Regulatory News:

NHOA (Paris:NHOA):

- In H1 2021 NHOA confirmed its growth trend in terms of

revenues, backlog and pipeline despite global restrictions for

Covid-19 and related delays in project development and execution.

However, the world has been affected dramatically by the ongoing

supply chain disruption, with no exception for NHOA. As of today,

NHOA is confirming the clear trajectory towards the achievement of

the 2021 and 2022 revenues guidance.

- Revenues and Other Income increased by 44% with respect to H1

2020, including non-recurring income related to the Vehicle-to-Grid

project with Stellantis.

- Backlog2 increased by 88% compared to September 2020, and

together with the Contracts Secured3 amount to €149 million.

- During H1 2021 NHOA has devoted significant costs and time to

the incorporation of the Joint Venture with Stellantis, and the

acquisition related to the major shareholder change, which are

one-time and non recurring events.

Revenues and Other Income amount to €7.2 million,

including €1 million of non-recurring income related to the

Vehicle-to-Grid project with Stellantis, as of 30 June 2021, up 44%

compared to First Half 2020. The increase in Revenues and Other

Income is mainly driven by the €4.9 million revenues realized by

the eMobility Global Business Line (“GBL”) which became

fully operational in May after the completion of the Joint Venture

(“JV”) between NHOA and Stellantis dedicated to eMobility

activities: Free2Move eSolutions. The Energy Storage GBL €2.3

million Revenues and Other Income, were partially affected by

Covid-19 related logistic restrictions that challenged construction

schedules. Nonetheless, NHOA has been able to realize the Factory

Acceptance Test for a 10 MWh system in Massachusetts, and complete

the test run of the Sol De Insurgentes solar-plus-storage project

in Mexico. Other Income is mainly driven by the recognition of the

non-recurring €1 million contribution related to the development of

the Vehicle-to-Grid project with Stellantis. The 26% Gross margin

including such non-recurring item is mainly driven by revenues mix,

and is partially affected by set up cost of the eMobility GBL. The

gross margin excluding this non-recurring income amounts to €0.9

million, i.e. 14%.

Backlog and Contracts Secured totalize €149 million,

represented by 700 MWh in U.S.A., Europe and Africa. Backlog

amounts to €45 million, up by 88% compared to the Backlog

communicated on 24 September 2020, with over 90 MWh between

California, Massachusetts, Vermont and Italy. Contracts Secured

amount to €104 million, thanks to more than 600 MWh of projects

secured in Guam and Hawaii with ENGIE.

Pipeline4 in the Energy Storage GBL5 increases by 6% over

the same period, reaching €835 million, thanks to the rapid market

acceleration we experienced across all key geographies particularly

in North America, Europe and Asia Pacific.

Personnel costs increased by 55% reaching €5.7 million

compared to €3.7 million in First Half 2020, in line with the

increase in headcount, increased by 63% over the period. As of 30

June 2021, NHOA has 179 employees, from 19 nationalities. The

strengthening of the workforce is in line with NHOA’s roadmap

following the Masterplan 10x and mainly devoted to the execution of

the projects in USA, APAC and the ramp-up of the eMobility GBL.

R&D investments amount to €1.6 million and represent

27% of the consolidated Revenues, confirming the strong commitment

towards R&D and innovation, which is progressively addressed

also towards the eMobility GBL.

Other Operating Expenses increased by 17% amounting to

€1.6 million, compared to €1.4 million in the first semester 2020

expressing a physiological growth in this specific moment of the

company.

EBITDA including non recurring income represents a €5.5

million loss in the first semester 2021 compared to a €4.4 million

loss in the first semester 2020, due to the increase in operating

expenses and in personnel costs, which more than offset the

increase in revenues. This is a natural effect of the investments

that NHOA made in terms of people and industrial footprint (just

partially offset by low revenues/gross margin generated as of H1

2021) in order to carry forward the industrial base needed to

execute the €149 million Backlog and Contracts Secured.

