Filed Pursuant to Rule 424(b)(3)

Registration No. 333-248905

PROSPECTUS

Up to 3,000,000 Shares

Common Stock

This prospectus relates to the sale of up to 3,000,000 shares of our common stock by Aspire Capital Fund, LLC (Aspire Capital). Aspire Capital is also referred to in this prospectus as the selling stockholder. The prices at which the selling stockholder may sell the shares will be determined by the prevailing market price for the shares or in negotiated transactions. We will not receive proceeds from the sale of the shares by the selling stockholder. However, we may receive proceeds of up to $20.0 million from the sale of our common stock to the selling stockholder, pursuant to a common stock purchase agreement entered into with the selling stockholder on September 11, 2020.

The selling stockholder is an “underwriter” within the meaning of the Securities Act of 1933, as amended (Securities Act). We will pay the expenses of registering these shares, but all selling and other expenses incurred by the selling stockholder will be paid by the selling stockholder.

Our common stock is listed on the Nasdaq Capital Market under the symbol “LIFE”. On October 1, 2020 the last reported sale price of our common stock was $3.28 per share.

You should read this prospectus and any prospectus supplement, together with additional information described under the headings “Incorporation of Certain Information by Reference” and “Where You Can Find More Information,” carefully before you invest in any of our securities.

We are an “emerging growth company” as defined by the Jumpstart Our Business Startups Act of 2012 and, as such, we have elected to comply with certain reduced public company reporting requirements for this prospectus and future filings. Please see “Prospectus Summary – Implications of Being an Emerging Growth Company and Smaller Reporting Company.”

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 6 of this prospectus and under similar headings in the documents incorporated by reference into this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is October 2, 2020

TABLE OF CONTENTS

We incorporate by reference important information into this prospectus. You may obtain the information incorporated by reference without charge by following the instructions under “Where You Can Find More Information.” You should carefully read this prospectus as well as additional information described under “Incorporation of Certain Information by Reference,” before deciding to invest in our common stock.

Neither we nor the selling stockholder have authorized anyone to provide you with additional information or information different from that contained in this prospectus filed with the Securities and Exchange Commission (the SEC). We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. The selling stockholder is offering to sell, and seeking offers to buy, our common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of shares of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside the United States: Neither we nor the selling stockholder have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of common stock and the distribution of this prospectus outside the United States.

i

PROSPECTUS SUMMARY

The following summary highlights information contained or incorporated by reference elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our common stock, you should carefully read this entire prospectus, including our financial statements and the related notes and other documents incorporated by reference into this prospectus, as well as the information under the caption “Risk Factors” herein and under similar headings in the other documents that are incorporated by reference into this prospectus.

Except as otherwise indicated herein or as the context otherwise requires, references in this prospectus to “aTyr,” the “company,” “we,” “us” and “our” refer to aTyr Pharma, Inc., together with our subsidiary, Pangu BioPharma Limited.

Company Overview

We are a biotherapeutics company engaged in the discovery and development of innovative medicines based on novel immunological pathways. We have concentrated our research and development efforts on a newly discovered area of biology, the extracellular functionality and signaling pathways of tRNA synthetases. Built on more than a decade of foundational science on extracellular tRNA synthetase biology and its effect on immune responses, we have built a global intellectual property estate directed to a potential pipeline of protein compositions derived from 20 tRNA synthetase genes and their extracellular targets, such as neuropilin-2 (NRP2).

Our primary focus is on ATYR1923, a clinical stage product candidate which downregulates immune responses by binding to the NRP2 receptor and is in development for the treatment of inflammatory lung diseases. ATYR1923, a fusion protein comprised of the immuno-modulatory domain of histidyl tRNA synthetase (HARS) fused to the fragment cystallizable (FC) region of a human antibody, is a selective modulator of NRP2 that downregulates the innate and adaptive immune response in inflammatory disease states.

We began developing ATYR1923 as a potential therapeutic for patients with interstitial lung diseases (ILDs), a group of immune-mediated disorders that cause progressive fibrosis of the lung tissue. We selected pulmonary sarcoidosis, a major form of ILD, as our first clinical indication and are currently enrolling a proof-of-concept Phase 1b/2a clinical trial in patients. The study has been designed to evaluate the safety, tolerability and immunogenicity of multiple doses of ATYR1923 and to evaluate established clinical endpoints and certain biomarkers to assess preliminary activity of ATYR1923. A blinded interim analysis of safety and tolerability, the primary endpoint of our ongoing Phase 1b/2a clinical trial, showed study drug (ATYR1923 or placebo) was observed to be generally well tolerated with no drug-related serious adverse events (SAEs), consistent with the earlier Phase 1 study results in healthy volunteers. The final results of our current Phase 1b/2a clinical trial will guide future development of ATYR1923 in pulmonary sarcoidosis and provide insight for the potential of ATYR1923 in other ILDs, such as connective tissue disease ILD (CTD-ILD) and chronic hypersensitivity pneumonitis (CHP).

In response to the COVID-19 pandemic, we are investigating ATYR1923’s potential as a treatment for COVID-19 patients with severe respiratory complications. The inflammatory lung injury related to COVID-19 may be similar to that of interstitial lung diseases. By targeting aberrant immune responses, we believe that ATYR1923’s mechanism of action has substantial overlap with this disease pathology and are currently enrolling a Phase 2 clinical trial in COVID-19 patients with severe respiratory complications. Our Phase 2 clinical trial is a randomized, double blind, placebo-controlled study with ATYR1923 in 30 confirmed COVID-19 positive patients at up to 10 centers in the United States.

In January 2020, we entered into a license with Kyorin Pharmaceutical Co., Ltd. (Kyorin) for the development and commercialization of ATYR1923 for ILDs in Japan. Under the collaboration and license agreement with Kyorin (the Kyorin Agreement), Kyorin received an exclusive right to develop and commercialize ATYR1923 in Japan for all forms of ILDs. We received an $8.0 million upfront payment and we are eligible to receive an additional $167.0 million in the aggregate upon achievement of certain development, regulatory and sales milestones, as well as tiered royalties ranging from the mid-single digits to mid-teens on net sales in Japan. Under the terms of the Kyorin Agreement, Kyorin will fund all research, development, regulatory, marketing and commercialization activities in Japan.

In conjunction with our clinical development of ATYR1923, we have in parallel been advancing our discovery pipeline of NRP2 antibodies and tRNA synthetases. NRP2 is a receptor that plays a key role in lymphatic development and in regulating inflammatory responses. In many forms of cancer, high NRP2 expression is associated with worse outcomes. NRP2 can interact with multiple ligands and coreceptors to influence their functional roles. We are actively investigating NRP2 receptor biology, both internally and in collaboration with key academic thought leaders, to identify new product candidates for a variety of disease settings, including cancer, inflammation, and lymphangiogenesis.

