Regulatory News:

This press release has been established by

Latécoère (Paris:LAT) and released in accordance with the

provisions of article 231-16 of the general regulation of the AMF

on September 16, 2019.

This document is an

unofficial English-language translation of the press release

relating to the filing of the draft response document. The French

version shall prevail.

THE DRAFT OFFER, THE DRAFT OFFER DOCUMENT

AND THE DRAFT RESPONSE DOCUMENT REMAIN SUBJECT TO REVIEW BY THE

AMF.

The draft response document (the “Draft Response

Document”) is available on the websites of Latécoère

(www.latecoere.aero) of the AMF (www.amf-france.org) and may be

obtained free of charge upon request to the registered office of

Latécoère located at 135, rue de Périole in Toulouse (31500).

I. PRESENTATION OF THE OFFER

Pursuant to Title III of Book II, and more specifically to

Articles 232-1 et seq. of the AMF General Regulation, SCP SKN

HOLDING I S.A.S., a simplified joint stock company (société par

actions simplifiée) whose registered office is located at 39, rue

de la Gare de Reuilly in Paris (75012), and registered with the

Company Registry of Paris under number 851 128 835 R.C.S. Paris1

(the “Offeror”), irrevocably proposes to the shareholders of

Latécoère, a public limited company (société anonyme) whose

registered office is located at 135, rue de Périole in Toulouse

(31500), and registered in the Company Registry of Toulouse under

number 572 050 169 R.C.S. Toulouse (“Latécoère” or the

“Company”), whose shares are admitted to trading on the

regulated market of Euronext Paris (“Euronext Paris”) under

ISIN code FR0000032278, ticker symbol “LAT”, to acquire all their

shares by means of a cash tender offer under the conditions

described below, at a share price of 3.85 euros per Latécoère share

(the “Offer Price”).

The Offer follows the acquisition by the Offeror, on June 26,

2019, of 24,697,727 Latécoère shares representing as many voting

rights, i.e. a stake of 26,05% of the share capital and 25.73% of

the theoretical voting rights of the Company2, from certain

investment funds managed by affiliates of Apollo Global Management,

LLC, Monarch Master Funding 2 (Luxembourg) S.à.r.l. and CVi

Partners SARL (the “Sellers”), for a total amount of

106,838,909.32 US dollars, representing a price of 3.85 euros per

Latécoère share based on the conversion rate agreed between the

parties of EUR 1 = USD 1.1236 (the “Acquisition of the

Stake”).

The Offer targets all outstanding Latécoère shares not held,

directly or indirectly, alone or in concert, by the Offeror,

representing at the date hereof, a maximum number of 70,470,791

shares of the Compay3 representing 74.05% of the share capital and

74.36% of the voting rights of the Company, determined as

follows:

Outstanding shares4

94,818,518

minus shares held by the

Offeror

24,697,727

Total number of shares

targeted by the Offer

70,120,791

It is indicated that, as of the date of the Draft Response

Document, the free shares of the Company allocated at the meetings

of the Board of Directors of the Company on 2 March 2016, 5 March

2018 and 5 March 2019, which represent a number equal to 1,334,206

Latécoère shares, will, unless in exceptional cases of waiver of

their unavailability provided by applicable legal or regulatory

provisions (death or disability of the beneficiary):

(i) for 146,290 of them, shares still in the

vesting period at the closing date of the Offer, which are

therefore not targeted by the Offer; and

(ii) for 1,187,916 of them, shares that will

still be in the retention period at the closing date of the Offer,

and which are targeted by the Offer and therefore included in the

70,120,791 shares targeted by the Offer indicated above. Among

these 1,187,916 shares under retention period, it is specified that

1,000,716 are registered shares held by employees and corporate

officers of the Company and the remaining 187,200 shares were

contributed to the FCPE B via the employee saving scheme and are

now held by the FCPE B.

The beneficiaries of free shares and the FCPE B will be offered

to subscribe to the liquidity mechanism described in sections 1.3.7

and 1.3.8 of the Draft Response Document and sections 2.2.6 and

2.2.7 below.

To the Company’s knowledge, there are no other equity securities

or financial instruments that could give access, immediately or in

the future, to share capital or voting rights of Latécoère.

The Offer will be carried out in accordance with the normal

procedure pursuant to Articles 232-1 et seq. of the AMF General

Regulation and will be open for a period of 25 trading days,

without prejudice to the possible reopening of the Offer by the AMF

in accordance with Article 232-4 of the AMF General Regulation.

The Offer is subject to the withdrawal threshold described in

section 2.6 of the Draft Offer Document.

II. CONTEXT ANDCHARACTERISTICS OF THE

OFFER

2.1. Context of the Offer

The Offer is being filed following the announcement of Latécoère

on April 2, 2019, by way of a press release, of the signing of an

acquisition agreement regarding the transfer by the Sellers to the

Offeror of their entire stake in the Company, representing

approximately 26% of the share capital of the Company (the

“Share Purchase Agreement”).

The Company welcomed this proposed transaction, during which the

Offeror expressed its support for the strategy proposed by

management and approved by the Board of Directors. The Company

confirmed on that occasion that the nomination of three members

proposed by Searchlight would be submitted to its Board of

Directors.