Non recurring expenses and Incentive Plan account

for €2.6 million and €4.8 million respectively, both items being

affected by the extraordinary transactions performed during the

period: such as the closing of the JV with Stellantis and

post-closing relevant events, essentially the closing between ENGIE

and TCC, implying an acceleration on SARs plan.

EBIT and Net Result as of 30 June 2021 stand,

respectively, at €-15.8 million and €-15.9 million compared to

€-6.5 million and €-6.5 for the previous year.

Net Financial Position at the end of the first semester

2021 stands at €-24.7 million compared to €-21.3 million on 31

December 2020.

NHOA

NHOA (formerly Engie EPS) develops technologies enabling the

global transition towards clean energy and sustainable mobility,

shaping the future of a next generation living in harmony with our

planet.

Listed on Euronext Paris regulated market (NHOA:PA), NHOA forms

part of the CAC® Mid & Small and CAC® All-Tradable financial

indices. Its registered office is in Paris, with research,

development and production located in Italy.

For further information, go to www.nhoa.energy.

Forward-looking statement

This release may contain forward-looking statements. These

statements are not undertakings as to the future performance of

NHOA. Although NHOA considers that such statements are based on

reasonable expectations and assumptions at the date of publication

of this release, they are by their nature subject to risks and

uncertainties which could cause actual performance to differ from

those indicated or implied in such statements. These risks and

uncertainties include without limitation those explained or

identified in the public documents filed by NHOA with the French

Financial Markets Authority (AMF), including those listed in the

“Risk Factors” section of the NHOA Universal Registration Document

filed with the AMF on 7 April 2021 (under number D.21-0273).

Investors and NHOA shareholders should note that if some or all of

these risks are realized they may have a significant unfavorable

impact on NHOA.

These forward looking statements can be identified by the use of

forward looking terminology, including the verbs or terms

“anticipates”, “believes”, “estimates”, “expects”, “intends”,

“may”, “plans”, “build- up”, “under discussion” or “potential

customer”, “should” or “will”, “projects”, “backlog” or “pipeline”

or, in each case, their negative or other variations or comparable

terminology, or by discussions of strategy, plans, objectives,

goals, future events or intentions. These forward-looking

statements include all matters that are not historical facts and

that are to different degrees, uncertain, such as statements about

the impacts of the Covid-19 pandemic on NHOA’s business operations,

financial results and financial position and on the world economy.

They appear throughout this announcement and include, but are not

limited to, statements regarding NHOA’s intentions, beliefs or

current expectations concerning, among other things, NHOA’s results

of business development, operations, financial position, prospects,

financing strategies, expectations for product design and

development, regulatory applications and approvals, reimbursement

arrangements, costs of sales and market penetration. Important

factors that could affect performance and cause results to differ

materially from management’s expectations or could affect NHOA’s

ability to achieve its strategic goals, include the uncertainties

relating to the impact of Covid-19 on NHOA’s business, operations

and employees. In addition, even if the NHOA’s results of

operations, financial position and growth, and the development of

the markets and the industry in which NHOA operates, are consistent

with the forward-looking statements contained in this announcement,

those results or developments may not be indicative of results or

developments in subsequent periods. The forward-looking statements

herein speak only at the date of this announcement. NHOA does not

have the obligation and undertakes no obligation to update or

revise any of the forward-looking statements.

Follow us on LinkedIn Follow us on Instagram

1.1 Consolidated Income

Statement

CONSOLIDATED INCOME STATEMENT (amounts

in Euro)

30/06/2021

31/12/2020

30/06/2020

Revenues

6.052.300

10.798.205

4.914.240

Other Income including non-recurring

1.145.868

253.596

111.887

TOTAL REVENUES AND OTHER INCOME

(including non-recurring income)

7.198.168

11.051.801

5.026.127

Cost of goods sold

(5.337.029)

(7.221.152)

(3.690.491)

GROSS MARGIN FROM SALES (including

non-recurring income)

