- Target amount of €5.33 million

- Subscription price: €1.22 per share

- Subscription ratio: 1 new share for every 2 existing

shares

- Subscription period: November 3, 2021 to November 18, 2021

inclusive

- Detachment of preferential subscription rights on October

29, 2021

- Subscription commitments received of €4,175,000

(78.26%)

This press release may not be published,

distributed or circulated, either directly or indirectly, in the

United States of America, Canada, Australia or Japan.

Regulatory News:

THERADIAG (ISIN: FR0004197747, Ticker: ALTER), a company

specializing in in vitro diagnostics and Theranostics, announces

the launch of a rights issue for a target amount of €5,334,745,24,

at a price of €1.22 per share with a nominal discount of 30.05% to

the closing price on 21 October 2021, and a ratio of 1 new share

for every 2 existing shares (the “Rights Issue”).

Bertrand de Castelnau, CEO of Theradiag, said: “Our

strategic refocus on innovation and the commercial development of

our two activities, Theranostics and in vitro diagnostics, has

enabled us to post very solid growth in recent semesters and be

close to breakeven in the first half of 20211. On the basis of

buoyant activity for our innovative solutions and a healthier cost

structure, we are entering a new phase of profitable growth with

the aim of strengthening our global leadership on the biotherapy

monitoring market.

Theradiag stands out on this growing biotherapy monitoring

market through its expertise and its ties with the healthcare

professionals ecosystem in France and abroad. Building on these

assets, the Company wants to begin a new chapter in its history

through this fundraising operation that will enable it to finance

the five projects that will structure its future growth:

- Secure the quality and commercial supply of antibodies via the

Humabdiag project developed thanks to the recent partnership with

the University of Tours (bioproduction of human monoclonal

antibodies);

- Accelerate the internationalization of existing activities in

the world’s main healthcare countries, and in particular accelerate

sales in the United States (which already account for 19% of

Theranostics revenue);

- Develop a technological solution to ensure Near Patient

Testing;

- Invest in new therapeutic fields with a substantial medical

need and strong growth (e.g. oncology, central nervous system,

rheumatology, etc.);

- Thanks to the expertise acquired in autoimmune diseases,

reposition and revive FIDIS technology, in particular in the United

States, and the activity covering serums used in quality

control.

Through our current structure and these five routes of

development that present substantial synergies, our unique

positioning will provide a response to the substantial demand on

the rapidly growing global biotherapy monitoring market.

In this perspective, the planned use of the funds raised in the

capital increase will be as follows:

- 50% of the funds will be used to strengthen the sales team by

recruiting sales professionals in the United States, France and the

rest of the world, to develop the autoimmunity portfolio and to

design a marketing campaign for Theradiag products;

- 30% of the funds to research new therapeutic areas, develop new

products and adapt near-patient testing;

- 10% of the funds raised to accelerate product registrations in

several countries, particularly the United States, in order to

increase international sales; and

- Up to 10% of the funds raised, in order to finance Theradiag's

working capital requirements, open subsidiaries and improve

production facilities.

If the issue is limited to 75%, the funds will be used as

follows:

- 50% of the funds will be used to strengthen the sales team by

recruiting sales professionals in the United States, France and the

rest of the world, to develop the autoimmunity portfolio and to

design a marketing campaign for Theradiag's products;

- 30% of the funds to research new therapeutic areas, develop new

products and adapt near-patient testing;

- 10% of the funds raised to accelerate product registrations in

several countries, particularly the United States, in order to

increase international sales; and

- 10% of the funds raised to finance Theradiag's working capital

requirements, open subsidiaries and improve production

facilities.

Theradiag is thus preparing for a new growth phase that requires

the financial means to match its ambitions. We want to involve you

in this new phase by launching a Rights Issue of approximately 5.3

million euros (through the issuance of up to 4,372,742 shares at a

price of €1.22 each). The funds raised will be allocated to boost

our R&D and internationalize our activities in our key

geographic areas, which are France and the United States. Our goal

is to achieve annual revenue of over €40 million2 within five years

while keeping our costs strictly under control in order to achieve

an operating margin of between 20 and 30%. This ambition should be

achieved through organic growth and the implementation of the five

development axes described. With the exception of public grants and

subsidies, the Company does not expect to call on other

complementary financing.”

