UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 6, 2023

Aura FAT Projects Acquisition Corp.

(Exact name of registrant as specified in its charter)

Cayman Islands

(State or other jurisdiction of incorporation)

| 001-901886 |

|

N/A |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

1 Phillip Street, #09-00, Royal One Phillip

Singapore, 048692

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code (65) 3135-1511

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

|

Trading Symbol(s) |

|

Name of Each Exchange on Which Registered |

| Units, each consisting of one Class A Ordinary Share and One Redeemable Warrant |

|

AFARU |

|

The Nasdaq Stock Market LLC |

| Class A Ordinary Shares, $0.0001 par value per share |

|

AFAR |

|

The Nasdaq Stock Market LLC |

| Redeemable Warrants, each warrant exercisable for one Class A Ordinary Share at an exercise price of $11.50 |

|

AFARW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01. |

Regulation FD Disclosure. |

As previously announced, Aura FAT Projects Acquisition Corp, a Cayman Islands exempt company limited by shares, with company registration number 384483 (the “Company”), Allrites Holdings Pte. Ltd., a Singapore private company limited by shares, with company registration number 201703484C (“Allrites”), and Meta Gold Pte. Ltd., a Singapore exempt private company limited by shares, with company registration number 202001973W, in its capacity as the representative for the shareholders of Allrites, entered into a Business Combination Agreement dated May 7, 2023 (as it may be subsequently amended, the “Business Combination Agreement”).

The Business Combination Agreement provides for a series of transactions, pursuant to which, among other things, Allrites’ shareholders will exchange all of their outstanding Allrites shares in consideration for newly issued Company Class A ordinary shares (the “Share Exchange”), subject to the conditions set forth in the Business Combination Agreement, with Allrites thereby becoming a wholly owned subsidiary of the Company (the Share Exchange and the other transactions contemplated by the Business Combination Agreement, together, the “Business Combination”). In connection with the Business Combination, the Company will change its corporate name to Allrites Ltd.

Furnished herewith as Exhibit 99.1 and incorporated into this Item 7.01 by reference is an investor memorandum that will be used by the Company and Allrites in connection with the Business Combination from time to time in presentations to investors and other stakeholders. The information in this Item 7.01, including Exhibit 99.1, is furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise be subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act.

By filing this Current Report on Form 8-K and furnishing the information contained herein, the Company makes no admission as to the materiality of any information in this report that is required to be disclosed solely by reason of Regulation FD. The information contained in the investor presentation is summary information that is intended to be considered in the context of the Company’s Securities and Exchange Commission filings and other public announcements that the Company may make, by press release or otherwise, from time to time. The Company undertakes no duty or obligation to publicly update or revise the information contained in this report, although it may do so from time to time as its management believes is warranted. Any such updating may be made through the filing of other reports or documents with the SEC, through press releases or through other public disclosure.

Additional Information and Where to Find It

This Current Report on Form 8-K does not contain all the information that should be considered concerning the Business Combination and is not intended to form the basis of any investment decision or any other decision in respect of the Business Combination. The Company will file a Registration Statement on Form F-4 with the SEC in the future (the “Registration Statement”) relating to the Business Combination. This communication is not intended to be, and is not, a substitute for the proxy statement or any other document that the Company has filed or may file with the SEC in connection with the Business Combination. When available, the definitive proxy statement/prospectus and other relevant materials will be sent to all the Company shareholders as of a record date to be established for voting on the Business Combination. The Company’s shareholders and other interested persons are advised to read the preliminary proxy statement/prospectus and the amendments thereto in the Registration Statement and, when available, the definitive proxy statement/prospectus and documents incorporated by reference therein filed in connection with the Business Combination, as these materials will contain important information about Allrites, the Company and the Business Combination. The Company also will file other documents regarding the Business Combination with the SEC. Promptly after the Registration Statement is declared effective by the SEC, the Company intends to mail the definitive proxy statement/prospectus and a proxy card to each shareholder entitled to vote at the meeting relating to the approval of the Business Combination and other proposals set forth in the proxy statement/prospectus. Before making any voting decision, investors and securities holders of the Company are urged to carefully read the Registration Statement, the definitive proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC in connection with the Business Combination as they become available because they will contain important information about the Company, Allrites and the Business Combination.

Before making any voting or investment decision, investors and stockholders of the Company are urged to carefully read the entire proxy statement, when they become available, and any other relevant documents filed with the SEC, as well as any amendments or supplements to these documents, because they will contain important information about the Business Combination. The Company investors and stockholders will also be able to obtain copies of the preliminary proxy statement, the definitive proxy statement, and other documents filed with the SEC that will be incorporated by reference therein, without charge, once available, at the SEC’s website at www.sec.gov, or by written request to the Company at Aura FAT Projects Acquisition Corp, 1 Phillip Street, #09-00, Royal One Phillip Singapore, 048692.

Participants in Solicitation

The

Company and Allrites and their respective directors and officers may be deemed to be participants in the solicitation of proxies

from the Company’s shareholders in connection with the Business Combination. Information about the Company’s directors

and executive officers and their ownership of the Company’s securities is set forth in the Company’s filings with the

SEC, including the Company’s Annual Report on Form 10-K for the fiscal year ended November 30, 2022, which was filed with the

SEC on February 23, 2023 and the Company’s Quarterly Report on Form 10-Q for the fiscal quarter ended February 28, 2023, which was

filed with the SEC on April 14, 2023. Additional information regarding the names and interests in the Business Combination of the

Company’s and Allrites’ respective directors and officers and other persons who may be deemed participants in the

Business Combination may be obtained by reading the proxy statement/prospectus contained in the Registration Statement regarding the

Business Combination and the definitive proxy statement/prospectus when it becomes available. You may obtain free copies of these

documents as described in the preceding paragraph.

No Offer or Solicitation

This Current Report on Form 8-K is not a proxy statement or solicitation of a proxy, consent or authorization with respect to any securities or in respect of the Business Combination and shall not constitute an offer to sell or a solicitation of an offer to buy the securities of the Company or Allrites, nor shall there be any sale of any such securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act, or exemptions therefrom.

|

Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Company has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

AURA FAT PROJECTS ACQUISITION CORP. |

| |

|

|

| Date: June 7, 2023 |

By: |

/s/

David Andrada |

| |

|

David Andrada |

| |

|

Co-Chief Executive Officer |

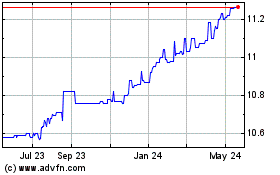

Aura FAT Projects Acquis... (NASDAQ:AFAR)

Historical Stock Chart

From Apr 2024 to May 2024

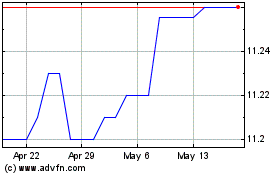

Aura FAT Projects Acquis... (NASDAQ:AFAR)

Historical Stock Chart

From May 2023 to May 2024