UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. __)

| | | | | |

| Filed by the Registrant | ☒ |

| Filed by a Party other than the Registrant | ☐ |

Check the appropriate box:

| | | | | |

☐ | Preliminary Proxy Statement |

☐ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material Pursuant to §240.14a-12 |

ENERGY FOCUS, INC.

| | | | | | | | |

| (Name of Registrant as Specified in Its Charter) | |

(Name of Person(s) Filing Proxy Statement, if other than the

Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

ENERGY FOCUS, INC.

32000 AURORA ROAD, SUITE B

SOLON, OHIO 44139

April 13, 2022

Dear Stockholder:

You are cordially invited to this year’s Annual Meeting of Stockholders (the “Annual Meeting”), which will be held virtually on Wednesday, May 25, 2022, at 9:00 A.M., Eastern Time. The Annual Meeting can be accessed by visiting www.virtualshareholdermeeting.com/EFOI2022, where you will be able to listen to and participate during the live meeting, submit questions, and vote online.

We believe that a virtual stockholder meeting will provide greater access to those who may want to attend, and therefore have chosen to conduct a virtual meeting rather than an in-person meeting. Because the Annual Meeting is virtual and being conducted electronically, stockholders cannot attend the Annual Meeting in person.

We are providing our proxy materials to our stockholders over the Internet. This reduces our environmental impact and our costs while ensuring our stockholders have timely access to this important information. Accordingly, stockholders of record at the close of business on March 28, 2022, will receive a Notice of Internet Availability of Proxy Materials with details on accessing these materials. Beneficial owners of our common stock at the close of business on March 28, 2022 will receive separate notices on behalf of their brokers, banks or other intermediaries through which they hold shares.

Your vote is important. Whether or not you plan to participate in the Annual Meeting, I hope that you will vote as soon as possible. Please review the instructions to each of your voting options described in the accompanying Proxy Statement.

Please also note that if you hold your shares in “street name” through a bank or broker, that custodian cannot vote your shares on any non-routine matters without your specific instructions.

Thank you for your ongoing support of, and continued interest in, Energy Focus, Inc.

| | | | | |

| Very truly yours, |

| |

| /s/ Stephen Socolof |

| Stephen Socolof |

| Chairman and Interim Chief Executive Officer |

ENERGY FOCUS, INC.

32000 AURORA ROAD, SUITE B

SOLON, OHIO 44139

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD MAY 25, 2022

TO STOCKHOLDERS:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders (the “Annual Meeting”) of Energy Focus, Inc. (the “Company”) will be held virtually on Wednesday, May 25, 2022, at 9:00 A.M., Eastern Time. The Annual Meeting can be accessed by visiting www.virtualshareholdermeeting.com/EFOI2022, where you will be able to listen to and participate during the live meeting, submit questions, and vote online. Because the Annual Meeting is virtual and being conducted electronically, stockholders cannot attend the Annual Meeting in person.

The Annual Meeting is being held for the following purposes:

1.To elect six directors to serve until the next annual meeting or until their successors are elected and appointed, the nominees for which are as follows: Jennifer Cheng, Gina Huang, Brian Lagarto, Jeffery Parker, Philip Politziner, and Stephen Socolof;

2.To approve the amendment and restatement of the Energy Focus, Inc. 2020 Stock Incentive Plan;

3.To ratify the appointment of GBQ Partners LLC as the Company’s independent registered public accounting firm for the year ending December 31, 2022;

4.To approve, on an advisory basis, the compensation of our named executive officers; and

5.To consider and act upon any other matters that may properly come before the Annual Meeting or any adjournment or postponement thereof.

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice. Only stockholders of record at the close of business on March 28, 2022 are entitled to notice of and to vote during the Annual Meeting and any adjournments or postponements thereof.

Most stockholders have a choice of voting over the Internet, by telephone or by using a traditional proxy card. Please refer to the attached proxy materials or the information forwarded by your bank, broker or other holder of record to see which voting methods are available to you. Your vote by proxy will ensure your representation at the Annual Meeting, regardless of whether you attend the meeting or not. Returning the proxy does not deprive you of your right to attend the meeting and to vote your shares at the virtual meeting.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 25, 2022:

This Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2021 are available at: http://www.proxyvote.com.

| | | | | |

|

BY ORDER OF THE BOARD OF DIRECTORS |

| |

| /s/ James R. Warren |

| James R. Warren |

| Senior Vice President, General Counsel and Corporate Secretary |

Solon, Ohio

April 13, 2022

TABLE OF CONTENTS

| | | | | |

| Information Concerning Solicitation and Voting of Proxies | |

| Proposal No. 1: Election of Directors | |

| Proposal No. 2: Stock Incentive Plan Proposal | |

| Proposal No. 3: Independent Registered Public Accounting Firm Ratification Proposal | |

| Proposal No. 4: Say-on-Pay Proposal | |

| Security Ownership of Principal Stockholders and Management | |

| Executive Compensation and Other Information | |

| Director Compensation | |

Certain Relationships and Related Transactions | |

| Delinquent Section 16(a) Reports | |

| Audit Committee Report | |

| Stockholder Proposals for the 2023 Annual Meeting | |

| Householding Information | |

| Other Matters | |

Annual Report on Form 10-K | |

| Appendix A - Energy Focus, Inc. 2020 Stock Incentive Plan | |

PROXY STATEMENT FOR ANNUAL MEETING OF STOCKHOLDERS

ENERGY FOCUS, INC.

32000 AURORA ROAD, SUITE B

SOLON, OHIO 44139

INFORMATION CONCERNING SOLICITATION AND VOTING OF PROXIES

General

The enclosed proxy is solicited on behalf of the Board of Directors (the “Board”) of Energy Focus, Inc., a Delaware corporation (“Energy Focus,” “we,” “our,” “us” or the “Company”), for use during the Annual Meeting of Stockholders (the “Annual Meeting”) to be held virtually on Wednesday, May 25, 2022, at 9:00 A.M., Eastern Time, or at any adjournments or postponements thereof, for the purposes set forth herein and in the accompanying Notice of Annual Meeting of Stockholders. The Annual Meeting can be accessed by visiting www.virtualshareholdermeeting.com/EFOI2022, where you will be able to listen to and participate during the live meeting, submit questions, and vote online.

The cost of soliciting these proxies will be borne by the Company. Regular employees and directors of the Company may solicit proxies in person, by telephone, by mail, or by email. No additional compensation will be given to employees or directors for such solicitation. The Company will request brokers and nominees who hold shares of common stock in their names to furnish proxy materials to the beneficial owners of such shares and will reimburse such brokers and nominees for their reasonable expenses incurred in forwarding solicitation material to such beneficial owners.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON MAY 25, 2022

This Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2021 are available at: http://www.proxyvote.com.

In accordance with U.S. Securities and Exchange Commission (the “SEC”) rules, we are providing access to our proxy materials over the Internet to our stockholders rather than in paper form, which reduces the environmental impact of our Annual Meeting and our costs.

Accordingly, if you are a stockholder of record, a one-page Notice of Internet Availability of Proxy Materials (the “Notice of Internet Availability”) was mailed to you on or about April 13, 2022. Stockholders of record may access the proxy materials on the website listed above or request a printed set of the proxy materials be sent to them by following the instructions in the Notice of Internet Availability. The Notice of Internet Availability also explains how you may request that we send future proxy materials to you by e-mail or in printed form by mail. If you choose the e-mail option, you will receive an e-mail next year with links to those materials and to the proxy voting site. We encourage you to choose this e-mail option, which will allow us to provide you with the information you need in a timelier manner, will save us the cost of printing and mailing documents to you and will conserve natural resources. Your election to receive proxy materials by e-mail or in printed form by mail will remain in effect until you terminate it.

If you are a beneficial owner, you did not receive a Notice of Internet Availability directly from us, but your broker, bank or other intermediary forwarded you a notice with instructions on accessing our proxy materials and directing that organization how to vote your shares, as well as other options that may be available to you for receiving our proxy materials.