1.861.139

3.830.649

1.335.636

% on Revenues and other income

25,9%

34,7%

26,6%

Personnel costs

(5.735.830)

(7.774.565)

(3.703.950)

Other operating expenses

(1.645.346)

(2.937.171)

(1.406.757)

Other costs for R&D and industrial

operations (1)

0

(1.543.425)

(610.141)

EBITDA excluding Stock Option and

Incentive Plans expenses, including non -recurring income

(2)

(5.520.036)

(8.424.511)

(4.385.212)

Amortization and depreciation

(2.815.237)

(3.325.887)

(1.291.930)

Impairment and write down

(56.348)

(1.509.491)

(196.061)

Non-recurring income and expenses and

Integration costs

(2.642.690)

(569.535)

(142.226)

Stock options and Incentive plans

(4.771.255)

(824.790)

(513.025)

EBIT

(15.805.568)

(14.654.215)

(6.528.455)

Net financial income and expenses

(54.459)

(90.791)

39.481

Income Taxes

(15.776)

(69.540)

(31.291)

NET INCOME (LOSS)

(15.875.803)

(14.814.545)

(6.520.264)

Attributable to:

Equity holders of the parent company

(15.463.596)

(14.814.545)

(6.520.264)

Non-controlling interests

(412.206)

0

0

Basic earnings per share

(1,21)

(1,16)

(0,51)

Weighted average number of ordinary shares

outstanding

12.766.860

12.766.860

12.766.860

Diluted earnings per share

(1,21)

(1,16)

(0,51)

(1) Other costs for R&D and industrial

operations have been reclassified to cost of goods sold in 2021. It

is defined in notes 4.5 of Consolidated Financial Statement.

(2) EBITDA excluding Stock Option and

Incentive Plans expenses is not defined by IFRS. It is defined in

notes 3.8 and 4.6 of Consolidated Financial Statement.

1.2 Consolidated Statement of

Other Comprehensive Income

OTHER COMPREHENSIVE INCOME (amounts in

Euro)

30/06/2021

31/12/2020

30/06/2020

NET INCOME (LOSS)

(15.463.596)

(14.814.545)

(6.520.264)

Exchange differences on translation of

foreign operations and other differences

0

0

(2.739)

Other comprehensive income not to be

reclassified to profit or loss in subsequent periods (net of

tax)

0

(1.323)

7.714

Actuarial gain and (losses) on employee

benefits

218.120

(193.087)

(64.945)

Other comprehensive income (loss) for the

year, net of tax

218.120

(194.410)

(59.970)

Total comprehensive income for the year,

net of tax

(15.245.477)

(15.008.955)

(6.580.235)

Attributable to Equity holders of the

parent company

(15.245.477)

(15.008.955)

(6.580.235)

1.3 Consolidated Balance

Sheet

ASSETS (amounts in Euro)

30/06/2021

31/12/2020

30/06/2020

Property, plant and equipment

3.744.415

2.521.277

2.860.550

Intangible assets

8.750.510

9.272.391

8.120.705

Investments in entities accounted using

the equity method

9.445

9.445

996

Other non-current financial assets

4.890.346

190.346

168.346

TOTAL NON CURRENT ASSETS

17.394.716

11.993.458

11.150.597

Trade and other receivables

9.950.093

11.639.388

4.068.586

Contract assets

344.311

1.068.083

7.226.231

Inventories

2.803.845

1.988.444

3.218.163

Other current assets

3.609.388

2.502.356

3.266.872

Current financial assets

8.174.213

467.500

459.219

Cash and cash equivalent

9.082.310

3.930.868

3.773.701

TOTAL CURRENT ASSETS

33.964.160

21.596.638

22.012.772

TOTAL ASSETS

51.358.876

33.590.096

33.163.369

EQUITY AND LIABILITIES (amounts in

Euro)

30/06/2021

31/12/2020

30/06/2020

Issued capital

2.553.372

2.553.372

2.553.372

Share premium

48.147.696

48.147.696

48.147.696

Other Reserves

4.623.788

4.399.167

4.529.648

Retained Earnings

(66.947.590)

