Current Report Filing (8-k)

November 12 2020 - 1:38PM

Edgar (US Regulatory)

0001013462FALSE00010134622020-11-092020-11-090001013462exch:XNGS2020-11-092020-11-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

November 9, 2020

Date of Report (date of earliest event reported)

ANSYS, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

0-20853

|

04-3219960

|

|

(State or other jurisdiction of incorporation or organization)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

|

2600 ANSYS Drive,

|

Canonsburg,

|

PA

|

|

|

15317

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

844-462-6797

(Registrant's telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of exchange on which registered

|

|

Common Stock, $0.01 par value per share

|

ANSS

|

Nasdaq Stock Market LLC

|

|

|

|

|

(Nasdaq Global Select Market)

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Item 1.01 Entry into a Material Definitive Agreement.

On November 9, 2020, ANSYS, Inc. (the “Company”) entered into a $375 million unsecured term loan facility with Bank of America, N.A. as Administrative Agent (the “Credit Agreement”). The term loan facility will be advanced by the lenders thereunder to the Company to finance the Company’s previously announced and pending acquisition of Analytical Graphics, Inc., a Pennsylvania corporation, pursuant to the Agreement and Plan of Merger, dated as of October 23, 2020, by and among the Company, Voyager Merger Sub, Inc., a Pennsylvania corporation, Analytical Graphics, Inc. and Fortis Advisors LLC, a Delaware limited liability company, solely as the shareholders’ representative (the “Acquisition”). The term loan will be funded in full upon the closing of the Acquisition and will mature on November 1, 2024. Principal on the term loan will be payable on the last business day of each fiscal quarter commencing with the quarter ending March 31, 2022 at a rate of 5% per annum, increasing to 10% per annum with the fiscal quarter ending March 31, 2023.

Borrowings under the term loan facility will accrue interest at the London Interbank Offered Rate (LIBOR) plus an applicable margin or at the base rate plus an applicable margin. The base rate is the highest of (i) the Federal Funds Rate plus 0.500%, (ii) the Bank of America prime rate and (iii) the one-month LIBOR plus 1.000%. The applicable margin for borrowings is a percentage per annum based on the lower of (1) a pricing level determined by the Company’s then-current consolidated leverage ratio and (2) a pricing level determined by the Company’s debt ratings (if such debt ratings exist). The term loan facility contains customary representations and warranties, affirmative and negative covenants and events of default.

The term loan facility also contains a financial covenant requiring the Company and its subsidiaries to maintain a consolidated leverage ratio not in excess of 3.50 to 1.00 as of the end of any fiscal quarter (for the four-quarter period ending on such date) with an opportunity for a temporary increase in such consolidated leverage ratio to 4.00 to 1.00 upon the consummation of certain qualified acquisitions for which the aggregate consideration is at least $250 million.

The foregoing description of the Credit Agreement does not purport to be complete and is subject to, and qualified in its entirety by reference to the Credit Agreement, which is attached hereto as Exhibit 10.1 and incorporated herein by reference.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance-Sheet Arrangement of a Registrant.

The information set forth above under Item 1.01 of this current report on Form 8-K is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits

|

|

|

|

|

|

|

|

|

|

|

Exhibit 10.1

|

|

|

|

|

|

|

Exhibit 104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ANSYS, Inc.

|

|

|

|

|

|

|

Date:

|

November 12, 2020

|

By:

|

/s/ Maria T. Shields

|

|

|

|

Name:

|

Maria T. Shields

|

|

|

|

Title:

|

Senior Vice President and Chief Financial Officer

|

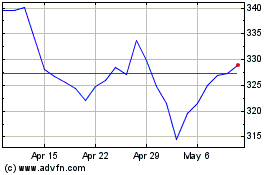

ANSYS (NASDAQ:ANSS)

Historical Stock Chart

From Mar 2024 to Apr 2024

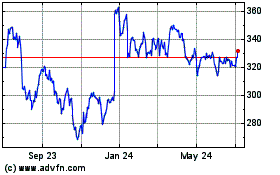

ANSYS (NASDAQ:ANSS)

Historical Stock Chart

From Apr 2023 to Apr 2024