false

0001516912

DEF 14A

0001516912

2023-01-01

2023-12-31

0001516912

2022-01-01

2022-12-31

0001516912

2021-01-01

2021-12-31

0001516912

2020-01-01

2020-12-31

0001516912

ecd:PeoMember

obk:ChangeInTheActuarialPresentValuesReportedUnderColumnChangeInPensionValueAndNonqualifiedDeferredCompensationEarningsOfSCTMember

2023-01-01

2023-12-31

0001516912

ecd:PeoMember

obk:ChangeInTheActuarialPresentValuesReportedUnderColumnChangeInPensionValueAndNonqualifiedDeferredCompensationEarningsOfSCTMember

2022-01-01

2022-12-31

0001516912

ecd:PeoMember

obk:ChangeInTheActuarialPresentValuesReportedUnderColumnChangeInPensionValueAndNonqualifiedDeferredCompensationEarningsOfSCTMember

2021-01-01

2021-12-31

0001516912

ecd:PeoMember

obk:ChangeInTheActuarialPresentValuesReportedUnderColumnChangeInPensionValueAndNonqualifiedDeferredCompensationEarningsOfSCTMember

2020-01-01

2020-12-31

0001516912

ecd:PeoMember

obk:ServiceCostForPensionPlansMember

2023-01-01

2023-12-31

0001516912

ecd:PeoMember

obk:ServiceCostForPensionPlansMember

2022-01-01

2022-12-31

0001516912

ecd:PeoMember

obk:ServiceCostForPensionPlansMember

2021-01-01

2021-12-31

0001516912

ecd:PeoMember

obk:ServiceCostForPensionPlansMember

2020-01-01

2020-12-31

0001516912

ecd:PeoMember

obk:StockAwardsReportedInSCTMember

2023-01-01

2023-12-31

0001516912

ecd:PeoMember

obk:StockAwardsReportedInSCTMember

2022-01-01

2022-12-31

0001516912

ecd:PeoMember

obk:StockAwardsReportedInSCTMember

2021-01-01

2021-12-31

0001516912

ecd:PeoMember

obk:StockAwardsReportedInSCTMember

2020-01-01

2020-12-31

0001516912

ecd:PeoMember

obk:FairValueAtFiscalYearEndOfUnvestedStockAwardsGrantedDuringCoveredFiscalYearMember

2023-01-01

2023-12-31

0001516912

ecd:PeoMember

obk:FairValueAtFiscalYearEndOfUnvestedStockAwardsGrantedDuringCoveredFiscalYearMember

2022-01-01

2022-12-31

0001516912

ecd:PeoMember

obk:FairValueAtFiscalYearEndOfUnvestedStockAwardsGrantedDuringCoveredFiscalYearMember

2021-01-01

2021-12-31

0001516912

ecd:PeoMember

obk:FairValueAtFiscalYearEndOfUnvestedStockAwardsGrantedDuringCoveredFiscalYearMember

2020-01-01

2020-12-31

0001516912

ecd:PeoMember

obk:ChangeInFairValueAtFiscalYearEndOfUnvestedStockAwardsGrantedInAnyPriorFiscalYearMember

2023-01-01

2023-12-31

0001516912

ecd:PeoMember

obk:ChangeInFairValueAtFiscalYearEndOfUnvestedStockAwardsGrantedInAnyPriorFiscalYearMember

2022-01-01

2022-12-31

0001516912

ecd:PeoMember

obk:ChangeInFairValueAtFiscalYearEndOfUnvestedStockAwardsGrantedInAnyPriorFiscalYearMember

2021-01-01

2021-12-31

0001516912

ecd:PeoMember

obk:ChangeInFairValueAtFiscalYearEndOfUnvestedStockAwardsGrantedInAnyPriorFiscalYearMember

2020-01-01

2020-12-31

0001516912

ecd:PeoMember

obk:ChangeInFairValueAtVestingDateOfStockAwardsGrantedInAnyPriorFiscalYearMember

2023-01-01

2023-12-31

0001516912

ecd:PeoMember

obk:ChangeInFairValueAtVestingDateOfStockAwardsGrantedInAnyPriorFiscalYearMember

2022-01-01

2022-12-31

0001516912

ecd:PeoMember

obk:ChangeInFairValueAtVestingDateOfStockAwardsGrantedInAnyPriorFiscalYearMember

2021-01-01

2021-12-31

0001516912

ecd:PeoMember

obk:ChangeInFairValueAtVestingDateOfStockAwardsGrantedInAnyPriorFiscalYearMember

2020-01-01

2020-12-31

0001516912

ecd:PeoMember

obk:ChangeInFairValueAtFiscalYearEndOfUnexercisedStockOptionsGrantedInAnyPriorFiscalYearMember

2023-01-01

2023-12-31

0001516912

ecd:PeoMember

obk:ChangeInFairValueAtFiscalYearEndOfUnexercisedStockOptionsGrantedInAnyPriorFiscalYearMember

2022-01-01

2022-12-31

0001516912

ecd:PeoMember

obk:ChangeInFairValueAtFiscalYearEndOfUnexercisedStockOptionsGrantedInAnyPriorFiscalYearMember

2021-01-01

2021-12-31

0001516912

ecd:PeoMember

obk:ChangeInFairValueAtFiscalYearEndOfUnexercisedStockOptionsGrantedInAnyPriorFiscalYearMember

2020-01-01

2020-12-31

0001516912

ecd:PeoMember

obk:ChangeInFairValueAtExercisingDateOfStockOptionsGrantedInAnyPriorFiscalYearMember

2023-01-01

2023-12-31

0001516912

ecd:PeoMember

obk:ChangeInFairValueAtExercisingDateOfStockOptionsGrantedInAnyPriorFiscalYearMember

2022-01-01

2022-12-31

0001516912

ecd:PeoMember

obk:ChangeInFairValueAtExercisingDateOfStockOptionsGrantedInAnyPriorFiscalYearMember

2021-01-01

2021-12-31

0001516912

ecd:PeoMember

obk:ChangeInFairValueAtExercisingDateOfStockOptionsGrantedInAnyPriorFiscalYearMember

2020-01-01

2020-12-31

0001516912

ecd:PeoMember

obk:DividendsPaidOnStockAwardsNotIncludedInTotalCompensationMember

2023-01-01

2023-12-31

0001516912

ecd:PeoMember

obk:DividendsPaidOnStockAwardsNotIncludedInTotalCompensationMember

2022-01-01

2022-12-31

0001516912

ecd:PeoMember

obk:DividendsPaidOnStockAwardsNotIncludedInTotalCompensationMember

2021-01-01

2021-12-31

0001516912

ecd:PeoMember

obk:DividendsPaidOnStockAwardsNotIncludedInTotalCompensationMember

2020-01-01

2020-12-31

0001516912

ecd:NonPeoNeoMember

obk:ChangeInTheActuarialPresentValuesReportedUnderColumnChangeInPensionValueAndNonqualifiedDeferredCompensationEarningsOfSCTMember

2023-01-01

2023-12-31

0001516912

ecd:NonPeoNeoMember

obk:ChangeInTheActuarialPresentValuesReportedUnderColumnChangeInPensionValueAndNonqualifiedDeferredCompensationEarningsOfSCTMember

2022-01-01

2022-12-31

0001516912

ecd:NonPeoNeoMember

obk:ChangeInTheActuarialPresentValuesReportedUnderColumnChangeInPensionValueAndNonqualifiedDeferredCompensationEarningsOfSCTMember

2021-01-01

2021-12-31

0001516912

ecd:NonPeoNeoMember

obk:ChangeInTheActuarialPresentValuesReportedUnderColumnChangeInPensionValueAndNonqualifiedDeferredCompensationEarningsOfSCTMember

2020-01-01

2020-12-31

0001516912

ecd:NonPeoNeoMember

obk:ServiceCostForPensionPlansMember

2023-01-01

2023-12-31

0001516912

ecd:NonPeoNeoMember

obk:ServiceCostForPensionPlansMember

2022-01-01

2022-12-31

0001516912

ecd:NonPeoNeoMember

obk:ServiceCostForPensionPlansMember

2021-01-01

2021-12-31

0001516912

ecd:NonPeoNeoMember

obk:ServiceCostForPensionPlansMember

2020-01-01

2020-12-31

0001516912

ecd:NonPeoNeoMember

obk:StockAwardsReportedInSCTMember

2023-01-01

2023-12-31

0001516912

ecd:NonPeoNeoMember

obk:StockAwardsReportedInSCTMember

2022-01-01

2022-12-31

0001516912

ecd:NonPeoNeoMember

obk:StockAwardsReportedInSCTMember

2021-01-01

2021-12-31

0001516912

ecd:NonPeoNeoMember

obk:StockAwardsReportedInSCTMember

2020-01-01

2020-12-31

0001516912

ecd:NonPeoNeoMember

obk:FairValueAtFiscalYearEndOfUnvestedStockAwardsGrantedDuringCoveredFiscalYearMember

