Current Report Filing (8-k)

August 05 2020 - 5:05PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

Form 8-K

_____________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event Reported): August 5, 2020

Anika Therapeutics, Inc.

(Exact Name of Registrant as Specified in Charter)

|

Delaware

|

000-21326

|

04-3145961

|

|

(State or Other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(I.R.S. Employer Identification Number)

|

|

32 Wiggins Avenue, Bedford, Massachusetts 01730

|

|

(Address of Principal Executive Offices) (Zip Code)

|

(781) 457-9000

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

[ ]

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

[ ]

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.01 per share

|

ANIK

|

NASDAQ Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On August 5, 2020, we announced that the board of directors has appointed Michael Levitz as our Executive Vice President, Chief Financial Officer and Treasurer, effective August 10, 2020.

Offer Letter with Michael Levitz

Pursuant to an offer letter dated July 29, 2020, we have agreed Mr. Levitz will receive an annual base salary of $450,000 and will be eligible to receive a discretionary annual cash bonus with a target bonus of 45% of his base salary (prorated for 2020). Upon the commencement of his employment, Mr. Levitz will be granted an equity package consisting of:

-

restricted stock units with a fair market value of $400,000 as of August 10, 2020, which will vest in three equal annual installments beginning one year from the date of grant;

-

performance stock units with a fair market value at target (i.e., 100% achievement of the performance metrics) of $400,000 as of August 10, 2020, which will vest when and to the extent certain performance criteria (standardized across our executive team) are met as measured by the board’s compensation committee following the audit of our financial statements for fiscal year 2022;

-

common stock options with a fair market (i.e., Black-Scholes) value of $800,000 as of August 10, 2020, which will vest in three equal annual installments beginning one year from the date of grant.

The foregoing description of our offer letter with Mr. Levitz does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the offer letter, which is included as Exhibit 10.1 to this report and is incorporated into this Item 5.02 by reference.

Background of Michael Levitz

Mr. Levitz served as the Senior Vice President, Chief Financial Officer and Treasurer of Insulet Corporation, a global medical device and drug delivery company, from May 2015 to January 2019. From 2009 to May 2015, Mr. Levitz was the Senior Vice President, Chief Financial Officer and Treasurer of Analogic Corporation, a global provider of medical guidance, diagnostic imaging and threat detection equipment. Previously, during his seven years with Hologic, Inc. and Cytyc Corporation (which merged with Hologic in October 2007), Mr. Levitz served in various capacities including Vice President and Corporate Controller. Mr. Levitz began his career in the high technology audit practice at Arthur Andersen LLP. Mr. Levitz earned his Bachelor of Arts in Business Economics, with emphasis in Accounting, from the University of California Santa Barbara and is a certified public accountant. He is 47 years old.

There are no relationships or related party transactions involving Mr. Levitz or any member of his immediate family required to be disclosed pursuant to Item 404(a) of Regulation S-K.

Transition Arrangements with Sylvia Cheung

Mr. Levitz succeeds Sylvia Cheung as our Chief Financial Officer and Treasurer. As described in our Current Report on Form 8-K filed with the Securities and Exchange Commission on June 2, 2020, Ms. Cheung notified us on May 27, 2020 that she was resigning from her position of Chief Financial Officer, Treasurer and Assistant Secretary effective August 21, 2020 for personal reasons. Ms. Cheung has advised us that she will continue with the Company in an advisory capacity for a period following the succession effective date to assist with a smooth transition.

Item 7.01. Regulation FD Disclosure.

On August 5, 2020, we issued a press release entitled “Anika Appoints Michael Levitz as Chief Financial Officer.” A copy of the press release is furnished as Exhibit 99.1 to this report.

The information contained in this Item 7.01 and in the press release furnished as Exhibit 99.1 to this report shall not be incorporated by reference into any of our filings with the Securities and Exchange Commission, whether made before, on or after the date of this report, regardless of any general incorporation language in such filing, unless expressly incorporated by specific reference in such filing. The information contained in this Item 7.01 and in the press release furnished as Exhibit 99.1 to this report shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that section or Section 11 or 12(a)(2) of the Securities Act of 1933.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Anika Therapeutics, Inc.

|

|

|

|

|

|

|

|

|

|

Date: August 5, 2020

|

By:

|

/s/ CHERYL R. BLANCHARD

|

|

|

|

President and Chief Executive Officer

|

|

|

|

|

|

|

|

|

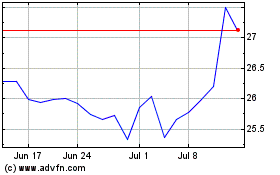

Anika Therapeutics (NASDAQ:ANIK)

Historical Stock Chart

From Mar 2024 to Apr 2024

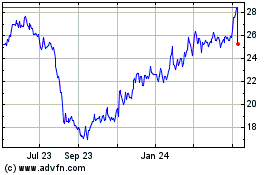

Anika Therapeutics (NASDAQ:ANIK)

Historical Stock Chart

From Apr 2023 to Apr 2024