First and foremost, at a time of great stress and health related

matters in our country, owing to the coronavirus pandemic

(“COVID-19”) worldwide, we wish all our shareholders, clients, bank

analysts and others who support and follow our company to stay

well. Banking is integral to a community’s welfare and here at

EagleBank, we are working hard to stay focused and meet our ongoing

commitments to clients old and new.

Eagle Bancorp, Inc. (the “Company”)

(NASDAQ:EGBN), the parent company of EagleBank (the “Bank”), today

announced quarterly net income of $23.1 million (basic and diluted

earnings per common share of $0.70) for the three months ended

March 31, 2020, as compared to $33.7 million net income (basic and

diluted earnings per common share of $0.98) for the three months

ended March 31, 2019.

Excluding nonrecurring costs in the first

quarter of 2019 related to share based compensation awards and the

resignation of our former CEO and Chairman amounting to $6.2

million ($0.13 per diluted share), earnings for the first quarter

of 2019 were $38.3 million ($1.11 per diluted

share).

Summary Financial Analysis

“For the first quarter of 2020, we are pleased

to report continued growth in total loans and total deposits,

continued superior operating leverage, and stable asset quality,”

noted Susan G. Riel, President and Chief Executive Officer of the

Company. Ms. Riel continued, “Capital levels remain strong and the

Company’s assets ended the first quarter of 2020 at $10.01 billion,

representing 19% growth over the first quarter of 2019, with total

shareholders’ equity of $1.18 billion. Net income in the first

quarter of 2020 resulted in an annualized return on average assets

of 0.98% and an annualized return on average tangible common equity

of 8.39%.”

Ms. Riel added, “Under accounting principles

generally accepted in the United States (“GAAP”), the Company

adopted the new standard for determining Loan Loss Allowances,

termed “CECL”. This adoption as of January 1, 2020, in combination

with first quarter 2020 loan loss provisioning taking into account

COVID-19 matters, had a pronounced impact on both retained earnings

and first quarter loan loss provisioning.” This matter is discussed

further below.

The Company’s performance in the first quarter

of 2020 as compared to the first quarter of 2019 was highlighted by

growth in average total loans of 8.7%, growth in average total

deposits of 10.0%, a net interest margin of 3.49%, and total

revenue of $85.2 million. Ms. Riel noted that the Company focuses

more on growth of average balances year over year since that

measure relates more directly to income statement results. As

compared to the fourth quarter of 2019, average loan growth in the

first quarter 2020 was 1.6% and average deposits declined by 0.4%.

Deposit growth tends to be seasonally lower in the first quarter of

each year. The efficiency ratio, which measures the ratio of

noninterest expense to total revenue, for the first quarter of 2020

was 43.83% as compared to 43.87% for the first quarter of 2019.

During the first quarter of 2020, the Company

incurred annualized net charge-offs of 12 basis points of average

loans. Nonperforming loans were down slightly at March 31, 2020

($47.0 million or 0.60% of total loans) as compared to December 31,

2019 ($48.7 million or 0.65% of total loans). We experienced an

increase in other real estate owned (“OREO”), which totaled $8.2

million at March 31, 2020 as compared to $1.5 million at December

31, 2019. The increase was due to foreclosures involving two ultra

high-end residential properties located in Washington, D.C. Both

properties were managed by a single sponsor who was unable to sell

and defaulted on both notes. The evolution of the COVID-19 pandemic

and related containment and relief measures will determine how the

impacts will be reflected in our loan portfolio, including these

measures, over time.

The pipeline of loan commitments remains strong

although the Bank has seen additional draws on committed lines of

credit during the second half of the first quarter. Ms. Riel added,

“For the first quarter of 2020, period end loan balances grew 3.9%

over December 31, 2019, and total deposits increased by 11.3%.

Management continues to focus on achieving relationship development

and growth while ensuring the existing portfolio is appropriately

monitored for any potential deterioration in credit.”

The net interest margin was 3.49% for the first

quarter of 2020, 4.02% for the first quarter of 2019, and 3.49% for

the fourth quarter of 2019. The net interest margin in the first

quarter of 2020 and the fourth quarter of 2019 was stable at 3.49%

due to a sharper decline in the cost of funds, which more than

offset declining yields on loans and investments. In a quarter when

the average one month LIBOR rate declined by 39 basis points, our

cost of funds declined by 9 basis points and our yield on earning

assets was down by 8 basis points (loan yields declined by 11 basis

points). We have also been able to maintain about a 30% mix of

average noninterest bearing deposits to total deposits, which is

favorable. Sharply lower market interest rates over the past four

quarters and a continuing relatively flat yield curve maintains

pressure on the Company’s net interest margin. The decline in the

net interest margin in the first quarter of 2020, versus the same

period in 2019, was due to a decline in the yield on earning assets

of 65 basis points exceeding the decline in the cost of funds of 13

basis points, as we elected to increase funding to meet a strong

loan demand. The significant decline in market rates (one month

LIBOR averaged 110 basis points lower in the first quarter of 2020

versus the first quarter of 2019) negatively impacted our large

variable and adjustable rate loan portfolio. The yield on our loan

portfolio was 5.07% in the first quarter of 2020 versus 5.62% in

2019. Interest rates are now at a point where loan floor rates are

operative, which will mitigate further loan yield declines. Ms.

Riel noted, “Even considering the decline in the net interest

margin, Management believes that the Company has historically

maintained a superior net interest margin compared to peers.”

Total revenue (net interest income plus

noninterest income) for the first quarter of 2020 was $85.2

million, or 2% below the $87.3 million of total revenue earned for

the first quarter of 2019. In addition to the effect of lower

margins on net interest income (down 2%), gains on loan sales were

negatively impacted by COVID-19 as described below.

As noted earlier, our asset quality measures

remained solid at March 31, 2020. Annualized net charge-offs were

0.12% of average loans ($2.2 million) for the first quarter of 2020

as compared to 0.19% of average loans for the first quarter of

2019. At March 31, 2020, the Company’s nonperforming loans amounted

to $47.0 million (0.60% of total loans) as compared to $40.3

million (0.56% of total loans) at March 31, 2019 and $48.7 million

(0.65% of total loans) at December 31, 2019. Nonperforming assets

amounted to $55.3 million (0.55% of total assets) at March 31, 2020

compared to $41.7 million (0.56% of total assets) at March 31, 2019

and $50.2 million (0.50% of total assets) at December 31, 2019. The

evolution of the COVID-19 pandemic and related containment and

relief measures will determine how the impacts will be reflected in

our loan portfolio, including these measures, over time.

The first quarter of 2020 saw significant

disruption in the outlook over credit quality, particularly in

certain industries, as COVID-19 resulted in the closure of

businesses across the region as stay-at-home orders were given in

the various municipalities in which the Company operates. Among

those industries most clearly impacted is the Accommodation and

Food Service industry. Exposure to this industry represents 9.7% of

the Bank’s loan portfolio as of March 31, 2020. Management is

closely monitoring borrowers and remains attentive to signs of

deterioration in borrowers’ financial conditions and is proactively

taking steps to mitigate risk as appropriate, including placing

loans on nonaccrual status. There is uncertainty regarding the

region’s overall economic outlook given lack of clarity over how

long COVID-19 will continue to impact our region. Management has

been working with customers on payment deferrals to assist

companies in managing through this crisis. These deferrals amounted

to 32 notes representing $45 million in outstanding exposure as of

March 31, 2020 and 234 notes representing $298 million in

outstanding exposure as of April 16, 2020. Some of these deferrals

might have met the criteria for treatment under U.S. GAAP as

troubled debt restructurings (TDRs), while many did not. None of

the deferrals are reflected in the Company’s balance sheet and

asset quality measures, however, due to the provision of the

Coronavirus Aid Relief and Economic Security Act (“CARES Act”) that

permits U.S. financial institutions to temporarily suspend the U.S.