Reverse Stock Split

All common stock share amounts and exercise or conversion prices relating to the common stock referenced in this Proxy Statement have been adjusted to reflect a one-for-five reverse stock split of our common stock, which became effective on June 11, 2020.

Record Date and Share Ownership

Only stockholders of record at the close of business on March 28, 2022 (the “Record Date”) will be entitled to notice of and to vote during the Annual Meeting and any adjournments or postponements thereof. The Company had 6,453,777 shares of common stock and 876,447 shares of Series A Convertible Preferred Stock, par value $0.0001 per share (the “Series A Preferred Stock”), issued and outstanding as of the Record Date.

Proposals to be Voted Upon

You are being asked to vote on the following matters at the Annual Meeting:

1.To elect six directors to serve until the next annual meeting or until their successors are elected and appointed, the nominees for which are as follows: Jennifer Cheng, Gina Huang, Brian Lagarto, Jeffery Parker, Philip Politziner, and Stephen Socolof (the “Director Election Proposal”);

2.To approve the amendment and restatement of the Energy Focus, Inc. 2020 Stock Incentive Plan (the “Stock Incentive Plan Proposal”);

3.To ratify the appointment of GBQ Partners LLC (“GBQ”) as the Company’s independent registered public accounting firm for the year ending December 31, 2022 (the “Independent Registered Public Accounting Firm Ratification Proposal”);

4.To approve, on an advisory basis, the compensation of our named executive officers (the “Say-on-Pay Proposal”); and

5.To consider and act upon any other matters that may properly come before the Annual Meeting or any adjournment or postponement thereof.

Voting

On each matter to be voted on at the Annual Meeting, each share of our outstanding stock held of record as of the Record Date shall be entitled to the following votes:

| | | | | |

| Class of Stock | Votes Per Share |

| Common Stock | 1 |

| Series A Preferred Stock | 0.11074 |

Each share of Series A Preferred Stock is convertible into 0.20 of a share of common stock. Pursuant to the Series A Certificate of Designation, each holder of outstanding shares of Series A Preferred Stock is entitled to vote with holders of outstanding shares of our common stock, voting together as a single class, with respect to any and all matters presented to the stockholders of the Company for their action or consideration, except as provided by law. In any such vote, each share of Series A Preferred Stock shall be entitled to a number of votes equal to 55.37% of the number of shares of common stock into which such share of Series A Preferred Stock is convertible. As a result, each share of Series A Preferred Stock is entitled to 0.11074 votes on each matter to be voted on at the Annual Meeting.

At the Annual Meeting, the holders of a majority in voting power of all issued and outstanding stock entitled to vote thereat, including Common Stock and Series A Preferred Stock, present in person or represented by proxy, shall constitute a quorum for the transaction of business at the Annual Meeting. Stockholders attending the meeting virtually shall be deemed present in person and permitted to vote at the Annual Meeting.

If you are a beneficial owner of shares that are held in “street name” (meaning a broker, trustee, bank or other nominee holds shares on your behalf), you will need to instruct your broker as to how to vote your shares on the Director Election Proposal, the Stock Incentive Plan Proposal and the Say-on-Pay Proposal, which are the non-routine proposals presented in this Proxy Statement. Failure to do so will result in a “broker non-vote” with respect to each such proposal because a broker will not have discretion to vote on your behalf with respect to such matter during the Annual Meeting. By contrast, the Independent Registered Accounting Firm Ratification Proposal is a routine proposal, and brokers will have discretion to vote on your behalf with respect to such matter at the Annual Meeting if you do not instruct your broker as to how to vote your shares. Consequently, the Company expects that there will not be any broker non-votes with respect to the

Independent Registered Accounting Firm Ratification Proposal and that any valid proxies received by the Company (and not revoked) will be included in the calculation of whether a quorum is present during the Annual Meeting, notwithstanding that the proxy may be marked as broker non-votes with respect to the other proposals. Any valid proxies received by the Company (and not revoked) marked as abstentions will also be included in the calculation of whether a quorum is present during the Annual Meeting.

The following describes the vote required to elect directors and to adopt each other proposal, and the manner in which votes will be counted:

1.Director Election Proposal. The six nominees receiving the greatest number of votes “For” election will be elected as directors. If you do not vote for a particular director nominee, or if you indicate “withhold authority” for a particular nominee on your proxy form, your vote will not have an effect on the outcome of the election of directors. Broker non-votes also will not have an effect on the outcome of the election of directors.

2.Stock Incentive Plan Proposal. The affirmative vote of a majority of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote on the Stock Incentive Plan Proposal is required to approve the Stock Incentive Plan Proposal. Abstentions will have the same effect as a vote against this proposal, and broker non-votes will have no effect on the outcome of this proposal.

3.Independent Registered Public Accounting Firm Ratification Proposal. The affirmative vote of a majority of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote on the Independent Registered Public Accounting Firm Ratification Proposal is required to approve the Independent Registered Public Accounting Firm Ratification Proposal. Nasdaq rules permit brokers to vote uninstructed shares at their discretion on this proposal, so broker non-votes are not expected for this proposal. Abstentions will have the same effect as a vote against this proposal.

4.Say-on-Pay Proposal. The affirmative vote of a majority of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote on the Say-on-Pay Proposal is required to approve the Say-on-Pay Proposal. Abstentions will have the same effect as a vote against this proposal, and broker non-votes will have no effect on the outcome of this proposal.

The shares represented by the proxies received, properly marked, dated, signed and not revoked will be voted during the Annual Meeting. Where such proxies specify a choice with respect to the proposal, the shares will be voted in accordance with the specifications made. Any proxy in the enclosed form which is returned signed and dated but is not marked will be voted as follows:

•“For All” of the nominees for director listed in this Proxy Statement;

•“For” the Stock Incentive Plan Proposal;

•“For” the Independent Registered Public Accounting Firm Ratification Proposal; and

•“For” the Say-on-Pay Proposal.

Revocability of Proxies

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before its use, either by delivering a written notice of revocation or a duly executed proxy bearing a later date to Energy Focus, Inc., Attention: Corporate Secretary, 32000 Aurora Road, Suite B, Solon, Ohio 44139, or by participating in the virtual Annual Meeting and voting electronically. If a proxy is properly signed and dated and not properly revoked, the shares it represents will be voted in accordance with the instructions of the stockholder. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to revoke your proxy or vote during the Annual Meeting, you must follow the instructions provided to you by the record holder and/or obtain from the record holder a legal proxy issued in your name. Participation in the Annual Meeting by a beneficial owner of shares that are held in “street name” will not, by itself, revoke a proxy.

Virtual Stockholder Meeting

The Annual Meeting will be conducted exclusively online via live webcast, allowing all of our stockholders the option to participate in the live, online meeting from any location convenient to them, providing stockholder access to our Board and management, and enhancing participation. Persons who held our stock at the close of business on the Record Date may attend, vote and ask questions at the Annual Meeting by following the instructions provided.

The virtual Annual Meeting can be accessed by visiting www.virtualshareholdermeeting.com/EFOI2022. We encourage you to access the Annual Meeting before the start time of 9:00 a.m., Eastern Time, on May 25, 2022. Please allow ample time for online check-in, which will begin at 8:45 a.m., Eastern Time, on May 25, 2022.

Stockholders who participate in, and vote electronically at, the virtual Annual Meeting by way of the website above will be deemed to be “present in person,” as such term is used in this Proxy Statement, including for purposes of determining a quorum and counting votes.