On June 26, 2019, the Offeror completed the Acquisition of the

Stake for a total amount of 106,838,909.32 US dollars, representing

a price of 3.85 euros per Latécoère share based on the euro-dollar

conversion rate on the signing date of the Share Purchase

Agreement5.

The Share Purchase Agreement contains a top-up provision in the

event that, within twelve months following the completion of the

Acquisition of the Stake, the Offeror, directly or indirectly,

alone or in concert, files with the AMF an exclusively cash tender

offer or including a cash component at a price per Latécoère share

higher than that of the Acquisition of the Stake (i.e. 3.85 euros

per share, adjusted, if necessary (a) in proportion to the new

outstanding number of Latécoère shares in the event of any

subdivision or consolidation of shares completed at any time

between the date of the Share Purchase Agreement and the date of

payment of the additional consideration, and (b) any distribution

of dividend or reduction of share capital of the Company made

between these two same dates), and whose outcome would be

successful (i.e., as a result of which the Offeror would hold more

than the threshold referred to in article 231-9 I 1° of the AMF

General Regulation, such threshold being more than 50% of the share

capital or voting rights of the Company).

In such case, the Offeror shall pay to the Sellers an additional

consideration (the “Top-Up”) exclusively in cash and in US dollars

equal to the sum, if positive, of:

(a) the number of shares acquired from the Sellers pursuant to

the Acquisition of the Stake multiplied by the difference, if

positive, between (i) the highest price per Latécoère share paid by

the Offeror in the tender offer up to a maximum price of 4 euros,

and (ii) 3.85 euros (as adjusted in the cases indicated above, if

applicable); and

(b) the number of shares acquired from the Sellers pursuant to

the Acquisition of the Stake, multiplied by 50% of the difference

between (i) the highest price per Latécoère share paid by the

Offeror in the tender offer (if it exceeds 4 euros) and (ii) 4

euros.

The payment of the Top-Up is subject to the completion of the

aforementioned tender offer and should be paid by the Offeror to

the Sellers no later than the 12th business day following the last

settlement-delivery of the said tender offer.

It is specified for the avoidance of doubt that the filing of

the Offer will not give rise to any additional consideration for

the benefit of the Sellers as long as the Offer Price does not

exceed 3.85 euros per Latécoère share.

On June 28, 2019, the Offeror announced its intention to file

this Offer.

Prior to the filing of the Offer, the Company has made available

to the Offeror a certain amount of information concerning it in the

context of a “data room” procedure in accordance with the

recommendations of the AMF on the procedures of data room contained

in the “Guide de l’information permanente et de la gestion de

l’information privilégiée DOC-2016- 08”. The Company considers that

this data room did not contain any privileged information relating

to the Company which would not have been made public as of the date

hereof.

2.2. Terms of the Offer

2.2.1. Main terms of the

Offer

In accordance with the provisions of Article 231-13 of the AMF

General Regulation, JPMorgan Chase Bank N.A., acting through its

Paris branch, acting on behalf on the Offer as presenting banks,

have filed the Offer with the AMF on September 16, 2019. It is

specified that only Natixis, acting as presenting and guaranteeing

bank, guarantees the content and the irrevocable nature of the

commitments undertaken by the Offeror in connection with the

Offer.

The Offer would be carried out in accordance with the normal

procedure pursuant to Articles 232-1 et seq. of the AMF General

Regulation.

The Offeror irrevocably undertakes to purchase from the

shareholders of the Company all the shares targeted by the Offer

and which will be tendered to the Offer, at a price of 3.85 euros

per Latécoère share, to be paid exclusively in cash, for a period

of 25 trading days, unless reopened by the AMF in accordance with

Article 232-4 of the AMF General Regulation.

2.2.2. Adjustment of the terms of

the Offer

In the event that between the date hereof and the date of the

last settlement-delivery of the Offer (included), the Company makes

any form of distribution of (i) a dividend, interim dividend,

reserve, premium, or any other distribution (in cash or in kind),

or (ii) to a redemption or reduction of its share capital, and in

both cases, for which the detachment date or the record date is set

before the date of the last settlement-delivery of the Offer, the

Offer Price would be adjusted accordingly to take into account such

transaction.

Any adjustment of the Offer Price would be subject to the prior

approval of the AMF and will be subject of a press release.

2.2.3. Number and type of shares

targeted by the Offer

It is recalled that, at the date of the Draft Response Document,

in accordance with the terms of the Draft Offer Document, the

Offeror holds, directly or indirectly, alone or in concert,

24,697,727 shares representing approximatively 26.05% of the share

capital and 25.73% of the theoretical voting rights (calculated in

accordance with Article 223-11 of the AMF General Regulation).

