UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) August 8, 2014

EBIX, INC.

(Exact name of registrant as specified in its charter)

|

| | | | |

Delaware | | 0-15946 | | 77-0021975 |

(State or other jurisdiction | | (Commission File Number) | | (IRS Employer |

of incorporation) | | | | Identification No.) |

|

| | |

5 Concourse Parkway, Suite 3200, Atlanta, Georgia | | 30328 |

(Address of principal executive offices) | | (Zip Code) |

Registrant's telephone number, including area code (678) 281-2020

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition.

On August 8, 2014, Ebix, Inc. issued a press release announcing its results of operations for its second fiscal quarter ended June 30, 2014. A copy of the related press release is being filed as Exhibit 99.1 to this Form 8-K and is incorporated herein by reference in its entirety.

The information in this Form 8-K and the exhibit attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

Exhibits

99.1 Press release, dated August 8, 2014, issued by Ebix, Inc.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

| EBIX, INC. |

| |

| |

| By: | /s/ Robert Kerris |

| Name: | Robert Kerris |

| Title: | Chief Financial Officer & Corporate Secretary |

| | | |

Dated: August 11, 2014

Ebix Announces SECOND Quarter 2014 Results

| |

• | Quarterly revenue of $51.5 million and operating cash flow of $17.8 million |

ATLANTA, GA - August 8, 2014 - Ebix, Inc. (NASDAQ: EBIX), a leading international supplier of On-Demand software and E-commerce services to the insurance industry, today reported results for the fiscal second quarter ended June 30, 2014.

Ebix delivered the following results for the second quarter of 2014:

Revenues: Total Q2 2014 revenue was $51.5 million, an increase of 1% on a year-over-year basis, as compared to Q2 2013 revenue of $51.0 million and a slight sequential increase over Q1 2014 revenue of $51.4 million.

On a constant currency basis, Ebix Q2 2014 revenue increased year over year to $52.0 million as compared to $51.0 million in Q2 of 2013. Also on a constant currency basis, year to date revenue increased to $105.2 million as compared to $103.6 million during the same period in 2013.

Earnings per Share: Q2 2014 diluted earnings per share of $0.35 were essentially at the same level as in the second quarter of 2013. For purposes of the Q2 2014 EPS calculation, there was an average of 38.7 million diluted shares outstanding during the quarter, as compared to 38.8 million diluted shares outstanding in Q2 2013.

Operating Cash: Cash generated from operations in Q2 2014 was strong at $17.8 million, up 68% year-over-year as compared to $10.6 million in Q2 2013 and 65% higher as compared to $10.8 million from Q1 of 2014. During the six months ended June 30, 2014, the Company generated $28.6 million of net cash flow from operating activities, an increase of 15% as compared to $24.8 million in the first six months of 2013.

Operating Income and Margins: Operating income for Q2 2014 was at $17.5 million as compared to $19.3 million of operating income in Q2 2013. Operating margins, for Q2 2014 were at 34% as compared to 38% for Q2 2013. The operating margins in Q2 2013 were favorably impacted by a $5.8 million reversal of earn out contingent liabilities pertaining to the PlanetSoft acquisition.

Net Income: Q2 2014 net income was $13.6 million, essentially at the same level as compared to Q2 2013 net income of $13.5 million. During the six months ended June 30, 2014, net income decreased $1.9 million or 6%, to $29.0 million compared to $30.9 million during the same period in 2013 primarily because of the onetime PlanetSoft related gains in Q2 of 2013.

Q3 2014 Diluted Share Count: As of today, the Company expects the diluted share count for Q3 2014 to be approximately 38.4 million.

