TO THE SIMPLIFIED TENDER OFFER FOR THE

SHARES OF NHOA S.A. INITIATED BY TAIWAN CEMENT EUROPE

HOLDINGS B.V., A SUBSIDIARY OF TCC

Regulatory News:

NHOA (Paris:NHOA):

Not for publication, dissemination or

distribution, directly or indirectly, in the United States of

America or any other jurisdiction in which the distribution or

dissemination of this Press Release is unlawful.

This Press Release does not constitute an offer

to purchase any securities. The Offer described hereinafter may

only be opened after the clearance of the French Autorité des

marchés financiers.

In the event of any differences between this

unofficial English-language translation and the official French

document, the official French document shall prevail.

This press release relating to the filing with the Autorité des

marchés financiers (the “AMF”) on 26 July 2021, of a draft

response offer document in relation to the draft simplified tender

offer for the shares of NHOA S.A., was prepared and issued by NHOA

S.A. on 26 July 2021 in accordance with the provisions of Article

231-16 III of its general regulation.

The draft simplified

tender offer (the “Offer”) and the Draft Response Document remain

subject to the review of the AMF.

The draft response offer document filed with the AMF on 26 July

2021 (the “Draft Response Document”) is available on the

websites of NHOA S.A. (www.nhoa.energy) and of the AMF

(www.amf-france.org) and may be obtained free of charge at the

registered office of NHOA S.A. (28 rue de Londres – 75009

Paris).

In accordance with Article 231-28 of the AMF General Regulation,

the information relating, in particular, to the legal, financial

and accounting characteristics of NHOA S.A. will be filed with the

AMF and made available to the public, no later than the day

preceding the opening of Offer.

A press release will be issued to inform the public of the

manner in which this information will be made available.

1. REMINDER OF THE MAIN TERMS AND CONDITIONS OF THE

OFFER

Pursuant to Title III of Book II, and more particularly Article

233-1, 2° and Articles 234-2 et seq. of the AMF General Regulation,

Taiwan Cement Europe Holdings B.V., a private company with limited

liability (besloten vennootschap met beperkte aansprakelijkheid)

organised under the laws of the Netherlands, with an issued share

capital of EUR 75,001,000, having its registered office at

Strawinskylaan 3051, 1077 ZX, Amsterdam, the Netherlands, and

registered with the trade register of the Dutch Chamber of Commerce

under number 82637970 (“TCEH” or the “Offeror”),

makes an irrevocable offer to the shareholders of NHOA S.A., a

société anonyme à conseil d’administration organised under the laws

of France, with a share capital of EUR 2,553,372, having its

registered office at 28 rue de Londres, 75009 Paris, France,

registered with the Trade and Companies Register of Paris under

number 808 631 691 (“NHOA” or the “Company”) and

whose shares are admitted to trading on Compartment C of the

regulated market of Euronext Paris (“Euronext Paris”) under

ISIN Code FR0012650166, ticker symbol “NHOA:PA” (the

“Shares”), to acquire all of their Shares at the price of

EUR 17.10 per Share, as part of a simplified tender offer (the

“Offer”), the terms and conditions of which are described in

the draft offer document filed with the AMF on 23 July 2021 (the

“Draft Offer Document”).

The Offeror is an indirect subsidiary of Taiwan Cement

Corporation, a company organised under the laws of the Republic of

China (Taiwan), whose registered office is at No. 113, Section 2,

Zhongshan North Road, Taipei City 104, Taiwan (“TCC”, and,

together with its subsidiaries, the “TCC Group”).

The Offer, which follows the acquisition on 20 July 2021 by the

Offeror from GDF International (the “Block Trade”) of

7,721,453 Shares representing 60.48% of the Company’s share capital

and theoretical voting rights, targets all the issued and

outstanding Shares not directly or indirectly held by the Offeror

as of the date of the Draft Response Document – i.e., to the

knowledge of the Company, a maximum number of 5,045,407 Shares,

representing 39.52% of the Company’s share capital and theoretical

voting rights.1

Pursuant to the provisions of Article L. 433-3, I of the French

Code monétaire et financier and of Article 234-2 of the AMF General

Regulation, the Offer is mandatory since the completion of the

Block Trade on 20 July 2021, resulted in the Offeror crossing

upward the thresholds of 30% of the Company’s share capital and

voting rights. The Offer is carried out in accordance with the

simplified offer procedure governed by Articles 233-1 et seq. of

the AMF General Regulation. The Offer will be open for a period of

ten (10) trading days. The attention of the shareholders of the

Company is drawn to the fact that the Offer, which is made under

the simplified procedure, will not be reopened after the

publication of the final result of the Offer.