2023-01-01

2023-12-31

0001516912

ecd:NonPeoNeoMember

obk:FairValueAtFiscalYearEndOfUnvestedStockAwardsGrantedDuringCoveredFiscalYearMember

2022-01-01

2022-12-31

0001516912

ecd:NonPeoNeoMember

obk:FairValueAtFiscalYearEndOfUnvestedStockAwardsGrantedDuringCoveredFiscalYearMember

2021-01-01

2021-12-31

0001516912

ecd:NonPeoNeoMember

obk:FairValueAtFiscalYearEndOfUnvestedStockAwardsGrantedDuringCoveredFiscalYearMember

2020-01-01

2020-12-31

0001516912

ecd:NonPeoNeoMember

obk:ChangeInFairValueAtFiscalYearEndOfUnvestedStockAwardsGrantedInAnyPriorFiscalYearMember

2023-01-01

2023-12-31

0001516912

ecd:NonPeoNeoMember

obk:ChangeInFairValueAtFiscalYearEndOfUnvestedStockAwardsGrantedInAnyPriorFiscalYearMember

2022-01-01

2022-12-31

0001516912

ecd:NonPeoNeoMember

obk:ChangeInFairValueAtFiscalYearEndOfUnvestedStockAwardsGrantedInAnyPriorFiscalYearMember

2021-01-01

2021-12-31

0001516912

ecd:NonPeoNeoMember

obk:ChangeInFairValueAtFiscalYearEndOfUnvestedStockAwardsGrantedInAnyPriorFiscalYearMember

2020-01-01

2020-12-31

0001516912

ecd:NonPeoNeoMember

obk:ChangeInFairValueAtVestingDateOfStockAwardsGrantedInAnyPriorFiscalYearMember

2023-01-01

2023-12-31

0001516912

ecd:NonPeoNeoMember

obk:ChangeInFairValueAtVestingDateOfStockAwardsGrantedInAnyPriorFiscalYearMember

2022-01-01

2022-12-31

0001516912

ecd:NonPeoNeoMember

obk:ChangeInFairValueAtVestingDateOfStockAwardsGrantedInAnyPriorFiscalYearMember

2021-01-01

2021-12-31

0001516912

ecd:NonPeoNeoMember

obk:ChangeInFairValueAtVestingDateOfStockAwardsGrantedInAnyPriorFiscalYearMember

2020-01-01

2020-12-31

0001516912

ecd:NonPeoNeoMember

obk:DividendsPaidOnStockAwardsNotIncludedInTotalCompensationMember

2023-01-01

2023-12-31

0001516912

ecd:NonPeoNeoMember

obk:DividendsPaidOnStockAwardsNotIncludedInTotalCompensationMember

2022-01-01

2022-12-31

0001516912

ecd:NonPeoNeoMember

obk:DividendsPaidOnStockAwardsNotIncludedInTotalCompensationMember

2021-01-01

2021-12-31

0001516912

ecd:NonPeoNeoMember

obk:DividendsPaidOnStockAwardsNotIncludedInTotalCompensationMember

2020-01-01

2020-12-31

0001516912

1

2023-01-01

2023-12-31

0001516912

2

2023-01-01

2023-12-31

0001516912

3

2023-01-01

2023-12-31

0001516912

4

2023-01-01

2023-12-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE

14A

Proxy Statement Pursuant to Section

14(a) of the Securities

Exchange Act of 1934 (Amendment No.

)

| |

|

|

|

| ☒ |

Filed by the Registrant |

☐ |

Filed by a Party other than the Registrant |

| Check the appropriate box: |

| ☐ |

Preliminary Proxy Statement |

| ☐ |

CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2)) |

| ☒ |

Definitive Proxy Statement |

| ☐ |

Definitive Additional Materials |

| ☐ |

Soliciting Material Under Rule 14a-12 |

Origin Bancorp,

Inc.

(Name of Registrant as Specified In

Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other than the Registrant)

| |

|

| Payment of Filing Fee (Check the appropriate box): |

| ☒ |

No fee required. |

| ☐ |

Fee paid previously with preliminary materials. |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

|

NOTICE

OF ANNUAL MEETING

OF STOCKHOLDERS |

|

|

|

|

500

South Service Road East, Ruston, Louisiana 71270

March

14, 2024

DEAR

ORIGIN BANCORP, INC. STOCKHOLDERS,

You

are cordially invited to attend the Annual Meeting of Stockholders of Origin Bancorp, Inc., a Louisiana corporation (the “Company”),

to be held on Wednesday, April 24, 2024, at 12:30 p.m., Central Time, at Squire Creek Country Club, 289 Squire Creek Parkway,

Choudrant, Louisiana 71227.

On

or about March 14, 2024, we mailed a Notice of Internet Availability of Proxy Materials to all stockholders of record at the close

of business on March 5, 2024, containing instructions on how to access our Proxy Statement and how to vote your shares, as well

as instructions on how to request a paper copy of our proxy materials. You are urged to vote by proxy via the Internet, telephone,

by mail, or in person at the Annual Meeting pursuant to the instructions in the Proxy Statement.

We

have adopted rules promulgated by the Securities and Exchange Commission (“SEC”) that allow companies to furnish proxy

materials to their stockholders over the Internet. The Proxy Statement contains information about the official business of the

Annual Meeting. Whether or not you expect to attend, please vote your shares now. Of course, if you decide to personally attend

the Annual Meeting, you will have the opportunity to revoke your proxy and vote your shares in person at the Annual Meeting.

We

appreciate your continued support of the Company.

|

|

|

|

|

2024

Proxy Statement |

iii |

| |

|

|

|

| |

|

|

|

| |

|

|

|

|

|

|

MEETING

INFORMATION

|

Notice of

Annual Meeting of

Stockholders |

Date:

April 24, 2024 |

Time:

