These Solana Numbers May Scare Off SOL Investors – Here’s Why

November 09 2022 - 8:07AM

NEWSBTC

After Binance and FTX engaged in a word war on social media – and

eventually making amends (well, sort of; Binance said today it’s

buying FTX) – Solana got dumped violently. Solana’s native token,

SOL, is trading in the red across all time frames, as reported by

CoinGecko, lending credence to the bearish claims. When asked what

a Binance deal for FTX meant for Solana, Ran Neuner of CNBC Crypto

Trader and founder of Crypto Banter referred to SOL’s pricing

issues. In a tweet, he said: “Solana [is] getting killed.”

He claims that the market has only recently realized that

Binance CEO Changpeng Zhao “now owns 10% of the tokens and that he

would prefer support the BNB chain than SOL.” This is a devastating

blow to SOL investors and traders. November has gone down in

history as one of the worst months ever for Solana investors.

Solana getting killed. Market realizing that @cz_binance now owns

10% of the tokens and that he would rather support BNB chain than

SOL. Also Solana just lost all the support and investment that FTX

and @SBF_FTX were making in the ecosystem. — Ran Neuner

(@cryptomanran) November 8, 2022 Based on figures by CoinMarketCap,

the coin registered more than 20% in weekly decline. At Coingecko,

SOL is down 37% in the last seven days. Chart: TradingView The

Solana network did benefit from recent advancements on its network,

but the market behavior of SOL over the past week has been very

lackadaisical. Related Reading: Polygon Soars 13% In Last 7 Days As

MATIC Bulls Work To Hit New Highs Negative Effects Of FTX On Solana

In a related development, the FTX’s native token, FTT, has had its

value drop across all time scales as well, and is currently trading

at $4.058. Meanwhile, after being rejected at the $38.26 area, SOL

is now trading in the red at the $17.52 range, reflecting the same

downward shift, courtesy of the negative impact that FTT’s drop has

brought along. Now, the charts also don’t look good for SOL buyers

and sellers. A total turnaround of mood, as shown by the CMF

signal, is only comparable to the market crash that occurred when

Terra pulled the crypto market down. Image: The Independent

Investors and traders are also receiving significant bear market

indications from the RSI, making the current market environment

considerably more precarious. Despite this, the crypto community is

still on the fence regarding a bullish reversal as the crypto

market cap plummeted after BTC and other tokens fell due to the FTX

brouhaha. What Can Still Be Done As the coin is currently in

freefall, SOL bulls can position themselves at the 23.60

Fibonacci retracement level, which can serve as a launchpad for a

possible relief rally in the near future. However, even this

potential support may remain hypothetical in the face of the

ongoing drama between FTX and Binance. With the decline of the

cryptocurrency market, all we can do is hope. The latest price

crunch is fueled in part by a high institutional fear

that another LUNA implosion might occur, and current investor

sentiment reflects this anxiety in the form of panic selling on the

cryptocurrency market, which exerts more downward pressure on SOL.

As of this writing, SOL is trading at a new low of $16.55, which

does not bode well for the coin’s investors and traders. If the

opportunity presents itself, however, investors and traders can

purchase the dip and potentially halt the current market decline.

Related Reading: Ethereum Loses $1,500 Grip As ETH Heads Down To

Correction Phase SOL total market cap at $7.18 billion on the daily

chart | Featured image from NBC News, Chart: TradingView.com

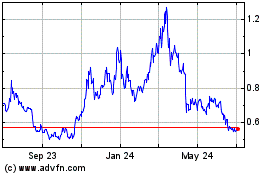

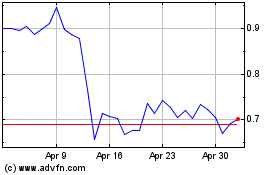

Polygon (COIN:MATICUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Polygon (COIN:MATICUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024