GAAP requirements to treat such short-term loan modifications as

TDR. These provisions have also been confirmed by interagency

guidance issued by the federal banking agencies and confirmed with

staff members of the Financial Accounting Standards Board. Other

loan portfolio areas of concern and additional COVID-19 loan

related matters are discussed below.

The new accounting standard known as the current

expected credit loss (“CECL”) standard (ASC 326) was adopted by the

Company in the first quarter of 2020. The new standard requires a

significant change in how banks assess credit risk and establish

reserves for possible future loan losses. Two significant changes

under the new standard are the requirement to establish loan loss

reserves at loan origination considering the entire life of the

loan and to estimate lifetime loss reserves by modeling a forecast

that is impacted by economic factors.

Under the CECL standard and based on the January

1, 2020 effective date, the Company made an initial adjustment to

the allowance for credit losses of $10.6 million along with $4.1

million to the reserve for unfunded commitments. This adjustment

increased the ratio of the allowance to total loans from 0.98% at

December 31, 2019 to 1.09% at January 1, 2020. In accordance with

adoption of CECL, the initial January 1, 2020 adjustment was to

retained earnings, net of taxes. Based on our ongoing risk analysis

and modeling through March 31, 2020, under the CECL allowance

methodology, the Company further increased the allowance for loan

losses to 1.23%, which reflects COVID-19 risks as of March 31,

2020. Management believes to the best of its knowledge that its

allowance for credit losses, at 1.23% of total loans (excluding

loans held for sale) at March 31, 2020, is adequate to absorb

potential credit losses within the loan portfolio at that date. The

portion of the provision related to COVID-19 matters was about two

thirds of the quarter’s reserve build. As noted above, uncertainty

remains about the duration of the COVID-19 pandemic and its

impacts, although further significant negative impact may occur and

the Company continues to monitor its loan portfolio and borrowers.

Under the prior accounting standard known as the incurred loss

model, the allowance for credit losses was 0.98% at both March 31,

2019 and December 31, 2019. The allowance for credit losses

represented 205% of nonperforming loans at March 31, 2020, as

compared to 174% at March 31, 2019 and 151% at December 31,

2019.

“The Company’s productivity remained strong in

the quarter,” noted Ms. Riel, “and the efficiency ratio of 43.83%

reflects management’s ongoing efforts to maintain superior

operating leverage. Further, the annualized level of noninterest

expenses as a percentage of average assets was 1.58% in the first

quarter of 2020 as compared to 1.52% in the first quarter of 2019.

The Company’s goal is to maximize operating performance without

inhibiting growth or negatively impacting our ability to service

our customers. Ms. Riel further noted, “Our total deposits at March

31, 2020 averaged $384 million per branch as compared to the FDIC’s

most recently reported regional average of $141 million per

branch.”

COVID-19 Discussion Matters

Employee Matters:

Management continues to thank and acknowledge

the flexibility and engagement of our hard working employees during

this crisis. As the COVID-19 pandemic has unfolded, our workforce

has transitioned to majority remote access operations. Our

information technology infrastructure has afforded our organization

the ability to work predominantly remotely with little interruption

as we continue to service the needs of our clients. While we

continue to strive to have the majority of our employees operating

from home, there are some functions that require a physical

presence at our banking offices. Employees are maintaining safe

distances and we have provided more frequent cleaning of our

facilities to maintain a safe environment. Management remains

connected to employees through periodic company-wide telephonic

meetings and regular notifications and updates through both email

and the Company’s intranet.

Branch Hours:

Branch hours and availability have been modified

in consideration of the safety of our employees and clients. While

lobbies are closed at all of our branches, six branches across the

Bank’s footprint remain available to our clients having drive-up

windows open during regular business hours.

The CARES Act:

Enacted March 27, 2020 the CARES Act included

several provisions designed to provide relief to individuals and

businesses as well as the banking system. Among the more

significant components of this legislation for our Company was the

creation of the $350 billion Paycheck Protection Program (“PPP”).

Loans made under the PPP are fully guaranteed as to principal and

interest by the Small Business Administration (“SBA”), whose

guarantee is backed by the full faith and credit of the U.S.

Government. PPP-covered loans also afford borrowers forgiveness up

to the principal amount of the PPP-covered loan if the proceeds are

used to retain workers and maintain payroll or make mortgage

interest, lease and utility payments. The SBA will reimburse PPP

lenders for any amount of a PPP-covered loan that is forgiven.

As an SBA preferred lender, the Bank is actively

participating in the PPP program, and began processing applications

once the SBA began accepting applications. The SBA funding

authority expired prior to the complete submission of many

applications, where we experienced heightened demand for the PPP

program. We are working hard to meet the needs of our customers,

and will be using our best efforts to process as many eligible

applications as we can in the likely event the program is

reauthorized.

Loan Portfolio Exposures:

Industry areas of potential concern within the

Loan Portfolio are represented below as of March 31, 2020:

|

|

|

|

|

Industry |

Principal Balance (in 000's) |

% of Loan Portfolio |

| Accommodation & Food

Services |

$761,346 |

9.7% |

| Retail Trade |

89,753 |

1.1% |

Concerns over exposures to the Accommodation and

Food Service industry and retail are the most immediate at this

time. Accommodation and Food Service exposure represents 9.7% of

the Bank’s loan portfolio as of March 31, 2020 among 349 customers.

Retail trade exposure represents 1.1% of the Bank’s loan

portfolio. The Bank has ongoing extensive outreach to these

customers, and is assisting where necessary with PPP loans and

payment deferrals or interest only periods in the short term as

customers work with the Bank to develop longer term stabilization

strategies as the landscape of the COVID-19 pandemic evolves. The

duration and severity of the pandemic will likely impact future

credit challenges in these areas.

In addition to the foregoing specific

industries, the Bank has exposure not included in the above

industry data secured by commercial real estate loans secured by

the below property types as of March 31, 2020:

|

|

|

|

|

Property Type |

Principal Balance (in 000's) |

% of Loan Portfolio |

| Restaurant |

$40,031 |

0.5% |

| Hotel |

40,751 |

0.5% |

| Retail |

391,158 |

4.97% |

Although not evidenced at March 31, 2020, It is

anticipated that some portion of the CRE loans secured by the above

property types could be impacted by the tenancies associated with

impacted industries. The Bank is working with CRE investor

borrowers and monitoring rent collections as part of our portfolio

management process.

Liquidity and Backup Sources:

Our primary and secondary sources of liquidity

remain strong. Over the last 12 months our average deposits have

increased by 10% and we maintain a very liquid investment

portfolio, including significant overnight liquidity. Average short

term liquidity was $606 million in first quarter of 2020, which is

above EagleBank’s average needs. Secondary sources of liquidity

amount to $2.95 billion.