1

In March 2020, our subsidiary, Pangu BioPharma Limited (Pangu BioPharma), together with the Hong Kong University of Science and Technology (HKUST) was awarded a grant of approximately $750,000 to build a high-throughput platform for the development of bi-specific antibodies. The two-year project is being funded by the Hong Kong government’s Innovation and Technology Commission under the Partnership Research Program (PRP). The PRP aims to support research and development projects undertaken by companies in collaboration with local universities and public research institutions. The grant will fund approximately 50% of the total estimated project cost, with our company contributing the remaining 50%. The research grant agreement between Pangu BioPharma, HKUST and the Government of the Hong Kong Special Administration was effective April 1, 2020.

Our continued research of tRNA synthetases is being conducted through both industry and academic collaborations. In March 2019, we entered into a research collaboration and option agreement, as amended, with CSL Behring (CSL) for the development of product candidates derived from up to four tRNA synthetases from our preclinical pipeline. Under the terms of the collaboration, CSL is obligated to fund all research and development activities and will pay a total of $4.25 million per synthetase program ($17.0 million if all four synthetase programs advance) in option fees based on achievement of research milestones and CSL’s determination to continue development.

The impact of the COVID-19 pandemic has been and will likely continue to be extensive in many aspects of society, which has resulted in and will likely continue to result in significant disruptions to the global economy, as well as businesses and capital markets around the world. Impacts to our business have included the delay in enrollment of our Phase 1b/2a clinical trial in patients with pulmonary sarcoidosis and the discontinuation of some patients in that trial, temporary closures of portions of our facilities and those of our licensees and collaborators, disruptions or restrictions on our employee's ability to travel and delays in certain research and development activities. Other potential impacts to our business include, but are not limited to disruptions to or delays in other clinical trials, third-party manufacturing supply and other operations, the potential diversion of healthcare resources away from the conduct of clinical trials to focus on pandemic concerns, interruptions or delays in the operations of the FDA or other regulatory authorities, and our ability to raise capital and conduct business development activities.

Risks Associated with Our Business

Investing in our securities involves substantial risk. The risks described under the heading “Risk Factors” immediately following this summary may cause us to not realize the full benefits of our strengths or may cause us to be unable to successfully execute all or part of our strategy. Some of the more significant challenges include the following:

|

|

•

|

We will need to raise additional capital or enter into strategic partnering relationships to fund our operations.

|

|

|

•

|

We have incurred significant losses since our inception and anticipate that we will continue to incur significant losses for the foreseeable future.

|

|

|

•

|

We may encounter substantial delays and other challenges in our clinical trials or we may fail to demonstrate safety and efficacy to the satisfaction of applicable regulatory authorities.

|

|

|

•

|

If we are unable to successfully complete or otherwise advance clinical development, obtain regulatory or marketing approval for, or successfully commercialize our therapeutic product candidates, including ATYR1923, or experience significant delays in doing so, our business will be materially harmed.

|

|

|

•

|

Our current product candidates and any other product candidates that we may develop from our discovery engine represent novel therapeutic approaches, which may cause significant delays or may not result in any commercially viable drugs.

|

|

|

•

|

Our therapeutic product candidates may cause undesirable side effects or have other properties that could delay or prevent their regulatory approval, limit the commercial profile of an approved label, or result in significant negative consequences following marketing approval, if any.

|

|

|

•

|

We depend on our collaborations with Kyorin and CSL and may depend on collaborations with additional third parties for the development and commercialization of certain of our product candidates. If our collaborations are not successful, we may not be able to capitalize on the market potential of these product candidates.

|

|

|

•

|

If we are unable to obtain, maintain or protect intellectual property rights related to our product candidates, or if the scope of such intellectual property protection is not sufficiently broad, we may not be able to compete effectively in our markets.

|

|

|

•

|

Our business could continue to be adversely affected by the effects of the COVID-19 pandemic.

|

2

|

|

•

|

Our future success depends on our ability to retain key employees, consultants and advisors and to attract, retain and motivate qualified personnel.

|

|

|

•

|

Our executive officers, directors, principal stockholders and their affiliates currently own a significant percentage of our stock and will be able to exert significant control over matters submitted to stockholders for approval.

|

Corporate Information

We were incorporated under the laws of the State of Delaware in September 2005. In October 2007, we formed our Hong Kong subsidiary, Pangu BioPharma. We hold 98% of the outstanding shares of Pangu BioPharma, and a subsidiary of HKUST holds the remaining outstanding shares.

Our principal executive office is located at 3545 John Hopkins Court, Suite #250, San Diego, California 92121, and our telephone number is (858) 731-8389. Our website address is www.atyrpharma.com and we regularly post copies of our press release as well as additional information about us on our website.

Our design logo, “aTyr,” and our other registered and common law trade names, trademarks and service marks are the property of aTyr Pharma, Inc.

The trademarks, trade names and service marks appearing in this prospectus are the property of their respective owners. We do not intend our use or display of other companies’ trademarks, trade names or service marks to imply a relationship with, or endorsement or sponsorship of us by, any other companies or products.

Implications of Being an Emerging Growth Company and Smaller Reporting Company

We are an emerging growth company, as defined in the Jumpstart Our Business Startups Act of 2012 (JOBS Act). For as long as we continue to be an emerging growth company, we may take advantage of exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies, including not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002 (Sarbanes-Oxley Act), reduced disclosure obligations regarding executive compensation in this prospectus and our periodic reports and proxy statements and exemptions from the requirements of holding nonbinding advisory votes on executive compensation and stockholder approval of any golden parachute payments not previously approved. We will cease to be an emerging growth company on December 31, 2020. Even after we no longer qualify as an emerging growth company, we may still qualify as a “smaller reporting company” which would allow us to take advantage of many of the same exemptions from disclosure requirements, including reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and the inclusion of only two years of audited financial statements and only two years of related selected financial data and management’s discussion and analysis of financial condition and results of operations disclosure. Additionally, even if we no longer qualify as an emerging growth company, as long as we are neither a “large accelerated filer” nor an “accelerated filer,” we would not be required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act. As a result, the information that we provide to our stockholders may be different than you might receive from other public reporting companies in which you hold equity interests.

We cannot predict if investors will find our securities less attractive because we may rely on these exemptions, which could result in a less active trading market for our securities and increased volatility in the price of our securities.

