|

PROSPECTUS SUPPLEMENT

(to the Prospectus dated August 3, 2016)

|

Filed pursuant to Rule 424(b)(5)

Registration Statement No. 333-212644

4,855,341 Shares of Common Stock

Pre-Funded Warrants to Purchase 7,175,525

shares of Common Stock

We are offering 4,855,341 shares of

our common stock, par value $0.0001 per share, pursuant to this prospectus supplement and the accompanying prospectus.

We

are also offering to certain purchasers whose purchase of shares of common stock in this offering would otherwise result in such

purchasers, together with any group that the holder is a member, beneficially owning more than 4.99% (or, at the election of the

purchaser, 9.99%) of our outstanding common stock immediately following this offering, pre-funded warrants to purchase 7,175,525

shares of common stock in lieu of shares of common stock that would otherwise result in such purchasers’ beneficial ownership

exceeding 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock

. The purchase price of each

pre-funded warrant will equal the price per share in this offering, minus $0.0001, and the exercise price of each pre-funded warrant

will equal $0.0001 per share. This offering also relates to the shares of common stock issuable upon exercise of the pre-funded

warrants sold in this offering.

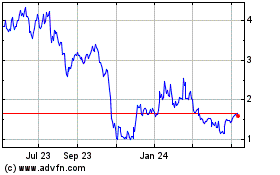

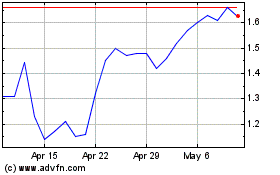

Our common stock is listed on The Nasdaq

Capital Market, or Nasdaq, under the symbol “DRIO.” On May 20, 2019, the last reported sale price for our common

stock was $0.73 per share. The aggregate market value of our outstanding common equity held by non-affiliates on May 20,

2019 was approximately $27.7 million based on 38,004,045 shares of outstanding common stock, of which 31,458,853 shares were held

by non-affiliates, and a per share price of $0.88, the price at which shares of our common stock were last sold on May 7, 2019.

During the twelve calendar months prior to and including the date hereof, we have not offered any securities pursuant to General

Instruction I.B.6. of Form S-3.

Our business and an investment in our

securities involve significant risks. See “Risk Factors” beginning on page S-6 of this prospectus supplement and on

page 1 of the accompanying prospectus.

Neither the Securities and Exchange

Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

|

|

|

Price

Per Share

|

|

|

Price Per Pre-

Funded

Warrant

|

|

|

Total

|

|

|

Public offering price

|

|

$

|

0.60

|

|

|

$

|

0.5999

|

|

|

$

|

7,217,802

|

|

|

Underwriting discounts and commissions

(1)

|

|

$

|

0.036

|

|

|

$

|

0.035994

|

|

|

$

|

433,068

|

|

|

Proceeds, before expenses, to us

|

|

$

|

0.564

|

|

|

$

|

0.563906

|

|

|

$

|

6,784,734

|

|

(1) The underwriter shall receive an underwriting

discount of 6% of the aggregate gross proceeds hereunder. See “Underwriting” for additional information regarding

underwriting compensation.

There is no established public trading

market for the pre-funded warrants and we do not expect a market to develop. In addition, we do not intend to list the pre-funded

warrants on Nasdaq, any other national securities exchange or any other nationally recognized trading system.

The underwriter expects to deliver the securities against payment

therefore on or about May 24

,

2019.

Craig-Hallum

Capital Group

May 22, 2019

TABLE OF CONTENTS

Prospectus Supplement

Prospectus

ABOUT

THIS PROSPECTUS SUPPLEMENT

This prospectus supplement and the accompanying

prospectus are part of a “shelf” registration statement on Form S-3 (File No. 333-212644) that we initially filed

with the Securities and Exchange Commission, or the SEC, on July 22, 2016 and was declared effective on August 3, 2016. Under

this shelf registration process, we may, from time to time, sell any combination of the securities described in the accompanying

prospectus in one or more offerings up to a total dollar amount of $40,000,000. To date, we have sold $4,495,000 of

our securities under the foregoing shelf registration.

This document is in two parts. The first

part is this prospectus supplement, which describes the specific terms of this offering and also adds to and updates information

contained in the accompanying prospectus and the documents incorporated by reference into this prospectus supplement and the accompanying

prospectus. The second part is the accompanying prospectus, which gives more general information about the shares of our common

stock and other securities we may offer from time to time under our shelf registration statement, some of which does not apply

to the common stock offered by this prospectus supplement.

Generally, when we refer to this prospectus

supplement, we are referring to both parts of this document combined together with all documents incorporated by reference. To

the extent there is a conflict between the information contained in this prospectus supplement, on the one hand, and the information

contained in the accompanying prospectus or any document incorporated by reference therein, on the other hand, you should rely

on the information in this prospectus supplement.

You should read this prospectus supplement,

the accompanying prospectus and the documents incorporated by reference in this prospectus supplement and the accompanying prospectus

before making an investment decision. You should also read and consider the information in the documents referred to in the sections

of this prospectus supplement entitled “Where You Can Find More Information” and “Incorporation of Certain Documents

by Reference.”

You should rely only on the information

contained in or incorporated by reference into this prospectus supplement or contained in or incorporated by reference into the

accompanying prospectus to which we have referred you. We have not authorized anyone to provide you with information that is different.

If anyone provides you with different or inconsistent information, you should not rely on it. The information contained in, or

incorporated by reference into, this prospectus supplement and contained in, or incorporated by reference into, the accompanying

prospectus is accurate only as of the respective dates thereof, regardless of the time of delivery of this prospectus supplement

and the accompanying prospectus or of any sale of securities.

We are offering to sell, and are seeking

offers to buy, our securities only in jurisdictions where such offers and sales are permitted. The distribution of this prospectus

supplement and the accompanying prospectus and the offering of our securities in certain states or jurisdictions or to certain

persons within such states and jurisdictions may be restricted by law. Persons outside the United States who come into possession

of this prospectus supplement and the accompanying prospectus must inform themselves about and observe any restrictions relating

to the offering of our securities and the distribution of this prospectus supplement and the accompanying prospectus outside the

United States. This prospectus supplement and the accompanying prospectus do not constitute, and may not be used in connection

with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this prospectus supplement and the accompanying

prospectus by any person in any state or jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

As used in this prospectus supplement, the terms the “Company”,

“we”, “us” and “our” mean DarioHealth Corp. unless otherwise indicated.

All dollar amounts refer to U.S. dollars unless otherwise indicated.

CAUTIONARY STATEMENT

REGARDING FORWARD-LOOKING STATEMENTS

This prospectus

supplement, the accompanying prospectus and the documents we incorporate by reference herein and therein contain forward-looking

statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other federal securities laws regarding

our business, financial condition, expenditures, results of operations and prospects. Words such as “expects,” “anticipates,”

“intends,” “plans,” “planned expenditures,” “believes,” “seeks,” “estimates”,

“may”, “will”, “should” or the negative thereof or other similar expressions or variations

of such words are intended to identify forward-looking statements, but are not deemed to represent an all-inclusive means of identifying

forward-looking statements as denoted in this prospectus supplement, the accompanying prospectus and the documents we incorporate

by reference herein and therein. Additionally, statements concerning future matters are forward-looking statements.