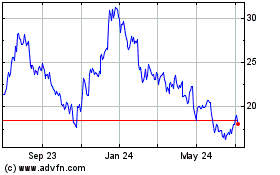

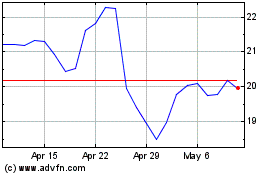

Share Repurchases:

While the Company’s capital position remains

well above regulatory well capitalized levels, due to the

heightened volatility of the stock market and uncertainty regarding

the impact of COVID-19, the Company’s remaining authorization to

repurchase shares has been put on hold. For the first quarter of

2020, the Company repurchased 1,182,841 shares (72% of authorized

shares) at an average cost of $37.31 per share. The Board of

Directors and Management continue to monitor this area and may

enter the markets from time to time as determined appropriate.

Dividends:

Management believes that our capital position

remains very strong and at this time, we expect to maintain our

quarterly dividend.

Balance Sheet Analysis

Total assets at March 31, 2020 were $10.01

billion, a 19% increase as compared to $8.39 billion at March 31,

2019, and an increase of 11% as compared to $8.99 billion at

December 31, 2019. Total loans (excluding loans held for sale) were

$7.84 billion at March 31, 2020, a 9% increase as compared to $7.17

billion at March 31, 2019, and a 4% increase as compared to $7.55

billion at December 31, 2019. Loans held for sale amounted to $60.0

million at March 31, 2020 as compared to $20.3 million at March 31,

2019, a 196% increase, and $56.7 million at December 31, 2019, a 6%

increase. The investment portfolio totaled $858.9 million at March

31, 2020, an 11% increase from the $772.2 million balance at March

31, 2019. As compared to December 31, 2019, the investment

portfolio at March 31, 2020 increased by $15.6 million or 2%.

Total deposits at March 31, 2020 were $8.14

billion compared to $6.68 billion at March 31, 2019, a 22% increase

and $7.22 billion at December 31, 2019, a 13% increase. Total

borrowed funds (excluding customer repurchase agreements) were

$567.8 million at March 31, 2020, $467.4 million at March 31, 2019

and $467.7 million at December 31, 2019.

Total shareholders’ equity increased 3% to $1.18

billion at March 31, 2020 compared to $1.15 billion at March 31,

2019, and decreased by less than 1% from $1.19 billion at December

31, 2019. The increase in shareholders’ equity at March 31, 2020

compared to the same period in 2019 was primarily the result of

growth in retained earnings offset by the day one CECL entry of

$10.9 million net of taxes, $44 million in stock repurchases, and

dividends declared of $7.2 million. The Company’s capital ratios

remain substantially in excess of regulatory minimum and buffer

requirements, with a total risk based capital ratio of 15.69% at

March 31, 2020, as compared to 16.22% at March 31, 2019, and 16.20%

at December 31, 2019, both common equity tier 1 (“CET1”) risk based

capital and tier 1 risk based capital ratios of 12.40% at March 31,

2020, as compared to 12.69% at March 31, 2019, and 12.87% at

December 31, 2019, a tier 1 leverage ratio of 11.58% at March 31,

2020, as compared to 12.49% at March 31, 2019, and 11.62% at

December 31, 2019. In addition, the tangible common equity ratio

was 10.90% at March 31, 2020, compared to 12.59% at March 31, 2019

and 12.22% at December 31, 2019. Tangible book value per share was

$33.54 at March 31, 2020, an 11% increase over $30.20 for the same

period in 2019.

Detail Income Statement

Analysis

Net interest income decreased 2% for the three

months ended March 31, 2020 over the same period in 2019 ($79.7

million versus $81.0 million), resulting primarily from lesser

average yields on loans (5.07% versus 5.62%) despite growth in

average earning assets of 5%. The net interest margin was 3.49% for

the three months ended March 31, 2020, as compared to 4.02% for the

three months ended March 31, 2019.

The provision for credit losses was $16.4

million for the three months ended March 31, 2020 as compared to

$3.4 million for the three months ended March 31, 2019. The higher

provisioning in the first quarter of 2020, as compared to the first

quarter of 2019, is primarily due to the implementation of CECL and

the impact of COVID-19 on our expected future credit losses. Net

charge-offs of $2.2 million in the first quarter of 2020

represented an annualized 0.12% of average loans, excluding loans

held for sale, as compared to $3.4 million, or an annualized 0.19%

of average loans, excluding loans held for sale, in the first

quarter of 2019. Net charge-offs in the first quarter of 2020 were

attributable primarily to commercial real estate loans ($2.3

million).

Noninterest income for the three months ended

March 31, 2020 decreased to $5.5 million from $6.3 million for the

three months ended March 31, 2019, a 13% decrease, due

substantially to lesser gains on the sale of residential mortgage

loans ($825 thousand versus $1.3 million) resulting from $2.6

million in hedge and mark to market losses attributable to the

Federal Reserve’s large purchase of mortgage backed securities

combined with sharp declines in servicing right valuations

associated with investor uncertainty surrounding COVID-19. Net

investment gains were $822 thousand for the three months ended

March 31, 2020 compared to $912 thousand for the same period in

2019. Residential mortgage loans closed were $193 million for the

first quarter of 2020 versus $93 million for the first quarter of

2019.

The efficiency ratio was 43.83% for the first

quarter of 2020, as compared to 43.87% for the first quarter of

2019. Noninterest expenses totaled $37.3 million for the three

months ended March 31, 2020, as compared to $38.3 million for the

three months ended March 31, 2019, a 3% decrease. Noninterest

expenses in the first quarter of 2020 increased 16% compared to

noninterest expenses of $32.2 million for the first quarter in 2019

excluding nonrecurring salaries and benefit costs defined below

owing substantially to increased legal expenses discussed

below.

Salaries and benefits costs decreased by $5.8

million. The Company recognized $6.2 million of nonrecurring

charges related to share based compensation awards and the

resignation of our former CEO and Chairman, Ron Paul, in March

2019. In addition, health insurance claims increased by $409

thousand during the first quarter of 2020 relative to the first

quarter of 2019. FDIC expenses increased $308 thousand due to a

higher assessment base resulting from growth in total assets. Other

expenses decreased $717 thousand, due primarily to lower broker

fees ($1.1 million) partially offset by higher telephone expenses

($173 thousand) associated with the transition to a new phone

provider.

Legal, accounting and professional fees

increased $5.3 million. Legal fees and expenditures of $4.6 million

for the first quarter were primarily associated with previously

disclosed ongoing governmental investigations and related subpoenas

and document requests and our defense of the previously disclosed

class action lawsuit, where we filed a motion to dismiss on April

2, 2020. These elevated legal expenses included substantial

expenses associated with the reviews by the Special Compliance

Committee and the Audit Committee, with the assistance of outside

legal counsel, of the facts and circumstances associated with these

various governmental investigations and legal proceedings.

These reviews have since concluded. The amount of legal fees

and expenditures for the quarter is net of expected insurance

coverage where we believe we have a high likelihood of recovery

pursuant to our D&O insurance policies but does not include any

offset for potential claims we may have in the future as to which

recovery is impossible to predict at this time.

The effective income tax rate for the first

quarter of 2020 was 26.5% as compared to 26.1% for the first

quarter of 2019. During the first quarter of 2020, the Company

recorded a discrete item related to restricted stock awards vesting

that increased the effective tax rate.

The financial information which follows provides

more detail on the Company’s financial performance for the three

months ended March 31, 2020 as compared to the three months ended

March 31, 2019 as well as providing eight quarters of trend data.

Persons wishing additional information should refer to the

Company’s Form 10-K for the year ended December 31, 2019 and other

reports filed with the Securities and Exchange Commission (the

“SEC”).