(52.139.663)

(52.953.882)

Profit (Loss) for the period before

Revaluation of European Investment Bank warrants liabilities (IFRS

2)

(15.463.596)

(14.814.546)

(6.520.264)

TOTAL GROUP EQUITY

(27.086.331)

(11.853.975)

(4.243.431)

Minorities interest

20.187.793

0

0

TOTAL EQUITY

(6.898.538)

(11.853.975)

(4.243.431)

Severance indemnity reserve and Employees'

benefits

1.441.327

4.925.948

4.819.075

Non current financial liabilities

32.780.509

24.237.071

20.254.905

Other non current liabilities

2.857.771

1.903.628

1.998.478

Non-current deferred tax liabilities

16.494

16.494

16.494

TOTAL NON CURRENT LIABILITIES

37.096.101

31.083.141

27.088.952

Trade payables

7.635.292

6.887.267

5.370.248

Other current liabilities

12.522.524

6.505.062

3.664.869

Current financial liabilities

1.003.498

968.600

1.271.175

Income tax payable

0

0

11.556

TOTAL CURRENT LIABILITIES

21.161.313

14.360.929

10.317.848

TOTAL EQUITY AND LIABILITIES

51.358.876

33.590.095

33.163.369

1.4 Consolidated Statement of

Changes in Equity

CONSOLIDATED STATEMENT OF CHANGES IN

EQUITY (amounts in Euro)

Share Capital

Premium Reserve

Stock Option and Warrants plan

reserve

Minority interests

Other Reserves

Retained Earnings

(Losses)

Profit (Loss) for the

period

Total Equity before European

Investment Bank variation (IFRS 2)

TOTAL EQUITY

Net Equity as of 31 December

2019

2.553.372

48.147.696

4.969.291

-

(382.504)

(38.306.765)

(14.644.285)

2.336.804

2.336.804

Previous year result allocation

(14.644.285)

14.644.285

-

-

Opening reclassification 01/01/2020

-

-

Other movements

-

-

Loss for the period

(6.520.264)

(6.520.264)

(6.520.264)

Total comprehensive income

-

-

-

-

(57.231)

(2.739)

-

(59.970)

(59.970)

Net Equity as of 30 June 2020

2.553.372

48.147.696

4.969.291

-

(439.735)

(52.953.789)

(6.520.264)

(4.243.431)

(4.243.431)

Previous year result allocation

6.520.264

6.520.264

6.520.264

Opening reclassification 01/01/2020

6.790

(6.790)

-

-

Other movements

818.178

818.178

818.178

Loss for the period

(14.814.545)

(14.814.545)

(14.814.545)

Total comprehensive income

-

-

-

(137.179)

2.739

-

(134.440)

(134.440)

Net Equity as of 31 December

2020

2.553.372

48.147.696

4.969.291

-

(570.125)

(52.139.663)

(14.814.546)

(11.853.975)

(11.853.975)

Previous year result allocation

(14.814.546)

14.814.546

-

-

Opening reclassification 01/01/2021

-

-

Other movements

6.502

6.618

13.120

13.120

Non controlling interests

20.187.793

20.187.793

20.187.793

Loss for the period

(15.463.596)

(15.463.596)

(15.463.596)

Total comprehensive income

-

-

-

-

218.120

-

-

218.120

218.120

Net Equity as of 30 June 2021

2.553.372

48.147.696

4.969.291

20.187.793

(345.503)

(66.947.590)

(15.463.596)

(6.898.538)

(6.898.538)

1.5 Consolidated Statement of

Cash Flows

CASH FLOW STATEMENT (amounts in

Euro)

30/06/2021

31/12/2020

30/06/2020

Net Income or Loss

(15.875.802)

(14.814.545)

(6.520.264)

Amortisation and depreciation

2.815.237

3.325.887

1.291.930

Impairment and write down

56.348

1.509.491

196.061

Stock option and incentive plans

impact

4.771.255

824.790

513.025

Defined Benefit Plan

(3.484.621)