PROPOSAL NO. 1: ELECTION OF DIRECTORS

Nominees

The Company’s Bylaws provide that the number of directors of the Company shall be no less than five and no more than nine, with the exact number within such range to be fixed by our Board. The size of our Board is currently set at six members. Upon the recommendation of the Nominating and Corporate Governance Committee of our Board (the “Nominating and Corporate Governance Committee”), the Board has nominated the six nominees listed below, each of whom is a current director. Of these directors, Ms. Cheng was appointed in connection with a settlement agreement between the Former Schedule 13D Parties (as defined below) and the Company. See “Certain Relationships and Related Transactions” below. Mr. Lagarto and Mr. Parker were appointed to the Board in February 2022 after being identified as candidates by a non-management director.

Unless otherwise instructed, the proxy holders will vote the proxies received by them for the six nominees named below. If the candidacy of any one or more of such nominees should, for any reason, be withdrawn, the proxy holders will vote in favor of the remainder of those nominated and for such substituted nominees, if any, as shall be designated by our Board. Please note that if the candidacy of one or more nominees should be withdrawn, the Board may reduce the number of directors to be elected at that time. Our Board has no reason to believe that any of the persons named will be unable or unwilling to serve as a nominee or as a director if elected.

Set forth below for each of the nominees is certain biographical information and their age as of the Record Date:

| | | | | | | | | | | |

| Name | Age | Director

Since | Background |

| | | |

| Jennifer Cheng | 55 | 2019 | Ms. Cheng has served as a member of our Board since February 2019. She is the co-founder and has served as director on the board of Social Energy Partners LLC, which develops sustainability and smart building/smart city projects in the United States, Caribbean, Southeast Asia and the Middle East, since September 2017. Ms. Cheng also served as an independent director within the meaning of the Nasdaq Marketplace Rules of the Company from 2012 to 2015. From 1997 to 2006, Ms. Cheng was the co-founder and chairwoman of The X/Y Group, a marketing enterprise that markets and distributes global consumer brand products, including JanSport and Skechers, in the greater China region. From 1995 to 1998, Ms. Cheng was a marketing director for Molten Metal Technology, a Boston-based clean energy company that developed patented technologies and offered solutions for advanced treatment and energy recycling for hazardous radioactive waste. Ms. Cheng received a Master’s degree in Business Administration from Fairleigh Dickinson University and a Bachelor’s degree in Economics and International Business from Rutgers University. She serves on the Advisory Board and contributes in the Diversity and Inclusion Committee for Pelham Together in Pelham, New York.

|

| | | Our Board believes that Ms. Cheng’s qualifications to serve as a Board member include her familiarity with the Company due to her prior service as a director and her experience with and insight into businesses focused on energy efficiency. Ms. Cheng has served as a member of the Nominating and Corporate Governance Committee since February 2019, a member of the Compensation Committee (as defined below) since December 2019 and a member of the Audit and Finance Committee since 2022. |

| | | | | | | | | | | |

| Name | Age | Director

Since | Background |

Gina Huang (Mei Yun Huang) | 60 | 2020 | Ms. Huang has served as a member of our Board since January 2020. She is the Founder and since January 1994, has been Honorary Chairwoman of Ti Town Technology Limited, an advanced industrial and mechanical equipment manufacturer based in Taiwan that specializes in the design, production, marketing and sales of corrosion-resistant pumps and motors, advanced filters and specialty alloys for semiconductor, electronic and chemical manufacturing industries, with offices across Asia and sales across the world. Since February 1996, Ms. Huang has also been the Founder and Chairwoman of Da Fa Industrial Limited, an investment company focusing on the global mining sector, Ms. Huang has founded each of Brilliant Start Limited and Jag International Limited, both investment companies focusing on technologies and special situations. Brilliant Start Limited and Jag International Limited were both founded in 2012, and Ms. Huang has served as Chairwoman of each since they were founded. Ms. Huang is a significant stockholder in the Company. |

| | | Ms. Huang received a B.A. degree in Textile Design from Vanung University in Taiwan. |

| | | Our Board believes Ms. Huang’s experience in manufacturing and her contacts with manufacturers in Asia as well as her significant investment in the Company qualify her to serve as a Board member. |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Brian Lagarto | 56 | 2022 | Mr. Lagarto has served as a member of our Board since February 2022. Mr. Lagarto retired in 2021 from SharkNinja Operating LLC, a leading global producer of small household appliances under the Shark and Ninja brands. At SharkNinja, Mr. Lagarto served as Executive Vice President, Chief Financial Officer from 2009 to 2017, as well as Chief Operating Officer from 2017 to 2018, with responsibility for global finance and operations. From 2019 until his retirement, he served as Chief People & Strategy Officer, with responsibility for corporate strategy, organizational design, talent and culture. Mr. Lagarto was one of the original equity partners in SharkNinja as part of the team that drove significant sales and earnings growth, converting a small, infomercial-driven business to a retail and commercial-focused business targeting consumers via major big box and online retailers in the United States, in addition to global expansion into the United Kingdom, Europe and Asia. He also led the successful sale process of SharkNinja during 2017, resulting in a sale price of $1.6 billion.

Previously, from 2007 to 2009, Mr. Lagarto was a Division Vice President & CFO of the WearGuard-Crest division of Aramark, a leading professional services company providing food services, facilities management, and uniform and career apparel worldwide, and from 2000 to 2007, he was Executive Vice President and Chief Financial Officer of FGX International Limited, one of the largest U.S. distributors of sunglasses, reading glasses and costume jewelry, in addition to previous accounting and finance roles of increasing responsibility. Since 2019, Mr. Lagarto has been a board member of Community Servings, a Boston-area nonprofit provider of medically tailored meals and nutrition services to individuals and families living with critical and chronic illnesses, and was previously a board member of Make-A-Wish of Massachusetts and Rhode Island from 2013 to 2015. Mr. Lagarto received his B.S. in Business Administration from Bryant University, and is a licensed Certified Public Accountant (inactive).

|

| | | | | | | | | | | |

| Name | Age | Director

Since | Background |

| | | Our Board believes that Mr. Lagarto’s qualifications to serve as a Board member include his considerable experience building a very successful consumer appliance and electronics company, running finance, operations, and supply chain. Additionally, his strong financial background and experience will continue to strengthen the Audit and Finance Committee (as defined below), on which he serves as a member. |

| | | |

Jeffery Parker | 58 | 2022 | Mr. Parker has served as a member of our Board since February 2022. Mr. Parker has spent nearly 30 years managing companies in the display, light-emitting diode (“LED”), medical and lighting markets. He has a proven track record of driving growth and market leadership by bringing innovative products to market. Since 2019, Mr. Parker has served as the Chief Executive Officer of Luminii, LLC, an industry-leading manufacturer of architectural LED lighting systems. From 2014 to 2018, Mr. Parker was the Chief Executive Officer at Soraa, Inc., an LED lighting company pioneering LEDs built from pure gallium nitride substrates, and served as Chairman of Soraa from 2018 to 2019. Previously, from 2010 to 2014, Mr. Parker was President of the Lighting and Display Business at Rambus following the acquisition of Global Lighting Technologies, where he was Chief Executive Officer from 2000 to 2010. Mr. Parker has earned over 250 granted patents covering inventions in LEDs, displays, fiber optics, medical illuminators, general lighting, micro-optics and other optoelectronics applications. Mr. Parker has served as a board member at Kateeva, Inc. (since 2018), SLD Laser (from 2014 to 2019), and Avogy Inc. (from 2014 to 2017). Mr. Parker received his B.S. in Mechanical Engineering from the University of Akron. |

| | | Our Board believes that Mr. Parker’s qualifications to serve as a Board member include his 30 years of leading companies in the solid-state lighting industry. Mr. Parker serves as the chair of both the Compensation Committee and the Nominating and Corporate Governance Committee. |

| | | |

| | | | | | | | | | | |

| Name | Age | Director

Since | Background |

| Philip Politziner | 82 | 2019 | Mr. Politziner has served as a member of our Board since August 2019. He was a founder, President and a member of the board of directors of Amper Politziner and Mattia. Amper Politziner and Mattia is one of two predecessor firms to Eisner Amper LLC, a full service advisory and accounting firm. Mr. Politziner retired from Eisner Amper in 2015, last serving as Chairman Emeritus. Mr. Politziner was appointed as a member of the board of directors of Jensyn Acquisition Corporation (NASDAQ: JSYN) in 2016, where he had been the chairman of the audit committee until June 2019 when it consummated its merger with Peck Electric Co. He previously served on the board of directors of Baker Tilly International North America, the board of directors of New Jersey Technology Council and the board of directors of Middlesex County Regional Chamber of Commerce. He has served on the Advisory Board of Jump Start New Jersey Angel Fund. He was awarded the Chamber of Commerce “Community Leader of Distinction” and was inducted into NJBiz Hall of Fame for businesspeople in New Jersey. He also appears in Who’s Who in Corporate Finance.

