net of commission - 1,000 2,000 3,000 4,000 5,000 6,000 $- $5,000 $10,000 $15,000 $20,000 $25,000 $30,000 $35,000 D ay s TC E R at e ($ s p er S h ip p in g D ay ) PANL Total Shipping Days PANL TCE Rate Market TCE Rate**

6 Recent Vessel Acquisitions Disciplined acquiror of complementary assets MV Bulk Sachuest - Supramax MV Bulk Courageous - Ultramax MV Bulk Promise - Panamax MV Bulk Valor - Supramax MV Bulk Concord - Panamax MV Nordic Nuluujaak – Post Panamax(1) MV Nordic Qinnqua – Post Panamax(1) MV Nordic Sanngijug – Post Panamax(1) MV Nordic Siku – Post Panamax(1) (1) Vessels are owned through a Joint Venture, of which Pangaea owns 50%. 2021 Purchased 7 vessels for $205 million Purchased 3 vessels for $64 million 2022 & 2023 MV Bulk Prudence - Ultramax

7 Return of Capital Program Stable quarterly cash dividend supported by stable profitability Annual Dividend Payout Ratio % of Adjusted Net Income Total Annual Cash Dividend Paid $s per Share Annual Dividend Coverage Ratio Ratio of Operating Cash Flow to Dividends Issued $0.11 $0.02 $0.11 $0.30 2019 2020 2021 2022 24 .4 % 6 .3% 7.4 % 16 .5% 20 19 20 20 20 21 20 22 Ta rg e te d d ivid e nd p o licy is a im e d towa rd sust a ina b ilit y t h ro ug h the cyc le Divid e nd p ayo ut ha s inc re a se d a m id favo ra b le m a rke t co nd it io ns a nd st ra te g ic exe c u t io n Im p rove d m a rg ins a nd c a sh co nve rs io n sup p o rt d ivid e nd cove ra g e d e sp ite vo la t ile d ry b u lk m a rke t 9.9x 22.9x 11.2x 10.1x 2019 2020 2021 2022

8 Balance Sheet Update Ample liquidity to support ongoing growth of business O p p o rtun ist ic a lly inve ste d in ow ne d sh ip fle e t d uring 20 21 a m id a t t ra c t ive m a rke t d yna m ic s Re p a id ove r $ 30 m illio n in d e b t d uring 20 22 th ro ug h fre e c a sh flow a nd ve sse l sa le s Ca p it a l a llo c a t io n p rio rit ie s w ill b e b a la nce d b e twe e n d e b t re p aym e nt , fle e t inve stm e nt , o p p o rtun ist ic M&A a nd sha re ho ld e r re tu rns $127.8 $116.4 $255.5 $175.6 $191.9 $53.1 $46.9 $56.2 $128.4 $87.4 2.4x 2.7x 2.4x 1.3x 2.2x 0.0x 0.5x 1.0x 1.5x 2.0x 2.5x 3.0x $- $50.0 $100.0 $150.0 $200.0 $250.0 $300.0 $350.0 2019 2020 2021 2022 3Q23 TT M N et D eb t/ A d j. E B IT D A $s in M ill io n s Total Net Debt Total Cash Net Leverage

9 Macro Shipping Outlook Focused on providing comprehensive logistics solutions with targeted dry bulks Near Term Outlook (4Q23 & 1H24) Medium Term Outlook (Full-Year 2024) Long-Term Outlook (2024-2026) • Geo-political tensions are weighing on near-term market sentiment and creating nervousness among shippers • US Infrastructure spending is beginning to ramp up, creating favorable tailwinds for construction related raw materials • Global dry bulk fleet growth is expected to remain limited amid limited new-building activity • Trade disruptions resulting from geopolitical tensions are expected to increase could create opportunities as trade looks to avoid regions of turmoil • Current risk to medium-term rate improvement is a more pronounced global recession • Clarity in emissions free fuel alternatives creates opportunity for fleet renewal and niche offerings • Supply chain reorganizations provide the opportunity for the Company to grow its logistics offerings with new and existing customers • Emissions regulations will continue to put pressure on markets as fleets age amid limited new and compliant vessels are built