12:30 p.m.,

Central Time |

Location: Squire Creek

Country Club, 289 Squire

Creek Parkway Choudrant,

Louisiana 71227

Format: In Person

Record Date: Close of

business on March 5, 2024 |

VOTING

ITEMS

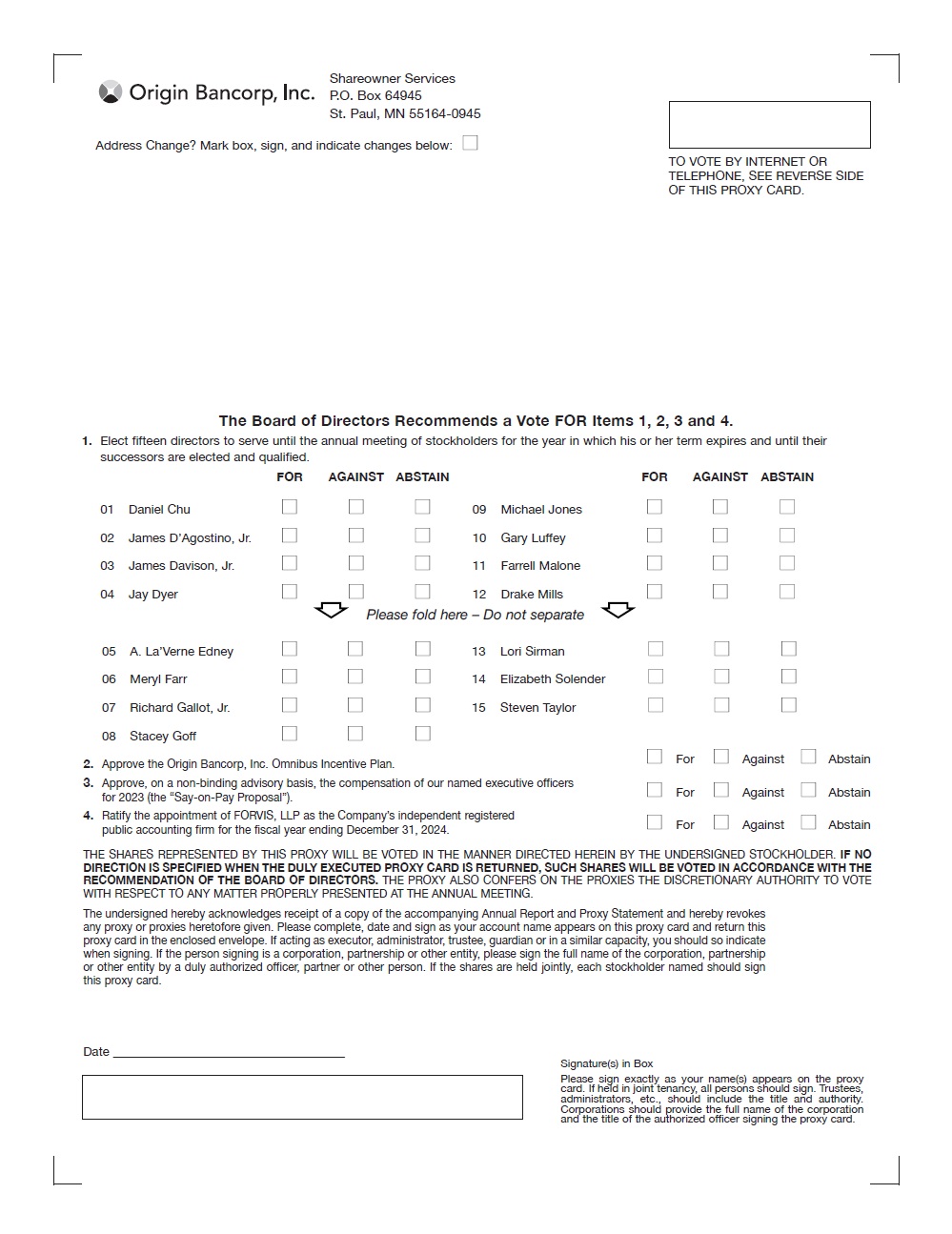

| 1. | Elect

15 directors, to serve until the next annual meeting of stockholders and to serve until

their successors are elected and qualified; |

| 2. | Approve

the Origin Bancorp, Inc. Omnibus Incentive Plan; |

| 3. | Approve,

on a non-binding advisory basis, the compensation of our named executive officers (“NEOs”)

for 2023 (the “Say-On-Pay Proposal”); and |

| 4. | Ratify

the appointment of FORVIS, LLP as the Company’s independent registered public accounting

firm for the fiscal year ending December 31, 2024. |

Our

Board of Directors (“Board”) has fixed the close of business on March 5, 2024, as the record date for the determination

of stockholders entitled to notice of, and to vote at, the Annual Meeting (the “Record Date”). A list of stockholders

entitled to vote at the Annual Meeting will be available for inspection by any stockholder at our principal office during ordinary

business hours beginning two business days after the Notice of Internet Availability of Proxy Materials is mailed through the

completion of the Annual Meeting, including any adjournment or postponement thereof. The mailing address for our principal office

is 500 South Service Road East, Ruston, Louisiana 71270.

Important

Notice Regarding the Availability of Proxy Materials for the 2024 Annual Meeting of Stockholders to be held on April 24, 2024. This proxy

statement and our annual report to stockholders are available at www.obkannualmeeting.com.

By

Order of the Board of Directors

Drake

Mills

Chairman, President and Chief Executive Officer

Ruston,

Louisiana

March 14, 2024

|

|

|

|

|

2024

Proxy Statement |

v |

| |

|

|

|

| |

|

|

|

| vi |

2024

Proxy Statement |

|

|

|

|

|

| |

|

|

|

| |

|

|

|

YOUR

VOTE IS IMPORTANT

Whether

or not you plan to attend the Annual Meeting, please read this proxy statement, the voting instructions in the Notice of Internet

Availability of Proxy Materials and vote. You may vote by proxy over the Internet, via telephone or, if you requested a paper

proxy card in the mail, by completing, signing, dating and mailing the completed proxy card to us. You may also vote in person

at the Annual Meeting. The instructions in the Notice of Internet Availability of Proxy Materials or your proxy card describe

how to use these convenient services. You may revoke your proxy in the manner described in this proxy statement at any time before

it is exercised. See “Voting Information and Questions You May Have—May I Change My Vote After I Have Submitted

a Proxy?” for more information on how to vote your shares or revoke your proxy.

PROXY

STATEMENT FOR

2024

Annual Meeting of Stockholders

to

be held on April 24, 2024

Unless

the context otherwise requires, references in this proxy statement to “we,” “us,” “our,” “our

company,” “the Company” or “Origin” refer to Origin Bancorp, Inc., a Louisiana corporation, and

its consolidated subsidiaries. All references to “Origin Bank” or “the Bank” refer to Origin Bank, our

wholly-owned bank subsidiary. In addition, unless the context otherwise requires, references to “stockholders” are

to the holders of our common stock, par value $5.00 per share.

This

proxy statement is being furnished in connection with the solicitation of proxies by our Board for use at the Annual Meeting of

the Stockholders to be held on Wednesday, April 24, 2024, at 12:30 p.m., Central Time, at Squire Creek Country Club, 289 Squire

Creek Parkway, Choudrant, Louisiana 71227, and any adjournments or postponements thereof for the purposes set forth in this proxy

statement and the related notice of the Annual Meeting. The mailing address of the Company’s principal executive office

is 500 South Service Road East, Ruston, Louisiana 71270.

Important

Notice Regarding the Availability of Proxy Materials for the 2024 Annual Meeting of Stockholders to be Held on April 24, 2024

Pursuant

to rules promulgated by the SEC, we have elected to provide access to our proxy materials, including this proxy statement and

our annual report to stockholders for the fiscal year ended December 31, 2023, over the Internet. Accordingly, we are providing

our stockholders with a Notice of Internet Availability of Proxy Materials (the “Notice”) instead of a paper copy

of our proxy materials. The Notice contains instructions on how to access our proxy materials and how to vote your shares, as

well as instructions on how to request a paper or e-mail copy of our proxy materials. We believe this electronic distribution

process expedites stockholders’ receipt of proxy materials and reduces the environmental impact and cost of printing and

distributing our proxy materials. We mailed the Notice on or about March 14, 2024, to all stockholders of record entitled to vote

at the Annual Meeting at the close of business on March 5, 2024. You should read our entire proxy statement carefully before voting.

|

|

|

|

|

2024

Proxy Statement |

1 |

| |

|

|

|

| |

|

|

|

ABOUT

THE ANNUAL MEETING

VOTING

INFORMATION AND QUESTIONS YOU MAY HAVE

The

information provided in the “question and answer” format below is for your convenience only and is merely a summary

of the information contained in this proxy statement. You should read this entire proxy statement carefully.

What

is the Purpose of the Annual Meeting?

Matters

to be Considered and Vote Recommendation

We

are asking stockholders to vote on the following matters at the Annual Meeting:

Matters

for Stockholder Consideration |

Our

Board’s

Recommendation |

Proposal

1: Election of Directors (page 16)

To

elect 15 directors to serve until the next annual meeting of stockholders and until their successors are elected and qualified.

Our Board believes that the 15 director nominees possess the necessary qualifications to provide effective oversight of

the Company’s business and quality counsel to our management. |

FOR

each

Director

Nominee |

Proposal

2: Approve the Origin Bancorp, Inc. Omnibus Incentive Plan (page 88)

We

are asking our stockholders to approve the Origin Bancorp, Inc. Omnibus Incentive Plan (the “Omnibus Plan”)

to replace the Origin Bancorp, Inc. 2012 Stock Incentive Plan, as amended (the “2012 Plan”). |

FOR |

Proposal

3: Advisory Vote on the Say-On-Pay Proposal (page 99)

We

are seeking a non-binding advisory vote from our stockholders to approve the compensation paid to our NEOs in 2023, as

described in the Compensation Discussion and Analysis section and the executive compensation tables that follow, beginning

on page 53 of this proxy statement. Our Board values our stockholders’ opinions and the Compensation Committee

will take into account the outcome of the advisory vote when considering future executive compensation decisions. |

FOR |

Proposal

4: Ratification of Independent Registered Public Accounting Firm (page 101) The Audit

Committee and the Board believe that the continued retention of FORVIS, LLP to serve

as the independent registered public accounting firm of the Company for the fiscal year

ending December 31, 2024, is in the best interests of the Company and its stockholders.