Mr. Politziner received his B.S. in accounting from New York University and is currently licensed as a CPA in New Jersey. He is a member of the American Institute of Certified Public Accountants (AICPA) and the New Jersey Society of Certified Public Accountants (NJSCPA).

|

| | | Our Board believes that Mr. Politziner’s qualifications to serve as a Board member include his considerable experience with financial and accounting matters and SEC compliance matters as the chairman of the audit committee of a public company. Mr. Politziner serves as chair of the Audit and Finance Committee. |

| | | | | | | | | | | |

| Name | Age | Director

Since | Background |

| Stephen Socolof | 62 | 2019 | Mr. Socolof has served as a member of our Board since May 2019 and as Lead Independent Director from September 2019 until he was appointed as Interim Chief Executive Officer in January 2022. Mr. Socolof has been Managing Partner of Tech Council Ventures, an early-stage venture capital firm, since 2018 and remains a Managing Partner of New Venture Partners, a venture capital firm that he co-founded in 2001. Previously, Mr. Socolof worked at Lucent Technologies, Inc. from 1996 to 2001 where he established Lucent’s New Ventures Group. Before joining Lucent, Mr. Socolof spent eight years with Booz, Allen & Hamilton Inc., where he was a leader of the firm’s innovation consulting practice. From 2008 to 2021, Mr. Socolof was a director of Everspin Technologies Inc., which is a semiconductor and electronics technology company listed on the Nasdaq Global Market. He is also currently a director on the boards of ChoiceWORX, Data Inventions and SunRay Scientific and an observer on the boards of Adrich, Kintra Fibers, and Vydia Inc. He was a director of Gainspan Corporation before its acquisition by Telit Communications, Silicon Hive, until its acquisition by Intel Corporation, StratIS IoT before its acquisition by RealPage, and SyChip, Inc. before its acquisition by Murata, and a board observer of Flarion Technologies, Inc., until its acquisition by Qualcomm Inc.

Mr. Socolof holds a Bachelor of Arts degree in economics and a Bachelor of Science degree in mathematical sciences from Stanford University and received his M.B.A. from the Amos Tuck School at Dartmouth College, where he was a Tuck Scholar. He currently serves on the Board of Advisors of the Center for the Study of Private Equity at the Tuck School. |

| | | Our Board believes that Mr. Socolof’s qualifications to serve as a Board member include his long history of investing in technology growth companies, significant leadership experience in the corporate venture community, and experience as a public company board member, as well as his financial, business, and investment expertise. Mr. Socolof currently serves as Chairman and Interim Chief Executive Officer and previously has been a member of the Audit and Finance Committee as well as chaired both of the Compensation Committee, and the Nominating and Corporate Governance Committee. |

| | | |

| | | |

| | | |

| | | |

Nasdaq Board Diversity Rules

On August 6, 2021, the SEC approved new Nasdaq Rules concerning board diversity. The new Nasdaq Rules require each Nasdaq-listed company to either have a diverse board or explain why it does not and to disclose its board diversity on an annual basis.

We currently meet Nasdaq’s diversity requirement. The Board diversity matrix below presents the Board’s diversity statistics as required by Nasdaq Rules.

| | | | | | | | | | |

| Board Diversity Matrix (As of March 31, 2022*) | | |

| Male | Female | | |

| Total Number of Directors | 6 | | |

| Part I: Gender Identity | | | | |

| Number of Directors Based on Gender Identity | 4 | 2 | | |

| Part II: Demographic Background | | | | |

| | | | |

| | | | |

| Asian | — | 2 | | |

| | | | |

| | | | |

| White | 4 | — | | |

| | | | |

| | | | |

| | | | |

*Based on self-identified diversity characteristics |

Board of Directors Recommendation

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE FOR ALL OF THE NOMINEES LISTED ABOVE.

Executive Officers

The following table sets forth certain information about the executive officers of the Company as of the Record Date. There are no family relationships among any of our directors and executive officers. For biographical information regarding our executive officers, see the discussion under “Biographical Information” below.

| | | | | | | | |

| Name | Age | Position |

| Stephen Socolof | 61 | Chairman and Interim Chief Executive Officer |

| | |

| Tod Nestor | 58 | Chief Operating Officer and Chief Financial Officer |

| James R. Warren | 39 | Senior Vice President, General Counsel and Corporate Secretary |

| Gregory S. Galluccio | 64 | Senior Vice President, Product Management and Engineering |

Biographical Information

Stephen Socolof

See the discussion under “Nominees” above.

Tod Nestor

Mr. Nestor joined the Company in July 2019 as President and Chief Financial Officer. In 2021, he became the Chief Operating Officer in addition to the Chief Financial Officer. From 2017 to 2018, Mr. Nestor served as Executive Vice President and Chief Financial Officer of Alumni Ventures Group, a Manchester, New Hampshire based venture capital firm with the most active global transaction volume in 2018 according to PitchBook. Between 2013 and 2016, Mr. Nestor served as the Chief Financial Officer of Merchants Automotive Group, Inc., a privately held fleet management, short-term rental, automobile retail and consumer financing company, which had over $300 million in revenue in 2016. Previously, Mr. Nestor also served as Senior Vice President and Chief Financial Officer of The Penn Traffic Company, a publicly traded grocery distribution company, which had $1.5 billion in revenue in 2009, and Chief Financial Officer for Fairway Holdings Corp., a privately held grocery store chain based in the greater New York City region, which had $750 million in revenue in 2011. Earlier in his career, Mr. Nestor held other senior leadership roles across a wide array of functions in large organizations such as American Eagle Outfitters, HJ Heinz, WR Grace, and PepsiCo, Inc. Mr. Nestor received a Bachelor of Business Administration degree in Accounting from the University of Notre Dame and an MBA in Finance and Entrepreneurial Management with a concentration in Strategic Planning from The Wharton School of the University of Pennsylvania. He is also a licensed Certified Public Accountant (CPA), Certified Management Account (CMA), Certified Financial Manager (CFM), and Chartered Financial Analyst (CFA).

James R. Warren

Mr. Warren joined the Company in September 2020 as Senior Vice President, General Counsel and Corporate Secretary. Prior to joining Energy Focus, Mr. Warren was a corporate and securities lawyer from 2018 to 2019 at GrafTech International Ltd. (NYSE:EAF), a global manufacturer of graphite electrodes for electric arc furnace steel production, and from 2017 to 2019 at FirstEnergy Corp. (NYSE:FE), one of the nation’s largest investor-owned electric systems. Mr. Warren began his legal career at Tucker Ellis LLP in Cleveland, where his work included mergers and acquisitions, securities, and other corporate transactions. Before law school, Mr. Warren worked as an electrical engineer, focusing on research and development of naval sensor systems and digital communications systems. Mr. Warren earned his undergraduate and graduate degrees in electrical engineering from the Massachusetts Institute of Technology, and his law degree from Case Western Reserve University School of Law.