The Offeror indicated his intention for the Shares to remain

listed on the regulated market of Euronext Paris and, therefore,

that it is not planning to make use of the option provided by

Article 237-1 of the AMF General Regulation and request the

implementation of a squeeze-out procedure targeting the Shares if

the number of Shares not tendered to the Offer by the minority

shareholders of the Company does not represent, upon closing of the

Offer, more than 10% of the share capital and voting rights of the

Company.

The Offer is presented by Société Générale which guarantees, in

accordance with the provisions of Article 231-13 of the AMF General

Regulation, the content and the irrevocable nature of the

commitments undertaken by the Offeror in connection with the

Offer.

2. REASONED OPINION OF THE BOARD OF DIRECTORS

2.1 Presentation of the ad hoc Committee

The Board of Directors, which met on 7 October 2020 following

the public announcement by ENGIE, on 31 July 2020, of its intention

to assess strategic options for the Company, including the

potential sale of its controlling stake in the Company, set up an

ad hoc committee which was first composed of the Company’s

independent directors (i.e., Mr Luigi Michi, Mr Romualdo Cirillo

and Mr Massimo Prelz Oltramonti) (the “Ad Hoc Committee”). Mr

Massimo Prelz Oltramonti resigned from his functions as director

and, consequently, as member of the Ad Hoc Committee on 11 February

2021.

Following the announcement by the Company of the entry into the

Share Purchase Agreement and the proposed Offer, by way of a press

release dated 20 April 2021, the Board of Directors of the Company

appointed Mr Carlalberto Guglielminotti as member of the Ad Hoc

Committee in replacement of Mr Massimo Prelz Oltramonti. The

President of the Ad Hoc Committee is Mr Romualdo Cirillo. The Ad

hoc is therefore composed of two thirds of independent

directors.

The Board of Directors, in the course of its meeting dated 10

May 2021, upon proposal of the Ad Hoc Committee, appointed the

financial services firm Associés en Évaluation et Expertise

Financières represented by Mrs Sonia Bonnet-Bernard as independent

expert (the “Independent Expert”) in charge of issuing a report on

the financial terms of the Offer in accordance with the provisions

of Article 261-1 I, 1° and 2° of the AMF General Regulation.

The appointment of the Independent Expert was publicly announced

by the Company by way of press release dated 19 May 2021.

The report of the Independent Expert and the reasoned opinion of

the Board of Directors are reproduced in full in the Draft Response

Document.

In accordance with the provisions of Article 261-1, III of the

AMF General Regulation, the members of the Ad hoc Committee met on

July 22, 2021, in order to examine the Offer and to prepare a draft

reasoned opinion on the interest and consequences of the Offer for

the Company, its shareholders and its employees. The draft reasoned

opinion of the Ad hoc Committee was approved unanimously by the

members of the Ad hoc Committee. Accordingly, the draft reasoned

opinion of the Ad hoc Committee was submitted to the Board of

Directors. It is reproduced below.

2.2 Reasoned opinion of the Board of Directors

In accordance with the provisions of Article 231-19 of the AMF

General Regulation, the members of the Board of Directors met on

July 23, 2021, to consider the proposed Offer and issue a reasoned

opinion on the interest and consequences of the Offer for the

Company, its shareholders and its employees.

All members of the Board of Directors of the Company were

present or represented.

The following documents were made available to the

directors:

- the Draft Offer Document to be filed by the Offeror with the

AMF, which notably includes the context and reasons for the Offer,

the intentions of the Offeror, the characteristics of the Offer and

the elements of appraisal of the Offer price;

- the draft reasoned opinion prepared by the Ad hoc committee in

accordance with Article 261-1, III of the AMF General

Regulation;

- the report of the financial services firm Associés en

Évaluation et Expertise Financières, acting as Independent

Expert;

- the opinion delivered to the Board of Directors by Lazard

S.r.l. (“Lazard”);

- the Company’s Draft Response Document, prepared in accordance

with Article 231-19 of the AMF General Regulation; and

- the draft “other information” document relating to the legal,

financial, accounting and other characteristics of the

Company.

