Report of Foreign Issuer (6-k)

February 05 2020 - 9:31AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

6-K

Report

of Foreign Private Issuer

Pursuant

to Rule 13a-16 or 15d-16

under

the Securities Exchange Act of 1934

For

the month of: February 2020 (Report No. 2)

Commission

file number: 001-37600

NANO

DIMENSION LTD.

(Translation

of registrant’s name into English)

2

Ilan Ramon

Ness

Ziona 7403635 Israel

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulations S-T Rule 101(b)(1):_____

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulations S-T Rule 101(b)(7):_____

CONTENTS

Pricing of Public Offering

On February 4, 2020,

Nano Dimension Ltd. (the “Company”) priced an underwritten public offering (the “Offering”)

of 2,333,000 American Depositary Shares (“ADSs”), at a price per ADS to the public of $1.50. ThinkEquity, a

division of Fordham Financial Management, Inc., is acting as the sole underwriter for the offering. The Offering is expected to

close on February 7, 2020, subject to customary closing conditions.

The ADSs to be issued

in the Offering will be issued pursuant to a prospectus supplement, which will be filed with the Securities and Exchange Commission

(the “SEC”), in connection with a takedown from the Company’s shelf registration statement on Form F-3 (File

No. 333-217173) (the

“Registration Statement”).

The Company’s

press release containing additional details of the Offering is filed as Exhibit 99.1 to this Report. A copy of the Underwriting

Agreement is filed as Exhibit 1.1 to this Report. The foregoing summary of such document is subject to, and qualified in their

entirety by reference to, such exhibit.

Debt Conversions and Termination of

Future Tranches of Debt Funding

Pursuant to a securities

purchase agreement dated August 30, 2019 (the “August 2019 SPA”), the Company issued convertible promissory

notes (the “Notes”) with an aggregate original principal amount of approximately $4.3 million and undertook

to issue an additional approximately $2.7 million of notes to be received in two subsequent closings. Subsequent to August 30,

2019, and prior to February 4, 2020, an aggregate of approximately $2.0 million of Notes were converted into ADSs. On February

4, 2020, the Company decreased the conversion price of approximately 85% of the Notes to $1.74 per ADS, and in consideration of

the reduced conversion price, the holders of such Notes have agreed to convert such Notes into ADSs concurrently with the closing

of the Offering. Additionally, the Company agreed to amend the exercise price under the warrants issued to such investors pursuant

to the August 2019 SPA to $1.914 per ADS, and the Company and the investors agreed to terminate substantially all remaining obligations

arising under the August 2019 SPA, including the two subsequent closings.

Forward Looking Statements

This report contains

forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation

Reform Act of 1995 and other Federal securities laws. Words such as “expects,” “anticipates,” “intends,”

“plans,” “believes,” “seeks,” “estimates” and similar expressions or variations

of such words are intended to identify forward-looking statements. For example, the Company is using forward-looking statements

in this report when it discusses the expected timing of the closing of the Offering, the possible offering of additional American

Depositary Shares, and the intended use of proceeds. Because such statements deal with future events and are based on the Company’s

current expectations, they are subject to various risks and uncertainties. Actual results, performance or achievements of the Company

could differ materially from those described in or implied by the statements in this report. The forward-looking statements contained

or implied in this report are subject to other risks and uncertainties, including market conditions and the satisfaction of all

conditions to, and the closing of, the Offering, as well as those discussed under the heading “Risk Factors” in the

Company’s annual report on Form 20-F filed with the Securities and Exchange Commission (“SEC”) on March 14, 2019,

and in any subsequent filings with the SEC. Except as otherwise required by law, the Company undertakes no obligation to publicly

release any revisions to these forward-looking statements to reflect events or circumstances after the date hereof or to reflect

the occurrence of unanticipated events.

Exhibits

Attached hereto and incorporated herein

are the following exhibits:

This report on Form

6-K shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of ADSs or warrants

in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the

securities laws of any such jurisdiction.

This Form 6-K is incorporated

by reference into the registration statements on Form F-3 (File No. 333-217173 and 333-233905) and Form S-8 (File No. 333-214520)

of the Registrant, filed with the Securities and Exchange Commission, to be a part thereof from the date on which this report is

submitted, to the extent not superseded by documents or reports subsequently filed or furnished.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

|

|

Nano

Dimension Ltd.

|

|

|

(Registrant)

|

|

|

|

|

|

Date: February

5, 2020

|

By:

|

/s/

Yael Sandler

|

|

|

Name:

|

Yael

Sandler

|

|

|

Title:

|

Chief

Financial Officer

|

2

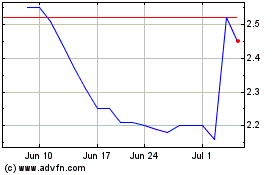

Nano Dimension (NASDAQ:NNDM)

Historical Stock Chart

From Mar 2024 to Apr 2024

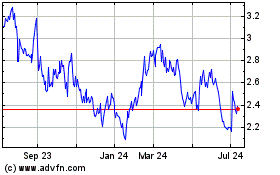

Nano Dimension (NASDAQ:NNDM)

Historical Stock Chart

From Apr 2023 to Apr 2024