Gregory S. Galluccio

Mr. Galluccio joined the Company in August 2021 as Senior Vice President, Product Management and Engineering. From 2020 to 2021, Mr. Galluccio served as a private consultant to the electrical industry. From 2015 to 2020, Mr. Gallucci was the Vice President, Engineering and Product Management, of MaxLite, Inc, an LED lamps and luminaires manufacturer. Previously, Mr. Galluccio worked in product management and business development for Leviton Manufacturing Company, focused on LED and lighting applications, and also has over 20 years of experience in engineering at Underwriters Laboratories. He has participated in numerous standards committees and working groups for lighting and electrical control products. Mr. Galluccio received his bachelor’s degree in electrical engineering from the University of Bridgeport and an MBA in Marketing and International Business from Northeastern University.

Corporate Governance

Director Independence

Our Board has determined that each of the following current directors and nominees is “independent” within the meaning of the Nasdaq Marketplace Rules:

Jennifer Cheng

Gina Huang

Brian Lagarto

Jeffery Parker

Philip Politziner

In this Proxy Statement these directors are referred to individually as an “Independent Director” and collectively as the “Independent Directors.”

Pursuant to the Nasdaq Marketplace Rules, Mr. Socolof is not independent while serving as the Interim Chief Executive Officer, but such service on an interim basis would not disqualify him from being considered independent following such service, provided the interim service does not last longer than one year. Mr. Socolof is not receiving any additional compensation for serving as our Interim Chief Executive Officer, although his previous Lead Director retainer was increased and renamed when he was appointed Chairman to partially offset retainers for committee service for which he is ineligible while serving as Chairman and Interim Chief Executive Officer. In the past, our Board has determined that Mr. Socolof met the independence criteria under the Nasdaq Marketplace Rules, and our Board has determined that Mr. Socolof currently has no relationships that would disqualify him from being considered independent, other than his service as Interim Chief Executive Officer. Accordingly, we expect that our Board will determine that Mr. Socolof is independent within the meaning of the Nasdaq Marketplace Rules once a new Chief Executive Officer is hired and Mr. Socolof’s service as Interim Chief Executive Officer ceases.

Board Meetings and Committees; Annual Meeting Attendance

Our Board held a total of eight meetings during the fiscal year ended December 31, 2021. All current directors that served during fiscal year 2021 attended at least 75% of the aggregate number of meetings of the Board and of the committees on which such directors served.

The Company does not have a policy regarding attendance by the directors at the Company’s annual meetings of stockholders. The Company generally encourages, but does not require, directors to attend the Company’s annual meetings of stockholders. All of the then-serving directors were present virtually at the last annual meeting of stockholders held May 26, 2021.

Compensation Committee

Our Board has a standing Compensation Committee (the “Compensation Committee”), currently consisting of Mr. Parker, as chair, and Ms. Cheng. Each of the members of the Compensation Committee is an Independent Director and is also independent under the Nasdaq Marketplace Rules for compensation committee membership. The Compensation Committee held four meetings in 2021. The Board has approved a charter for the Compensation Committee. A copy of this charter can be found on the Company’s website at http://investors.energyfocus.com/corporate-governance.

The Compensation Committee’s primary functions are to:

•receive proposals from management and review and recommend to the Board the corporate goals and objectives relevant to compensation of the Chief Executive Officer, evaluate his or her performance in light of such goals and objectives, and recommend to the Board for approval his or her compensation level based on this evaluation;

•develop and recommend to the Board compensation arrangements for other executive officers of the Company;

•review and recommend to the Board incentive compensation plans and equity-based plans, and administer such plans;

•review and recommend to the Board all other employee benefit plans for the Company; and

•review and make recommendations to the Board regarding compensation of the Board.

The authority of the Compensation Committee may be delegated to a subcommittee of the Compensation Committee, consisting of one or more directors. Further, the Compensation Committee may delegate certain equity award grant authority and responsibilities (including ministerial duties) under the Company’s equity plan to certain other committees of the Board or to authorized officers of the Company, subject to applicable law. The Chief Executive Officer may provide recommendations regarding compensation of other executive officers. The Compensation Committee is empowered to retain consultants for advice on compensation matters. For more information about the Company’s executive and director compensation programs, see the “Executive Compensation and Other Information” and “Director Compensation” sections of this Proxy Statement.

Compensation Committee Interlocks and Insider Participation

No director currently serving on the Compensation Committee is or has been an officer or employee of the Company or any of the Company’s subsidiaries. No interlocking relationships exist between our Board or Compensation Committee and the board or compensation committee of any other entity, nor has any interlocking relationship existed in the past.

Audit and Finance Committee

The Audit and Finance Committee of the Board (“the Audit and Finance Committee”) acts as the standing audit committee of our Board and currently consists of Mr. Politziner, as chair, Mr. Lagarto and Ms. Cheng. The Audit and Finance Committee held four meetings in 2021. Each of the members of the Audit and Finance Committee is an Independent Director and is also independent under the criteria established by the SEC and the Nasdaq Stock Market for audit committee membership. Our Board has determined that Mr. Politziner and Mr. Lagarto each is an “audit committee financial expert,” as defined under the rules of the SEC. Our Board has approved a charter for the Audit and Finance Committee. A copy of this charter can be found on the Company’s website at http://investors.energyfocus.com/corporate-governance.

The Audit and Finance Committee’s primary functions are to assist our Board in its oversight of the integrity of the Company’s financial statements and other financial information, the Company’s compliance with legal and regulatory requirements, the qualifications, independence and performance of the Company’s independent registered public accounting firm. More specifically, the Audit and Finance Committee:

•appoints, compensates, evaluates and, when appropriate, replaces the Company’s independent registered public accounting firm;

•reviews and pre-approves audit and permissible non-audit services;

•reviews the scope of the annual audit;

•monitors the independent registered public accounting firm’s relationship with the Company;

•meets with the independent registered public accounting firm and management to discuss and review the Company’s financial statements, internal controls, and auditing, accounting and financial reporting processes; and

•reviews managements risk management of legal, compliance and major financial risks.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee currently consists of Mr. Parker, as chair, and Ms. Cheng. Each of the members of the Nominating and Corporate Governance Committee is an Independent Director. The Nominating and Corporate Governance Committee held five meetings in 2021. Our Board has approved a charter for the Nominating and Corporate Governance Committee. A copy of this charter can be found on the Company’s website at http://investors.energyfocus.com/corporate-governance.

The Nominating and Corporate Governance Committee’s primary functions are to carry out the responsibilities delegated by the Board relating to the Company’s director nominations process and procedures, developing and maintaining the Company’s corporate governance policies, and any related matters required by the Nasdaq Stock Market or federal securities laws. More specifically, the Nominating and Corporate Governance Committee:

•determines, makes recommendations, and reviews periodically with the Board, the appropriate number of directors that shall constitute the Board, along with the qualifications required to be a director, the Board’s leadership structure and its committee structure and composition;

•conducts searches for and reviews individuals qualified to become members of the Board;

•makes recommendations to the Board regarding the selection and approval of the nominees for director to be submitted during the annual meeting of stockholders and identifies and makes recommendations to the Board regarding the selection and approval of candidates to fill vacancies on the Board;

•evaluates and makes a recommendation to the Board with respect to the “independence” of directors;

•oversees the Company’s corporate governance practices, procedures, corporate governance guidelines and other governing documents, and other governance matters required by the SEC or Nasdaq Stock Market and makes related recommendations to the Board;

•oversees the Board’s and committees’ evaluation and charter review process; and

•develops and recommends to the Board for approval, after taking into account any input provided by the Compensation Committee, a Chief Executive Officer succession plan.