The Board of Directors of the Company, in the course of such

meeting held on 23 July 2021, has thus issued the following

reasoned opinion unanimously (including all the independent

directors, the other directors having followed and voted in

accordance with the position recommended by the Ad Hoc

Committee).

The excerpt of the deliberations of this meeting including the

reasoned opinion of the Board of Directors is reproduced below:

Presentation of the report of the Independent Expert

A2EF, which was appointed as independent expert pursuant to

Article 261-1 I of the AMF General Regulation, presented its

finalised report to the Ad Hoc Committee at its meeting held on

July 22, 2021.

Such report was communicated to the Board members and was

presented to the Board by the Independent Expert at its meeting

held on July 23, 2021.

Ms. Sonia Bonnet-Bernard, on behalf of A2EF presented the work

of the Independent Expert regarding the valuation of the Company

and the analysis of the fairness of the price offered by the

Offeror in the Offer.

A2EF presented the conclusion of its report, noting that the

price offered:

- is equivalent to the price obtained by Engie as part of the

sale of its 60.48% stake in the Company’s capital to TCC at the end

of a competitive sale process;

- represents a discount of 18.6% on the spot price the day before

the announcement of the signing of the sale agreement between Engie

and TCC, and discounts of 7.4% and 6.3% on 20- and 60-day weighted

average prices. It should be reiterated that the price increased

significantly following the signing of the joint venture agreement

with Stellantis in January 2021; and

- represents a premium and share interval of +4.1% to -23% on the

values obtained through an analysis of discounted future cash flows

from the Company’s business plan (the Masterplan10x), incorporating

an ambitious Management goal over the period 2026-2030. It should

be noted that given the ongoing “start-up” character of the Company

(in particular in eMobility operating through the JV Free2Move

eSolutions, which is starting its activity), the forecasts are

based upon a high level of uncertainty,

and concluding that:

- In the context of the present optional Offer for the minority

shareholders, and given the intentions of the Offeror, shareholders

who would like to remain exposed to the Company’s development can

retain their shares and will be able to participate in the

Company’s next capital increases, whose terms are not yet known. As

reiterated in the press release of 23 July 2021, the Strategic

Ambitions set targets with respect to increasing market share at a

significant level in a rapidly growing and competitive market; they

also involve high execution risks; and

- In this context, the Independent expert is of the opinion that

the price of 17.10 euros per share offered to the Company’s

minority shareholders as part of the present Offer is fair in that

it offers them the opportunity to exit at the same price as the

controlling shareholder for the transfer of its 60.48% stake, being

recalled that the Offeror does not intend to request the

implementation of a squeeze-out procedure.

Presentation by Lazard

A representative of Lazard S.r.l. (“Lazard”) made a

presentation to the Ad Hoc Committee at its meeting held on July

22, 2021 and to the Board at its meeting held on July 23, 2021.

Lazard, after reviewing the financial terms and conditions of

the simplified tender offer document and performing various

financial analyses, concluded that, as of the date of its opinion

and subject to the limitations, qualifications and assumptions set

forth in its opinion, the offer price, is fair, from a financial

point of view, to the shareholders of the Company (other than the

Offeror or any of its affiliates).

It should be noted that Lazard’s opinion does not constitute an

"attestation d’équité" and Lazard shall not be considered as an

"expert indépendant", in each case within the meaning of the AMF

regulations. Further Lazard’s opinion does not constitute a

recommendation to any person as to whether such person should

tender its shares in the offer.

Activities and recommendations of the Ad Hoc

Committee

Mr Romualdo Cirillo, acting as President of the Ad Hoc

Committee, reports on the committee’s mission and summarizes

hereafter the activities conducted in the context of such

mission:

(a) Appointment of the independent

expert

- Associés en Évaluation et Expertise Financières (“A2EF”)

represented by Mrs Sonia Bonnet-Bernard, was identified by the Ad

Hoc Committee among other financial services firms likely to meet

the competence criteria required by applicable regulations and was

then appointed by the board of directors as independent expert,

taking into account its experience in comparable recent and complex

operations, its reputation and in the absence of any conflict of

interests.