According to Article 231-6 of the AMF General Regulation, the

Offer targets all outstanding Latécoère shares not held, directly

or indirectly, alone or in concert, by the Offeror, representing at

the date of the Draft Response Document, a maximum total number of

70,120,791 shares of the Company representing 73.93% of the share

capital and 74.27% of the voting rights of the Company, determined

as follows:

Outstanding shares6

94,818,518

minus shares held by the

Offeror

24,697,727

Total number of shares

targeted by the Offer

70,120,791

It is indicated that, as of the date of the Draft Response

Document, the free shares of the Company allocated at the meetings

of the Board of Directors of the Company on 2 March 2016, 5 March

2018 and 5 March 2019, which represent a number equal to 1,334,206

Latécoère shares, will, unless in exceptional cases of waiver of

their unavailability provided by applicable legal or regulatory

provisions (death or disability of the beneficiary):

(i) for 146,290 of them, shares still in the

vesting period at the closing date of the Offer, which are

therefore not targeted by the Offer; and

(ii) for 1,187,916 of them, shares that will

still be in the retention period at the closing date of the Offer,

and which are targeted by the Offer and therefore included in the

70,120,791 shares targeted by the Offer indicated above. Among

these 1,187,916 shares under retention period, it is specified that

1,000,716 are registered shares held by employees and corporate

officers of the Company and the remaining 187,200 shares were

contributed to the FCPE B via the employee saving scheme and are

now held by the FCPE B.

The beneficiaries of free shares and the FCPE B will be offered

to subscribe to the liquidity mechanism described in sections 1.3.7

and 1.3.8 of the Draft Response Document and sections 2.2.6 and

2.2.7 below.

To the Company’s knowledge, there are no other equity securities

or financial instruments that could give access, immediately or in

the future, to share capital or voting rights of Latécoère.

2.2.4. Regulatory, administrative

and antitrust clearances

Clearance from the Committee on

Foreign Investment in the United States

In accordance with the provisions of Article 231-32 of the AMF

General Regulation, the opening of the Offer was subject to the

approval of the Committee on Foreign Investment in the United

States (the “CFIUS”), pursuant to the Defense Production Act

of 1950, relating to foreign investments made in the United States

of America.

A notification to the CFIUS has been made on July 3, 2019. The

CFIUS authorization was obtained on July 25, 2019.

Clearance from the Ministry of

Economy

In accordance with the provisions of Article 231-32 of the AMF

General Regulation, the opening of the Offer is subject to the

prior approval of the French Ministry of the Economy pursuant to

Article L. 151-3 of the French Monetary and Financial Code relating

to foreign investments made in France.

A request for prior authorization was filed with the French

Ministry of Economy on June 27 2019.

Authorization by the German

competition authority (Bundeskartellamt)

On July 1, 2019, the Offeror filed an application for approval

of the proposed acquisition under the Offer with the

Bundeskartellamt. The approval was obtained on July 12, 2019.

2.2.5. Situation of the

beneficiaries of free shares and liquidity mechanism

The table below sets out the main characteristics of the free

shares allocated by the Company at the date hereof:

Plan

MIP 1

Plan 2018

MIP 2

Tranche 1

Tranche 2

Tranche 3

Tranche 4

Tranche 1

Tranche 2

Tranche 3

Date of the general meeting of

shareholders

15/07/2015

15/07/2015

03/06/2016

03/06/2016

03/06/2016

03/06/2016 and 14/05/2018

Date of the decision of the Board of

Directors on the shares attributable to the beneficiaries

22/09/2015

10/11/2016 and

19/05/2017

05/03/2018

N/A

16/01/2018 and

05/03/2018

16/01/2018 and

05/03/2019

16/01/2018

Total number of free shares attributable

under conditions

350,050

495,894

847.132

847,132

N/A

513,100

568,800

448,8007

Number of beneficiaries

4

0

7

0

1381

16

21

7

Date of the free shares granted by the

Board of Directors

02/03/2016

10/03/2017

05/03/2018

05/03/2019

05/03/2018

05/03/2019

03/2020

03/2021

Total number of free shares granted

350,050

0

423,566

0

471,900

146,290

-

-

Vesting date of free shares

02/03/2018

02/03/2019

05/03/2019

05/03/2020

05/03/2019

05/03/2020

05/03/2021

05/03/2022

Total number of free shares vested

350,050

0

423,566

0

414,300

-

-

-

End date of the retention

period

02/03/2020

02/03/2021

05/03/2020

03/2021

05/03/2020

03/2021

03/2022

03/2023

Cumulative number of shares cancelled or

lapsed

0

495,894

423,566

847,132

57,600

366,810

-

-

Total number of remaining attributable

free shares

0

0

0

0

0

0

568,800

448,800

Unless in exceptional cases of waiver of their unavailability

provided by applicable legal or regulatory provisions (death or

disability of the beneficiary):

(i) for the 146,290 free shares granted by

the Board of Directors on March 5, 2019 under tranche 1 of the Plan

MIP 2, and for which the final vesting has not occurred yet, such

free shares will still be in the course of the vesting period at

the closing date of the Offer and are therefore not targeted by the

Offer (the “Free Shares under Vesting Period”);

(ii) for the 1,187,916 free shares granted,

corresponding to the sum of:

a) the 350,050 free shares granted by the

Board of Directors on March 2, 2016 under tranche 1 of the Plan MIP

1,

b) the 423,566 free shares granted by the

Board of Directors on March 5, 2018 under tranche 3 of the Plan MIP

1, and

c) the 227,100 free shares granted by the

Board of Directors on March 5, 2019 under the Plan 2018 and which

were not contributed by the employees to the FCPE via the employees

saving scheme;

for which the retention period will not have expired at the

closing date of the Offer, are targeted by the Offer (the “Free

Shares under Retention Period”).