The Nominating and Corporate Governance Committee will consider various candidates for Board membership, including those suggested by other Board members, by any executive search firm engaged by the Nominating and Corporate Governance Committee, and by stockholders. While the Nominating and Corporate Governance Committee does not have minimum qualifications for candidacy, it considers a variety of criteria in assessing potential candidates, including their diversity of personal and professional background, experience, and perspective; personal and professional integrity, ethics and values; experience relevant to the Company’s industry and relevant concerns; practical and mature business judgment, including the ability to make independent analytical inquiries; the ability to commit sufficient time and attention to the activities of the Board; specific experience with accounting, finance, leadership and strategic planning; satisfaction of applicable independence criteria for independent members; and the absence of potential conflicts of interest with the Company’s interests. A stockholder who wishes to suggest a prospective nominee for the Board to consider should notify the Corporate Secretary of the Company or any member of the Nominating and Corporate Governance Committee in writing, with any supporting material the stockholder considers appropriate, at the following address: Energy Focus, Inc. , Attention: Corporate Secretary, 32000 Aurora Road, Suite B, Solon, Ohio 44139.

Board Leadership Structure and Role in Risk Oversight

The Company is currently recruiting a permanent Chief Executive Officer; During this interim period, Mr. Socolof currently serves as the Chairman and Interim Chief Executive Officer. The Nominating and Corporate Governance Committee periodically considers whether the roles of Chief Executive Officer and Chairman should be separate, but believes at this time that combining the roles of Chairman and Interim Chief Executive Officer fosters accountability, effective decision-making and alignment between interests of the Board and management.

Prior to becoming Chairman and Interim Chief Executive Officer, Mr. Socolof served as the lead independent director (the “Lead Director”) of the Board, a position established in September 2019. When a permanent Chief Executive Officer that also serves as Chairman is in place, the Lead Director serves as a liaison between the Independent Directors and the Chief Executive Officer and the full Board, consults with and advises the Chairman regarding Board matters, calls and chairs meetings of Independent Directors and chairs meetings of the Board when the Chairman is not present. Once a new Chief Executive Officer is hired, we expect that our Board will appoint Mr. Socolof to continue his Board leadership role as either Chairman or Lead Director.

It is management’s responsibility to manage risk and bring material risks to the attention of the Board. The Board administers its risk oversight role by reviewing strategic, financial and execution risks and exposures associated with the Company’s operations and financial condition; litigation and other matters that may present material risk to our operations, plans, prospects or reputation; acquisitions and divestitures; and senior management succession planning. This oversight role is performed directly and through the committee structure and the committees’ regular reports to our Board. The Audit and Finance Committee reviews risks associated with legal, compliance, cybersecurity and major financial and accounting matters, including financial reporting, accounting, disclosure, internal control over financial reporting and ethics and compliance programs. The Compensation Committee reviews risks related to executive compensation and the design of compensation programs, plans and arrangements (there are no risks that are reasonably likely to have a material adverse effect on the Company). The Nominating and Corporate Governance Committee reviews risks associated with the Company’s corporate governance policies, as well as Nasdaq Stock Market rules and federal securities laws.

Stockholder Communications with the Board

Stockholders may communicate with our Board through the Corporate Secretary of the Company by writing to the following address: Energy Focus, Inc., Attention: Corporate Secretary, 32000 Aurora Road, Suite B, Solon, Ohio 44139. Any such communication should indicate whether the communication is intended to be directed to our entire Board or to a particular director or directors, and must indicate the number of shares of Company stock beneficially owned by the stockholder. Our Corporate Secretary will forward appropriate communications to our Board and/or the appropriate director(s). Inappropriate communications include correspondence that does not relate to the business or affairs of the Company or the functioning of our Board or its committees, advertisements or other commercial solicitations or communications, and communications that are frivolous, threatening, illegal or otherwise not appropriate for delivery to directors.

Employee, Officer and Director Hedging

The Company’s Insider Trading Policy prohibits all of our executive officers, directors and other designated employees from engaging in short sales or investing in other kinds of hedging transactions or financial instruments (including prepaid variable forward contracts, equity swaps, collars and exchange funds) that are designed to hedge or offset any decrease in the market value of the Company’s securities.

Code of Ethics

We have adopted a Code of Ethics and Business Conduct, which applies to all of our directors, officers, and employees. Our Code of Ethics and Business Conduct can be found on our website at www.energyfocus.com.

We intend to disclose on our website any amendment to, or waiver from, a provision of our Code of Ethics and Business Conduct that applies to our directors and executive officers, including our principal executive officer, principal financial officer, principal accounting officer or controller, or any persons performing similar functions, and that is required to be publicly disclosed pursuant to the rules of the SEC.

PROPOSAL NO. 2: STOCK INCENTIVE PLAN PROPOSAL

On April 12, 2022, our Board of Directors, upon the recommendation of the Compensation Committee, approved the amendment and restatement of the Energy Focus, Inc. 2020 Stock Incentive Plan, subject to stockholder approval at the Annual Meeting. We refer to the original Energy Focus, Inc. 2020 Stock Incentive Plan as the “2020 Plan,” and we refer to the amended and restated Energy Focus, Inc. 2020 Stock Incentive Plan as the “Amended 2020 Plan.”

Background

The Company’s stockholders previously approved the 2020 Plan with an available share pool of 350,000 shares. As of March 31, 2022, the Company had outstanding 271,509 options to purchase common stock with a weighted average exercise price of $3.14 per share and a weighted average remaining term of 8.4 years, plus 42,400 restricted stock units, in each case granted under the 2020 Plan or predecessor plans (such predecessor plans, the “Prior Plans”).

The Company currently has the ability under the 2020 Plan to award stock options, restricted stock awards, restricted stock units, stock appreciation rights and other share-based or cash awards. As of March 31, 2022, the 2020 Plan had a total of only 123,944 shares remaining available from the original 350,000 share pool for future awards. Based on the current average annual rate at which the Company has issued stock options and restricted stock units awards to participants under the 2020 Plan, we estimate that the remaining shares available for future awards under the 2020 Plan will be insufficient to support future awards beginning with grants anticipated for 2023. You are being asked to approve the Amended 2020 Plan.

Stockholder approval of the Amended 2020 Plan would primarily make available for awards under the Amended 2020 Plan an additional 300,000 shares of common stock, par value $0.0001 per share, of the Company (“Common Stock”), as described below and in the Amended 2020 Plan, with such amount subject to adjustment, including under the applicable share counting rules. The Board recommends that you vote to approve the Amended 2020 Plan. If the Amended 2020 Plan is approved by stockholders at the Annual Meeting, it will be effective as of the day of the Annual Meeting, and future grants will be made on or after such date under the Amended 2020 Plan’s terms. If the Amended 2020 Plan is not approved by our stockholders, then it will not become effective, no awards will be granted under the Amended 2020 Plan’s terms, and the 2020 Plan will continue in accordance with its terms as previously approved by our stockholders.

The actual text of the Amended 2020 Plan is attached to this Proxy Statement as Appendix A. The following description of the Amended 2020 Plan is only a summary of its principal terms and provisions and is qualified by reference to the actual text as set forth in Appendix A.

Why We Believe You Should Vote for this Proposal

The Compensation Committee and the Board believe that our provision of equity compensation has been a key factor in aligning the interests of our employees, officers and directors with those of our stockholders by providing an incentive for our employees, officers and directors to work to increase stockholder value. Moreover, equity awards have been, and will continue to be, an important factor contributing to our ability to provide incentive-based compensation and compete for and retain talented executives and other personnel. If the Amended 2020 Plan is not approved, we may be compelled to increase significantly the cash component of our employee and director compensation, which approach may not necessarily align employee and director compensation interests with the investment interests of our stockholders. Replacing equity awards with cash also would increase cash compensation expense and use cash that might be better utilized.

In recommending the number of shares to request for approval under the Amended 2020 Plan, the Compensation Committee considered the important role that equity compensation has played over the past several years in providing flexibility in the manner in which employees have been compensated and its ability to incentivize achievement of the Company’s goals. Due to the Company’s cash position, the Company has used its equity award program to attract and retain its executive officers and other employees who have been central to its efforts to restructure the organization to focus on growing its LED lighting products business. Given the management changes that have occurred over the past few years, we anticipate that we will continue to utilize equity awards as a significant element of the compensation packages to our management team.