- A2EF confirmed that it is not in a situation of conflict of

interests and that it has the means and the availability required

to act as independent expert and to conduct its mission in the

contemplated timetable.

- The description of A2EF’s mission with the Company was provided

for in an engagement letter dated 17 May 2021.

(b) Activities of the ad hoc committee and

discussions with the independent expert

- The Ad Hoc Committee met eight times since the announcement of

the signing of the Share Purchase Agreement between Engie and TCC,

including four times with the presence of the Independent Expert,

as well as Lazard and the legal advisors appointed by the Ad Hoc

Committee. The matters reviewed at such meetings included: (i) a

presentation of the methodology used by the Independent Expert,

(ii) the status of its access to the information requested by the

Independent Expert, notably with the assistance of the management

of the Company and (iii) the progressive advancement of its work

presented by the Independent Expert at each meeting. The Ad hoc

Committee also received information from the Company as to the

status of regulatory approvals sought in connection with the

acquisition contemplated by the Share Purchase Agreement.

- Each time, the Ad Hoc Committee ensured that the independent

expert’s work was conducted in satisfactory conditions at every

step.

- In addition, the Ad Hoc Committee ensured throughout the

process, notably with the assistance of Mr Carlalberto

Guglielminotti, that the independent expert received all the

available information required for the purpose of performing its

mission.

- The Company provided the independent expert with the following

information regarding its business plan: the Company drew up a

detailed business plan at the end of 2019, the Long Term Strategic

Plan for the period 2020- 2025 approved by the board of Directors

of the Company. Such plan was updated in November 2020 for the

preparation of the 2021 budget (as amended, the “LTSP”). In

addition, as part of the negotiations with FCA which led to the

creation of Free2Move eSolutions, a joint-venture business plan was

agreed upon and appended to the January 2021 agreement.

As announced by the Company, the management of the Company

undertook a comprehensive strategic review of the Company after the

signing of the agreement between TCC and ENGIE, aimed at updating

short and medium-term objectives and setting a layout to guide

future growth and development in the context of the new horizons

ahead with TCC. As a result of such strategic review, the Company

updated its short and long-term guidance which was consolidated in

the Masterplan10x integrating the updated LTSP with (i)

extrapolation made by management until 2030 for Storage on the

basis of long-term outlook, and (ii) the eMobility business plan

appended to the agreement entered into with FCA, updated by the

Company on estimated selling prices of the device and product mix.

The Masterplan10x was approved by the Board of Directors held on 22

July 2021; it is announced in the press release of 23 July 2021 and

presented on this same day by the management during the Masterplan

Day digital event.

The Independent Expert was also informed of the creation of a

new business line named Atlante, announced in the same press

release as the Masterplan10x, through which NHOA has the strategic

ambition to own and operate a fastcharging network for electric

vehicles in Southern Europe. This project would require important

capex (between €3.5 and €4.9 billion over the period 2022-2030)

which could lead to a doubling of revenue in 2030 and a significant

additional EBITDA. This project would require important capex

(between €3.5 and €4.9 billion over the period 2022-2030) which

could lead to a doubling of revenue in 2030 and a significant

additional EBITDA. The Independent Expert was informed by

management a strategic ambition, management indicated that it did

not prepare any business plan yet and the project is not entirely

funded.

- The Ad Hoc Committee acknowledged that no question or

observation were raised by any shareholder to the Ad Hoc Committee

or to the independent expert, including via the AMF.

(c) Conclusions and recommendations of the

Ad Hoc Committee – draft reasoned opinion

- The Ad Hoc Committee acknowledged the elements resulting from

the intentions and objectives declared by the Offeror in its draft

offer document, including in particular:

- With regard to industrial, commercial and financial policy, The

Offeror indicated that it, and, more generally the whole TCC Group,

intends to support and develop the Company’s ability to maintain

its positioning as a key-player in the energy storage, industrial

solutions and e-mobility markets. The Offeror’s ambition is for the

Company to pursue its key strategic orientations, and the Offeror

intends to assist the Company in the efficient and coherent

execution of the Company’s strategy, as set forth in the

Masterplan10x. In particular, the Offeror plans to accelerate the

Company’s development in Asia.

