UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

_____________________________________________

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

|

Filed by the Registrant ¨

|

|

|

Filed by a Party other than the Registrant x

|

|

Check the appropriate box:

|

¨

|

Preliminary Proxy Statement

|

|

¨

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

¨

|

Definitive Proxy Statement

|

|

x

|

Definitive Additional Materials

|

|

¨

|

Soliciting Material under §240.14a-12

|

FARMER BROS. CO.

(Name of Registrant as Specified in its

Charter)

JEANNE FARMER GROSSMAN

Jeanne

Grossman Living Trust

1964

Jeanne Ann Farmer Grossman Trust

1969

Jeanne Ann Farmer Grossman Trust

1972

Jeanne Ann Farmer Grossman Trust

1987

Roy F Farmer Trust II

1988

Roy F Farmer Trust II

1988

Roy F Farmer Trust III

1990

Brynn Elizabeth Grossman Trust

1992

Brynn Elizabeth Grossman Trust

Thomas

William Mortensen

Jonathan

Michael Waite

(Name of Person(s) Filing Proxy Statement,

if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate

box):

|

x

|

No fee required.

|

|

|

|

|

|

¨

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

(5)

|

Total fee paid:

|

|

¨

|

Fee paid previously with preliminary materials:

|

|

|

|

|

|

¨

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

(3)

|

Filing Party:

|

|

|

(4)

|

Date Filed:

|

CONCERNED STOCKHOLDERS ISSUE OPEN LETTER

TO FARMER BROS. EMPLOYEES AND STOCKHOLDERS REGARDING COMPANY’S LATEST EFFORTS TO PROTECT CURRENT ENTRENCHED BOARD

LOS ANGELES, California, December 9, 2019 – Jeanne

Farmer Grossman (individually and as the sole trustee of certain trusts), Thomas William Mortensen, and Jonathan Michael Waite

(collectively, the “Concerned Stockholders”), who together beneficially own approximately 4.9% of the outstanding

common stock of Farmer Bros. Co. (“Farmer Bros.” or the “Company”), today issued an open

letter to employees and stockholders of Farmer Bros. Co. In it, Ms. Grossman responds to the Company’s efforts to exploit

estranged members of the Company’s founding family in a desperate campaign to protect the current entrenched Board of Directors

at the upcoming Annual Meeting. Ms. Grossman continues to urge stockholders to vote the GOLD proxy card to elect

Mr. Mortensen and Mr. Waite and bring needed change and experience to the Farmer Bros. Board. The full text follows.

December 9, 2019

Dear Fellow Farmer Bros Co. Employees and Stockholders,

In the best interests of the employees and stockholders of Farmer

Bros. and in the best interests of the truth, I feel compelled to respond to the inaccuracies and false narrative recently promoted

by the Company in the name of Richard Farmer, whose deep animus toward the founding family of the Company continues to exploit

to protect an entrenched Board of Directors, as it did in its last proxy fight in 2016.

While the origin of Mr. Farmer’s grievances are irrelevant

in the context of the upcoming Annual Meeting, what is relevant is how cynically he and the Company appear to exploit each other

in the service of their respective goals, Mr. Farmer’s to injure the larger Farmer family and the Company’s to further

a false narrative of an active, accountable Board. However, I strongly dispute that either is aligned with what matters most to

me, my group and my family: the long-term interests of Farmer Bros.’s employees and stockholders.

For example, ahead of the 2016 Annual Meeting, Mr. Farmer came

out strongly in favor of the Company’s slate and against his sister’s dissident slate, which other family members whole-heartedly

supported. In fact, he has stated several times that his goal was to sell ALL Farmer Bros. stock in the Family Trusts (roughly

32% of total FARM shares at the time) and diversify the portfolios without any FARM stock (which was totally against the intent

of the trust creators and the rest of the family). Shortly thereafter, he sold 600,000 shares of stock personally held by

him, further at odds with the faith he claimed to have had in the Company’s outlook and leadership. He demonstrated time

and again that he really did not care about nor know much about the Company.

Other stockholders and employees were not so lucky, as reflected

in the 59% share price decline over the past three years. Were it not for Mr. Farmer’s cynical intervention ahead of the

2016 Annual Meeting, perhaps our Company’s Board would have received much needed experience and accountability and avoided

the tremendous losses we have suffered since that time.

I fear history is repeating itself now, with dire consequences.