About Eagle Bancorp: The

Company is the holding company for EagleBank, which commenced

operations in 1998. The Bank is headquartered in Bethesda,

Maryland, and operates through twenty branch offices, located in

Suburban Maryland, Washington, D.C. and Northern Virginia. The

Company focuses on building relationships with businesses,

professionals and individuals in its marketplace.

Conference Call: Eagle Bancorp

will host a conference call to discuss its first quarter 2020

financial results on Thursday, April 23, 2020 at 10:00 a.m. eastern

daylight time. The public is invited to listen to this conference

call by dialing 1.877.303.6220, conference ID Code 2947417, or by

accessing the call on the Company’s website,

www.EagleBankCorp.com. A replay of the conference call will be

available on the Company’s website through May 7, 2020.

Forward-looking Statements:

This press release contains forward-looking statements within the

meaning of the Securities Exchange Act of 1934, as amended,

including statements of goals, intentions, and expectations as to

future trends, plans, events or results of Company operations and

policies and regarding general economic conditions. In some cases,

forward-looking statements can be identified by use of words such

as “may,” “will,” “anticipates,” “believes,” “expects,” “plans,”

“estimates,” “potential,” “continue,” “should,” “could,” and

similar words or phrases. These statements are based upon current

and anticipated economic conditions, nationally and in the

Company’s market (including the macroeconomic and other challenges

and uncertainties resulting from the COVID-19 pandemic, including

on our credit quality and business operations), interest rates and

interest rate policy, competitive factors, and other conditions

which by their nature, are not susceptible to accurate forecast and

are subject to significant uncertainty. Because of these

uncertainties and the assumptions on which this discussion and the

forward-looking statements are based, actual future operations and

results in the future may differ materially from those indicated

herein. For details on factors that could affect these

expectations, see the risk factors and other cautionary language

included in the Company’s Annual Report on Form 10-K for the year

ended December 31, 2019, in the Company’s upcoming Quarterly Report

on Form 10-Q for the quarter ended March 31, 2020 and in other

periodic and current reports filed with the SEC. Readers are

cautioned against placing undue reliance on any such

forward-looking statements. The Company’s past results are not

necessarily indicative of future performance. All information is as

of the date of this press release. Any forward-looking statements

made by or on behalf of the Company speak only as to the date they

are made. Except to the extent required by applicable law or

regulation, the Company undertakes no obligation to revise or

update publicly any forward-looking statement for any reason.

CONTACT:Michael T. Flynn301.986.1800

| |

|

|

|

|

Eagle Bancorp, Inc. |

|

|

|

|

Consolidated Financial Highlights (Unaudited) |

|

|

|

| (dollars in

thousands, except per share data) |

|

| |

Three Months March 31, |

| |

|

2020 |

|

|

|

2019 |

|

|

Income Statements: |

|

|

|

| Total

interest income |

$ |

103,801 |

|

|

$ |

105,134 |

|

| Total

interest expense |

|

24,057 |

|

|

|

24,117 |

|

| Net interest

income |

|

79,744 |

|

|

|

81,017 |

|

| Provision

for credit losses |

|

16,422 |

|

|

|

3,360 |

|

| Net interest

income after provision for credit losses |

|

63,322 |

|

|

|

77,657 |

|

| Noninterest

income (before investment gain) |

|

4,648 |

|

|

|

5,379 |

|

| Gain on sale

of investment securities |

|

822 |

|

|

|

912 |

|

| Total

noninterest income |

|

5,470 |

|

|

|

6,291 |

|

| Total

noninterest expense |

|

37,347 |

|

|

|

38,304 |

|

| Income

before income tax expense |

|

31,445 |

|

|

|

45,644 |

|

| Income tax

expense |

|

8,322 |

|

|

|

11,895 |

|

| Net

income |

$ |

23,123 |

|

|

$ |

33,749 |

|

| |

|

|

|

| Per

Share Data: |

|

|

|

| Earnings per

weighted average common share, basic |

$ |

0.70 |

|

|

$ |

0.98 |

|

| Earnings per

weighted average common share, diluted |

$ |

0.70 |

|

|

$ |

0.98 |

|

| Weighted

average common shares outstanding, basic |

|

32,850,112 |

|

|

|

34,480,772 |

|

| Weighted

average common shares outstanding, diluted |

|

32,871,831 |

|

|

|

34,536,236 |

|

| Actual

shares outstanding at period end |

|

32,197,258 |

|

|

|

34,537,193 |

|

| Book value

per common share at period end |

$ |

36.79 |

|

|

$ |

33.25 |

|

| Tangible

book value per common share at period end (1) |

$ |

33.54 |

|

|

$ |

30.20 |

|

| Dividend per

common share |

$ |

0.22 |

|

|

$ |

- |

|

| |

|

|

|

|

Performance Ratios (annualized): |

|

|

|

| Return on

average assets |

|

0.98 |

% |

|

|

1.62 |

% |

| Return on

average common equity |

|

7.67 |

% |

|

|

12.12 |

% |

| Return on

average tangible common equity |

|

8.39 |

% |

|

|

13.38 |

% |

| Net interest

margin |

|

3.49 |

% |

|

|

4.02 |

% |

| Efficiency

ratio (2) |

|

43.83 |

% |

|

|

43.87 |

% |

| |

|

|

|

|

Other Ratios: |

|

|

|

| Allowance

for credit losses to total loans (3) |

|

1.23 |

% |

|

|

0.98 |

% |

| Allowance

for credit losses to total nonperforming loans |

|

204.83 |

% |

|

|

173.72 |

% |

|

Nonperforming loans to total loans (3) |

|

0.60 |

% |

|

|

0.56 |

% |

|

Nonperforming assets to total assets |

|

0.55 |

% |

|

|

0.50 |

% |

| Net

charge-offs (annualized) to average loans (3) |

|

0.12 |

% |

|

|

0.19 |

% |

| Common

equity to total assets |

|

11.83 |

% |

|

|

13.69 |

% |

| Tier 1

capital (to average assets) |

|

11.58 |

% |

|

|

12.49 |

% |

| Total

capital (to risk weighted assets) |

|

15.69 |

% |

|

|

16.22 |

% |

| Common

equity tier 1 capital (to risk weighted assets) |

|

12.40 |

% |

|

|

12.69 |

% |

| Tangible

common equity ratio (1) |

|

10.90 |

% |

|

|

12.59 |

% |

| |

|

|

|

| Loan

Balances - Period End (in thousands): |

|

|

|

| Commercial

and Industrial |

$ |

1,773,478 |

|

|

$ |

1,510,835 |

|

| Commercial

real estate - owner occupied |

$ |

971,634 |

|

|

$ |

990,372 |

|

| Commercial

real estate - income producing |

$ |

3,827,024 |

|

|

$ |

3,370,692 |

|

| 1-4 Family

mortgage |

$ |

104,558 |

|

|

$ |

101,860 |

|

| Construction

- commercial and residential |

$ |

969,166 |

|

|

$ |

1,044,305 |

|

| Construction

- C&I (owner occupied) |

$ |

114,138 |

|

|

$ |

64,845 |

|

| Home

equity |

$ |

78,228 |

|

|

$ |

87,009 |

|

| Other

consumer |

$ |

2,647 |

|

|

$ |

3,140 |

|

| |

|

|

|

|

Average Balances (in thousands): |

|

|

|

| Total

assets |

$ |

9,469,285 |

|

|

$ |

8,455,680 |

|

| Total

earning assets |

$ |

9,176,174 |

|

|

$ |

8,185,711 |

|

| Total

loans |

$ |

7,650,993 |

|

|

$ |

7,038,472 |

|

| Total

deposits |

$ |

7,696,764 |

|

|

$ |

6,987,468 |

|

| Total

borrowings |

$ |

485,948 |

|

|

$ |

266,209 |

|

| Total

shareholders’ equity |

$ |

1,212,802 |

|

|

$ |

1,128,869 |

|

| |

|

|

|

- Tangible common equity to tangible

assets (the "tangible common equity ratio"), tangible book value

per common share, and the annualized return on average tangible

common equity are non-GAAP financial measures derived from GAAP

based amounts. The Company calculates the tangible common equity

ratio by excluding the balance of intangible assets from common

shareholders' equity and dividing by tangible assets. The Company

calculates tangible book value per common share by dividing

tangible common equity by common shares outstanding, as compared to

book value per common share, which the Company calculates by

dividing common shareholders' equity by common shares outstanding.