- With regard to employment. The Offeror believes that a key

element of the success of the Company is preserving and developing

the talent of its personnel. Following closing of the Offer, the

Company will remain a separate entity with governance and functions

adapted to the management of the businesses that it is responsible

for. In this respect, the Offeror does not expect any particular

impact of the Offer on the approach pursued by the Company in

relation with employment and employee policy. In particular, the

Offeror does not intend to reduce the number of the Company’s

employees in the short and medium-term or to change the operational

headquarters of the Company, currently located in Milan,

Italy.

- With regards to the listing. The Offeror does not intend to

request, upon closing of the Offer or within a period of three (3)

months therefrom, the implementation of a squeeze-out procedure

pursuant to Articles 237-1 et seq. of the AMF General Regulation,

to the extent the number of Shares not tendered to the Offer by the

Company’s shareholders represent, upon closing of the Offer, less

than 10% of the Company’s share capital and voting rights.

- As regards TCC’s intended support of the development of the

Company, the Ad Hoc Committee further noted TCC’s commitment to

subscribe to a capital increase of the Company following completion

of the Offer designed, in part, to finance the development of its

e-mobility activity, and its support in securing 100 million euros

of credit lines;

- As regards the Company’s teams, the Ad Hoc Committee also noted

that Mr. Carlalberto Guglielminotti was renewed as Chief Executive

Officer at the Board held on July 20, 2021, immediately after the

closing of the acquisition of the 60.48% block by TCC, and that

Executive Director, Mr. Giuseppe Artizzu, would remain in

position

- The Ad Hoc Committee further noted that the price offered is

equal to the price paid by TCC to Engie and TCC has undertaken not

to take any actions that would result in the payment of a price

supplement to Engie.

- The Ad Hoc Committee reviewed the interest of the Offer for the

Company, its shareholders and its employees. Based on the

intentions and objectives of the Offeror set out in the draft offer

document, the Ad Hoc Committee noted that the Offer is in the

interest of the Company and its employees.

In respect of the interest of the Offer for the shareholders,

the Ad Hoc Committee noted the following:

- On the one hand, considering that the terms of the Offer are

considered fair by the Independent Expert who, after reviewing the

terms and context of the acquisition by TCC of the controlling

block held by Engie in the Company, as well as performing a

multi-criteria valuation, concluded to the fairness of the offered

price for the shareholders of the Company, as well as by Lazard,

the Offer may represent an opportunity to obtain full and immediate

liquidity, on the same terms as Engie, as seller of the controlling

block;

- On the other hand, those shareholders not seeking immediate

liquidity and willing to participate to the Company’s ESG-oriented

development plan with the related execution risk and potential

capital increases, may decide to not tender their shares in the

Offer. Notably, the Offeror does not intend to delist the Company

and it has announced its intent to sustain the strategic

development of the Company which, following the acquisition of the

controlling block by TCC, has announced (i) the new business plan

entitled “Masterplan10x”, which includes new short-term

targets and long-term outlook, and (ii) the additional

Strategic Ambitions with project Atlante.

- As a consequence, at the meeting held on July 22, 2021, it

decided to present to the Board of Directors the draft reasoned

opinion set forth above, and to recommend to the Board of Directors

to adopt a similar reasoned opinion.

Reasoned opinion of the Company’s Board of Directors

After reviewing the elements made available to it prior to the

meeting (including the intentions of the Offeror summarized above)

and having heard a presentation of its report by the Independent

Expert, a presentation of its opinion by Lazard and a presentation

of the work of the Ad hoc Committee by its Chairman, and after a

deliberation, the Board of Directors :

- noted that the Independent Expert concluded that the price of

17.10 euros per share offered to the Company’s minority

shareholders as part of the present Offer is fair in that it offers

them the opportunity to exit at the same price as the controlling

shareholder for the transfer of its 60.48% stake, being recalled

that the Offeror does not intend to request the implementation of a

squeeze-out procedure;

- acknowledged the elements resulting from the intentions and

objectives declared the Offeror in its draft offer document,

including in particular those summarized above;

- decided to approve, without modification, the draft reasoned

opinion prepared by the Ad hoc Committee in accordance with Article

261-1,III of the AMF General Regulation as set forth above..