Channel Revenues: The Exchange channel continued to be the largest channel for Ebix accounting for 80% of the Company’s Q2 2014 revenues.

|

| | | | |

(dollar amounts in thousands) | Three Months Ended June 30, | Six Months Ended June 30, |

Channel | 2014 | 2013 | 2014 | 2013 |

Exchanges | $ 41,350 | $ 40,501 | $ 83,455 | $ 82,187 |

Broker Systems | 4,865 | 4,766 | 9,351 | 9,488 |

Risk Compliance Solutions (RCS) | 3,652 | 4,013 | 7,077 | 8,177 |

Carrier Systems | 1,609 | 1,724 | 2,997 | 3,718 |

Total Revenue | $ 51,476 | $ 51,004 | $ 102,880 | $ 103,570 |

The continued strengthening of the US dollar, year over year, as compared to the Australian dollar and the Brazilian real decreased revenue by $0.5 million in Q2 2014 and $2.3 million during the six months ended June 30, 2014 across the Exchange and Broker Systems Channels.

Ebix Chairman, President and CEO Robin Raina said, “Ebix has always been a cash story and towards that extent I am pleased with the operating cash flows of $17.8 million in Q2 of 2014. Ebix has successfully continued to fill in for the large drop in professional services revenues associated with some of our Pharma and PlanetSoft initiatives through increase revenues from other exchange product lines. As we start deploying some of the recently agreed to PlanetSoft projects with three leading carriers in the United States, we would expect our professional services revenues to accordingly start growing again and become a significant contributor to our revenues.”

“We are continuing to pursue a number of deals that can have a meaningful impact on our future revenues. Our sales pipeline is strong and we feel good about the opportunities ahead of us.” Robin said. “Our customer retention rates continue to be strong, and we have not lost any exchange clients who even account for more than 0.2 percent of Ebix revenues.”

Robin added, “The recently announced $150 million credit line provides Ebix with the flexibility to pursue share buybacks and our acquisition strategy. We have consistently proven that we have the ability to make accretive acquisitions with strong cash flows. We are pleased with the support granted by the financial institutions to pursue our acquisition plans.”

“During the second quarter Ebix reduced debt on our revolver and other debt by $17.7 million." said Ebix EVP and CFO Robert Kerris. “We paid $13.1 million in Q2 towards the purchase of office buildings in Atlanta and Noida, targeted at reducing our ongoing rental and infrastructure expenses while providing for future growth. During the quarter we continued to invest in the growth of the business with the purchase of Healthcare Magic for $6 million, and the payment of $2.25 million in earn-out obligations from prior business acquisitions. We also paid $2.9 million in cash dividends to our stockholders. After paying approximately $42 million towards the above, Ebix still had aggregate cash, cash equivalents, and short-term cash deposit investments in the amount of $34.3 million as of June 30, 2014. Operating cash flow for the 2nd quarter was $17.8 million, an increase of $7.0 million from Q1 and $7.2 million from the same period in 2013. This cash performance, in our view speaks to the strength of the Ebix business model.”

About Ebix, Inc.

A leading international supplier of On-Demand software and E-commerce services to the insurance industry, Ebix, Inc., (NASDAQ: EBIX) provides end-to-end solutions ranging from infrastructure exchanges, carrier systems, agency systems and risk compliance solutions to custom software development for all entities involved in the insurance industry.

With 35+ offices across Australia, Brazil, Canada, India, New Zealand, Singapore, the US and the UK, Ebix powers multiple exchanges across the world in the field of life, annuity, health and property & casualty insurance. Through its various SaaS-based software platforms, Ebix employs hundreds of insurance and technology professionals to provide products, support and consultancy to thousands of customers on six continents. For more information, visit the Company’s website at www.ebix.com.

SAFE HARBOR REGARDING FORWARD-LOOKING STATEMENTS

As used herein, the terms “Ebix,” “the Company,” “we,” “our” and “us” refer to Ebix, Inc., a Delaware corporation, and its consolidated subsidiaries as a combined entity, except where it is clear that the terms mean only Ebix, Inc.

The information contained in this Press Release contains forward-looking statements and information within the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934. This information includes assumptions made by, and information currently available to management, including statements regarding future economic performance and financial condition, liquidity and capital resources, acceptance of the Company’s products by the market, and management’s plans and objectives. In addition, certain statements included in this and our future filings with the Securities and Exchange Commission (“SEC”), in press releases, and in oral and written statements made by us or with our approval, which are not statements of historical fact, are forward-looking statements. Words such as “may,” “could,” “should,” “would,” “believe,” “expect,” “anticipate,” “estimate,” “intend,” “seeks,” “plan,” “project,” “continue,” “predict,” “will,” “should,” and other words or expressions of similar meaning are intended by the Company to identify forward-looking statements, although not all forward-looking statements contain these identifying words. These forward-looking statements are found at various places throughout this report and in the documents incorporated herein by reference. These statements are based on our current expectations about future events or results and information that is currently available to us, involve assumptions, risks, and uncertainties, and speak only as of the date on which such statements are made.