The Amended 2020 Plan would make an additional 300,000 shares available for new awards. Shares subject to awards that are outstanding under the Prior Plans will not become available for future grants under the Amended 2020 Plan if they are cancelled, forfeited or unearned or expire prior to being exercised and shares that remained available for grant under the Prior Plans as of the effective date of the 2020 Plan did not become part of the pool of shares available under the 2020 Plan.

The Compensation Committee also considered the historical amount of equity awards the Company has granted over the past three completed years. The following table sets forth the number of stock options and time-based restricted shares or units (“RSUs”) granted by the Company in the years ended December 31, 2019, 2020 and 2021. In addition, the table provides the weighted average number of shares of common stock outstanding in the year indicated.

| | | | | | | | | | | | | | | | | | | | |

| Fiscal Year | | Number of Stock Options Granted | | Number of Time-Based Restricted Stock or RSU Awards Granted | | Weighted Average Shares of Common Stock Outstanding |

| | | | | | |

| 2021 | | 88,240 | | | 50,000 | | | 4,561,427 | |

| 2020 | | 112,350 | | | 19,200 | | | 3,270,119 | |

| 2019 | | 137,860 | | | 17,114 | | | 2,461,843 | |

The following includes aggregated information regarding our view of the overhang and dilution associated with the Prior Plans and the 2020 Plan, and the potential dilution associated with the Amended 2020 Plan. This information is as of March 31, 2022. As of that date, there were approximately 6,453,777 shares of Common Stock outstanding:

Common Stock subject to outstanding awards and available for future awards:

•Total shares of Common Stock subject to outstanding awards (stock options and RSUs): 313,909 shares (approximately 4.9% of our outstanding Common Stock); and

•Total shares of Common Stock available for future awards under the 2020 Plan: 123,944 shares (approximately 1.9% of our outstanding Common Stock) (no further grants may be made under the Prior Plans after the effectiveness of the 2020 Plan).

Proposed Common Stock available for awards under the Amended 2020 Plan:

•300,000 additional shares of Common Stock (approximately 4.6% of our outstanding Common Stock, which percentage reflects the simple dilution of our stockholders that would occur if the Amended 2020 Plan is approved), subject to adjustment, including under the share counting rules of the Amended 2020 Plan; and

•The total shares of Common Stock subject to outstanding awards as described above as of March 31, 2022 (313,909 shares), plus the shares of Common Stock available for future awards under the 2020 Plan (123,944 shares), plus the proposed additional shares of Common Stock available for future awards under the Amended 2020 Plan (300,000 shares), represent a total overhang of 737,853 shares (11.4%) regarding the Amended 2020 Plan.

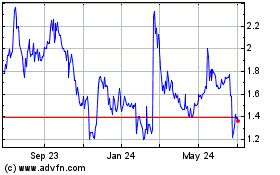

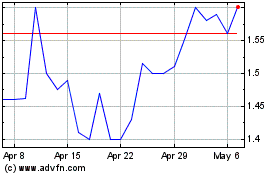

Based on the closing price on the Nasdaq Capital Market for our Common Stock on March 31, 2022 of $1.36 per share, the aggregate market value as of March 31, 2022 of the additional 300,000 shares of Common Stock requested under the Amended 2020 Plan was $408,000.

Our equity grants in fiscal years 2019, 2020, and 2021 are indicated in the table above. Based on our basic weighted average Common Stock outstanding for those three fiscal years, for the three-fiscal-year period 2019-2021, our average burn rate, not taking into account forfeitures, was 4.45% (our individual years’ burn rates were 6.30% for 2019, 4.02% for 2020 and 3.03% for 2021). In determining the number of additional shares to request for approval under the Amended 2020 Plan, our management team evaluated a number of factors, including our recent share usage and criteria expected to be utilized by institutional proxy advisory firms in evaluating our proposal for the Amended 2020 Plan.

If the Amended 2020 Plan is approved, we intend to utilize the shares authorized under the Amended 2020 Plan to continue our practice of incentivizing key individuals through equity grants. If our stockholders approve the Amended 2020 Plan, we believe that, based on our past practices, the shares authorized for issuance under the Amended 2020 Plan will support awards for the next three years. This period is based on our historic grant rates, new hiring and the approximate

current share price, but the shares could last for a different period of time if actual practice does not match recent rates or our share price changes materially. As noted below, our Compensation Committee retains full discretion under the Amended 2020 Plan to determine the number and amount of awards to be granted under the Amended 2020 Plan, subject to the terms of the Amended 2020 Plan. Future benefits that may be received by participants under the Amended 2020 Plan are not determinable at this time. In evaluating this proposal, stockholders should consider all of the information in this proposal and this Proxy Statement.

Overview of the Amended 2020 Plan

The purpose of the Amended 2020 Plan remains to enhance stockholder value by linking the compensation of directors of the Company and officers, other employees and consultants of the Company and its affiliates to the price of our common stock and/or the achievement of other objectives, and to encourage ownership in our common stock by key personnel whose long-term employment is considered essential to our continued progress and success. The Amended 2020 Plan is also intended to continue to assist us in recruiting new directors and employees and to motivate, retain and encourage such directors and employees to act in the stockholders’ interest and share in our success.

The Amended 2020 Plan is an “omnibus” plan that provides for several different kinds of awards, including stock options, stock appreciation rights (“SARs”), stock awards, RSUs and other stock-based awards. The Amended 2020 Plan permits the same types of awards as could be granted under the 2020 Plan.

The following summary of the material terms of the Amended 2020 Plan is qualified in its entirety by reference to the full text of the Amended 2020 Plan, a copy of which is attached as Appendix A to this Proxy Statement.

Material Changes from the 2020 Plan

As an initial matter, the Amended 2020 Plan (1) increases the number of shares of Common Stock available for awards under the 2020 Plan by 300,000 shares, (2) correspondingly increases the limit on shares that may be issued or transferred upon the exercise of incentive stock options granted under the 2020 Plan, during its duration (as described below) by 300,000 shares, and (3) extends the term of the 2020 Plan until the tenth anniversary of the date of stockholder approval of the Amended 2020 Plan. The Amended 2020 Plan also (1) expands the list of qualifying performance criteria for awards to be non-exhaustive, rather than limited to the list of potential metrics contained in the written Amended 2020 Plan document, (2) allows for the Administrator to exercise both positive and negative discretion (as opposed to just negative discretion) with respect to awards earned pursuant to qualifying performance criteria, (3) requires underlying awards to be earned before dividends and dividend equivalents on such awards may be paid (dividends and dividend equivalents are not payable on stock options or SARs) and (4) makes equitable, anti-dilution adjustments with respect to any award terms under Section 15(a) of the Amended 2020 Plan mandatory as determined by the Administrator (as opposed to just permissive).

The Amended 2020 Plan also makes certain other conforming, clarifying or non-substantive changes to the terms of the 2020 Plan to implement and clarify the operation of the Amended 2020 Plan.

Shares Authorized for Issuance under the Amended 2020 Plan; Share Counting Procedure

A maximum of 650,000 shares are proposed to be available for awards under the Amended 2020 Plan (consisting of 350,000 shares that were originally approved by stockholders at the 2020 annual meeting of stockholders, and 300,000 shares that are newly provided for under the Amended 2020 Plan), subject to the share counting rules and the adjustment provisions of the Amended 2020 Plan. Shares (1) delivered (or withheld upon settlement or otherwise used) under the Amended 2020 Plan, in payment of the exercise price of a stock option or in payment of tax withholding obligations with respect to stock options, or SARs, and (2) subject to a SAR under the Amended 2020 Plan that are not issued in connection with a stock settlement on exercise of the SAR, will not be added back to the total shares available under the Amended 2020 Plan. Similarly, shares reacquired by us using cash proceeds from the exercise of stock options under the Amended 2020 Plan will not be added back to the total shares available under the Amended 2020 Plan. The limitation described above with respect to shares delivered, withheld or otherwise used in payment of tax withholding obligations does not apply to shares underlying awards other than stock options and SARs.