Pierre Morgon, Chairman of the Board, adds: “We are

determined to take Theradiag to a new dimension thanks to the added

value of our solutions and the current dynamic of the market

segments we are targeting. On behalf of the Board of Directors and

our entire team, I would like to thank you for your trust in and

support for this operation that should put Theradiag on a track to

faster growth and contribute to strengthening its leadership

position in biotherapy monitoring.”

In accordance with the provisions of article L.411-2-1 1° of the

Monetary and Financial Code and article 211-3 of the General

Regulations of the French Financial Markets Authority (AMF), this

Rights Issue will not be subject to a prospectus requiring a visa

from the AMF as the total amount of the offering calculated over a

period of 12 months does not exceed the threshold of 8,000,000

euros.

This Rights Issue, aimed primarily at THERADIAG’s shareholders,

will be carried out via the issuance of a maximum of 4,372,742 new

shares, at a price of €1.22 per share, on the basis of 1 new share

for every 2 existing shares held: 2 preferential subscription

rights (PSR) will allow shareholders to subscribe to 1 new

share.

As of August 31, 2021, the Company's cash position amounted to €

2.3 million, representing a financing horizon for its activities

until the end of 2026, with no implementation of the strategic plan

consisting of the five projects mentioned above. The completion of

this capital increase will not change this funding outlook but will

enable the implementation of the strategic plan described.

The Company was granted a State-guaranteed loan of € 1.9

million, which is expected to be repaid over the next 4 to 5 years

thanks to the Company's cash position and the generated cash

flow.

Main terms of the Rights

Issue

Share capital prior to the operation Prior to the

operation, THERADIAG’s share capital consists of 8,745,485 shares,

fully subscribed and paid-up, with a par value of €1.01 each.

Share and Rights Issue codes Name: THERADIAG ISIN:

FR0004197747 Ticker: ALTER Rights ISIN: FR00140069U4 Listing

market: Euronext Growth Paris LEI: 969500CDG241WHIFL611

Number of new shares issued 4,372,742 new shares with a

par value of €1.01 each.

Subscription price of the New Shares €1.22 per share

(including €1.01 par value and €0.21 issuance premium). The price

of €1.22 per new share must be fully paid-up in cash at the time of

subscription.

Gross proceeds from the operation €5,334,745.24

Subscription commitments and net proceeds from the

operation Any new shares not subscribed on an irreducible or

reducible basis could be allocated to the 20 investors who have

signed subscription commitments for free subscriptions for a total

amount of €4,175,000.

These subscription commitments represent 78.26% of the planned

Rights Issue and were made by institutional and private investors

who are not currently shareholders of the Company and include Vatel

Capital, HMG Finance, Friedland Gestion, Aurore Invest Fund and

Sully Patrimoine Gestion.

Under the terms of these twenty subscription commitments, a

guarantee fee will be payable by the Company to the signatories of

these commitments independently of the actual subscription.

Assuming a 100% subscription of the issue (representing an issue

size of approximately EUR 5.3 million) with a 100% service rate to

the investors having signed the underwriting commitments, the total

net amount of the issue (corresponding to the gross amount less all

financial, legal and communication costs relating to the issue)

would amount to approximately EUR 4.5 million. Assuming that 78.26%

of the issue is subscribed (representing an issue size of

approximately EUR 4.2 million), including a 100% service rate to

investors who have signed underwriting commitments, the total net

amount of the issue (corresponding to the gross amount less all

costs relating to the issue) would be approximately EUR 3.4

million.

The Company is not aware of its other shareholders’

intentions.

Subscription period From November 3 to November 18, 2021

included on the Euronext Growth market in Paris.

