Australian, NZ Dollars Fall As Risk Sentiment Worsens

February 04 2022 - 1:50AM

RTTF2

The Australian and NZ dollars fell against their major

counterparts in the European session on Friday, amid lingering

worries over inflation and looming central bank rate hikes.

Investors digested comments from European Central Bank president

Christine Lagarde signaling a major policy shift. Following

Lagarde's hawkish remarks, money markets are pricing in nearly 50

basis points of tightening by the end of this year.

The Bank of England raised its key rate again and several

policymakers preferred a 50 basis point increase to tackle

inflation.

Investors awaited U.S. jobs data due later today, which is

expected to show a gain of 150,000 jobs in January. The

unemployment rate is expected to hold at 3.9 percent.

The Reserve Bank of Australia raised its inflation outlook

citing robust demand for housing and the increases in prices of

durable goods and fuel.

In the latest Statement on Monetary Policy, the central bank

said underlying inflation picked up in recent quarters and is

forecast to increase further to 3.25 percent in mid-2022, largely

reflecting upstream cost pressures amid strong demand in housing

construction and the durables goods sector.

The aussie depreciated to 3-day lows of 0.7097 against the

greenback and 0.9021 against the loonie, down from its prior highs

of 0.7152 and 0.9063, respectively. The aussie may locate support

around 0.68 against the greenback and 0.89 against the loonie.

Pulling away from its previous highs of 1.6000 against the euro

and 1.0718 against the kiwi, the aussie dropped to a fresh 2-month

low of 1.6165 and a 4-day low of 1.0680, respectively. The next

immediate support for the aussie is seen around 1.64 against the

euro and 1.045 against the kiwi.

The aussie reversed from an early high of 82.22 against the yen,

reaching as low as 81.53. The currency is poised to challenge

support around the 80.00 mark.

The kiwi weakened to 0.6629 against the greenback and 76.13

against the yen, off its early 9-day high of 0.6683 and a 2-week

high of 76.78, respectively. The kiwi is seen finding support

around 0.63 against the greenback and 74.00 against the yen.

The kiwi fell to more than a 1-year low of 1.7299 against the

euro, reversing from an early high of 1.7137. If the currency drops

further, 1.75 is possibly seen as its next support level.

Looking ahead, U.S. and Canadian jobs data and Canada Ivey PMI,

all for January, will be released in the New York session.

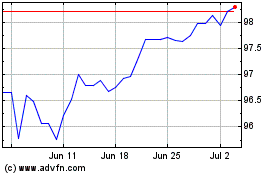

NZD vs Yen (FX:NZDJPY)

Forex Chart

From Mar 2024 to Apr 2024

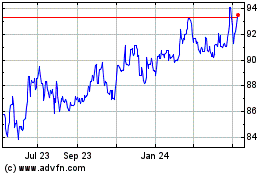

NZD vs Yen (FX:NZDJPY)

Forex Chart

From Apr 2023 to Apr 2024