10 Value Creation Strategy Durable business model insulated from macro volatility – focused on deploying capital to drive above-sector growth Integrated shipping- logistics model • Provide solutions to customer supply chain issues • More efficient, lower total cost of delivery for customer • Adds volume and margins to PANL ocean freight offerings High fleet utilization • Utilize chartered in fleet to arbitrage vessel positions and provide more revenue days Organic investment • Expand capabilities to offer cargo movement beyond ocean transportation • Expand owned fleet for growth using our unique business plan • Apply consistent approach to expand and renew fleet Inorganic investment • Purchase vessels in support of existing long- term COAs, to maximize returns • Acquire logistics companies to grow in logistics sector Return of capital • Sustain consistent dividend approach, not a payout formula • Conserve capital for fleet renewal and opportunistic growth • Compensate for volatility of sector by maintaining reasonable liquidity Balance sheet optionality • Promote historical lending relationships, sustainable business plan, and consistent performance to help provide favorable lending terms • Maintain low net leverage and substantial free cash generation to provide flexibility in financing growth projects • Consider joint ventures to help mitigate risks and create synergies

11 Investment Conclusion Small-cap growth play with stable return of capital program Integrated shipping-logistics model delivering consistent, above-market returns Focused on consistently high fleet utilization to drive operating leverage Positioned to benefit from tightening global supply of dry- bulk vessels amid continued demand growth On-shore logistics offering provides significant, incremental revenue opportunities Leading position within Ice-Class trades supports superior earned TCE rates Disciplined capital allocation strategy Long-term cargo-based contracts provide multi-year demand visibility Significant balance sheet optionality to pursue growth, low net leverage

Co nfid e n t ia l: Pa ng a e a Lo g is t ic s So lu t io ns Appendix

13 Selected Balance Sheet Data (in thousands,may not foot due to rounding) September 30, 2023 December 31, 2022 (unaudited) Current Assets Cash and cash equivalents 87,358$ 128,385$ Accounts receivable, net 53,499 36,755 Other current assets 57,628 57,371 Total current assets 198,484 222,511 Fixed assets, including finance lease right of use assets, net 520,932 520,446 Goodwill 3,105 - Other Non-current Assets 6,107 5,284 Total assets 728,628$ 748,241$ Current liabilities Accounts payable, accrued expenses and other current liabilities 42,375$ 38,554$ Current portion long-term debt and finance lease liabilities 58,136 32,148 Other current liabilities 14,775 21,510 Total current liabilties 115,286 92,212 Secured long-term debt and finance lease liabilities, net 217,428 267,334 Other long-term liabilities 18,502 19,974 Total Pangaea Logistics Solutions Ltd. equity 326,710 314,226 Non-controlling interests 50,668 54,495 Total stockholders' equity 377,378 368,722 Total liabilities and stockholders' equity 728,594$ 748,241$

14 Selected Income Statement Data Ad jus t e d EBITDA re p re se n t s ne t inc o m e (o r lo ss) , d e t e rm ine d in a c c o rd a nc e w ith U.S. GAAP, e xc lud ing in t e re s t e xp e nse , in t e re s t inc o m e , inc o m e t a xe s , d e p re c ia t io n a nd a m o rt iza t io n , lo ss o n im p a irm e nt , lo ss o n sa le a nd le a se b a c k o f ve sse ls , sha re -b a se d c o m p e nsa t io n , o the r no n-o p e ra t ing inc o m e a nd / o r e xp e nse , a nd o the r no n-re c urring it e m s , if a ny. (in thousands,may not foot due to rounding) 2023 2022 2023 2022 (unaudited) (unaudited) (unaudited) (unaudited) Revenues: Voyage revenue 127,885$ 173,168$ 346,300$ 522,694$ Charter revenue 3,798 11,309 16,637 49,090 Terminal & stevedore revenue 3,934 - 4,454 - Total revenue 135,616 184,477 367,391 571,783 Expenses: Voyage expense 59,075 74,716 170,349 207,874 Charter hire expense 25,467 50,751 77,183 194,175 Vessel operating expenses 14,253 15,362 41,070 41,479 Terminal Expenses 3,518 - 3,892 - General and administrative 5,500 5,777 17,115 16,195 Depreciation and amortization 8,092 7,366 22,546 21,960 Loss on impairment of vessel - - - 3,008 Loss on sale of vessel - - 1,172 318 Loss on sale and leaseback of vessels - - - - Total expenses 115,905 153,971 333,329 485,011 Income from operations 19,711 30,506 34,062 86,773 Total other income (expense), net 479 (10,745) (7,702) (17,077) Net income 20,190 19,761 26,360 69,696 Income attributable to noncontrolling interests (1,322) (973) (1,173) (5,707) Net income attributable to Pangaea Logistics Solutions Ltd. 18,868$ 18,788$ 25,187$ 63,989$ Adjusted EBITDA (1) 27,881$ 38,490$ 60,042$ 114,034$ Nine months ended September 30,Three months ended September 30,

