Atrion Reports First Quarter Results

May 07 2020 - 4:30PM

Atrion Corporation (Nasdaq - ATRI) today announced that revenues

for the quarter ended March 31, 2020 were $43.6 million compared

with $41.6 million for the same period in 2019. Net income in the

current-year quarter totaled $8.9 million compared to $9.4 million

in last year’s first quarter, with diluted earnings per share for

the first quarter of 2020 at $4.79 compared to $5.07 for the first

quarter of 2019.

In announcing results for the first quarter of

2020, David A. Battat, President & CEO, said, “Before

discussing our results, I wish to express my gratitude to my

co-workers for their truly exceptional efforts during the COVID-19

pandemic. All of our facilities have remained operational thanks to

their dedication. This was a monumental effort requiring the

modification of manufacturing lines to increase distancing, scale

up production capacity of critically needed products, and make

personal protective equipment for our employees and for donation to

our communities. Despite enormous personal and professional

challenges, my co-workers accomplished all of this with courage,

grace and dignity. I am privileged to work alongside

them.”

Commenting on the Company’s results for the

quarter compared to the same period last year, Mr. Battat stated,

“We are pleased to report a 5% growth in revenues, despite the bans

on elective surgery that impacted orders for our cardiovascular

products as well as our decision to phase out certain 20 year-old

ophthalmic products. Revenues from our fluid delivery products,

many of which are used in critical care settings, saw an increase

of 23%.” Mr. Battat continued, “We are especially pleased that

operating income was up 6%, despite higher manufacturing costs due

to the pandemic as well as higher expenses as we increased our

research and development efforts. Net income and diluted EPS were

both lower by 6% due to the unfavorable impact of mark-to-market

valuation of our investment portfolio. During the quarter we

purchased 14,576 of our shares at an average price of $634.27 per

share while continuing to hold $96.4 million in cash and short- and

long- term investments as of March 31, 2020. Addressing

expectations for 2020, Mr. Battat concluded, “The world changed

after we provided financial guidance for 2020, requiring us to

completely reassess that forecast. With the COVID-19 pandemic

continuing, and the likelihood of a second wave in the fall and

winter, many of our OEM and hospital customers are reporting they

are uncertain about their 2020 buying patterns. We could also be

affected by a lasting economic slowdown, or mass illnesses

requiring us to close our operations. Given all of this volatility,

the only guidance we can provide for 2020 is that we will work

tirelessly to manage this crisis effectively and compassionately,

and that our focus on long-term growth will be steadfast.”

Statements in this press release that are

forward looking are based upon current expectations and actual

results or future events may differ materially. Such statements

include, but are not limited to, Atrion’s guidance for 2020. Words

such as “expects,” “believes,” “anticipates,” “forecasts,”

“intends,” "should", "plans," "will" and variations of such words

and similar expressions are intended to identify such

forward-looking statements. Forward-looking statements involve

risks and uncertainties. The following are some of the factors that

could cause actual results or future events to differ materially

from those expressed in or underlying our forward-looking

statements: the impact of the COVID-19 virus; risk that the

COVID-19 virus further disrupts or causes us to cease operations;

changing economic, market, and business conditions; acts of war or

terrorism; the effects of governmental regulation; and the

diversion of management and other resources to respond to the

COVID-19 outbreak. The foregoing list of factors is not exclusive,

and other factors are set forth in the Company’s filings with the

Securities and Exchange Commission. The forward-looking statements

in this press release are made as of the date hereof, and we do not

undertake any obligation, and disclaim any duty, to supplement,

update, or revise such statements, whether as a result of

subsequent events, changed expectations or otherwise, except as

required by applicable law.

Atrion Corporation develops and manufactures

products primarily for medical applications. The Company’s

website is www.atrioncorp.com.

Contact: Jeffery

Strickland

Vice President and Chief Financial

Officer

(972) 390-9800

ATRION CORPORATIONCONSOLIDATED STATEMENTS OF

INCOME(In thousands, except per share data)(Unaudited)

|

|

Three Months EndedMarch 31, |

|

|

|

2020 |

|

|

|

2019 |

|

| Revenues |

$ |

43,594 |

|

|

$ |

41,614 |

|

| Cost of goods sold |

|

23,726 |

|

|

|

22,911 |

|

|

Gross profit |

|

19,868 |

|

|

|

18,703 |

|

| Operating expenses |

|

8,154 |

|

|

|

7,666 |

|

|

Operating income |

|

11,714 |

|

|

|

11,037 |

|

| |

|

|

|

| Interest and dividend income |

|

462 |

|

|

|

582 |

|

| Other investment income (loss) |

|

(997 |

) |

|

|

211 |

|

|

Income before income taxes |

|

11,179 |

|

|

|

11,830 |

|

| Income tax provision |

|

(2,281 |

) |

|

|

(2,392 |

) |

|

Net income |

|

8,898 |

|

|

|

9,438 |

|

| |

|

|

|

| |

|

|

|

| Income per basic share |

$ |

4.80 |

|

|

$ |

5.09 |

|

| |

|

|

|

| Weighted average basic shares outstanding |

|

1,853 |

|

|

|

1,853 |

|

| |

|

|

|

| |

|

|

|

| Income per diluted share |

$ |

4.79 |

|

|

$ |

5.07 |

|

| |

|

|

|

| Weighted average diluted shares outstanding |

|

1,859 |

|

|

|

1,862 |

|

| |

|

|

|

|

|

|

|

ATRION CORPORATIONCONSOLIDATED BALANCE SHEETS(In

thousands)

| |

Mar. 31, |

|

Dec. 31, |

| ASSETS |

2020 |

|

2019 |

| |

(Unaudited) |

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

44,080 |

|

$ |

45,048 |

|

Short-term investments |

|

18,568 |

|

|

23,766 |

|

Total cash and short-term investments |

|

62,648 |

|

|

68,814 |

|

Accounts receivable |

|

22,813 |

|

|

18,886 |

|

Inventories |

|

41,252 |

|

|

42,093 |

|

Prepaid expenses and other |

|

1,367 |

|

|

2,545 |

|

Total current assets |

|

128,080 |

|

|

132,338 |

| Long-term investments |

|

33,718 |

|

|

31,772 |

| Property, plant and equipment, net |

|

85,446 |

|

|

84,606 |

| Other assets |

|

13,186 |

|

|

13,315 |

| |

|

|

|

| |

$ |

260,430 |

|

$ |

262,031 |

| |

|

|

|

| |

|

|

|

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

| |

|

|

|

|

Current liabilities |

|

12,961 |

|

|

11,274 |

|

Line of credit |

|

-- |

|

|

-- |

|

Other non-current liabilities |

|

12,472 |

|

|

12,887 |

|

Stockholders’ equity |

|

234,997 |

|

|

237,870 |

| |

|

|

|

| |

$ |

260,430 |

|

$ |

262,031 |

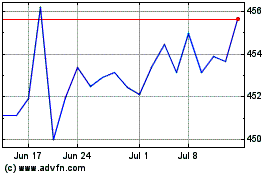

ATRION (NASDAQ:ATRI)

Historical Stock Chart

From Mar 2024 to Apr 2024

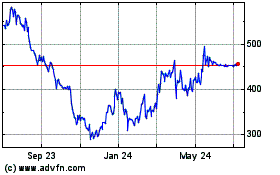

ATRION (NASDAQ:ATRI)

Historical Stock Chart

From Apr 2023 to Apr 2024