Although forward-looking

statements in this prospectus supplement, the accompanying prospectus and the documents we incorporate by reference herein and

therein reflect the good faith judgment of our management, such statements can only be based on facts and factors known by us

as of such date. Consequently, forward-looking statements are inherently subject to risks and uncertainties and actual results

and outcomes may differ materially from the results and outcomes discussed in or anticipated by the forward-looking statements.

Factors that could cause or contribute to such differences in results and outcomes include, without limitation, those specifically

addressed under the heading

“Risk Factors”

in this prospectus supplement, the accompanying prospectus and the

documents we incorporate by reference herein and therein, as well as those discussed elsewhere in this prospectus supplement and

the accompanying prospectus. Readers are urged not to place undue reliance on these forward-looking statements, which speak only

as of the date of this prospectus supplement, the accompanying prospectus or the respective documents incorporated by reference

herein or therein, as applicable. Except as required by law, we undertake no obligation to revise or update any forward-looking

statements in order to reflect any event or circumstance that may arise after the date of such forward-looking statements. Readers

are urged to carefully review and consider the various disclosures made throughout the entirety of this prospectus supplement,

the accompanying prospectus and the documents incorporated by reference herein and therein, which attempt to advise interested

parties of the risks and factors that may affect our business, financial condition, results of operations and prospects.

PROSPECTUS SUPPLEMENT

SUMMARY

This summary contains basic information

about us and this offering. Because it is a summary, it does not contain all of the information that you should consider before

investing. Before you decide to invest in our securities, you should read this entire prospectus supplement and the accompanying

prospectus carefully, including the sections entitled “Risk Factors,” and our consolidated financial statements and

the related notes and other documents incorporated by reference herein and in the accompanying prospectus.

OUR COMPANY

We are a global Digital Therapeutics (DTx)

company intending to revolutionize the way people manage their health across the chronic condition spectrum. By delivering evidence-based

interventions that are driven by data, high quality software and coaching, we developed a novel approach that empowers individuals

to adjust their lifestyle in a personalized way. Our cross-functional team operates at the intersection of biology, behavioral

science and software technology to deliver highly engaging therapeutic interventions. Our existing Dario

TM

product

is already the highest rated diabetes solution by tens of thousands of consumers who report that they love our user-centered approach.

DarioHealth is rapidly moving into new chronic conditions and geographic markets.

Our flagship product, Dario

TM

,

which we also refer to as our Dario Smart Diabetes Management Solution, is a mobile, real-time, cloud-based, diabetes management

solution based on an innovative, multi-feature software application to track and monitor all facets of diabetes, combined with

a stylish, ‘all-in-one’, pocket-sized, blood glucose monitoring device, which we call the Dario Blood Glucose Monitoring

System, that essentially turns a smartphone into a glucometer. In addition, our future product offerings will focus on the newly

launched DarioEngage software platform, where we, or any care giver, can digitally engage with Dario users, assist them in monitoring

their chronic conditions and provide them with coaching, support, digital communications, and real-time alerts, trends and pattern

analysis. The DarioEngage platform can be leveraged by our potential partners, such as clinics, health care service providers,

employers, and payers for scalable monitoring of people with diabetes in a cost-effective manner, which we expect will open for

us additional revenue streams. Finally, we intend to utilize the data we obtain from our Dario Smart Diabetes Management Solution

and the DarioEngage platform to develop our upcoming healthcare analytics program, Dario Intelligence, which will provide our

users with evidence-based therapeutic intervention to assist them and enhance their diabetes management skills. As such, our solutions

will span the full spectrum of disease monitoring, real-time response, user-centric engagement, motivational tools, nutritional

data and content, coaching tools, and big data and intelligence solutions. We have obtained regulatory clearance or approval for

the Dario Blood Glucose Monitoring System in the U.S., Canada, the E.U., Israel and Australia. We believe that our targeted health

platform is a highly personalized preventative and proactive approach to health improvement based on individual behavior and treatment,

that provides care independent of a user’s schedule and in their private environment, tailored to each person’s unique

profile.

Our Corporate Information

Our address is 8 HaTokhen Street, Caesarea

Industrial Park, 3088900, Israel and our telephone number is +(972)-(4) 770 4055. Our corporate website is: www.mydario.com. The

content of our website shall not be deemed incorporated by reference in this prospectus.

THE OFFERING

|

Common stock offered by us

|

|

4,855,341 shares of common stock

|

|

|

|

|

|

Offering price of common stock

|

|

$0.60 per share.

|

|

|

|

|

|

Pre-funded warrants offered by us

|

|

We are also offering to certain purchasers pre-funded warrants to

purchase up to 7,175,525 shares of common stock, in lieu of purchasing shares of common stock.

The purchase price of each pre-funded warrants will equal the price per share in this offering,

minus $0.0001, and the exercise price of each pre-funded warrants will be $0.0001 per share.

Each pre-funded warrant will be exercisable immediately upon issuance and may be exercised

at any time until all of the pre-funded warrants are exercised in full. A holder will not

have the right to exercise any portion of the pre-funded warrants if the holder (together

with any group that the holder is a member) would beneficially own in excess of 4.99% (or,

at the election of the purchaser, 9.99%), of the number of shares of our common stock outstanding

immediately after giving effect to the exercise, as such percentage ownership is determined

in accordance with the terms of the pre-funded warrants. This prospectus supplement also relates

to the offering of the shares of common stock issuable upon exercise of such pre-funded warrants.

See “Description of Securities We are Offering—Pre-Funded Warrants” for

a discussion on the terms of the pre-funded warrants.

|

|

|

|

|

|

Offering price of pre-funded warrants

|

|

$0.5999 per pre-funded warrant.

|

|

|

|

|

|

Common stock outstanding after this offering

|

|

50,034,911

shares

of common stock (assuming the exercise in full of the pre-funded warrants and the issuance

in full of the shares of common stock underlying the pre-funded warrants).

|

|

|

|

|

|

Use of proceeds

|

|

We intend to use the net proceeds from this offering for commercialization

efforts of our products, such as increased marketing or production expenses, and for general

working capital purposes. See “Use of Proceeds” on page S-9 for more information.

|

|

|

|

|

|

Risk factors

|

|

See “Risk Factors” beginning on page S-6 of this prospectus

supplement and other information included or incorporated by reference into this prospectus

supplement and the accompanying prospectus for a discussion of factors you should carefully

consider before deciding to purchase our securities.

|

|

Nasdaq symbol

|

|

DRIO. The pre-funded warrants will not be listed

for trading on any national securities exchange.

|

Unless we indicate

otherwise, all information in this prospectus supplement is based on 38,004,045 shares of common stock outstanding as of May 20,