The Company calculates the annualized return on average tangible

common equity ratio by dividing net income available to common

shareholders by average tangible common equity which is calculated

by excluding the average balance of intangible assets from the

average common shareholders’ equity. The Company considers this

information important to shareholders as tangible equity is a

measure that is consistent with the calculation of capital for bank

regulatory purposes, which excludes intangible assets from the

calculation of risk based ratios and as such is useful for

investors, regulators, management and others to evaluate capital

adequacy and to compare against other financial institutions. The

table below provides a reconciliation of these non-GAAP financial

measures with financial measures defined by GAAP.

| |

|

|

|

|

| |

|

|

|

|

| GAAP

Reconciliation (Unaudited) |

|

|

|

|

| (dollars in

thousands except per share data) |

|

|

|

|

| |

Three Months

Ended |

Three Months

Ended |

| |

March 31, 2020 |

|

March 31, 2019 |

|

| Common

shareholders' equity |

$ |

1,184,640 |

|

|

$ |

1,148,488 |

|

|

| Less:

Intangible assets |

|

(104,695 |

) |

|

|

(105,466 |

) |

|

|

Tangible common equity |

$ |

1,079,945 |

|

|

$ |

1,043,022 |

|

|

| |

|

|

|

|

| Book value

per common share |

$ |

36.79 |

|

|

$ |

33.25 |

|

|

| Less:

Intangible book value per common share |

|

(3.25 |

) |

|

|

(3.05 |

) |

|

|

Tangible book value per common share |

$ |

33.54 |

|

|

$ |

30.20 |

|

|

| |

|

|

|

|

| Total

assets |

$ |

10,014,081 |

|

|

$ |

8,388,406 |

|

|

| Less:

Intangible assets |

|

(104,695 |

) |

|

|

(105,466 |

) |

|

|

Tangible assets |

$ |

9,909,386 |

|

|

$ |

8,282,940 |

|

|

|

Tangible common equity ratio |

|

10.90 |

% |

|

|

12.59 |

% |

|

| |

|

|

|

|

| Average

common shareholders' equity |

$ |

1,212,802 |

|

|

$ |

1,128,869 |

|

|

| Less:

Average intangible assets |

|

(104,697 |

) |

|

|

(105,581 |

) |

|

|

Average tangible common equity |

$ |

1,108,105 |

|

|

$ |

1,023,288 |

|

|

| |

|

|

|

|

| Net Income

Available to Common Shareholders |

$ |

23,123 |

|

|

$ |

33,749 |

|

|

| Average

tangible common equity |

|

1,108,105 |

|

|

|

1,023,288 |

|

|

|

Annualized Return on Average Tangible Common

Equity |

|

8.39 |

% |

|

|

13.38 |

% |

|

| |

|

|

|

|

- Computed by dividing

noninterest expense by the sum of net interest income and

noninterest income. The efficiency ratio measures a bank’s overhead

as a percentage of its revenue.

- Excludes loans held for sale.