Dilution Impact of the Rights Issue on shareholder’s equity

per share

Equity amount per share (in

euros)*

Before the issuance of new shares

resulting from the Rights Issue

€0,600

After the issuance of 3,279,556 new shares

resulting from the Rights Issue should 75% of the original offer be

carried out

€0,436

After the issuance of 4,372,742 new shares

resulting from the Rights Issue

€0,400

* based on a share capital of 5,247,842

euros as of 30/06/2021.

Impact of the issue on a shareholder’s situation

Stake (%)

Before the issuance of new shares

resulting from the Rights Issue

1.00%

After the issuance of 3,279,556 new shares

resulting from the Rights Issue should 75% of the original offer be

carried out

0.73%

After the issuance of 4,372,742 new shares

resulting from the Rights Issue

0.67%

Shareholding To the knowledge of the Company, as of the

date of this press release, the shares comprising the capital and

voting rights are distributed as follows:

Before the Capital

Increase

Total number of shares

% of capital

Total number of exercisable

voting rights

% of voting rights

Treasury shares

94,100

1.1 %

n/a

n/a

Management

18,181

0.2 %

21,700

0.2 %

Other shareholders

8,633,204

98.7 %

8,674,545

99.8 %

20 Guarantors

0

0

n/a

n/a

Total

8,745,485

100.0 %

8,696,245

100.0 %

Following the Capital Increase, the shares comprising the

capital and voting rights would be distributed as follows:

After the Capital

Increase

Total number of shares

% of capital

Total number of exercisable

voting rights

% of voting rights

Treasury shares

94,100

0.7 %

n/a

n/a

Management

18,181

0.1 %

21,700

0.2 %

Other shareholders

9,583,815

73.1 %

9,625,156

73.6 %

20 Guarantors*

3,422,131

26.1%

3,422,131

26.1%

Total**

13,118,227

100.0 %

13,068,987

100.0 %

* Assuming that the subscription

commitments are served in full

** Assuming a 100% issue.

Subscription terms and conditions

Preferential subscription rights on an irreducible basis

Subscriptions to New Shares will be reserved in priority for

holders of existing shares registered in their securities account

at the close of business on October 28, 2021, who will be allocated

preferential subscription rights (PSR) or assignees of their PSR.

They will be able to subscribe, on an irreducible basis, to 1 New

Share for every 2 existing shares they hold (2 PSR enabling people

to subscribe to 1 New Share at a price of €1.22 per share).

Shareholders or assignees of their PSR who do not hold, with

respect to subscriptions on an irreducible basis, a sufficient

number of existing shares or PSR to obtain a whole number of New

Shares may buy or sell over the counter the number of PSR enabling

them to achieve the multiple leading to a whole number of New

Shares.

For indicative purposes, it is specified that, as of October 21,

2021, the Company holds 94,100 treasury shares.

Preferential subscription rights on a reducible basis For

the benefit of shareholders, the Company is introducing a reducible

right to subscribe to shares that will be undertaken

proportionately to their rights and within the limit of their

requests. At the same time as they deposit their subscriptions on

an irreducible basis, shareholders or assignees of their rights

will be able to subscribe on a reducible basis to the number of new

shares they want, in addition to the number of new shares resulting

from the exercise of their rights on an irreducible basis.

Any new shares not subscribed on an irreducible basis will be

divided up and allocated to subscribers on a reducible basis.

Subscription orders on a reducible basis will be satisfied within

the limit of their requests proportionally to the number of

existing shares whose rights are used to support their subscription

on an irreducible basis, without this being able to result in the

allocation of a fraction of a new share.

In the case of a same subscriber presenting a number of separate

subscriptions, the number of shares due to them on an irreducible

basis will only be calculated across all their subscription rights

if they specifically request this in writing no later than the

final day of the subscription period. This special request should

be attached to one of the subscriptions and include all the

information needed to group the rights together, including the

number of subscriptions established and the establishments or

intermediaries with which these subscriptions have been filed.

Subscriptions in the names of different subscribers cannot be

grouped together to obtain shares on a reducible basis.

A notice published in a legal announcement bulletin at the

Company’s head offices and by Euronext Paris will indicate, if

appropriate, how subscriptions on a reducible basis will be

apportioned.