2019, and excludes:

|

|

·

|

2,351,794 shares of our common

stock issuable upon exercise of outstanding stock options under our Amended and Restated 2012 Equity Incentive Plan at

a weighted average exercise price of $4.32 per share, with 770,951 shares of common stock remaining available for future

grant under such plan as of May 20, 2019, and 58,322 shares of our common stock issuable upon exercise of outstanding

non-plan stock options at a weighted average exercise price of $39.27 per share;

|

|

|

·

|

18,168,645 shares of our common stock

issuable upon exercise of outstanding warrants at a weighted average exercise price of $1.67 per share as of May 20, 2019; and

|

|

|

·

|

7,175,525

shares

of our common stock issuable upon exercise of the pre-funded warrants sold in this offering.

|

RISK

FACTORS

An investment in our securities involves

significant risks. You should carefully consider the risk factors contained in this prospectus supplement, the accompanying prospectus

and in the documents incorporated by reference herein and therein, including our Annual Report on Form 10-K for the fiscal year

ended December 31, 2018, or Annual Report, as well as all of the information contained below and elsewhere in this prospectus

supplement, the accompanying prospectus and the documents incorporated by reference herein or therein, before you decide to invest

in our securities. Our business, prospects, financial condition and results of operations may be materially and adversely affected

as a result of any of such risks. The value of our common stock could decline as a result of any of these risks. You could lose

all or part of your investment in our securities. Some of our statements in sections entitled

“Risk Factors”

are

forward-looking statements. The risks and uncertainties we have described are not the only ones we face. Additional risks and

uncertainties not presently known to us or that we currently deem immaterial may also affect our business, prospects, financial

condition and results of operations.

Risks Related to this Offering

You will experience immediate and

substantial dilution in the net tangible book value per share of the common stock you purchase.

Since the price per share of our common

stock being offered is higher than the net tangible book value per share of our common stock, you will suffer substantial dilution

in the net tangible book value of the common stock you purchase in this offering. Based on the public offering price of $0.60

per share (or share equivalent), and after deducting the underwriting discount and estimated offering expenses payable by us,

if you purchase shares of common stock or pre-funded warrants in this offering, you will suffer immediate and substantial dilution

of $0.39 per share in the net tangible book value of the common stock (assuming the exercise of the pre-funded warrants

offered hereby).

Furthermore, if outstanding options or warrants are exercised, you could

experience further dilution.

See the section entitled “Dilution” on page S-12 in this prospectus supplement

for a more detailed discussion of the dilution you will incur if you purchase securities in this offering.

Our management has significant flexibility

in using the net proceeds of this offering.

We intend to use the net proceeds from

this offering for commercialization efforts of our products, such as increased marketing or production expenses, and for general

working capital purposes. Our management will have significant flexibility in applying the net proceeds of this offering. The

actual amounts and timing of expenditures will vary significantly depending on a number of factors, including the amount of cash

used in our operations and our research and development efforts. Management’s failure to use these funds effectively

would have an adverse effect on the value of our common stock and could make it more difficult and costly to raise funds in the

future.

We may need additional financing

in the future. We may be unable to obtain additional financing or if we obtain financing it may not be on terms favorable to us.

You may lose your entire investment.

Based on our current plans, we believe

our existing cash and cash equivalents, along with cash generated from this offering, will be sufficient to fund our operating

expense and capital requirements for at least 12 months from the date hereof, although there is no assurance of this, and we may

need funds in the future. If we are unable to obtain additional funds on terms favorable to us, we may be required to cease or

reduce our operating activities. If we must cease or reduce our operating activities, you may lose your entire investment.

There is no public market for the

pre-funded warrants being offered in this offering.

There

is no established public trading market for the pre-funded warrants being offered in this offering, and we do not expect a market

to develop. In addition, we do not intend to apply to list the pre-funded warrants on any securities exchange or nationally recognized

trading system, including Nasdaq. Without an active market, the liquidity of the pre-funded warrants will be limited.

Holders

of pre-funded warrants purchased in this offering will have no rights as holders of common stock until such holders exercise their

pre-funded warrants and acquire our common stock, except as set forth in the pre-funded warrants.

Until holders

of pre-funded warrants acquire shares of our common stock upon exercise of the pre-funded warrants, holders of pre-funded warrants

will have no rights with respect to the shares of our common stock underlying such pre-funded warrants, except as set forth in

the pre-funded warrants. Upon exercise of the pre-funded warrants, the holders will be entitled to exercise the rights of a holder

of common stock only as to matters for which the record date occurs after the exercise date.

Our share price may be volatile.

The market price of our common stock has

fluctuated in the past. Consequently, the current market price of our common stock may not be indicative of future market prices,

and we may be unable to sustain or increase the value of an investment in our common stock.

We do not anticipate paying any

dividends.

No dividends have been paid on our common

stock. We do not intend to pay cash dividends on our common stock in the foreseeable future, and anticipate that profits, if any,

received from operations will be reinvested in our business. Any decision to pay dividends will depend upon our financial condition,

operating results, and current and anticipated cash needs.

Our actual financial results may

differ materially from any guidance we may publish from time to time.

We have in the past and may, from time

to time, voluntarily publish guidance regarding our future performance that represents our management’s estimates as of

the date of relevant release. Any such guidance is based upon a number of assumptions and estimates that, while presented with

numerical specificity, is inherently subject to significant business, economic and competitive uncertainties and contingencies,

many of which are beyond our control and are based upon specific assumptions with respect to future business decisions, some of

which will change. Guidance is necessarily speculative in nature, and it can be expected that some or all of the assumptions of

the guidance furnished by us will not materialize or will vary significantly from actual results. Further, our sales during any

given year may be unevenly distributed as individual orders tend to close in greater numbers immediately prior to the relevant

year end. Our revenues from individual customers may also fluctuate from time to time based on the timing and the terms under

which further orders are received and the duration of the delivery and implementation of such orders. Therefore, if our projected

sales do not close before the end of the relevant year, our actual results may be inconsistent with our published guidance. Accordingly,

our guidance is only an estimate of what management believes is realizable as of the date of release. Actual results may vary

from the guidance and the variations may be material. Investors should also recognize that the reliability of any forecasted financial

data diminishes the farther in the future that the data is forecast. In light of the foregoing, investors are urged to consider

any guidance we may publish in context and not to place undue reliance on it.

Our common stock may be involuntarily

delisted from trading on Nasdaq if we fail to comply with the continued listing requirements. A delisting of our common stock

is likely to reduce the liquidity of our common stock and may inhibit or preclude our ability to raise additional financing.

We are required to comply with certain

Nasdaq continued listing requirements, including a series of financial tests relating to shareholder equity, market value of listed

securities and number of market makers and shareholders. If we fail to maintain compliance with any of those requirements, our

common shares could be delisted from Nasdaq.

We are currently not in compliance with

the quantitative listing standards of Nasdaq, which require, among other things, that listed companies maintain a minimum closing

bid price of $1.00 per share. We failed to satisfy this threshold for 30 consecutive trading days and on December 28, 2018 we

received a letter from Nasdaq indicating that we have been provided a period of 180 calendar days in which to regain compliance.

In the event that Nasdaq does not grant us an additional compliance period or we fail to regain compliance by the end of such

additional compliance period, our board of directors will weigh the available alternatives to regain compliance. However, there

can be no assurance that we will be able to successfully resolve such noncompliance.