15 Reconciliation of Non-GAAP Measures 9/30/2023 9/30/2022 9/30/2023 9/30/2022 (unaudited) (unaudited) (unaudited) (unaudited) Net Transportation and Service Revenue Gross Profit 25,240,555$ 36,301,324$ 52,433,372$ 106,349,167$ Add: Vessel Depreciation and amortization 8,063,270 7,347,170 22,462,168 21,905,239 Net transportation and service revenue 33,303,825$ 43,648,494$ 74,895,540$ 128,254,406$ Adjusted EBITDA Net Income 20,190,102$ 19,761,025$ 26,359,872$ 69,695,660$ Interest expense 4,348,686 4,400,473 12,724,920 11,445,249 Interest income (775,504) (284,154) (2,867,914) (323,025) Income attributable to Non-controlling interest recorded as long-term liability interest expense 267,198 2,418,844 1,027,798 5,961,851 Depreciation and amortization 8,092,495 7,365,561 22,546,350 21,960,413 EBITDA 32,122,977 33,661,749 59,791,026 108,740,148 Non-GAAP Adjustments: Loss on impairment of vessels - - - 3,007,809 Loss on sale of vessels - - 1,172,196 318,032 Share-based compensation 270,007 319,188 1,393,514 1,457,972 Unrealized (gain) loss on derivative instruments, net (4,531,912) 4,508,758 (2,760,059) 510,093 Other non-recurring items 19,476 - 445,178 - Adjusted EBITDA 27,880,548$ 38,489,695$ 60,041,855$ 114,034,054$ For the three months ended For the nine months ended

16 Reconciliation of Non-GAAP Measures 9/30/2023 9/30/2022 9/30/2023 9/30/2022 (unaudited) (unaudited) (unaudited) (unaudited) Earnings Per Common Share Net income attributable to Pangaea Logistics Solutions Ltd. 18,868,291$ 18,788,414$ 25,187,098$ 63,988,812$ Weighted average number of common shares - basic 44,775,438 44,415,575 44,754,620 44,386,628 Weighted average number of common shares - diluted 45,081,668 44,640,278 45,108,039 44,624,228 Earnings per common share - basic 0.42$ 0.42$ 0.56$ 1.44$ Earnings per common share - diluted 0.42$ 0.42$ 0.56$ 1.43$ Adjusted EPS Net income attributable to Pangaea Logistics Solutions Ltd. 18,868,291$ 18,788,414$ 25,187,098$ 63,988,812$ Non-GAAP Add: Loss on impairment of vessels - - - 3,007,809 Loss on sale of vessels - - 1,172,196 318,032 Unrealized (gain) loss on derivative instruments, net (4,531,912) 4,508,758 (2,760,059) 510,093 Other non-recurring items 19,476 - 445,178 - Non-GAAP adjusted net income attributable to Pangaea Logistics Solutions Ltd. 14,355,855 23,297,172 24,044,413 67,824,746 Weighted average number of common shares - basic 44,775,438 44,415,575 44,754,620 44,386,628 Weighted average number of common shares - diluted 45,081,668 44,640,278 45,108,039 44,624,228 Adjusted EPS - basic 0.32$ 0.52$ 0.54$ 1.53$ Adjusted EPS - diluted 0.32$ 0.52$ 0.53$ 1.52$ For the three months ended For the nine months ended

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

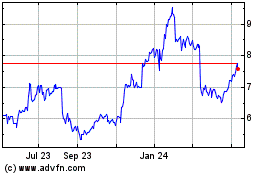

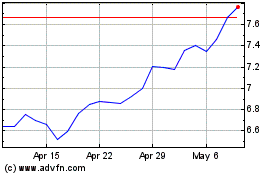

Pangaea Logistics Soluti... (NASDAQ:PANL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pangaea Logistics Soluti... (NASDAQ:PANL)

Historical Stock Chart

From Apr 2023 to Apr 2024