Exercise of preferential subscription rights To exercise

their PSR, holders must make such a request to their authorized

financial intermediary at any time during the subscription period

and pay the corresponding subscription price. Each subscription

must be accompanied by the payment of the subscription price in

cash. Subscriptions that have not been fully paid-up will

automatically be cancelled without the need for formal notice.

PSR must be exercised by their beneficiaries, under penalty of

revocation, before the expiry of the subscription period. Failing a

subscription before November 16, 2021 or the divestment of these

PSR, they will become void at the close of trading and will have no

value.

The funds paid with respect to subscriptions will be centralized

by Invest securities via Parel, who will be responsible for

establishing the certificate of deposit confirming the

implementation of the Rights Issue and issuance of shares.

Any new shares not absorbed by subscriptions on an irreducible

basis will be divided up and allocated to subscribers on a

reducible basis. Subscription orders on a reducible basis will be

satisfied within the limit of their requests pro rata to the number

of existing shares whose rights are used to support their

subscription on an irreducible basis, without this being able to

result in the allocation of a fraction of a new share.

Listing of preferential subscription rights The PSR will

be listed and traded on the Euronext Growth market in Paris under

ISIN FR00140069U4 from October 29 to November 16, 2021.

Theoretical value of preferential subscription rights

0.17 euros (based on Theradiag’s share closing price on October 21,

2021, i.e. 1.74 euros). The subscription price of €1.22 per share

represents a discount of 22.3% on the theoretical ex-right value of

the share.

Open subscription requests As well as the possibility of

subscribing on an irreducible or reducible basis in accordance with

the terms and conditions indicated above, any physical or moral

person, whether they hold preferential subscription rights or not,

may subscribe to this capital increase on an open basis.

Persons wishing to subscribe on an open basis must send their

request to their authorized financial intermediary at any time

during the subscription period and pay the corresponding

subscription price.

In accordance with the provisions of article L.225-134 of the

French Commercial Code, open subscriptions will only be taken into

account if subscriptions on an irreducible and reducible basis have

not already absorbed the entire Rights Issue, it being specified

that the Board of Directors will have the power to freely allocate

shares that have not been subscribed, in whole or in part, among

those (shareholders or third persons) it chooses who have filed

requests for subscriptions on an open basis.

Limitation of the Rights Issue In accordance with article

L. 225-134 of the French Commercial Code, the Board of Directors

may notably limit the Rights Issue to the number of subscriptions

received, subject to these subscriptions reaching at least 75% of

the initial amount, it being specified however that the Company has

already received subscription commitments for 78.26% of the total

amount of the Rights Issue.

Paying agents — Subscription payments Subscriptions for

New Shares and payments of funds by subscribers whose securities

are held in administered registered or bearer form will be received

until and including the final date of the subscription period by

their authorized intermediary acting in their name and on their

behalf.

Subscriptions and payments by subscribers whose shares are

registered in pure registered form will be received without charge

by CACEIS.

The New Shares must be fully paid for in cash at the time of

their subscription, the total amount due being the par value plus

the issuance premium, it being specified that the total issuance

premium will be booked in the liabilities section of the balance

sheet in a special “Issuance Premium” account to which all existing

and new shareholders shall have rights.

Funds paid with regard to subscriptions will be centralized by

Parel SA on behalf of Invest Securities, which will draw up a

certificate of deposit confirming the implementation of the Rights

Issue.

Subscriptions for which payment has not been received will

automatically be cancelled without the need for formal notice to

this effect.

Guarantee This offer will not be subject to a conclusion

guarantee within the meaning of article L. 225-145 of the French

Commercial Code. Trading in these shares will therefore only begin

once settlement-delivery operations have been completed and the

depositary’s certificate has been received.

Indicative timetable of the Rights Issue

October 26, 2021

Publication of a press release by

THERADIAG describing the main characteristics of the Rights

Issue.

Publication by Euronext Paris of the

notice of issue.

October 28, 2021

Business day at the end of which the

holders of existing shares registered for accounting purposes in

their securities account will be allocated preferential

subscription rights (PSR).