3

The Offering

|

|

|

|

|

|

|

|

|

|

Common stock being offered by the selling stockholder

|

|

Up to 3,000,000 shares

|

|

|

|

|

Common stock outstanding

|

|

9,383,425 shares (as of June 30, 2020)

|

|

|

|

|

Use of proceeds

|

|

The selling stockholder will receive all of the proceeds from the sale of the shares offered for sale by it under this prospectus. We will not receive proceeds from the sale of the shares by the selling stockholder. However, we may receive up to $20.0 million in proceeds from the sale of our common stock to the selling stockholder under the common stock purchase agreement described below. We expect that proceeds that we receive under the common stock purchase agreement will be used for working capital and general corporate purposes.

|

|

|

|

|

Nasdaq Capital Market symbol

|

|

“LIFE”

|

|

|

|

|

Risk factors

|

|

Investing in our common stock involves a high degree of risk. You should carefully review and consider the “Risk Factors” section of this prospectus beginning on page 6 and the other information included in this prospectus and incorporated by reference herein for a discussion of factors to consider before deciding to invest in shares of our common stock.

|

The number of shares of common stock outstanding as of June 30, 2020 excludes:

|

|

•

|

685,993 shares of common stock issuable upon the exercise of stock options outstanding as of June 30, 2020, with a weighted average exercise price of $21.29 per share;

|

|

|

•

|

7,677 shares of common stock issuable upon the vesting and settlement of restricted stock units outstanding as of June 30, 2020;

|

|

|

•

|

13,904 shares of common stock issuable upon the exercise of warrants outstanding as of June 30, 2020, with a weighted average exercise price of $64.95 per share;

|

|

|

•

|

272,204 shares of common stock reserved for future issuance under our 2015 Stock Option and Incentive Plan (2015 Plan) as of June 30, 2020; and

|

|

|

•

|

76,917 shares of common stock reserved for future issuance under our 2015 Employee Stock Purchase Plan (ESPP) as of June 30, 2020.

|

Unless otherwise indicated, all information contained in this prospectus assumes no exercise of the outstanding options or warrants and no settlement of the outstanding restricted stock units described above.

Purchase Agreement with Aspire Capital

On September 11, 2020, we entered into a common stock purchase agreement (the Purchase Agreement), with Aspire Capital Fund, which provides that, upon the terms and subject to the conditions and limitations set forth therein, Aspire Capital is committed to purchase up to an aggregate of $20.0 million of shares of our common stock over the 30-month term of the Purchase Agreement. Concurrently with entering into the Purchase Agreement, we also entered into a registration rights agreement with Aspire Capital (the Registration Rights Agreement) in which we agreed to file one or more registration statements, including the registration statement to

4

which this prospectus relates, as permissible and necessary to register under the Securities Act, the sale of the shares of our common stock that have been and may be issued to Aspire Capital under the Purchase Agreement.

As of October 1, 2020, there were 10,007,792 shares of our common stock outstanding, excluding the 3,000,000 shares offered hereby that may be issuable to Aspire Capital pursuant to the Purchase Agreement. If all of such 3,000,000 shares of our common stock offered hereby were issued and outstanding as of the date hereof, such shares would represent 23.06% of the total common stock outstanding as of October 1, 2020. The number of shares of our common stock ultimately offered for sale by Aspire Capital is dependent upon the number of shares purchased by Aspire Capital under the Purchase Agreement.

The aggregate number of shares that we may issue to Aspire Capital under the Purchase Agreement may in no case exceed 1,987,474 shares of our common stock (which is equal to 19.99% of the common stock outstanding on the date of the Purchase Agreement) unless (i) stockholder approval is obtained to issue more, in which case this 1,987,474 share limitation will not apply, or (ii) stockholder approval has not been obtained and at any time the 1,987,474 share limitation is reached and at all times thereafter the average price paid for all shares issued under the Purchase Agreement is equal to or greater than $3.83, referred to as the Minimum Price; provided that at no one point in time shall Aspire Capital (together with its affiliates) beneficially own more than 19.99% of our common stock.

Pursuant to the Purchase Agreement and the Registration Rights Agreement, we are registering 3,000,000 shares of our common stock under the Securities Act that we may issue to Aspire Capital after the date of this prospectus. All 3,000,000 shares of common stock are being offered pursuant to this prospectus. If we elect to sell more than the 3,000,000 shares of common stock offered hereby, we must first register under the Securities Act the sale by Aspire Capital of such additional shares.

On October 1, 2020, the conditions necessary for purchases under the Purchase Agreement to commence were satisfied. On any trading day on which the closing sale price of our common stock exceeds $0.25, we have the right, in our sole discretion, to present Aspire Capital with a purchase notice (each, a Purchase Notice), directing Aspire Capital (as principal) to purchase up to 100,000 shares of our common stock (not to exceed $1,000,000 worth of shares) per trading day, up to $20.0 million of our common stock in the aggregate at a per share price (the Purchase Price) calculated by reference to the prevailing market price of our common stock (as more specifically described below in the section titled “The Aspire Capital Transaction”).

In addition, on any date on which we submit a Purchase Notice for 100,000 shares to Aspire Capital, we also have the right, in our sole discretion, to present Aspire Capital with a volume-weighted average price purchase notice (each, a VWAP Purchase Notice) directing Aspire Capital to purchase an amount of stock equal to up to 30% of the aggregate shares of our common stock traded on the Nasdaq Capital Market on the next trading day (the VWAP Purchase Date), subject to a maximum number of shares we may determine (the VWAP Purchase Share Volume Maximum) and a minimum trading price (the VWAP Minimum Price Threshold) (as more specifically described below). The purchase price per Purchase Share pursuant to such VWAP Purchase Notice (the VWAP Purchase Price) is calculated by reference to the prevailing market price of our common stock (as more specifically described below in the section titled “The Aspire Capital Transaction”).

The Purchase Agreement provides that we and Aspire Capital shall not effect any sales under the Purchase Agreement on any purchase date where the closing sale price of our common stock is less than $0.25 per share (the Floor Price). There are no trading volume requirements or restrictions under the Purchase Agreement, and we will control the timing and amount of any sales of our common stock to Aspire Capital. Aspire Capital has no right to require any sales by us, but is obligated to make purchases from us as we direct in accordance with the Purchase Agreement. There are no limitations on use of proceeds, financial or business covenants, restrictions on future financings, rights of first refusal, participation rights, penalties or liquidated damages in the Purchase Agreement. Aspire Capital may not assign its rights or obligations under the Purchase Agreement. The Purchase Agreement may be terminated by us at any time effective upon one business day prior notice, at our discretion, without any cost to us.

5

RISK FACTORS

Investing in our common stock involves a high degree of risk. You should consider carefully the following risks and uncertainties as well as the risks and uncertainties described in the section entitled “Risk Factors” contained in our Annual Report on Form 10-K for the year ended December 31, 2019, as filed with the SEC on March 26, 2020, as well as in our subsequent Quarterly and Current Reports filed with the SEC, which descriptions are incorporated into this prospectus by reference in their entirety, as well as in any prospectus supplement hereto. These risks and uncertainties are not the only risks and uncertainties we face. Additional risks and uncertainties not currently known to us, or that we currently view as immaterial, may also impair our business. If any of the risks or uncertainties described in our SEC filings or any additional risks and uncertainties actually occur, our business, financial condition, results of operations and cash flow could be materially and adversely affected. In that case, the trading price of our common stock could decline and you might lose all or part of your investment. You should carefully consider the following information about risks, together with the other information contained in this prospectus, before making an investment in our common stock.

