SocGen 3Q Net Profit, Revenue Fell; Capital Rose -- Earnings Review

November 06 2019 - 5:16AM

Dow Jones News

By Pietro Lombardi

Societe Generale SA (GLE.FR) reported third-quarter results on

Wednesday. Here's what you need to know:

NET PROFIT: France's third-largest listed bank by assets

reported a 35% decline in net profit for the period to 854 million

euros ($948.1 million). Deutsche Bank analysts had forecast a net

profit of EUR922 million.

REVENUE: Net banking income, the bank's top-line revenue figure,

fell 8.4% to EUR5.98 billion. This compares with analysts'

expectations of EUR6.02 billion, according to a consensus forecast

provided by FactSet.

WHAT WE WATCHED:

-CAPITAL: The core Tier 1 ratio, a key measure of capital

strength, rose to 12.5% in September from 12% at the end of June.

The bank "continues to deliver strong on capital," Jefferies

said.

-INVESTMENT BANK: The performance of the bank's global banking

and investor-solutions business, which includes investment banking

and asset management, weighed on the results. Earnings at the unit

declined almost 27% on year, with revenue down 7.6%. Fixed-income

revenue grew 1% while equities revenue fell 20%.

-OTHER DIVISIONS: Earnings fell 2.8% at the bank's French retail

banking operations while they were down 3.6% at the international

retail banking and financial services division.

Write to Pietro Lombardi at pietro.lombardi@dowjones.com

(END) Dow Jones Newswires

November 06, 2019 05:01 ET (10:01 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

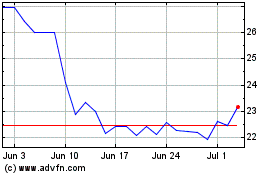

Societe Generale (EU:GLE)

Historical Stock Chart

From Mar 2024 to Apr 2024

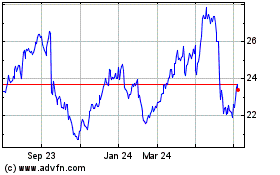

Societe Generale (EU:GLE)

Historical Stock Chart

From Apr 2023 to Apr 2024