2.2.6. Liquidity

mechanism

For Free Shares under Retention Period

relating to the tranche 1 of the Plan MIP 1

Free Shares under Retention Period relating to the tranche 1 of

the Plan MIP 1 (corresponding to 350,050 shares to date) (the

“Free Shares 1”) are offered a liquidity mechanism

consisting in reciprocal put and call options between the

beneficiaries of the Free Shares 1 (the “Beneficiaries 1”)

and the Offeror.

Under the terms of this liquidity mechanism:

(i) Beneficiaries 1 will be granted with a

put option allowing them to sell all (and only all) their Free

Shares 1 to the Offeror (or any entity that may be substituted to

it) within the 30 calendar days as from March 3, 2020 subject that

on such date the Offeror holds, alone or in concert, more than 75%

of the share capital of the Company; and

(ii) the Offeror (or any entity that may be

substituted to it) will be granted with a call option allowing it

to acquire all (and only all8) the Free Shares 1 from the

Beneficiaries 1 within the 60 calendar days as from the first

business day following the expiry date of the exercise period of

the put option abovementioned.

In the event such put or call options are exercised, the

purchase price of the Free Shares 1 will correspond to the Offer

price (i.e. €3.85 per Latécoère share); it being specified that in

case of occurrence of an event having a significant impact on the

valuation of the Company before March 3, 2020, the parties will

agree in good faith in order to subsequently adjust the price. In

case of absence of agreement, an expert will be designated to

determine the amount at stake.

For Free Shares under Retention Period

relating to the tranche 3 of the Plan MIP 1, to the Plan 2018, to

the Free Shares under Vesting Period and to the shares that have

not been attributed yet

Free Shares under Retention Period relating to the tranche 3 of

the Plan MIP 1 (i.e. 423,566 shares to date) and to the Plan 2018

registered shares held by employees (i.e. 227,100 shares), Free

Shares under Vesting Period (i.e. 146,290 shares) and free shares

that have not been attributed yet but that are still attributable

under tranche 2 and 3 of the Plan MIP 2 (i.e. 1,017,600 shares)

(together the “Free Shares 2”, corresponding to a maximum of

1,814,556 shares) are offered a liquidity mechanism consisting in

reciprocal put and call options between the beneficiaries of such

Free Shares 2 (the “Beneficiaries 2”) and the Offeror.

Under the terms of this liquidity mechanism:

(i) Beneficiaries 2 will be granted with a

put option allowing them to sell all (and only all) their Free

Shares 2 to the Offeror (or any entity that may be substituted to

it) within the 30 calendar days as from the first business day

following the date of the first anniversary of the expiry date of

the retention period of such free shares (the “Exercise

Date”), subject that, on the Exercise Date the Offeror holds,

alone or in concert, more than 75% of the share capital of the

Company; and

(ii) the Offeror (or any entity that may be

substituted to it) will be granted with a call option allowing it

to acquire all (and only all 8 ) the free shares from the

Beneficiaries 2 within the 30 calendar days as from the first

business day following the expiry date of the exercise period of

the put option abovementioned.

In the event such put and call options are exercised, the

purchase price of the Free Shares 2 will be set as follows:

a) in the event the shares of the Company are

not listed on Euronext Paris anymore on the Exercise Date, the

purchase price of the Free Shares 2 will be calculated on the basis

of the multiple of the 2018 current gross operating surplus induced

by the Offer price;

b) in the event the Offeror holds, alone or

in concert, more than 75% of the share capital of the Company and

the shares of the Company are still admitted to trading on Euronext

Paris on the Exercise Date, the sale price of Free Shares 2 will be

equal to the average price weighted by the transaction volumes of

the Latécoère share during the twenty trading days preceding the

Exercise Date. By way of exception, in the event that the average

daily trading volume of Latécoère shares during the twenty trading

days preceding the Exercise Date is less than 0.05% of the

Company's share capital on that date, the price of the Free Shares

2 will be calculated in the same manner as in (a) above.

It will also be provided that in the event that the Offeror

holds, alone or in concert, more than 75% of the Company's share

capital and the Company's shares remain admitted to trading on

Euronext Paris, the Company will be required to subscribe to and

maintain a liquidity and animation agreement with an investment

services provider.

For the avoidance of doubt, the Beneficiaries 1 and the

Beneficiaries 2 do not act in concert with the Offeror. They are

invited to contact the Offeror in order to enter into the liquidity

mechanisms abovedescribed, at the latest on November 8, 2019

(included).

Pursuant to Article L. 233-9, I., 4° of the French Commercial

Code, and subject to the Offer holding, alone or in concert, more

than 75% of the share capital of the Company, the Free Shares under

Retention Period for which a call option has been granted by the

Offeror under the abovementioned liquidity mechanism before the

closing of the Offer (and before the closing of the Reopened Offer,

if any) will be assimilated to the shares held by the Offeror and

will not be transferred to the Offeror in the context of a

potential squeeze-out.

