Statement of Changes in Beneficial Ownership (4)

January 15 2020 - 4:33PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Li Yubao |

2. Issuer Name and Ticker or Trading Symbol

CTI INDUSTRIES CORP

[

CTIB

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

__X__ Director __X__ 10% Owner

_____ Officer (give title below) _____ Other (specify below)

|

|

(Last)

(First)

(Middle)

ROOM 4, 19F, ZHONGBEI ROAD #126 |

3. Date of Earliest Transaction

(MM/DD/YYYY)

1/13/2020 |

|

(Street)

WUHAN HUBEI, F4 430000

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Series A Preferred Stock | $1 (1)(2)(3) | 1/13/2020 (1)(3)(4) | | P | | 250000 | | (3) | (1) | Common Stock | 2500000 | $10 | 250000 | I | By LF International Pte. Ltd. |

| Explanation of Responses: |

| (1) | Pursuant to the Stock Purchase Agreement by and between CTI Industries Corporation ("Company") and LF International Pte. Ltd. ("LF") dated January 3, 2020, LF agreed to purchase, in multiple closings, up to 500,000 shares of Series A Convertible Preferred Stock ("Series A Preferred Stock") of the Company. On January 13, 2020, the parties completed an initial closing by which LF purchased 250,000 Series A Preferred Stock. Each share of Series A Preferred Stock of the Company is initially convertible into ten (10) shares of the Company's common stock, subject to certain conditions, and has no expiration date. Mr. Li has 95% voting and dispositive control over the shares held by the LF and may be deemed the beneficial owner of such Series A Preferred Stock. |

| (2) | Each holder of Series A Preferred Stock shall have the right to convert the stated value of such shares, as well as accrued but unpaid declared dividends thereon (collectively the "Conversion Amount") into shares of the Company's common stock. The number of shares of common stock issuable upon conversion of the Conversion Amount shall equal the Conversion Amount divided by the conversion price of $1.00, subject to certain customary adjustments, such that each share of Series A Preferred Stock is initially convertible into ten (10) shares of the Company's common stock. |

| (3) | The Series A Preferred Stock is convertible at any time, except that it may not be converted to the shares of the Company's common stock to the extent such conversion would result in the holder beneficially owning more than 4.99% of the Company's outstanding common stock. Additionally, until the Company obtains shareholder approval for the issuance of the common stock underlying the Series A Preferred Stock, as may be required by the applicable rules and regulations of the Nasdaq Stock Market, the Company may not issue, upon conversion of the Series A Preferred Stock, a number of shares of common stock which, when aggregated with any shares of common stock previously issued upon conversion of the Series A Preferred Stock, would equal 20% or more of the common stock of 20% or more of the voting power of the Company. |

| (4) | Holders of Series A Preferred Stock shall vote together with the holders of the Company's common stock on an as-if-converted basis, whereby each share of the Series A Preferred Stock will be entitled to ten (10) votes, subject to adjustment. Notwithstanding the foregoing, holders of Series A Preferred Stock may not vote shares of the Series A Preferred Stock to the extent the shares of common stock issuable upon conversion of such Series A Preferred Stock would exceed the conversion limitations described above. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Li Yubao

ROOM 4, 19F

ZHONGBEI ROAD #126

WUHAN HUBEI, F4 430000 | X | X |

|

|

Signatures

|

| /s/ Yubao Li | | 1/15/2020 |

| **Signature of Reporting Person | Date |

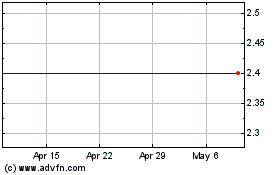

Yunhong CTI (NASDAQ:CTIB)

Historical Stock Chart

From Mar 2024 to Apr 2024

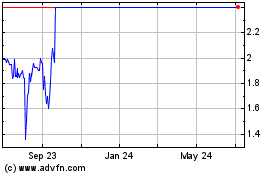

Yunhong CTI (NASDAQ:CTIB)

Historical Stock Chart

From Apr 2023 to Apr 2024