If, for any reason, Nasdaq should delist

our common stock from trading on its exchange and we are unable to obtain listing on another national securities exchange or take

action to restore our compliance with the Nasdaq continued listing requirements, a reduction in some or all of the following may

occur, each of which could have a material adverse effect on our stockholders:

|

|

·

|

the

liquidity of our common stock;

|

|

|

·

|

the

market price of our common stock;

|

|

|

·

|

we

will become a “penny stock”, which will make trading of our common stock

much more difficult;

|

|

|

·

|

our

ability to obtain financing for the continuation of our operations;

|

|

|

·

|

the number

of institutional and general investors that will consider investing in our common stock;

|

|

|

·

|

the number

of investors in general that will consider investing in our common stock;

|

|

|

·

|

the number

of market makers in our common stock;

|

|

|

·

|

the availability

of information concerning the trading prices and volume of our common stock; and

|

|

|

·

|

the number

of broker-dealers willing to execute trades in shares of our common stock.

|

USE

OF PROCEEDS

We estimate that our net proceeds from

the sale of the securities offered pursuant to this prospectus supplement will be approximately $6.5 million

,

based upon the public offering price of $

0.60

per share (or share equivalent) and

after deducting underwriting discount and the estimated offering expenses that are payable by us.

We intend to use the net proceeds from

this offering for commercialization efforts for our products, such as increased marketing or production expenses, and for general

working capital purposes.

We have not yet determined the amount

of net proceeds to be used specifically for any of the foregoing purposes. Accordingly, our management will have significant discretion

and flexibility in applying the net proceeds from this offering.

DIVIDEND POLICY

We have never declared or paid cash dividends

on our common stock. We currently intend to retain our future earnings, if any, for use in our business and therefore do not anticipate

paying cash dividends in the foreseeable future. Payment of future dividends, if any, will be at the discretion of our Board of

Directors after taking into account various factors, including our financial condition, operating results, and current and anticipated

cash needs.

CAPITALIZATION

The following

table sets forth our capitalization as of March 31, 2019:

|

|

·

|

on

an actual basis; and

|

|

|

·

|

on

an as adjusted basis to give effect to our sale in this offering of 4,855,341 shares

of common stock and pre-funded warrants to purchase up to 7,175,525 shares of common

stock, assuming the exercise of all of the pre-funded warrants, at a public offering

price of $0.60 per share (or share equivalent), after deducting placement agent fees

and estimated offering expenses payable by us.

|

You should read

this table together with the information contained in this prospectus supplement and the accompanying prospectus and the information

incorporated by reference from our Quarterly Report on Form 10-Q for the quarter ended March 31, 2019 and our Annual Report on

Form 10-K for the year ended December 31, 2018, including the historical financial statements and related notes included in each

of those reports.

|

|

|

As of March

31, 2019

|

|

|

|

|

(Actual)

|

|

|

(As

Adjusted)

|

|

|

|

|

U.S. dollars in thousands

(unaudited)

|

|

|

Stockholders’ equity:

|

|

|

|

|

|

|

|

|

Common Stock of $0.0001 par

value –

Authorized: 160,000,000 shares at March 31, 2019 (unaudited) and December 31, 2018; Issued and Outstanding:

36,821,173 and 36,607,755 shares at March 31, 2019 (unaudited) and December 31, 2018, respectively

|

|

$

|

8

|

|

|

$

|

8

|

|

Preferred Stock of $0.0001 par value -

Authorized: 5,000,000

shares at March 31, 2019 (unaudited) and December 31, 2018; Issued and Outstanding: None at March 31, 2019 (unaudited) and

December 31, 2018

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional paid-in capital (through March 31, 2019)

|

|

|

98,487

|

|

|

|

105,047

|

|

|

Accumulated deficit (through March 31, 2019)

|

|

|

(94,630

|

)

|

|

|

(94,630

|

)

|

|

Total stockholders’ equity

|

|

$

|

3,865

|

|

|

$

|

10,425

|

|

The above discussion and table are

based on

36,821,173

shares of common stock outstanding as of March 31, 2019 and excludes

the following:

|

|

·

|

2,351,794

shares of our common stock issuable upon exercise of outstanding stock options under

our Amended and Restated 2012 Equity Incentive Plan at a weighted average exercise price

of $4.32 per share, with 770,951 shares of common stock remaining available for future

grant under such plan as of May 20, 2019, and 58,322 shares of our common stock issuable

upon exercise of outstanding non-plan stock options at a weighted average exercise price

of $39.27 per share; and

|

|

|

·

|

18,168,645

shares of our common stock issuable upon exercise of outstanding warrants at a weighted

average exercise price of $1.67 per share as of May 20, 2019.

|

DILUTION

Purchasers of the securities offered by

this prospectus supplement and the accompanying prospectus will suffer immediate and substantial dilution in the net tangible

book value per share of common stock. Our net tangible book value as of March 31, 2019 was approximately $0.10 per share of our

common stock. Net tangible book value per share represents the amount of tangible assets less total liabilities, divided by 36,821,173

shares of common stock, which was the number of shares of our common stock outstanding as of March 31, 2019.

Dilution in net tangible book value per

share represents the difference between the amount per share or pre-funded warrant paid by purchasers in this offering and the

net tangible book value per share of our common stock immediately after this offering. After giving effect to the sale of shares

of common stock in this offering (including the shares of common stock underlying the pre-funded warrants and assuming the exercise

of all of the pre-funded warrants) at a public offering price of $0.60 per share (or share equivalent), and after deducting the

underwriting discount and the estimated offering expenses payable by us, our as adjusted net tangible book value as of March 31,

2019 would have been approximately $0.21 per share of common stock. This represents an immediate increase in net tangible book

value of $0.11 per share of common stock to our existing stockholders and an immediate dilution in net tangible book value

of $0.39 per share of common stock to investors participating in this offering. The following table illustrates this per share

dilution:

|

Public offering price per share (or share equivalent)

|

|

|

|

|

|

$

|

0.60

|

|

|

Net tangible book value per share as of

March 31, 2019

|

|

$

|

0.10

|

|

|

|

|

|

|

Increase per share

attributable to this offering

|

|

$

|

0.11

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted

net tangible book value per share as of March 31, 2019 after this offering

|

|

|

|

|

|

$

|

0.21

|

|

|

|

|

|

|

|

|

|

|

|

|

Dilution per share to new investors in

this offering

|

|

|

|

|

|

$

|

0.39

|

|

The discussion of dilution, and the table

quantifying it, assume the sale of all shares (or pre-funded warrants) covered by this prospectus supplement but no exercise of

outstanding options or warrants to purchase shares of our common stock.

DESCRIPTION OF

PRE-FUNDED WARRANTS

The following

is a brief summary of certain terms and conditions of the pre-funded warrants being offered by this prospectus

supplement. The following description is subject in all respects to the provisions contained in the pre-funded warrants.

Form

The pre-funded warrants will

be issued as individual warrant certificates to the investors. The form of pre-funded warrant will be filed

as an exhibit to our Current Report on Form 8-K that we will file with the SEC in connection with this offering.

Term

The pre-funded warrants

do not have a termination date and will terminate only when they are exercised in full.