We will need to raise substantial additional capital in the future to fund our operations and we may be unable to raise such funds when needed and on acceptable terms.

We will need to raise substantial additional capital in the future to fund our operations. The extent to which we utilize the Purchase Agreement with Aspire Capital as a source of funding will depend on a number of factors, including the prevailing market price of our common stock, the volume of trading in our common stock and the extent to which we are able to secure funds from other sources. The number of shares that we may sell to Aspire Capital under the Purchase Agreement on any given day and during the term of the Purchase Agreement is limited. See “The Aspire Capital Transaction” for additional information. Additionally, we and Aspire Capital may not effect any sales of shares of our common stock under the Purchase Agreement during the continuance of an event of default or on any trading day that the closing sale price of our common stock is less than $0.25 per share. Even if we are able to access the full $20.0 million under the Purchase Agreement, we will still need additional capital to fully implement our business, operating and development plans.

The sale of our common stock to Aspire Capital may cause substantial dilution to our existing stockholders and the sale of the shares of common stock acquired by Aspire Capital could cause the price of our common stock to decline.

We are registering for sale up to 3,000,000 shares that we may sell to Aspire Capital from time to time under the Purchase Agreement. It is anticipated that shares registered in this offering will be sold over a period of up to approximately 30 months from the date of commencement. The number of shares ultimately offered for sale by Aspire Capital under this prospectus is dependent upon the number of shares we elect to sell to Aspire Capital under the Purchase Agreement. Depending on a variety of factors, including market liquidity of our common stock, the sale of shares under the Purchase Agreement may cause the trading price of our common stock to decline.

Aspire Capital may ultimately purchase all, some or none of the 3,000,000 shares of common stock that is the subject of this prospectus. Aspire Capital may sell all, some or none of our shares that it holds or comes to hold under the Purchase Agreement. Sales by us to Aspire Capital of shares pursuant to the Purchase Agreement may result in dilution to the interests of other holders of our common stock. The sale of a substantial number of shares of our common stock by Aspire Capital in this offering, or anticipation of such sales, could cause the trading price of our common stock to decline or make it more difficult for us to sell equity or equity-related securities in the future at a time and at a price that we might otherwise desire.

Management will have broad discretion as to the use of the proceeds from sales of shares to Aspire Capital, and may not use the proceeds effectively.

This prospectus relates to shares of our common stock that may be offered and sold from time to time by Aspire Capital. We will not receive any proceeds upon the sale of shares by Aspire Capital. However, we may receive gross proceeds of up to $20.0 million from the sale of shares under the Purchase Agreement to Aspire Capital. Our anticipated use of net proceeds from the sale of our common stock to Aspire Capital under the Purchase Agreement represents our intentions based upon our current plans and business conditions. Because we have not designated the amount of net proceeds from this offering to be used for any particular purpose, our management will have broad discretion as to the application of the net proceeds from this offering and could use them for purposes other than those contemplated at the time of the offering. Our management may use the net proceeds for corporate purposes that may not improve our financial condition or market value.

We do not intend to pay dividends on our common stock, and therefore any returns will be limited to the value of our stock.

We have never declared or paid any cash dividends on our common stock. We anticipate that we will retain future earnings for the development, operation and expansion of our business and do not anticipate declaring or paying any cash dividends for the foreseeable future. Any return to stockholders will therefore be limited to the appreciation of their stock. Any future determination

6

related to dividend policy will be made at the discretion of our board of directors and will depend upon, among other factors, our results of operations, financial condition, capital requirements, tax considerations, legal or contractual restrictions, business prospects, the requirements of current or then-existing debt instruments, general economic conditions and other factors our board of directors may deem relevant.

7

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference herein contain forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended (the Exchange Act). Any statements about our expectations, beliefs, plans, objectives, assumptions or future events or performance are not historical facts and may be forward-looking. These statements are often, but are not always, made through the use of words or phrases such as “may,” “will,” “could,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “projects,” “potential,” “continue,” and similar expressions, or the negative of these terms, or similar expressions. Accordingly, these statements involve estimates, assumptions, risks and uncertainties which could cause actual results to differ materially from those expressed in them. Any forward-looking statements are qualified in their entirety by reference to the factors discussed throughout this prospectus, and in particular those factors referenced in the section “Risk Factors.”

This prospectus and the documents incorporated by reference herein contain forward-looking statements that are based on our management’s belief and assumptions and on information currently available to our management. These statements relate to future events or our future financial performance, and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Forward-looking statements include, but are not limited to, statements about:

|

|

•

|

the success, cost and timing of our clinical trials and whether the results of our trials will be sufficient to support U.S. or foreign regulatory approvals;

|

|

|

•

|

the results and timing of our clinical trials of ATYR1923;

|

|

|

•

|

the impact of the COVID-19 pandemic on our ATYR1923 Phase 1b/2a clinical trial in patients with pulmonary sarcoidosis and any resulting cost increases as a result of the COVID-19 pandemic;

|

|

|

•

|

whether our existing capital resources will be sufficient to enable us to complete any particular portion of our planned clinical development of our product candidates or support our operations through particular time periods;

|

|

|

•

|

the potential benefits of our collaborations with Kyorin and CSL;

|

|

|

•

|

the likelihood and timing of regulatory approvals for our product candidates;

|

|

|

•

|

our ability to identify and discover additional product candidates;

|

|

|

•

|

our ability to obtain, maintain, defend and enforce intellectual property rights protecting our product candidates;

|

|

|

•

|

our estimates of our expenses, ongoing losses, future revenue, capital requirements and our needs for or ability to obtain additional financing;

|

|

|

•

|

the performance of third-party service providers and independent contractors upon whom we rely to conduct our clinical trial and to manufacture our product candidates or certain components of our product candidates;

|

|

|

•

|

our ability to develop sales and marketing capabilities or to enter into strategic partnerships to develop and commercialize our product candidates;

|

|

|

•

|

the timing and success of the commercialization of our product candidates;

|

|

|

•

|

the rate and degree of market acceptance of our product candidates;

|

|

|

•

|

the size and growth of the potential markets for our product candidates and our ability to serve those markets;

|

|

|

•

|

regulatory developments in the United States and foreign countries;

|

|

|

•

|

the success of competing therapies that are or may become available;

|

|

|

•

|

our ability to attract and retain key scientific, medical or management personnel;

|

|

|

•

|

our ability to sell shares of common stock to Aspire Capital pursuant to the terms of the Purchase Agreement and our ability to register and maintain the registration of shares issuable thereunder; and

|

8

|

|

•

|

our anticipated use of the net proceeds from the potential sale of shares of our common stock to Aspire Capital.