Our actual results may differ materially from those expressed or implied in these forward-looking statements. Factors that may cause such a difference, include, but are not limited to those discussed in our Annual Report on Form 10-K and subsequent reports filed with the SEC, as well as: the risk of an unfavorable outcome of the pending governmental investigations or shareholder class action lawsuits, reputational harm caused by such investigations and lawsuits, the willingness of independent insurance agencies to outsource their computer and other processing needs to third parties; pricing and other competitive pressures and the Company’s ability to gain or maintain share of sales as a result of actions by competitors and others; changes in estimates in critical accounting judgments; changes in or failure to comply with laws and regulations, including accounting standards, taxation requirements (including tax rate changes, new tax laws and revised tax interpretations) in domestic or foreign jurisdictions; exchange rate fluctuations and other risks associated with investments and operations in foreign countries (particularly in Australia and India wherein we have significant operations); equity markets, including market disruptions and significant interest rate fluctuations, which may impede our access to, or increase the cost of, external financing; and international conflict, including terrorist acts.

Except as expressly required by the federal securities laws, the Company undertakes no obligation to update any such factors, or to publicly announce the results of, or changes to any of the forward-looking statements contained herein to reflect future events, developments, changed circumstances, or for any other reason.

Readers should carefully review the disclosures and the risk factors described in the documents we file from time to time with the SEC, including future reports on Forms 10-Q and 8-K, and any amendments thereto.

You may obtain our SEC filings at our website, www.ebix.com under the “Investor Information” section, or over the Internet at the SEC’s web site, www.sec.gov.

CONTACT:

Aaron Tikkoo

678 -281-2027 or atikkoo@ebix.com

Ebix, Inc. and Subsidiaries

Condensed Consolidated Statements of Income

(In thousands, except per share data)

(Unaudited)

|

| | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 30, | | June 30 |

| 2014 | | 2013 | | 2014 | | | 2013 | |

Operating revenue | $ | 51,476 | | | $ | 51,004 | | | $ | 102,880 | | | $ | 103,570 | |

| | | | | | | | | | | |

Operating expenses: | | | | | | | | | | | |

Cost of services provided | 9,964 | | | 10,358 | | | 19,576 | | | 20,249 | |

Product development | 6,758 | | | 6,724 | | | 13,451 | | | 13,759 | |

Sales and marketing | 3,784 | | | 3,827 | | | 7,085 | | | 7,739 | |

General and administrative, net | 11,068 | | | 8,253 | | | 20,909 | | | 18,224 | |

Amortization and depreciation | 2,441 | | | 2,548 | | | 4,993 | | | 5,000 | |

Total operating expenses | 34,015 | | | 31,710 | | | 66,014 | | | 64,971 | |

| | | | | | | | | | | |

Operating income | 17,461 | | | 19,294 | | | 36,866 | | | 38,599 | |

Interest income | 130 | | | 91 | | | 265 | | | 184 | |

Interest expense | -211 | | | -281 | | | -458 | | | -643 | |

Non-operating (loss)/income - put options | -139 | | | -1,425 | | | 315 | | | -1,343 | |

Foreign currency exchange loss | -336 | | | -123 | | | -455 | | | -293 | |

Income before income taxes | 16,905 | | | 17,556 | | | 36,533 | | | 36,504 | |

Income tax expense | -3,326 | | | -4,014 | | | -7,537 | | | -5,618 | |

Net income | $ | 13,579 | | | $ | 13,542 | | | $ | 28,996 | | | $ | 30,886 | |

| | | | | | | | | | | |

Basic earnings per common share | $ | 0.35 | | | $ | 0.36 | | | $ | 0.76 | | | $ | 0.83 | |

| | | | | | | | | | | |

Diluted earnings per common share | $ | 0.35 | | | $ | 0.35 | | | $ | 0.75 | | | $ | 0.80 | |

| | | | | | | | | | | |

Basic weighted average shares outstanding | 38,427 | | | 37,210 | | | 38,373 | | | 37,189 | |

| | | | | | | | | | | |

Diluted weighted average shares outstanding | 38,647 | | | 38,789 | | | 38,624 | | | 38,784 | |

