Definitive Materials Filed by Investment Companies. (497)

January 10 2020 - 4:18PM

Edgar (US Regulatory)

Filed Pursuant to Rule

497

Securities Act File No. 333-224976

NEWTEK BUSINESS SERVICES

CORP.

Supplement

No. 3, dated January 10, 2020

to

Prospectus Supplement,

dated July 10, 2019

This supplement contains

information which amends, supplements or modifies certain information contained in the Prospectus of Newtek Business Services

Corp. (the “Company”), dated July 3, 2019 (the “Prospectus”), as supplemented by the prospectus supplement

dated July 10, 2019 and the prospectus supplements dated August 13, 2019 and November 13, 2019 (each, a “Prospectus Supplement”

and together, the “Prospectus Supplements”), which relate to the sale of shares of common stock of the Company in

an “at the market” offering pursuant to an equity distribution agreement, dated as of July 10, 2019, by and between

the Company and the several Placement Agents named in Schedule A thereto. Capitalized terms used but not defined herein shall

have the same meaning given them in the Prospectus Supplements or Prospectus, as applicable.

You should carefully consider

the “Risk Factors” below and beginning on page 19 of the Prospectus before you decide to invest.

STATUS OF OUR OFFERINGS

On July 10,

2019, we established an at the market program to which this Supplement No. 3, dated January 10, 2020 relates, and through which

we may sell, from time to time at our sole discretion, up to 3,000,000 shares of our common stock. Through January 10, 2020, we

have sold 1,428,638 shares of our common stock for net proceeds of approximately $31,821,000 after sales commissions to the Placement

Agents of $650,000 and offering costs, under the at the market program. As a result, 1,571,362 shares of our common stock remain

available for sale under the at the market program.

RECENT DEVELOPMENTS

Fourth Quarter Loan Activity

On January

10, 2020, the Company announced that for the three months ended December 31, 2019, Newtek Small Business Finance (“NSBF”),

a wholly owned portfolio company, funded $183.0 million in SBA 7(a) loans, which represents a 22.8% increase over SBA 7(a) loans

funded for the three months ended December 31, 2018. For the year ended December 31, 2019, NSBF funded $517.7 million in SBA 7(a)

loans; an increase of 10.3% over the previous year. In addition, with respect to total loan closings for the three months ended

December 31, 2019, NSBF, Newtek Business Lending (“NBL”), a wholly owned portfolio company, and Newtek Conventional

Lending (“NCL”), the Company’s joint venture between a Newtek wholly owned subsidiary and Conventional Lending

TCP Holding, LLC, a wholly owned affiliate of BlackRock TCP Capital Corp, closed a total of $249.1 million of SBA 7(a), SBA 504

and non-conforming conventional loans.

Principal

Executive Office Address

Effective

immediately, each reference to the address 1981 Marcus Avenue, Suite 130, Lake Success, NY 11042 in the Prospectus Supplement,

dated July 10, 2019, is replaced in its entirety by the following address: 4800 T-Rex Avenue, Suite 120, Boca Raton, FL 33431.

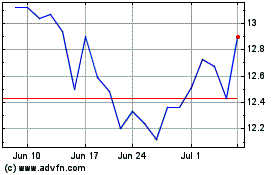

NewtekOne (NASDAQ:NEWT)

Historical Stock Chart

From Mar 2024 to Apr 2024

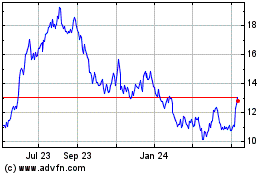

NewtekOne (NASDAQ:NEWT)

Historical Stock Chart

From Apr 2023 to Apr 2024