As a matter of good corporate governance, our stockholders are being asked to ratify

the selection of FORVIS, LLP to serve as the Company’s independent registered public

accounting firm for the fiscal year ending December 31, 2024. |

FOR |

Stockholders

will also transact any other business that may properly come before the Annual Meeting or any adjournment or postponement thereof.

| 2 |

2024

Proxy Statement |

|

|

|

|

|

| |

|

|

|

| |

|

|

|

When

and Where Will the Annual Meeting Be Held?

The

Annual Meeting is scheduled to take place at Squire Creek Country Club, 289 Squire Creek Parkway, Choudrant, Louisiana 71227,

at 12:30 p.m., Central Time, on Wednesday, April 24, 2024.

Who

Are the Nominees for Directors?

Please

see Director Nominees section under Proposal 1: Election of Directors in this document for further information.

Who

is Entitled to Vote?

Holders

of record of our common stock at the close of business on the Record Date, March 5, 2024, may vote at the Annual Meeting. At the

Record Date, we had 31,008,656 shares of common stock outstanding. In deciding all matters at the Annual Meeting, each stockholder

will be entitled to one vote for each share of common stock held by such stockholder on the Record Date. We do not have cumulative

voting rights for the election of directors.

What

Constitutes a Quorum for the Annual Meeting?

The

holders of at least a majority of the outstanding shares of common stock entitled to vote on the Record Date must be represented

at the Annual Meeting, in person or by proxy, in order to constitute a quorum for the transaction of business.

What

is the Difference Between a Stockholder of Record and a “Street Name” Holder?

If

your shares are registered directly in your name with EQ Shareowner Services, the Company’s stock transfer agent, you are

considered the stockholder of record with respect to those shares. The Notice and, if requested, any printed copies of the proxy

materials, including any proxy cards or voting instructions, are being sent directly to you by EQ Shareowner Services at the Company’s

request.

If

your shares are held in a brokerage account or by a bank, broker or other nominee, the nominee is considered the stockholder of

record of those shares. You are considered the beneficial owner of these shares, and your shares are held in “street name.”

The Notice and, if applicable, any printed copies of the proxy materials, including any proxy cards or voting instructions, are

being forwarded to you by your nominee. As the beneficial owner, you have the right to direct your nominee on how to vote your

shares.

How

do I Vote?

You

may vote your shares of common stock either in person at the Annual Meeting or by proxy. The process for voting your shares depends

on how your shares are held, as described below.

|

|

|

|

|

2024

Proxy Statement |

3 |

| |

|

|

|

| |

|

|

|

Shares

Registered in Your Name

If

you are a stockholder of record on the Record Date for the Annual Meeting, you may vote by proxy or you may attend the Annual

Meeting and vote in person. If you are a record holder and want to vote your shares by proxy, you have three ways to vote:

| • | Via

the Internet: You may vote your proxy over the Internet by visiting the website www.proxypush.

com/obk. Have the Notice or, if applicable, the proxy card that may have been

provided to you in hand when you access the website and follow the instructions for Internet

voting on that website. |

| • | Via

Telephone: To vote over the telephone, dial toll-free 1-866-883-3382 using a touch-tone

phone and follow the recorded instructions. You will be asked to provide the control

number from the Notice. |

| • | Via

Mail: If you request a paper copy of the proxy materials by mail, you may vote by

indicating on the proxy card(s) applicable to your common stock how you want to vote

and signing, dating and mailing your proxy card(s) in the enclosed pre-addressed postage-paid

envelope as soon as possible to ensure that it will be received in advance of the Annual

Meeting. |

Please

refer to the specific instructions set forth in your Notice or proxy card for additional information on how to vote. Voting your

shares by proxy will enable your shares of common stock to be represented and voted at the Annual Meeting if you do not attend

the Annual Meeting and vote your shares in person.

If

voting via mail, the Company must receive your proxy via mail no later than April 23, 2024, to be counted at the Annual Meeting.

If voting shares of common stock held in our 401(k) plan, you must vote via Internet or telephone by no later than 11:59 p.m.,

Central Time, on April 21, 2024. If voting shares of common stock held in our 401(k) plan via mail, the Company must receive your

proxy via mail no later than April 21, 2024, to be counted at the Annual Meeting.

Shares

Registered in the Name of a Broker or Bank

If

your shares of common stock are held in “street name,” your ability to vote depends on your bank, broker or other

nominee’s voting process. Your bank, broker or other nominee should provide you with voting instructions and materials to

vote your shares. By following those voting instructions, you may direct your nominee on how to vote your shares. Without instructions

from you, your bank, broker or other nominee will be permitted to exercise its own voting discretion with respect to the ratification

of the appointment of FORVIS, LLP (Proposal 3), but will not be permitted to exercise voting discretion with respect to any of

the other proposals being voted on at the Annual Meeting.

To

vote the shares that you hold in “street name” in person at the Annual Meeting, you must bring a legal proxy from

your broker, bank or other nominee (i) confirming that you were the beneficial owner of those shares at the close of business

on the Record Date, (ii) stating the number of shares of which you were the beneficial owner that were held for your benefit on

the Record Date by that broker, bank or other nominee and (iii) appointing you as the record holder’s proxy to vote the

shares covered by that proxy at the Annual Meeting. If you fail to bring a nominee-issued proxy to the Annual Meeting, you will

not be able to vote your nominee-held shares in person at the Annual Meeting.

| 4 |

2024

Proxy Statement |

|

|

|

|

|

| |

|

|

|

| |

|

|

|

What

is a Broker Non-Vote?

A

broker non-vote occurs when a bank, broker, or other nominee holding shares of common stock for a beneficial owner does not vote

on a particular proposal because such nominee does not have discretionary voting power with respect to that proposal and has not

received voting instructions from the beneficial owner.

Your

broker has discretionary authority to vote your shares with respect to the ratification of the appointment of FORVIS, LLP as our

independent registered public accounting firm for the fiscal year ending December 31, 2024 (Proposal 4). In the absence of specific

instructions from you, your broker does not have discretionary authority to vote your shares with respect to any other proposal.

May

I Change My Vote After I Have Submitted a Proxy?

Yes.

Regardless of the method used to cast a vote, if you are a stockholder of record, you may change your vote or revoke your proxy

by:

| • | Casting

a new vote over the Internet by visiting the website www.proxypush.com/obk and

following the instructions online or in your Notice or the proxy card that may have been

provided to you before the Internet voting deadline; |

| • | Casting

a new vote by telephone by calling 1-866-883-3382 using a touch-tone phone and following

the recorded instructions before the telephone voting deadline; |

| • | Completing,

signing and returning a new proxy card with a later date than your original proxy card,

if applicable, no later than the deadline, and any earlier proxy will be revoked automatically;

or |

| • | Attending

the Annual Meeting and vote in person, which would revoke any earlier proxy. However,

attending the Annual Meeting in person will not automatically revoke your proxy unless

you vote again in person at the Annual Meeting. |

How

Will My Shares Be Voted if I Return a Signed and Dated Proxy Card, but Do Not Specify How My Shares Will Be Voted?

If you are a stockholder of record who

returns a completed proxy card that does not specify how you want to vote your shares on one or more proposals, the proxies will

vote your shares for each proposal as to which you provide no voting instructions, and such shares will be voted in the following

manner:

| Proposal

1 |

FOR

the election of all of the nominees for director; |

| Proposal

2 |

FOR

the Origin Bancorp, Inc. Omnibus Incentive Plan; |

| Proposal

3 |

FOR

on an advisory basis, the Say-On-Pay Proposal; |

| Proposal

4 |

FOR

the ratification of the appointment of FORVIS, LLP to serve as our independent registered public accounting firm for the fiscal year ending December 31, 2024; |

|

|

|

|

|

2024

Proxy Statement |

5 |

| |

|

|

|

| |

|

|

|

If

you are a “street name” holder and do not provide voting instructions on one or more proposals, your bank, broker

or other nominee will be unable to vote those shares on any of the proposals except to vote on the ratification of the appointment

of FORVIS, LLP, for the fiscal year ending December 31, 2024 (Proposal 4).

What

Are My Choices When Voting?

With

respect to all proposals you may vote “For” or “Against” or you may “Abstain” from voting.

What

Percentage of the Vote is Required to Approve Each Proposal?

