Fifth Third's Profit Declines as Noninterest Expenses Climb 24%

July 23 2019 - 7:25AM

Dow Jones News

By Allison Prang

Fifth Third Bancorp's (FITB) profit fell as the company's

expenses and provision for credit losses increased and noninterest

income fell.

Net income was $453 million, down 25% from the comparable

quarter a year prior. Earnings were 57 cents a share, down from 82

cents a share. Analysts polled by FactSet were expecting 63 cents a

share.

Revenue rose 8.1% to $1.91 billion. Analysts were expecting $1.9

billion. Noninterest income fell 11% while net interest income on a

fully taxable equivalent basis rose 22%.

Fifth Third's provision for credit losses was $85 million up

from $14 million. Its provision fell from $90 million in the first

quarter.

Noninterest expenses rose 24%. Technology and communication

costs more than doubled to $136 million up from $67 million a year

earlier. The company said total merger-related costs -- which

include $49 million in technology and communications expense --

were $109 million, up from $2 million a year earlier.

Fifth Third's net interest margin was 3.37%, an increase of 16

basis points year over year and up nine basis points from the first

quarter. Its adjusted net interest margin, not including a purchase

accounting accretion from MB Financial's non-purchase credit

impaired loan portfolio, was 3.32%, up 11 basis points year over

year and up four basis points from the first quarter.

Write to Allison Prang at allison.prang@wsj.com

(END) Dow Jones Newswires

July 23, 2019 07:10 ET (11:10 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

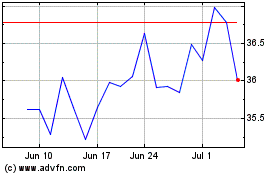

Fifth Third Bancorp (NASDAQ:FITB)

Historical Stock Chart

From Mar 2024 to Apr 2024

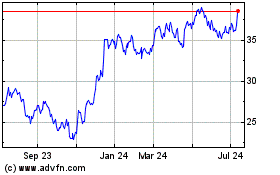

Fifth Third Bancorp (NASDAQ:FITB)

Historical Stock Chart

From Apr 2023 to Apr 2024