100.328

(6.544)

Working capital adjustments

Decrease (increase) in tax assets

(296.234)

(296.234)

(790.475)

Decrease (increase) in trade and other

receivables and prepayments

1.199.318

8.461.612

9.140.030

Decrease (increase) in inventories

(815.401)

997.504

(232.215)

Increase (decrease) in trade and other

payables

6.709.138

(8.598.884)

(11.631.110)

Increase (decrease) in non current assets

and liabilities

(3.289.635)

(459.378)

584.369

Net cash flows from operating

activities

(8.210.397)

(8.949.428)

(7.455.193)

Investments

Net Decrease (Increase) in intangible

assets

(3.372.219)

(4.528.996)

(1.995.160)

Net Decrease (Increase) in tangible

assets

(144.276)

(208.837)

(53.117)

Net Decrease (Increase) due to IFRS 16

FTA

(1.254.962)

(53.207)

0

Reversal of IFRS 15 FTA

0

818.178

0

Net cash flows from investments

activities

(4.771.457)

(3.972.862)

(2.048.277)

Financing

Increase (decrease) in bank debts

8.578.334

10.673.494

6.993.903

Minorities cash injection

8.300.000

IFRS 16 Impact

1.254.962

(251.711)

(148.104)

Net cash flows from financing

activities

18.133.296

10.421.783

6.845.799

Net cash and cash equivalent at the

beginning of the period

3.930.868

6.431.375

6.431.375

NET CASH FLOW FOR THE PERIOD

5.151.442

(2.500.507)

(2.657.670)

NET CASH AND CASH EQUIVALENTS AT THE

END OF THE PERIOD

9.082.310

3.930.868

3.773.704

_________________ 1 These preliminary results are unaudited.

Completion of the standard audit procedures and release of audit

report with publication of the H1 2021 Financial Statements is

expected on September 30, 2021. 2 As per the Universal Registration

Document 2020, Backlog or Project Backlog means, as of a given

date, the estimated revenues and other income attributable to (i)

purchase orders received, contracts signed and projects awarded as

of the date hereof, and (ii) Project Development contracts

associated with a Power Purchase Agreement, where the agreed value

is a price per kWh of electricity and an amount of MW to be

installed. 3 According to the Universal Registration Document 2020,

Contracts Secured means projects awarded, for which the signature

of the full sets of the agreements has not been yet completed.

Typically, when NHOA is awarded with a tender, typically being

project financing, there are several steps to be completed (i.e.

the EPC Agreement, the Notice to Proceed, permission to be signed).

Once terms of documentation and planning permissions are defined,

Contracts Secured becomes Backlog. 4 As defined in the Universal

Registration Document 2020, Pipeline means the estimate, to date,

of the amount of potential projects, tenders and requests for

proposal for which the NHOA Group has decided to participate or

respond. 5 As per the Press Release dated 23 July 2021 and

consistently with the trading and operational update to be released

on a quarterly basis, Pipeline will be an indicator exclusively

referring to the Energy Storage Global Business Line (and Atlante

GBL, starting from Q3 2021).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210915006145/en/

Press Office: Claudia Caracausi, Image Building, +39 02

89011300, nhoa@imagebuilding.it Corporate and Institutional

Communication: Cristina Cremonesi, +39 345 570 8686,

ir@nhoa.energy

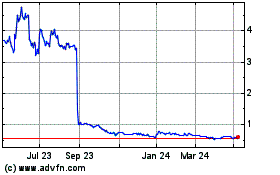

NHOA (EU:NHOA)

Historical Stock Chart

From Mar 2024 to Apr 2024

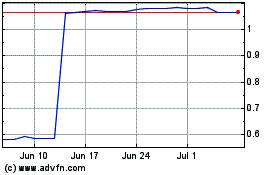

NHOA (EU:NHOA)

Historical Stock Chart

From Apr 2023 to Apr 2024