2.2.7. Situation of the Latécoère

shares held through the Company Mutual Fund (FCPE)

The Latécoère shares held through the Company Mutual Funds A and

B are targeted by the Offer.

The supervisory board of the FCPE A and B, which respectively

hold 124,000 and 2,032,300 Latécoère shares (including, for the

latter, the 187,200 free shares granted under Plan 2018, which were

contributed to the FCPE by employees under the company savings

plan, and which are now held by the FCPE B), will decide whether or

not to tender the Latécoère shares they hold.

In addition, the FCPE B is offered to enter into a liquidity

mechanism consisting in reciprocal put and call options between the

FCPE B and the Offeror.

Under the terms of this liquidity mechanism:

(i) the FCPE B will be granted a put option

allowing it to sell all (and only all9) its Latécoère shares to the

Offeror (or any entity that may be substituted to it) within the 30

calendar days as from July 2024, subject that, on such date the

Offeror holds, alone or in concert, more than 75% of the share

capital of the Company; and

(ii) the Offeror (or any entity that may be

substituted to it) will be granted with a call option allowing it

to acquire all (and only all) the Latécoère shares owned by the

FCPE B within the 30 calendar days as from the first business day

following the expiry date of the exercise period of the put option

abovementioned.

In the event such put and call options are exercised, the

purchase price of the Latécoère shares owned by the FCPE B will be

set as follows:

a) in the event the shares of the Company are

not listed on Euronext Paris anymore in July 2024, the purchase

price of the Latécoère shares owned by the FCPE B will be

calculated on the basis of the multiple of the 2018 current gross

operating surplus induced by the Offer price;

b) in the event the Offeror holds, alone or

in concert, more than 75% of the share capital of the Company and

the shares of the Company are still admitted to trading on Euronext

Paris on the Exercise Date, the sale price of the shares held by

the FCPE B will be equal to the average price weighted by the

transaction volumes of the Latécoère share during the twenty

trading days preceding the Exercise Date. By way of exception, in

the event that the average daily trading volume of Latécoère shares

during the twenty trading days preceding the Exercise Date is less

than 0.05% of the Company's share capital on that date, the price

of the shares of the FCPE B will be calculated in the same manner

as in (a) above.

For the avoidance of doubt, the FCPE B does not act in concert

with the Offeror. The FCPE B is invited to contact the Offeror in

order to enter into the liquidity mechanism above described, at the

latest on November 8, 2019 (included).

Pursuant to Article L. 233-9, I., 4° of the French Commercial

Code, and subject to the Offer holding, alone or in concert, more

than 75% of the share capital of the Company, the share held by the

FCPE B for which a call option has been granted by the Offeror

under the abovementioned liquidity mechanism before the closing of

the Offer (and before the closing of the Reopened Offer, if any)

will be assimilated to the shares held by the Offeror and will not

be transferred to the Offeror in the context of a potential

squeeze-out.

2.2.8. Intentions regarding a

squeeze-out or a delisting following the Offer

Intentions regarding a

squeeze-out following the Offer

If the legal conditions are fulfilled, the Offeror intends to

implement a squeeze-out at the end of the Offer under the

conditions required by applicable regulations.

In the event that the number of Company shares not tendered to

the Offer by the Company’s minority shareholders does not represent

more than 10% of the share capital and voting rights of the

Company, the Offeror intends to request, within three months of the

closing date of the Offer, in accordance with the provisions of

Article L. 433-4 II of the French Monetary and Financial Code and

Articles 237-1 et seq. of the AMF General Regulation, the

implementation of a squeeze-out procedure to transfer the shares

not tendered to the Offer, in consideration for a compensation for

compensation equal to the Offer Price, net of all costs, it being

specified that this squeeze-out procedure will lead to the

delisting of the Company’s shares from Euronext Paris.

The amount of the indemnity will be paid, net of all fees, after

the squeeze-out, into a blocked account opened for this purpose

with Natixis, designated as the centralizing agent for the

squeeze-out indemnification operations. After the closure of the

affiliates’ accounts, Natixis, upon presentation of the balance

certificates issued by Euroclear France, will credit the

depositaries responsible for the amount of the indemnity, with the

latter being responsible for crediting the accounts of holders of

Latécoère shares.

In accordance with Article 237-8 of the AMF Regulations,

unrestricted funds corresponding to the indemnification of

Latécoère shares whose beneficiaries have remained unknown will be

retained by Natixis for a period of ten (10) years from the date of

the delisting and paid to the Caisse des dépôts et consignations at

the end of this period. These funds will be held at the disposal of

the beneficiaries, subject to the thirty-year prescription for the

benefit of the State.

Intentions regarding a

delisting of the Company’s shares

The Offeror reserves the right, if it does not implement a

squeeze-out, to request Euronext Paris to delist the shares of the

Company from the Euronext Paris market.