|

These forward-looking statements are neither promises nor guarantees of future performance due to a variety of risks and uncertainties, many of which are beyond our control, which could cause actual results to differ materially from those indicated by these forward-looking statements, including, without limitation: the possibility that we may experience slower than expected clinical site initiation or slower than expected identification and enrollment of evaluable patients; the potential for delays or problems in analyzing data or the need for additional analysis, data or patients; the potential that future pre-clinical and clinical results may not support further development of our product candidates; the potential for unexpected adverse events in the conduct of one of our clinical trials to impact our ability to continue the clinical trial or further development of a product candidate; the risk that we may encounter other unexpected hurdles or issues in the development and manufacture of our product candidates that may impact our cost, timing or progress, as well as those risks more fully discussed in the “Risk Factors” section in this prospectus and the documents incorporated by reference herein.

Given these uncertainties, readers should not place undue reliance on our forward-looking statements. You should read this prospectus, the documents incorporated by reference herein and the documents that we have filed as exhibits to the registration statement to which this prospectus relates completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of the forward-looking statements in this prospectus and the documents incorporated by reference herein by these cautionary statements. Except as required by law, we undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise.

9

DIVIDEND POLICY

We have never declared or paid cash dividends on our capital stock. We currently intend to retain all available funds and any future earnings, if any, to fund the development and expansion of our business and we do not anticipate paying any cash dividends in the foreseeable future. In addition, pursuant to the Loan Agreement, we are restricted from paying cash dividends without the consent of the Lenders and future debt instruments may materially restrict our ability to pay dividends on our common stock. Any future determination related to dividend policy will be made at the discretion of our board of directors and will depend upon, among other factors, our results of operations, financial condition, capital requirements, tax considerations, legal or contractual restrictions, business prospects, the requirements of current or then-existing debt instruments, general economic conditions and other factors our board of directors may deem relevant.

10

THE ASPIRE CAPITAL TRANSACTION

General

On September 11, 2020, we entered into the Purchase Agreement, which provides that, upon the terms and subject to the conditions and limitations set forth therein, Aspire Capital is committed to purchase up to an aggregate of $20.0 million of our shares of common stock over the term of the Purchase Agreement. Concurrently with entering into the Purchase Agreement, we also entered into the Registration Rights Agreement, in which we agreed to file one or more registration statements as permissible and necessary to register under the Securities Act, the sale of the shares of our common stock that have been and may be issued to Aspire Capital under the Purchase Agreement.

As of October 1, 2020, there were 10,007,792 shares of our common stock outstanding, excluding the 3,000,000 shares offered hereby that may be issuable to Aspire Capital pursuant to the Purchase Agreement. If all of such 3,000,000 shares of our common stock offered hereby were issued and outstanding as of October 1, 2020, such shares would represent 23.06% of the total common stock outstanding. The number of shares of our common stock ultimately offered for sale by Aspire Capital is dependent upon the number of shares purchased by Aspire Capital under the Purchase Agreement.

The aggregate number of shares that we may issue to Aspire Capital under the Purchase Agreement may in no case exceed 1,987,474 shares of our common stock (which is equal to 19.99% of the common stock outstanding on the date of the Purchase Agreement) unless (i) stockholder approval is obtained to issue more, in which case this 1,987,474 share limitation will not apply, or (ii) stockholder approval has not been obtained and at any time the 1,987,474 share limitation is reached and at all times thereafter the average price paid for all shares issued under the Purchase Agreement is equal to or greater than $3.83, referred to as the Minimum Price; provided that at no one point in time shall Aspire Capital (together with its affiliates) beneficially own more than 19.99% of our common stock.

Pursuant to the Purchase Agreement and the Registration Rights Agreement, we are registering 3,000,000 shares of our common stock under the Securities Act which we may issue to Aspire Capital after the date of this prospectus. All 3,000,000 shares of common stock are being offered pursuant to this prospectus. Under the Purchase Agreement, we have the right but not the obligation to issue more than the 3,000,000 shares of common stock included in this prospectus to Aspire Capital under some circumstances. If we elect to sell more than the 3,000,000 shares of common stock offered hereby, we must first register under the Securities Act the sale by Aspire Capital of any such additional shares.

On October 1, 2020, the conditions necessary for purchases under the Purchase Agreement to commence were satisfied. On any trading day on which the closing sale price of our common stock is not less than $0.25 per share, we have the right, in our sole discretion, to present Aspire Capital with a Purchase Notice, directing Aspire Capital (as principal) to purchase up to 100,000 shares of our common stock per business day, up to $20.0 million of our common stock in the aggregate over the term of the Purchase Agreement, at a Purchase Price calculated by reference to the prevailing market price of our common stock over the preceding 10-business day period (as more specifically described below); however, no sale pursuant to a Purchase Notice may exceed $1,000,000 per trading day.

In addition, on any date on which we submit a Purchase Notice for 100,000 shares to Aspire Capital, we also have the right, in our sole discretion, to present Aspire Capital with a VWAP Purchase Notice directing Aspire Capital to purchase an amount of stock equal to up to 30% of the aggregate shares of our common stock traded on the Nasdaq Capital Market on the next trading day, subject to the VWAP Purchase Share Volume Maximum and the VWAP Minimum Price Threshold. The VWAP Purchase Price is calculated by reference to the prevailing market price of our common stock (as more specifically described below).

The Purchase Agreement provides that we and Aspire Capital shall not effect any sales under the Purchase Agreement on any purchase date where the closing sale price of our common stock is less than the Floor Price. There are no trading volume requirements or restrictions under the Purchase Agreement, and we will control the timing and amount of any sales of our common stock to Aspire Capital. Aspire Capital has no right to require any sales by us, but is obligated to make purchases from us as we direct in accordance with the Purchase Agreement. There are no limitations on use of proceeds, financial or business covenants, restrictions on future financings, rights of first refusal, participation rights, penalties or liquidated damages in the Purchase Agreement.

Aspire Capital may not assign its rights or obligations under the Purchase Agreement. The Purchase Agreement may be terminated by us at any time, at our discretion, without any cost to us.