The

affirmative vote of a majority of the votes cast by the holders of shares entitled to vote at the Annual Meeting is required for

(i) the election of the director nominees (Proposal 1), (ii) the approval of the Origin Bancorp, Inc. Omnibus Incentive Plan (Proposal

2), (iii) the approval, on a non-binding basis, of our Say-On-Pay Proposal (Proposal 3), and (iv) the ratification of FORVIS,

LLP’s appointment as the Company’s independent registered public accounting firm for the fiscal year ending December

31, 2024 (Proposal 4). A majority of the votes cast shall mean that the number of shares that voted “For” the election

of a director or a proposal, as applicable, exceeds the number of shares voted “Against” that director or proposal,

as applicable.

How

Are Broker Non-Votes and Abstentions Treated?

Broker

non-votes and abstentions are counted for purposes of determining the presence or absence of a quorum. A broker non-vote or an

abstention with respect to (i) the election of the director nominees (Proposal 1), (ii) the approval of the Origin Bancorp, Inc.

Omnibus Incentive Plan (Proposal 2), (iii) the approval, on a non-binding basis, of our Say-On-Pay Proposal (Proposal 3), and

(iv) the ratification of FORVIS, LLP’s appointment as the Company’s independent registered public accounting firm

for the fiscal year ending December 31, 2024 (Proposal 4), will not be counted as a vote cast either “For” or “Against”

such proposals.

Are

There Any Other Matters to be Acted Upon at the Annual Meeting?

Management

does not intend to present any business at the Annual Meeting for a vote other than the matters set forth in the Notice, and management

has no information that others will do so. The proxy also confers on the proxies the discretionary authority to vote with respect

to any matter properly presented at the Annual Meeting. If other matters requiring a vote of our stockholders properly come before

the Annual Meeting, it is the intention of the persons named in the accompanying form of proxy to vote the shares represented

by the proxies held by them in accordance with applicable law and their judgment on such matters.

Where

Can I Find Voting Results?

We

will publish the voting results in a current report on Form 8-K, which will be filed with the SEC within four business days following

the Annual Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after

the Annual Meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final

results are known to us, file an additional Form 8-K to publish the final results.

| 6 |

2024

Proxy Statement |

|

|

|

|

|

| |

|

|

|

| |

|

|

|

What

Are the Solicitation Expenses and Who Pays the Cost of this Proxy Solicitation?

Our

Board is asking for your proxy, and we will pay all of the costs of soliciting proxies from our stockholders. We have engaged

D.F. King & Co., Inc. to solicit proxies for us. We have agreed to reimburse D.F. King for reasonable expenses. In addition

to the solicitation of proxies via mail, our officers, directors and employees may solicit proxies personally or through other

means of communication, such as electronic mail, without being paid additional compensation for such services. The Company will

reimburse banks, brokerage houses and other custodians, nominees and fiduciaries for their reasonable expenses incurred in forwarding

the proxy materials to beneficial owners of the Company’s common stock.

How

Can I Communicate with the Board?

Our

Board welcomes suggestions and comments from stockholders and has adopted a formal process by which stockholders may communicate

with our Board or any of its directors. Stockholders who wish to communicate with our Board may do so by sending written communications

addressed to Origin Bancorp, Inc., 500 South Service Road East, Ruston, Louisiana 71270, Attn: Corporate Secretary, or via e-mail

at corpsecretary@origin.bank. Stockholder communications will be sent directly to the specific director or directors of the Company

indicated in the communication or to all members of our Board if not specified. All communications (other than commercial communications

soliciting the sale of goods or services to, or employment with, the Company or directors of the Company) will be directed to

the appropriate committee, the Chairman of the Board, the Lead Independent Director, or to any individual director specified in

the communication, as applicable. In addition, all stockholders are encouraged to attend the Annual Meeting where senior management

and representatives from our independent registered public accounting firm, as well as members of our Board, will be available

to answer questions.

Why

did I Receive a One-Page Notice in the Mail Regarding the Internet Availability of Proxy Materials Instead of Printed Proxy Materials?

In

accordance with rules promulgated by the SEC, instead of mailing a printed copy of our proxy materials to all of our stockholders,

we have elected to provide access to such materials to our stockholders over the Internet. Accordingly, on or about March 14,

2024, we mailed a Notice of Internet Availability of Proxy Materials to all stockholders of record on the Record Date entitled

to vote at the Annual Meeting. Stockholders will have the ability to access our proxy materials on the website referred to in

the Notice. The Notice also contains instructions on how to vote your shares, as well as instructions on how to request a paper

or e-mail copy of our proxy materials. We encourage you to take advantage of the availability of the proxy materials over the

Internet to help reduce the environmental impact and cost of printing and distributing our proxy materials.

How

Can I Get Electronic Access to the Proxy Materials?

The

Notice provides you with instructions regarding how to:

| • | View

our proxy materials for the Annual Meeting over the Internet; |

| • | Vote

your shares after you have viewed our proxy materials (including any control/identification

numbers that you need to access your form of proxy); |

|

|

|

|

|

2024

Proxy Statement |

7 |

| |

|

|

|

| |

|

|

|

| • | Obtain

directions to attend the Annual Meeting and vote in person; |

| • | Request

a printed copy or e-mail copy with links to the proxy materials, including the date by

which the request should be made to facilitate timely delivery; and |

| • | Instruct

us to send our future proxy materials to you by mail or electronically by e-mail. |

Will

I Receive any Other Proxy Materials by Mail (Besides the Notice)?

If

you request paper copies of our proxy materials by following the instructions in the Notice, we will send you our proxy materials,

including a proxy card, in the mail.

What

Should I Do if I Receive More Than One Set of Voting Materials?

You

may receive more than one set of voting materials, including multiple copies of the Notice or other proxy materials, including

multiple proxy cards or voting instruction cards. For example, if you hold your shares in more than one brokerage account, you

may receive separate voting instructions for each brokerage account in which you hold shares. Similarly, if you are a stockholder

of record and hold shares in a brokerage account, you may receive a proxy card for shares held in your name and voting instructions

for shares held in “street name.” To ensure that all of your shares are voted, we encourage you to respond to each

set of voting materials that you receive.

COMMITMENT

TO SUSTAINABILITY

Origin

is a financial holding company headquartered in Ruston, Louisiana. Our wholly-owned bank subsidiary, Origin Bank, was founded

in 1912 in Choudrant, Louisiana, and Origin Bank has been committed to serving our community since its founding. Deeply rooted

in our history is a culture committed to providing personalized, relationship banking to businesses, municipalities and personal

clients to enrich the lives of the people in the communities we serve. We’ve helped people, small businesses, and large

companies grow and prosper throughout Louisiana, Texas and Mississippi, and continue to do so in these legacy markets as well

as in our new Southeast market with our planned entry into Mobile, Alabama and Fort Walton Beach, Florida in 2024.

We

are dedicated to helping each client make their vision a reality. Our mission is to passionately pursue ways to make banking and

insurance more rewarding for our employees, customers, communities and shareholders. As a part of this overall mission, we are

focused on integrating environmental, social and governance (‘ESG’) principles into our business strategy in ways

that optimize opportunities to make positive impacts while advancing long-term goals. Our Board oversees these ESG efforts, led

by our Nominating and Corporate Governance Committee.

Sustainability

Oversight

Origin

strives to foster a team that reflects our strong belief in corporate responsibility. In 2022, Origin continued to build upon

and improve our long-standing corporate sustainability commitment and evolved its strategy. Our executive leadership team and

our Board recognizing the importance of these responsibilities, established an internal cross-functional management working group

that is tasked with driving progress in the initiatives that promote sustainability and further transparency. Our inaugural Corporate

Sustainability Report, published last spring, adopted a priority-based approach, and was informed by the comprehensive Sustainability

Accounting Standard Board (“SASB”) standard with oversight provided by our working group.

| 8 |

2024

Proxy Statement |

|

|

|

|

|

| |

|

|

|

| |

|

|

|

In

2023, we have continued to enhance our corporate sustainability strategy to align with our commitment and stated mission. Our

executive management team has prioritized the incorporation of sustainability objectives into our operational framework and working

group. The Board, led by our Nominating and Corporate Governance Committee, is updated regularly regarding Origin’s sustainability

initiatives and actively oversees and supports the working group as they lead the Company’s efforts to integrate sustainability

into day-to-day operations. Our executive management team has prioritized the incorporation of sustainability objectives into

our operational framework.