Ebix, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

(In thousands, except share amounts)

|

| | | | | | | |

| June 30, 2014 | | December 31, 2013 |

ASSETS | (Unaudited) | | | |

Current assets: | | | | | |

Cash and cash equivalents | $ | 32,903 | | | $ | 56,674 | |

Short-term investments | 1,427 | | | 801 | |

Trade accounts receivable, less allowances of $1,450 and $1,049, respectively | 40,416 | | | 39,070 | |

Deferred tax asset, net | 1,400 | | | 256 | |

Other current assets | 4,951 | | | 5,548 | |

Total current assets | 81,097 | | | 102,349 | |

| | | | | |

Property and equipment, net | 21,148 | | | 8,528 | |

Goodwill | 352,833 | | | 337,068 | |

Intangibles, net | 49,091 | | | 50,734 | |

Indefinite-lived intangibles | 30,887 | | | 30,887 | |

Deferred tax asset, net | 14,880 | | | 12,194 | |

Other assets | 1,518 | | | 3,682 | |

Total assets | $ | 551,454 | | | $ | 545,442 | |

| | | | | |

LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | |

Current liabilities: | | | | | |

Accounts payable and accrued liabilities | $ | 16,258 | | | $ | 17,818 | |

Accrued payroll and related benefits | 5,410 | | | 6,482 | |

Short term debt | 18,750 | | | 13,062 | |

Revolving line of credit | 7,840 | | | 0 | |

Current portion of long term debt and capital lease obligations, net of discount of $10 and $10, respectively | 761 | | | 827 | |

Current deferred rent | 246 | | | 254 | |

Contingent liability for accrued earn-out acquisition consideration | 137 | | | 4,137 | |

Liability - securities litigation settlement | 0 | | | 4,226 | |

Put option liability | 530 | | | 845 | |

Deferred revenue | 18,494 | | | 18,918 | |

Other current liabilities | 89 | | | 106 | |

Total current liabilities | 68,515 | | | 66,675 | |

| | | | | |

Revolving line of credit | 0 | | | 22,840 | |

Long term debt and capital lease obligations, less current portion, net of discount of $10 and $38, respectively | 9,284 | | | 20,124 | |

Other liabilities | 11,031 | | | 4,719 | |

Contingent liability for accrued earn-out acquisition consideration | 17,072 | | | 10,283 | |

Deferred revenue | 148 | | | 391 | |

Long term deferred rent | 1,971 | | | 2,185 | |

Total liabilities | 108,021 | | | 127,217 | |

| | | | | |

| | | | | |

Temporary equity | 5,000 | | | 5,000 | |

| | | | | |

Stockholders’ equity: | | | | | |

Preferred stock, $0.10 par value, 500,000 shares authorized, no shares issued and outstanding at June 30, 2014 and December 31, 2013 | 0 | | | 0 | |

|

| | | | | | | |

Common stock, $0.10 par value, 60,000,000 shares authorized, 38,435,320 issued and 38,394,811 outstanding at June 30, 2014 and 38,088,391 issued and 38,047,882 outstanding at December 31, 2013 | 3,839 | | | 3,805 | |

Additional paid-in capital | 163,588 | | | 164,216 | |

Treasury stock (40,509 shares as of June 30, 2014 and December 31, 2013) | -76 | | | -76 | |