It is recalled that the procedure for the implementation of the

aforementioned delisting is governed by the provisions of Article

6905 of Book I (Harmonised Rules) of the Euronext Market Rules. In

this context, Euronext Paris may remove securities admitted to

listing and/or trading on its market at the written request of the

Company, which must indicate the reasons for its request. Euronext

Paris may decide not to delist the shares as requested if such

delisting would adversely impact the fair, orderly and efficient

functioning of the market Euronext Paris. Euronext Paris may also

subject any removal of securities to such additional requirements

as it deems appropriate.

III. REASONNED OPINION OF THE BOARD OF

DIRECTORS OF THE COMPANY

In accordance with the provisions of Article 231-19 of the AMF

General Regulation, a meeting of the Board of Directors of the

Company was held on 12 September 2019, convened and chaired by

Pierre Gadonneix, Chairman of the Board of Directors, to examine

the Offer and render a reasoned opinion on the interest and the

consequences of the Offer for the Company, its shareholders and its

employees.

All members of the Board of Directors were physically present

and / or by audio conference.

The deliberation of the Board of Directors containing the

reasoned opinion is reproduced below.

“It is specified that the three directors appointed by

Searchlight, the Offeror, namely Mr. Ralf Ackermann, Ms. Helen Lee

Bouygues and Mr. Grégoire Huttner, have decided not to take part in

the vote on the Board of Directors’ reasoned opinion on the

Offer.

The Chairman reminds that, on the basis of the information

provided and in accordance with the provisions of Article 231-19 of

the AMF General Regulation, the Board of Directors must deliver its

reasoned opinion on the interest of the Offer and its consequences

for employees, the Company and its shareholders.

After deliberation, the Board of Directors, having considered

(i) the terms of the Offer, (ii) the Offeror’s reasons and

intentions, and the valuation elements prepared by J.P. Morgan and

Natixis as set out in the draft information notice, (iii) the

valuation and analysis of the related agreements, as set out in the

independent expert’s report, (iv) the opinion of the ad hoc

committee and (v) the opinion of the Works Council,

acknowledges that:

- the Offer is in line with Searchlight

Capital Partners’ acquisition, on June 26, 2019, of a block of

shares of the Company representing approximately 26% of the share

capital (the « Block Acquisition») from certain investment

funds managed by affiliates of Apollo Global Management LLC and

Monarch Master Funding 2 (Luxembourg) and CVi Partners SARL;

- as the Offeror holds less than 30% of the

share capital or voting rights of the Company, the Offer is

voluntary;

- the Offer will lapse if, on the date of its

closing, Searchlight does not hold a number of shares of the

Company representing a fraction of the share capital or voting

rights of the Company greater than 50%;

- the opening of the Offer remains subject to

the obtaining of the required authorization from the French

Minister of Economy for investment control (it being specified that

the authorization from the Committee on Foreign Investment in the

United States (CFIUS) was obtained on July 25, 2019 and the

required authorization from the German competition authority was

obtained on July 12, 2019);

- the Offeror intends to request the AMF

under the Offer to implement a mandatory squeeze-out of the

Company’s shares and to request the delisting of the Company’s

shares from the regulated market of Euronext in Paris if the shares

not presented in the Offer do not represent more than 10% of the

Company’s share capital and voting rights or any other percentage

of the Company’s share capital and voting rights that would be

applicable at the closing of the takeover bid. Under the

squeeze-out, shares of the Company other than those held by the

Offeror that have not been tendered to the Offer will be

transferred to it for the same compensation as the Offer price,

i.e. €3.85 per share, net of any costs;

- employees and corporate officers holding

free shares as well as FCPE B, subject to the decision of its

Supervisory Board, will be offered the opportunity to subscribe to

the liquidity mechanism consisting of cross promises to buy and

sell between the beneficiaries and the Offeror.

also notes that:

- the price of €3.85 per share of the

Company, proposed in the Offer, reflects a premium of 34.1% on the

Company’s closing price on June 28, 2019 (last trading day prior to

the announcement of the Offer) and 29.7%, 22.3% and 23.8%

respectively compared to the average of the prices weighted by

trading volumes over the one, three and six months respectively

preceding June 28, 2019;

- the price offered is identical to the price

offered by the Offeror in connection with the Company’s Block

Acquisition, namely €3.85 per share of the Company;

- the Offer price compares favorably with all

the valuation criteria as presented in the Offer price assessment

elements prepared by Natixis and JP Morgan, the institutions

presenting the Offer, and set out in section 3 of the Offeror’s

draft information notice.

further notes that the Offeror’s intentions, as described

in the draft information notice, are as follows:

- in terms of the Company’s industrial and

commercial strategy and policy, the Offeror intends to support the

existing management team and the development of the Company. It

does not intend to modify the strategic orientations implemented by

Latécoère in order to pursue its development. It does not intend to

modify Latécoère’s industrial, commercial and financial strategy or

policy;

- in terms of employment, the Offer is in

line with Latécoère’s business continuity and development strategy

and should not have a particular impact on Latécoère’s workforce,

salary policy or human resources management policy. The Offer is

therefore not expected to have any impact on employment at

Latécoère

- in the area of dividends, at this stage,

Searchlight does not intend to change the dividend distribution

policy. However, it reserves the right to review the Company’s

dividend distribution policy at the end of the Offer in the light

of changes in the Company’s distribution capacity.