How

we understand, prioritize, and approach sustainability topics most relevant to our business is communicated through our ESG reporting.

Against this backdrop, we have, with the assistance of outside expertise, engaged with our internal and external stakeholders

on sustainability topics to help further inform our future direction and determine our ESG strategic priorities. The three tenants

of our sustainability strategy are: (1) Environmental Responsibility, (2) Social Impact, and (3) a Culture of Governance.

In

conjunction with our 2024 Annual Meeting, we plan to complete our second materiality assessment, which will include examining

a range of key stakeholders, including investors, clients, employees and rating organizations as well as studying industry peers.

This analysis will result in the release of our Corporate Sustainability Report, which will feature two years of data and detail

our 2023 successes.

| Environmental Responsibility |

|

We

embed the principles of advancing a circular economy into our practices through green investments and long-term implementation

of new technologies. We are devoted to operating our business in a sustainable manner and have undertaken several initiatives

designed to reduce our impact on the environment and to promote environmentally friendly projects and practices. With a view to

increasing efficiency and reducing waste, we are continuing to digitize manual back office and financial center functions. In

2023, we:

| • | encouraged

the continuance of environmentally friendly work practices by supporting the recycling

of plastic, glass, and paper and utilizing collection bins for batteries, aluminum toner

cartridges, and computer hardware. |

| • | continued

offering filtered water refill stations for employees at majority of our locations. |

| • | increased

the use of e-records and e-signing technology, resulting in paper waste and carbon emissions

reduction, including utilizing digital solutions such as mobile/online banking, eStatements,

electronic bill pay, and remote deposit capture. |

| • | continued

to migrate technology infrastructure to a cloud environment, reducing energy usage, and

accordingly, our carbon footprint. |

Origin

is constantly improving its operations to proactively find more efficient and effective ways to ensure our long-term success.

Through our modernization efforts, we strive to do our part in offsetting negative impacts on the environment. We continue to

evaluate green equipment for office use such as Energy-Star® appliances, motion detector lighting, as well as high-efficiency

HVAC units. Beginning in 2018, we commenced a project to retrofit our offices with LED lighting, which decreased our electricity

usage (kWh) by roughly 29% or 2,000,000 kWh. Currently, most of Origin’s total office space utilizes

|

|

|

|

|

2024

Proxy Statement |

9 |

| |

|

|

|

| |

|

|

|

LED

lighting. Additionally, select office locations are LEED certified. This certification, awarded by the U.S. Green Building

Council, is based on the properties’ use of sustainable materials, water and energy efficiency, indoor environmental quality,

location and transportation, and overall innovation.

Origin

complies with applicable legal and regulatory requirements to control and reduce its environmental footprint. We are committed

to making the necessary investments in systems and technology to ensure compliance and to meet or exceed these standards. Origin

has also begun to further integrate information on environmental risks and challenges by incorporating climate risks into credit

analyses. We have always innately incorporated environmental issues into our credit decisions. In 2024, our internal working group

has begun to evaluate climate change and other environmental considerations as part of our broader commitment to identifying sustainability

risks such as drought, fire or flood.

We

believe that our focus on environmental sustainability, with the objective of reducing costs and improving sustainability of our

operations will provide a strategic benefit. Furthermore, we recognize that climate change is a growing risk for our planet, and

we are committed to doing our part to mitigate this risk by placing increased focus and emphasis on environmental responsibility.

| Social Impact |

|

At

Origin, everything we do matters: that’s the difference. Our outlook shapes our culture and our culture shapes our outlook.

Together, they create success. And passion succeeds at Origin Bank. Making a difference for our customers starts with setting

an example through our own actions. We employ proven, knowledgeable team members with extensive expertise when it comes to our

banking and insurance activities. Each member of our Origin team brings their own personal experiences and interests to inform

the service they provide. In return, we learn from our customers and use this new understanding to go out and improve the places

we call home.

One

of our core values is genuine respect for yourself and others. This value makes the support of diversity, equity and inclusion

a natural fit for our culture and essential to the way we conduct business, foster individual and team enrichment, and participate

in our communities. We believe it is only with a diverse, equitable, and inclusive workplace that the organization can truly perform

at its best, carry out its vision, and make a difference in the communities we serve. In 2023, Origin Bank announced the formation

of the Diversity Council, which consists of 18 diverse employees that collectively advance our Diversity, Equity, and Inclusion

efforts in a way that makes a difference within our workplace and in the communities we serve. We believe all employees should

be given opportunities to perform to their full potential, knowing their performance will be measured and rewarded fairly.

Diversity

& Inclusion

Our

commitment to Diversity & Inclusion starts with our goal of attracting, retaining and developing a workforce that is diverse

in background, knowledge, skill and experience. Origin is committed to providing equal employment opportunities, and makes all

recruiting, payment, performance and

| 10 |

2024

Proxy Statement |

|

|

|

|

|

| |

|

|

|

| |

|

|

|

promotion

decisions based on merit, without discrimination on the basis of gender, sexual orientation, age, family status, ethnic origin,

nationality, disability or religious belief.

Origin

is committed to improving workforce diversity at all levels of the organization and providing equal opportunity in all aspects

of employment. In 2023, the Company continues to make progress toward attracting and retaining a diverse workforce. In order to

support and live our culture, the Company’s talent acquisition team attends job fairs that attract ethnically and culturally

diverse employees. We also have engaged a third-party workforce development company that utilizes a connected system of job recruiting

sites that post our employment opportunities with various groups that include, but are not limited to the following: veterans,

LGBTQ-identifying individuals, individuals with disabilities, minorities and women, professional and industry organizations, skilled

trade associations and college students.

In

addition, we have a formal internship program that is designed to develop a strong pool of diverse candidates through on-campus

recruiting with local colleges and universities including local Historically Black Colleges and Universities (HBCUs). We continue

to use VIBE Central at Origin, where VIBE stands for Value, Inclusion, Belonging and Equity. This allows senior leaders in our

organization to set goals and monitor progress by assessing, measuring, benchmarking, and managing diversity and inclusion by

the dimensions of their choice, such as race/ethnicity and gender.

We

surveyed our employees in regards to diversity, equity and inclusion. Nine out of ten responses in the survey exceeded the benchmarks

of Glint’s top 10% of global companies. The previously mentioned 18 member Diversity Council was one initiative that was

launched based on the results of the survey and it will collectively advance our diversity, equity, and inclusion efforts in a

way that makes a difference within our workplace and in the communities we serve. In 2023, our Diversity Council introduced Employee

Spotlights as a platform to drive engagement and build connections by sharing employees’ stories to highlight different

backgrounds and cultures within our organization.

Our

team members form deeper relationships with those around them based on mutual respect, dignity and understanding. The Company

has non-discrimination and anti-harassment policies as outlined in our Employee Handbook. These policies drive a workplace and

workforce that embraces the highest ethical and moral standards. Furthermore, all employees participate in diversity and inclusion

training. We also offer weekly micro lessons to our managers through a program called Blue Ocean Brain which supports our

endeavor to reimagine diversity and inclusion training in the workplace and provides our employees with a wide array of learning

topics.

Origin

has been recognized as a “Best Bank to Work For” by American Banker magazine for eleven consecutive years,

which we believe is attributable to our deep commitment to corporate culture, and our focus on initiatives to support and develop

our employees. This ranking is based on feedback from surveys given directly to the American Banker magazine from our employees.

Health

& Wellness

We

provide competitive compensation and benefits in order to attract and retain top talent. In addition to base pay and stock awards,

we have several incentive programs which are designed to link performance to pay and drive results towards the achievement of

overall corporate goals.

|

|

|

|

|

2024

Proxy Statement |

11 |

| |

|

|

|

| |

|

|

|

We

are committed to our employees’ mental and physical health and safety. We offer a robust benefits package which includes:

| • | Comprehensive

medical benefits with $0 cost options for employees |

| • | Competitive

ancillary benefits, such as dental, vision, critical illness, legal and identify theft

coverage |

| • | Generous

paid time off (“PTO”) policy |

| • | Company-paid

short and long-term disability and life insurance |

| • | Flexible

spending accounts for both healthcare and dependent care |

| • | Health

savings accounts with Employer contributions |

| • | 401(k)

retirement savings program with company match |

| • | Employee

Stock Purchase Program |

| • | Employee

Assistance Program which offers counseling and mental wellness appointments at no cost

to the employee |

Our

dedicated health and safety function ensures that employees are trained on best practices to create a safe and healthy workplace

for all. Over the last few years, we have expanded our work from home (“WFH”) capabilities in order to allow our employees

to better serve our customers while putting safety first. We continue to focus on the mental, emotional and physical health of

our employees by caring for their emotional and physical well-being. We employ a full-time certified Holistic Health Coach to

spearhead our employee health and wellness initiatives. In addition to providing health and wellness information on a regular

basis to all employees, we currently have over 10% of our employees working directly with our Health Coach on a personalized basis

to meet their desire to be healthier.