Purchase of Shares under the Purchase Agreement

Under the Purchase Agreement, on any trading day selected by us on which the closing sale price of our common stock exceeds $0.25 per share, we may direct Aspire Capital to purchase up to 100,000 shares of our common stock per trading day. The Purchase Price of such shares is equal to the lesser of:

11

|

|

•

|

the lowest sale price of our common stock on the purchase date; or

|

|

|

•

|

the average of the three lowest closing sale prices for our common stock during the ten consecutive trading days ending on the trading day immediately preceding the purchase date.

|

In addition, on any date on which we submit a Purchase Notice to Aspire Capital for the purchase of up to 100,000 shares, we also have the right to direct Aspire Capital to purchase an amount of stock equal to up to 30% of the aggregate shares of our common stock traded on the Nasdaq Capital Market on the next trading day, subject to the VWAP Purchase Share Volume Maximum and the VWAP Minimum Price Threshold, which is equal to the greater of (a) 80% of the closing price of our common stock on the business day immediately preceding the VWAP Purchase Date or (b) such higher price as set forth by us in the VWAP Purchase Notice. The VWAP Purchase Price of such shares is the lower of:

|

|

•

|

the closing sale price on the VWAP Purchase Date; or

|

|

|

•

|

97% of the volume-weighted average price for our common stock traded on the Nasdaq Capital Market:

|

|

|

•

|

on the VWAP Purchase Date, if the aggregate shares to be purchased on that date have not exceeded the VWAP Purchase Share Volume Maximum or

|

|

|

•

|

during that portion of the VWAP Purchase Date until such time as the sooner to occur of (i) the time at which the aggregate shares traded on the Nasdaq Capital Market exceed the VWAP Purchase Share Volume Maximum or (ii) the time at which the sale price of our common stock falls below the VWAP Minimum Price Threshold.

|

The Purchase Price will be adjusted for any reorganization, recapitalization, non-cash dividend, stock split, or other similar transaction occurring during the trading day(s) used to compute the Purchase Price. We may deliver multiple Purchase Notices and VWAP Purchase Notices to Aspire Capital from time to time during the term of the Purchase Agreement, so long as the most recent purchase has been completed.

Minimum Share Price

Under the Purchase Agreement, we and Aspire Capital may not effect any sales of shares of our common stock under the Purchase Agreement on any trading day that the closing sale price of our common stock is less than $0.25 per share.

Events of Default

Generally, Aspire Capital may terminate the Purchase Agreement upon the occurrence of any of the following, among other, events of default:

|

|

•

|

the effectiveness of any registration statement that is required to be maintained effective pursuant to the terms of the Registration Rights Agreement between us and Aspire Capital lapses for any reason (including, without limitation, the issuance of a stop order) or is unavailable to Aspire Capital for sale of our shares of common stock, and such lapse or unavailability continues for a period of ten consecutive business days or for more than an aggregate of 30 business days in any 365-day period, which is not in connection with a post-effective amendment to any such registration statement or the filing of a new registration statement; provided, however, that in connection with any post-effective amendment to such registration statement or filing of a new registration statement that is required to be declared effective by the SEC such lapse or unavailability may continue for a period of no more than 30 consecutive business days, which such period shall be extended for an additional 30 business days if we receive a comment letter from the SEC in connection therewith;

|

|

|

•

|

the suspension from trading or failure of our common stock to be listed on our principal market for a period of three consecutive business days;

|

|

|

•

|

the delisting of our common stock from our principal market, provided our common stock is not immediately thereafter trading on the New York Stock Exchange, the NYSE American, the Nasdaq Capital Market, the Nasdaq Global Select Market or the Nasdaq Global Market;

|

|

|

•

|

our transfer agent’s failure to issue to Aspire Capital shares of our common stock which Aspire Capital is entitled to receive under the Purchase Agreement within five business days after an applicable purchase date;

|

|

|

•

|

any breach by us of the representations or warranties or covenants contained in the Purchase Agreement or any related agreements which could have a material adverse effect on us, subject to a cure period of five business days;

|

|

|

•

|

if we become insolvent or are generally unable to pay our debts as they become due; or

|

|

|

•

|

if we become a party to insolvency or bankruptcy proceedings by or against us.

|

12

Our Termination Rights

The Purchase Agreement may be terminated by us at any time, at our discretion, without any penalty or cost to us.

No Short-Selling or Hedging by Aspire Capital

Aspire Capital has agreed that neither it nor any of its agents, representatives and affiliates shall engage in any direct or indirect short-selling or hedging of our common stock during any time prior to the termination of the Purchase Agreement.

Effect of Performance of the Purchase Agreement on Our Stockholders

The Purchase Agreement does not limit the ability of Aspire Capital to sell any or all of the 3,000,000 shares registered in this offering. It is anticipated that shares registered in this offering will be sold over a period of up to approximately 30 months from the date of commencement. The sale by Aspire Capital of a significant amount of shares registered in this offering at any given time could cause the market price of our common stock to decline and/or to be highly volatile. Aspire Capital may ultimately purchase all, some or none of the 3,000,000 shares of common stock not yet issued but registered in this offering. After it has acquired such shares, it may sell all, some or none of such shares. Therefore, sales to Aspire Capital by us pursuant to the Purchase Agreement also may result in substantial dilution to the interests of other holders of our common stock. However, we have the right to control the timing and amount of any sales of our shares to Aspire Capital and the Purchase Agreement may be terminated by us at any time at our discretion without any penalty or cost to us.

Percentage of Outstanding Shares after Giving Effect to the Purchased Shares Issued to Aspire Capital

In connection with entering into the Purchase Agreement, we authorized the sale to Aspire Capital of up to $20.0 million of our shares of common stock. However, we estimate that we will sell no more than 3,000,000 shares to Aspire Capital under the Purchase Agreement, all of which are included in this offering. Subject to any required approval by our board of directors, we have the right but not the obligation to issue more than the 3,000,000 shares included in this prospectus to Aspire Capital under the Purchase Agreement under some circumstances. In the event we elect to issue more than 3,000,000 shares under the Purchase Agreement, we will be required to register the resale by Aspire Capital of such additional shares. The number of shares ultimately offered for sale by Aspire Capital in this offering is dependent upon the number of shares purchased by Aspire Capital under the Purchase Agreement. The following table sets forth the number and percentage of outstanding shares to be held by Aspire Capital after giving effect to the sale of shares of common stock sold to Aspire Capital at varying purchase prices, but assuming that we will not sell in excess of 1,987,474 shares of our common stock (which is equal to 19.99% of the common stock outstanding on the date of the Purchase Agreement) unless the average price paid for all shares issued under the Purchase Agreement is equal to or greater than $3.83 per share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assumed Average Purchase Price

|

|

Proceeds from the Sale of Shares to Aspire Capital Under the Purchase Agreement Registered in this Offering

|

|

Number of Shares to be Issued in this Offering at the Assumed Average Purchase Price

|

|

Total Number of Outstanding Shares After Giving Effect to the Shares Issued to Aspire Capital(1)

|

|

Percentage of Outstanding Shares After Giving Effect to the Purchased Shares Issued to Aspire Capital(2)

|

|

|

$

|

3.00

|

$

|

5,962,422

|

|

1,987,474

|

|

11,929,814

|

|

16.66%

|

|

|

$

|

4.00

|

$

|

20,000,000

|

|

5,000,000

|

|

14,942,340

|

|

33.46%

|

|

|

$

|

5.00

|

$

|

20,000,000

|

|

4,000,000

|

|

13,942,340

|

|

28.69%

|

|

|

$

|

10.00

|

$

|

20,000,000

|

|

2,000,000

|

|

11,942,340

|

|

16.75%

|

|

|

(1)

|

Based on 9,942,340 shares of common stock outstanding as of September 11, 2020 (the date of the Purchase Agreement) and the assumed number of shares set forth in the preceding adjacent column that we would have sold to Aspire Capital.