Exercisability

The pre-funded warrants are

exercisable at any time after their original issuance. The pre-funded warrants will be exercisable, at the

option of each holder, in whole or in part by delivering to us a duly executed exercise notice and by payment in full of the exercise

price in immediately available funds for the number of shares of common stock purchased upon such exercise. In addition, the holder

may elect to exercise the pre-funded warrant through a cashless exercise, in which the holder would receive upon such exercise

the net number of shares of common stock determined according to the formula set forth in the pre-funded warrant. No

fractional shares of common stock will be issued in connection with the exercise of a pre-funded warrant.

Exercise

limitations

Under the pre-funded warrants, we

may not effect the exercise of any pre-funded warrant, and a holder will not be entitled to exercise any portion

of any pre-funded warrant, which, upon giving effect to such exercise, would cause the holder, together with

any group that the holder is a member, to beneficially own more than 4.99% (or, at the election of the holder, 9.99%) of the outstanding

shares of our common stock immediately after such exercise, provided that a holder may terminate, increase or decrease such beneficial

ownership limitation

upon at least 61 days’ advance notice to us

.

In addition,

purchasers of the pre-funded warrants may not effect the exercise of any pre-funded warrant if the holder, together with any group

that the holder is a member, would beneficially own more than 19.99% of the outstanding shares of our common stock immediately

before such exercise, unless we obtain stockholder approval as required by the applicable rules of Nasdaq.

Exercise

price

The

exercise price per whole share of our common stock purchasable upon the exercise of the pre-funded warrants is $0.0001 per share

of common stock. The exercise price of the pre-funded warrants and the number of shares of our common stock issuable

upon exercise of the pre-funded warrants is subject to appropriate adjustment in the event of certain stock dividends

and distributions, stock splits, stock combinations, reclassifications or similar events affecting our common stock and also upon

any distributions of assets, including cash, stock or other property to our stockholders. The exercise price will not be adjusted

below the par value of our common stock.

Transferability

Subject to applicable

laws, the pre-funded warrants may be offered for sale, sold, transferred or assigned without our consent.

Exchange

listing

We do not plan

on applying to list the pre-funded warrants on Nasdaq, any other national securities exchange or any other

nationally recognized trading system.

Fundamental

transactions

In the event

of a fundamental transaction, as described in the pre-funded warrants and generally including any reorganization,

recapitalization or reclassification of our common stock, the sale, transfer or other disposition of all or substantially all

of our properties or assets, our consolidation or merger with or into another person, the acquisition of more than 50% of our

outstanding common stock, or any person or group becoming the beneficial owner of 50% of the voting power represented by our outstanding

common stock, upon consummation of such a fundamental transaction, the holders of the pre-funded warrants will

be entitled to receive upon exercise of the pre-funded warrants the kind and amount of securities, cash or

other property that the holders would have received had they exercised the pre-funded warrants immediately prior to

such fundamental transaction without regard to any limitations on exercised contained in the pre-funded warrants.

No rights

as a stockholder

Except by virtue

of such holder’s ownership of shares of our common stock and except as set forth in the pre-funded warrants, the holder

of a pre-funded warrant does not have the rights or privileges of a holder of our common stock, including

any voting rights, until the holder exercises the pre-funded warrant.

UNDERWRITING

We are offering the shares of common stock

and pre-funded warrants described in this prospectus supplement and the accompanying prospectus through the underwriter listed

below. The underwriter named below has agreed to buy, subject to the terms of the underwriting agreement, the number of securities

listed opposite its name below. The underwriter is committed to purchase and pay for all of the securities if any are purchased.

Craig-Hallum Capital Group LLC is the sole underwriter.

|

Underwriter

|

|

Number of

Shares

|

|

|

Number of Pre-

Funded

Warrants

|

|

|

Craig-Hallum Capital Group LLC

|

|

|

4,855,341

|

|

|

|

7,175,525

|

|

The underwriter has advised us that they

propose to offer the shares of common stock and pre-funded warrants to the public at a price of $0.60 per share and the pre-funded

warrants at a price of $0.5999 per pre-funded warrant. The underwriter proposes to offer the shares of common stock to certain

dealers at the same price less a concession of not more than $0.0216 per share. If all of the securities are not sold at the public

offering price, the underwriter may change the offering price and other selling terms.

The underwriter is offering the shares

and pre-funded warrants, subject to prior sale, when, as and if issued to and accepted by it, subject to approval of legal matters

by its counsel, including the validity of the shares, and other conditions contained in the underwriting agreement, such as the

receipt by the underwriter of officers’ certificates and legal opinions. The underwriter reserves the right to withdraw,

cancel or modify offers to the public and to reject orders in whole or in part. The underwriter has advised us that it does not

intend to confirm sales to any accounts over which it exercises discretionary authority.

The shares and pre-funded warrants sold

in this offering are expected to be ready for delivery on or about May 24, 2019, against payment in immediately available funds.

The table below summarizes the underwriting

discounts that we will pay to the underwriter. In addition to the underwriting discount, we have agreed to reimburse up to $100,000

of the fees and expenses of the underwriter, which includes the fees and expenses of counsel to the underwriter, in connection

with this offering. The fees and expenses of the underwriter that we have agreed to reimburse are not included in the underwriting

discounts set forth in the table below. The underwriting discount and reimbursable expenses the underwriter will receive were

determined through arms’ length negotiations between us and the underwriter.

|

|

|

Per Share

|

|

|

Per Pre-

Funded

Warrant

|

|

|

Total

Aggregate

Proceeds

|

|

|

Public offering price

|

|

$

|

0.60

|

|

|

$

|

0.5999

|

|

|

$

|

7,217,802

|

|

|

Underwriting

discounts and commissions paid by us

(1)

|

|

$

|

0.036

|

|

|

$

|

0.035994

|

|

|

$

|

433,068

|

|

|

Proceeds to us, before expenses

|

|

$

|

0.564

|

|

|

$

|

0.563906

|

|

|

$

|

6,784,734

|

|

(1) The underwriter shall receive an underwriting

discount of 6% of the aggregate gross proceeds hereunder.

We estimate that the total expenses of

this offering, excluding underwriting discounts, will be $225,000. This includes $100,000 of fees and expenses of the underwriter

which are payable by us.

We also have agreed to indemnify the underwriter

against certain liabilities, including civil liabilities under the Securities Act of 1933, as amended, or to contribute to payments

that the underwriter may be required to make in respect of those liabilities.

Lock-Up Agreements

We and each of our directors and officers

have agreed not to offer, sell, agree to sell, directly or indirectly, or otherwise dispose of any shares of common stock or any

securities convertible into or exchangeable for shares of common stock without the prior written consent of Craig-Hallum Capital

Group LLC for a period of 90 days after the date of this prospectus supplement. These lock-up agreements provide limited exceptions

and their restrictions may be waived at any time by Craig-Hallum Capital Group LLC.

Stabilization

In connection with this offering, the

underwriter may engage in stabilizing transactions. Stabilizing transactions permit bids to purchase shares of common stock so

long as the stabilizing bids do not exceed a specified maximum, and are engaged in for the purpose of preventing or retarding

a decline in the market price of the common stock while the offering is in progress.