|

Eagle Bancorp, Inc. |

|

|

|

|

|

|

Consolidated Balance Sheets (Unaudited) |

|

|

|

|

|

| (dollars in

thousands, except per share data) |

|

|

|

|

|

| |

|

|

|

|

|

|

Assets |

March 31,

2020 |

|

December 31,

2019 |

|

March 31,

2019 |

| Cash and due

from banks |

$ |

7,177 |

|

|

$ |

7,539 |

|

|

$ |

6,817 |

|

| Federal

funds sold |

|

28,277 |

|

|

|

38,987 |

|

|

|

15,403 |

|

| Interest

bearing deposits with banks and other short-term investments |

|

904,160 |

|

|

|

195,447 |

|

|

|

99,870 |

|

| Investment

securities available for sale, at fair value |

|

858,916 |

|

|

|

843,363 |

|

|

|

772,229 |

|

| Federal

Reserve and Federal Home Loan Bank stock |

|

39,988 |

|

|

|

35,194 |

|

|

|

34,995 |

|

| Loans held

for sale |

|

60,036 |

|

|

|

56,707 |

|

|

|

20,268 |

|

| Loans |

|

7,840,873 |

|

|

|

7,545,748 |

|

|

|

7,173,058 |

|

| Less

allowance for credit losses |

|

(96,336 |

) |

|

|

(73,658 |

) |

|

|

(69,943 |

) |

|

Loans, net |

|

7,744,537 |

|

|

|

7,472,090 |

|

|

|

7,103,115 |

|

| Premises and

equipment, net |

|

13,687 |

|

|

|

14,622 |

|

|

|

15,798 |

|

| Operating

lease right-of-use assets |

|

25,655 |

|

|

|

27,372 |

|

|

|

28,928 |

|

| Deferred

income taxes |

|

30,366 |

|

|

|

29,804 |

|

|

|

31,763 |

|

| Bank owned

life insurance |

|

76,139 |

|

|

|

75,724 |

|

|

|

73,865 |

|

| Intangible

assets, net |

|

104,695 |

|

|

|

104,739 |

|

|

|

105,466 |

|

| Other real

estate owned |

|

8,237 |

|

|

|

1,487 |

|

|

|

1,394 |

|

| Other

assets |

|

112,211 |

|

|

|

85,644 |

|

|

|

78,495 |

|

|

Total Assets |

$ |

10,014,081 |

|

|

$ |

8,988,719 |

|

|

$ |

8,388,406 |

|

| |

|

|

|

|

|

|

Liabilities and Shareholders' Equity |

|

|

|

|

|

|

Deposits: |

|

|

|

|

|

|

Noninterest bearing demand |

$ |

1,994,209 |

|

|

$ |

2,064,367 |

|

|

$ |

2,216,270 |

|

|

Interest bearing transaction |

|

931,597 |

|

|

|

863,856 |

|

|

|

588,326 |

|

|

Savings and money market |

|

3,950,495 |

|

|

|

3,013,129 |

|

|

|

2,515,269 |

|

|

Time, $100,000 or more |

|

608,355 |

|

|

|

663,987 |

|

|

|

791,956 |

|

|

Other time |

|

656,912 |

|

|

|

619,052 |

|

|

|

571,098 |

|

|

Total deposits |

|

8,141,568 |

|

|

|

7,224,391 |

|

|

|

6,682,919 |

|

| Customer

repurchase agreements |

|

31,377 |

|

|

|

30,980 |

|

|

|

26,418 |

|

| Other

short-term borrowings |

|

300,000 |

|

|

|

250,000 |

|

|

|

250,000 |

|

| Long-term

borrowings |

|

267,784 |

|

|

|

217,687 |

|

|

|

217,394 |

|

| Operating

lease liabilities |

|

28,242 |

|

|

|

29,959 |

|

|

|

32,752 |

|

| Reserve for

unfunded commitments |

|

6,230 |

|

|

|

- |

|

|

|

- |

|

| Other

liabilities |

|

54,240 |

|

|

|

45,021 |

|

|

|

30,435 |

|

|

Total liabilities |

|

8,829,441 |

|

|

|

7,798,038 |

|

|

|

7,239,918 |

|

| |

|

|

|

|

|

|

Shareholders' Equity |

|

|

|

|

|

| Common

stock, par value $.01 per share; shares authorized 100,000,000,

shares |

|

|

|

|

|

|

issued and outstanding 32,197,258, 33,241,496, and 34,537,193,

respectively |

|

320 |

|

|

|

331 |

|

|

|

343 |

|

| Additional

paid in capital |

|

439,321 |

|

|

|

482,286 |

|

|

|

530,894 |

|

| Retained

earnings |

|

731,343 |

|

|

|

705,105 |

|

|

|

618,243 |

|

| Accumulated

other comprehensive income (loss) |

|

13,656 |

|

|

|

2,959 |

|

|

|

(992 |

) |

|

Total Shareholders' Equity |

|

1,184,640 |

|

|

|

1,190,681 |

|

|

|

1,148,488 |

|

|

Total Liabilities and Shareholders' Equity |

$ |

10,014,081 |

|

|

$ |

8,988,719 |

|

|

$ |

8,388,406 |

|

|

|

|

|

|

|

` |

| |

|

|

|

|

|

|

Eagle Bancorp, Inc. |

|

|

|

|

Consolidated Statements of Income (Unaudited) |

|

|

|

| (dollars in

thousands, except per share data) |

|

|

|

| |

|

| |

Three Months Ended March 31, |

|

Interest Income |

|

2020 |

|

|

2019 |

|

Interest and fees on loans |

$ |

96,755 |

|

$ |

97,821 |

|

Interest and dividends on investment securities |

|

5,427 |

|

|

5,598 |

|

Interest on balances with other banks and short-term

investments |

|

1,559 |

|

|

1,666 |

|

Interest on federal funds sold |

|

60 |

|

|

49 |

|

Total interest income |

|

103,801 |

|

|

105,134 |

|

Interest Expense |

|

|

|

|

Interest on deposits |

|

20,546 |

|

|

20,900 |

|

Interest on customer repurchase agreements |

|

87 |

|

|

98 |

|

Interest on other short-term borrowings |

|

357 |

|

|

140 |

|

Interest on long-term borrowings |

|

3,067 |

|

|

2,979 |

|

Total interest expense |

|

24,057 |

|

|

24,117 |

| Net

Interest Income |

|

79,744 |

|

|

81,017 |

|

Provision for Credit Losses |

|

16,422 |

|

|

3,360 |

| Net

Interest Income After Provision For Credit Losses |

|

63,322 |

|

|

77,657 |

| |

|

|

|

|

Noninterest Income |

|

|

|

|

Service charges on deposits |

|

1,425 |

|

|

1,694 |

|

Gain on sale of loans |

|

944 |

|

|

1,388 |

|

Gain on sale of investment securities |

|

822 |

|

|

912 |

|

Increase in the cash surrender value of bank owned life

insurance |

|

414 |

|

|

425 |

|

Other income |

|

1,865 |

|

|

1,872 |

|

Total noninterest income |

|

5,470 |

|

|

6,291 |

|

Noninterest Expense |

|

|

|

|

Salaries and employee benefits |

|

17,797 |

|

|

23,644 |

|

Premises and equipment expenses |

|

3,821 |

|

|

3,852 |

|

Marketing and advertising |

|

1,078 |

|

|

1,148 |

|

Data processing |

|

2,496 |

|

|

2,375 |

|

Legal, accounting and professional fees |

|

6,988 |

|

|

1,709 |

|

FDIC insurance |

|

1,424 |

|

|

1,116 |

|

Other expenses |

|

3,743 |

|

|

4,460 |

|

Total noninterest expense |

|

37,347 |

|

|

38,304 |

|

Income Before Income Tax Expense |

|

31,445 |

|

|

45,644 |

|

Income Tax Expense |

|

8,322 |

|

|

11,895 |

| Net

Income |

$ |

23,123 |

|

$ |

33,749 |

| |

|

|

|

|

Earnings Per Common Share |

|

|

|

|

Basic |

$ |

0.70 |

|

$ |

0.98 |

|

Diluted |

$ |

0.70 |

|

$ |

0.98 |

| Eagle

Bancorp, Inc. |

| Consolidated

Average Balances, Interest Yields And Rates

(Unaudited) |

| (dollars in

thousands) |

| |

|

|

|

|

|

|

|

| |

Three Months Ended March 31, |

| |

|

2020 |

|

|

|

2019 |

|

|

|

Average Balance |

Interest |

Average Yield/Rate |

|

Average Balance |

Interest |

Average Yield/Rate |

|

ASSETS |

|

|

|

|

|

|

|

| Interest

earning assets: |

|

|

|

|

|

|

|

| Interest

bearing deposits with other banks and other short-term

investments |

$ |

588,148 |

$ |

1,559 |

1.07 |

% |

|

$ |

301,020 |

$ |

1,666 |

2.24 |

% |

| Loans held

for sale (1) |

|

38,749 |

|

354 |

3.65 |

% |

|

|

17,919 |

|

200 |

4.46 |

% |

| Loans

(1) (2) |

|

7,650,993 |

|

96,401 |

5.07 |

% |

|

|

7,038,472 |

|

97,621 |

5.62 |

% |

| Investment

securities available for sale (2) |

|

867,666 |

|

5,427 |

2.52 |

% |

|

|

810,550 |

|

5,598 |

2.80 |

% |

| Federal

funds sold |

|

30,618 |

|

60 |

0.79 |

% |

|

|

17,750 |

|

49 |

1.12 |

% |

| Total

interest earning assets |

|

9,176,174 |

|

103,801 |

4.55 |

% |

|

|

8,185,711 |

|

105,134 |

5.21 |

% |

| |

|

|

|

|

|

|

|

| Total

noninterest earning assets |

|

377,939 |

|

|

|

|

339,420 |

|

|

| Less:

allowance for credit losses |

|

84,828 |

|

|

|

|

69,451 |

|

|

| Total

noninterest earning assets |

|

293,111 |

|

|

|

|

269,969 |

|

|

|

TOTAL ASSETS |

$ |

9,469,285 |

|

|

|

$ |

8,455,680 |

|

|

| |

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

|

| Interest

bearing liabilities: |

|

|

|

|

|

|

|

| Interest

bearing transaction |

$ |

805,134 |

$ |

1,666 |

0.83 |

% |

|

$ |

590,853 |

$ |

1,181 |

0.81 |

% |

| Savings and

money market |

|

3,337,958 |

|

11,082 |

1.34 |

% |

|

|

2,792,552 |

|

11,963 |

1.74 |

% |

| Time

deposits |

|

1,287,310 |

|

7,798 |

2.44 |

% |

|

|

1,330,939 |

|

7,756 |

2.36 |

% |

| Total

interest bearing deposits |

|

5,430,402 |

|

20,546 |

1.52 |

% |

|

|

4,714,344 |

|

20,900 |

1.80 |

% |

| Customer

repurchase agreements |

|

30,008 |

|

87 |

1.17 |

% |

|

|

27,793 |

|

98 |

1.43 |

% |

| Other

short-term borrowings |

|

220,058 |

|

357 |

0.64 |

% |

|

|

21,059 |

|

140 |

2.66 |

% |

| Long-term

borrowings |

|

235,882 |

|

3,067 |

5.14 |

% |

|

|

217,357 |

|

2,979 |

5.48 |

% |

| Total

interest bearing liabilities |

|

5,916,350 |

|

24,057 |

1.64 |

% |

|

|

4,980,553 |

|

24,117 |

1.96 |

% |

| |

|

|

|

|

|

|

|

| Noninterest

bearing liabilities: |

|

|

|

|

|

|

|

| Noninterest

bearing demand |

|

2,266,362 |

|

|

|

|

2,273,124 |

|

|

| Other

liabilities |

|

73,771 |

|

|

|

|

73,134 |

|

|

| Total

noninterest bearing liabilities |

|

2,340,133 |

|

|

|

|

2,346,258 |

|

|

| |

|

|

|

|

|

|

|

|

Shareholders’ Equity |

|

1,212,802 |

|

|

|

|

1,128,869 |

|

|

|

TOTAL LIABILITIES AND SHAREHOLDERS'

EQUITY |

$ |

9,469,285 |

|

|

|

$ |

8,455,680 |

|

|

| |

|

|

|

|

|

|

|

| Net interest

income |

|

$ |

79,744 |

|

|

|

$ |

81,017 |

|

| Net interest

spread |

|

|

2.91 |

% |

|

|

|

3.25 |

% |

| Net interest

margin |

|

|

3.49 |

% |

|

|

|

4.02 |

% |

| Cost of

funds |

|

|

1.06 |

% |

|

|

|

1.19 |

% |

| |

|

|

|

|

|

|

|

| (1) Loans placed on

nonaccrual status are included in average balances. Net loan fees

and late charges included in interest income on loans totaled $4.3

million and $4.1 million for the three months ended March 31,

2020 and 2019, respectively. |

| (2) Interest and fees

on loans and investments exclude tax equivalent

adjustments. |

| |

|

|

|

|

|

|

|

| Eagle Bancorp,

Inc. |

|

|

|

|

|

|

|

|

| Statements of

Income and Highlights Quarterly Trends

(Unaudited) |

|

|

|

|

|

| (dollars in

thousands, except per share data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended |

| |

March

31, |

|

December

31, |

|

September

30, |

|

June

30, |

|

March

31, |

|

December

31, |

|

September

30, |

|

June

30, |

|

Income Statements: |

|

2020 |

|

|

|

2019 |

|

|

|

2019 |

|

|

|

2019 |

|

|

|

2019 |

|

|

|

2018 |

|

|

|

2018 |

|

|

|

2018 |

|

| Total

interest income |

$ |

103,801 |

|

|

$ |

107,183 |

|

|

$ |

109,034 |

|

|

$ |

108,279 |

|

|

$ |

105,134 |

|

|

$ |

105,581 |

|

|

$ |

102,360 |

|

|

$ |

96,296 |

|

| Total

interest expense |

|

24,057 |

|

|

|

26,473 |

|

|

|

28,045 |

|

|

|

26,950 |

|

|

|

24,117 |

|

|

|

23,869 |

|

|

|

21,069 |

|

|

|

18,086 |

|

| Net interest

income |

|

79,744 |

|

|

|

80,710 |

|

|

|

80,989 |

|

|

|

81,329 |

|

|

|

81,017 |

|

|

|

81,712 |

|

|

|

81,291 |

|

|

|

78,210 |

|

| Provision

for credit losses |

|

16,422 |

|

|

|

2,945 |

|

|

|

3,186 |

|

|

|

3,600 |

|

|

|

3,360 |

|

|

|

2,600 |

|

|

|

2,441 |

|

|

|

1,650 |

|

| Net interest

income after provision for credit losses |

|

63,322 |

|

|

|

77,765 |

|

|

|

77,803 |

|

|

|

77,729 |

|

|

|

77,657 |

|

|

|

79,112 |

|

|

|

78,850 |

|

|

|

76,560 |

|

|

Noninterest income (before investment gain (loss)) |

|

4,648 |

|

|

|

6,845 |

|

|

|

6,161 |

|

|

|

5,797 |

|

|

|

5,379 |

|

|

|

6,060 |

|

|

|

5,640 |

|

|

|

5,527 |

|

| Gain (Loss)