|

|

(2)

|

The numerator is the number of shares set forth in the column titled, “Number of Shares to be Issued in this Offering at the Assumed Average Purchase Price.” The denominator is set forth in the preceding adjacent column. Pursuant to the terms of the Purchase Agreement, at no one point in time may Aspire Capital (together with its affiliates) beneficially own more than 19.99% of our common stock.

|

13

USE OF PROCEEDS

This prospectus relates to shares of our common stock that may be offered and sold from time to time by Aspire Capital. We will not receive any proceeds upon the sale of shares by Aspire Capital. However, we may receive gross proceeds of up to $20.0 million from the sale of shares under the Purchase Agreement to Aspire Capital. We anticipate that the proceeds from any sales of shares to Aspire Capital under the Purchase Agreement will be used for working capital and general corporate purposes. This anticipated use of net proceeds from the sale of our common stock to Aspire Capital under the Purchase Agreement represents our intentions based upon our current plans and business conditions.

SELLING STOCKHOLDER

The selling stockholder may from time to time offer and sell any or all of the shares of our common stock set forth below pursuant to this prospectus. When we refer to the “selling stockholder” in this prospectus, we mean the entity listed in the table below, and its respective pledgees, donees, permitted transferees, assignees, successors and others who later come to hold any of the selling stockholder’s interests in shares of our common stock other than through a public sale.

The following table sets forth, as of the date of this prospectus, the name of the selling stockholder for whom we are registering shares for sale to the public, the number of shares of common stock beneficially owned by the selling stockholder prior to this offering, the total number of shares of common stock that the selling stockholder may offer pursuant to this prospectus and the number of shares of common stock that the selling stockholder will beneficially own after this offering. Except as noted below, the selling stockholder does not have, or within the past three years has not had, any material relationship with us or any of our predecessors or affiliates and the selling stockholder is not or was not affiliated with registered broker-dealers.

Based on the information provided to us by the selling stockholder, assuming that the selling stockholder sells all of the shares of our common stock beneficially owned by it that have been registered by us and does not acquire any additional shares during the offering, the selling stockholder will not own any shares, as reflected in the column entitled “Beneficial Ownership After This Offering.” We cannot advise you as to whether the selling stockholder will in fact sell any or all of such shares of common stock. In addition, the selling stockholder may have sold, transferred or otherwise disposed of, or may sell, transfer or otherwise dispose of, at any time and from time to time, the shares of our common stock in transactions exempt from the registration requirements of the Securities Act after the date on which it provided the information set forth in the table below.

|

|

|

|

|

|

|

|

|

|

|

|

Beneficial Ownership After this Offering (1)

|

|

Name

|

|

Shares of Common Stock Owned Prior to this Offering

|

Additional Shares of Common Stock Being Offered

|

Number of Shares

|

%

|

|

Aspire Capital Fund, LLC (2)

|

|

225,000 (3)

|

3,000,000

|

225,000

|

1.7%

|

(1)Assumes the sale of all shares of common stock registered pursuant to this prospectus, although the selling stockholder is under no obligation known to us to sell any shares of common stock at this time.

(2)Aspire Capital Partners LLC (Aspire Partners) is the Managing Member of Aspire Capital Fund LLC (Aspire Fund). SGM Holdings Corp (SGM) is the Managing Member of Aspire Partners. Mr. Steven G. Martin (Mr. Martin) is the president and sole shareholder of SGM, as well as a principal of Aspire Partners. Mr. Erik J. Brown (Mr. Brown) is the president and sole shareholder of Red Cedar Capital Corp (Red Cedar), which is a principal of Aspire Partners. Mr. Christos Komissopoulos (Mr. Komissopoulos) is president and sole shareholder of Chrisko Investors Inc. (Chrisko), which is a principal of Aspire Partners. Mr. William F. Blank, III (Mr. Blank) is president and sole shareholder of WML Ventures Corp. (WML Ventures), which is a principal of Aspire Partners. Each of Aspire Partners, SGM, Red Cedar, Chrisko, WML Ventures, Mr. Martin, Mr. Brown, Mr. Komissopoulos and Mr. Blank may be deemed to be a beneficial owner of common stock held by Aspire Fund. Each of Aspire Partners, SGM, Red Cedar, Chrisko, WML Ventures, Mr. Martin, Mr. Brown, Mr. Komissopoulos and Mr. Blank disclaims beneficial ownership of the common stock held by Aspire Fund.

(3)Represents shares of our common stock beneficially owned by Aspire Capital as of October 1, 2020.

PLAN OF DISTRIBUTION

The common stock offered by this prospectus is being offered by Aspire Capital, the selling stockholder. The common stock may be sold or distributed from time to time by the selling stockholder directly to one or more purchasers or through brokers, dealers, or underwriters who may act solely as agents at market prices prevailing at the time of sale, at prices related to the prevailing market prices, at negotiated prices, or at fixed prices, which may be changed. The sale of the common stock offered by this prospectus may be effected in one or more of the following methods:

14

|

|

•

|

ordinary brokers’ transactions;

|

|

|

•

|

transactions involving cross or block trades;

|

|

|

•

|

through brokers, dealers, or underwriters who may act solely as agents;

|

|

|

•

|

“at the market” into an existing market for the common stock;

|

|

|

•

|

in other ways not involving market makers or established business markets, including direct sales to purchasers or sales effected through agents;

|

|

|

•

|

in privately negotiated transactions; or

|

|

|

•

|

any combination of the foregoing.

|

In order to comply with the securities laws of certain states, if applicable, the shares may be sold only through registered or licensed brokers or dealers. In addition, in certain states, the shares may not be sold unless they have been registered or qualified for sale in the state or an exemption from the registration or qualification requirement is available and complied with.

The selling stockholder may transfer the shares of common stock by other means not described in this prospectus.

Brokers, dealers, underwriters, or agents participating in the distribution of the shares as agents may receive compensation in the form of commissions, discounts, or concessions from the selling stockholder and/or purchasers of the common stock for whom the broker-dealers may act as agent. Aspire Capital has informed us that each such broker-dealer will receive commissions from Aspire Capital which will not exceed customary brokerage commissions.