Retained earnings | 280,777 | | | 257,574 | |

Accumulated other comprehensive loss | -9,695 | | | -12,294 | |

Total stockholders’ equity | 438,433 | | | 413,225 | |

Total liabilities and stockholders’ equity | $ | 551,454 | | | $ | 545,442 | |

Ebix, Inc. and Subsidiaries

Condensed Consolidated Statements of Cash Flows (In thousands) (Unaudited) |

| | | | | | | |

| Six Months Ended |

| June 30, |

| 2014 | | 2013 |

Cash flows from operating activities: | | | | | |

Net income | $ | 28,996 | | | $ | 30,886 | |

Adjustments to reconcile net income to net cash provided by operating activities: | | | | | |

Depreciation and amortization | 4,993 | | | 5,000 | |

Provision (benefit) for deferred taxes | -1,668 | | | -14,119 | |

Share based compensation | 882 | | | 996 | |

Provision for doubtful accounts | 748 | | | 527 | |

Debt discount amortization on promissory note payable | 18 | | | 23 | |

Unrealized foreign exchange (gain) loss | 517 | | | 339 | |

(Gain) loss on put option | -315 | | | 1,344 | |

Reduction of acquisition earnout accruals | -1,762 | | | -6,114 | |

Changes in assets and liabilities, net of effects from acquisitions: | | | | | |

Accounts receivable | -2,992 | | | -2,101 | |

Other assets | 917 | | | 182 | |

Accounts payable and accrued expenses | -1,914 | | | 7,303 | |

Accrued payroll and related benefits | 2,007 | | | 1,296 | |

Deferred revenue | -1,128 | | | -3,051 | |

Deferred rent | -195 | | | 11 | |

Reserve for potential uncertain income tax return positions | 3,866 | | | 2,349 | |

Liability - securities litigation settlement payment | -4,218 | | | 0 | |

Other liabilities | -128 | | | -32 | |

Net cash provided by operating activities | 28,624 | | | 24,839 | |

| | | | | |

Cash flows from investing activities: | | | | | |

Acquisition of Qatarlyst, net of cash acquired | 0 | | | -4,740 | |

Acquisition of Healthcare Magic, net of cash acquired | -5,856 | | | 0 | |

Acquisition of CurePet, Inc., net of cash acquired | 3 | | | 0 | |

Payment of acquisition earn-out contingency, Taimma | -2,250 | | | -2,250 | |

Payment of acquisition earn-out contingency, USIX | 0 | | | -727 | |

Maturities of marketable securities | 0 | | | 225 | |

Purchases of marketable securities | -567 | | | 0 | |

Capital expenditures | -13,852 | | | -652 | |

Net cash used in investing activities | -22,522 | | | -8,144 | |

| | | | | |

Cash flows from financing activities: | | | | | |

Repayments on revolving line of credit | -15,000 | | | -5,000 | |

Principal payments of term loan obligation | -4,813 | | | -4,125 | |

Repurchases of common stock | -2,234 | | | -2,492 | |

Excess tax benefit from share-based compensation | -3,200 | | | 0 | |

Proceeds from the exercise of stock options | 788 | | | 662 | |

Forfeiture of certain shares to satisfy exercise costs and the recipients income tax obligations related to stock options exercised and restricted stock vested | -30 | | | -728 | |

Dividend payments | -5,793 | | | -2,794 | |

Principal payments of debt obligations | -321 | | | -624 | |

Payments of capital lease obligations | -103 | | | -155 | |

Net cash used in financing activities | -30,706 | | | -15,256 | |

Effect of foreign exchange rates on cash | 833 | | | -2,494 | |

Net change in cash and cash equivalents | -23,771 | | | -1,055 | |

Cash and cash equivalents at the beginning of the period | 56,674 | | | 36,449 | |

Cash and cash equivalents at the end of the period | $ | 32,903 | | | $ | 35,394 | |

Supplemental disclosures of cash flow information: | | | | | |

Interest paid | $ | 436 | | | $ | 635 | |

Income taxes paid | $ | 6,774 | | | $ | 11,830 | |

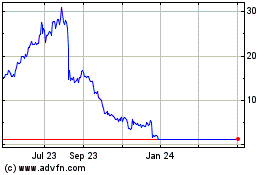

Ebix (NASDAQ:EBIX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ebix (NASDAQ:EBIX)

Historical Stock Chart

From Apr 2023 to Apr 2024