on sale of investment securities |

|

822 |

|

|

|

(111 |

) |

|

|

153 |

|

|

|

563 |

|

|

|

912 |

|

|

|

29 |

|

|

|

- |

|

|

|

26 |

|

| Total

noninterest income |

|

5,470 |

|

|

|

6,734 |

|

|

|

6,314 |

|

|

|

6,360 |

|

|

|

6,291 |

|

|

|

6,089 |

|

|

|

5,640 |

|

|

|

5,553 |

|

|

Salaries and employee benefits |

|

17,797 |

|

|

|

19,360 |

|

|

|

19,095 |

|

|

|

17,743 |

|

|

|

23,644 |

|

|

|

15,907 |

|

|

|

17,157 |

|

|

|

17,812 |

|

|

Premises and equipment |

|

3,821 |

|

|

|

3,380 |

|

|

|

3,503 |

|

|

|

3,652 |

|

|

|

3,852 |

|

|

|

3,969 |

|

|

|

3,889 |

|

|

|

3,873 |

|

|

Marketing and advertising |

|

1,078 |

|

|

|

1,200 |

|

|

|

1,210 |

|

|

|

1,268 |

|

|

|

1,148 |

|

|

|

1,147 |

|

|

|

1,191 |

|

|

|

1,291 |

|

| Other

expenses |

|

14,651 |

|

|

|

10,786 |

|

|

|

9,665 |

|

|

|

10,696 |

|

|

|

9,660 |

|

|

|

10,664 |

|

|

|

9,377 |

|

|

|

9,313 |

|

| Total

noninterest expense |

|

37,347 |

|

|

|

34,726 |

|

|

|

33,473 |

|

|

|

33,359 |

|

|

|

38,304 |

|

|

|

31,687 |

|

|

|

31,614 |

|

|

|

32,289 |

|

| Income

before income tax expense |

|

31,445 |

|

|

|

49,773 |

|

|

|

50,644 |

|

|

|

50,730 |

|

|

|

45,644 |

|

|

|

53,514 |

|

|

|

52,876 |

|

|

|

49,824 |

|

| Income tax

expense |

|

8,322 |

|

|

|

14,317 |

|

|

|

14,149 |

|

|

|

13,487 |

|

|

|

11,895 |

|

|

|

13,197 |

|

|

|

13,928 |

|

|

|

12,528 |

|

| Net

income |

$ |

23,123 |

|

|

$ |

35,456 |

|

|

$ |

36,495 |

|

|

$ |

37,243 |

|

|

$ |

33,749 |

|

|

$ |

40,317 |

|

|

$ |

38,948 |

|

|

$ |

37,296 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Per

Share Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per

weighted average common share, basic |

$ |

0.70 |

|

|

$ |

1.06 |

|

|

$ |

1.07 |

|

|

$ |

1.08 |

|

|

$ |

0.98 |

|

|

$ |

1.17 |

|

|

$ |

1.14 |

|

|

$ |

1.09 |

|

| Earnings per

weighted average common share, diluted |

$ |

0.70 |

|

|

$ |

1.06 |

|

|

$ |

1.07 |

|

|

$ |

1.08 |

|

|

$ |

0.98 |

|

|

$ |

1.17 |

|

|

$ |

1.13 |

|

|

$ |

1.08 |

|

| Weighted

average common shares outstanding, basic |

|

32,850,112 |

|

|

|

33,468,572 |

|

|

|

34,232,890 |

|

|

|

34,540,152 |

|

|

|

34,480,772 |

|

|

|

34,349,089 |

|

|

|

34,308,684 |

|

|

|

34,305,693 |

|

| Weighted

average common shares outstanding, diluted |

|

32,871,831 |

|

|

|

33,498,681 |

|

|

|

34,255,889 |

|

|

|

34,565,253 |

|

|

|

34,536,236 |

|

|

|

34,460,985 |

|

|

|

34,460,794 |

|

|

|

34,448,354 |

|

| Actual

shares outstanding at period end |

|

32,197,258 |

|

|

|

33,241,496 |

|

|

|

33,720,522 |

|

|

|

34,539,853 |

|

|

|

34,537,193 |

|

|

|

34,387,919 |

|

|

|

34,308,473 |

|

|

|

34,305,071 |

|

| Book value

per common share at period end |

$ |

36.79 |

|

|

$ |

35.82 |

|

|

$ |

35.13 |

|

|

$ |

34.30 |

|

|

$ |

33.25 |

|

|

$ |

32.25 |

|

|

$ |

30.94 |

|

|

$ |

29.82 |

|

| Tangible

book value per common share at period end (1) |

$ |

33.54 |

|

|

$ |

32.67 |

|

|

$ |

32.02 |

|

|

$ |

31.25 |

|

|

$ |

30.20 |

|

|

$ |

29.17 |

|

|

$ |

27.84 |

|

|

$ |

26.71 |

|

| Dividend per

common share |

$ |

0.22 |

|

|

$ |

0.22 |

|

|

$ |

0.22 |

|

|

$ |

0.22 |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Performance Ratios (annualized): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Return on

average assets |

|

0.98 |

% |

|

|

1.49 |

% |

|

|

1.62 |

% |

|

|

1.74 |

% |

|

|

1.62 |

% |

|

|

1.90 |

% |

|

|

1.93 |

% |

|

|

1.92 |

% |

| Return on

average common equity |

|

7.67 |

% |

|

|

11.78 |

% |

|

|

12.09 |

% |

|

|

12.81 |

% |

|

|

12.12 |

% |

|

|

14.82 |

% |

|

|

14.85 |

% |

|

|

14.93 |

% |

| Return on

average tangible common equity |

|

8.39 |

% |

|

|

12.91 |

% |

|

|

13.25 |

% |

|

|

14.08 |

% |

|

|

13.38 |

% |

|

|

16.43 |

% |

|

|

16.54 |

% |

|

|

16.71 |

% |

| Net interest

margin |

|

3.49 |

% |

|

|

3.49 |

% |

|

|

3.72 |

% |

|

|

3.91 |

% |

|

|

4.02 |

% |

|

|

3.97 |

% |

|

|

4.14 |

% |

|

|

4.15 |

% |

| Efficiency

ratio (2) |

|

43.83 |

% |

|

|

39.71 |

% |

|

|

38.34 |

% |

|

|

38.04 |

% |

|

|

43.87 |

% |

|

|

36.09 |

% |

|

|

36.37 |

% |

|

|

38.55 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Ratios: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Allowance

for credit losses to total loans (3) |

|

1.23 |

% |

|

|

0.98 |

% |

|

|

0.98 |

% |

|

|

0.98 |

% |

|

|

0.98 |

% |

|

|

1.00 |

% |

|

|

1.00 |

% |

|

|

1.00 |

% |

| Allowance

for credit losses to total nonperforming loans

(4) |

|

204.83 |

% |

|

|

151.16 |

% |

|

|

127.87 |

% |

|

|

192.70 |

% |

|

|

173.72 |

% |

|

|

429.72 |

% |

|

|

452.28 |

% |

|

|

612.42 |

% |

|

Nonperforming loans to total loans (3) (4) |

|

0.60 |

% |

|

|

0.65 |

% |

|

|

0.76 |

% |

|

|

0.51 |

% |

|

|

0.56 |

% |

|

|

0.23 |

% |

|

|

0.22 |

% |

|

|

0.16 |

% |

|

Nonperforming assets to total assets (4) |

|

0.55 |

% |

|

|

0.56 |

% |

|

|

0.66 |

% |

|

|

0.45 |

% |

|

|

0.50 |

% |

|

|

0.21 |

% |

|

|

0.20 |

% |

|

|

0.16 |

% |

| Net

charge-offs (annualized) to average loans (3) |

|

0.12 |

% |

|

|

0.16 |

% |

|

|

0.08 |

% |

|

|

0.08 |

% |

|

|

0.19 |

% |

|

|

0.05 |

% |

|

|

0.05 |

% |

|

|

0.05 |

% |

| Tier 1

capital (to average assets) |

|

11.58 |

% |

|

|

11.62 |

% |

|

|

12.19 |

% |

|

|

12.66 |

% |

|

|

12.49 |

% |

|

|

12.08 |

% |

|

|

12.13 |

% |

|

|

11.97 |

% |

| Total

capital (to risk weighted assets) |

|

15.69 |

% |

|

|

16.20 |

% |

|

|

16.08 |

% |

|

|

16.36 |

% |

|

|

16.22 |

% |

|

|

16.08 |

% |

|

|

15.74 |

% |

|

|

15.59 |

% |

| Common

equity tier 1 capital (to risk weighted assets) |

|

12.40 |

% |

|

|

12.87 |

% |

|

|

12.76 |

% |

|

|

12.87 |

% |

|

|

12.69 |

% |

|

|

12.47 |

% |

|

|

12.11 |

% |

|

|

11.89 |

% |

| Tangible

common equity ratio (1) |

|

10.90 |

% |

|

|

12.22 |

% |

|

|

12.13 |

% |

|

|

12.60 |

% |

|

|

12.59 |

% |

|

|

12.11 |

% |

|

|

12.01 |

% |

|

|

11.79 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average Balances (in thousands): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total

assets |

$ |

9,469,285 |

|

|

$ |

9,426,220 |

|

|

$ |

8,923,406 |

|

|

$ |

8,595,523 |

|

|

$ |

8,455,680 |

|

|

$ |

8,415,480 |

|

|

$ |

8,023,535 |

|

|

$ |

7,789,564 |

|

| Total

earning assets |

$ |

9,176,174 |

|

|

$ |

9,160,034 |

|

|

$ |

8,655,196 |

|

|

$ |

8,328,323 |

|

|

$ |

8,185,711 |

|

|

$ |

8,171,010 |

|

|

$ |

7,793,422 |

|

|

$ |

7,558,138 |

|

| Total

loans |

$ |

7,650,993 |

|

|

$ |

7,532,179 |

|

|

$ |

7,492,816 |

|

|

$ |

7,260,899 |

|

|

$ |

7,038,472 |

|

|

$ |

6,897,434 |

|

|

$ |

6,646,264 |

|

|

$ |

6,569,931 |

|

| Total

deposits |

$ |

7,696,764 |

|

|

$ |

7,716,973 |

|

|

$ |

7,319,314 |

|

|

$ |

6,893,981 |

|

|

$ |

6,987,468 |

|

|

$ |

6,950,714 |