Accordingly, after reviewing the interest of the Offer for the

Company, its shareholders and its employees, and based on the

intentions and objectives of the Offeror set out in the draft offer

document, the Board of Directors noted that the Offer is in the

interest of the Company and its employees.

In respect of the interest of the Offer for the shareholders,

the Board of Directors noted the following:

- On the one hand, considering that the terms of the Offer are

considered fair by the Independent Expert who, after reviewing the

terms and context of the acquisition by TCC of the controlling

block held by Engie in the Company, as well as performing a

multi-criteria valuation, concluded to the fairness of the offered

price for the shareholders of the Company, as well as by Lazard,

the Offer may represent an opportunity to obtain full and immediate

liquidity, on the same terms as Engie, as seller of the controlling

block; and

- On the other hand, those shareholders not seeking immediate

liquidity and willing to participate to the Company’s ESG-oriented

development plan with the related execution risk and potential

capital increases, may decide to not tender their shares in the

Offer. Notably, the Offeror does not intend to delist the Company

and it has announced its intent to sustain the strategic

development of the Company which, following the acquisition of the

controlling block by TCC, has announced (i) the new business plan

entitled “Masterplan10x”, which includes new short-term

targets and long-term outlook, and (ii) the additional

Strategic Ambitions with project Atlante.

3. REPORT OF THE INDEPENDENT EXPERT

In accordance with the provisions of Article 261-1, I, 1° and 2°

of the AMF General Regulation, the Independent Expert was appointed

on 10 May 2021 by the Board of Directors of the Company in order to

prepare a report on the financial terms of the Offer.

The conclusion of the report, dated 23 July 2021, is reproduced

below:

Our mission involved assessing the fairness of the financial

terms offered by TCC to Nhoa’s shareholders through an analysis of

the value of the Company.

At the end of our work, we observed that the price offered:

- is equivalent to the price obtained by Engie in the context of

the sale of its 60.48% stake in the Company’s capital to TCC at the

end of a competitive sales process;

- represents a discount of 18.6% on the spot price the day before

the announcement of the signing of the sale agreement between Engie

and TCC, and discounts of 7.4% and 6.3% on 20- and 60-day weighted

average prices. It should be reiterated that the price increased

significantly following the signing of the joint venture agreement

with Stellantis in January 2021;

- represents a premium and share interval of +4.1% to -23% on the

values obtained through an analysis of discounted future cash flows

from the Company’s business plan (the Masterplan10x), incorporating

an ambitious Management goal over the period 2026-2030. It should

be noted that given the ongoing “start-up” character of the Company

(in particular in eMobility operating through the JV Free2Move

eSolutions, which is starting its activity), the forecasts are

based upon a high level of uncertainty.

(…)

In this context, we are of the opinion that the price of 17.10

euros per share offered to the Company’s minority shareholders as

part of the present Offer is fair in that it offers them the

opportunity to exit at the same price as the controlling

shareholder for the transfer of its 60.48% stake, being recalled

that the Offeror does not intend to request the implementation of a

squeeze-out procedure.

This report is reproduced in Annex of the Draft Response

Document.

4. AVAILABILITY OF THE INFORMATION RELATING TO THE

COMPANY

Other information relating to the Company in particular, to the

legal, financial and accounting characteristics of NHOA S.A. will

be filed with the AMF and made available to the public, no later

than the day preceding the opening of Offer.

In accordance with Article 231-28 of the AMF General Regulation,

this information will be made available on the websites of NHOA

S.A. (www.nhoa.energy) and of the AMF (www.amf-france.org) no later

than the day preceding the opening of Offer and may be obtained

free of charge at the registered office of NHOA S.A. (28 rue de

Londres – 75009 Paris).

Offer restrictions outside of

France

As indicated in Section 2.8 of the Draft

Offer Document, the Offer will be made exclusively in France.

The Draft Response Document will not be

distributed in countries other than France.

