South Korean Won Tumbles Against Yen And Dollar

September 23 2009 - 7:55PM

RTTF2

Thursday in Asia, the South Korean won tumbled against its

Japanese and US counterparts as a slump in South Korean stocks

decreased demand for the local currency.

The South Korean market drifted lower today with the overnight

negative close on Wall Street and lower commodity prices prompting

investors to go in for some selling in technology, shipbuilding and

energy sectors.

The benchmark KOSPI index, which rebounded into positive

territory after early weakness, has faltered into the red to 1,704,

posting a loss of 7.5 points or 0.44%.

During Thursday's early Asian deals, the South Korean won

declined to 1198.10 against the dollar. The next downside target

level for the Korean currency is seen at 1210.10. The dollar-won

pair was worth 1192.60 at Wednesday's close.

From U.S., the Labor Department is due to release its customary

weekly jobless claims report for the week ended September 19th at

8:30 am ET. Economists expect a small increase in claims to

550,000. At 10:00 am ET, the National Association of Realtors is

scheduled to release its report on existing home sales for August.

Economists estimate existing home sales of 5.35 million for the

month.

The Chair of the White House Council of Economic Advisers

Christina Romer is scheduled to deliver the keynote address to the

Chicago Federal Reserve Bank's International Banking Conference in

Chicago at 1 pm ET

In early Asian trading on Thursday, the South Korean won edged

down against its Japanese counterpart. The won reached 13.1680

against the yen, with 13.23 seen as the next downside target level.

The yen-won pair was worth 13.0590 at yesterday's New York session

close.

The yen has been rallying against other major currencies today

as Japan posted a merchandise trade surplus in August. Japan saw a

merchandise trade surplus of 185.7 billion yen in August, the

Ministry of Finance said today. That beat analyst expectations for

a surplus of 157 billion yen following the revised 377.9 billion

yen surplus in July, and it marked the seventh consecutive month of

surplus.

Exports were down 36 percent on year, compared to forecasts for

a 36.5 percent annual decline to 4.511 trillion yen. Overall,

exports have fallen now in 11 consecutive months.

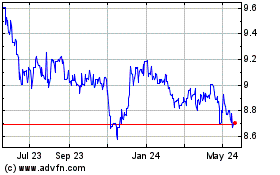

Yen vs KRW (FX:JPYKRW)

Forex Chart

From Apr 2024 to May 2024

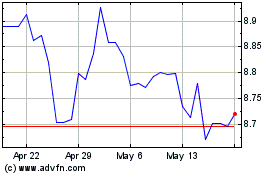

Yen vs KRW (FX:JPYKRW)

Forex Chart

From May 2023 to May 2024