Other Relationships

The

underwriter and its respective affiliates have engaged in, and may in the future engage in, investment banking and other commercial

dealings in the ordinary course of business with us or our affiliates. The underwriter has received, or may in the future receive,

customary fees and commissions for these transactions

.

In the ordinary course of its various

business activities, the underwriter and its affiliates may make or hold a broad array of investments and actively trade debt

and equity securities (or related derivative securities) and financial instruments (including bank loans) for their own account

and for the accounts of its customers, and such investment and securities activities may involve securities and/or instruments

of the issuer. The underwriter and its affiliates may also make investment recommendations and/or publish or express independent

research views in respect of such securities or instruments and may at any time hold, or recommend to clients that they acquire,

long and/or short positions in such securities and instruments.

Electronic

Offer, Sale and Distribution

A prospectus in electronic format may

be made available on the websites maintained by the underwriter, if any, participating in this offering and the underwriter may

distribute prospectuses electronically. Other than the prospectus in electronic format, the information on these websites is not

part of this prospectus supplement, the accompanying prospectus or the registration statement of which this prospectus supplement

and the accompanying prospectus form a part, has not been approved or endorsed by us or the underwriter, and should not be relied

upon by investors.

Listing

Our common stock is listed on Nasdaq

under the symbol “DRIO”.

Transfer Agent and Registrar

The transfer agent and registrar for

our common stock is VStock Transfer, LLC.

Selling Restrictions

Canada

.

The offering of the securities in Canada is being made on a private placement basis in reliance on exemptions from the prospectus

requirements under the securities laws of each applicable Canadian province and territory where the common stock may be offered

and sold, and therein may only be made with investors that are purchasing as principal and that qualify as both an “accredited

investor” as such term is defined in National Instrument 45-106-Prospectus Exemptions and as a “permitted client”

as such term is defined in National Instrument 31-103-Registration Requirements, Exemptions and Ongoing Registrant Obligations.

Any offer and sale of the common stock in any province or territory of Canada may only be made through a dealer that is properly

registered under the securities legislation of the applicable province or territory wherein the common stock is offered and/or

sold or, alternatively, by a dealer that qualifies under and is relying upon an exemption from the registration requirements therein.

Any resale of

the securities by an investor resident in Canada must be made in accordance with applicable Canadian securities laws, which may

require resales to be made in accordance with prospectus and registration requirements, statutory exemptions from the prospectus

and registration requirements or under a discretionary exemption from the prospectus and registration requirements granted by

the applicable Canadian securities regulatory authority. These resale restrictions may under certain circumstances apply to resales

of the common stock outside of Canada.

LEGAL

MATTERS

The validity of the securities offered

hereby will be passed upon for us by Zysman, Aharoni, Gayer and Sullivan & Worcester LLP, New York, New York. Certain

legal matters related to the offering will be passed upon for the underwriter by Ellenoff Grossman & Schole LLP, New York,

New York.

EXPERTS

The consolidated financial statements

of DarioHealth Corp. at December 31, 2018 and 2017, and for each of the two years in the period ended December 31, 2018, incorporated

by reference in this prospectus have been audited by Kost Forer Gabbay & Kasierer, a member of Ernst & Young Global, independent

registered public accounting firm, as set forth in their report thereon (which contains an explanatory paragraph describing conditions

that raise substantial doubt about our ability to continue as a going concern as described in Note 1c to the consolidated financial

statements) appearing elsewhere herein, and are included in reliance upon such report given on the authority of such firm as experts

in accounting and auditing.

WHERE YOU CAN FIND

MORE INFORMATION

We file annual, quarterly and other reports,

proxy statements and other information with the SEC. Our SEC filings are available to the public over the Internet at the SEC’s

website at

http://www.sec.gov

.

Our Annual Report on Form 10-K, Quarterly

Reports on Form 10-Q, and Current Reports on Form 8-K, including any amendments to those reports, and other information we file

with or furnish to the SEC pursuant to Section 13(a) or 15(d) of the Exchange Act can also be accessed free of charge at our website

at http:// www.mydario.com. Such information is made available on our website as soon as reasonably practicable after we electronically

file it with or furnish it to the SEC. Information contained on, or accessible through, our website is not part of this prospectus

supplement.

INCORPORATION

OF CERTAIN DOCUMENTS BY REFERENCE

We are “incorporating by reference”

certain documents we file with the SEC, which means that we can disclose important information to you by referring you to those

documents. The information in the documents incorporated by reference is considered to be part of this prospectus. Statements

contained in documents that we file with the SEC and that are incorporated by reference in this prospectus will automatically

update and supersede information contained in this prospectus, including information in previously filed documents or reports

that have been incorporated by reference in this prospectus, to the extent the new information differs from or is inconsistent

with the old information.

We have filed the following documents

with the SEC. These documents are incorporated herein by reference as of their respective dates of filing:

(1) Our

Annual Report on Form 10-K for the fiscal year ended December 31, 2018, as filed with the SEC on March 25, 2019;

(2) Our

Quarterly Report on Form 10-Q for the quarter ended March 31, 2019, as filed with the SEC on May 13, 2019;

(3) Our

Current Report on Form 8-K as filed with the SEC on May 21, 2019;

(4) The

description of our Common Stock contained in our Registration Statement on Form 8-A filed with the SEC on February 25, 2016,

including any amendments and reports filed for the purpose of updating such description.

All documents filed by us pursuant to

Section 13(a), 13(c), 14 or 15(d) of the Exchange Act (1) after the date of the filing of the registration statement

of which this prospectus forms a part and prior to its effectiveness and (2) until all of the Common Stock to which this

prospectus relates has been sold or the offering is otherwise terminated, except in each case for information contained in any

such filing where we indicate that such information is being furnished and is not to be considered “filed” under the

Exchange Act, will be deemed to be incorporated by reference in this prospectus and any accompanying prospectus supplement and

to be a part hereof from the date of filing of such documents.

We will provide a copy of the documents

we incorporate by reference, at no cost, to any person who receives this prospectus. To request a copy of any or all of these

documents, you should write or telephone us at 8 HaToKhen Street, Caesarea Industrial Park, 3088900, Israel, Attention: Controller,

+(972)-(4) 770 4055.

PROSPECTUS

![[GRAPHIC MISSING]](https://content.edgar-online.com/edgar_conv_img/2019/05/22/0001144204-19-027767_IMG2.JPG)

LABSTYLE INNOVATIONS

CORP.

$

40,000,000

COMMON STOCK

WARRANTS

UNITS

We may from time

to time sell common stock, warrants to purchase common stock and units of such securities, in one or more offerings, for an aggregate

initial offering price of $40,000,000. We refer to the common stock, the warrants to purchase common stock and the units collectively

as the securities. This prospectus describes the general manner in which our securities may be offered using this prospectus.

We may sell these securities to or through underwriters or dealers, directly to purchasers or through agents. We will set forth

the names of any underwriters, dealers or agents in an accompanying prospectus supplement. You should carefully read this prospectus

and any accompanying supplements before you decide to invest in any of these securities.

Our common stock and warrants are traded

on the Nasdaq Capital Market, or Nasdaq, under the symbols “DRIO” and “DRIOW,” respectively.