The selling stockholder and its affiliates have agreed not to engage in any direct or indirect short selling or hedging of our common stock during the term of the Purchase Agreement.

The selling stockholder is an “underwriter” within the meaning of the Securities Act. We have agreed to provide indemnification and contribution to the selling stockholder against certain civil liabilities, including liabilities under the Securities Act. Aspire Capital has agreed to indemnify us against liabilities under the Securities Act that may arise from certain written information furnished to us by Aspire Capital specifically for use in this prospectus or, if such indemnity is unavailable, to contribute amounts required to be paid in respect of such liabilities.

Neither we nor Aspire Capital can presently estimate the amount of compensation that any agent will receive. We know of no existing arrangements between Aspire Capital, any other stockholder, broker, dealer, underwriter, or agent relating to the sale or distribution of the shares offered by this prospectus. At the time a particular offer of shares is made, a prospectus supplement, if required, will be distributed that will set forth the names of any agents, underwriters, or dealers and any compensation from the selling stockholder, and any other required information. We will pay all of the expenses incident to the registration, offering, and sale of the shares to the public, other than commissions or discounts of underwriters, broker-dealers, or agents, and other than fees and disbursements of counsel for Aspire Capital.

We have advised the selling stockholder that while it is engaged in a distribution of the shares included in this prospectus, it is required to comply with Regulation M promulgated under the Exchange Act. With certain exceptions, Regulation M precludes the selling stockholder, any affiliated purchasers, and any broker-dealer or other person who participates in the distribution from bidding for or purchasing, or attempting to induce any person to bid for or purchase any security which is the subject of the distribution until the entire distribution is complete. Regulation M also prohibits any bids or purchases made in order to stabilize the price of a security in connection with the distribution of that security. All of the foregoing may affect the marketability of the shares offered hereby this prospectus.

We may suspend the sale of shares by the selling stockholder pursuant to this prospectus for certain periods of time for certain reasons, including if the prospectus is required to be supplemented or amended to include additional material information.

This offering as it relates to Aspire Capital will terminate on the date that all shares offered by this prospectus have been sold by Aspire Capital.

15

LEGAL MATTERS

The validity of the shares of common stock being offered by this prospectus has been passed upon for us by Cooley LLP, San Diego, California.

EXPERTS

Ernst & Young LLP, independent registered public accounting firm, has audited our consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2019, as set forth in their report, which is incorporated by reference in this prospectus and elsewhere in the registration statement. Our financial statements are incorporated by reference in reliance on Ernst & Young LLP's report, given on their authority as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC a registration statement on Form S-1 under the Securities Act with respect to the shares of common stock offered hereby. This prospectus, which constitutes a part of the registration statement, does not contain all of the information set forth in the registration statement or the exhibits and schedules filed therewith. For further information about us and the common stock offered hereby, we refer you to the registration statement and the exhibits filed thereto. Statements contained in this prospectus regarding the contents of any contract or any other document that is filed as an exhibit to the registration statement are not necessarily complete, and each such statement is qualified in all respects by reference to the full text of such contract or other document filed as an exhibit to the registration statement. We are required to file periodic reports, proxy statements and other information with the SEC pursuant to the Exchange Act. The SEC maintains an Internet website that contains reports, proxy statements and other information about registrants, like us, that file electronically with the SEC. The address of that site is http://www.sec.gov.

We file periodic reports, proxy statements and other information with the SEC. Such periodic reports, proxy statements and other information will be available at the website of the SEC referred to above. We maintain a website at www.atyrpharma.com. You may access our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act with the SEC free of charge at our website as soon as reasonably practicable after such material is electronically filed with, or furnished to, the SEC. The reference to our website address does not constitute incorporation by reference of the information contained on our website, and you should not consider the contents of our website in making an investment decision with respect to our common stock.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to “incorporate by reference” information from other documents that we file with it, which means that we can disclose important information to you by referring you to those documents. The information incorporated by reference is considered to be part of this prospectus.

We incorporate by reference into this prospectus and the registration statement to which this prospectus relates the information or documents listed below that we have filed with the SEC, and any future filings we will make with the SEC under Sections 13(a), 13(c), 14, or 15(d) of the Exchange Act after the date of this prospectus and until the termination of the offering of the shares covered by this prospectus (other than information furnished under Item 2.02 or Item 7.01 of Form 8-K):

|

|

•

|

the information specifically incorporated by reference into our Annual Report on Form 10-K for the fiscal year ended December 31, 2019 from our definitive proxy statement on Schedule 14A (other than information furnished rather than filed) filed with the SEC on April 2, 2020;

|

|

|

•

|

our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2020 and June 30, 2020 filed with the SEC on May 12, 2020 and August 13, 2020, respectively;

|

|

|

•

|

our Current Reports on Form 8-K (other than information furnished rather than filed) filed with the SEC on January 6, 2020, February 28, 2020, April 21, 2020, May 8, 2020, May 20, 2020 and September 14, 2020.

|

Any statement contained in this prospectus or in a document incorporated or deemed to be incorporated by reference into this prospectus will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus or any other subsequently filed document that is deemed to be incorporated by reference into this prospectus modifies or

16

supersedes the statement. Any statements so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

We will furnish without charge to you, on written or oral request, a copy of any or all of the documents incorporated by reference into this prospectus, including exhibits to these documents. You should direct any requests for documents to aTyr Pharma, Inc., 3545 John Hopkins Court, Suite 250, San Diego CA 92121; telephone: (858) 731-8389.

You also may access these filings on our website at www.atyrpharma.com. We do not incorporate the information on our website into this prospectus or any supplement to this prospectus and you should not consider any information on, or that can be accessed through, our website as part of this prospectus or any supplement to this prospectus (other than those filings with the SEC that we specifically incorporate by reference into this prospectus).

DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION FOR SECURITIES ACT LIABILITY

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to our directors, officers and controlling persons, we have been advised that in the opinion of the SEC this indemnification is against public policy as expressed in the Securities Act and is therefore, unenforceable.

17

Up to 3,000,000 Shares

Common Stock

PROSPECTUS

October 2, 2020

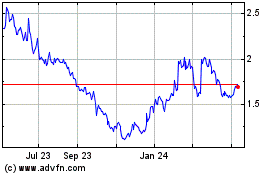

aTyr Pharma (NASDAQ:LIFE)

Historical Stock Chart

From Mar 2024 to Apr 2024

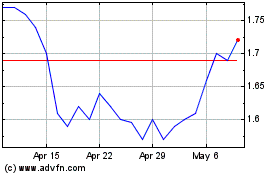

aTyr Pharma (NASDAQ:LIFE)

Historical Stock Chart

From Apr 2023 to Apr 2024