Our

Dream Manager® program assists our employees in meeting their own personal and professional goals in addition to helping them

improve physically, emotionally, intellectually, and spiritually. Over 300 employees have participated in this program since 2019.

We launched a nationally-recognized financial wellness program (“SmartDollar”) that is designed to assist our employees

in becoming debt-free and saving money for emergencies and retirement, empowering them to become better financially prepared for

their future, which during both the years ended 2022 and 2023, had an over 40% participation rate. Due to our adoption rate, we

won a national award from the Dave Ramsey Foundation called the “Vision” award.

Employee

Feedback

Attracting,

developing and retaining talented employees is critical to our success and is an integral part of our human capital strategy.

Employee feedback is highly valued at Origin and our employees provide anonymous input via quarterly surveys facilitated by Glint,

a people success platform built on an approach that helps organizations increase employee engagement, develop their people, and

improve business results.

| 12 |

2024

Proxy Statement |

|

|

|

|

|

| |

|

|

|

| |

|

|

|

Our

employees consistently rank Origin in the top 10% of Glint’s global customer base with regard to employee engagement and

several other categories such as company culture, recognition, and communication. We regularly receive hundreds of written comments

from each survey that in turn are used to improve processes, policies, or programs in an effort to show tangible affirmation of

those comments. We also have continued a practice that was implemented at the beginning of the pandemic called “The Origin

Insider” which takes a deep dive into various topics and departments. This program gives employees an inside look at executives

on a personal level, allows employees to learn about lesser-known departments and also supports areas of physical and mental awareness.

Additionally, we offer Take 5, which is a program designed specifically to support and engage WFH employees. These meetings

occur monthly and feature internal and external speakers who discuss a wide range of topics designed to promote employee engagement

and satisfaction.

Talent

Development

Talent

development at Origin begins with our comprehensive recruitment program and continues throughout the employee life cycle. The

Company recognizes that its success is highly dependent on its ability to attract, retain and develop our people. To foster this

development, the Company engages in annual succession planning focused on building a strong, diverse talent pipeline.

We

conduct regular talent succession assessments along with individual performance reviews in which managers provide regular feedback

and coaching to assist with the development of our employees, including the use of individual development plans to assist with

career development. Our Giving Interns Valuable Experience (“G.I.V.E.”) program was launched in 2021 and since

that time, we have welcomed a diverse group of 42 interns from 23 different universities. Over 40% of interns have been minorities.

The program has successfully promoted Origin’s brand and resulted in strong experiential feedback while also creating job

opportunities for 16 of the 42 interns since inception of the program.

We

provide our employees and their families access to a platform called “Right Now Media at Work” which has thousands

of streaming videos dedicated to both personal and professional development. This tool is designed to enhance work, life and leadership

skills and is used for team building and individual development plans. In addition, employees can access a variety of personal

care topics such as finances, relationships and mental health.

We

utilize assessment tools and provide multiple resources and venues, such as our Career Development Center, for employees to determine

what career path is the best fit for them in order to help them grow and enhance their promotional opportunities. We also provide

advanced development for next-generation leaders via our Leadership Academy classes, which provide structured training and collaboration

with other aspiring leaders throughout the organization, as well as mentoring relationships. Participants in the two-year Origin

Leadership Academy are appointed by senior management. Our Emerging Leaders Council is a one-year program designed

to train and develop emerging leaders in our organization. All employees are eligible to apply for participation in the Emerging

Leaders Council. We also implemented a program called Career Manager which provides young professionals within our

organization one-on-one time with senior leaders to enhance their career aspirations and accelerate their understanding of the

business of banking. We find benefit in developing our future leaders from within and succession plans are in place for senior

level positions as well as many other key leadership positions.

|

|

|

|

|

2024

Proxy Statement |

13 |

| |

|

|

|

| |

|

|

|

Community

& Volunteerism

Since

our inception, we have been deeply committed to building relationships and making a difference in our local communities. Investing

in people, neighborhoods and local businesses is part of our mission. We strive to understand the needs of our local communities

and how we can help them attain their goals and improve the quality of lives throughout our footprint.

Additionally,

in one specific initiative designed to help the communities we serve, our Project Enrich program provides employees with

up to twenty hours of paid time off to volunteer in their communities. In 2023, the employees of Origin volunteered 5,037 hours

in the community during working hours, not including over 1,100 hours on personal time outside of working hours. To supplement

our volunteer work, we seek out areas where we can make an additional impact through financial donations. Our Bank on Their

Future program was created to help provide support to local schools and thereby invest in our community’s future.

Over

the past several years, Origin Bank has been recognized for our commitment to our communities and our customers, including:

| • | United

Way Circle of Honor and Gold Award |

| • | Boys

and Girls Club as well as multiple educational initiatives |

We

are extremely grateful for the many local non-profit organizations and are proud of our long- standing history of supporting the

efforts of these organizations. Our goal is to have a positive impact on the communities we serve. We focus our philanthropic

giving on initiatives that promote community and economic development, asset building, financial education, youth programs, and

social impact service organizations that assist low and moderate incomes.

| Culture of Governance |

|

Origin

is committed to maintaining a high-quality governing body and achieving excellence in our corporate governance practices. We emphasize

a culture of accountability and strive to conduct our business in a manner that is fair, ethical and responsible to earn the trust

of our stakeholders. Our Board is comprised of a majority of independent directors as defined by the NYSE listing standards and

our Guidelines. Our corporate governance policies and practices include annual evaluations of the Board and its committees, as

well as continuing director education. Our Code of Ethics ensures that our directors, officers, and colleagues comply with all

applicable rules and regulations.

We

implement robust risk management programs to ensure compliance with applicable laws and regulations governing ethical business

practices, including our relationships with suppliers, customers and business partners, and our industry. Origin’s whistleblower

policy further supports our stated goals within our governance structure. Monitored by an independent third party, this program

is designed to receive complaints of financial irregularities, breaches of internal controls, conflicts of interest and fraud.

| 14 |

2024

Proxy Statement |

|

|

|

|

|

| |

|

|

|

| |

|

|

|

We

are subject to rigorous controls and audits, and our board actively oversees our cybersecurity practices. Our risk management

teams ensure compliance with applicable laws and regulations and coordinate with subject-matter experts (SMEs) throughout the

business to identify, monitor and mitigate material risks. Each employee and director receives mandatory ongoing compliance training

on a variety of topics including, but not limited to, the areas of Fair Lending and Anti-Money Laundering (AML), which includes

recognizing and reporting unusual or suspicious activity. We leverage the latest encryption configurations and cyber technologies

on our systems, devices, and third-party connections and we further review vendor encryption to ensure proper information security

safeguards are maintained. Additionally, we have engaged the former Chief Information Officer of a Fortune 500 global technology

company to consult with our Board of Directors on cybersecurity and data privacy matters.

Origin

has a robust Information Security program. Our IT team is available 24/7 and uses a combination of industry-leading tools and

innovative technologies to help protect our stakeholder’s data. Our team members are responsible for complying with our

data security standards and complete mandatory annual training to understand the behaviors and technical requirements necessary

to keep Personal Identifiable Information (PII) data secure. To protect clients’ personal information from unauthorized

access and use, the Company uses security measures that comply with Federal law. We restrict access to personal information about

customers to employees who need to know such information to provide products and services.

The

Audit Committee oversees risks related to financial reporting, internal controls and cybersecurity. Our IT team uses a combination

of industry tools and innovative technologies to help protect stakeholders against cybercriminals. We leverage the latest encryption

configurations and cyber technologies on our systems, devices and third-party connections and further review vendor encryption

to ensure proper information security safeguards are maintained.

We

routinely engage with our stockholders to better understand their ESG views, carefully considering the feedback we receive and

acting when appropriate.