October 29, 2021

Ex-rights date of PSR (before market).

First day of trading in PSR.

October 29, 2021

Publication of a notice in the BALO legal

journal.

November 3, 2021

Start of the subscription period.

November 16, 2021

Last day of trading in PSR.

November 18, 2021

End of the subscription period.

November 24, 2021

Publication of a press release by

THERADIAG announcing the results of the subscriptions.

Publication by Euronext Paris of the

notice regarding the admission to trading of the New Shares, the

definitive amount of the Rights Issue and how subscriptions on a

reducible basis will be apportioned.

November 26, 2021

Issuance of the New Shares –

Settlement-Delivery.

Admission of the New Shares to trading on

Euronext Growth Paris.

Rights attached to the New Shares The New Shares, which

will be subject to all statutory provisions, will have dividend

rights from January 1, 2021. They will be assimilated with existing

shares as soon as they are issued. In accordance with the

indicative timetable of the Rights Issue, the New Shares are

scheduled to be registered in securities accounts on November 26,

2021.

Currency of the issuance of New Shares The New Shares

will be issued in euros (€).

Listing of the New Shares The New Shares resulting from

the Rights Issue will be the subject of an application for

admission to trading on the Euronext Growth market in Paris. They

will only be listed once the certificate of deposit has been

issued. They will be admitted on the same line as the Company’s

existing shares and will be fully assimilated as soon as they are

admitted for trading. The start of trading of these New Shares on

the Euronext Growth market in Paris is scheduled for November 26,

2021.

Legal framework of the operation The carrying out of the

Rights Issue is based on the ninth resolution adopted by the

Ordinary and Extraordinary Shareholders’ Meeting of June 25, 2020,

implemented by the Company’s Board of Directors at its meeting of

October 22, 2021.

In accordance with the provisions of article L.411-2 of the

Monetary and Financial Code and article 211-2 of the General

Regulations of the French Financial Markets Authority (AMF), this

Rights Issue will not be subject to a prospectus requiring a visa

from the AMF, as the total amount of the offering calculated over a

period of 12 months does not exceed 8,000,000 euros.

A notice to shareholders regarding this operation will be

published in the BALO French official journal of legal notices on

October 29, 2021.

Risk factors specific to this operation The main risk

factors associated with this Rights Issue are the following:

- The market for PSR may provide only limited liquidity and could

be subject to substantial volatility;

- Shareholders who do not exercise their PSR would see their

stake in the Company diluted;

- The market price of the Company’s shares may fluctuate and fall

below the subscription price of shares issued on exercise of

PSR;

- The volatility and liquidity of the Company’s shares could see

negative fluctuations; and

- If the market price of the Company’s shares falls, PSR could

decrease in value.

Before making an investment decision, investors are invited to

review the half-yearly financial report (in French:

https://www.theradiag.com/wp-content/uploads/2021/09/Etats-financiers-Rapport-de-gestion-au-30-juin-2021.pdf)

and the risks associated with THERADIAG as described in the annual

financial report, section II as well as in section IX on

significant events since the end of the financial year (in French:

https://www.theradiag.com/wp-content/uploads/2021/04/Rapport-Financier-Annuel-2020.pdf),

namely:

- The risk of a lack of success for the Company’s Research &

Development projects;

- The risk relative to the commercial launches of new diagnostic

or Theranostics products;

- Risks associated with the Company’s distribution and

partnership activity (dependency risk vis-à-vis distributors and/or

partners, risk of losing a distribution contract);

- Risks associated with the regulatory environment;

- Risks associated with changes in healthcare reimbursement

policies;

- Risks associated with defective products;

- Risks associated with international activities; and

- The risk of exposure to repercussions of the Covid-19

pandemic.

You can find a presentation of the Company’s Rights Issue via

the following link:

https://www.theradiag.com/en/category/financial-presentations/

About Theradiag Theradiag is the market leader in

biotherapy monitoring. Capitalizing on its expertise in the

diagnostics market, the Company has been developing, manufacturing

and marketing innovative in vitro diagnostic (IVD) tests for over

30 years.