The Board of Directors has taken note of:

- the independent expert’s conclusion that

the Offer price of €3.85 per share is fair from a financial point

of view to Latécoère shareholders in the context of the Offer and

in the event that the mandatory squeeze-out procedure is

implemented at the end of the Offer, in particular after applying

and comparing the main valuation methods for the shares; In this

respect, the Independent Expert notes in particular that the

proposed price shows a premium of +34% compared to the closing

price before the announcement of the Offer, and premiums of between

+18% and +29% compared to the weighted average volume prices over 1

month, 3 months, 6 months and 12 months; the Independent Expert

also points out that the price offered is above the ranges of

values resulting from valuation methods deemed relevant, based on a

multi-criteria approach; the Independent Expert also points out

that the agreements that may have a significant influence on the

assessment of the Offer, namely the block sale contract, the

executive compensation mechanisms and the liquidity mechanisms

offered to holders of free shares, do not contain any provisions

that would call into question the fairness of the Offer from a

financial point of view;

- the work carried out by the ad hoc

committee; and

- the favorable opinion of the Works Council

as mentioned above.

After an exchange of views on the draft Offer, after analysis,

in particular, of the Offeror’s draft information notice, which

includes the Offeror’s intentions, the draft takeover response

document prepared by the Company, the independent expert’s report

and the opinion of the ad hoc committee and the Works Council, the

Board of Directors:

decides unanimously by the directors who took part in the

vote, to issue a favorable opinion on the draft Offer as presented,

considering that the Offer is in accordance with the interests:

- of the Company’s employees, the Offer not

having any particular impact on employment;

- the Company, in that the backing of a solid

controlling shareholder, such as the Offeror, will support the

Company’s development strategy in France and abroad and its

participation in the consolidation, as well as its research and

development activities; and

- the Company’s shareholders, as the latter

will benefit, if they so wish, from an immediate liquidity

opportunity on the entirety of their participation at a price per

share representing a premium of 34.1% on the Company’s closing

price on June 28, 2019 (last trading day preceding the announcement

of the Offer) and, respectively, of 29.7%, 22.3% and 23.8% compared

to the average of the prices weighted by trading volumes over one,

three and six months respectively preceding that same date,

decides, therefore unanimously by the directors who took

part in the vote, to recommend to those of the shareholders who

would like to benefit from a certain liquidity, to tender their

shares to the Offer,

approves unanimously by the directors who took part in

the vote the Company’s draft takeover response document, the draft

"Other Information" document relating to the Company’s legal,

financial, accounting and other characteristics, as well as the

draft press release relating to the Board’s reasoned opinion, and

gives full powers to the Company’s Chief Executive Officer to

finalize, sign and file these documents with the AMF.

Claire Deyfus-Cloarec and Pierre Gadonneix have indicated that

they intend to tender their shares to the Offer, it being specified

that there is no statutory provision requiring directors to hold a

minimum number of shares. Yannick Assouad has indicated that she

intends not to tender its shares to the Offer as soon as they are

reinvested in the Offeror’s capital as part of the incentive scheme

set up for the benefit of the Company’s managers and employees.

In addition, after deliberation, the Board of Directors decides,

unanimously by the directors who took part in the vote, to tender

to the Offer all of the Company’s treasury shares, excluding the

treasury shares allocated to the liquidity contract entered into

with Gilbert Dupont, shares intended to be cancelled and those that

may be delivered under the executive and employee incentive plans,

i.e. a total of 369,410 shares to be tendered to the Offer.”

IV. OPINION OF THE WORKS COUNCIL

In accordance with the provisions of Articles L. 2323-35 et seq.

Of the Labor Code, the works council (comité d’entreprise) of

Latécoère was consulted in the context of the

information-consultation of the representative bodies of the

Company’s employees and rendered, on 26 July 2019, a favorable

opinion on the proposed Offer. This opinion is reproduced in its

entirety in Appendix 1 of the Draft Response Document, in

accordance with the provisions of Article 231-19 of the AMF

Regulations and Article L. 2323-39 of the Labor Code.

The works council of Latécoère has appointed the expert firm

Syncea, pursuant to the provisions of Articles L. 2323-38 et seq.

of the Labor Code. Syncea’s report is reproduced in its entirety in

Appendix 2 of the Draft Response Document, in accordance with the

provisions of Article 231-19 of the AMF General Regulation and

Article L. 2323-39 of the Labor Code.

V. REPORT OF THE INDEPENDENT EXPERT IN

ACCORDANCE WITH ARTICLE 261-1 OF THE AMF REGULATIONS

Pursuant to article 261-1 of the RGAMF, the Board of Directors

of the Company has appointed Finexsi as an independent expert to

report on the financial terms of the Offer and a possible Squeeze

out. The conclusion of the report dated September 16, 2019 is

reproduced below:

The conclusion of Finexsi is the following:

“The Offer price of €3.85 per share corresponds to the price of

the transaction concluded between the Offeror and the investment

funds Apollo, Monarch and CVI Partners, namely the Offeror’s

acquisition on 1 April 2019 of a 26% block of the Company’s shares.