Investing in the securities involves

risks. See

“Risk Factors”

beginning on page 1 of this prospectus.

As of July 21, 2016, the aggregate market

value of our common stock held by non-affiliates was approximately $18,527,880 based on a per share price of $4.61, the price

at which shares of our common stock were last sold on July 21, 2016. We have not offered and sold any securities in a primary

offering pursuant to Instruction I.B.6 of the General Instructions to Form S-3 during the period of 12 calendar months immediately

prior to and including the date of this prospectus.

Neither the Securities and Exchange

Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or

accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this

prospectus is August 3, 2016.

TABLE OF CONTENTS

You should rely only on the information

contained in this prospectus, any prospectus supplement and the documents incorporated by reference, or to which we have referred

you. We have not authorized anyone to provide you with different information. If anyone provides you with different or inconsistent

information, you should not rely on it. This prospectus and any prospectus supplement does not constitute an offer to sell, or

a solicitation of an offer to purchase, the securities offered by this prospectus and any prospectus supplement in any jurisdiction

to or from any person to whom or from whom it is unlawful to make such offer or solicitation of an offer in such jurisdiction.

You should not assume that the information contained in this prospectus, any prospectus supplement or any document incorporated

by reference is accurate as of any date other than the date on the front cover of the applicable document.

Neither the delivery of this prospectus

nor any distribution of securities pursuant to this prospectus shall, under any circumstances, create any implication that there

has been no change in the information set forth or incorporated by reference into this prospectus or in our affairs since the

date of this prospectus. Our business, financial condition, results of operations and prospects may have changed since such date.

When used herein, unless the context

requires otherwise, references to the “Company,” “we,” “our” and “us” refer to

LabStyle Innovations Corp., a Delaware corporation, collectively with its wholly-owned subsidiary, LabStyle Innovation Ltd., an

Israeli corporation.

All dollar amounts refer to U.S. dollars

unless otherwise indicated.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration

statement that we filed with the Securities and Exchange Commission, or the SEC, using a “shelf” registration process.

Under this shelf registration process, we may, from time to time, sell any combination of the securities described in this prospectus

in one or more offerings up to a total dollar amount of $40,000,000. This prospectus describes the securities we may offer and

the general manner in which our securities may be offered by this prospectus. Each time we sell securities, we will provide a

prospectus supplement that will contain specific information about the terms of that offering. We may also add, update or change

in the prospectus supplement any of the information contained in this prospectus. To the extent there is a conflict between the

information contained in this prospectus and the prospectus supplement, you should rely on the information in the prospectus supplement,

provided that if any statement in one of these documents is inconsistent with a statement in another document having a later date—for

example, a document incorporated by reference in this prospectus or any prospectus supplement—the statement in the document

having the later date modifies or supersedes the earlier statement.

OUR COMPANY

This summary highlights information

contained in the documents incorporated herein by reference. Before making an investment decision, you should read the entire

prospectus, and our other filings with the SEC, including those filings incorporated herein by reference, carefully, including

the sections entitled “Risk Factors” and “Cautionary Statement Regarding Forward-Looking Statements.”

We are a digital health (mHealth) company

that is developing and commercializing a patented and proprietary technology providing consumers with laboratory-testing capabilities

using smart phones and other mobile devices. Our flagship product, Dario

TM

, which we also refer to as our Dario

TM

Smart Diabetes Management Solution, is a mobile, real-time, cloud-based, diabetes management solution based on an innovative,

multi-feature software application combined with a stylish, ‘all-in-one’, pocket-sized, blood glucose monitoring device,

which we call the Dario

TM

Smart Meter.

Beyond the benefits of individual diabetes

management, we envision the Dario

TM

application becoming the centerpiece in a new era of interconnected devices and

services, providing healthier and better lives for diabetic patients worldwide. With every single measurement captured and stored

on a secure cloud data base, LabStyle’s software driven, comprehensive data-management technology has the potential to deliver

actionable insight and analytical tools to manage individual patients or large populations, as well as provide a complete and

comprehensive “big data” solution for healthcare providers and payers.

Our address is 9 Halamish Street, Caesarea

Industrial Park, 3088900, Israel and our telephone number is +(972)-(4) 770 4055. Our corporate website is: www.mydario.com. The

content of our website shall not be deemed incorporated by reference in this prospectus.

RISK FACTORS

An investment in our common stock involves

significant risks. You should carefully consider the risk factors contained in any prospectus supplement and in our filings with

the SEC, including our Annual Report on Form 10-K for the fiscal year ended December 31, 2015, as well as all of the information

contained in this prospectus, any prospectus supplement and the documents incorporated by reference herein or therein, before

you decide to invest in our common stock. Our business, prospects, financial condition and results of operations may be materially

and adversely affected as a result of any of such risks. The value of our common stock could decline as a result of any of these

risks. You could lose all or part of your investment in our common stock. Some of our statements in sections entitled “Risk

Factors” are forward-looking statements. The risks and uncertainties we have described are not the only ones we face. Additional

risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our business, prospects,

financial condition and results of operations.

CAUTIONARY STATEMENT

REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, any prospectus supplement

and the documents we incorporate by reference contain forward-looking statements within the meaning of the Private Securities

Litigation Reform Act of 1995 and other federal securities laws, regarding our business, clinical trials, financial condition,

expenditures, results of operations and prospects. Words such as “expects,” “anticipates,” “intends,”

“plans,” “planned expenditures,” “believes,” “seeks,” “estimates”

and similar expressions or variations of such words are intended to identify forward-looking statements, but are not deemed to

represent an all-inclusive means of identifying forward-looking statements as denoted in this prospectus, any prospectus supplement

and the documents we incorporate by reference. Additionally, statements concerning future matters are forward-looking statements.

Although forward-looking statements in

this prospectus, any prospectus supplement and the documents we incorporate by reference reflect the good faith judgment of our

management, such statements can only be based on facts and factors known by us as of such date. Consequently, forward-looking

statements are inherently subject to risks and uncertainties and actual results and outcomes may differ materially from the results

and outcomes discussed in or anticipated by the forward-looking statements. Factors that could cause or contribute to such differences

in results and outcomes include, without limitation, those specifically addressed under the heading “Risk Factors”

herein and in the documents we incorporate by reference, as well as those discussed elsewhere in this prospectus and any prospectus

supplement. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date

of this prospectus, any prospectus supplement or the respective documents incorporated by reference, as applicable. Except as

required by law, we undertake no obligation to revise or update any forward-looking statements in order to reflect any event or

circumstance that may arise after the date of such forward-looking statements. Readers are urged to carefully review and consider

the various disclosures made throughout the entirety of this prospectus, any prospectus supplement and the documents incorporated

by reference, which attempt to advise interested parties of the risks and factors that may affect our business, financial condition,

results of operations and prospects.

USE

OF PROCEEDS

Unless we otherwise indicate in the applicable

prospectus supplement, we currently intend to use the net proceeds from the sale of the securities for research and development

of our products and for general working capital purposes.