More

information about Origin’s commitment to sustainability matters, including policies, programs and our recent Corporate Sustainability

Report, are available on Origin’s website at ir.origin.bank.

|

|

|

|

|

2024

Proxy Statement |

15 |

| |

|

|

|

| |

|

|

|

| |

|

PROPOSAL 1. ELECTION

OF DIRECTORS |

|

|

|

|

PROPOSAL

1: ELECTION OF DIRECTORS

Proposal

Snapshot

What

am I voting on?

Stockholders are being asked to elect 15 directors to serve until the next annual meeting of stockholders and until their successors are elected and qualified. This section includes information about the Board and each director nominee.

Voting

recommendation:

FOR

the election of each director nominee. We believe the combination of the various qualifications, skills and experiences of each of the director nominees will contribute to an effective and well-functioning Board. The director nominees possess the necessary qualifications to provide effective oversight of our business and quality advice and counsel to our management.

|

Director

Nominees

Based

on the recommendation of the Nominating and Corporate Governance Committee of the Board, our Board, which currently consists of

15 directors, has nominated each of the 15 incumbent directors to serve as directors for a one-year term.

We

seek directors with strong reputations and experience in areas relevant to the strategy, growth and operations of our businesses.

Each of the nominees for director has experience that meets this objective. In their current and prior positions, each of the

director nominees has gained experience in core management skills, such as strategic and financial planning, corporate governance,

risk management, and leadership development. We also believe that each of the director nominees has other key attributes that

are important to an effective Board, including: integrity and high ethical standards; sound judgment; analytical skills; the ability

to engage management and each other in a constructive and collaborative fashion; diversity of background, experience, and thought;

and the commitment to devote significant time and energy to service on our Board and its committees.

None

of the director nominees were selected pursuant to any arrangement or understanding with any person. There are no family relationships

among directors or executive officers of the Company. Each of the director nominees currently serving on the Board were elected

by our stockholders at a previous annual meeting of stockholders.

Each

director nominee has agreed to serve if elected, and we have no reason to believe that any of the director nominees will be unable

or unwilling to serve if elected. However, if any nominee should become unable or unwilling to serve, proxies may be voted for

another person nominated as a substitute by the Board, or the Board may reduce the number of directors.

| 16 |

2024

Proxy Statement |

|

|

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

PROPOSAL 1. ELECTION

OF DIRECTORS |

|

|

|

|

Director

Nominee Qualifications and Experience

The following table presents

certain information with respect to the Board’s nominees for director. Typically, all of the directors are elected on an

annual basis at each annual meeting of stockholders. Additionally, all director nominees of the Company are also directors of

the Bank, the Company’s principal subsidiary for so long as they are directors of the Company.

Director

Nominee |

Background |

Qualifications |

Daniel

Chu

Independent

Founder,

CEO &

Chairman

Tricolor

Holdings

Age(1):

60

Director

Since 2022

Board

Committees:

• Compensation

Committee

• Nominating

and Corporate Governance |

Daniel

Chu is the Founder, Chairman, and CEO of Tricolor Holdings, a direct-to- consumer, AI-powered

platform, focused on serving the underserved Hispanic market. Tricolor was named by Inc.

Magazine as Best in Business for 2022 and has been recognized by

several major fintech publications for its use of artificial intelligence to advance financial

inclusion to a highly underserved market and offer responsible, affordable, credit- building

auto loans to individuals with no or limited credit history. Tricolor is a two-time recipient

of the Fintech Nexus Excellence in Financial Inclusion Award in both 2022 and 2023 and the

Finovate Excellence in Financial Inclusion Award in 2023. Tricolor was named one of the top

entrepreneurial companies in America by Entrepreneur magazine for two consecutive years in

2019 and 2020 and was awarded the Auto Finance News Award of Excellence in Community Service

in 2022 and Excellence in Technology in 2019. Tricolor also has been recognized by Inc. magazine

for eight consecutive years as one of the fastest growing companies in America. Headquartered

in Dallas, Texas, Tricolor became the first in consumer auto ABS to issue a rated social

bond. Tricolor is the only auto lender issuing in the capital markets to be certified by

the U.S. Department of the Treasury as a Community Development Financial Institution (CDFI).

Mr. Chu has distinguished himself as a successful serial entrepreneur, having founded six

companies over the past thirty years. Prior to his current role, Mr. Chu founded two other

firms in the auto financial services industry which became publicly traded. He has served

in the capacity of CEO with seven different companies. |

• B.S.

in Electrical Engineering from Washington University

• M.S.in

Athletic Administration from the University of Miami

• Mr.

Chu’s entrepreneurial and management experience make him a valuable asset to our Board |

|

|

|

|

|

2024

Proxy Statement |

17 |

| |

|

|

|

| |

|

|

|

| |

|

PROPOSAL 1. ELECTION

OF DIRECTORS |

|

|

|

|

Director

Nominee |

Background |

Qualifications |

James

D’Agostino, Jr.

Independent

Managing

Director

Encore

Interests LLC

Chairman

of the Board Houston Trust Company

Age(1):

77

Director

Since 2013

Board Committees:

• Audit

Committee

• Finance

Committee (Chair)

• Nominating

and Corporate Governance

• Risk

Committee |

Mr.

D’Agostino, Jr. is the Lead Independent Director of the Company and Origin Bank. He

has over 50 years of experience in numerous capacities in the banking and financial services

industries. Mr. D’Agostino, Jr. founded Encore Bancshares, Inc. in 2000 and served

as its Chairman of the Board and CEO from 2000 until the organization was sold in 2012. Currently,

Mr. D’Agostino, Jr. is the Managing Director of Encore Interests LLC, which is focused

on banking, investments, and investment management. In 2013, Mr. D’Agostino, Jr. became

Chairman of the Board of Houston Trust Company, a privately- owned trust company headquartered

in Houston, Texas with approximately $9.5 billion of assets under management. |

• B.S.

in Economics from Villanova University

• J.D.

from Seton Hall University School of Law, and has completed the Advanced Management Program at Harvard Business School

• Mr.

D’Agostino, Jr.’s extensive banking experience and his knowledge of the law and the financial services industry enables

him to make valuable contributions to our Board |

James

Davison, Jr.

Independent

Director

Genesis

Energy, L.P.

(NYSE:

GEL)

Age(1):

57

Director

Since 1999

Board

Committees:

• Finance

Committee

• Risk

Committee (Chair) |

Mr.

Davison, Jr., has served as a director for Genesis Energy, L.P. (NYSE: GEL) since 2007, and

currently serves on its Governance, Compensation and Business Development Committees. From

1996 until 2007, he served in executive leadership positions of several related entities

acquired by, or oversaw substantial assets of which were acquired by, Genesis Energy, L.P. |

• B.S.

from Louisiana Tech University

• Mr.

Davison, Jr.’s management experience in the energy and transportation industries and

his work as a director of a publicly-traded enterprise enables him to make valuable contributions to our Board |

Jay

Dyer

Co-founder

& Managing Partner

Park

Hallow Capital

Former

Market Executive, Executive Vice President, Origin Bank

Age(1):

48

Director

Since 2022 |

Mr.

Dyer is co-founder and managing partner of Park Hollow Capital. Mr. Dyer served as Executive

Vice President and Market Executive of Origin Bank from 2022 until 2023. Prior to joining

Origin Bank, Mr. Dyer served as Executive Vice President of BTH Bank, N.A., (“BTH Bank”)

from 2013 to 2022 including service on the boards of directors for the bank and its holding

company, BT Holdings, Inc.(“BT Holdings”). Prior to BTH Bank, Mr. Dyer served

as Senior Vice President of Texas Security Bank. He held prior leadership positions with

Bank of Texas and The Northern Trust Company. |

• B.B.A

in Finance from Texas Christian University

• J.D.

from South Texas College of Law

• Mr.

Dyer’s knowledge of the banking industry; executive leadership, banking experience and personal contacts gained through

his previous role at BTH Bank.; and his legal education make him an asset to our Board. |

| 18 |

2024

Proxy Statement |

|

|

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

PROPOSAL 1. ELECTION

OF DIRECTORS |

|

|

|

|

Director

Nominee |

Background |

Qualifications |

A.

La’Verne Edney

Independent

Litigation

Partner

Butler

Snow LLP

Age(1):

57

Director

Since 2021

Board

Committees:

• Nominating

and Corporate Governance

• Risk

Committee |

Ms.

Edney has been a litigation partner at the law firm Butler Snow LLP since 2018, where she