This price constitutes a direct and relevant reference because it

is the result of (i) a very open and competitive process for the

sale of the Company and (ii) a negotiation between independent

parties. We were also able to verify that the agreements concluded

between the Offeror and the Sellers are not such as to cause

unequal treatment of the Company’s other shareholders in the

framework of this Offer. This Offer gives the Company’s minority

shareholders immediate access to liquidity, the price of which

reflects a 34% premium on the closing price before announcement of

the Offer, and premiums of between 18% and 29% in relation to the

1-month, 3-month, 6‑month and 12-month volume weighted average

price. The Latécoère share price did not attain the Offer price

following the transaction between the Offeror and Apollo, Monarch

and CVI Partners or after announcement of the Offer. The Company’s

share is historically highly volatile, reflecting market perception

of the Company’s intrinsic risk.

The Offer price reflects a 16% premium on the central value

resulting from the discounted cash flow valuation, based on

management projections which include anticipated revenue growth and

significant improvements in the Company’s profitability, in

particular due to the LiFi technology, which is not yet marketed.

From our standpoint, the use of these management projections in the

DCF valuation consequently gives the Company’s full value.

We also find that the Offer price yields premiums on the values

derived from comparable companies (39% on the central value) and

comparable transactions (2%). A synthesis of analysts’ target

prices before announcement of the Offer yields a 6% discount on the

Offer price, though we consider that in this particular instance

the criterion should be regarded as of secondary importance.

From our review of agreements that could have a material impact

on assessment of the Offer, namely the block acquisition agreement,

the arrangements for the remuneration of senior executives and the

liquidity arrangements offered to holders of free shares, described

in the Draft Offer Document, we consider that they do not contain

provisions likely to cast doubt on the fairness of the Offer from a

financial standpoint.

Consequently, it is our opinion that the Offer price of €3.85

per share is fair from a financial standpoint for Latécoère’s

shareholders.

It is our opinion that this Offer price of €3.85 per share is

fair from a financial standpoint should the Squeeze-Out Procedure

be implemented on conclusion of this Offer.”

The report of the independent expert is reproduced in Annex 3 of

the Draft Response Document.

1 SCP SKN HOLDING I S.A.S. is indirectly and wholly owned by SCP

EPC II UK Limited, a company incorporated under British law, which

is managed by Searchlight Capital Partners II GP, L.P., a limited

partnership registered in the Cayman Islands (which is ultimately

controlled and managed by Searchlight Capital Partners II GP, LLC,

a Delaware limited liability company, United States, whose three

founding members are Mr. Eric Zinterhofer, Mr. Erol Uzumeri and Mr.

Oliver Haarmann, each of them holding a one-third interest in

Searchlight Capital Partners II GP, LLC. 2 On the basis of a total

number of 95,168,518 shares and 96,330,699 theoretical voting

rights of the Company (information as at August 30, 2019 published

by the Company on its website in accordance with Article 223-16 of

the AM General Regulation), minus, in share capital and voting

rights, the 350,000 Latécoère shares whose cancellation was decided

by the meeting of the Board of directors of Latécoère held on

September 12, 2019. In accordance with Article 223-11 of the AMF

General Regulation, the total number of voting rights is calculated

on the basis of all shares to which voting rights are attached,

including shares without voting rights. 3Ibid. 4 Including the

664.232 treasury shares as of the date hereof, it being specified

that such number takes into account the cancellation of 350,000

Latécoère decided by the meeting of the Board of directors of

Latécoère held on September 12, 2019. 5 The exchange rate on the

signing date of the Share Purchase Agreement was equal to 1 EUR =

1,1236 USD. 6 Including the 664.232 treasury shares as of the date

hereof, it being specified that such number takes into account the

cancellation of 350,000 Latécoère decided by the meeting of the

Board of directors of Latécoère held on September 12, 2019. 7 It

being specified that 174.999 shares may be allocated with respect

to this tranch in accordance with the regulations of the MIP 2

Plan. 8 It being specifed that it will be proposed to the corporate

officers holding free shares subject to the mandatory retention of

a certain number of registered shares, pursuant to Article L.

225-197-1 II of the French commercial Code and the regulations of

the corresponding plans, to enter into cross-sell and buy-in

agreements in the event of the departure, provided that on that

date the Offeror holds, alone or in concert, more than 75% of the

share capital, under the same conditions as those provided for

under the liquidity mechanism. 9 Intermediary exercise periods

would also be put in place to allow FCPE B to meet its regular

liquidity needs.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190916005650/en/

Latécoère

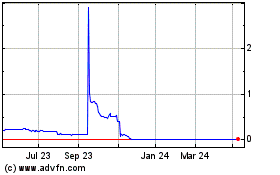

Latecoere (EU:LAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

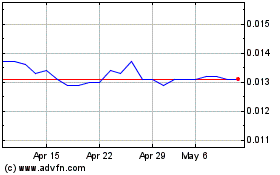

Latecoere (EU:LAT)

Historical Stock Chart

From Apr 2023 to Apr 2024