Further, the Company’s recent press release, issued in

Mr. Farmer’s name, does not address any of the mistakes or blunders that were constant throughout the all-important period

from 2017 to May 2019, when the Company was damaged so profoundly. This lack of accountability is symptomatic of what ails our

Company and of the long tenures of Board Directors Christopher Mottern and Charles Marcy, who have overseen and supported the strategic

missteps and failed CEO appointment that have wreaked havoc on our Company, and thus can be expected to continue to avoid their

proper duty of oversight and accountability.

The real question before the shareholders is whether to support

two directors who are largely responsible for the last three years of lost profits and shareholder value, high costs and huge debt,

and the resulting chaotic state of the Company, OR to support two individuals, Tom Mortensen and Jonathan Waite, who deeply care

about the Company, want to see it return to profitability, and have successfully helped turn the Company around after a very similar

situation in 2010/2012. I also believe Tom and Jonathan could more ably assist Mr. Maserang and the newer, truly independent Board

members – Allison Boersma, Stacy Loretz-Congdon and David Ritterbush, each of whom have demonstrated actions that sincerely

reflect their interests in returning the Company to profitability – unlike those two directors whose actions have caused

Farmer Bros.’ current, perpetual turnaround situation.

For this reason, I again ask you to elect our two director

nominees on the GOLD PROXY today, and remove two of the principal architects of the Company’s failures, Directors Charles

Mottern and Chris Marcy.

Your support is extremely important. If you have any questions,

please call our proxy solicitor Okapi Partners toll-free at (877) 274-8654 or email info@okapipartners.com.

Sincerely,

Jeanne Farmer Grossman

IMPORTANT

If your shares are held in street name, your bank or broker

can vote your shares only upon receipt of your specific instructions. Please contact the person responsible for your account and

instruct them that you only wish to vote the GOLD proxy card.

If you have any questions or need further assistance, please

contact Okapi Partners at (877) 274-8654 or by e-mail at info@okapipartners.com.

INVESTOR CONTACT:

Okapi Partners LLC

1212 Avenue of the Americas, 24th Floor

New York, NY 10036

+1 877-796-5274

info@okapipartners.com

MEDIA CONTACT:

Dan Gagnier / Jeffrey Mathews

Gagnier Communications

+1 646-569-5897

farmerbros@gagnierfc.com

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

The Concerned Stockholders have filed a definitive proxy statement

and an accompanying GOLD proxy card with the Securities and Exchange Commission (the “SEC”) to be used to solicit votes

for the election of its nominees at the 2019 Annual Meeting of Stockholders of Farmer Bros. Co.

THE CONCERNED STOCKHOLDERS STRONGLY ADVISE ALL STOCKHOLDERS

OF THE COMPANY TO READ THEIR PROXY STATEMENT AND OTHER PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION. SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEB SITE AT WWW.SEC.GOV. IN ADDITION,

THE CONCERNED STOCKHOLDERS WILL PROVIDE COPIES OF THEIR PROXY STATEMENT WITHOUT CHARGE UPON REQUEST. REQUESTS FOR COPIES SHOULD

BE DIRECTED TO THE CONCERNED STOCKHOLDERS’ PROXY SOLICITOR, OKAPI PARTNERS, AT ITS TOLL-FREE NUMBER: (877) 274-8654 OR AT

INFO@OKAPIPARTNERS.COM.

The participants in the proxy solicitation are: Jeanne Farmer

Grossman, the Jeanne Grossman Living Trust, the 1964 Jeanne Ann Farmer Grossman Trust, the 1969 Jeanne Ann Farmer Grossman Trust,

the 1972 Jeanne Ann Farmer Grossman Trust, the 1987 Roy F Farmer Trust II, the 1988 Roy F Farmer Trust II, the 1988 Roy F Farmer

Trust III, the 1990 Brynn Elizabeth Grossman Trust, and the 1992 Brynn Elizabeth Grossman Trust, Thomas William Mortensen, and

Jonathan Michael Waite.

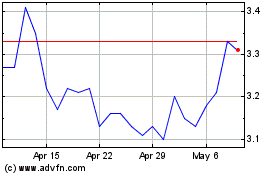

Farmer Brothers (NASDAQ:FARM)

Historical Stock Chart

From Mar 2024 to Apr 2024

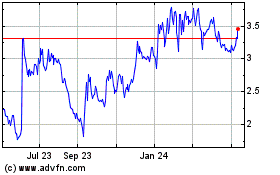

Farmer Brothers (NASDAQ:FARM)

Historical Stock Chart

From Apr 2023 to Apr 2024