Theradiag pioneered “theranostics” testing (combining therapy

with diagnosis), which measures the efficacy of biotherapy in the

treatment of chronic inflammatory diseases. Going beyond mere

diagnosis, Theranostics aims to help clinicians set up “customized

treatment” for each patient. This method favors the

individualization of treatment, evaluation of its efficacy and the

prevention of drug resistance. In response to this challenge,

Theradiag develops and markets the CE-marked TRACKER® range, a

comprehensive solution of inestimable medical value.

The Company is based in Marne-la-Vallée, near Paris, has

operations in over 70 countries and employs over 60 people. In

2020, the Company posted revenue of €10.4 million. The Theradiag

share is listed on Euronext Growth Paris (ISIN: FR0004197747) and

is eligible for the French PEA-PME personal equity plan.

For more information about Theradiag, please visit our website:

https://www.theradiag.com/

Disclaimer This press release does not constitute, and

shall not be deemed to constitute, an offer to the public or an

offer to purchase, or an offer to solicit public interest in a

transaction by way of public offering. No communication or

information relating to this transaction or to THERADIAG may be

disseminated to the public in any jurisdiction in which any

registration or approval requirement must be satisfied. No steps

have been taken (or will be taken) in any country in which such

steps would be required. The purchase of THERADIAG shares may be

subject to specific legal or regulatory restrictions in certain

countries. THERADIAG assumes no liability for any violation by any

person of such restrictions.

This press release constitutes a promotional communication and

not a prospectus within the meaning of Regulation (EU) No.

2017/1129 of the European Parliament and of the Council of 14 June

2017 (the "Prospectus Regulation"). In France, an offer of

securities to the public may only be made pursuant to a prospectus

approved by the AMF. With respect to member states of the European

Economic Area other than France (the "Member States"), no action

has been taken or will be taken to permit an offer of the

securities to the public that would require the publication of a

prospectus in any of those Member States. Accordingly, the

securities cannot and will not be offered in any Member State

(other than France), except in accordance with the exemptions

provided for in Article 1(4) of the Prospectus Regulation, or in

other cases not requiring the publication by THERADIAG of a

prospectus under the Prospectus Regulation and/or the regulations

applicable in those Member States. This press release does not

constitute an offer of securities to the public in the United

Kingdom. This press release does not constitute an offer of

securities or a solicitation to purchase or subscribe for

securities in the United States or in any other country (other than

France). Securities may not be offered, purchased or sold in the

United States except pursuant to registration under the U.S.

Securities Act of 1933, as amended (the "U.S. Securities Act"), or

pursuant to an exemption from such registration. THERADIAG's shares

have not been and will not be registered under the U.S. Securities

Act and THERADIAG does not intend to make any public offering of

its securities in the United States.

The distribution of this press release in certain countries may

constitute a violation of applicable law. The information contained

in this press release does not constitute an offer of securities in

the United States, Canada, Australia or Japan. This press release

may not be published, transmitted or distributed, directly or

indirectly, in the United States, Canada, Australia or Japan.

_____________________ 1 The Company's operating result and net

result at 30 June 2021 amount to -178 K€ and -92 K€ respectively. 2

The Company's sales as at 30 June 2021 was €5.5 million.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20211025005843/en/

Theradiag Bertrand de Castelnau CEO/Managing

Director +33 (0)1 64 62 10 12 contact@theradiag.com

NewCap Financial Communications & Investor Relations

Pierre Laurent Quentin Massé +33 (0)1 44 71 94 94

theradiag@newcap.eu

NewCap Media Relations Nicolas Mérigeau +33 (0)1

44 71 94 98 nmerigeau@newcap.fr

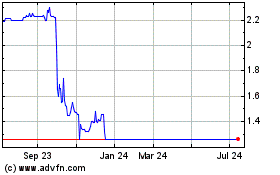

Theradiag (EU:ALTER)

Historical Stock Chart

From Mar 2024 to Apr 2024

Theradiag (EU:ALTER)

Historical Stock Chart

From Apr 2023 to Apr 2024