The maximum number of shares to be issued or transferred pursuant to incentive stock options (within the meaning of Section 422 of the Internal Revenue of 1986, as amended (the “Code”) that may be granted under the Amended 2020 Plan is 650,000, subject to the adjustment provisions of the Amended 2020 Plan.

Eligible Participants

All of the Company’s directors and officers, as well as other regular, active employees of the Company or any affiliate selected by our Board of Directors or a board committee administering the Amended 2020 Plan, are eligible to receive awards under the Amended 2020 Plan. Consultants who provide bona fide services to us also are eligible to participate in the Amended 2020 Plan, provided that the consultants’ services are not in connection with the offer and sale of our securities in a capital-raising transaction and the consultants do not directly or indirectly promote or maintain a market in our securities. Incentive stock options may only be granted to our employees and employees of our “subsidiaries” (as defined in the Amended 2020 Plan). As of March 31, 2022, there were approximately 53 such employees, and six non-employee directors of the Company that would be eligible to participate in the Amended 2020 Plan. The basis for participation in the Amended 2020 Plan by eligible persons is the selection of such persons for participation by the Board of Directors or committee (or its proper delegate) in its discretion.

Administration

The Amended 2020 Plan will be administered by our Board of Directors or a committee designated by our Board, that satisfies applicable independence requirements of the principal U.S. national securities exchange on which our common stock is traded. It is expected that the Amended 2020 Plan will be administered by our Compensation Committee. The administrator has the authority, among other things, to determine the employees, directors and consultants to whom awards may be granted, determine the number of shares subject to each award, determine the type and the terms of any award to be granted, approve forms of award agreements, interpret the terms of the Amended 2020 Plan and awards granted under the Amended 2020 Plan, adopt rules and regulations relating to the Amended 2020 Plan and amend awards, subject to limitations set forth in the Amended 2020 Plan, including a limitation generally prohibiting an amendment that materially impairs any outstanding award without the written agreement of the participant. The administrator may delegate day-to-day administration of the Amended 2020 Plan to one or more individuals.

To the extent that the administrator determines it desirable for awards granted to officers and directors under the Amended 2020 Plan to qualify for the exemption set forth in Rule 16b-3 (“Rule 16b-3”) under the Exchange Act of 1934, as amended (the “Exchange Act”) such awards may only be made by the entire board or a committee of “non-employee directors,” as defined in Rule 16b-3 (which, if it so qualifies, may be the administrator).

Term

The 2020 Plan became effective on September 17, 2020. The Amended 2020 Plan version will become effective upon approval by the Company’s stockholders (expected to be May 25, 2022), and will terminate ten years after such approval.

Types of Awards

Stock Options and Stock Appreciation Rights

The Amended 2020 Plan authorizes the grant of stock options (which may be either incentive stock options within the meaning of Section 422 of the Code, which are eligible for special tax treatment, or nonqualified stock options) and SARs. The aggregate fair market value of shares, determined as of the date of grant, for which any employee may be granted incentive stock options that are exercisable for the first time in any calendar year may not exceed $100,000. To the extent that an incentive stock option exceeds the $100,000 threshold, or otherwise does not comply with the applicable conditions of Section 422 of the Code, the stock option will be treated as a non-qualified stock option.

The term of a stock option granted under the Amended 2020 Plan cannot be longer than 10 years from the date of grant, and (except with respect to conversion awards as described in the Amended 2020 Plan) the exercise price per share underlying the option may not be less than the fair market value of a share of our common stock on the date of grant. The administrator will determine the acceptable forms of consideration for exercise of the option, which may include cash, check or wire transfer; shares of our common stock held for more than six months; our withholding of shares otherwise issuable upon exercise of the stock option; a broker-assisted sale and remittance program acceptable to the administrator that complies with applicable law; and such other consideration as is permitted by applicable law; or any combination of the foregoing. Re-pricing of options (i.e., reducing the exercise price or cancelling an option in exchange for cash, another award or an option with a lower exercise price) is not permitted under the Amended 2020 Plan without approval of our stockholders.

The 2020 Plan permits the grant of SARs related to a stock option or other award, which is commonly referred to as a “tandem SAR.” A SAR may be granted in tandem with a stock option either at the time of the stock option grant or thereafter during the term of the stock option. The Amended 2020 Plan also permits the grant of SARs separate and apart from the grant of another award, which is commonly referred to as a “freestanding SAR.” Tandem SARs typically may be exercised upon surrender of a related stock option to the extent of an equivalent number of shares of common stock. SARs entitle the grantee, upon exercise of SARs, to receive a payment equal to the excess of the fair market value (on the date of exercise) of the designated number of shares of common stock underlying the SAR over the fair market value of such shares of common stock on the date the SAR was granted or, in the case of a SAR granted in tandem with a stock option, on the date the stock option was granted. Payments by us in respect of a SAR may be made in shares of our common stock, in cash, or partly in cash and partly in shares of common stock, as the administrator may determine. The term of SARs granted under the Amended 2020 Plan cannot be longer than ten years from the date of grant, and otherwise will be subject to the same terms and conditions applicable to stock options.

Stock Awards and Other Stock-Based Awards

Under the Amended 2020 Plan, the administrator may grant participants stock awards, which may involve the award of shares or the award of RSUs representing an amount equivalent in value to the fair market value of a share, payable in cash, property or shares. The administrator may also grant participants any other type of equity-based or equity-related award, including the grant or offer for sale of unrestricted shares of common stock, as well as cash-based bonuses subject to the attainment of one or more of the performance criteria described in the Amended 2020 Plan. Stock awards and other stock-based awards are subject to terms and conditions determined by the administrator and set forth in an award agreement, which may include conditions on vesting, achievement of performance conditions and other provisions consistent with the Amended 2020 Plan as may be determined by the administrator.

Dividends and Dividend Equivalents

The administrator may provide for payment of dividends or dividend equivalents on the shares of common stock subject to an award, other than stock options and SARs, prior to vesting. However, dividends and dividend equivalents will not be paid on any stock award or stock-based award prior to the date the award is earned or vests, and then shall be payable only with respect to the number of shares or stock units actually earned or vested under the award. Dividends or dividend equivalent payments may be paid in cash, shares or stock units, or may be credited to a participant’s account and settled in cash, shares or a combination of cash or shares upon vesting of the underlying award. The administrator may, in its discretion, provide that payment of dividend equivalents is subject to specified conditions and contingencies.

Transferability

Unless determined otherwise by the administrator, awards are not transferable, other than by beneficiary designation, will or the laws of descent and distribution. The administrator may make an award transferable by a participant only if the participant does not receive consideration for the transfer.

Termination of Board Membership or Employment

The administrator may specify the effect of termination of service as a director or termination of employment on an award at the time of grant, subject to the administrator’s right to modify the award terms after the date of grant in accordance with the terms of the Amended 2020 Plan. In the absence of such specification, the following provisions apply.

Stock Options and SARs

• Non-vested stock options held by non-employee directors will be forfeited upon the termination from board membership of the director.

• Vested stock options held by a non-employee director whose membership on the board terminates will remain exercisable for the lesser of one year from the termination or the remaining term of the option.

• Upon termination of an employee or termination from membership on the board by a non-employee director due to death or disability, any unvested stock options will vest, and all stock options held by the employee or non-employee director on the date of such termination will remain exercisable for the lesser of one year after such termination or the remaining term of the stock option.

• Upon termination of employment due to retirement, vested stock options will remain outstanding for the lesser of one year or the remaining term of the stock option.

• Any other termination of employment, other than termination for cause, will result in immediate cancellation of all unvested stock options; vested stock options will remain exercisable for the lesser of 90 days after such termination or the remaining term of the stock option.