We may set forth additional information

on the use of net proceeds from the sale of securities we offer under this prospectus in a prospectus supplement relating to the

specific offering. Pending the application of the net proceeds, we intend to invest the net proceeds in bank deposits or investment-grade

and interest-bearing securities subject to any investment policies our management may determine from time to time.

THE SECURITIES WE

MAY OFFER

The descriptions of the securities contained

in this prospectus, together with any applicable prospectus supplement, summarize the material terms and provisions of the various

types of securities that we may offer. We will describe in any applicable prospectus supplement relating to any securities the

particular terms of the securities offered by that prospectus supplement. If we so indicate in any applicable prospectus supplement,

the terms of the securities may differ from the terms we have summarized below. We may also include in any prospectus supplement

information, where applicable, about material U.S. federal income tax consequences relating to the securities, and the securities

exchange or market, if any, on which the securities will be listed.

We may sell from time to time, in one or

more offerings, one or more of the following securities:

|

|

·

|

warrants to purchase

common stock; and

|

|

|

·

|

units of the securities

mentioned above.

|

The total initial offering price of all

securities that we may issue in these offerings will not exceed $40,000,000.

DESCRIPTION

OF CAPITAL STOCK

The following summary is a description of the material

terms of our share capital. We encourage you to read our Certificate of Incorporation, as amended, and Amended and Restated By-laws

which have been filed with the SEC, as well as the provisions of the Delaware General Corporation Law.

General

Our authorized capital stock currently

consists of 160,000,000 shares of common stock, par value $0.0001 per share and 5,000,000 shares of blank-check preferred stock,

par value $0.0001 per share. As of July 21, 2016, we had 5,688,358 shares of common stock outstanding and no shares of preferred

stock designated, issued or outstanding. No other class or series of capital stock has been established.

Description of Common Stock

Upon our liquidation, dissolution or winding

up, the holders of common stock are entitled to share ratably in all net assets available for distribution to security holders

after payment to creditors. The common stock is not convertible or redeemable and has no preemptive, subscription or conversion

rights. Each outstanding share of common stock is entitled to one vote on all matters submitted to a vote of security holders.

There are no cumulative voting rights. The holders of outstanding shares of common stock are entitled to receive dividends out

of assets legally available therefore at such times and in such amounts as our Board of Directors, or our Board, may from time

to time determine. Holders of common stock will share equally on a per share basis in any dividend declared by our Board. We have

not paid any dividends on our common stock and do not anticipate paying any cash dividends on such stock in the foreseeable future.

In the event of a merger or consolidation, all holders of common stock will be entitled to receive the same per share consideration.

Meetings of Stockholders

An annual meeting of our stockholders shall

be held on the day and at the time as may be set by our Board, at which the stockholders shall elect the board of directors and

transact such other business as may properly be brought before the meeting. All annual meetings of stockholders are to be held

at our registered office in the State of Delaware or at such other place as may be determined by our Board.

Special meetings of our stockholders may

be called for any purpose or purposes, unless otherwise prescribed by statute, by our Board of Directors, the Chairman of the

Board or the Chief Executive Officer, President or other executive officer of the Company, or at the request, in writing, of the

stockholders of record, and only of record, owning not less than sixty-six and two-thirds percent (66 2/3%) of the entire capital

stock of the Company issued and outstanding and entitled to vote. Business transacted at any special meeting of stockholders shall

be confined to the purpose or purposes stated in the notice for such meeting.

Anti-Takeover Effect of Delaware Law, Certain Charter and

Bylaw Provisions

Our certificate of incorporation and bylaws

contain provisions that could have the effect of discouraging potential acquisition proposals or tender offers or delaying or

preventing a change of control of our company. These provisions are as follows:

|

|

·

|

they provide

that special meetings of stockholders may be called only by the Board of Directors, Chief

Executive Officer, President or our Chairman of the Board of Directors, or at the request,

in writing, by stockholders of record owning at least sixty-six and two-thirds (66 2/3%)

percent of the issued and outstanding voting shares of common stock;

|

|

|

·

|

they do not

include a provision for cumulative voting in the election of directors. Under cumulative

voting, a minority stockholder holding a sufficient number of shares may be able to ensure

the election of one or more directors. The absence of cumulative voting may have the

effect of limiting the ability of minority stockholders to effect changes in our Board

of Directors; and

|

|

|

·

|

they allow

us to issue, without stockholder approval, up to 5,000,000 shares of preferred stock

that could adversely affect the rights and powers of the holders of our common stock.

|

We are subject to the provisions of Section

203 of the General Corporation Law of the State of Delaware, an anti-takeover law. In general, Section 203 prohibits a publicly

held Delaware corporation from engaging in a “business combination” with an “interested stockholder” for

a period of three years after the date of the transaction in which the person became an interested stockholder, unless the business

combination is approved in the following prescribed manner:

|

|

·

|

prior to the

time of the transaction, the board of directors of the corporation approved either the

business combination or the transaction which resulted in the stockholder becoming an

interested stockholder;

|

|

|

·

|

upon completion

of the transaction that resulted in the stockholder becoming an interested stockholder,

the stockholder owned at least 85% of the voting stock of the corporation outstanding

at the time the transaction commenced, excluding for purposes of determining the number

of shares outstanding (1) shares owned by persons who are directors and also officers

and (2) shares owned by employee stock plans in which employee participants do not have

the right to determine confidentially whether shares held subject to the plan will be

tendered in a tender or exchange offer; and

|

|

|

·

|

on or subsequent

to the time of the transaction, the business combination is approved by the board and

authorized at an annual or special meeting of stockholders, and not by written consent,

by the affirmative vote of at least 66 2/3% of the outstanding voting stock which

is not owned by the interested stockholder.

|

Generally, for purposes of Section 203,

a “business combination” includes a merger, asset or stock sale, or other transaction resulting in a financial benefit

to the interested stockholder. An “interested stockholder” is a person who, together with affiliates and associates,

owns or, within three years prior to the determination of interested stockholder status, owned 15% or more of a corporation’s

outstanding voting securities.

Transfer Agent and Registrar

VStock Transfer, LLC is the transfer agent

and registrar for our common stock. Their address is 18 Lafayette Place, Woodmere, NY 11598, telephone (212) 828-8436.

Listing

Our common stock and warrants are traded

on Nasdaq under the symbols “DRIO” and “DRIOW,” respectively.

DESCRIPTION OF WARRANTS

As of July 21, 2016, warrants to purchase

an aggregate of 4,897,994 shares of common stock were outstanding with expiration dates between July 23, 2016 and March 8, 2021

at exercise prices ranging from $3.24 to $135 per share, subject to adjustments for stock splits, dividends, reclassifications

and the like. Of those warrants, warrants to purchase 973,705 shares of common stock at an adjusted exercise price of $3.59 per

share are subject to “weighted average” adjustment for dilutive issuance. Additionally, 1,528,333 of those warrants

are traded on Nasdaq under the symbol “DRIOW.”

The following description, together with

the additional information we may include in any applicable prospectus supplement, summarizes the material terms and provisions

of the warrants that we may offer under this prospectus and the related warrant agreements and warrant certificates. While the

terms summarized below will apply generally to any warrants that we may offer, we will describe the particular terms of any series