To the Company’s knowledge, the Offer will

not be registered or approved outside of France and no action will

be taken to register or approve it abroad. The Draft Offer

Document, the Draft Response Document and the other documents

relating to the Offer do not constitute an offer to sell or

purchase transferable securities or a solicitation of such an offer

in any other country in which such an offer or solicitation is

illegal or to any person to whom such an offer or solicitation

could not be duly made.

The holders of the Shares located outside

of France can only participate in the Offer if permitted by the

local laws to which they are subject, without the Offeror having to

carry out additional formalities. Participation in the Offer and

the distribution of the Draft Offer Document and the Draft Response

Document may be subject to particular restrictions applicable in

accordance with laws in effect outside France. The Offer will not

be made to persons subject to such restrictions, whether directly

or indirectly, and cannot be accepted in any way in a country in

which the Offer would be subject to such restrictions. Accordingly,

persons in possession of the Draft Offer Document and/or the Draft

Response Document are required to obtain information on any

applicable local restrictions and to comply therewith. Failure to

comply with these restrictions could constitute a violation of

applicable securities and/or stock market laws and regulations in

one of these countries. The Company will not accept any liability

in case of a violation by any person of the local rules and

restrictions that are applicable to it.

United States of America

In the specific case of the United States

of America, it is stipulated that the Offer will not be made,

directly or indirectly, in the United States of America, or by the

use of postal services, or by any other means of communication or

instrument (including by fax, telephone or email) concerning trade

between States of the United States of America or between other

States, or by a stock market or a trading system of the United

States of America or to persons having residence in the United

States of America or “US persons” (as defined in and in accordance

with Regulation S of the US Securities Act of 1933, as amended). No

acceptance of the Offer may come from the United States of America.

Any acceptance of the Offer that could be assumed as resulting from

a violation of these restrictions shall be deemed void.

The subject of the Draft Response Document

is limited to the Offer and no copy of the Draft Response Document

and no other document concerning the Offer, the Draft Offer

Document or the Draft Response Document may be sent, communicated,

distributed or submitted directly or indirectly in the United

States of America other than in the conditions permitted by the

laws and regulations in effect in the United States of America.

Any holder of Shares that will tender its

Shares to the Offer shall be deemed to represent that (i) it has

not received a copy of the Draft Offer Document, the Draft Response

Document or any other document relating to the Offer into the

United States of America and it has not sent or otherwise

transmitted any such document into the United States of America,

(ii) it is not a person having residence in the United States of

America and it is not a “US person” (as defined in and in

accordance with Regulation S of the US Securities Act of 1933, as

amended) and that it is not issuing a tender order for the Offer

from the United States of America, (iii) it has not used, directly

or indirectly, postal services, telecommunication means or any

other instruments concerning trade between States of the United

States of America or between other States, or services of a stock

market or a trading system in the United States of America in

connection with the Offer, (iv) it was not located in the United

States of America when it has accepted the terms of the Offer or

its tender order for the Offer, and (v) it is neither an agent nor

a representative acting on behalf of a person other than a person

that communicated instructions outside of the United States.

Authorised intermediaries shall not be

allowed to accept tender orders which do not comply with the

foregoing provisions (save for any authorisation or opposite

instruction by or on behalf of the Offeror at the Offeror’s

discretion). Any acceptance of the Offer which could be assumed to

result from a breach of these restrictions will be deemed void.

The Draft Response Document does not

constitute an offer to sell or purchase transferable securities or

a solicitation of such an offer in the United States of America and

it has not been submitted to, registered with or approved by the

U.S. Securities and Exchange Commission.

For the purposes of this section, “United

States of America” means the United States of America, its

territories and possessions, any one of these States, and the

District of Columbia.

1 On the basis of a total number of 12,766,860 Shares,

representing the same number of theoretical voting rights of the

Company (information as of 4 June 2021 published by the Company on

its website), computed pursuant to Article 223-11 of the AMF

General Regulation.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210726005359/en/

NHOA S.A.

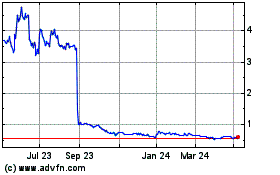

NHOA (EU:NHOA)

Historical Stock Chart

From Mar 2024 to Apr 2024

NHOA (EU:NHOA)

Historical Stock Chart

From Apr 2023 to Apr 2024